- Browse All Articles

- Newsletter Sign-Up

FamilyBusiness →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

MIT Libraries home DSpace@MIT

- DSpace@MIT Home

- MIT Libraries

- Graduate Theses

Understanding the family businesses : a case study from Brazil

Other Contributors

Terms of use, description, date issued, collections.

Topics, trends and theories in family business research: 1996–2020

- Published: 14 October 2023

- Volume 19 , pages 1855–1891, ( 2023 )

Cite this article

- Mehmet Bağiş ORCID: orcid.org/0000-0002-3392-3376 1 ,

- Li̇ri̇don Kryeziu ORCID: orcid.org/0000-0002-1382-7520 2 ,

- Mehmet Nurullah Kurutkan ORCID: orcid.org/0000-0002-3740-4231 3 ,

- Besni̇k A. Krasniqi 4 ,

- Omer Yazici 1 &

- Esra Memili 5

860 Accesses

2 Citations

Explore all metrics

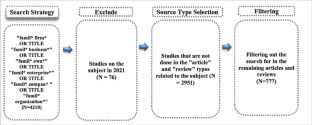

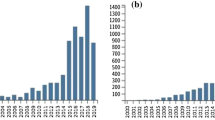

The existing body of literature on family business studies has expanded considerably. However, despite numerous literature reviews in past research, certain aspects, such as the evolving conceptual patterns in the field and the theories that guide it, remain unexplored. This article aims to uncover the conceptual patterns and theoretical foundations shaping the field, highlighting influential sources, institutions, countries, and authors within the realm of family businesses. The research utilizes bibliometric analyses and qualitative content analysis. Our findings determined that family business research produced its first theoretical studies between 1996 and 2004 (the first period), focusing on management, altruism, and agency issues during this period. During this period, agency theory dominated the field. In the period 2005–2013 (second period), we identified the following as emerging concepts in the field: diversification, entrepreneurship, family capital, family values, family involvement, relationship conflict, stewardship, succession, commitment, and psychological ownership. The dominant theories during this period were agency theory, resource-based theory, management theory, and institutional theory. In the third period, the prominent topics are the following: dynamic capabilities, stewardship, familiness, family dynamics, non-family employees, top management team, governance, trust, sustainability, corporate social responsibility, family management, family ownership, social capital, internationalization, corporate entrepreneurship, entrepreneurial orientation, family influence, knowledge sharing, board of directors, succession planning, succession process, emotions, gender, family control, and heterogeneity. In this period, in addition to the theories in the previous period, Socio-Emotional Wealth theory, social identity theory, social capital theory, stakeholder theory, and upper echelon theory are dominant in the field. The article concludes with recommendations for future research directions.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

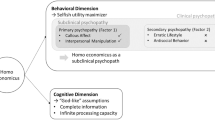

The Homo Economicus as a Prototype of a Psychopath? A Conceptual Analysis and Implications for Business Research and Teaching

Corporate entrepreneurship: a systematic literature review and future research agenda

Corporate governance and sustainability: a review of the existing literature

Abell, P., Felin, T., & Foss, N. (2008). Building micro-foundations for the routines, capabilities, and performance links. Managerial and Decision Economics, 29 (6), 489–502. https://doi.org/10.1002/mde.1413

Article Google Scholar

Alayo, M., Iturralde, T., Maseda, A., & Aparicio, G. (2020). Mapping family firm internationalisation research: bibliometric and literature review. Review of Managerial Science , 1–44. https://doi.org/10.1007/s11846-020-00404-1

Alonso, A. D., Kok, S., & O’Shea, M. (2018). Family businesses and adaptation: A dynamic capabilities approach. Journal of Family and Economic Issues, 39 (4), 683–698. https://doi.org/10.1007/s10834-018-9586-3

Alonso, A. D., Kok, S., & O’Shea, M. (2019). The family business, adversity and change: A dynamic capabilities and knowledge-based approach. Journal of General Management, 44 (2), 96–109. https://doi.org/10.1177/0306307018810585

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58 (3), 1301–1328. https://doi.org/10.1111/1540-6261.00567

