- Set up your Design System Workshop

- Tečaj: oblikovalski sistem

- UI tečaj: od ideje do prototipa

- DSG Newsletter

- The Design Strategy Cards

- The Ultimate Design Strategy e-book

- Free Design Strategy Crash Course

No products in the cart.

How to conduct user research: A step-by-step guide

This is part one of a guide to User research.

Continue with part two: How to conduct user research: A Step-by-step guide

Continue with part three: What is exploratory research and why is it so exciting?

What user research did you conduct to reveal your ideal user?

Uh-oh. Not this question again. We both know the most common answer and it’s not great.

“Uhm, we talked to some users and had a brainstorming session with our team. It’s not much, but we don’t have time to do anything more right now. It’s better than nothing.”

Let’s be brutally honest about the meaning of that answer and rephrase it:

“ We don’t have time to get to know our actual user and maximize our chances of success. We’ll just assume that we know what they want and then wonder why the product fails at a later stage.”

If that sounds super bad, it’s because IT IS. You don’t want to end up in this situation. And you won’t.

After reading this guide, you’ll know exactly how to carry out the user research that will become your guiding star during product development.

On this page

Why is user research so important?

Step #1: define research objectives.

Go ahead – create that fake persona

Step #2: Pick your methods

Qualitative methods – the why, quantitative methods – the what, behavioral and attitudinal methods, step #3: find your participants, how to recruit participants, how many participants, step #4: conduct user research.

Focus groups

Competitive analysis

Field studies

What’s next?

User research can be a scary word. It may sound like money you don’t have, time you can’t spare, and expertise you need to find. That’s why some people convince themselves that it’s not that important.

Which is a HUGE mistake.

User research is crucial – without it, you’ll spend your energy, time and money on a product that is based around false assumptions that won’t work in the real world.

Let’s take a look at Segway, a technologically brilliant product with incredible introductory publicity. Although it’s still around, it simply didn’t reach initial expectations. Here are some of the reasons why:

- It brought mockery, not admiration. The user was always “that guy”, who often felt fat or lazy.

- Cities were not prepared for it. Neither users nor policemen knew if it should be used on the road or on the sidewalk.

- A large segment of the target market comprised of postal and security workers. However, postal workers need both hands while walking, and security workers prefer bikes that don’t have a limited range.

Segway mainly fell short because of issues that could’ve been foreseen and solved by better user research.

Tim Brown, the CEO of the innovation and design firm IDEO, sums it up nicely:

“Empathy is at the heart of design. Without the understanding of what others see, feel, and experience, design is a pointless task.”

? Bonus material Download User research checklist and a comparison table

Never forget – you are not your user.

You require proper user research to understand your user’s problems, pain points, needs, desires, feelings and behaviours.

Let’s start with the process!

Before you get in touch with your target users, you need to define why you are doing the research in the first place.

Establish clear objectives and agree with your team on your exact goals – this will make it much easier to gain valuable insights. Otherwise, your findings will be all over the place.

Here are some sample questions that will help you to define your objectives:

- What do you want to uncover?

- What are the knowledge gaps that you need to fill?

- What is already working and what isn’t?

- Is there a problem that needs to be fixed? What is that problem?

- What will the research bring to the business and/or your customers?

Once you start answering questions like these, it’s time to make a list of objectives. These should be specific and concise .

Let’s say you are making a travel recommendation app. Your research goals could be:

- Understand the end-to-end process of how participants are currently making travel decisions.

- Uncover the different tools that participants are using to make travel decisions.

- Identify problems or barriers that they encounter when making travel decisions.

I suggest that you prioritize your objectives and create an Excel table. It will come in handy later.

Go ahead, create that fake persona

A useful exercise for you to do at this stage is to write down some hypotheses about your target users.

Ask yourself:

What do we think we understand about our users that is relevant to our business or product?

Yes, brainstorm the heck out of this persona, but keep it relevant to the topic at hand.

Here’s my empathy map and empathy map canvas to really help you flesh out your imaginary user.

Once you’re finished, research any and every statement , need and desire with real people.

It’s a simple yet effective way to create questions for some of the research methods that you’ll be using.

However, you need to be prepared to throw some of your assumptions out of the window. If you think this persona may affect your bias, don’t bother with hypotheses and dive straight into research with a completely open mind.

Alright, you have your research goals. Now let’s see how you can reach them.

Here’s the main question you should be asking yourself at this step in the process:

Based on our time and manpower, what methods should we select?

It’s essential to pick the right method at the right time . I’ll delve into more details on specific methods in Step #4. For now, let’s take a quick look at what categories you can choose from.

Qualitative research tells you ‘why’ something occurs. It tells you the reasons behind the behavior, the problem or the desire. It answers questions like: “ Why do you prefer using app X instead of other similar apps?” or “What’s the hardest part about being a sales manager? Why?” .

Qualitative data comes in the form of actual insights and it’s fairly easy to understand.

Most of the methods we’ll look at in Step #4 are qualitative methods.

Quantitative research helps you to understand what is happening by providing different metrics.

It answers questions such as “What percentage of users left their shopping cart without completing the purchase?” or “Is it better to have a big or small subscription button?”.

Most quantitative methods come in handy when testing your product, but not so much when you’re researching your users. This is because they don’t tell you why particular trends or patterns occur.

There is a big difference between “what people do” and “what people say”.

As their names imply, attitudinal research is used to understand or measure attitudes and beliefs, whereas behavioral research is used to measure and observe behaviors.

