What is capital equipment? Definition and meaning

Capital equipment refers to items that are not permanently attached to buildings or grounds (freestanding) and cost more than $5,000 net of sales tax, freight and installation costs. It must have a useful life of at least one year and is not consumed in the normal course of business.

If the item costs less than $5,000, is freestanding and has a use life of one year or more, it is generally known as non-capital equipment.

Capital equipment is used to manufacture a product or provide a service. It is used to sell, store and deliver merchandise ( the term ‘merchandise has several meanings – in this context it means ‘goods’ or ‘products’).

Generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period.

According to ft.com/lexicon, capital equipment is :

“Machinery, tools, vehicles, etc. used to generate a finished product or service.”

Capital equipment may include items acquired in several different ways, which can be bought, leased or donated.

Some items, such as land or software, may meet the general requirements but tend to be excluded from the category.

Capital equipment definition varies

Items that are classed as capital equipment vary from business to business and industry to industry. In colleges and schools, it may include microscopes, scanning machines and computers. In the mining industry, it could include sifters, drills, or underground trains.

The acquisition of capital equipment items is generally planned, managed and financed on an organization-wide basis. Choices are generally decided by a committee, which receives capital funding requests and prioritizes them.

Marty Schmidt writes in an article published by Solution Matrix Limited:

“Authorization for acquisition and funding is granted for highest priority proposals first, continuing through lower priority proposals, until the capital spending ceiling for the current capital budgeting cycle is reached.”

“Acquisitions of non-capital items, by contrast, is typically initiated and authorized by many different individual managers at different levels.”

Video – Capital Equipment

In this video, James Kilgour, a capital equipment specialist, talks about his job. He selects equipment for specific veterinary practices. He says his service saves clients a great deal of time.

Share this:

- Renewable Energy

- Artificial Intelligence

- 3D Printing

- Financial Glossary

Updated on September 23, 2023

What is Capital Equipment & How To Manage It

Capital Equipment is any equipment a company has or needs that will provide a benefit for the company at some point in the future by generating profits, reducing expenses, sold for cash or retain some of it's value over a long period of time. For equipment to be defined as Capital Equipment, it has to be essential to the companies operations, difficult to be replaced, a operational life of more than1 year and produce a value more than what it cost to purchase . Since it will have a usage of more than one year, Capital Equipment is also defined as a fixed asset.

Key Points: Capital equipment is expensive, long-lasting equipment These purchases tend to represent major investments in your company Few businesses can buy capital equipment out of pocket, so many rely on financing

The Purpose of Defining Equipment as Capital Equipment

The goal of designating equipment as capital equipment is to identify which items will serve as long-term investments in a company's operations and which are intended as short-term investments.

Capital equipment must be distinguished from other types of expenses, such as operating expenses, which are normally billed the month it was purchased. A business's capital equipment consists of items such as machinery, vehicles, tools, buildings, and furniture that can be utilized for many years.

These items are regarded as investments with a long-term horizon since they generate recurring rewards across numerous accounting periods. Rather than incurring all costs in a single year, corporations can spread out these costs across time by capitalizing them. It is also essential for firms to effectively track capital expenditures in order to analyze their return on investment (ROI). Companies are then able to make informed judgments regarding future investments and manage resources wisely when they maintain reliable records of capital expenditures.

- Examples include machinery, cars, equipment, structures, furnishings, tangible and intangible items.

- Instead of deducting all expenditures in a single year, capitalizing purchases helps spread out expenses over time.

- Accurately monitoring capital expenditures enables monitoring ROI and making educated decisions on future investments.

- Capital equipment is depreciated throughout its useful life and knowing by how much provides a company with better control over it's cash flow.

- By defining certain items as capital equipment , businesses can better manage their assets and ensure that they are making wise long-term investments.

- In certain instances , companies may be able to deduct capital expenditures in a single year.

- By assessing their capital equipment , businesses may ensure they are not overinvesting in items that may no longer be useful.

How To Effectively Manage Your Current Capital Equipment Assets

A crucial aspect of business operations is the effective management of capital equipment assets. It is necessary to manage these assets to ensure that they remain in good shape, operate at maximum efficiency, and generate the anticipated return on investment.

Conduct regular maintenance and inspections: Frequent maintenance and inspections are necessary for keeping your equipment in peak operational condition. This involves routine equipment inspections, cleaning, and maintenance. By doing routine maintenance, you may identify and resolve minor issues before they become big ones, ensuring your equipment's continued dependability and efficiency.

Keep accurate records: Effective asset management requires accurate documentation of equipment maintenance, repair, and replacement. You can follow the equipment's history, monitor its performance, and make educated decisions on repairs, replacements, and upgrades with the help of accurate records. In addition, it allows you to spot patterns and trends in equipment usage and maintenance, allowing you to create successful preventative maintenance programs.

Implement an asset tracking system: Installing an asset tracking system permits you to monitor the location, status, and utilization of your equipment in real time. This allows you to improve equipment use, detect underutilized or overutilized equipment, and make educated asset allocation and disposition decisions.

Develop a comprehensive asset management plan: Create a comprehensive plan for asset management Creating a thorough plan for asset management is crucial for effective asset management. This plan should detail your asset purchase, maintenance, and disposal procedures, as well as an upgrade, replacement, and retirement schedule. In addition, performance indicators and targets for asset use, maintenance, and downtime should be outlined.

Plan for Replacement: Capital equipment assets will eventually require replacement. Prepare for replacement by tracking the useful life of your assets and developing a schedule for replacement. This can help to reduce equipment failure-related downtime and unforeseen expenditures.

Utilize Technology: There are a variety of technological resources available to properly manage capital equipment assets. For instance, computerized maintenance management systems (CMMS) can assist with maintenance scheduling, inventory tracking, and identifying possible problems. Use these tools to streamline and improve your equipment management operations.

Successful capital equipment asset management demands a proactive and strategic strategy , including routine maintenance, precise recordkeeping, asset tracking, comprehensive planning, and staff empowerment. You may assure optimal equipment performance, avoid downtime, and improve long-term operational efficiency and profitability by applying these guidelines.

How To Effectively Manage Future Capital Equipment Investment

Capital equipment investments are substantial expenditures that can have long-term repercussions for a company's finances. As a result, it is essential to carefully budget for these investments to guarantee that your business can afford them and that they will generate the anticipated returns.

- Assess your current financial situation: Before committing to an investment in capital equipment, you should evaluate your present financial standing. Assess your cash flow, debt levels, and financial objectives when determining how much you can afford to invest. This will assist you avoid overspending and ensure that the investment is consistent with your entire financial strategy.

- Research the equipment and its costs: Once you've determined how much you can afford to invest, conduct research on the equipment and its associated costs. Consider the purchase price, the cost of upkeep, and any additional expenses related with the investment. This can help you develop a more accurate budget and provide you with a deeper grasp of the investment's entire cost.

- Consider financing options: If you do not have the cash on hand to make the investment in full, you might examine financing options. This may involve obtaining a loan, leasing the necessary equipment, or researching further finance possibilities. Compare the expenses and benefits of each alternative to discover the best cost-effective option for your company.

- Create a detailed budget: Once you have a comprehensive grasp of the costs connected with the investment, you should develop a detailed budget. This should cover all expenditures involved with the investment as well as any additional fees that may develop during its lifetime. Consider any prospective revenue streams that could balance the investment's expenses.

- Monitor and alter the budget: Finally, it is vital to constantly monitor and adapt the budget. Track your spending and revenue streams to ensure the investment is working as anticipated. Adjust your budget, if required, to keep your finances on track and confirm that the investment is yielding the anticipated returns.

Efficiently budgeting for capital equipment purchases requires evaluating your financial status, studying equipment pricing, considering financing possibilities, developing a precise budget , and constantly reviewing and changing the budget. By adhering to these guidelines, you can make well-informed decisions on capital equipment investments and ensure that they align with the financial objectives of your business.

Capital Equipment vs. Operating Expenses: What's the Difference and Why Does It Matter?

