47 case interview examples (from McKinsey, BCG, Bain, etc.)

One of the best ways to prepare for case interviews at firms like McKinsey, BCG, or Bain, is by studying case interview examples.

There are a lot of free sample cases out there, but it's really hard to know where to start. So in this article, we have listed all the best free case examples available, in one place.

The below list of resources includes interactive case interview samples provided by consulting firms, video case interview demonstrations, case books, and materials developed by the team here at IGotAnOffer. Let's continue to the list.

- McKinsey examples

- BCG examples

- Bain examples

- Deloitte examples

- Other firms' examples

- Case books from consulting clubs

- Case interview preparation

Click here to practise 1-on-1 with MBB ex-interviewers

1. mckinsey case interview examples.

- Beautify case interview (McKinsey website)

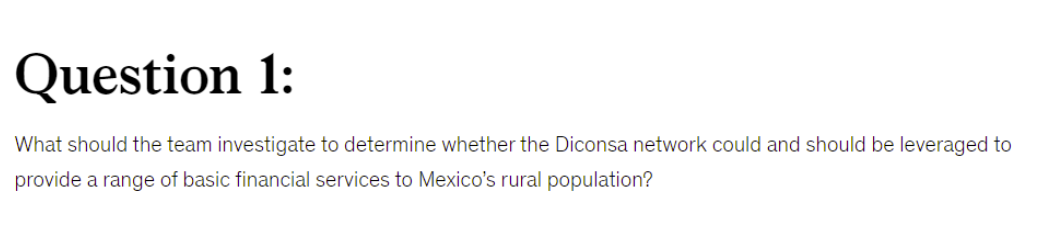

- Diconsa case interview (McKinsey website)

- Electro-light case interview (McKinsey website)

- GlobaPharm case interview (McKinsey website)

- National Education case interview (McKinsey website)

- Talbot Trucks case interview (McKinsey website)

- Shops Corporation case interview (McKinsey website)

- Conservation Forever case interview (McKinsey website)

- McKinsey case interview guide (by IGotAnOffer)

- Profitability case with ex-McKinsey manager (by IGotAnOffer)

- McKinsey live case interview extract (by IGotAnOffer) - See below

2. BCG case interview examples

- Foods Inc and GenCo case samples (BCG website)

- Chateau Boomerang written case interview (BCG website)

- BCG case interview guide (by IGotAnOffer)

- Written cases guide (by IGotAnOffer)

- BCG live case interview with notes (by IGotAnOffer)

- BCG mock case interview with ex-BCG associate director - Public sector case (by IGotAnOffer)

- BCG mock case interview: Revenue problem case (by IGotAnOffer) - See below

3. Bain case interview examples

- CoffeeCo practice case (Bain website)

- FashionCo practice case (Bain website)

- Associate Consultant mock interview video (Bain website)

- Consultant mock interview video (Bain website)

- Written case interview tips (Bain website)

- Bain case interview guide (by IGotAnOffer)

- Digital transformation case with ex-Bain consultant

- Bain case mock interview with ex-Bain manager (below)

4. Deloitte case interview examples

- Engagement Strategy practice case (Deloitte website)

- Recreation Unlimited practice case (Deloitte website)

- Strategic Vision practice case (Deloitte website)

- Retail Strategy practice case (Deloitte website)

- Finance Strategy practice case (Deloitte website)

- Talent Management practice case (Deloitte website)

- Enterprise Resource Management practice case (Deloitte website)

- Footloose written case (by Deloitte)

- Deloitte case interview guide (by IGotAnOffer)

5. Accenture case interview examples

- Case interview workbook (by Accenture)

- Accenture case interview guide (by IGotAnOffer)

6. OC&C case interview examples

- Leisure Club case example (by OC&C)

- Imported Spirits case example (by OC&C)

7. Oliver Wyman case interview examples

- Wumbleworld case sample (Oliver Wyman website)

- Aqualine case sample (Oliver Wyman website)

- Oliver Wyman case interview guide (by IGotAnOffer)

8. A.T. Kearney case interview examples

- Promotion planning case question (A.T. Kearney website)

- Consulting case book and examples (by A.T. Kearney)

- AT Kearney case interview guide (by IGotAnOffer)

9. Strategy& / PWC case interview examples

- Presentation overview with sample questions (by Strategy& / PWC)

- Strategy& / PWC case interview guide (by IGotAnOffer)

10. L.E.K. Consulting case interview examples

- Case interview example video walkthrough (L.E.K. website)

- Market sizing case example video walkthrough (L.E.K. website)

11. Roland Berger case interview examples

- Transit oriented development case webinar part 1 (Roland Berger website)

- Transit oriented development case webinar part 2 (Roland Berger website)

- 3D printed hip implants case webinar part 1 (Roland Berger website)

- 3D printed hip implants case webinar part 2 (Roland Berger website)

- Roland Berger case interview guide (by IGotAnOffer)

12. Capital One case interview examples

- Case interview example video walkthrough (Capital One website)

- Capital One case interview guide (by IGotAnOffer)

12. EY Parthenon case interview examples

- Candidate-led case example with feedback (by IGotAnOffer)

14. Consulting clubs case interview examples

- Berkeley case book (2006)

- Columbia case book (2006)

- Darden case book (2012)

- Darden case book (2018)

- Duke case book (2010)

- Duke case book (2014)

- ESADE case book (2011)

- Goizueta case book (2006)

- Illinois case book (2015)

- LBS case book (2006)

- MIT case book (2001)

- Notre Dame case book (2017)

- Ross case book (2010)

- Wharton case book (2010)

5. How to practise case interviews

We've coached more than 15,000 people for interviews since 2018. There are essentially three activities you can do to practice case interviews. Here’s what we've learned about each of them.

5.1 Practise by yourself

Learning by yourself is an essential first step. We recommend you make full use of the free prep resources on our consulting blog and also watch some mock case interviews on our YouTube channel . That way you can see what an excellent answer looks like.

Once you’re in command of the subject matter, you’ll want to practice answering cases. But by yourself, you can’t simulate thinking on your feet or the pressure of performing in front of a stranger. Plus, there are no unexpected follow-up questions and no feedback.

That’s why many candidates try to practice with friends or peers.

5.2 Practise with peers

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

5.3 Practise with experienced MBB interviewers

In our experience, practising real interviews with experts who can give you company-specific feedback makes a huge difference.

Find a consulting interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Learn how to tell the right stories, better.

- Save time by focusing your preparation

Landing a job at a top consulting company often results in a $50,000 per year or more increase in total compensation. In our experience, three or four coaching sessions worth ~$500 will make a significant difference in your ability to land the job. That’s an ROI of 100x!

Click here to book case interview coaching with experienced MBB interviewers.

Related articles:

Hacking the Case Interview

Case interview frameworks or consulting frameworks are arguably the most critical component of a case interview. Outstanding case frameworks set you up for success for the case while poor frameworks make the case difficult to solve.

Struggling on how to use frameworks in your case interviews? Unsure of which frameworks to use?

Don't worry because we have you covered! We'll teach you step-by-step, how to craft tailored and unique frameworks for any case interview situation.

By the end of this article, you will learn four different strategies on how to create unique and tailored frameworks for any case interview.

Strategy #1: Creating Frameworks from Scratch

- Strategy #2: Memorizing 8 – 10 Broad Business Areas

- Strategy #3: Breaking Down Stakeholders

- Strategy #4: Breaking Down Processes

- Strategy #5: Two-Part MECE Frameworks

You will apply these strategies to learn how to create case frameworks for the six most common types of case interviews.

Profitability Framework

Market entry framework, merger and acquisition framework, pricing framework, new product framework, market sizing framework.

You will also learn six consulting frameworks that nearly every consultant knows.

Porter’s Five Forces Framework

Swot framework, 4 p’s framework, 3 c’s / business situation framework, bcg 2x2 matrix framework, mckinsey 7s framework.

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

What is a Case Interview Framework?

A case interview framework is simply a tool that helps you structure and break down complex problems into simpler, smaller components. Think of a framework as brainstorming different ideas and organizing them into different categories.

Let’s look at an example: Coca-Cola is a large manufacturer and retailer of non-alcoholic beverages, such as sodas, juices, sports drinks, and teas. They are looking to grow and are considering entering the beer market in the United States. Should they enter?

In order for you to decide whether Coca-Cola should enter the beer market, you likely have many different questions you’d like to ask:

- Does Coca-Cola know how to produce beer?

- Would people buy beer made by Coca-Cola?

- Where would Coca-Cola sell its beer?

- How much would it cost to enter the beer market?

- Will Coca-Cola be profitable from selling beer?

- How would Coca-Cola outcompete competitors?

- What is the size of the beer market in the United States?

This is not a very structured way of thinking through the case. The questions are listed in no particular order. Additionally, many of the questions are similar to one another and could be grouped together.

A case framework would provide a structure to organize these ideas and questions in a way that is easy to understand.

A framework for this case might look like the following.

Notice that we have simplified the list of questions we had into four main categories. These broad categories are frequently called framework “buckets.” Also notice that we have grouped similar questions together under each framework bucket.

This case framework tells us what areas we need to explore in order to make a recommendation to Coca-Cola. It also clearly shows what questions we need to answer under each area.

This is the power of a case interview framework. It simplifies a complex business problem into smaller and separate components that we can tackle one at a time.

So how do you develop a case framework? The next section will reveal four robust strategies for creating unique and tailored consulting frameworks for any case interview.

Case Interview Framework Strategies

There are four case interview framework strategies you should have in your toolkit:

When given a case interview, you will need to decide which framework strategy you want to use. Some framework strategies will be more effective than others depending on what type of case interview you get.

Therefore, choose the case framework strategy that is easiest for you given the type of case that you get.

This case framework strategy can be used for any type of case. This is the most time-consuming strategy, but yields case frameworks that are the most tailored and unique for the given case interview.

To create a framework from scratch, ask yourself what 3 – 4 statements must be true for you to be 100% confident in your recommendation. These 3 – 4 areas will become the buckets in your framework.

Once you have your framework buckets, brainstorm a few questions for each bucket that you need answers to.

Let’s return to the Coca-Cola case example in which we are asked to determine whether or not they should enter the beer market. What 3 – 4 statements must be true for us to recommend that Coca-Cola should enter the beer market?

The four major statements that must be true are:

- The beer market is an attractive market

- Competitors in the market are weak

- Coca-Cola has the capabilities to produce outstanding beer

- Coca-Cola will be highly profitable from entering the beer market

These will be the major areas or buckets in our framework.

Next, let’s add a few bullet points under each area to add more detail to our case framework.

To determine whether the beer market is attractive, we would need to know the market size, the market growth rate, and the average profit margins in the market.

To assess whether the market is competitive, we would need to know who the competitors are, how much market share they have, and if they have any differentiation or competitive advantages.