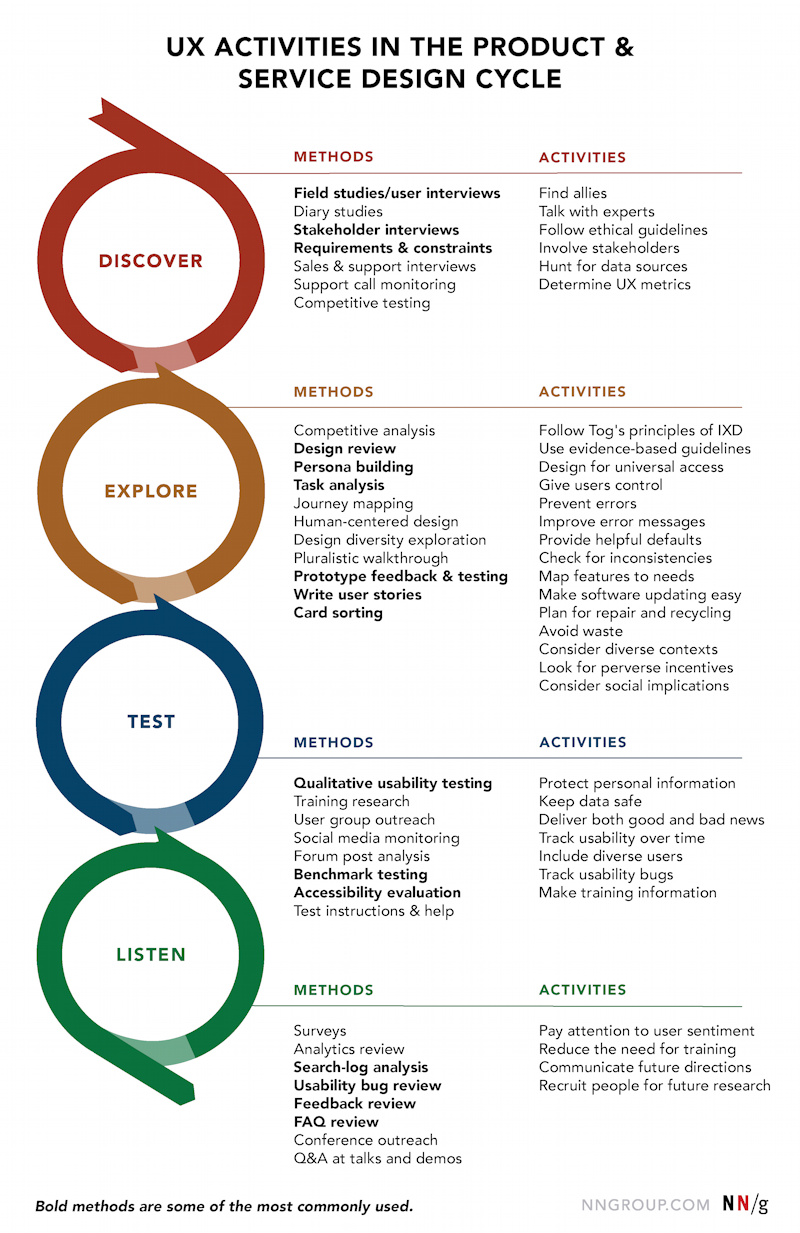

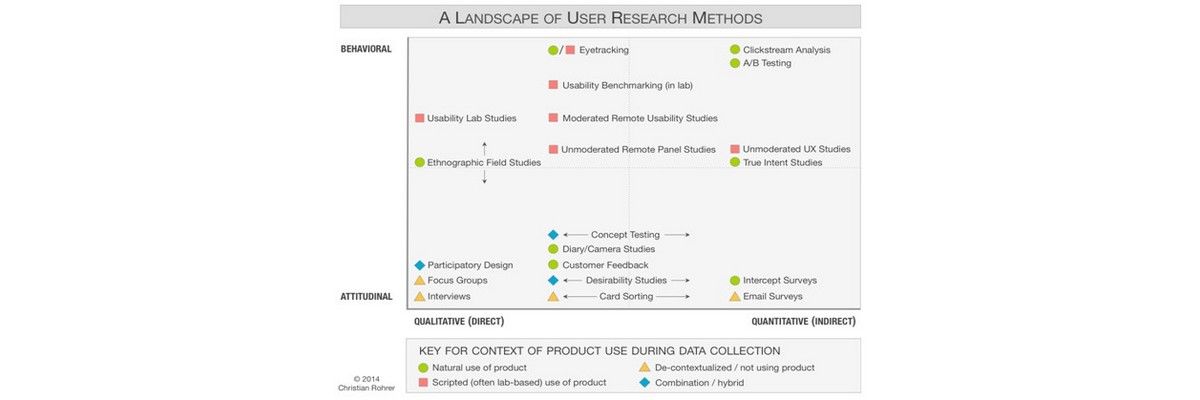

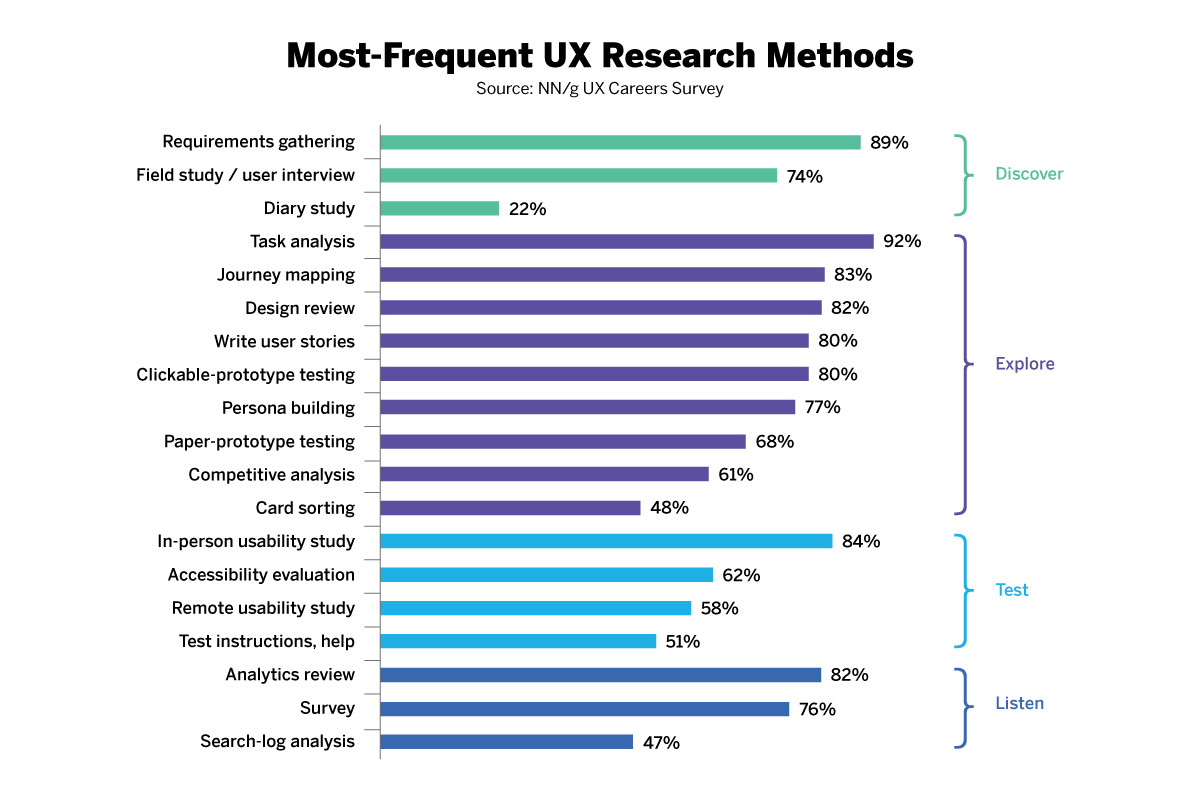

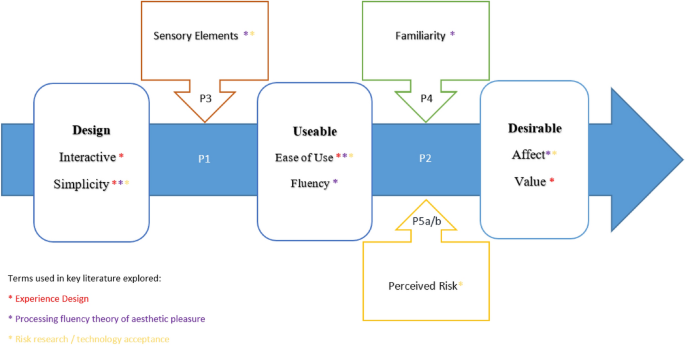

Here’s a practical landscape that will help you choose the best methods for you. If it doesn’t make sense now, return to it once you’ve finished the guide and you’ll have a much better understanding.

Source: Nielsen Norman Group

I’ll give you my own suggestions and tips about the most common and useful methods in Step #4 – Conducting research.

In general, if your objectives are specific enough, it shouldn’t be too hard to see which methods will help you achieve them.

Remember that Excel table? Choose a method or two that will fulfill each objective and type it in the column beside it.

It won’t always be possible to carry out everything you’ve written down. If this is the case, go with the method(s) that will give you most of the answers. With your table, it will be easy to pick and choose the most effective options for you.

Onto the next step!

This stage is all about channeling your inner Sherlock and finding the people with the secret intel for your product’s success.

Consider your niche, your objectives and your methods – this should give you a general idea of the group or groups you want to talk to and research further.

Here’s my advice for most cases.

If you’re building something from the ground up, the best participants might be:

- People you assume face the problem that your product aims to solve

- Your competitors’ customers

If you are developing something or solving a problem for an existing product, you should also take a look at:

- Advocates and super-users

- Customers who have recently churned

- Users who tried to sign up or buy but decided not to commit

There are plenty of ways to bring on participants, and you can get creative so long as you keep your desired target group in mind.

You can recruit them online – via social media, online forums or niche community sites.

You can publish an ad with requirements and offer some kind of incentive.

You can always use a recruitment agency, too. This can be costly, but it’s also efficient.

If you have a user database and are changing or improving your product, you can find your participants in there. Make sure that you contact plenty of your existing users, as most of them won’t respond.

You can even ask your friends to recommend the right kind of people who you wouldn’t otherwise know.

With that said, you should always be wary of including friends in your research . Sure, they’re the easiest people to reach, but your friendship can (and probably will) get in the way of obtaining honest answers. There are plenty of horror stories about people validating their “brilliant” ideas with their friends, only to lose a fortune in the future. Only consider them if you are 100% sure that they will speak their mind no matter what.

That depends on the method. If you’re not holding a massive online survey, you can usually start with 5 people in each segment . That’s enough to get the most important unique insights. You can then assess the situation and decide whether or not you need to expand your research.

Finally! Let’s go through some of the more common methods you’ll be using, including their pros and cons, some pro tips, and when you should use them.

Engaging in one-on-one discussions with users enables you to acquire detailed information about a user’s attitudes, desires, and experiences. Individual concerns and misunderstandings can be directly addressed and cleared up on the spot.

Interviews are time-consuming, especially on a per participant basis. You have to prepare for them, conduct them, analyze them and sometimes even transcribe them. They also limit your sample size, which can be problematic. The quality of your data will depend on the ability of your interviewer, and hiring an expert can be expensive.

- Prepare questions that stick to your main topics. Include follow-up questions for when you want to dig deeper into certain areas.

- Record the interview . Don’t rely on your notes. You don’t want to interrupt the flow of the interview by furiously scribbling down your answers, and you’ll need the recording for any potential in-depth analysis later on.

- Conduct at least one trial run of the interview to see if everything flows and feels right. Create a “playbook” on how the interview should move along and update it with your findings.

- If you are not comfortable with interviewing people, let someone else do it or hire an expert interviewer. You want to make people feel like they are talking to someone they know, rather than actually being interviewed. In my experience, psychologists are a great choice for an interviewer.

Interviews are not really time-sensitive, as long as you do them before the development process.

However, they can be a great supplement to online surveys and vice-versa. Conducting an interview beforehand helps you to create a more focused and relevant survey, while conducting an interview afterwards helps you to explain the survey answers.

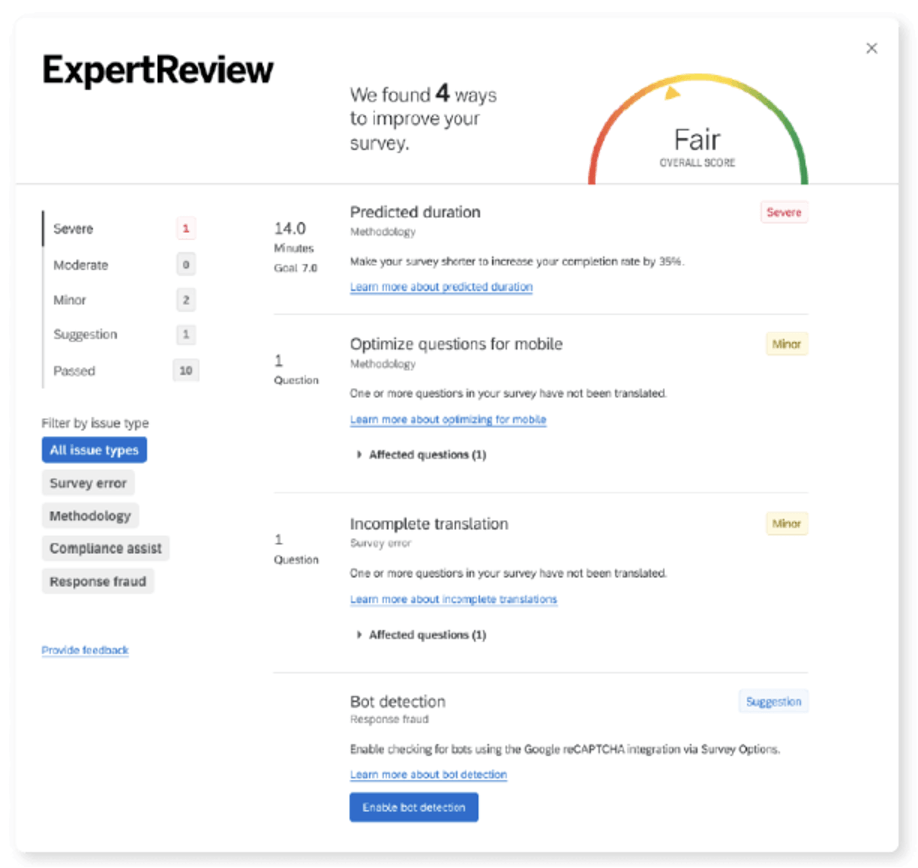

Surveys are generally conducted online, which means that it’s possible to gather a lot of data in a very short time for a very low price . Surveys are usually anonymous, so users are often more honest in their responses.