Andres, C. (2008). Large shareholders and firm performance—An empirical examination of founding-family ownership. Journal of Corporate Finance, 14 (4), 431–445. https://doi.org/10.1016/j.jcorpfin.2008.05.003

Arcese, G., Valeri, M., Poponi, S., & Elmo, G. C. (2020). Innovative drivers for family business models in tourism, Journal of Family Business Management , Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/JFBM-05-2020-0043

Bacharach, S. B. (1989). Organisational theories: Some criteria for evaluation. Academy of Management Review, 14 (4), 496–515. https://doi.org/10.5465/amr.1989.4308374

Bağış, M. (2020). A Longitudinal Analysis on the Micro-foundations of Strategic Management: Where are Micro-foundations Going? Business & Management Studies: An International Journal , 8 (2), 1310–1333. https://doi.org/10.15295/bmij.v8i2.1454

Bağış, M. (2021). A research on the cognitive and behavioral foundations of strategic management: 1995–2020. Ege Academic Review , 21 (3), 163–180. https://doi.org/10.21121/eab.959904

Bağış, M., & Ardıç, K. (2021). Changes in the Intellectual Structure of Business Ethics: A Review on Journal of Business Ethics, 2000–2020. Turkish Journal of Business Ethics . 14 (2), 296–328. https://doi.org/10.12711/tjbe.2021.14.2.2059

Bağış, M., Karagüzel, E. S., Kryeziu, L., & Ardıç, K. (2019). A Longitudinal analysis on intellectual structure of human resources management: Theoretical foundations and research trends. Mehmet Akif Ersoy Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi , 6 (3), 796–814. https://doi.org/10.30798/makuiibf.569513

Bağış, M., Kryeziu, L., Kurutkan, M. N., & Ramadani, V. (2022). "Women entrepreneurship in family business: dominant topics and future research trends", Journal of Family Business Management , Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/JFBM-03-2022-0040

Bammens, Y., Voordeckers, W., & Van Gils, A. (2011). Boards of directors in family businesses: A literature review and research agenda. International Journal of Management Reviews, 13 (2), 134–152. https://doi.org/10.1111/j.1468-2370.2010.00289.x

Bandura, A. (1986). Social Foundations of Thought and Action: A social Cognitive Theory . Prentice-Hall, Inc.

Bandura, A. (1989). Social Cognitive Theory. Six Theories of Child DevelopmentIn R. Vasta (Ed.), Annals of Child Development (Vol. 6, pp. 1–60). JAI Press.

Google Scholar

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17 (1), 99–120. https://doi.org/10.1177/014920639101700108

Barros, I., Hernangómez, J., & Martin-Cruz, N. (2016). A theoretical model of strategic management of family firms. A dynamic capabilities approach. Journal of Family Business Strategy , 7 (3), 149–159. https://doi.org/10.1016/j.jfbs.2016.06.002

Basco, R., Calabrò, A., & Campopiano, G. (2019). Transgenerational entrepreneurship around the world: Implications for family business research and practice. Journal of Family Business Strategy, 10 (4), 100249. https://doi.org/10.1016/j.jfbs.2018.03.004

Bednarz, J., Bieliński, T., Nikodemska-Wołowik, A., & Otukoya, A. (2017). Sources of the competitive advantage of family enterprises: An international approach focusing on China, Nigeria and Poland. Entrepreneurial Business and Economics Review , 5 (2), 123. https://doi.org/10.15678/EBER.2017.050207

Benavides-Velasco, C. A., Quintana-García, C., & Guzmán-Parra, V. F. (2013). Trends in family business research. Small Business Economics, 40 (1), 41–57. https://doi.org/10.1007/s11187-011-9362-3

Bennedsen, M., Nielsen, K. M., Pérez-González, F., & Wolfenzon, D. (2007). Inside the family firm: The role of families in succession decisions and performance. The Quarterly Journal of Economics, 122 (2), 647–691. https://doi.org/10.1162/qjec.122.2.647

Berrone, P., Cruz, C., & Gomez-Mejia, L. R. (2012). Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Family Business Review, 25 (3), 258–279. https://doi.org/10.1177/0894486511435355