To decide whether Coca-Cola has the capabilities to produce beer, we need to know if there are any capability gaps or if there are significant synergies that Coca-Cola can leverage.

Finally, to determine the expected profitability of entering the market, we would need to know what expected revenues are, what expected costs are, and how long it would take Coca-Cola to break even.

This gives us our case framework.

You can repeat this process for any case interview that you get to create an outstanding case framework.

Strategy #2: Memorizing 8 – 10 Broad Business Areas to Make a Framework

Creating case frameworks from scratch can be quite time-consuming. Because of this, many interview candidates make the mistake of using memorized frameworks for case interviews.

Candidates will either use a single memorized framework for every case or memorize a different framework for every type of case interview.

The issue with using memorized frameworks is that they aren’t tailored to the specific case you are solving for. When given an atypical business problem, your framework areas or buckets will not be entirely relevant.

A poor framework makes the case interview significantly more difficult to solve.

Additionally, Interviewers can easily tell that you are regurgitating memorized information and not thinking critically.

Instead of creating frameworks from scratch each time, this second case framework strategy provides a method to speed up the process while still creating frameworks that are unique and tailored to the case. Additionally, you won’t need to memorize multiple different frameworks.

First, memorize a list of 8 - 10 broad business areas, such as the following:

When given a case, mentally run through this list and pick the 3 - 5 areas that are most relevant to the case.

This will be your framework.

If the list does not give you enough areas for your framework, brainstorm and add your own ideas as areas to your framework.

Finally, add a few bullet points under each area to add more detail to your case framework.

This strategy guarantees that your framework elements are relevant to the case. It also demonstrates that you can create unique, tailored frameworks for every business problem.

Let’s return to the Coca-Cola case example in which we are asked to determine whether or not they should enter the beer market.

Running through our list of memorized framework areas, the following six areas would be relevant:

- Market attractiveness : Is the beer market attractive?

- Competitive landscape : How tough is competition?

- Company capabilities : Does Coca-Cola have the capabilities to enter the market?

- Profitability : Will Coca-Cola be profitable from entering the market?

- Risks : What are the risks of entering the market?

- Strategic alternatives : Are there other more attractive markets Coca-Cola should enter?

You can pick 3 – 5 of these areas as the basis for your framework.

This strategy is a shortcut for creating unique and tailored frameworks for every business problem. Even if you and a friend used this same strategy, you both may end up with different frameworks.

That is completely fine. As long as the buckets in your framework are major areas and are relevant to the case, your case framework will be significantly better than most candidates’ frameworks.

You do not need to develop a framework entirely from scratch every time to create outstanding case frameworks. This case framework strategy can be applied to over 90% of case interviews.

For the remaining 10% of case interviews, you will need to learn and use the next two case interview framework strategies.

Strategy #3: Breaking Down Stakeholders to Make a Framework

The first two case framework strategies can be applied to over 90% of cases. However, some cases may require you to identify and focus on various stakeholders that are involved in running or operating a business.

For these cases, the primary areas of your case framework will be these major stakeholders.

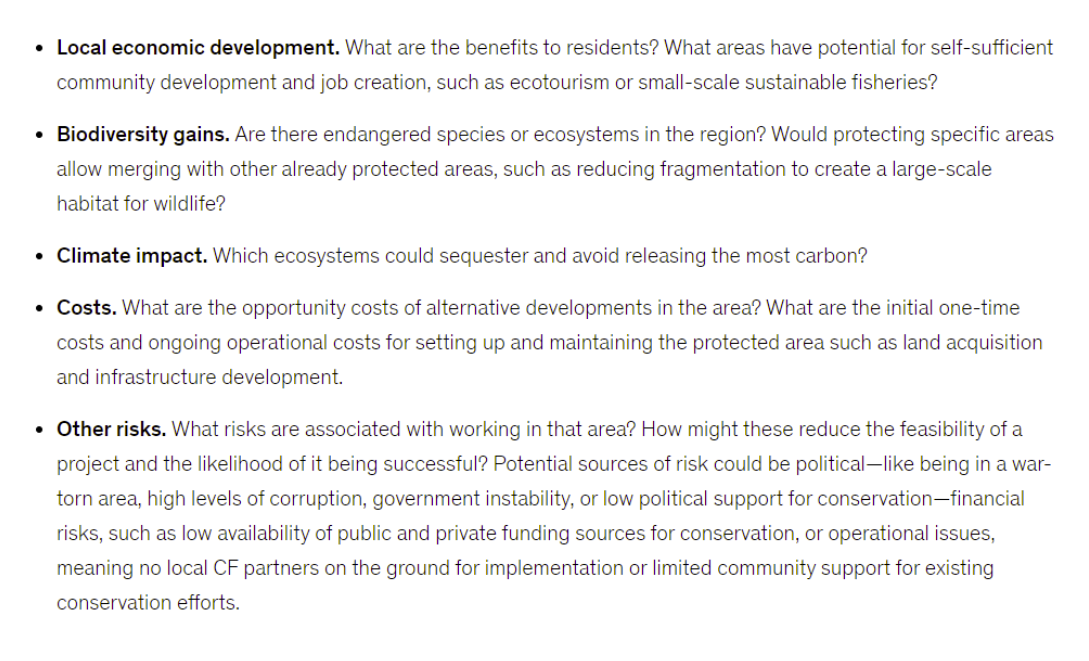

Let’s take a look at an example: Your client is a non-profit blood bank. They have volunteer nurses that go to schools and companies to collect blood from donors. They then sell this blood to hospitals, which use this blood for emergency situations when a blood transfusion is required. Currently, Hearts4Lives is not profitable because they are not able to collect enough blood to sell to their hospital partners. What can they do to fix this?

This case involves many different stakeholders:

- Volunteer nurses

- Blood donors

- Schools and companies

For cases in which many different stakeholders are involved, it will be useful to look at each stakeholder and determine what each could do to address the problem.

One potential framework could look like the following:

Strategy #4: Breaking Down Processes to make a Framework

Similar to the previous case framework strategy, some cases may require you to focus on improving or optimizing a particular process.

For these cases, the primary areas of your case framework will be each major step of the process.

Let’s take a look at an example: Your client is a waste disposal company that manages a fleet of drivers and garbage trucks that go to residential homes, collect garbage, and then dump the garbage in city landfills. They have an obligation to collect each home’s garbage once a week. Recently, they have been failing to meet this requirement and are backed up with garbage disposal requests. What is causing this issue and what should they do to fix it?

For cases involving processes and efficiencies, it can be helpful to look at the different components or steps in the process.

We can think about the process of collecting and disposing of garbage in the following steps:

- Get in a garbage truck

- Drive along a designated route

- Collect garbage at each stop

- Dispose of the garbage in the landfill

Using these steps as the primary areas of our framework, we can create the following case framework:

Once you have systematically listed all of the steps in a process, you can identify the pain points or bottlenecks that are causing the issue and determine ways to improve the process.

Strategy #5: Two-part MECE Frameworks

An easy way to make a 100% MECE framework is to use a two-part MECE framework. For the first step, start with a X and Not X framework. Some examples include:

- Internal / external

- Short-term / long-term

- Economic / non-economic

- Quantitative / qualitative

- Direct / indirect

- Supply-side / demand-side

- Upside / downside

- Benefits / cost

There are probably hundreds more frameworks that follow this pattern.

These frameworks are by definition 100% MECE. Since all of these frameworks are X or Not-X, they are mutually exclusive. There is no redundancy or overlap between X and Not-X.

Together, X and Not-X are also completely exhaustive. They cover the universe of all ideas and possibilities.

The X and Not-X framework by itself is good enough for a lot of the questions you could get asked in a case interview.

If you’re asked to brainstorm ways to decrease costs, you can create a framework consisting of decreasing variable costs and decreasing non-variable costs, also known as fixed costs.

If you’re asked to brainstorm barriers to entry, you can create a framework consisting of economic barriers to entry, such as cash and equipment, and non-economic barriers to entry, such as brand name or distribution channels.

However, to take your framework to the next level and truly impress your interviewer, we have the option of doing step two.

Step two involves adding another layer of X and Not X into your framework. What do we mean by this?

Let’s say you are trying to help a city decide whether they should host the upcoming summer Olympics. You start off with a framework consisting of benefits and costs. You can take this framework to the next level by adding another layer, such as adding in short-term and long-term.

With this additional layer, your framework now has four categories: short-term benefits, long-term benefits, short-term costs, and long-term costs. This is a 100% MECE framework that enables you to think through all possible considerations in deciding whether a city should host the Olympics.

Let’s look at another example. Suppose you are trying to figure out how to reduce a company’s costs. You start with a framework consisting of variable costs and fixed costs. You can take this framework to the next level by adding another layer, such as direct and indirect.

With this additional layer, your framework now has four categories: ways to directly reduce variable costs, ways to indirectly reduce variable costs, ways to directly reduce fixed costs, and ways to indirectly reduce fixed costs. This is another 100% MECE framework.

Case Frameworks: The 6 Most Common Frameworks

There are six common case frameworks in consulting case interviews.

Profitability frameworks are the most common types of frameworks you’ll likely use in consulting first round interviews.

A profitability case might look like this: “An electric car manufacturer has recently been experiencing a decline in profits. What should they do?”

There are two steps to solving a profitability case.

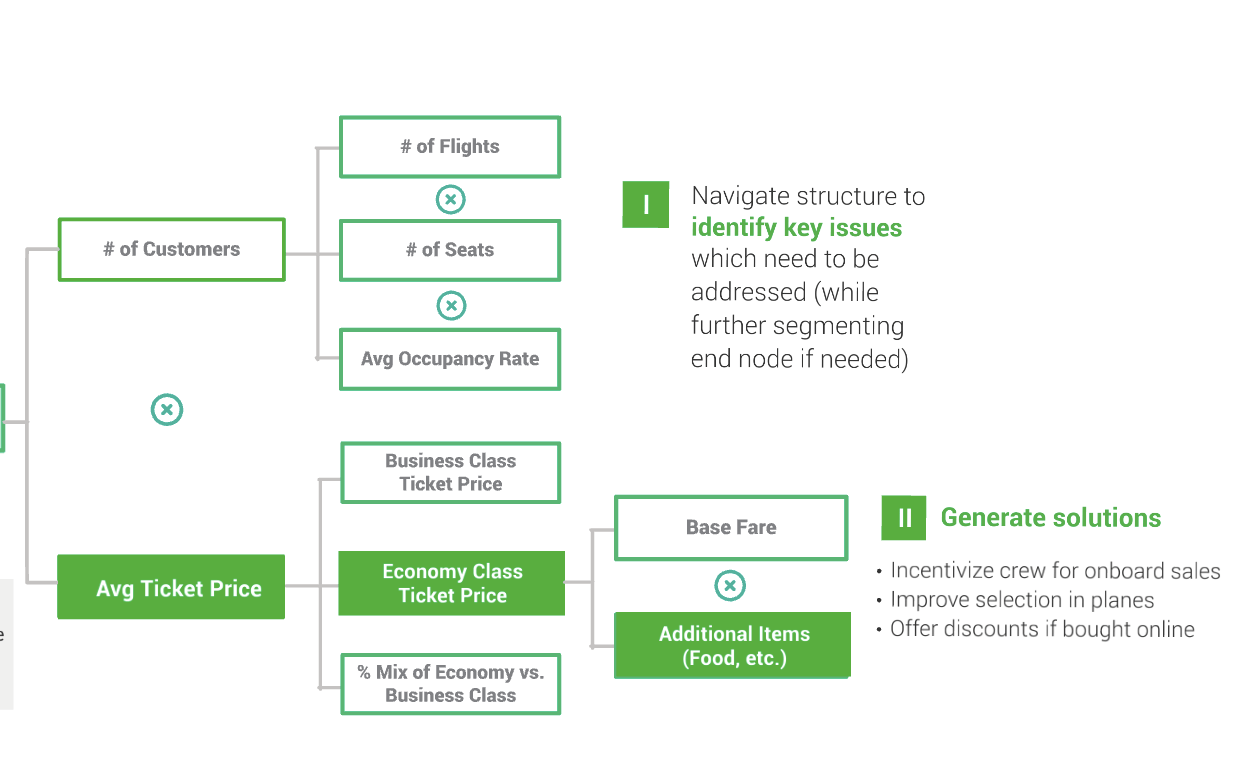

First, you need to understand quantitatively, what is the driver causing the decline in profits?