It’s more difficult to get a representative sample because it’s tough to control who takes part in the survey – especially if you post it across social media channels or general forums. Surveys are quite rigid and if you don’t account for all possible answers, you might be missing out on valuable data. You have to be very careful when choosing your questions – poorly worded or leading ones can negatively influence how users respond. Length can also be an issue, as many people hate taking long surveys.

- Keep your surveys brief , particularly if participants won’t be compensated for their time. Only focus on what is truly important.

- Make sure that the questions can be easily understood. Unclear or ambiguous questions result in data on which you can’t depend. Keep the wording as simple as possible.

- Avoid using leading questions. Don’t ask questions that assume something, such as “What do you dislike about X?”. Replace this with “What’s your experience with X?”.

- Find engaged, niche online communities that fit your user profile. You’ll get more relevant data from these.

Similar to interviews. It depends on whether you want to use the survey as a preliminary method, or if you want a lot of answers to a few, very focused questions.

Focus Groups

Focus groups are moderated discussions with around 5 to 10 participants, the intention of which is to gain insight into the individuals’ attitudes, ideas and desires.

As focus groups include multiple people, they can quickly reveal the desires, experiences, and attitudes of your target audience . They are helpful when you require a lot of specific information in a short amount of time. When conducted correctly, they can act like interviews on steroids.

Focus groups can be tough to schedule and manage. If the moderator isn’t experienced, the discussion can quickly go off-topic. There might be an alpha participant that dictates the general opinion, and because it’s not one-on-one, people won’t always speak their mind.

- Find an experienced moderator who will lead the discussion. Having another person observing and taking notes is also highly recommended, as he or she can emphasize actionable insights and catch non-verbal clues that would otherwise be missed.

- Define the scope of your research . What questions will you ask? How in-depth do you want to go with the answers? How long do you want each discussion to last? This will determine how many people and groups should be tested.

- If possible, recruit potential or existing users who are likely to provide good feedback, yet will still allow others to speak their mind. You won’t know the participants most of the time, so having an experienced moderator is crucial.

Focus groups work best when you have a few clear topics that you want to focus on.

Competitive Analysis

A competitive analysis highlights the strengths and weaknesses of existing products . It explores how successful competitors act on the market. It gives you a solid basis for other user research methods and can also uncover business opportunities. It helps you to define your competitive advantage , as well as identify different user types.

A competitive analysis can tell you what exists, but not why it exists. You may collect a long feature list, but you won’t know which features are valued most by users and which they don’t use at all. In many cases, it’s impossible to tell how well a product is doing, which makes the data less useful. It also has limited use if you’re creating something that’s relatively new to the market.

- Create a list or table of information that you want to gather – market share, prices, features, visual design language, content, etc.

- Don’t let it go stale. Update it as the market changes so that you include new competitors.

- If you find something really interesting but don’t know the reason behind it, conduct research among your competitor’s users .

- After concluding your initial user research, go over the findings of your competitive analysis to see if you’ve discovered anything that’s missing on the market .

It can be a great first method, especially if you’re likely to talk to users of your competitors’ products

Field Studies

Field studies are research activities that take place in the user’s context, rather than at your company or office. Some are purely observational (the researcher is a “fly on the wall”), others are field interviews, and some act as a demonstration of pain points in existing systems.

You really get to see the big picture – field studies allow you to gain insights that will fundamentally change your product design . You see what people actually do instead of what they say they do. A field study can explain problems and behaviours that you don’t understand better than any other method.

It’s the most time-consuming and expensive method. The results rely on the observer more than any of the other options. It’s not appropriate for products that are used in rare and specific situations.

- Establish clear objectives. Always remember why you are doing the research. Field studies can provide a variety of insights and sometimes it can be hard to stay focused. This is especially true if you are participating in the observed activity.

- Be patient. Observation might take some time. If you rush, you might end up with biased results.

- Keep an open mind and don’t ask leading questions. Be prepared to abandon your preconceptions, assumptions and beliefs. When interviewing people, try to leave any predispositions or biases at the door.

- Be warm but professional. If you conduct interviews or participate in an activity, you won’t want people around you to feel awkward or tense. Instead, you’ll want to observe how they act naturally.

Use a field study when no other method will do or if it becomes clear that you don’t really understand your user. If needed, you should conduct this as soon as possible – it can lead to monumental changes.

We started with a user persona and we’ll finish on this topic, too. But yours will be backed by research 😉

A persona outlines your ideal user in a concise and understandable way. It includes the most important insights that you’ve discovered. It makes it easier to design products around your actual users and speak their language. It’s a great way to familiarize new people on your team with your target market.

A persona is only as good as the user research behind it. Many companies create a “should be” persona instead of an actual one. Not only can such a persona be useless, it can also be misleading.

- Keep personas brief. Avoid adding unnecessary details and omit information that does not aid your decision making. If a persona document is too long, it simply won’t be used.

- Make personas specific and realistic. Avoid exaggerating and include enough detail to help you find real people that represent your ideal user.

Create these after you’ve carried out all of the initial user research. Compile your findings and create a persona that will guide your development process.

Now you know who you are creating your product for – you’ve identified their problems, needs and desires. You’ve laid the groundwork, so now it’s time to design a product that will blow your target user away! But that’s a topic for a whole separate guide, one that will take you through the process of product development and testing 😉

PS. Don’t forget -> Here is your ? User Research Checklist and comparison table

About the author

Oh hey, I’m Romina Kavcic

I am a Design Strategist who holds a Master of Business Administration. I have 14+ years of career experience in design work and consulting across both tech startups and several marquee tech unicorns such as Stellar.org, Outfit7, Databox, Xamarin, Chipolo, Singularity.NET, etc. I currently advise, coach and consult with companies on design strategy & management, visual design and user experience. My work has been published on Forbes, Hackernoon, Blockgeeks, Newsbtc, Bizjournals, and featured on Apple iTunes Store.

More about me * Let’s connect on Linkedin * Let’s connect on Twitter

Explore more

Username or email address *

Password *

Remember me Log in

Lost your password?

Insert/edit link

Enter the destination URL

Or link to existing content

How to Conduct User Experience Research Like a Professional

Whether you’re looking to develop a broad UX design skillset, or you’re exploring UX research as a design specialization , here’s your complete introduction to conducting user research like a pro.

Hello, I’m Raven, a mentor for aspiring UX designers enrolled in the CareerFoundry UX Design Course . I also work as a UX Research Assistant at IBM and studied behavioral science at the University of Texas. I have 10 years of experience studying and analyzing human behavior—user research is definitely my thing.

During the past few years, I’ve worked with major companies, academic institutions, and non-profit organizations to develop and improve impactful products and applications. I’ve moderated focus groups, designed and administered surveys, carried out usability testing, and conducted user interviews. I also know a thing or two about creating a good persona!

In this guide, we’re going to cover the basics of UX research. We’ll start with exactly what it is, and then move on to discuss the various steps and associated terminology of UX research , as well as its role and value within the broader design process . We’ll then review the most common UX research methods, diving into how they’re conducted and a few best practices.

If you’re particularly interested in one of these topics, simply select it from the list below to jump straight to it. I’ve also added videos throughout the guide for those of you who prefer to learn with both eyes and ears—and I recommend you save this set of free UX research tutorials for later, too. Sound good? Let’s get started!

Introduction To User Experience (UX) Research

- What is UX research?

- What’s the difference between good and bad UX research?

- What are the five steps of UX research?

- What’s the role of research in the UX design process?

- Whats the value of UX research?

Introduction To User Experience Research Methods

- User Groups

- Usability Testing

- User Interviews

- Online Surveys

- User Personas

- What Next? User Research Analysis

1. What is UX research?

You read my bio in the introduction. Using only this information, could you explain why I recently switched from one time management app to another? Probably not. In order to answer this question, you need more context. UX research provides that context. So, what is UX research and what is its purpose ?

“User research is how you will know your product or service will work in the real world, with real people. It’s where you will uncover or validate the user needs which should form the basis of what you are designing.”

— Chris Mears, UXr

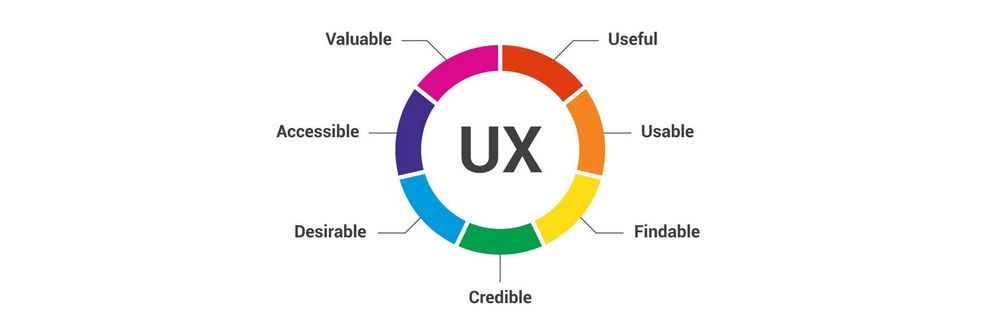

According to Design Modo , UX research is; “The process of understanding user behaviors, needs, and attitudes using different observation and feedback collection methods.” One of the other benefits of user experience research is that it helps us understand how people live their lives so that we can respond to their needs with informed design solutions. Good UX research involves using the right method at the right time during the development of a product.

Maria Arvidsson, Head of Product and UX at Usabilla , describes UX research as:

“The means through which you try to understand your users’ needs, behaviors and motivations and validate your assumptions and solutions.”

2. What’s the difference between good and bad UX research?

The biggest sign of an amateur UX designer is excluding end users from the design process. At the very start of my career I held the attitude that I could test any app, website, or product on myself, replacing the act of speaking with users. Never a good idea. It took time for me to learn a more professional approach, which is to start the design process by listening to the end user. Overall, UX research helps us avoid our biases since we are required to design solutions for people who are not like us.

“Insights that are received directly from user experience research are like muscle memory; the more you do research, the more insights you build up. But just like muscle memory, YOU have to be a part of the hard work in order to enjoy the lasting benefits of it that are specific to you. While it may be tempting to outsource research to a specialized team (and sometimes you can’t avoid it), you should try your utmost best to engage in at least a little bit of the research so that the insights grow under your skin instead of being handed to you from someone else who has sweated it.”