Bird, B., Welsch, H., Astrachan, J. H., & Pistrui, D. (2002). Family business research: The evolution of an academic field. Family Business Review, 15 (4), 337–350. https://doi.org/10.1111/j.1741-6248.2002.00337.x

Block, J. H. (2012). R&D investments in family and founder firms: An agency perspective. Journal of Business Venturing, 27 (2), 248–265. https://doi.org/10.1016/j.jbusvent.2010.09.003

Blumentritt, T., Mathews, T., & Marchisio, G. (2013). Game theory and family business succession: An introduction. Family Business Review, 26 (1), 51–67. https://doi.org/10.1177/0894486512447811

Bormann, K. C., Backs, S., & Hoon, C. (2020). What makes non-family employees act as good stewards? Emotions and the moderating roles of stewardship culture and gender roles in family firms. Family Business Review, 0894486520968826. https://doi.org/10.1177/0894486520968826

Botella-Carrubi, M. D., & González-Cruz, T. F. (2019). Context as a provider of key resources for succession: A case study of sustainable family firms. Sustainability, 11 (7), 1873. https://doi.org/10.3390/su11071873

Boyd, B., Royer, S., Pei, R., & Zhang, X. (2015). Knowledge transfer in family business successions: Implications of knowledge types and transaction atmospheres. Journal of Family Business Management, 5 (1), 17–37. https://doi.org/10.1108/JFBM-05-2014-0009

Brinkerink, J., Van Gils, A., Bammens, Y., & Carree, M. (2017). Open innovation: A literature review and recommendations for family business research (pp. 241–266). Routledge.

Brunninge, O., Nordqvist, M., & Wiklund, J. (2007). Corporate governance and strategic change in SMEs: The effects of ownership, board composition and top management teams. Small Business Economics , 29 (3), 295–308. https://www.jstor.org/stable/40229558

Calabro, A., Minola, T., Campopiano, G., & Pukall, T. (2016). Turning innovativeness into domestic and international corporate venturing: The moderating effect of high family ownership and influence. European Journal of International Management, 10 (5), 505–533. https://doi.org/10.1504/EJIM.2016.078789

Carney, M. (2005). Corporate governance and competitive advantage in family–controlled firms. Entrepreneurship Theory and Practice, 29 (3), 249–265. https://doi.org/10.1111/j.1540-6520.2005.00081.x

Carney, M., Zhao, J., & Zhu, L. (2019). Lean innovation: Family firm succession and patenting strategy in a dynamic institutional landscape. Journal of Family Business Strategy, 10 (4), 100247. https://doi.org/10.1016/j.jfbs.2018.03.002

Cater, J. J., & Justis, R. T. (2009). The development of successors from followers to leaders in small family firms: An exploratory study. Family Business Review, 22 (2), 109–124. https://doi.org/10.1177/0894486508327822

Chadwick, I. C., & Dawson, A. (2018). Women leaders and firm performance in family businesses: An examination of financial and nonfinancial outcomes. Journal of Family Business Strategy, 9 (4), 238–249. https://doi.org/10.1016/j.jfbs.2018.10.002

Chandler, J. A., Payne, G. T., Moore, C., & Brigham, K. H. (2019). Family involvement signals in initial public offerings. Journal of Family Business Strategy, 10 (1), 8–16. https://doi.org/10.1016/j.jfbs.2019.01.004

Chen, H. L., Hsu, W. T., & Chang, C. Y. (2016). Independent directors’ human and social capital, firm internationalisation and performance implications: An integrated agency-resource dependence view. International Business Review, 25 (4), 859–871. https://doi.org/10.1016/j.ibusrev.2015.10.010

Chirico, F., & Bau', M. (2014). Is the family an "asset" or "liability" for firm performance? The moderating role of environmental dynamism. Journal of Small Business Management , 52 (2), 210–225. https://doi.org/10.1111/jsbm.12095

Chirico, F., & Salvato, C. (2008). Knowledge integration and dynamic organisational adaptation in family firms. Family Business Review, 21 (2), 169–181. https://doi.org/10.1111/j.1741-6248.2008.00117.x