Capital expenditures and operating expenses are two very distinct forms of corporate expenditures. Capital equipment is a significant investment in a company's productivity and efficiency, whereas operating expenses are the ongoing costs connected with day-to-day operations. In order to budget efficiently and make well-informed decisions, firms must comprehend the distinction between these two categories of expenditures.

How to Depreciate Capital Equipment

Depreciation is the process of accounting for the loss in value of a capital asset over time due to wear and tear, obsolescence, or any other condition that causes the asset to become obsolete.

Businesses must depreciate capital equipment to account for the cost of purchasing these assets and to predict future replacement costs. Here are five practical suggestions to help organizations successfully depreciate capital equipment:

Choose the right depreciation method: Several depreciation methods are available, such as straight-line, declining balance, and sum-of-years'-digits. Each method has its own benefits and drawbacks. Straight-line is the simplest and most prevalent way, while declining balance is more aggressive and sum-of-the-years'-digits falls in the middle.

Straight-line capital depreciation = ( The cost of the equipment - The estimated salvage value) ÷ Estimated useful life of the equipment

Determine the equipment's useful life: The useful life of an asset is the period over which it is expected to be beneficial to the business. Knowing the equipment's useful life is vital for appropriately calculating depreciation costs. The useful life can be approximated using variables such as the equipment's age, condition, and frequency of usage.

Determine the salvage value: The salvage value is the asset's projected value at the end of its useful life. This value is removed from the asset's initial cost to calculate its depreciable basis. When computing depreciation expenses using the declining balance technique, the salvage value is a key consideration.

Keep accurate records: To successfully depreciate capital equipment, organizations must maintain precise records of the asset's acquisition date, cost, usable life, and salvage value. This data is utilized to compute depreciation costs and track the asset's value over time.

Consult with a professional: Depreciation is a complicated process. Organizations with considerable capital assets should contact with a tax expert or an accountant to verify that they are depreciating the assets effectively. An expert can provide advice on selecting the appropriate depreciation method, evaluating the usable life and salvage value of the asset, and assuring the accuracy of the data.

Accounting for the depreciation of capital equipment is critical for businesses with considerable capital assets. To properly depreciate capital equipment, organizations must select the appropriate depreciation method, evaluate the usable life of the equipment, calculate the salvage value, maintain correct records, and, if required, consult an expert.

Different Definitions of Capital Equipment

There are a few different types of capital equipment.

- Fixed Capital Equipment (FCE): This includes capital equipment that cannot be moved from its location. For example, a piece of real estate would be a type of FCE.

- Stationary Capital Equipment (SCE): Stationary capital equipment can’t be moved without a high cost and are generally housed in the same location.

- Portable Capital Equipment (PCE): Portable capital equipment is more easily moved as needed. For example, audio-visual equipment may be expensive capital equipment, but can be moved without significant cost or effort.

Capital Equipment Loans

Capital equipment loans are a way to finance the purchase of expensive machinery and equipment. There are many sources of funds to consider.

One is a bank loan or loan from an online lender. These loans are relatively simple. You borrow a set amount to make the purchase, then pay the loan off over the course of years. Typically, the equipment you buy serves as collateral for these loans, making them easier to qualify for. You might like to check out loan terms of the best equipment financing lenders here.

Many equipment sellers may also offer financing as an option when you purchase equipment.

For less expensive capital equipment, you could consider using a line of credit or even a business credit card. However, credit cards and equipment lines of credit would only work for relatively cheap equipment.

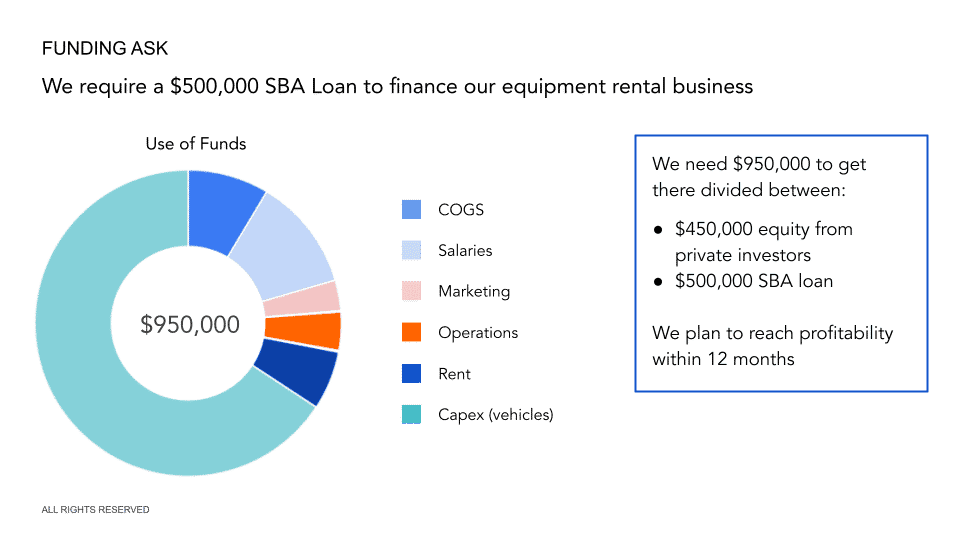

SBA loans are another good option, especially for newer companies. The Small Business Administration offers lenders guarantees on these loans, which make them easier to qualify for. Best of all, these loans can offer up to $5 million or more in funding. However, they can take longer to originate, so they’re not great for quick funding.

Capital Equipment Leasing

An alternative to buying capital equipment is leasing it. With a lease, you’re renting the equipment from its owner instead of purchasing it.

Leasing has the benefit of being less expensive. You don’t need to come up with a down payment and the monthly lease payments are typically smaller than the cost of a loan payment. With equipment lease , you may also have less to worry about when it comes to maintenance and repairs.

However, leasing has a few drawbacks.

The main one is that you never build equity in the equipment . With financing, you’d eventually own the equipment outright and get to use it for years without having to make monthly payments. If you ever decide to upgrade, you could sell the equipment to recoup some of the cost.

However, leasing means you always have to make a monthly payment if you want to keep using the equipment.

Leasing can also be less flexible in some ways. You have to pay a fee to cancel a lease early if you want to change equipment. You also can’t make modifications or customizations to the equipment.

What Are the Risks Associated with Capital Equipment?

- Cost overruns are one of the primary risks connected with capital equipment. Investing in capital equipment frequently entails hefty up-front costs, and the acquisition of the equipment may cost more than anticipated.

- Maintenance costs may exceed the budget if unexpected repairs are required or if replacement parts are difficult to get. Cost overruns can strain a company's financial resources and result in a decline in profitability.

- Operational disruption is an additional risk connected with capital equipment. Unexpected malfunctions or breakdowns of capital equipment might result in production and service delivery delays. If a business is unable to meet client requests owing to an interruption in operations, it might suffer reputational harm and revenue loss.

- Safety concerns are the fourth risk linked with capital equipment. If capital equipment is not adequately maintained or is operated improperly, it might be hazardous. Due to malfunctioning equipment or inadequate training, employees may be exposed to hazardous working circumstances, which could result in injury or even death.

- Can become obsolete over time as a result of technology improvements or alterations in consumer preferences. Businesses may find themselves with outmoded capital equipment that must be replaced or modernized in order to maintain their market competitiveness. This can need more expenses and time investments, which can have a detrimental effect on a company's bottom line.

The Role of Data Analytics in Capital Equipment Management

Capital equipment management is growing more and more reliant on data analytics. It offers businesses with data regarding the condition of their capital equipment, enabling them to make decisions and plan for the future . It can be used to monitor performance and predict future demands, enabling businesses to plan for prospective problems and maximize their investments.

Information can shed light on the cost effectiveness of capital equipment. By monitoring the expenses associated with maintaining and replacing equipment, firms can make educated decisions regarding when to invest in new machinery or services, thereby preserving their competitive advantage in the market.

In addition, data analytics can assist businesses find areas where they might save money by streamlining procedures or decreasing labor costs . In addition to tracking production rates, data analytics enables businesses to identify places where more efficient processes should be employed.