—UX designer Ali Rushdan Tariq from ARTariq

A quick plug before we continue: If you’re looking to become a professional in this subdomain of UX, be sure to take a look at our guide to becoming a UX researcher

3. What are the five steps of UX research?

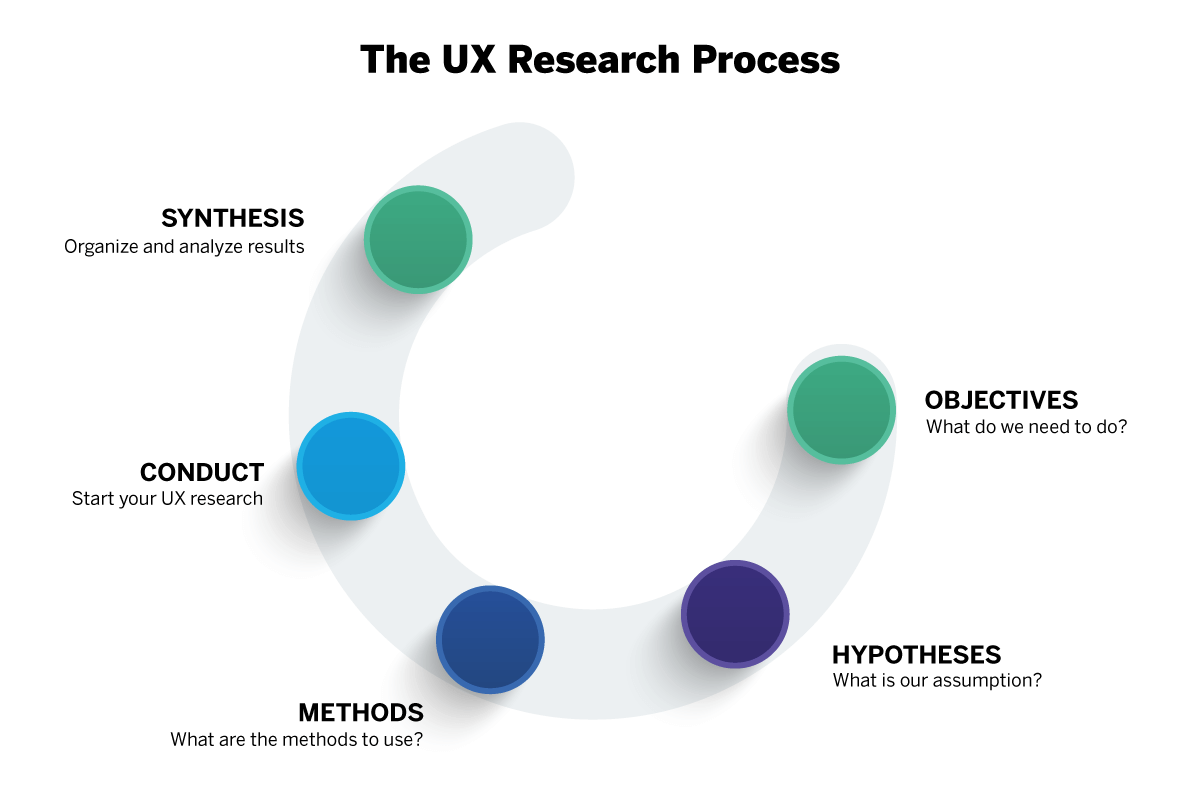

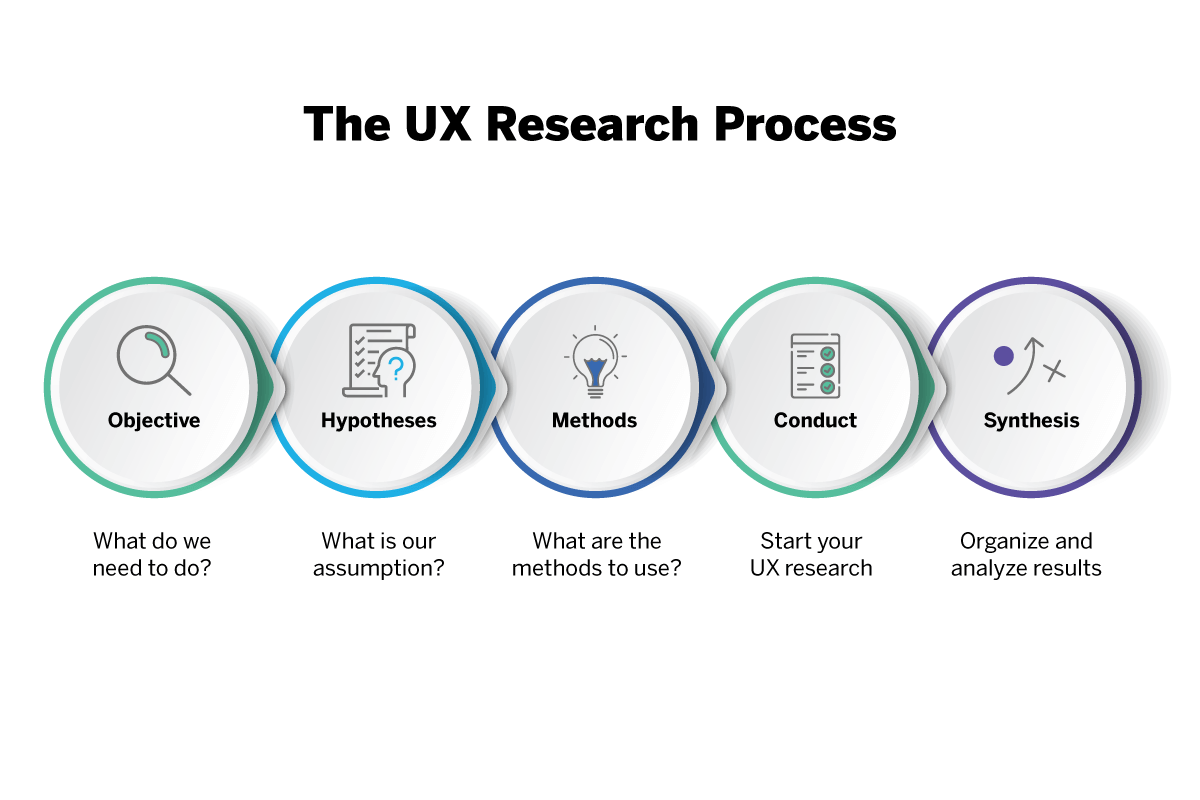

Created by Erin Sanders , the Research Learning Spiral provides five main steps for conducting UX research. The first two steps are about forming questions and hypotheses, and the last three steps are about gathering knowledge through selected UX research methods.

- Objectives: What are the knowledge gaps we need to fill?

- Hypotheses: What do we think we understand about our users?

- Methods: Based on time and manpower, what methods should we select?

- Conduct: Gather data through the selected methods.

- Synthesize: Fill in the knowledge gaps, prove or disprove our hypotheses, and discover opportunities for our design efforts.

4. What’s the role of research in the UX design process?

UX research is the starting point for a project . Research helps us learn about the users and their behavior, goals, motivations, and needs. It also shows us how they currently navigate a system, where they have problems and, most importantly, how they feel when interacting with our product.

UX research comes first in the UX design process because without it, our work can only be based on our own experiences and assumptions, which is not objective. As Neil Turner, founder of UX for the Masses told us, a good foundation is key to successful design:

“Good user research is key to designing a great user experience. Designing without good user research is like building a house without solid foundations—your design will soon start to crumble and eventually fall apart.”

5. What’s the value of UX research?

In the current digital product landscape, the real value of UX research is its ability to reduce uncertainty in terms of what users want and need , which yields benefits for the product, the business, and, of course, the users themselves.

1. Product Benefits

UX research provides data about the end user of the product, how and when the user will use the product, and the main problems the product will solve. UX research is also helpful when UX designers and the rest of the team (and stakeholders) have to decide between multiple design solutions.

2. Business Benefits

UX research brings a lot of a value to businesses. By knowing the end users and incorporating design requirements upfront, businesses can speed up the product development process, eliminate redesign costs, and increase user satisfaction.

3. User Benefits

One of the greatest values of user experience research is that it’s unbiased user feedback. Simply put, UX research speaks the user’s thoughts—without any influence from outside authority. It also serves as a bridge between users and the company.

“User experience research provides powerful insights that allow companies to humanize their customers and insert their needs, intentions, and behaviors into the design and development process. In turn, these insights enable companies to create experiences that meet—and sometimes exceed—customer needs and expectations. User experience research should be conducted well before the first sketch is drawn and integrated throughout the concept, iterative design, and launch phases of a product.”

—Janelle Estes, Director of Research Strategy at UserTesting

UX research is based on observation, understanding, and analysis. With the help of various UX research techniques, you will:

- O bserve your users , keeping an eye out for non-verbal clues as to how they are feeling;

- Develop an understanding of the user’s mental model : what does the user anticipate when using a certain product? Based on their previous experience, how do they expect this particular product to work?

- A nalyze the insights you’ve gathered and try to identify patterns and trends. Eventually, these insights will inform the decisions you make about the product and how it is designed.

With that in mind, let’s consider some of the most valuable user research techniques.

1. User Groups

User groups—also called “focus group discussions” or “focus groups”—are structured interviews that quickly and inexpensively reveal the desires, experiences, and attitudes of a target audience. User groups are a helpful user experience research method when a company needs a lot of insight in a short amount of time. If you are unsure when to use a user experience research method, user groups can be a good one to start with.

Why Do We Conduct User Groups?

User groups can help your company better understand:

1) How users perceive a product

2) What users believe are a product’s most important features

3) What problems users experience with the product

4) Where users feel the product fails to meet expectations

User groups can also be used to generate ideas of what users want to see in the future.

What people say and what people do are often very different, therefore user groups do not provide an accurate measurement of behavior . And because user groups are conducted with more than one user at a time, participants may influence each other’s opinions and preferences (aka “groupthink”), thus introducing bias and producing inaccurate data.

Best Practices For User Groups

Getting the most out of your user group is straightforward if you consider the following best practices when conducting this particular user research technique.

- Ask good questions: Make sure your questions are clear, open-ended, and focused on the topics you’re investigating.

- Choose a few topics: On average, plan to discuss 3-5 topics during a 90-minute focus group.