Chirico, F., Ireland, R. D., & Sirmon, D. G. (2011). Franchising and the family firm: Creating unique sources of advantage through “familiness”. Entrepreneurship Theory and Practice, 35 (3), 483–501. https://doi.org/10.1111/j.1540-6520.2011.00441.x

Chrisman, J. J., Chua, J. H., & Litz, R. A. (2004). Comparing the agency costs of family and non–family firms: Conceptual issues and exploratory evidence. Entrepreneurship Theory and Practice, 28 (4), 335–354. https://doi.org/10.1111/j.1540-6520.2004.00049.x

Chrisman, J. J., Chua, J. H., & Sharma, P. (2005). Trends and directions in the development of a strategic management theory of the family firm. Entrepreneurship Theory and Practice, 29 (5), 555–575. https://doi.org/10.1111/j.1540-6520.2005.00098.x

Chrisman, J. J., Chua, J. H., Kellermanns, F. W., & Chang, E. P. (2007). Are family managers agents or stewards? An exploratory study in privately held family firms. Journal of Business Research, 60 (10), 1030–1038. https://doi.org/10.1016/j.jbusres.2006.12.011

Chrisman, J. J., Chua, J. H., Pearson, A. W., & Barnett, T. (2012). Family Involvement, Family Influence, and Family-Centered Non–Economic Goals in Small Firms. Entrepreneurship Theory and Practice, 36 (2), 267–293. https://doi.org/10.1111/j.1540-6520.2010.00407.x

Chrisman, J. J., Kellermanns, F. W., Chan, K. C., & Liano, K. (2010). Intellectual foundations of current research in family business: An identification and review of 25 influential articles. Family Business Review, 23 (1), 9–26. https://doi.org/10.1177/0894486509357920

Chrisman, J. J., Steier, L. P., & Chua, J. H. (2008). Toward a theoretical basis for understanding the dynamics of strategic performance in family firms. Entrepreneurship Theory and Practice, 32 (6), 935–947. https://doi.org/10.1111/j.1540-6520.2008.00264.x

Chua, J. H., Chrisman, J. J., & Sharma, P. (2003). Succession and nonsuccession concerns of family firms and agency relationship with non-family managers. Family Business Review, 16 (2), 89–107. https://doi.org/10.1111/j.1741-6248.2003.00089.x

Chung, H. M. (2013). The role of family management and family ownership in diversification: The case of family business groups. Asia Pacific Journal of Management, 30 (3), 871–891. https://doi.org/10.1007/s10490-012-9284-x

Craig, J., & Dibrell, C. (2006). The natural environment, innovation, and firm performance: A comparative study. Family Business Review, 19 (4), 275–288. https://doi.org/10.1111/j.1741-6248.2006.00075.x

Craig, J. B., Moores, K., Howorth, C., & Poutziouris, P. (2009). Family business research at a tipping point threshold. Journal of Management & Organization, 15 (3), 282–293. https://doi.org/10.5172/jmo.2009.15.3.282

Cunningham, J., Seaman, C., & McGuire, D. (2016). Knowledge sharing in small family firms: A leadership perspective. Journal of Family Business Strategy, 7 (1), 34–46. https://doi.org/10.1016/j.jfbs.2015.10.002

D’Allura, G. M. (2019). The leading role of the top management team in understanding family firms: Past research and future directions. Journal of Family Business Strategy, 10 (2), 87–104. https://doi.org/10.1016/j.jfbs.2018.12.001

D’Angelo, A., Majocchi, A., & Buck, T. (2016). External managers, family ownership and the scope of SME internationalisation. Journal of World Business, 51 (4), 534–547. https://doi.org/10.1016/j.jwb.2016.01.004

Daspit, J. J., Chrisman, J. J., Ashton, T., & Evangelopoulos, N. (2021). Family Firm Heterogeneity: A Definition, Common Themes, Scholarly Progress, and Directions Forward. Family Business Review , 08944865211008350. https://doi.org/10.1177/08944865211008350

Davis, J. H., Allen, M. R., & Hayes, H. D. (2010). Is blood thicker than water? A study of stewardship perceptions in family business. Entrepreneurship Theory and Practice, 34 (6), 1093–1116. https://doi.org/10.1111/j.1540-6520.2010.00415.x

Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Davis, Schoorman, and Donaldson reply: The distinctiveness of agency theory and stewardship theory. Academy of Management Review, 22 (3), 611–613.