By examining production output trends over time, businesses may discover which methods are most effective and make necessary adjustments . This assists in optimizing procedures, avoiding waste, and reducing unnecessary costs.

- Cost Efficiency: Gives insight into the cost-effectiveness of capital equipment by tracking the costs involved with its maintenance and replacement.

- Production Rates: Studying manufacturing output trends over time enables firms to discover which strategies are most successful for optimization purposes and to decrease waste or unnecessary expenses.

- Reliability: Businesses can use data analytics to monitor the reliability of capital equipment over time in order to take preemptive steps to increase productivity while avoiding costly repairs or downtime caused by faulty machinery.

- Maintenance: Data analytics enables organizations to discover areas requiring maintenance before greater problems occur, allowing them to invest in new equipment or services as necessary. Add 3 more bullet points.

- Risk Management: Data analytics can be used to examine potential risks connected with capital equipment, thereby assisting businesses in mitigating the possibility of unanticipated problems affecting operations.

- Long-Term Planning: Businesses can utilize data analytics to plan for the future by anticipating future demands and taking precautions to ensure readiness.

- Prediction of Costs: Data analytics can also be used to estimate future costs associated with maintenance and replacement of capital equipment, allowing organizations to budget accordingly.

How Does a Company Report Its Capital Equipment?

Using the financial accounts provided in its annual report, a corporation discloses its fixed assets. Capital equipment consists of assets utilized in the functioning of a business, such as automobiles, buildings, furniture, and computers.

These assets are listed as property and equipment on the balance sheet (PP&E) . On the balance sheet, corporations list their PP&E under "Asset," with subheadings for each asset category. As a result, businesses will report the carrying amount and depreciation rate associated with the value of all capital equipment owned during a given accounting period.

Depreciation: The cost of capital assets is depreciated over time to represent their diminishing value as they age and wear out. Businesses may calculate depreciation using many methods, such as straight-line, accelerated, or sum-of-years-digits.

Utilizing different depreciation methods will result in companies having varying values for PP&E on their balance sheets when compared to other companies that utilize different depreciation methods.

Fair Value Adjustments: Businesses may also execute fair market value adjustments on certain forms of capital equipment, such as buildings and land, that are recorded at historical costs rather than current market values. Fair market value adjustments can have a substantial impact on a company's financial condition, depending on how much they fluctuate from year to year and whether they are marked up or down from historical cost levels.

Revaluations: Revaluations occur when an external expert appraises a piece of capital equipment and assigns it a higher or lower value than what was reported in the previous accounting period as a result of changes in market conditions or technological advancements resulting in more efficient machines, etc. Reevaluations may be conducted annually or at intervals chosen by management, depending on how frequently advances in technology impact the appropriate industry sector.

Dispositions & Impairment Charges: When businesses dispose of existing property, plant, and equipment (PP&E), they must report any gains or losses from disposal transactions as well as, if appropriate, impairment costs owing to deteriorating economic conditions affecting asset values. Disposals and impairment charges must be accounted for when reporting capital equipment since they are non cash expenses that will affect net income statistics over time but do not appear directly in cash flow statements because there is no linked cash transaction occurring at this moment. This is crucial for investors to consider when analyzing a company's financial statements, as these non-cash expenses can have a substantial impact on reported earnings or losses.

Internal & External Use: Businesses record both internal and exterior use of capital equipment. Externally, assets are used to offer investors information such as current asset values and net income numbers. Internally, assets are utilized to track the cost of assets owned by the company and precisely calculate depreciation charges. This enables investors to have a better understanding of a company's financial health by examining PP&E values and other relevant data, such as depreciation rates and fair market value adjustments.

Capital Expenditure Tracking: Businesses must track their capital expenditures each accounting period in order to appropriately record any changes in asset values or impairments resulting from economic downturns or technical improvements. This enables businesses to have an accurate snapshot of their financial status at any given time, enabling them to make more educated decisions about how to spend their resources in the future.

Off-Balance Sheet Items: Some pieces of capital equipment, such as leased assets that are not wholly held by the company, may be reported off-balance sheet. These items must still be tracked and reported in order for a company's financial statements to be correct, but they will not appear immediately on the balance sheet because they are not owned by the company.

Pieces of capital equipment are the important, expensive pieces of machinery and tools that make a business run. They’re a major investment, but essential for your company to produce a profit. When acquiring capital equipment for your company, consider both equipment financing and leasing options and decide which is right for you.

This app literally changed my like. It provides a great experience. I absolutely love it!

- https://www.sba.gov/blog/business-equipment-financing-leasing-7-key-tips-know

- https://www.nationalfunding.com/equipment-leasing/

- https://www.myaccountingcourse.com/capital-equipment

- https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/templates-business-guides/glossary/financial-statements

About the Author

I have in-depth experience in reviewing financial products such as savings accounts, credit cards, and brokerages, writing how-tos, and answering financial questions both simple and complicated.

Related Articles

Equipment Financing For Startups

Equipment Financing: Everything You Need To Know

Equipment Leasing vs. Financing: Which One?

Equipment Financing for Bad Credit: A Guide for Businesses

Equipment Financing Rates & How They Affect Your Payments

Equipment Breakdown Coverage: What is It & Should You Get a Policy?

How to Write Off Equipment for A Small Business

Equipment Line of Credit: What It Is and How To Decide

Used Equipment Financing: Is It the Right Choice for Your Business?

How to Depreciate Equipment: A Step-by-Step Guide

Equipment vs Supplies: The Differences & Why They Matter

Is Equipment a Current Asset & How to Classify It Correctly

Camera Financing For Your Business: Know All The Options

Heavy Equipment Financing - What to Know Before You Apply

Construction Equipment Financing: Know All The Options

Farm Equipment Financing: What Is It & How to Apply

Financing Semi-Trucks: What You Need To Know

Restaurant Equipment Financing: Unlocking the Possibilities

Medical Equipment Financing: How to Use It Right

Dental Equipment Financing: What Every Dentist Needs to Know

Equipment Needed to Start a Bakery & How to Finance It

Gym Equipment Financing - Practical Tips on How to Get Funding

Brewery Equipment Financing: Helping Your Brewery Thrive

Salon Equipment Financing: Best Way to Lower Your Upfront Costs

Forestry Equipment Financing Made Simple and Accessible

Equipment Finance Agreement - Why It's Worth Getting One

Equipment Lease Agreement - Key Points to Know Before Signing

Equipment Management Software: Why Your Business Can’t Succeed Without It

- Starting a Business

- Growing a Business

- Business News

- Science & Technology

- Money & Finance

- Subscribers For Subscribers

- ELN Write for Entrepreneur

- Store Entrepreneur Store

- Spotlight Spotlight

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- How to Use Your Business Plan Most Effectively

- The Basics of Writing a Business Plan

- 12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 12 Ways to Set Realistic Business Goals and Objectives

- 3 Key Things You Need to Know About Financing Your Business

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- What Equipment and Facilities to Include in Your Business Plan

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

What Equipment and Facilities to Include in Your Business Plan Investors will want a detailed list of the equipment your business requires and where you plan to operate. Here's a checklist to get you started.

By Eric Butow • Oct 27, 2023

Opinions expressed by Entrepreneur contributors are their own.

This is part 1 / 11 of Write Your Business Plan: Section 5: Organizing Operations and Finances series.

A manufacturer will likely need all sorts of equipment, such as cars, trucks, computers, telecom systems, and machinery of every description for bending metal, milling wood, forming plastic, or otherwise making a product out of raw materials. A lot of this equipment is expensive and hard to move or sell once purchased.

Moreover, manufacturers often require a facility to house this equipment and operate the business.

Related: How to List Personel and Materials in Your Business Plan

Naturally, investors are very interested in your plans for purchasing equipment and facilities. But this part of your plan doesn't have to be long—just be sure it's complete.

Make a list of every sizable piece of equipment you anticipate needing. Include a description of its features, its functions, and, of course, its cost. In addition, list all facilities you plan on buying or leasing.