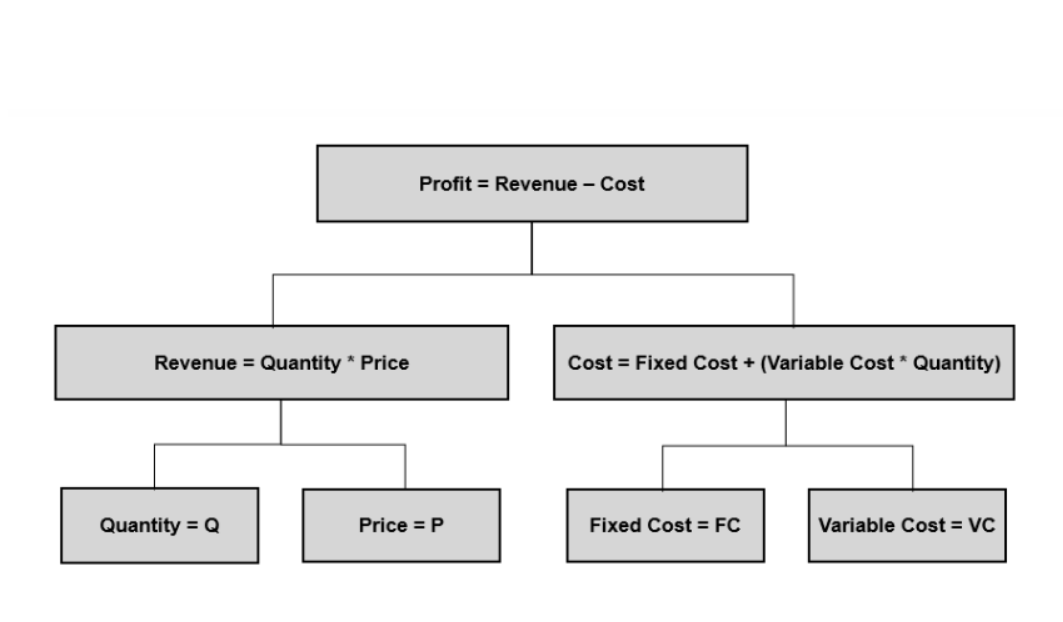

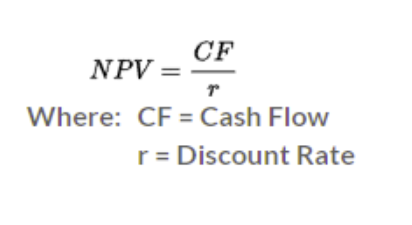

You should know the following basic profit formulas.

Is the decline in profitability due to a decline in revenue, an increase in costs, or both?

On the revenue side, what is causing the decline? Is it from a decrease in quantity of units sold? If so, is the decrease concentrated in a particular product line, geography, or customer segment?

Or is the decline due to a decrease in price? Are we selling products at a lower price? Is there a sales mix change? In other words, are we selling more low-priced products and fewer high-priced products?

On the cost side, what is causing the increase in costs? Is it from an increase in variable costs? If so, which cost elements have gone up?

Or is the increase in costs due to an increase in fixed costs? If so, which fixed costs have gone up?

Next, you need to understand qualitatively, what factors are driving the decline in profitability that you identified in the previous step.

Looking at customers, have customer needs or preferences changed? Have their purchasing habits or behaviors changed? Have their perceptions of the company changed?

Looking at competitors, have new players entered the market? Have existing competitors made any recent strategic moves? Are competitors also experiencing a decline in profitability?

Looking at the market, are there any market trends that we should be aware of? For example, are there new technology or regulatory changes? How do these trends impact profitability?

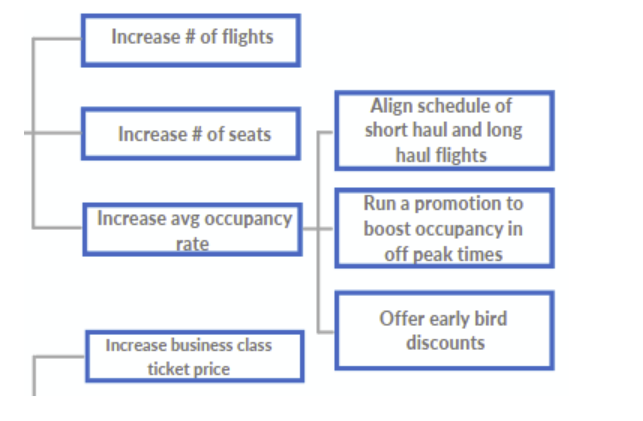

Putting all of this together, we get the following profitability framework.

Once you have gone through this profitability framework and understand both quantitatively what is causing the decline in profits and qualitatively why this is happening, you can begin brainstorming ideas to address the profitability issue.

Among the ideas that you brainstorm, you can prioritize which recommendations to focus on based on the level of impact and ease of implementation.

See the video below for an example of how to solve a profitability case using this profitability framework.

Market entry frameworks are the second most common types of frameworks you’ll likely use in consulting first round interviews.

A market entry case might look like this: “Coca-Cola is considering entering the beer market in the United States. Should they enter?”

To create a market entry framework, there are typically four statements that need to be true in order for you to recommend entering the market:

- The market is attractive

- Competition is weak

- The company has the capabilities to enter

- The company will be highly profitable from entering the market

These statements form the foundation of our market entry framework.

Note the logical order of the buckets in the framework.

We first want to determine whether the market is attractive. Then, we need to check if competition is weak and if there is an opportunity to capture meaningful market share.

If these two conditions are true, then we need to confirm that the company actually has the capabilities to enter the market.

Finally, even if the company has the capabilities to enter the market, we need to verify that they will be profitable from entering.

This is a logical progression that your market entry framework will take you through to develop a recommendation for market entry cases.

Merger and acquisition frameworks are also common frameworks you’ll use in consulting interviews.

There are two common business situations.

The first situation is a company looking to acquire another company in order to access a new market, access new customers, or to grow its revenues and profits.

Another situation is a private equity company looking to acquire a company as an investment. Their goal is to then grow the business using their operational expertise and then sell the company years later for a high return on investment. This type of case interview is called a private equity case interview .

In either of these situations, mergers and acquisition cases typically involve acquiring an attractive, successful company.

It is rare to get a case in which a company or private equity firm is looking to acquire a poorly performing company to purchase at a discount. Nevertheless, you can always clarify the goal of the merger or acquisition with the interviewer before beginning the case.

In order to recommend making an acquisition, four statements need to be true.

- The market that the acquisition target is in is attractive

- The acquisition target is an attractive company

- The acquisition generates meaningful synergies

- The acquisition target is at a great price and will generate high returns on investment

These statements become the basis of our merger and acquisition framework.

Synergies is an area that should absolutely be included in any merger or acquisition framework. A merger or acquisition can lead to revenue synergies and cost synergies.

Revenue synergies include:

- Having access to new customer segments

- Having access to new markets

- Having access to new distribution channels

- Cross-selling opportunities

- Up-selling opportunities

Cost synergies include:

- Eliminating cost redundancies

- Consolidating functions or groups

- Increasing buying power with suppliers, manufacturers, distributors, or retailers

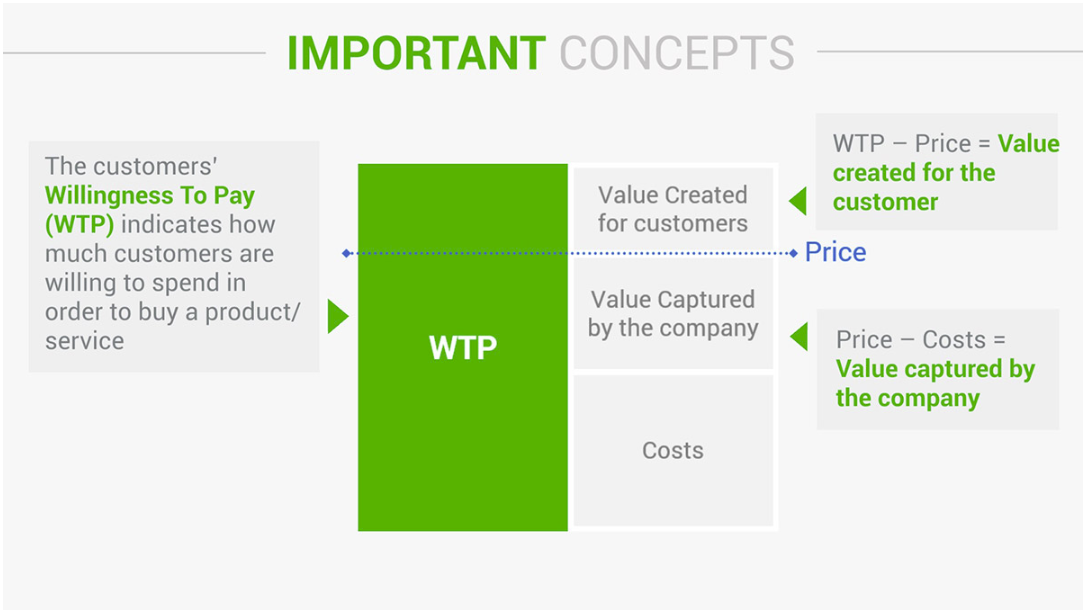

Pricing frameworks are used in cases involving the pricing of a product or service. To develop a pricing framework, you should be familiar with the three different ways to price a product or service.