- Include the right amount of people: A good focus group should include 3-6 users—large enough to include a variety of perspectives, but small enough so everyone has a chance to speak.

“Conducting user research allows you to dive deep beneath the surface of what your users say they want, to instead uncover what they actually need. It’s the key to ensuring that your products and features will actually solve the problems that your clients face on a day to day basis. User research is imperative if you want to create a successful, habit forming product.”

— Jennifer Aldrich, UX and Content Strategist at InVisionApp

How To Conduct User Experience Research With User Groups

Conducting user groups can be broken down into a few major steps:

- Create a schedule that provides enough time for recruiting, testing, analyzing, and integrating results.

- Assemble your team, and establish roles: choose a moderator, note-taker, and discussion leader.

- Define the scope of your research: what questions will you ask? And how in-depth do you want to explore the answers? This will determine the number of people and the number of groups that need to be tested.

- Create a discussion guide that includes 3-5 topics for discussion.

- Recruit potential or existing users who are likely to provide good feedback.

- Conduct user group testing, and record data.

- Analyze and report findings.

“It’s really hard to design products by user groups. A lot of times, people don’t know what they want until you show it to them.”

—Steve Jobs

2. Usability Testing

According to the usability.gov website, usability testing refers to “evaluating a product or service by testing it with representative users.” During a test, participants will be asked to complete specific tasks while one or more observers watch, listen, and record notes. The main goal of this user experience testing method is to identify usability problems, collect qualitative data, and determine participants’ overall satisfaction with the product.

Why Do We Perform Usability Testing?

Usability testing helps identify problems before they are coded. When development issues are identified early on, it is typically less expensive to fix them. Usability testing also reveals how satisfied users are with the product , as well as what changes are required to improve user satisfaction and performance .

Unfortunately, usability testing is not 100% representative of the real life scenario in which a user will engage with your product. Also, because the data is qualitative, this kind of UX testing method doesn’t provide the large samples of feedback a questionnaire might. The good news it that the qualitative feedback you receive can be far more accurate and insightful.

Best Practices For Usability Testing

- Test with five users: Testing five users is typically enough to identify a design’s most important usability problems.

- Invite your team to the testing sessions: Anyone who is involved with how fast and how well problems are addressed should be invited to the usability testing sessions. These stakeholders may include the executive team, and lead developers or designers.

- Keep the findings brief and to-the-point: When you report the findings of a usability test, limit the comments to the ones that are really important. One good rule of thumb is to include the top three positive comments and the top three problems. The overall report should be no more than approximately 50 comments and 30 pages.

How to Conduct UX Research with Usability Testing

Usability testing can be broken down into a few major steps:

- Identify what needs to be tested and why (e.g. a new product, feature, etc.)

- Identify the target audience (or your desired customers).

- Create a list of tasks for the participants to work through.

- Recruit the right participants for the test.

- Involve the right stakeholders.

- Apply what you learn.

“One of usability’s most hard-earned lessons is that ‘you are not the user.’ If you work on a development project, you’re atypical by definition. Design to optimize the user experience for outsiders, not insiders.”

– Jakob Nielsen

3. User Interviews

A well-known user experience methodology is an interview. An interview is a user experience research method used to discover the attitudes, beliefs, and experiences of users (and potential users) of a product. Interviews are typically conducted by one interviewer speaking to one user at a time for 30 minutes to an hour. Interviews can take place face-to-face, over the phone, or via video streaming.

Why Do We Conduct Interviews?

Of all the user experience design methods, interviews are typically conducted at the beginning of the product development cycle when reviewing product goals. Because of the one-to-one nature of the interview, individual concerns and misunderstandings can be directly addressed and cleared up.

Face-to-face interviews also allow you to capture verbal and nonverbal cues, such as emotions and body language, which may identify enthusiasm for the product or discomfort with the questions.

When thinking about what research methodology to use, bear in mind that interviews are also a good supplement to online surveys: conducting an interview beforehand helps you refine questions for the survey, while conducting an interview afterwards allows you to gain explanations for survey answers.

There are a few drawbacks, however. First, because interviews require a team of people to conduct them, personnel costs are usually difficult to keep low. Sample size is also limited to the size of the interviewing staff.

Best Practices For User Interviews

- Hire a skilled interviewer: A skilled interviewer asks questions in a neutral manner, listens well, makes users feel comfortable, and knows when and how to probe for more details.

- Create a discussion guide: Write up a discussion guide (or an interview protocol) for all interviewers to follow. This guide should include questions and follow-up questions.

- Get informed consent: Before conducting the interview, make sure to get permission or consent to record the session. It’s also good to have one or two note takers on hand.

How To Conduct User Experience Research With User Interviews

Conducting an interview can be broken down into a few major steps:

- Prepare a discussion guide, or a list of questions to ask participants.

- Select a recording method (e.g. written notes, tape recorder, video).

- Conduct at least one trial run of the interview.

- Recruit the right participants for the interview.

- Conduct the interview.

- Analyze and report the results.

“Curiosity is a natural outcome of caring, and it is the single greatest contributor to effective user research … Caring and curiosity engender personal investment, and investment motivates a researcher to develop a deep understanding of users.”

– Demetrius Madrigal

4. Online Surveys

A survey is a research tool that typically includes a set of questions used to find out the preferences, attitudes, and opinions of your users on a given topic. Today, surveys are generally conducted online and in various lengths and formats. Data collected from surveys is received automatically, and the survey tool selected generally provides some level of analysis, the data from which can then be used for user experience studies further down the line to inform your product.

“It is so important to avoid using leading questions when it comes to surveys. It’s a common mistake that many people make. For example phrasing a question like “What do you dislike about Uber?” assumes the user has a negative preference for the service off the bat. A more neutral phrase would be “Tell us about your experience getting around town.” – this elicits more natural user feedback and behavior instead of forcing them down a funnel.”

– Top tip from UXBeginner

Why Do We Conduct Online Surveys?

Unlike traditional surveys, online surveys enable companies to quickly collect data from a broad (and sometimes remote) audience for free—or a low price. Surveys also help you discover who your users are , what your users want to accomplish, and what information your users are looking for.

Unfortunately, what users say versus what they do are two different things and can often yield inaccurate results. Furthermore, poorly worded questions can negatively influence how users respond. Length can also be an issue—many people hate taking long surveys. This is why it’s important to create short surveys so users are more likely to complete them and participate in future research efforts.

Best Practices For Online Surveys

- Keep it short: Keep your surveys brief, especially if participants will be compensated little or not at all. Only focus on what is truly important.

- Keep it simple: Make sure questions can be easily understood: ambiguous or complex wording can make questions more difficult to understand, which can bring the data into question.

- Keep it engaging: Include a mix of both multiple choice questions and open-ended questions (or questions in which users complete the answer).

How To Conduct User Experience Research With Online Surveys

Conducting an online survey can be broken down into a few major steps:

- Identify goals and objectives of the survey.

- Create survey questions.

Note: Consider collecting information about how satisfied users are with your product, what users like/dislike, and if they have suggestions for improvement.

- Select an online survey tool (e.g. SurveyMonkey, Qualtrics).

- Recruit participants.

- Conduct the survey.

“We have to arm ourselves with data, research … and a clear understanding of our users so our decisions are not made out of fear but out of real, actionable information. Although our clients may not have articulated reasons for why they want what they want, it is our responsibility to have an ironclad rationale to support our design decisions.”

– Debra Levin Gelman

5. User Personas

A user persona is a fictional representation of your ideal customer. A persona is generally based on user research and includes the needs, goals, and observed behavior patterns of your target audience. You can find out how to create a user persona in this detailed guide .

Why Do We Create User Personas?

Whether you’re developing a smartphone app or a mobile-responsive website, any user experience research job will require you to understand who will be using the product. Knowing your audience will help influence the features and design elements you choose, thus making your product more useful. A persona clarifies who is in your target audience by answering the following questions:

- Who is my ideal customer?

- What are the current behavior patterns of my users?

- What are the needs and goals of my users?

Understanding the needs of your users is vital to developing a successful product. Well-defined personas will enable you to efficiently identify and communicate user needs. Personas will also help you describe the individuals who use your product, which is essential to your overall value proposition.

Unfortunately, creating personas can be expensive — it all depends on how deep into user research your organization is willing to go. There is also no real “scientific logic” behind persona building, which makes some people a little more hesitant to accept them.

Best Practices For User Personas

- Create a well-defined user persona: A great persona contains four key pieces of information: header, demographic profile, end goal(s), scenario.

- Keep personas brief: As a rule of thumb, avoid adding extra details that cannot be used to influence the design. If it does not affect the final design or help make any decisions easier: omit it.

- Make personas specific and realistic: Avoid exaggerated caricatures, and include enough detail to help you find real-life representation.

How To Conduct User Experience Research By Creating Personas

Creating user personas can be broken down into these main steps:

- Discuss and identify who your target users are with stakeholders (e.g. UX team, marketing team, product manager).

- Survey and/or interview real users to get their demographic information, pain points, and preferences.

- Condense the research, and look for themes to define your groups.

- Organize your groups into personas.

- Test your personas.

“Be someone else. It takes great empathy to create a good experience. To create relevant experiences, you have to forget everything you know and design for others. Align with the expected patience, level of interest, and depth of knowledge of your users. Talk in the user’s language.”

– Niko Nyman

Which User Experience Research Method Should You Use?

Now that you know more about the various user experience research methods, which one do you choose? Well, it all depends on your overall research goals.

You’ll also need to consider what stage you’re at in the design process. If you’re just starting out, you’ll want to focus on understanding your users and the underlying problem . What are you trying to solve? Who are you trying to solve it for? At this early stage in the design process, you’ll typically use a mixture of both qualitative and quantitative methods such as field studies, diary studies, surveys, and data mining.

Once you’ve established a direction for your design, you’ll start to think about actually building your product. Your UX research will now focus on evaluating your designs and making sure that they adequately address your users’ needs . So, you’ll choose research methods that can help you to optimize your designs and improve usability—such as card sorting and usability testing.

Eventually, you’ll have finalized your design and developed a working product—but this doesn’t mean your research is done! This is the ideal time to investigate how well the product performs in the real world. At this point, you’ll focus mainly on quantitative research methods , such as usability benchmarking, surveys, and A/B testing.