Be ready to defend the need to own the more expensive items. Bankers and other investors are loath to plunk down money for capital equipment that can be resold only for far less than its purchase price. Also, consider leasing what you need if you are starting out. Once you show that you are responsible for paying your bills and sales look good, you can apply for a small business loan or a line of credit with greater success.

Related: How to Write an Operations Plan for Manufacturers

Unless you're a globe-trotting consultant whose office is his suitcase, your plan will need to describe the facilities in which your business will be housed. Even home-based business owners now describe their home offices as the trend continues to snowball, thanks largely to mobile communications.

Land and buildings are often the largest capital items on any company's balance sheet. So it makes sense to go into detail about what you have and what you need. Decide first how much space you require in square feet. Don't forget to include room for expansion if you anticipate growth. Now consider the location. You may need to be close to a labor force and materials suppliers. Transportation needs, such as proximity to rail, interstate highways, or airports, can also be important. Next, ask whether there is any specific layout that you need.

Related: What Technology to Include In Your Business Plan

Draw up a floor plan to see if your factory floor can fit into the space you have in mind. Manufacturers today do most of their ordering and communications online, so you need to ensure that your location has excellent connectivity.

To determine the cost of facilities, you'll first have to decide whether you will lease or buy space and what your rent or mortgage payments will be for the chosen option. Don't forget to include brokerage fees, moving costs, and the cost of any leasehold improvements you'll need. Finally, take a look at operating costs. Utilities, including phone, electric, gas, water, and trash pickup are concerns; also consider such costs as your computer connections, possibly satellite connections, maintenance, and general upkeep.

Related: Bursting at the Seams? Tips for Expanding Your Startup's Office Space

Facilities checklist

Use this checklist to analyze your facility's requirements.

- Initial space

- Expansion space

- Total space

- Technology requirements, including connectivity

- Proximity to the labor pool

- Proximity to suppliers

- Transportation availability

- Layout Requirements:

- Purchase/lease costs

- Brokerage costs

- Moving costs

- Improvement costs

- Operating costs

These aren't the only operations concerns of manufacturers. You should also consider your need to acquire or protect such valuable operations assets as proprietary processes and patented technologies.

Related: How to Determine How Much Real Estate Your Business Needs

For many businesses— for example, Coca-Cola with its secret soft drink formula comes to mind—intellectual property is more valuable than their sizable accumulations of plants and equipment. Investors should be warned if they must pay to acquire intellectual property. If you already have it, they will be happy to learn they'll be purchasing an interest in a valuable and protected technology.

More in Write Your Business Plan

Section 1: the foundation of a business plan, section 2: putting your business plan to work, section 3: selling your product and team, section 4: marketing your business plan, section 5: organizing operations and finances, section 6: getting your business plan to investors.

Successfully copied link

- Baker University

- Subject Guides

Writing a Business Plan - Financials

- Capital Equipment

- Introduction

- Funding Sources

- Start-up Costs

- Financial Issues

- Equipment used to manufacture a product, provide a service, or sell, store, and deliver merchandise

- NOT equipment used in the normal course of business, but equipment one will use and wear out as one does business.

- Does not include items expected to be replaced annually or more frequently.

Where to obtain capital equipment

- The Internet, in general

- Vendor catalogs

- << Previous: Funding Sources

- Next: Start-up Costs >>

Capital Equipment – A Complete Guide In 2022

- June 17, 2021

- Capital Equipment – A Co ...

There are two schools of thought when it comes to determining whether to buy and register capital equipment on your books. The first option is to buy and install the necessary equipment at a time throughout the year when increased demand merits it, ensuring adequate cash flow to cover additional loan payments or the outright purchase of the equipment.

The second way is to purchase and install the equipment before the start of the business year or when you’ll really need it, giving time for training and problem fixes before going into full production.

What Is Capital Equipment?

Physical things bought for productive activity are referred to as capital equipment. These products are commonly purchased by businesses in order to grow their operations or stay up with new techniques or technological advancements.

Capital equipment has a useful life of more than one year and is employed in a company’s productive activities. It’s a financial commitment made by a corporation to continue or expand its manufacturing operations.

Example Of Capital Equipment

Plastic Pipes Co. is a manufacturer of water pipes for the building and residential markets. The company’s Board of Directors is now examining the investment strategy for the coming year. The plan calls for a total investment of $5,400,000, which will be split among the following programmes: $1,400,000 for a new building, $2,000,000 for capital equipment, $1,500,000 for stock investments, and $500,000 for new staff dining facilities.

The capital equipment investment includes the purchase of new machinery to establish three new production lines, as well as the procurement of new packaging equipment and the renovation of the raw material storage. This investment program is expected to boost the company’s profits per share by 50% in the coming fiscal year.

Types of Capital Equipment

1. Fixed Capital Equipment (FCE)

- A building’s capital equipment is permanently linked to it.

- FCE has a useful life of more than two years and costs $5,000 or more to acquire.

- The FCE’s removal would have a significant impact on the building’s worth.

- Fixed capital equipment is regarded as a part of the building and an enhancement to the building.

- Fixed capital equipment isn’t given an inventory number and hence isn’t recorded in inventory records.

Heating and electrical equipment, plumbing fixtures, built-in shelving and cupboards, and inlaid carpets are examples of permanent capital equipment.

2. Movable Capital Equipment (MCE)

- Capital equipment that is not permanently linked to a building or structure is referred to as movable capital equipment.

- The environment in which mobile capital equipment operates is not an important element of its design. Its removal has no effect on the item’s worth or the value of the real estate.

- MCE items have inventory numbers assigned to them and are kept in the Generalized Inventory file. Any change in status, such as moving, selling, surprising, stealing, trading-in, and so forth, must be notified to Purchasing.

Movable capital equipment is further defined as stationary or portable.

3. Stationary Capital Equipment (SCE)

- Because of their size and/or use, several pieces of transportable capital equipment are typically stored in the same place.

- These objects are categorized as stationary, and their positions are recorded in the inventory record permanently.

4. Portable Capital Equipment (PCE)

- Because of their size, usage, or application, many pieces of moveable capital equipment are continually relocated from one location to another.

- Dictating machines, audio-visual equipment, test meters, and other items are examples.

- This category includes items that are referred to as portable capital equipment.

- A “home” location must be set to PCE. A record of the PCE’s present location, including the name of the person to whom it is provided, should be preserved at the “home” location. Home locations must also be notified to Purchasing so that inventory data may be updated.

Attributes Of Capital Equipments

1. acquisition cost .

For capital acquisitions, each facility or practice will have a defined cost barrier. This may cost as little as $500 or as much as $5000, depending on the size of your practice, and is actually decided by the administrative procedure of the facility. A small clinic with fewer assets may afford to deal with lower criteria since it has more time.

The price of the equipment and additional costs associated with the sale, such as shipping and setup, are included in acquisition expenses. Items like printers, keyboards, and software might be included in the cost of purchases with peripherals, such as computers.

2. Not Disposable or Consumable

Capital expenditures cannot be decided only on the basis of cost. Consumables, by definition, are goods that are used up fast. Some healthcare expenditures may reach the cost criterion, but they may not qualify as capital if they are acquired to be utilized, or “consumed.”

Capital equipment is a type of asset that should be identified and inventoried as such, as well as being subject to depreciation.

3. Stand Alone

Even if a big component acquisition meets both the cost and non-consumable criteria, it may not be considered capital equipment on its own. The term “stand-alone” refers to an item that may be utilized on its own. Understanding this feature can assist you in appropriately grouping components so that they may be priced and documented with the major capital equipment if necessary.

Keep in mind, however, that your procurement process may allow you to add value or prolong the life of an existing piece of capital equipment by purchasing subsequent components such as capital equipment. The value of the sponsored equipment might be increased by the subsequent purchase.

4. Useful Life of One Year or More

A basic definition of a capital asset is one that is bought with the intention of making a profit and will benefit the firm for at least a year. Additionally, your capital equipment must have a useful life of more than one year in order to meet present value and future value in computing depreciation . If it doesn’t, it’ll be classified as consumable by most accounting systems.