- Pricing based on costs : set a price by applying a profit margin on the total costs to produce or deliver the product or service

- Pricing based on competition : set a price based on what competitors are charging for products similar to yours

- Pricing based on value added : set a price by quantifying the benefits that the product provides customers

Your answer to pricing cases will likely involve a mix of all three of these pricing strategies.

Your pricing framework will look something like the following.

Pricing based on costs will determine the minimum price you can realistically set. Pricing based on value added will determine the maximum possible price. Pricing based on competition will determine which price in between these two price points you should set.

In order to get customers to purchase your product, the difference between your price point and the customer’s maximum willingness to pay must be greater than or equal to the difference between your competitor’s price point and the customer’s maximum willingness to pay for their product.

New product frameworks are used to help a company decide whether or not to launch a product or service.

New product frameworks share many similarities with market entry frameworks. In order to recommend launching a new product, the following statements would need to be true:

- The product targets an attractive market segment

- The product meets customer needs and is superior to competitor products

- The company has the capabilities to successfully launch the product

- Launching the product will be highly profitable

Expanding on these areas, your new product framework could look like the following:

A comprehensive guide to market sizing questions and market sizing frameworks can be found in our comprehensive market sizing article. You can also watch the video below:

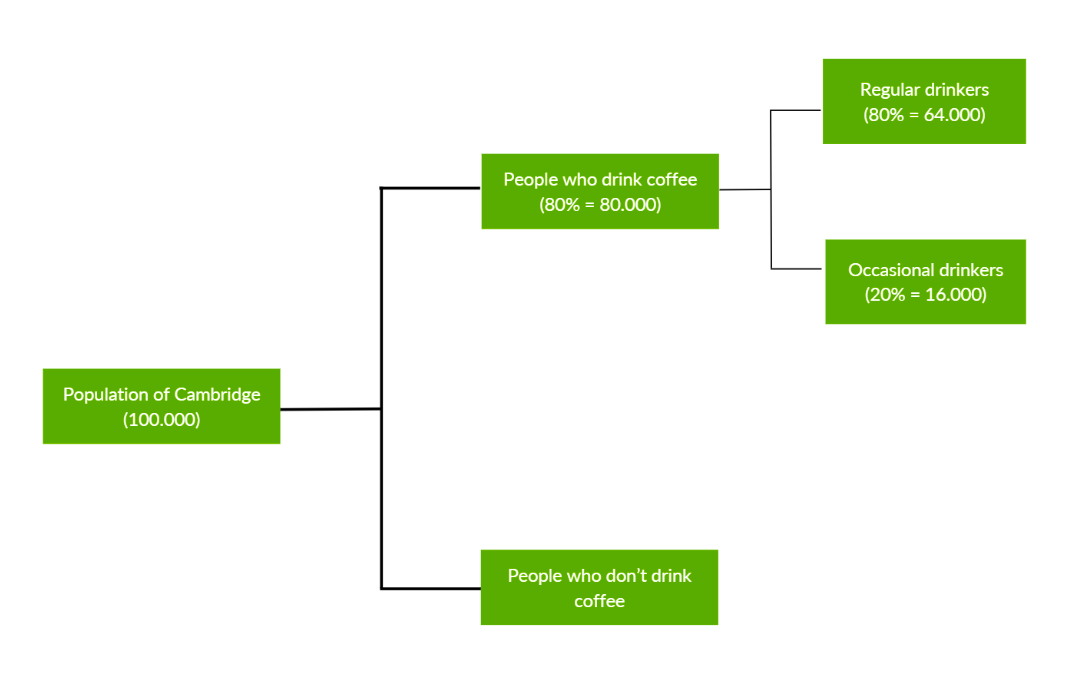

As a summary, market sizing or estimation questions ask you to determine the size of a particular market or to estimate a particular figure.

There are two different market sizing frameworks or approaches:

- Top-down approach : start with a large number and then refine and break down the number until you get your answer

- Bottom-up approach : start with a small number and then build up and increase the number until you get your answer

To create your market sizing framework, simply write out in bullet points, the exact steps you would take to calculate the requested market size or estimation figure.

Consulting Frameworks Every Consultant Knows

There are six consulting frameworks that nearly every consultant knows.

I would not recommend using these exact frameworks during a case interview because the interviewer may think you are just regurgitating memorized information instead of thinking critically about the case.

Instead use the four framework strategies that we covered earlier in this article to create tailored and unique frameworks for each case.

Nevertheless, it is helpful to review these common consulting frameworks in order to understand the fundamental concepts and business principles behind them.

Porter’s Five Forces framework was developed by Harvard Business School professor Michael Porter. This framework is used to analyze the attractiveness of a particular industry.

There are five forces that determine whether an industry is attractive or unattractive.

Competitive rivalry: How competitive is the industry?

The more competitive an industry is in terms of number and strength of competitors, the less attractive the industry is. The less competitive an industry is, the more attractive the industry is.

Supplier power: How much power do suppliers have?

Suppliers are companies that provide the raw materials for your company to produce goods or services. The fewer suppliers there are, the more bargaining power suppliers have in setting prices. The more suppliers there are, the weaker bargaining power suppliers have in setting prices.

Therefore, high supplier power makes the industry less attractive while low supplier power makes the industry more attractive.

Buyer power: How much power do buyers have?

Buyers are customers or companies that purchase your company’s product. The more buyers there are, the weaker bargaining power buyers have in setting prices. The fewer buyers there are, the more bargaining power buyers have in setting prices.

Therefore, high buyer power makes the industry less attractive while low buyer power makes the industry more attractive.

Threat of substitution: How difficult is it for customers to find and use substitutes over your product?

The availability of many substitutes makes the industry less attractive while a lack of substitutes makes the industry more attractive

Threat of new entry: How difficult is it for new players to enter the market?

If barriers to entry are high, then it is difficult for new players to enter the market and it is easier for existing players to maintain their market share.

If barriers to entry are low, then it is easy for new players to enter the market and more difficult for existing players to maintain their market share.

A low threat of new entrants makes the market more attractive while a high threat of new entrants makes the market less attractive.

A SWOT framework is used to assess a company’s strategic position. SWOT stands for strengths, weaknesses, opportunities, and threats.

Strengths : What does the company do well? What qualities separate them from competitors?

Weaknesses : What does the company do poorly? What are the things that competitors do better?

Opportunities : Where are the company’s opportunities for growth or improvement?

Threats : Who are the most threatening competitors? What are the major risks to the company’s business?

The 4 P’s framework is used to develop a marketing strategy for a product. The 4 P’s in this framework are: product, place, promotion, and price.

Product : If there are multiple products or different versions of a product, you will need to decide which product to market. To do this, you will need to fully understand the benefits and points of differentiation of each product.

Select the product that best fits customer needs for the customer segment you are focusing on.

Place : You will need to decide where the product will be sold to customers. Different customer segments have different purchasing habits and behaviors. Therefore, some distribution channels will be more effective than others.

Should the product be sold directly to the customer online? Should the product be sold in the company’s stores? Should the product be sold through retail partners instead?

Promotion : You will need to decide how to spread information about the product to customers. Different customer segments have different media consumption habits and preferences. Therefore, some promotional strategies will be more effective than others.

Promotional techniques and strategies include advertising, social media marketing, email marketing, search engine marketing, video marketing, and public relations. Select the strategies and techniques that will be the most effective.

Price : You will need to decide how to price the product. Pricing is important because it determines the profits and the quantity of units sold. Pricing can also communicate information on the quality or value of the product.

If you price the product too high, you may be pricing the product above your customer segment’s willingness to pay. This would lead to lost sales.

If you price the product too low, you may be losing potential profit from customers who were willing to pay a higher price. You may also be losing profits from customers who perceive the product as low-quality due to a low price point.

In deciding on a price, you can consider the costs to produce the product, the prices of other similar products, and the value that you are providing to customers.

The 3 C’s framework is used to develop a business strategy for a company. 3 C’s stands for customers, competition, and company.

The business situation framework was developed by a former McKinsey consultant, Victor Cheng, who added a fourth component to this framework, product.

Both of these frameworks are used to develop a business strategy for a company in a variety of situations, such as market entry, new product launch, and acquisition.

There is another similar framework called the 4C framework that expands upon the 3 C's. The 4C framework stands for customer, competition, capabilities, and cost.

The BCG 2x2 Matrix Framework was developed by BCG founder Bruce Hendersen. It is used to examine all of the different businesses of a company to determine which businesses the company should invest in and focus on.

The BCG 2x2 Matrix has two different dimensions:

- Market growth : How quickly is the market growing?

- Relative market share : How much market share does the company have compared to competitors?

Each business of the company can be assessed on these two dimensions on a scale of low to high. This is what creates the 2x2 Matrix because it creates four different quadrants.

Each quadrant has a recommended strategy.

- Stars : These are businesses that have high market growth rate and high relative market share. These businesses should be heavily invested in so they can continue to grow.

- Cows : These are businesses that have low market growth rate, but high relative market share. These businesses should be maintained since they are stable, profitable businesses.

- Dogs : These are businesses that have low market growth rate and low relative market share. These businesses should not be invested in and should possibly even be divested to free up cash for other businesses.

- Unknown : These are businesses that have high market growth rate and low relative market share. The strategy for these businesses is not clear. With enough investment, these businesses could become stars. However, these businesses could also become dogs if the market growth slows or declines.

The McKinsey 7S Framework was developed by two former McKinsey consultants, Tom Peters and Robert Waterman. The 7S Framework identifies seven elements that a company needs to align on in order to be successful.

These elements are:

- Strategy : The company’s plan to grow and outcompete competitors

- Structure : The organization of the company

- Systems : The company’s daily activities and processes

- Shared values : The core beliefs, values, or mission of the company

- Style : The style of leadership or management used

- Staff : The employees that are hired

- Skills : The capabilities of the company’s employees

Land your Dream Consulting Job

Here are the resources we recommend to land your dream consulting job:

For help landing consulting interviews

- Resume Review & Editing : Transform your resume into one that will get you multiple consulting interviews

For help passing case interviews

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Case Interview Coaching : Personalized, one-on-one coaching with a former Bain interviewer.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

For help passing consulting behavioral & fit interviews

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer.

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

S T R E E T OF W A L L S

Consulting case study interview: overview.

Case Studies are the critical part of the consulting interview process—the “heart and soul,” if you will. However, they are very challenging. They can be so challenging, in fact, that they scare many people who might otherwise be interested in Management Consulting into simply not applying. Therefore preparing for Case Studies—from becoming comfortable with the concept all the way up to being ready and confident for the Case, whatever it may be—is one of the most important things a prospective Consultant must do in the Consulting recruiting process.