To help you with the task of choosing your research methods, let’s explore some important distinctions between the various techniques.

Behavioral vs. Attitudinal Research

As mentioned before, there is a big difference between “what people do” versus “what people say.” Attitudinal research is used to understand or measure attitudes and beliefs, whereas behavioral research is used to measure behaviors. For example, usability testing is a behavioral user research method that focuses on action and performance. By contrast, user research methods like user groups, interviews, and persona creation focus on how people think about a product.

UX designers often conduct task analysis to see not how users say they complete tasks in a user flow, but how they actually do.

Quantitative vs. Qualitative Research

When conducting UX research and choosing a suitable method, it’s important to understand the difference between quantitative and qualitative research.

Quantitative research gathers data that is measurable. It gives you clear-cut figures to work with, such as how many users purchased an item via your e-commerce app, or what percentage of visitors added an item to their wishlist. “Quant methods”, as they’re sometimes called in the industry, help you to put a number on the usability of your product. They also allow you to compare different designs and determine if one version performs significantly better than another.

Qualitative research explores the reasons or motivations behind these actions. Why did the user bounce from your website? What made them “wishlist” an item instead of purchasing it? While quantitative data is fixed, qualitative data is more descriptive and open-ended. You can learn all about qualitative research in the video guide below, in which CareerFoundry graduate and professional UX designer Maureen Herben takes you through the most common qualitative user research processes and tools.

A further distinction to make is between how qualitative and quantitative studies go about collecting data. Studies that are qualitative in nature are based on direct observation. For example, you’ll gather data about the user’s behaviours or attitudes by observing them directly in action. Quantitative studies gather this data indirectly—through an online survey, for example.

Qualitative research methods (e.g. usability testing, user groups, interviews) are better for answering questions about why or how to fix a problem, whereas quantitative methods (e.g. online surveys) are great for answering questions about how many and how much.

Ideally, you’ll use a mixture of both qualitative and quantitative methods throughout your user research, and work hard to ensure that the UX research you conduct is inclusive !

6. What Next? Conducting User Research Analysis

Once you’ve conducted extensive user research, you’ll move on to the analysis phase. This is where you’ll turn the raw data you’ve gathered into valuable insights. The purpose of UX research analysis is to interpret what the data means; what does it tell you about the product you’re designing, and the people you’re designing it for? How can you use the data you’ve gathered to inform the design process?

Watch this video to learn how to conduct user research analysis in five simple steps:

Final thoughts

“User experience research is the work that uncovers and articulates the needs of individuals and/or groups in order to inform the design of products and services in a structured manner.”

—Nick Remis, Adaptive Path

Overall, the purpose of user experience research is simple: to discover patterns and reveal unknown insights and preferences from the people who use your product. It basically provides the context for our design. Research also helps us fight the tendency to design for ourselves (or our stakeholders)—and returns the focus on designing for the user.

If you’d like to learn more about UX research, check out these articles:

- What Does a UX Researcher Actually Do? The Ultimate Career Guide

- The Ultimate Guide to UX Research Bootcamps

- Top 5 Mistakes to Avoid in Your UX Research Portfolio

- Interview Toolkit: Top 5 UX Research Questions to Prepare For

And to get inspired, check out these 15 quotes from influential designers in the industry.

The Complete Guide to UX Research Methods

UX research provides invaluable insight into product users and what they need and value. Not only will research reduce the risk of a miscalculated guess, it will uncover new opportunities for innovation.

By Miklos Philips

Miklos is a UX designer, product design strategist, author, and speaker with more than 18 years of experience in the design field.

PREVIOUSLY AT

“Empathy is at the heart of design. Without the understanding of what others see, feel, and experience, design is a pointless task.” —Tim Brown, CEO of the innovation and design firm IDEO

User experience (UX) design is the process of designing products that are useful, easy to use, and a pleasure to engage. It’s about enhancing the entire experience people have while interacting with a product and making sure they find value, satisfaction, and delight. If a mountain peak represents that goal, employing various types of UX research is the path UX designers use to get to the top of the mountain.

User experience research is one of the most misunderstood yet critical steps in UX design. Sometimes treated as an afterthought or an unaffordable luxury, UX research, and user testing should inform every design decision.

Every product, service, or user interface designers create in the safety and comfort of their workplaces has to survive and prosper in the real world. Countless people will engage our creations in an unpredictable environment over which designers have no control. UX research is the key to grounding ideas in reality and improving the odds of success, but research can be a scary word. It may sound like money we don’t have, time we can’t spare, and expertise we have to seek.

In order to do UX research effectively—to get a clear picture of what users think and why they do what they do—e.g., to “walk a mile in the user’s shoes” as a favorite UX maxim goes, it is essential that user experience designers and product teams conduct user research often and regularly. Contingent upon time, resources, and budget, the deeper they can dive the better.

What Is UX Research?

There is a long, comprehensive list of UX design research methods employed by user researchers , but at its center is the user and how they think and behave —their needs and motivations. Typically, UX research does this through observation techniques, task analysis, and other feedback methodologies.

There are two main types of user research: quantitative (statistics: can be calculated and computed; focuses on numbers and mathematical calculations) and qualitative (insights: concerned with descriptions, which can be observed but cannot be computed).

Quantitative research is primarily exploratory research and is used to quantify the problem by way of generating numerical data or data that can be transformed into usable statistics. Some common data collection methods include various forms of surveys – online surveys , paper surveys , mobile surveys and kiosk surveys , longitudinal studies, website interceptors, online polls, and systematic observations.

This user research method may also include analytics, such as Google Analytics .

Google Analytics is part of a suite of interconnected tools that help interpret data on your site’s visitors including Data Studio , a powerful data-visualization tool, and Google Optimize, for running and analyzing dynamic A/B testing.

Quantitative data from analytics platforms should ideally be balanced with qualitative insights gathered from other UX testing methods , such as focus groups or usability testing. The analytical data will show patterns that may be useful for deciding what assumptions to test further.

Qualitative user research is a direct assessment of behavior based on observation. It’s about understanding people’s beliefs and practices on their terms. It can involve several different methods including contextual observation, ethnographic studies, interviews, field studies, and moderated usability tests.

Jakob Nielsen of the Nielsen Norman Group feels that in the case of UX research, it is better to emphasize insights (qualitative research) and that although quant has some advantages, qualitative research breaks down complicated information so it’s easy to understand, and overall delivers better results more cost effectively—in other words, it is much cheaper to find and fix problems during the design phase before you start to build. Often the most important information is not quantifiable, and he goes on to suggest that “quantitative studies are often too narrow to be useful and are sometimes directly misleading.”

Not everything that can be counted counts, and not everything that counts can be counted. William Bruce Cameron

Design research is not typical of traditional science with ethnography being its closest equivalent—effective usability is contextual and depends on a broad understanding of human behavior if it is going to work.

Nevertheless, the types of user research you can or should perform will depend on the type of site, system or app you are developing, your timeline, and your environment.

Top UX Research Methods and When to Use Them

Here are some examples of the types of user research performed at each phase of a project.

Card Sorting : Allows users to group and sort a site’s information into a logical structure that will typically drive navigation and the site’s information architecture. This helps ensure that the site structure matches the way users think.

Contextual Interviews : Enables the observation of users in their natural environment, giving you a better understanding of the way users work.

First Click Testing : A testing method focused on navigation, which can be performed on a functioning website, a prototype, or a wireframe.

Focus Groups : Moderated discussion with a group of users, allowing insight into user attitudes, ideas, and desires.

Heuristic Evaluation/Expert Review : A group of usability experts evaluating a website against a list of established guidelines .

Interviews : One-on-one discussions with users show how a particular user works. They enable you to get detailed information about a user’s attitudes, desires, and experiences.

Parallel Design : A design methodology that involves several designers pursuing the same effort simultaneously but independently, with the intention to combine the best aspects of each for the ultimate solution.

Personas : The creation of a representative user based on available data and user interviews. Though the personal details of the persona may be fictional, the information used to create the user type is not.

Prototyping : Allows the design team to explore ideas before implementing them by creating a mock-up of the site. A prototype can range from a paper mock-up to interactive HTML pages.

Surveys : A series of questions asked to multiple users of your website that help you learn about the people who visit your site.

System Usability Scale (SUS) : SUS is a technology-independent ten-item scale for subjective evaluation of the usability.

Task Analysis : Involves learning about user goals, including what users want to do on your website, and helps you understand the tasks that users will perform on your site.

Usability Testing : Identifies user frustrations and problems with a site through one-on-one sessions where a “real-life” user performs tasks on the site being studied.

Use Cases : Provide a description of how users use a particular feature of your website. They provide a detailed look at how users interact with the site, including the steps users take to accomplish each task.

You can do user research at all stages or whatever stage you are in currently. However, the Nielsen Norman Group advises that most of it be done during the earlier phases when it will have the biggest impact. They also suggest it’s a good idea to save some of your budget for additional research that may become necessary (or helpful) later in the project.

Here is a diagram listing recommended options that can be done as a project moves through the design stages. The process will vary, and may only include a few things on the list during each phase. The most frequently used methods are shown in bold.

Reasons for Doing UX Research

Here are three great reasons for doing user research :

To create a product that is truly relevant to users

- If you don’t have a clear understanding of your users and their mental models, you have no way of knowing whether your design will be relevant. A design that is not relevant to its target audience will never be a success.

To create a product that is easy and pleasurable to use

- A favorite quote from Steve Jobs: “ If the user is having a problem, it’s our problem .” If your user experience is not optimal, chances are that people will move on to another product.

To have the return on investment (ROI) of user experience design validated and be able to show:

- An improvement in performance and credibility

- Increased exposure and sales—growth in customer base

- A reduced burden on resources—more efficient work processes

Aside from the reasons mentioned above, doing user research gives insight into which features to prioritize, and in general, helps develop clarity around a project.

What Results Can I Expect from UX Research?

In the words of Mike Kuniaysky, user research is “ the process of understanding the impact of design on an audience. ”

User research has been essential to the success of behemoths like USAA and Amazon ; Joe Gebbia, CEO of Airbnb is an enthusiastic proponent, testifying that its implementation helped turn things around for the company when it was floundering as an early startup.