5. Qualifies as Tangible Property

Non-tangible assets that benefit a firm, such as trademarks and intellectual property, are included in the definition of capital assets. However, in order to comprehend capital equipment purchase, the final feature should be that it is a physical asset .

Tangible property is defined by taxing jurisdictions as everything that can be moved and is used in the company. Items acquired for resale may not qualify as tangible property and would be classified as inventory rather than capital equipment.

Final Thoughts

Capital Equipment is classified as a non-current asset in the financial world, indicating it is depreciated and capitalized over the course of its useful life. In general, we choose contemporary technology and equipment that can produce a higher-quality product at a cheaper cost and with less waste.

long-term objectives, future technology developments, the need for new goods, and other considerations unique to each firm must all be considered when making capital investment decisions.

- What’s The Best Strategy For Avoiding ATM Fees?

- Which Type Of Account Typically Has Low Liquidity?

- How to Buy Green Axis Capital Corp Stock?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Create mode – the default mode when you create a requisition and PunchOut to Bio-Rad. You can create and edit multiple shopping carts

- Edit mode – allows you to edit or modify an existing requisition (prior to submitting). You will be able to modify only the cart that you have PunchedOut to, and will not have access to any other carts

- Inspect mode – when you PunchOut to Bio-Rad from a previously created requisition but without initiating an Edit session, you will be in this mode. You cannot modify any Cart contents

- Order Status

- Quick Order

- Bioprocessing

- Clinical Research

- Drug Discovery & Development

- Translational Research

- Wastewater Surveillance

- Diabetes / Hemoglobinopathies

- Hospital / Clinical Core Lab

- Infectious Disease

- Newborn Screening

- Transfusion Medicine

- Quality Control

- Food & Beverage Testing

- Classroom Education

- Bioprocess Analytics

- Bioprocess Chromatography

- Cell Line Development / Characterization

- Cell Research

- Gene Expression Analysis

- Mutation Detection

- Pathogen Detection

- Protein Expression / Characterization / Quantitation

- Viral / Vector Characterization

- Bacteriology

- Blood Typing, Screening & Antibody Identification

- Hemoglobinopathies

- Infectious Disease Testing

- Molecular Diagnostics

- Data Management Systems

- Proficiency Testing & EQAS

- Verification & Validation

- Food & Beverage Safety Testing

- Cannabis Testing

- Veterinary Diagnostics

- Water Quality Testing

- Biotechnology Textbook & Program

- DNA, PCR & Agarose Gel Electrophoresis

- Genetic Engineering, Microbiology & Model Organisms

- Proteins, Enzymes & ELISA

- COVID-19 Assay & Research

- Cell Isolation & Analysis

- Chromatography

- Digital PCR

- Electrophoresis & Blotting

- Flow Cytometers

- Immunoassays

- PCR & qPCR

- Sample Preparation & Quantitation

- Transfection

- Autoimmune Testing

- Blood Typing & Antibody Detection

- Diabetes Testing

- Hemoglobinopathy Testing

- Microbiology Testing

- Quality Controls

- Software & Data Analysis

- Molecular Testing

- B2B Commerce Solutions

- Custom PCR Plastics & Reagents

- Expert Care Service

- New Labs & New Grants

- Remote Diagnostic Services

- Supply Center Program

- Instrument Service Support Plans

- Trade-Up Program

- Certificate of Analysis

- Literature Library

- Electronic IFUs

- Product Safety Data Sheets

- Quality Management Systems Certificates

- Quality Control Inserts

- Life Science

- Clinical Testing Solutions

- Bioprocess Chromatography Resources

- Classroom Resources

- Product News

- Corporate News

How to Make a Business Case for Capital Equipment Purchase

- Bio-rad Twitter

- Bio-rad Facebook

- Bio-rad LinkedIn

Key Considerations for Building a Business Case for Purchasing Capital Equipment

The process of scaling up laboratory capacity, replacing old equipment, or purchasing new technology to help accelerate your team’s objectives must be accompanied by carefully evaluating the overall costs involved. But how should you determine whether a capital equipment purchase is the best option for your team, and how do you ensure your business case gives you the highest chance of success for approval? This article explores the key factors to consider when building a business case for capital equipment purchases, according to feedback from procurement leaders with a combined 30+ years of experience in the field.

Continue Reading

Share a little information with us to view this article in its entirety.

Content you'll also find interesting

Are Costly Experimental Failures Causing a Reproducibility Crisis?

How to Incorporate Automation into Your Flow Cytometry Workflows

Mitigating Risks When Adopting a New Technology

Thank you for submitting the form.

When is Capital Equipment Purchase Needed?

The purchase of capital equipment significantly differs from the recurrent purchase of consumable materials and relatively low-cost equipment (e.g., a pH meter) that typically utilizes an operational budget. Instead, capital equipment is purchased through a department’s capital expenditure (CapEx) budget. Capital equipment can be described as a high-cost, fixed assets to be capitalized and depreciated over the equipment’s lifecycle (e.g., confocal microscope). In broad terms, a capital purchase can either satisfy a team's current needs or help meet new research or business objectives.

"When considering day-to-day business operations, two factors could determine a case for capital purchase: obsolescence and capacity. Is there a need to replace or update your existing base? Are you expanding your business? Alternatively, the business may be changing. Are you looking at new technology that will help drive a specific strategy for your department or division? Any of these situations would highlight a need for capital equipment purchase." — Robert Jerzewski, PhD, former Director of Equipment Commissioning and Qualification at Bristol-Myers Squibb

Using laboratory capacity as an example, the available equipment should be able to satisfy current project needs while considering headcount. However, if a laboratory is expanding or relocating into a larger space, capacity also increases, and a capital equipment purchase will be needed to ensure existing workflows continue running smoothly. In addition to capacity, different equipment involved in a single workflow must be compatible with each other and the relevant software. If the software is no longer supported by a department’s IT service or the manufacturer, that instrument becomes obsolete and will have to be replaced with a new model through the capital purchase process. Alternatively, team objectives may change by offering a new service, branching into a new market, or switching research fields. In this case, it is likely that needs cannot be met using existing equipment alone, and new technologies must be introduced.

Building a Business Case

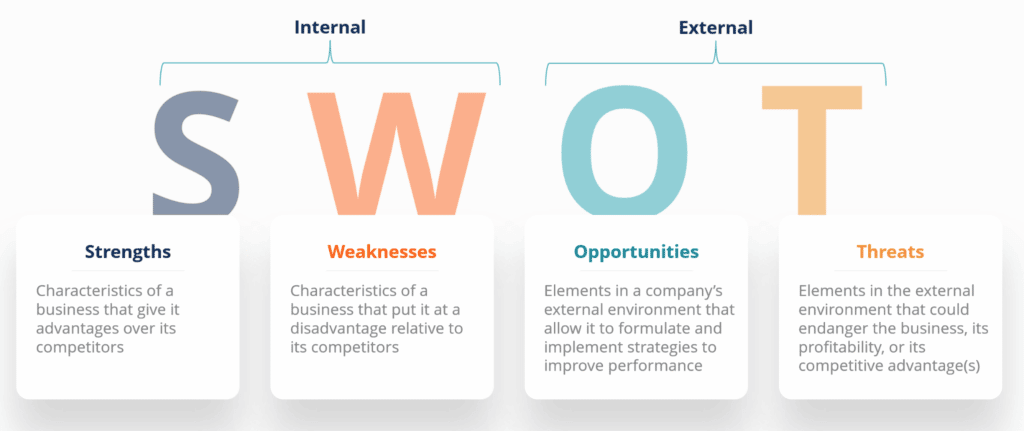

All business cases for capital equipment purchase, regardless of the instrument in question or template being used, follow the same format and include three key sections: an executive summary, a situational analysis, and financial justification.