First, let’s ponder an important question: why do Management Consulting firms focus so much on Case Studies as part of the interview process? After all, the firm already knows your work experience, your grades and all your accomplishments, from your resume and other portions of the interview process. Why run the risk of scaring off so much good potential talent, or threatening their candidacy for the job with such a (seemingly) daunting interview component?

The key reason is very simple: that the case interviews are highly reflective of the daily work of a Consultant . Thinking on your feet, being structured and articulate in communication, synthesizing information, and demonstrating your ability to respond well under pressure are all central to being effective in the Consulting industry. Case studies offer a method to evaluate who the firm believes will be the best Consultants among many qualified and talented candidates. In other words: it doesn’t matter how much “raw talent” you have—if you cannot succeed in the Case Studies portion of Consulting interviews, there is a good chance that Consulting may not be the right field for you.

Importantly, many corporations (e.g. Microsoft, Google, etc.) and financial industry firms (such as hedge funds and private equity firms) have followed the Consulting industry’s lead by developing Case Study interview methodologies of their own. In each case, the core concept of Case Study-oriented interviewing has been tweaked to fit the demands and specifics of the relevant firm or industry. For example, high-tech firms that have adopted this framework tend to ask about technology-oriented cases, while hedge funds and private equity firms use Case Studies that are more investments-oriented. We believe, therefore, that this training guide can be very effective for individuals applying for jobs in those areas as well.

We recommend that all Management Consulting job candidates, as well as individuals applying for jobs where Case Studies are an important part of the process, review all the concepts and methodologies laid out in this training guide and practice an enormous number of cases to successfully crack the cases.

Case Study Basics

Here are the basics. First, there are two predominant types of Case Study interview questions: Business Situation Case Studies and Guesstimate Case Studies. Business Situation Case Studies are typically more involved and often require specific frameworks (or a selection of possible frameworks) to address well. These cases require a high degree of structure in order to summarize the issues and drill down into them effectively. Guesstimate Case Studies tend to be smaller/shorter, and require a strong ability to determine the important factors in making an estimation, as well as to actually do the math behind the estimation. Each of these types of Case Study questions is addressed directly in a separate chapter later in this guide.

Another category of Case Study questions is the “Brainteaser” category. We also address this question type in a separate chapter at the end of this training guide. However please note that this category is less common than the others, and is becoming even less common. Part of the reason for this is that the issue being tested in “Brainteasers” is more “hit or miss.” A job candidate might get lucky in determining what the core issue is in a “Brainteaser” case, while another candidate, otherwise highly skilled, might simply draw a blank. There is a consensus among some Consultants, therefore, that “Brainteaser” questions are not as predictive as Business Situation Cases and Guesstimate Cases.

When you are given a Case Study question of any type, the following areas will be tracked and graded by the interviewing Consultant as you respond:

- Ability to structure ideas in an effective way. Can the candidate quickly enumerate and prioritize the issues? Is the overall approach to the problems posed in the case systematic and organized? Is the approach appropriate given the type of information available?

- Ability to communicate articulately and concisely. Can the candidate communicate the issues and priorities back to the interviewer in a lucid way? Can he or she ask appropriate questions and quickly and accurately dive deeper into puzzling issues?

- Numerical/quantitative ability. How comfortable is the candidate with quickly performing numerical analysis in his or her head or on a piece of paper? Can he or she estimate accurately and efficiently? Is the overall quantitative approach systematic and accurate?

- “Thinking on your feet” under pressure. Does the candidate demonstrate comfort and confidence as the analysis of the case proceeds? If a candidate gets stuck on an issue, does he or she convey the ability to maintain composure and recover effectively?

- Ability to synthesize information. Can the candidate aggregate the information and analysis in a cohesive way to “see the big picture” and provide targeted, actionable, and accurate recommendations?

Responding to a Case Study

There is a general approach that applies to responding to Case Studies that you should take into account as you practice cases. Case studies vary in type and style, but these general points apply to all cases whether they are open-ended looking for a series of recommendations or seeking a specific numerical answer.

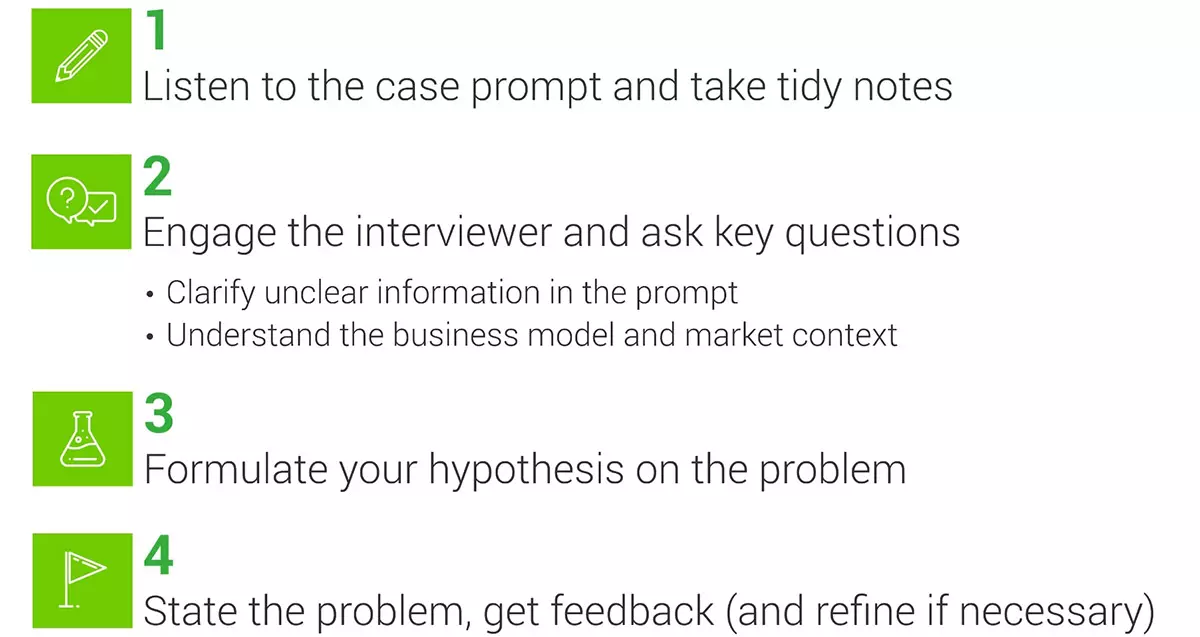

- Understand and Address the Question : Listen carefully when the interviewer outlines the case. Take brief notes if you need to, and don’t be afraid to proceed deliberately with this if you need to. Be certain you understand the case and what the interviewer is asking you to conclude (e.g. size of market, the reasons profit is falling, a specific number or a range of numbers, etc.). You are allowed to, and it is expected that you will, ask questions to better understand the case and deliverables. Asking questions and interacting with the interviewer shows an ability to be composed under pressure . As needed, clarify the case facts/questions to the interviewer and the outcome/conclusion that you will provide (For example: “The facts are x and y ; and I will ultimately provide a series of recommendations about how to improve profitability… Am I understanding the situation correctly?”). Always accept the facts and advice offered by the interviewer ; this is not the time to attempt to show that you are smarter than the interviewer. Do not be concerned about being repetitive—it is more important to be sure that you are answering the right question . Many nervous applicants start to answer the question before they understand what they are being asked to do.

- Structure your Analysis: Before launching in to the analysis, clearly outline your initial ideas/thoughts/plan and share it with the interviewer. A simple outline structure helps you to keep your analysis and answer structured, which is important. It is better to be articulate, coherent and mostly correct than come across as disorganized and completely correct. (Remember, the interviewer needs to be confident that he or she can put you in front of a client.) Also, at times the interviewer might help guide you in a different direction if you outline your plan for the analysis, which is actually a good sign. Listen carefully to any guidance or revisions and be flexible. Address any insights/direction offered by the interviewer. You are more than permitted to ask for extra time to prepare your structure/answer. In fact, if you need it, we insist upon it!

- Analyze : Work through your outline to ask questions, drill down on issues, perform back-of the envelope calculations, and ultimately arrive at an answer. Think/analyze out loud in order to make this part of the process interactive with the interviewer. Just like in a real-live case, the interviewer will likely engage in your thought process. Continue to ask questions about the approach you are taking or for any missing information. Keep in mind that solution-oriented questions are better than open-ended questions. For example, “I will run the analysis this way; does that sound reasonable to you?” is superior to “How should I run the analysis?”. Listen carefully to any input/insights provided by the interviewer, and integrate them into your thought process. (One reliable sign that you are not on the right track is if the Consultant offers some specific guidance that you don’t use!) Carefully organize your sub-answers and assumptions (highlighting them), so that they can be easily accessed and altered at a later point if required. Ultimately, you hope to arrive at the best answer possible in a short time frame, but don’t rush . Remember, in most cases there is no perfect answer, but there are good ones (thorough, thoughtful, and well-communicated) and there are not-so-good ones.

- Company filings

- Industry data (often available from trade organizations)

- Company Investor Relations presentations

- Interviews with Industry experts (through LinkedIn or an expert network)

- Relevant media articles

In responding to Consulting Case Study questions, your thought process should always go back to this 4-step process . An effective way to remember this is to drill the following into your mind: “ Understand , Structure , Analyze , and Answer .”

Additional Case Study Tips

- Being structured and articulate is the most important component of your response. Always think structure, structure, structure .

- Don’t be afraid to be original—creative approaches and ideas often gain traction from interviewers. But make sure the “creative” answer has a logical underpinning. In other words, make sure your approach will lead to an interesting, thought-provoking result.

- Use the frameworks and concepts laid out in later chapters of this training guide, but do not try and fit each Case Study response into one specific framework. Case Studies are not that simple—often there will be no best framework to address a problem, which means you will need to do a lot of probing to determine the best course of action. Or, there may be multiple aspects to a case that need to be analyzed separately in different ways. Trying to “shoehorn” a Case into a specific framework will be obvious to the interviewer, and will generally result in a poor performance.

- Develop an opinion on the Case as your analysis proceeds and more information becomes clear to you. You should remain flexible on this, because there might be a twist, but don’t be ambivalent. A note on this: don’t jump to conclusions, either. Wait until there seems to be sufficient information to indicate that one direction or result is far more likely to be correct than its alternatives.

- Discuss the “So what?” aspect of an answer. If you figure out an answer, you are generally only half way there. Evaluating the “So what?” piece—the implications of your analysis and recommendations—will set you apart from other candidates. For example: “The market size in Turkey for widgets is approximately $x billion; so what does that imply?” A good response might be: “That market size is attractive, we should advise Company ABC to enter that market; furthermore, the widget market in Turkey appears to be growing more rapidly than in other countries in the region, which makes the opportunity even more attractive.”