Some of the results generated through UX research confirm that improving the usability of a site or app will:

- Increase conversion rates

- Increase sign-ups

- Increase NPS (net promoter score)

- Increase customer satisfaction

- Increase purchase rates

- Boost loyalty to the brand

- Reduce customer service calls

Additionally, and aside from benefiting the overall user experience, the integration of UX research into the development process can:

- Minimize development time

- Reduce production costs

- Uncover valuable insights about your audience

- Give an in-depth view into users’ mental models, pain points, and goals

User research is at the core of every exceptional user experience. As the name suggests, UX is subjective—the experience that a person goes through while using a product. Therefore, it is necessary to understand the needs and goals of potential users, the context, and their tasks which are unique for each product. By selecting appropriate UX research methods and applying them rigorously, designers can shape a product’s design and can come up with products that serve both customers and businesses more effectively.

Further Reading on the Toptal Blog:

- How to Conduct Effective UX Research: A Guide

- The Value of User Research

- UX Research Methods and the Path to User Empathy

- Design Talks: Research in Action with UX Researcher Caitria O'Neill

- Swipe Right: 3 Ways to Boost Safety in Dating App Design

- How to Avoid 5 Types of Cognitive Bias in User Research

Understanding the basics

How do you do user research in ux.

UX research includes two main types: quantitative (statistical data) and qualitative (insights that can be observed but not computed), done through observation techniques, task analysis, and other feedback methodologies. The UX research methods used depend on the type of site, system, or app being developed.

What are UX methods?

There is a long list of methods employed by user research, but at its center is the user and how they think, behave—their needs and motivations. Typically, UX research does this through observation techniques, task analysis, and other UX methodologies.

What is the best research methodology for user experience design?

The type of UX methodology depends on the type of site, system or app being developed, its timeline, and environment. There are 2 main types: quantitative (statistics) and qualitative (insights).

What does a UX researcher do?

A user researcher removes the need for false assumptions and guesswork by using observation techniques, task analysis, and other feedback methodologies to understand a user’s motivation, behavior, and needs.

Why is UX research important?

UX research will help create a product that is relevant to users and is easy and pleasurable to use while boosting a product’s ROI. Aside from these reasons, user research gives insight into which features to prioritize, and in general, helps develop clarity around a project.

- UserResearch

Miklos Philips

London, United Kingdom

Member since May 20, 2016

About the author

World-class articles, delivered weekly.

Subscription implies consent to our privacy policy

Toptal Designers

- Adobe Creative Suite Experts

- Agile Designers

- AI Designers

- Art Direction Experts

- Augmented Reality Designers

- Axure Experts

- Brand Designers

- Creative Directors

- Dashboard Designers

- Digital Product Designers

- E-commerce Website Designers

- Full-Stack Designers

- Information Architecture Experts

- Interactive Designers

- Mobile App Designers

- Mockup Designers

- Presentation Designers

- Prototype Designers

- SaaS Designers

- Sketch Experts

- Squarespace Designers

- User Flow Designers

- User Research Designers

- Virtual Reality Designers

- Visual Designers

- Wireframing Experts

- View More Freelance Designers

Join the Toptal ® community.

Learn / Guides / UX research guide

Back to guides

A 7-step adaptable UX research process

Every team knows how important great UX research is for satisfying and converting users. But with so many tasks to juggle, research can get pushed to the bottom of the workflow.

You conduct research—but only in response to stakeholder requests, user complaints, or a major new web or product launch. By then, it’s too late for your research to shape your design. The result? Scrappy research and a missed opportunity to forge your product around user needs.

Last updated

Reading time.

Be proactive rather than reactive by implementing a solid user experience (UX) research process from the start. Stay tuned to learn how to structure a flexible, 7-step research process that will guide your product development and design thinking to help you generate customer delight.

Boost your UX research with Hotjar

Design confidently with Hotjar’s rich, data-informed user experience insights

Why a strong UX research process is key

The UX research process acts as the foundation for all other stages of UX design and product development.

Mar P., product researcher at Hotjar, says: “The main goal of UX research is to create a product that works for your users and your business. It's about understanding real user problems so the team can work on solutions and move away from assumptions that can lead to bad product decisions. ”

Without a strong UX research process, you’ll end up with frustrated users, low conversion and customer loyalty rates, high error and churn rates, and costly redesigns. In short, if you rely on guesswork rather than research , users suffer—and so do your business objectives and team.

What are the benefits of great UX research?

Great UX research helps you make confident UX decisions.

It lets you validate your assumptions and weed out unpromising ideas before you waste resources on them, and ensures your product is designed to delight users from the start.

Ongoing UX research is crucial to cultivating empathy for users throughout your organization . User experience data helps you solve problems and continually optimize your platform or product to meet user needs, and gives you the insights you need to get stakeholder buy-in on fixes and redesigns.

UX research is critical in validating that a team’s concepts are on the right track. It fosters alignment between an idea and the reality of what users actually want and need. UX research also allows teams to ‘fail early’ and adapt before large sums of time and money are spent.

The UX research process

Clearly, research is critical to UX design and development success.

So it can’t just happen sporadically to put out customer or stakeholder fires, or when you happen to find yourself with extra time—which, let's be honest, never happens .

Instead, engage in a structured UX research process to prioritize research and infuse all stages of UX design with data insights.

But remember: a structured process doesn’t mean a rigid process. There’s no one-size-fits-all solution to UX research: the best processes are flexible, adaptable, and tailored to the unique needs of your users, team, and business.

Use our guide to establish a solid UX research process—tweaking it throughout to fit your workflow, company culture, and customer types.

You want your UX research to inform decisions, rather than post-rationalize decisions that have already been made without customer input. That’s why you need to define a research process.

7 steps for user research with impact

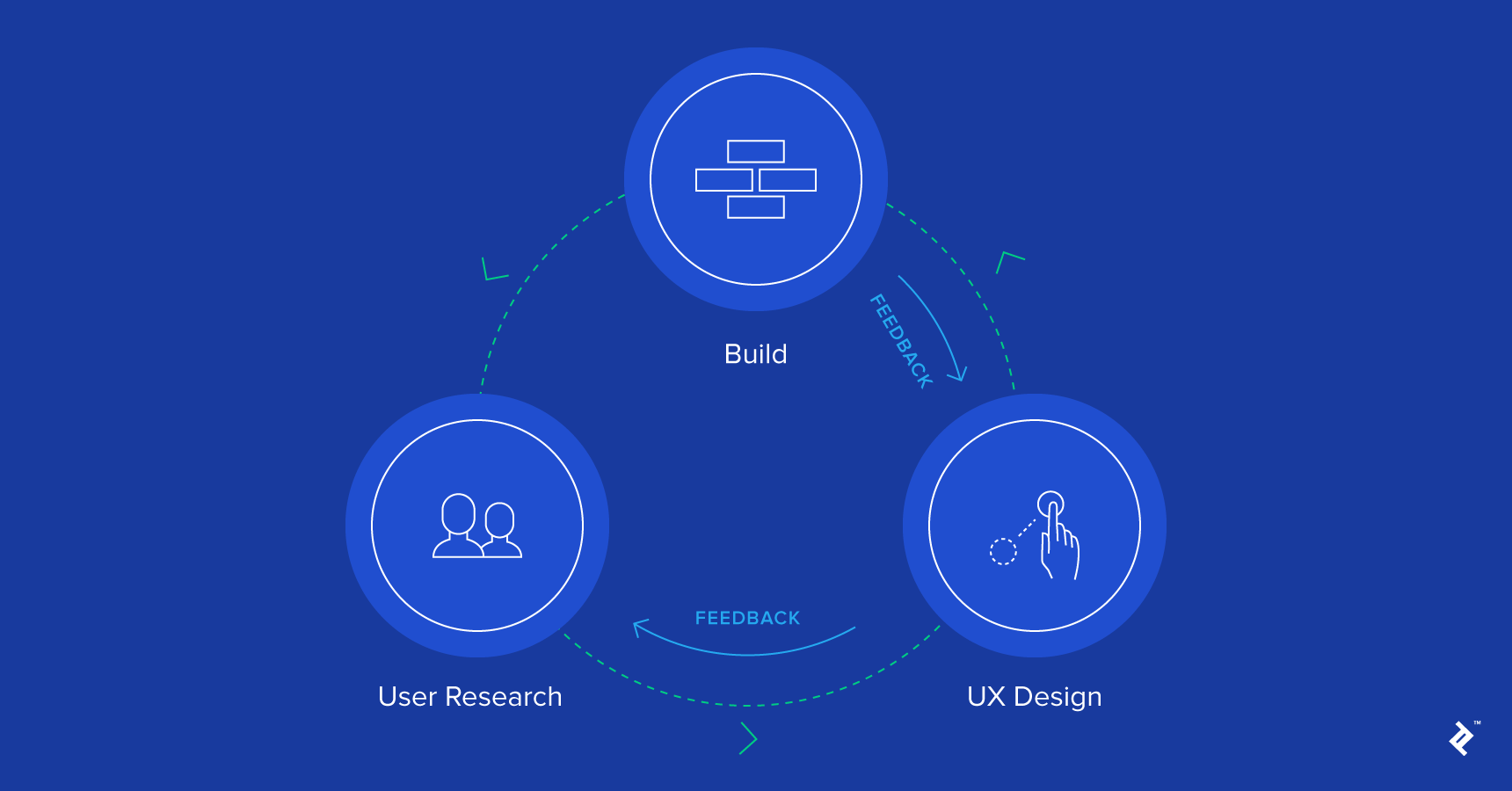

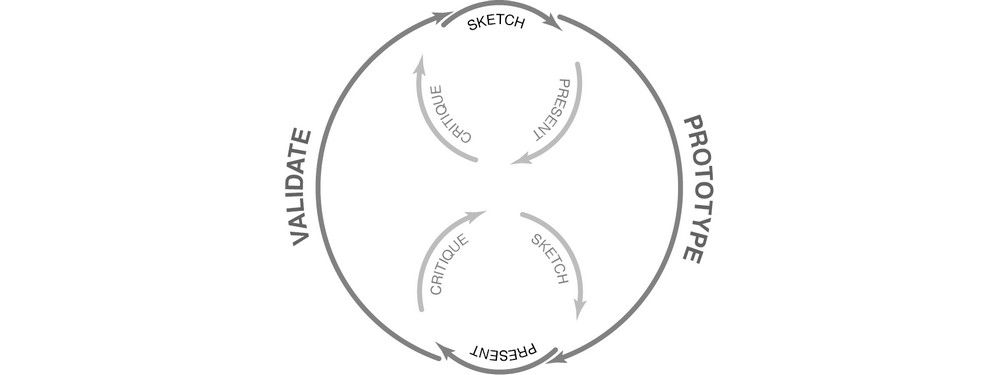

Our step-by-step guide to UX research is based on lean UX design principles, meaning continuous iteration, testing, and user feedback are central.