- Executive summary : a contextual introduction outlining the problem, proposing a solution, and stating the predicted results and benefits of the purchase

- Situational analysis : a more detailed review of the issue, supported by financial data and highlighting where the new instrument would have an impact. This should also include a discussion of potential risks to the proposed solutions and the alternatives available, such as upgrading the current technology

- Financial justification section : covers all the costs associated with the purchase, including installation and maintenance costs, as well as the predicted financial benefits and forecasted income and budgets associated with the new instrument

What to Consider During the Justification Process

When completing the justification documentation, it is important to consider the views and priorities of all individuals involved in the CapEx management and include expert input from laboratory personnel who will be using the new instrument. A decision matrix displaying the requirements and limitations of each individual or group involved in decision-making can be a useful tool to balance viewpoints, stay on budget, and ultimately support the business case for the best-suited supplier or equipment for the team.

Initially, direct users should confirm which technical specifications they require and pull together an executive summary focusing on instrument capabilities, quality, and additional supplier-provided services, such as maintenance plans. Those who will use the equipment are best suited to identify where new instrumentation is needed and research potential solutions. Various research teams within the same organization may require the use of the same instrument. For example, an HPLC instrument may be utilized by R&D, QC, QA, external projects, and internal testing teams. All these parties will have the same requirements for an instrument but demonstrating a piece of equipment’s multifunctionality will further support the business case.

Departmental leadership teams and procurement leaders will be focused on the financial side of the business case, taking into consideration all the additional organizational expenses and overall CapEx and operational budgets. In addition, facilities management and health and safety teams will inform on the installation and setup stages and compatibility with existing infrastructure.

Tallying Up the Costs

When putting together a business case for capital equipment purchase, a major consideration is the cost associated with the new equipment, not just in procurement but overall costs throughout its lifecycle.

"When building the business case, the technology and price are both important criteria. For both, it includes the equipment and services. I would always consider the total cost of ownership, including the price of the instrument and its upkeep." — Vice President, Head of Capital Investment at Pharma Company

The total cost of ownership includes the following:

- Purchasing : the initial cost of buying a new instrument, along with delivery. When scheduling delivery, it is also important to evaluate the options available. Site location and access will play into this and may incur additional costs

- Installation : does the instrument need to be installed or built into a lab, and can this be done in-house by facility management teams, rather than a specialist engineer from the manufacturer?

- Set up : can the new instrument be connected and integrated into existing systems and software by the user, or will this require a specialist engineer?

- Compatibility : is the new device compatible with the software currently used in the laboratory, or will the whole system require updating or replacing? Can current disposable materials be used with the new equipment?

- Insurance : most equipment will come with a form of warranty, but will it also require insurance? If so, does the manufacturer offer an insurance plan, or can the instrument be listed under the client’s existing insurance policy?

- Ongoing maintenance : some suppliers offer a maintenance plan with regular check-ups and ongoing support, while others simply provide a call-out service in case of emergencies. Each of these plans comes with a cost, dependent on the level of coverage and support. For most teams, the maintenance cost will come from the operational budget. If that budget is not increasing, maintaining the equipment may not be possible

A thorough business case should encompass the overall cost of ownership throughout the equipment lifecycle, views of all relevant stakeholders, and a comprehensive demonstration of how the particular instrument is the optimal choice for a specific laboratory. Incorporating each of these elements, alongside supporting evidence, is the best way to ensure your justification documentation is compliant and, therefore, most likely to be successful.

BIO-RAD is a trademark of Bio-Rad Laboratories, Inc. All trademarks used herein are the property of their respective owner. © 2023 Bio-Rad Laboratories, Inc

Recommended Features

How Field Application Scientists Smooth Research Journeys

Read this first hand perspective highlighting how scientists are supported by Bio-Rad field application scientists.

Purchasing Equipment for a New Lab

Follow this comprehensive infographic which outlines eight practical steps and considerations to keep in mind when buying lab equipment for a new lab.

Advancing Scientific Discovery: Bio-Rad Tools Featured in Influential Publications

Learn how Bio-Rad instrumentation has been supporting researchers like you in your mission to improve health. Read this synposis of key publications.

These pages list our product offerings in these areas. Some products have limited regional availability. If you have a specific question about products available in your area, please contact your local sales office or representative .

- Bio-rad LinkedIn Bio-rad Antibodies LinkedIn

- Bio-rad YouTube Bio-rad Antibodies YouTube

- Bio-rad Twitter Bio-rad Antibodies Twitter

- Bio-rad Facebook Bio-rad Antibodies Facebook

- Bio-rad Instagram

- Bio-rad Pinterest

About Bio-Rad

Bioradiations, sustainability, investor relations.

- Search Search Please fill out this field.

What Is Capital Investment?

- How It Works

Capital Investments for Business

- Advantages and Disadvantages

Accounting for Capital Investments

The bottom line.

- Investing Basics

Capital Investment: Types, Example, and How It Works

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Capital investment is the acquisition of physical assets by a company for use in furthering its long-term business goals and objectives. Real estate, manufacturing plants, and machinery are among the assets that are purchased as capital investments.

The capital used may come from a wide range of sources from traditional bank loans to venture capital deals.

Key Takeaways

- Capital investment is the expenditure of money to fund a company's long-term growth.

- The term often refers to a company's acquisition of permanent fixed assets such as real estate and equipment.

- Capital assets are reported as non-current assets and most are depreciated.

- The funds for capital investment can come from a number of sources, including cash on hand, though big projects are most often financed through obtaining loans or issuing stock.

- Examples of capital investments are land, buildings, machinery, equipment, or software.

Investopedia / Theresa Chiechi

How Capital Investment Works

Capital investment is a broad term that can be defined in two distinct ways:

- An individual, a venture capital group or a financial institution may make a capital investment in a business. The money can be provided as a loan or a share of the profits down the road. In this sense of the word, capital means cash.

- The executives of a company may make a capital investment in the business. They buy long-term assets such as equipment that will help the company run more efficiently or grow faster. In this sense, capital means physical assets.

In either case, the money for capital investment must come from somewhere. A new company might seek capital investment from any number of sources, including venture capital firms, angel investors , or traditional financial institutions. When a new company goes public, it is acquiring capital investment on a large scale from many investors.

An established company might make a capital investment using its own cash reserves or seek a loan from a bank. It might issue bonds or stock shares in order to finance capital investment. There is no minimum or maximum capital investment. It can range from less than $100,000 in seed financing for a start-up to hundreds of millions of dollars for massive projects undertaken by companies in capital-intensive sectors such as mining, utilities, and infrastructure.

Capital investment is meant to benefit a company in the long run, but it nonetheless can have short-term downsides.

A decision by a business to make a capital investment is a long-term growth strategy. A company plans and implements capital investments in order to ensure future growth. Capital investments generally are made to increase operational capacity, capture a larger share of the market, and generate more revenue. The company may make a capital investment in the form of an equity stake in another company's complementary operations for the same purposes.

In many cases, capital investments are a necessary and normal part of an industry. Consider an oil-drilling company that relies on heavy machinery to extract raw materials to be processed. As opposed to a law firm that will have low-to-no capital investment requirements, capital-intensive businesses usually need specific assets in order to operate.

In addition, there are strategic components for a business to consider when deciding whether or not to invest in a capital asset. For instance, consider how certain heavy machinery such as a company vehicle could be leased. Should the company be willing to incur debt and tie up capital, the company may spend less money in the long-term by incurring a capital investment as opposed to a periodic "rental" expense.

Types of Capital Investments

Companies often acquire capital investments for diversification, modernization, or business expansion. This may mean buying capital investments different from existing aspects of its business or capital investments that simply do things better than before. Some specific types of capital investments include:

- Land: Companies may buy bare land to be used for development or expansion.

- Buildings: Companies may buy existing buildings for manufacturing, storage, production, or headquarter operations.

- Assets Under Development: Companies may incur spending over time to assemble assets that may be capitalized. For example, a company can build its own building; the accumulation of charges may be considered a capital investment.

- Furniture and Fixtures: Though furniture and fixtures may be more temporary in nature, certain aspects of accounting rules result in some overlap between FFE and capital investments.

- Machines: Companies that invest in the production elements of making goods are making capital investments.

- Software Development or Computing Devices: Companies more frequently invest capital to build software; these costs now commonly qualify for capitalization and amortization over time.

Because land does not deteriorate in a similar manner compared to other capital investments, it is not depreciated.