- Most Case Studies will require you to make some assumptions. When making assumptions, be sure to voice the logic behind the assumption; think it through first, if necessary. For example, if you decide to assume that sales volume will be flat (no growth) on the U.S. West Coast, be sure to say why—for example, something like “the economic situation is challenging and there is unlikely to be any market growth unless this changes” would be helpful.

- Always round up or down for numbers and percentages. Estimation of this type will be helpful in getting through the math quickly—remember, in most cases it is more important to come up with an approximate number quickly than an exact number very slowly. Practice your math speed, and get used to adding, dividing and multiplying large estimated numbers (division shortcuts, working with powers of ten, estimating compounded growth, etc.). We estimate that about 10 hours of practice with this can make you about 25% faster at “back-of-the-envelope” math of this type—this is a key skill that Consultants use on a regular basis.

- Draw from personal examples and experiences, but keep the stories and anecdotes succinct and articulate. And remember that you don’t need to do this, so don’t dredge for examples that either don’t exist or don’t fit the case. They are helpful, but you can also do perfectly fine on a case without using examples from your experience.

- Maintain reasonable eye contact with the interviewer, as though you were talking with a friend.

- Importantly: no matter what happens, stay composed, energetic and confident. Be positive as you work through the issues and don’t get flustered. These cases are challenging, but they can also be extremely interesting and thought-provoking. Have fun and smile as you work through them!

- Case Interview: A comprehensive guide

- Pyramid Principle

- Hypothesis driven structure

- Fit Interview

- Consulting math

- The key to landing your consulting job

- What is a case interview?

- Types of case interview

- How to solve cases with the Problem-Driven Structure?

- Inside the consultant's mind

- Building blocks

- How do I prepare for case interviews

- Interview day tips

- How we can help

1. The key to landing your consulting job.

A case interview is a core element of the consulting recruitment process at top firms like McKinsey, Bain, and BCG (the “MBB” firms). During a case interview, you will be asked to solve a business case study , which challenges you to think critically and strategically, just like a real consultant. Beyond MBB, firms like LEK, Kearney, Oliver Wyman, and the Big Four (PwC, Deloitte, EY, KPMG) also use case study interviews as a major component of their hiring process.

Why Case Interviews Are Essential

If your goal is to land a role at one of these prestigious consulting firms, you’ll need to master multiple case interviews . These interviews test your ability to think on your feet, structure complex problems, and provide actionable business solutions. Successfully cracking a consulting case interview is a critical step in consulting interview preparation .

The Rise of Online Case Interviews

In addition to traditional face-to-face case interviews , firms are increasingly adopting online case interview formats . Many candidates now face AI-driven case studies or cases delivered by chatbots. These assessments might occur before the actual interview or in tandem with first-round consulting interviews . Knowing how to approach these online assessments is key to staying competitive in today’s consulting interview process .

Why You Need to Prepare Thoroughly for Case Interviews

It’s important to note that case interviews are not something you can approach casually or "wing." Consulting firms explicitly expect candidates to be well-prepared , and many of your competitors will have been practicing for months. Lack of preparation is a major reason why candidates fail. That’s where MCC is here to guide you every step of the way !

What This Guide Will Cover

This guide provides a comprehensive overview of consulting case interviews . You’ll learn everything from how to approach case studies like a consultant to mastering the emerging online case formats . Along the way, we’ll direct you to more detailed articles and resources that let you dive deeper into key aspects of the consulting interview process .

If you prefer a video guide, you can watch the video below:

Key Topics Covered:

- What is the standard format of a case interview?

- What skills are firms like McKinsey, Bain, and BCG looking for?

- How are candidates assessed in case interviews?

- What strategies can you use to ace a consulting case study?

With these insights, you’ll have a clear understanding of what to expect and how to excel in your consulting case interviews . Let’s get started!

Professional help

Before we go any further, if this feels overwhelming, don’t worry — we’re here to help! Whether you need guidance to refine your preparation or prefer an experienced consultant to guide you through the entire selection process, we’ve got you covered. Explore our tailored coaching packages below.

2. What is a Case Interview?

A case interview simulates real consulting work by having you solve a business case study in conversation with your interviewer. You’ll be tasked with advising a client (an imaginary business or organization) on how to solve a problem or make a decision. Your job is to analyze the provided information and make a final recommendation.

While some business problems may seem straightforward, consulting firms focus on solving complex, unique issues that require creative, non-standard solutions.

Examples of case questions include:

- How much would you pay for a banking license in Ghana?

- Estimate the potential value of the electric vehicle market in Germany.

- How much gas storage capacity should a UK domestic energy supplier build?

Consulting firms seek bright minds to work on these challenging, real-world problems. You’ll need to think outside the box and be prepared for novel solutions during your interview.

2.1. Where Are Case Interviews in the Consulting Selection Process?

Not everyone who applies to a consulting firm will make it to a case interview. In fact, firms eliminate up to 80% of candidates before the interview stage. This is because case interviews are expensive and time-consuming, requiring firms to pull consultants from active projects.

Most candidates are cut based on their resumes and performance in aptitude tests. For example, McKinsey uses its Solve assessment and resumes to eliminate over 70% of applicants before interviews.

Getting to a case interview with a top firm is already an achievement. You’ll need to get through the resume screen, aptitude tests, and possibly other assessments to reach the interview stage.

Let’s take a closer look at the selection process, including application screens, aptitude tests, and interview rounds.

2.1.1. Application Screen

A large portion of candidates are eliminated at the application stage. Resumes and cover letters are often reviewed by a combination of AI tools, recruitment staff, and consulting staff.

To improve your chances, make sure your resume and cover letter are top-notch. Check out our free resume guide and cover letter guide , or consider getting help with editing .

2.1.2. Aptitude Tests and Online Cases

The selection process has been evolving quickly, with firms increasingly using sophisticated online case studies in addition to traditional aptitude tests.

McKinsey now uses an online case as part of its Solve assessment, while BCG’s Casey chatbot directly replaces a live first-round interview. We expect these online cases to become more prevalent in the future, but they are still just simulations of live case interviews.

Whether you’re dealing with an online case or a live interview, your preparation will remain the same. You’ll still need to learn how to solve cases effectively.

2.1.3. Rounds of Interviews

Despite the rise of AI and online cases, live case interviews are still central to consulting selection. Firms will always require live interviews due to the client-facing nature of consulting.

To secure an offer from McKinsey, Bain, BCG, or a similar firm, you’ll need to complete four to six case interviews , typically split across two rounds. Each interview will last approximately 50-60 minutes.

First-round interviews usually consist of two or three case interviews, sometimes accompanied by an online case. If you perform well in the first round, you’ll be invited to a second, more challenging round. After successfully completing up to six case interviews, you may receive an offer.

2.2. Differences between first and second round interviews

Despite case interviews in the first and second round following the same format, second/final round interviews will be significantly more intense . The seniority of the interviewer, time pressure (with up to three interviews back-to-back), and the sheer value of the job at stake will likely make a second round consulting case interview one of the most challenging moments of your professional life.

There are three key differences between the two rounds:

- Time Pressure : Final round case interviews test your ability to perform under pressure, with as many as three interviews in a row and often only very small breaks between them.

- Focus : Since second round interviewers tend to be more senior (usually partners with 12+ years experience) and will be more interested in your personality and ability to handle challenges independently. Some partners will drill down into your experiences and achievements to the extreme. They want to understand how you react to challenges and your ability to identify and learn from past mistakes.

- Psychological Pressure: While case interviews in the first round are usually more focused on you simply cracking the case, second round interviewers often employ a "bad cop" strategy to test the way you react to challenges and uncertainty.

2.3. What skills do case interviews assess?

Reliably impressing your interviewers means knowing what they are looking for. This means understanding the skills you are being assessed against in some detail.

Overall, it’s important always to remember that, with case studies, there are no strict right or wrong answers. What really matters is how you think problems through, how confident you are with your conclusions and how quick you are with the back of the envelope arithmetic.

The objective of this kind of interview isn’t to get to one particular solution, but to assess your skillset. This is even true of modern online cases, where sophisticated AI algorithms score how you work as well as the solutions you generate.

If you visit McKinsey , Bain and BCG web pages on case interviews, you will find that the three firms look for very similar traits, and the same will be true of other top consultancies.

Broadly speaking, your interviewer will be evaluating you across five key areas:

2.1.1.One: Probing mind

Showing intellectual curiosity by asking relevant and insightful questions that demonstrate critical thinking and a proactive nature. For instance, if we are told that revenues for a leading supermarket chain have been declining over the last ten years, a successful candidate would ask:

“ We know revenues have declined. This could be due to price or volume. Do we know how they changed over the same period? ”

This is as opposed to a laundry list of questions like:

- Did customers change their preferences?

- Which segment has shown the decline in volume?

- Is there a price war in the industry?

2.1.2. Structure

Structure in this context means structuring a problem. This, in turn, means creating a framework - that is, a series of clear, sequential steps in order to get to a solution.

As with the case interview in general, the focus with case study structures isn’t on reaching a solution, but on how you get there.

This is the trickiest part of the case interview and the single most common reason candidates fail.

We discuss how to properly structure a case in more detail in section three. In terms of what your interviewer is looking for at high level, though, key pieces of your structure should be:

- Proper understanding of the objective of the case - Ask yourself: "What is the single crucial piece of advice that the client absolutely needs?"

- Identification of the drivers - Ask yourself: "What are the key forces that play a role in defining the outcome?"

Our Problem Driven Structure method, discussed in section three, bakes this approach in at a fundamental level. This is as opposed to the framework-based approach you will find in older case-solving

Focus on going through memorised sequences of steps too-often means failing to develop a full understanding of the case and the real key drivers.

At this link, we run through a case to illustrate the difference between a standard framework-based approach and our Problem Driven Structure method.

2.1.3. Problem Solving

You’ll be tested on your ability to identify problems and drivers, isolate causes and effects, demonstrate creativity and prioritise issues. In particular, the interviewer will look for the following skills:

- Prioritisation - Can you distinguish relevant and irrelevant facts?

- Connecting the dots - Can you connect new facts and evidence to the big picture?

- Establishing conclusions - Can you establish correct conclusions without rushing to inferences not supported by evidence?

2.1.4. Numerical Agility

In case interviews, you are expected to be quick and confident with both precise and approximated numbers. This translates to:

- Performing simple calculations quickly - Essential to solve cases quickly and impress clients with quick estimates and preliminary conclusions.