Lean UX is based on an agile cycle with three phases:

Think: brainstorming and reflecting on areas for improvement

Make: creating new designs or features to solve user problems

Check: testing assumptions and verifying designs with real customers

UX research is a non-linear process—research doesn’t end when design and development begin. The best research centers on continuous discovery at every stage, and involves circling back and forth between those stages.

These 7 steps will get you well on your way:

1. Clarify your goals

Clear goals will help you define the process, efficiently distribute resources, get stakeholders on board, and maximize the user insights you uncover .

Start by formulating hypotheses and topics of interest based on the potential problems and opportunities you want to learn more about. These might emerge from previous research, new opportunities you’ve identified, or from creative brainstorming.

Then, define the key UX research questions you want to answer . These might center on user behavior (why are customers abandoning carts?), on different UX design options (which new CTA option performs best?), or on customer goals (which new features would most improve the user experience?).

Pro tip : design user questions that are focused but flexible enough to allow for free discovery. Don’t go in armed with too many assumptions and don’t ask leading questions. Make sure you leave space to discover new information from your users that might not have occurred to you. Set up Hotjar’s Feedback widget to collect open-ended feedback from users to start.

Next, make sure you contextualize UX research goals in line with larger organizational objectives and success metrics: how will decreasing cart abandonment impact conversions and revenue, for example?

Finally, explain to key stakeholders what you’re doing—and why—to get their support and maximize the reach of your research.

It’s important to set research goals around current problems. For instance, if we need to offer an advanced search function for an ecommerce website, the goal will be to find the best solution for our users that’s easy to implement from the development perspective.

2. Define your research methods

Once you’ve set goals and designed user questions, decide what kinds of research you’ll do and the type of data you want to collect.

Use a variety of methods to cover all the bases and fill potential gaps. These will depend on your user and business needs, and the resources you have available.

Make sure you include both attitudinal and behavioral UX research methods .

Behavioral research is about observing how users act. Heatmaps, A/B testing, user recordings, and eye-tracking are all important sources you can use to understand user behavior data.

Attitudinal research tells you how users are thinking and feeling . This often involves asking them directly through surveys, focus groups, customer interviews, concept testing, and card sorting.

If you rely on only one of these, you’ll be missing out on the big picture. Combining behavioral and attitudinal research fills in the gaps between what users say and what they actually do , which don’t always align.

Seek to also explore a mix of qualitative and quantitative UX data.

Quantitative studies put a number on user behavior. Analyzing the number of users who scrolled past your CTA or clicked in frustration where they couldn’t find a button will help you spot patterns in clickthroughs, conversions, user engagement, and retention.

Qualitative data uncovers the reasons behind these patterns. They’re opportunities to learn what your users really think and help you understand their needs more deeply.

Remember: Hotjar’s tools combine behavioral and attitudinal research methods through a blend of quantitative and qualitative data. Use Hotjar Surveys and Feedback widgets to collect voice-of-customer (VoC) feedback, and Heatmaps and Session Recordings to round out the picture with behavioral insights.

3. Dive into discovery

Once you’ve set up research questions and UX analysis methods, the next step is to jump into the discovery phase, where the spotlight should be on speaking to your customers and understanding what they need to convert.

Seek to develop a deep understanding of your users, the problems they experience, and what will help them with their jobs to be done.

User interviews are a great way to start—video tools like UserInterview can really help when paired with Hotjar's brilliant interview tips .

Check out our in-depth guide to UX research tools that can help streamline the process.

You should also:

Observe customers using other similar sites (lab studies are great, but you can also use session recordings to see how users behave in their own environment)

Deploy Hotjar Feedback widgets to learn what users are thinking while they browse and understand blocks in navigation

Use surveys to ask users questions about their current and ideal experience

Run competitive analyses and conduct market research to understand the UX offered by other companies and identify areas of improvement and exploration

Make sure to ask customers open-ended questions about their experiences and what they’d like to see, as well as targeted questions around navigating particular product pages or features. For example, are they finding all the information they need to confidently complete the checkout process? You might discover that your users like to check out reviews before making a final decision, so making reviews more accessible could help UX and conversions alike.

4. Dig deeper and explore

Use the insights from the discovery phase as a starting point, then get more specific and home in on answering your specific UX research questions and really understanding your users at a granular level.

Map out customer journeys and develop user personas and stories to clarify and communicate the information you’ve learned.

You should also use your discoveries to inform preliminary idea development, design sketches, and wireframes and prototypes.

Maybe you’re losing customers at the checkout stage, and discovery phase feedback has suggested it could be because you don’t have a ‘guest checkout’ option, forcing users to sign up for a full account, which creates friction if they’re browsing your site on mobile.

Start by validating the guest checkout idea with your users, then design and test different iterations through prototypes, mockups, and card sorting experiments.

5. Iterate and test

Once you have a working model of your website or product redesign, focus on testing the user experience to refine it.

Here's how:

Start with usability testing to ensure that your website hierarchies, user flow, and search filters make sense. Run A/B and multivariate testing to see which designs users respond to best, and use heatmaps to see exactly where they're clicking and scrolling.

Make sure you also evaluate accessibility: is the guest checkout option easy to find? Is it visible to users across different devices, and with different vision needs?

Next, go deeper: seek to build a complete picture of the UX and how it facilitates and blocks users from getting their needs met.

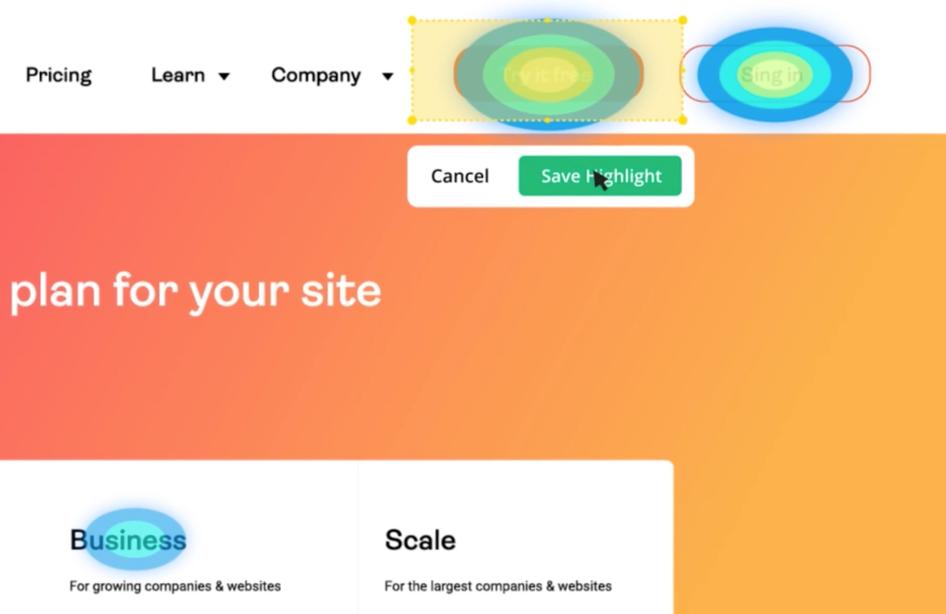

Observe users in action. Use Hotjar Heatmaps to identify click and scroll patterns and Session Recordings to track the entire user journey. This helps the UX team see what their customers see, which is crucial at this testing stage when you’re often too close to the design to understand the experience from the outside.

Look at the page elements customers are engaging with, and which ones they’re scrolling past. Filter session recordings by rage clicks to see where users may be clicking in frustration expecting a button or action. Pay special attention to dissatisfied customers or users who didn’t complete key conversion actions, and understand what their journey looks like.

Complement this understanding of user behavior with qualitative interviews and survey methods that will help you understand their motivations and product experience (PX).

6. Evaluate and communicate research findings

By now, you’ve collected many research insights. Organize your data using categories and tags, focusing on user pain points . Look for key patterns and recurring issues—and once you’ve identified them, ask users more questions if needed.

Make your research insights searchable, manipulable, and easily accessible by everyone on the team.

Then, engage in cross-functional communication outside the core UX team. Make sure you keep different departments informed and involved with your UX research process.

Create UX analysis reports and engage stakeholders with comprehensive UX and user storytelling and strong product narratives. But make sure you also share key nuggets of user data along the way, so your research insights filter throughout the whole organization.

Pro tip : use Hotjar Highlights to easily share user recording clips, screenshots, heatmap snippets, and VoC quotes throughout your company. You can also use the Slack integration to automatically keep different departments up to date!

7. Put your research into action

The UX research data you gather is a potential goldmine. It can help you prioritize brilliantly and boost user satisfaction, engagement, and retention. But only if you turn those insights into action .

You need to put the data to work in making key UX design decisions.

Use your UX research insights to prioritize fixes and product updates . Focus on urgent issues that are affecting key metrics and blocking users from meeting their needs.

Heatmaps and session recordings can help you quickly spot low-hanging fruit. You might find you could drastically improve conversions by positioning your CTA differently or making your signup form more streamlined and intuitive.

For larger design opportunities that will require significant resources, UX research data can help you to justify the cost to stakeholders.

I follow the process of finding patterns in the data, pulling at least one insight from each identified pattern, and then creating at least one design recommendation or design principle for each insight. When you are designing you can easily refer back to your identified design principles and requirements to help guide your decision making and have data-supported designs when it’s time for handoff.

Building the UX research process into your design culture

UX research isn’t a one-time activity to be forgotten about once you begin designing and developing.

The UX research process should happen continuously, influencing all other aspects of UX design and product development. Ongoing research, testing, and user conversations are all part of confident, user-led design thinking.