Advantages and Disadvantages of Capital Investments

Pros of capital investments.

The advantages of capital investments can vary depending on the specific situation. However, most companies embark on capital investments for productivity. By investing in new equipment or technology, companies can improve their efficiency, thus lower costs and increasing output. These types of investments may also improve the quality of goods produced.

Capital investments can also lead to cost savings over time. For example, a new piece of equipment may be more energy-efficient than an older model, which can result in lower utility bills. Similarly, new technology may streamline processes and reduce the need for manual labor. Last, companies may decide the long-term discounted cash flow is favorable when comparing the upfront investment of a capital investment compared to the long-term, ongoing cash outlay of a recurring expense.

By investing in their long-term assets, companies can also gain a competitive advantage in the market. This can make it more difficult for competitors to catch up and can help the company to maintain its market position over the long term. If a company is willing to take a risk and incur a large investment to strengthen its business, this may create a barrier to entry that competitors can not overcome or compete against.

Cons of Capital Investment

The preferred option for capital investment is always a company's own operating cash flow, but that may not be sufficient to cover the anticipated costs. It is more likely the company will resort to outside financing. Therefore, there is usually a little more risk to capital investments. This is especially true for capital investments that are customized or hard to liquidate; once the company has bought the capital investment, it may be hard to exit the investment.

Capital investment is meant to benefit a company in the long run, but it nonetheless can have short-term downsides. Capital investments tends to reduce earnings growth in the short term, and that never pleases stockholders of a public company. This may be especially true for capital investments that also incur operating costs (i.e. the acquisition of land will be accompanied by a potentially hefty annual property tax assessment).

In addition, if a company does not have sufficient capital on hand to make a large investment, there are downsides to each of its financing options. Issuing additional stock shares, which is often the funding option for public companies, dilutes the value of its outstanding shares. Existing shareholders generally dislike finding that their stake in the company has been reduced. Alternatively, the total amount of debt a company has on the books is closely watched by stockholders and analysts . The payments on that debt can stifle the company's further growth.

May increase productivity if capital investment is more efficient than prior methods

May result in higher quality manufactured goods

May be cheaper in the long-run when compared against rented or monthly expensed solutions

May create a barrier to entry that yields a competitive advantage

May be too expensive for the company to outright purchase on their own.

May limit or restrict short-term profitability of the company

May be accompanied by additional operating expenses

May reduce the liquidity of the company should it be difficult to sell the capital asset

Accounting practices for capital investments involve recording the cost of the asset, allocating the cost over its useful life, and carrying the investment as the difference between cost and accumulated depreciation . The accounting treatment can vary depending on the type of asset, as land is not depreciated but many other capital investments are depreciated.

The cost of the asset should be recorded in the company's accounting records. This can include the purchase price of the asset as well as any additional costs related to the purchase such as installation or transportation costs. Companies may record the fair market value for certain capital investments under certain circumstances, but capital investments must initially be recorded at cost.

If the asset has a cost that meets the company's capitalization policy, the cost of the asset will be recorded as a capital asset on the balance sheet. This allows the company to spread the cost of the asset over its useful life and to recognize the expense over time. This is the primary difference between the assets mentioned earlier and normal operating costs, as operating costs are expensed in the period they are incurred while capital investment costs are spread over time.

The useful life of a capital investment is an estimate of the number of years that the asset will be used by the company. The depreciation method used will depend on the asset and the company's accounting policies, but commonly used methods include straight-line, declining balance, and sum-of-the-years'-digits. Companies may also record impairments to reduce the value of a capital investment should a loss be incurred. In addition, whereas operating expenses may simply be stopped, companies have a series of entries to post when a capital investment is disposed of.

Example of Capital Investment

As part of its year-end financial statements, Amazon.com reported the following assets it owned for fiscal year 2021 and 2022.

This format of the balance sheet is standard where assets are reported by liquidity starting with the most liquid assets. Because capital investments are not liquid, they are often reported lower in the list.

At year-end 2022, Amazon reported a net asset balance of $186.7 billion for property and equipment. This figure is net because capital investments, aside from land, are often depreciated and reported as their cost less any accumulated depreciation. Note that this $186.7 billion is also being excluded from current assets. Because of the long-term nature of capital investments, they are reported as noncurrent assets.

What Is an Example of a Capital Investment?

When a company buys land, that is often a capital investment. Because of the long-term nature of buying land and the illiquidity of the asset, a company usually needs to raise a lot of capital to buy the asset.

How Does a Capital Investment Work?

A capital investment works based on the benefits a company may receive over a long period of time compared to the short-term investment. In theory, a company will pay a large sum of money upfront (or over time). Then, the company will receive a benefit from the asset (potentially even after it has finished paying for it). The idea is a capital investment should provide better long-term value compared to a good or service that is being purchased and used in a single accounting period.

What Is the Largest Downside to a Capital Investment?

Companies must often make a long-term financial or legal commitment when buying capital investments. This means tying up cash, getting rid of flexibility, and taking a risk that may not pan out. Whereas a company can be more nimble by paying for something smaller, a company aims to leverage a single investment to scale growth or innovate. That growth or innovation may not materialize.

Companies may decide to make capital investments as a way to innovate, modernize, and capture a competitive advantage over its competitors. This investment often requires a large sum of money, and the company often receives an illiquid asset such as land, buildings, machinery, or equipment. The accounting treatment for capital investments if often different than operating outlays as capital investments are usually depreciated.

Amazon. " Form 10-K (2022) ."

:max_bytes(150000):strip_icc():format(webp)/CAPEXandOPEX-69072a25fa41477bad1c02321c0fd308.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Capital Planning

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 12, 2023

Get Any Financial Question Answered

Table of contents, what is capital planning.

Capital planning is a critical process that businesses undertake to allocate financial resources to long-term investments and projects, such as acquiring new equipment, launching new products, or expanding operations.

The primary aim of capital planning is to ensure that a company's investments generate the highest possible return, contribute to its long-term growth and success, and minimize financial risks.

A well-designed capital plan can help a company identify the most beneficial investment opportunities, create a balanced portfolio of projects, and allocate resources strategically.

Effective capital planning is crucial for a business's long-term success and financial stability.

It allows organizations to make strategic decisions about where to invest resources to achieve their growth objectives, maximize shareholder value, and maintain a competitive edge in the marketplace.

By carefully evaluating potential investments, companies can ensure that they are putting their money into projects that align with their overall strategy and have the potential to deliver significant returns.

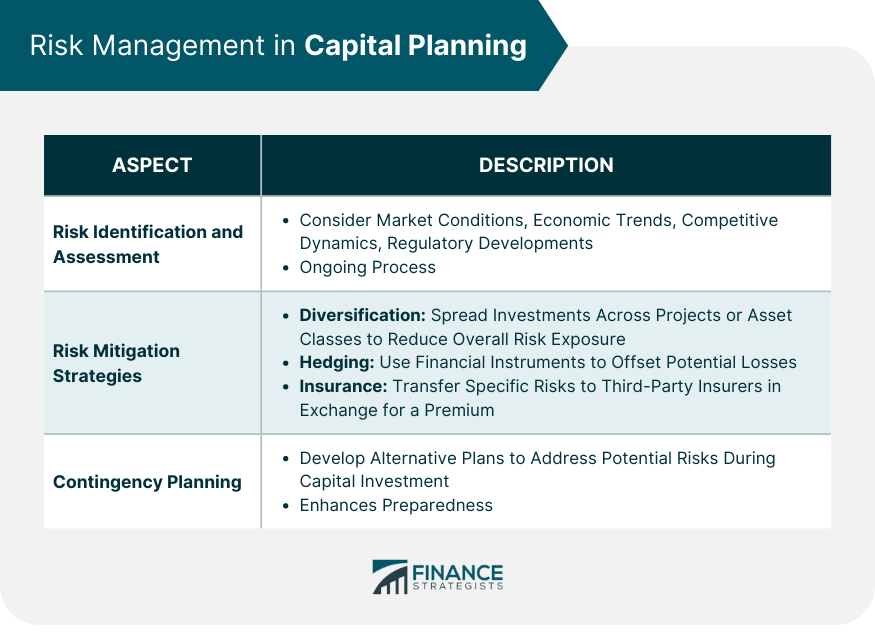

Furthermore, capital planning helps businesses minimize investment risks by identifying potential threats and developing strategies to mitigate them.