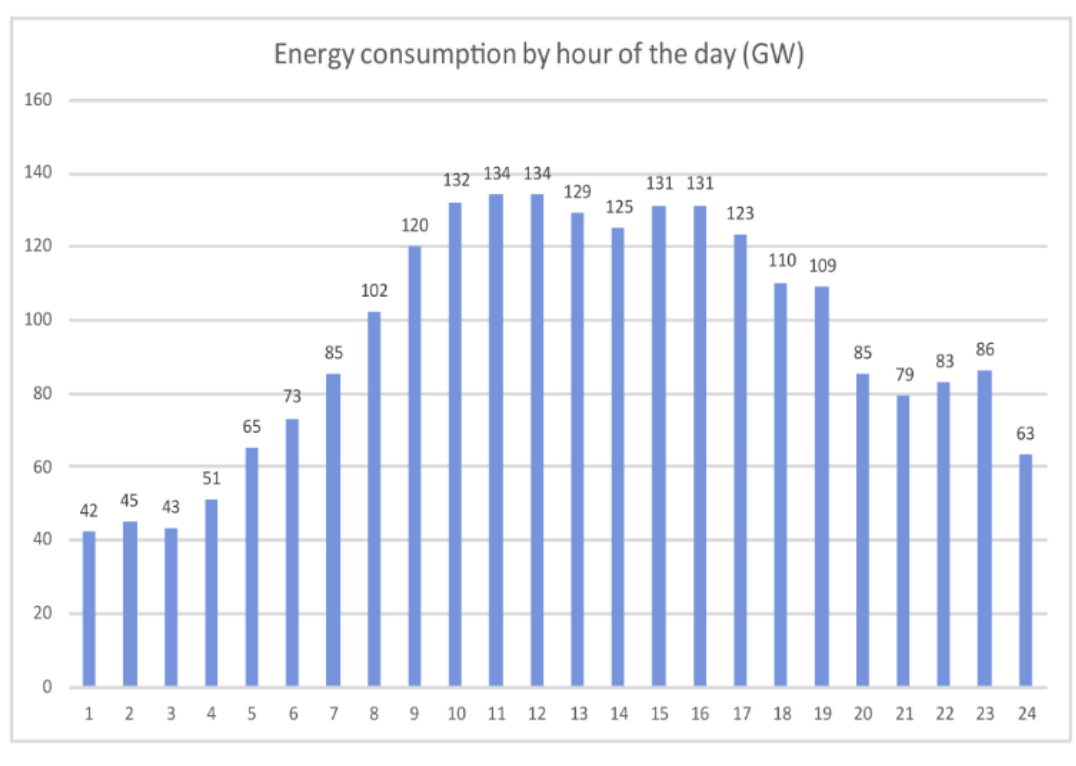

- Analysing data - Extract data from graphs and charts, elaborate and draw insightful conclusions.

- Solving business problems - Translate a real world case to a mathematical problem and solve it.

Our article on consulting math is a great resource here, though the extensive math content in our MCC Academy is the best and most comprehensive material available.

2.1.5. Communication

Real consulting work isn’t just about the raw analysis to come up with a recommendation - this then needs to be sold to the client as the right course of action.

Similarly, in a case interview, you must be able to turn your answer into a compelling recommendation. This is just as essential to impressing your interviewer as your structure and analysis.

Consultants already comment on how difficult it is to find candidates with the right communication skills. Add to this the current direction of travel, where AI will be able to automate more and more of the routine analytic side of consulting, and communication becomes a bigger and bigger part of what consultants are being paid for.

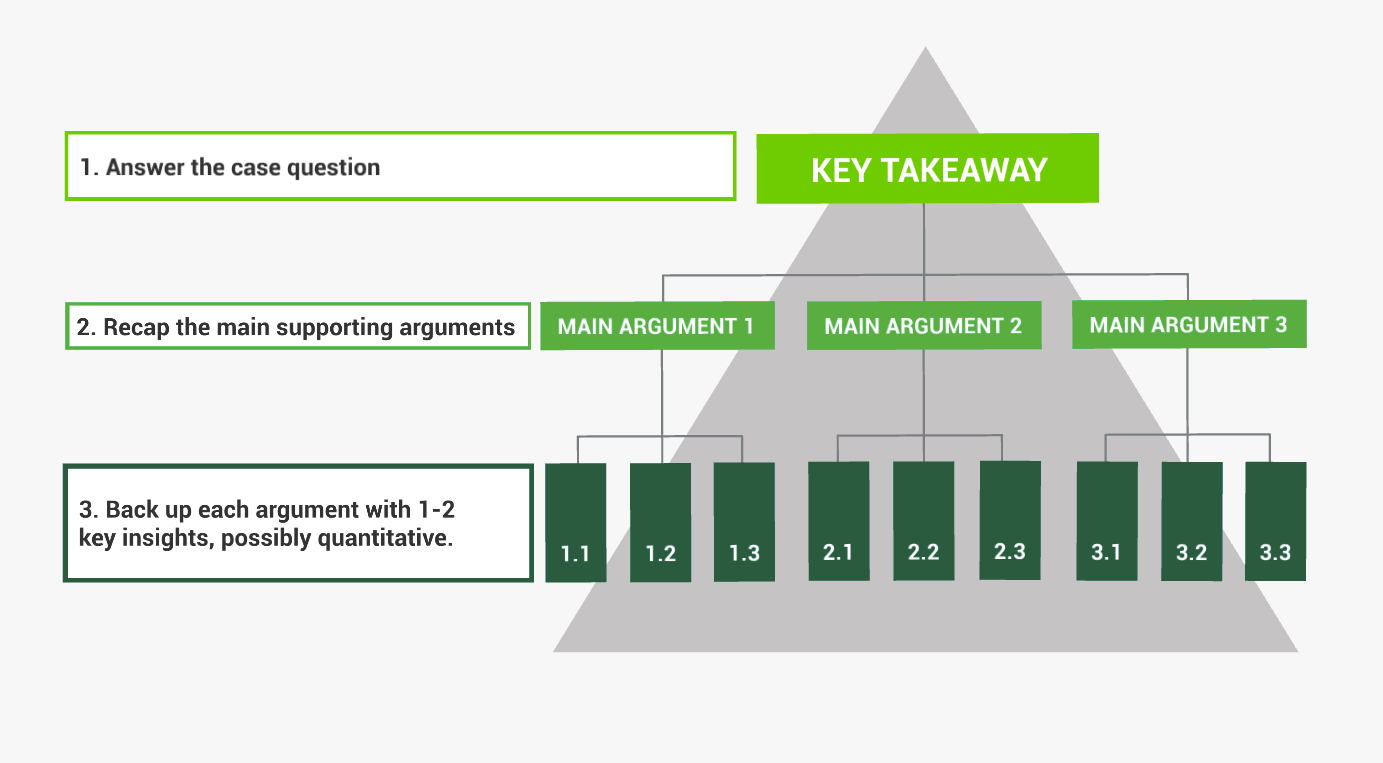

So, how do you make sure that your recommendations are relevant, smart, and engaging? The answer is to master what is known as CEO-level communication .

This art of speaking like a CEO can be quite challenging, as it often involves presenting information in effectively the opposite way to how you might normally.

To get it right, there are three key areas to focus on in your communications:

- Top down : A CEO wants to hear the key message first. They will only ask for more details if they think that will actually be useful. Always consider what is absolutely critical for the CEO to know, and start with that. You can read more in our article on the Pyramid Principle .

- Concise : This is not the time for "boiling the ocean" or listing an endless number possible solutions. CEOs, and thus consultants, want a structured, quick and concise recommendation for their business problem, that they can implement immediately.

- Fact-based : Consultants share CEOs' hatred of opinions based on gut feel rather than facts. They want recommendations based on facts to make sure they are actually in control. Always go on to back up your conclusions with the relevant facts.

Being concise and to the point is key in many areas, networking being one for them. For more detail on all this, check out our full article on delivering recommendations .

Prep the right way

3. types of case interview.

While most case interviews share a similar structure, firms will have some differences in the particular ways they like to do things in terms of both the case study and the fit component.

As we’ll see, these differences aren’t hugely impactful in terms of how you prepare. That said, it's always good to know as much as possible about what you will be going up against.

3.1. Different case objectives

A guiding thread throughout this article and our approach in general will be to treat each case as a self-contained problem and not try to pigeonhole it into a certain category. Having said that, there are of course similarities between cases and we can identify certain parameters and objectives.