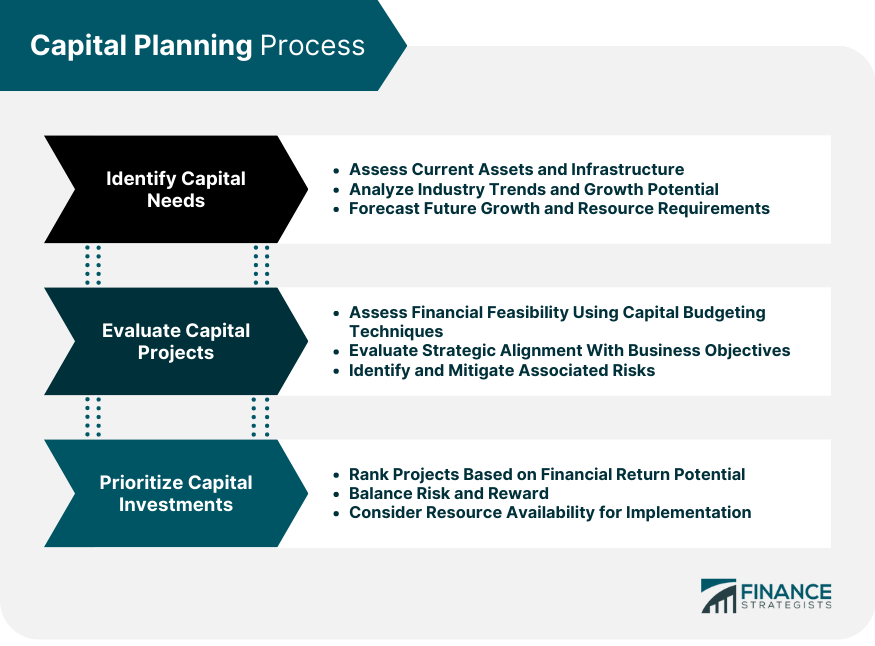

Capital Planning Process

Identifying capital needs.

This step involves assessing a company’s current assets , forecasting future growth, and analyzing industry trends.

It includes evaluating the organization's existing infrastructure, equipment, and technology to determine if they are adequate to meet its short and long-term objectives.

Additionally, companies should assess their growth potential by analyzing market trends, customer demand, and competition to identify areas where investment may be required.

Forecasting future growth is critical to identifying capital needs, as it provides valuable insights into the company's potential revenue streams and resource requirements.

Companies should utilize historical data, market research, and industry analysis to create accurate growth projections.

Understanding industry trends is essential for identifying opportunities for investment and potential challenges that may impact the organization's financial performance.

Evaluating Capital Projects

Evaluating a company’s potential capital projects is done to determine their financial feasibility, strategic alignment, and associated risks. Financial feasibility refers to the project's ability to generate a return on investment (ROI) that exceeds its cost of capital .

This can be assessed using various capital budgeting techniques , such as net present value (NPV) , internal rate of return (IRR) , and payback period.

Strategic alignment is essential in the evaluation process, as it ensures that the proposed project aligns with the company's overall business strategy and objectives.

This may involve analyzing the project's potential impact on market share , competitive positioning, and long-term growth potential.

Risk assessment is another critical aspect of project evaluation, as it involves identifying potential risks associated with the investment and developing strategies to mitigate them.

Prioritizing Capital Investments

This involves ranking projects according to their potential for financial return, considering factors such as projected cash flows, payback period, and NPV. Balancing risk and reward is also a critical aspect of prioritizing investments.

Companies should aim to create a balanced portfolio of projects that offers an optimal mix of potential returns and risk exposure.

Resource availability is another important factor to consider when prioritizing capital investments.

Companies must ensure they have the financial, human, and technological resources to support the successful implementation of their chosen projects. This may require reallocating resources from other business areas or seeking external financing to fund the investment.

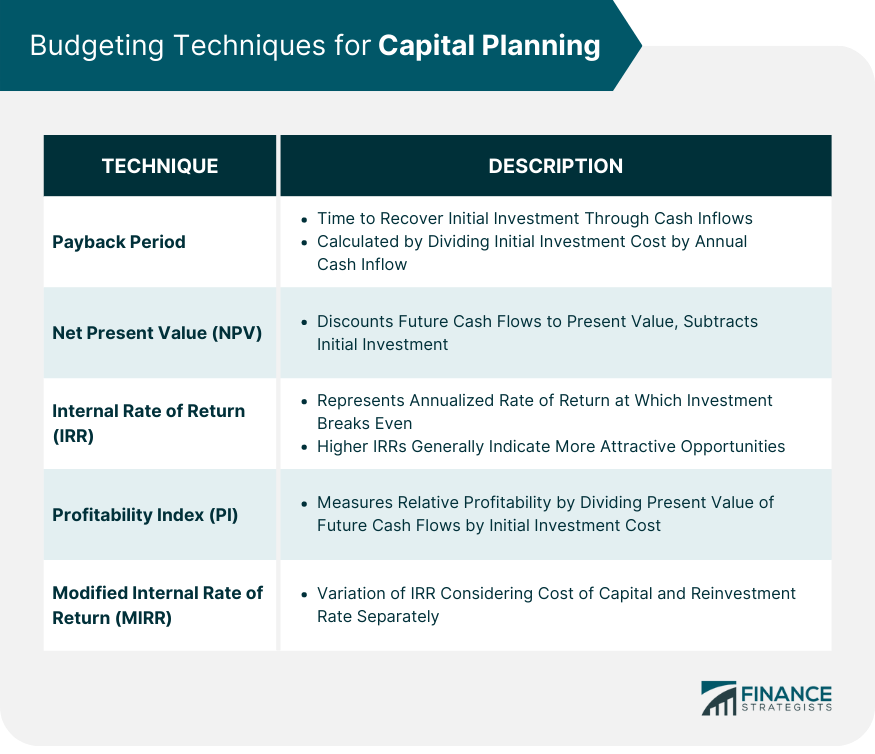

Budgeting Techniques for Capital Planning

Payback period.

The payback period is a simple capital budgeting technique that calculates the amount of time it takes for an investment to recoup its initial cost through cash inflows.

It is calculated by dividing the initial investment cost by the annual cash inflow generated by the project.

The payback period is useful for comparing investment options with similar risk profiles , as it provides a straightforward measure of how quickly an investment will start generating positive returns.

However, the payback period must account for the time value of money or cash flows generated after the initial investment has been recouped, which may limit its usefulness in evaluating long-term projects.

Net Present Value

NPV is a more sophisticated capital budgeting technique that accounts for the time value of money by discounting future cash flows to their present value.

The NPV is calculated by subtracting the present value of cash outflows (initial investment) from the present value of cash inflows generated by the project over its life.

A positive NPV indicates that the project is expected to generate a return greater than the cost of capital, making it a potentially worthwhile investment.

In contrast, a negative NPV suggests that the project's returns are unlikely to cover its costs. NPV is widely used by businesses to compare investment opportunities and determine their financial viability.

Internal Rate of Return

The IRR calculates the discount rate at which the net present value of a project's cash flows becomes zero. In other words, the IRR represents the annualized rate of return at which the investment breaks even.

The IRR can be used to compare the profitability of different investment options, with higher IRRs generally indicating more attractive opportunities.

It is important to note that the IRR assumes that all future cash flows are reinvested at the same rate, which may only sometimes be the case in practice.

Profitability Index (PI)

The profitability index measures the relative profitability of an investment by dividing the present value of its future cash flows by the initial investment cost.

A PI greater than 1 indicates that the project is expected to generate a positive net present value. In contrast, a PI of less than 1 suggests that the investment may not be financially viable.

The PI is useful for comparing the relative profitability of different investment options, as it takes into account both the size of the investment and the potential returns.