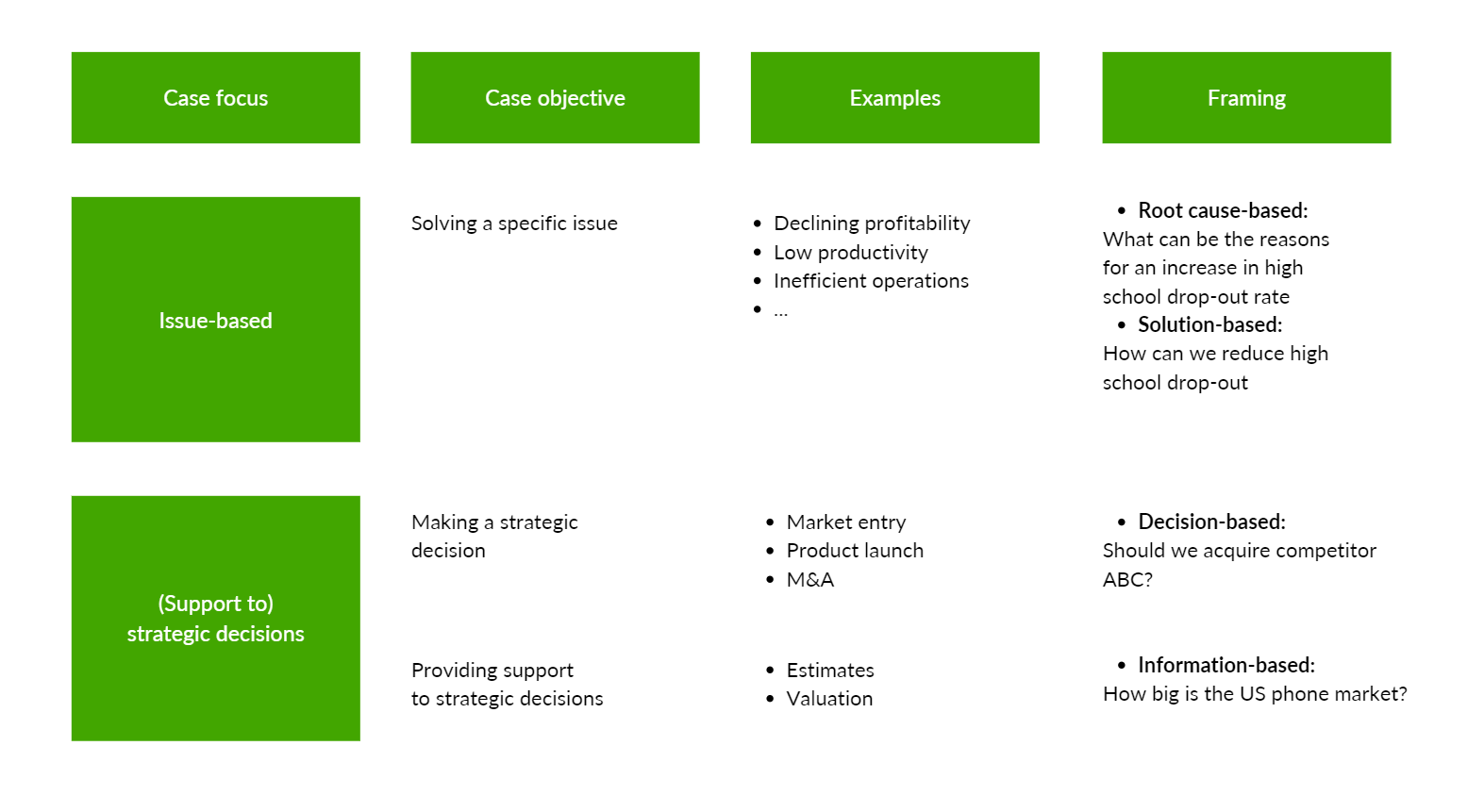

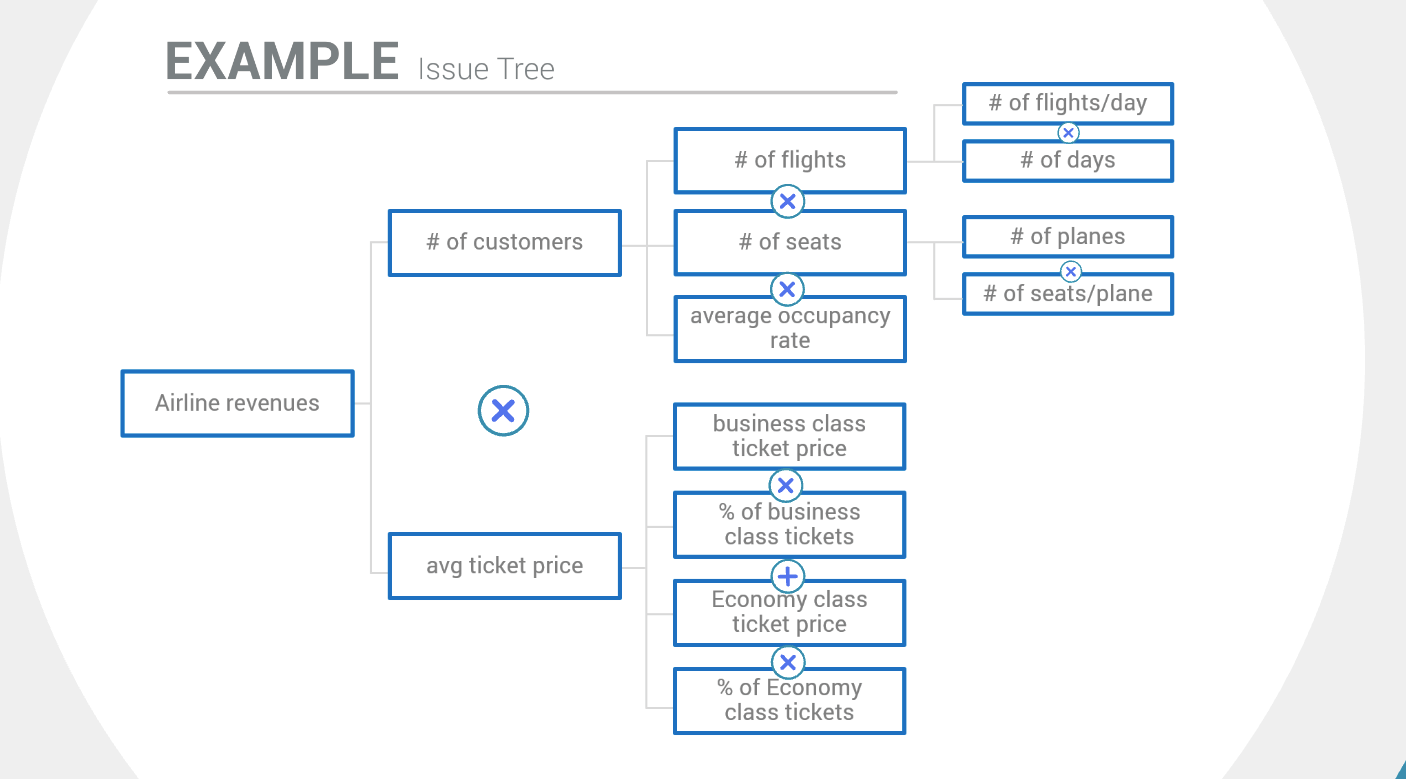

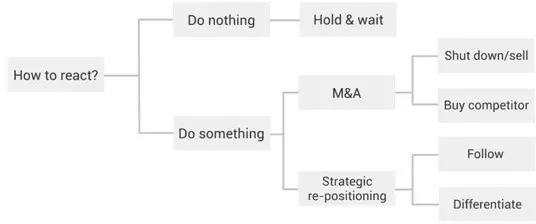

Broadly speaking, cases can be divided into issue-based cases and strategic decision cases. In the former you will be asked to solve a certain issue, such as declining profits, or low productivity whereas in the latter you will be ask whether your client should or should not do something, such as enter a specific market or acquire another company. The chart below is a good breakdown of these different objectives:

3.2. How do interviewers craft cases

While interviewers will very likely be given a case bank to choose from by their company, a good number of them will also choose to adapt the cases they would currently be working on to a case interview setting. The difference is that the latter cases will be harder to pigeonhole and apply standard frameworks to, so a tailored approach will be paramount.

If you’ve applied for a specific practice or type of consulting - such as operational consulting, for example - it’s very likely that you will receive a case geared towards that particular area alongside a ‘generalist’ consulting case (however, if that’s the case, you will generally be notified). The other main distinction when it comes to case interviews is between interviewer-led and candidate-led.

3.3. Candidate-led cases

Most consulting case interview questions test your ability to crack a broad problem, with a case prompt often going something like:

" How much would you pay to secure the rights to run a restaurant in the British Museum? "

You, as a candidate, are then expected to identify your path to solve the case (that is, provide a structure), leveraging your interviewer to collect the data and test your assumptions.

This is known as a “candidate-led” case interview and is used by Bain, BCG and other firms. From a structuring perspective, it’s easier to lose direction in a candidate-led case as there are no sign-posts along the way. As such, you need to come up with an approach that is both broad enough to cover all of the potential drivers in a case but also tailored enough to the problem you are asked to solve. It’s also up to you to figure out when you need to delve deeper into a certain branch of the case, brainstorm or ask for data. The following case from Bain is an excellent example on how to navigate a candidate-led case.

3.4. Interviewer-led cases

This type of case - employed most famously by McKinsey - is slightly different, with the interviewer controlling the pace and direction of the conversation much more than with other case interviews.

At McKinsey, your interviewer will ask you a set of pre-determined questions, regardless of your initial structure. For each question, you will have to understand the problem, come up with a mini structure, ask for additional data (if necessary) and come to the conclusion that answers the question. This more structured format of case also shows up in online cases by other firms - notably including BCG’s Casey chatbot (with the amusing result that practising McKinsey-style cases can be a great addition when prepping for BCG).

Essentially, these interviewer-led case studies are large cases made up of lots of mini-cases. You still use basically the same method as you would for standard (or candidate-led) cases - the main difference is simply that, instead of using that method to solve one big case, you are solving several mini-cases sequentially. These cases are easier to follow as the interviewer will guide you in the right direction. However, this doesn’t mean you should pay less attention to structure and deliver a generic framework! Also, usually (but not always!) the first question will ask you to map your approach and is the equivalent of the structuring question in candidate-led cases. Sometimes, if you’re missing key elements, the interviewer might prompt you in the right direction - so make sure to take those prompts seriously as they are there to help you get back on track (ask for 30 seconds to think on the prompt and structure your approach). Other times - and this is a less fortunate scenario - the interviewer might say nothing and simply move on to the next question. This is why you should put just as much thought (if not more) into the framework you build for interviewer-led cases , as you may be penalized if you produce something too generic or that doesn’t encompass all the issues of the case.

3.5. Case and fit

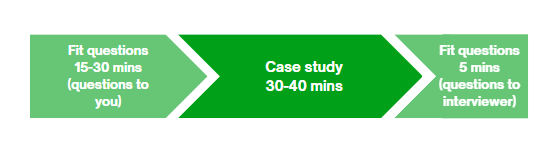

The standard case interview can be thought of as splitting into two standalone sub-interviews. Thus “case interviews” can be divided into the case study itself and a “fit interview” section, where culture fit questions are asked.

This can lead to a bit of confusion, as the actual case interview component might take up as little as half of your scheduled “case interview”. You need to make sure you are ready for both aspects.

To illustrate, here is the typical case interview timeline:

- First 15-30 minutes: Fit Interview - with questions assessing your motivation to be a consultant in that specific firm and your traits around leadership and teamwork. Learn more about the fit interview in our in-depth article here .

- Next 30-40 minutes: Case Interview - solving a case study

- Last 5 minutes: Fit Interview again - this time focussing on your questions for your interviewer.

Both the Case and Fit interviews play crucial roles in the finial hiring decision. There is no “average” taken between case and fit interviews: if your performance is not up to scratch in either of the two, you will not be able to move on to the next interview round or get an offer.

NB: No case without fit

Note that, even if you have only been told you are having a case interview or otherwise are just doing a case study, always be prepared to answer fit questions. At most firms, it is standard practice to include some fit questions in all case interviews, even if there are also separate explicit fit interviews, and interviewers will almost invariably include some of these questions around your case. This is perfectly natural - imagine how odd and artificial it would be to show up to an interview, simply do a case and leave again, without talking about anything else with the interviewer before or after.

3.5.2. The McKinsey PEI

McKinsey brands its fit aspect of interviews as the Personal Experience Interview or PEI. Despite the different name, this is really much the same interview you will be going up against in Bain, BCG and any similar firms.

McKinsey does have a reputation for pushing candidates a little harder with fit or PEI questions , focusing on one story per interview and drilling down further into the specific details each time. We discuss this tendency more in our fit interview article . However, no top end firm is going to go easy on you and you should absolutely be ready for the same level of grilling at Bain, BCG and others. Thus any difference isn’t hugely salient in terms of prep.

3.6. What is different in 2024?

For the foreseeable future, you are going to have to go through multiple live case interviews to secure any decent consulting job. These might increasingly happen via Zoom rather than in person, but they should remain largely the same otherwise.

However, things are changing and the rise of AI in recent months seems pretty much guaranteed to accelerate existing trends.

Even before the explosive development of AI chatbots like ChatGPT we have seen in recent months, automation was already starting to change the recruitment process.

As we mentioned, case interviews are expensive and inconvenient for firms to run . Ideally, then, firms will try to reduce the number of interviews required for recruitment as far as possible. For many years, tests of various kinds served to cut down the applicant pool and thus the number of interviews. However, these tests had a limited capacity to assess candidates against the full consulting skillset in the way that case interviews do so well.