Dawson, A. (2011). Private equity investment decisions in family firms: The role of human resources and agency costs. Journal of Business Venturing, 26 (2), 189–199. https://doi.org/10.1016/j.jbusvent.2009.05.004

De Las Heras-Rosas, C., & Herrera, J. (2020). Family Firms and Sustainability. A Longitudinal Analysis. Sustainability, 12 (13), 5477. https://doi.org/10.3390/su12135477

De Massis, A. (2012). Article commentary: Family involvement and procedural justice climate among nonfamily managers: The effects of affect, social identities, trust, and risk of non–reciprocity. Entrepreneurship Theory and Practice, 36 (6), 1227–1234. https://doi.org/10.1111/j.1540-6520.2012.00547.x

De Massis, A., & Foss, N. J. (2018). Advancing family business research: The promise of microfoundations. Family Business Review, 31 (4), 386–396. https://doi.org/10.1177/0894486518803422

De Massis, A., & Rondi, E. (2020). COVID-19 and the future of family business research. Journal of Management Studies, 57 (8), 1727–1731. https://doi.org/10.1111/joms.12632

De Massis, A., Chua, J. H., & Chrisman, J. J. (2008). Factors preventing intra-family succession. Family Business Review, 21 (2), 183–199. https://doi.org/10.1111/j.1741-6248.2008.00118.x

De Massis, A., Frattini, F., & Lichtenthaler, U. (2013a). Research on technological innovation in family firms: Present debates and future directions. Family Business Review, 26 (1), 10–31. https://doi.org/10.1177/0894486512466258

De Massis, A., Frattini, F., Pizzurno, E., & Cassia, L. (2015). Product innovation in family versus non-family firms: An exploratory analysis. Journal of Small Business Management, 53 (1), 1–36. https://doi.org/10.1111/jsbm.12068

De Massis, A., Kotlar, J., Campopiano, G., & Cassia, L. (2013b). Dispersion of family ownership and the performance of small-to-medium size private family firms. Journal of Family Business Strategy, 4 (3), 166–175. https://doi.org/10.1016/j.jfbs.2013.05.001

Debicki, B. J., Matherne, C. F., III., Kellermanns, F. W., & Chrisman, J. J. (2009). Family business research in the new millennium: An overview of the who, the where, the what, and the why. Family Business Review, 22 (2), 151–166. https://doi.org/10.1177/0894486509333598

Donaldson, L., & Davis, J. H. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16 (1), 49–64. https://doi.org/10.1177/031289629101600103

Duncan, K., & Hasso, T. (2018). Family governance signals and heterogeneous preferences of investors. Journal of Behavioral Finance, 19 (4), 381–395. https://doi.org/10.1080/15427560.2018.1405267

Dyer, W. G., Jr. (2003). The family: The missing variable in organisational research. Entrepreneurship Theory and Practice, 27 (4), 401–416. https://doi.org/10.1111/1540-8520.00018

Dyer, W. G., Jr. (2006). Examining the “family effect” on firm performance. Family Business Review, 19 (4), 253–273. https://doi.org/10.1111/j.1741-6248.2006.00074.x

Eddleston, K. A. (2008). Commentary: The prequel to family firm culture and stewardship: The leadership perspective of the founder. Entrepreneurship Theory and Practice, 32 (6), 1055–1061. https://doi.org/10.1111/j.1540-6520.2008.00272.x

Eddleston, K. A., & Kellermanns, F. W. (2007). Destructive and productive family relationships: A stewardship theory perspective. Journal of Business Venturing, 22 (4), 545–565. https://doi.org/10.1016/j.jbusvent.2006.06.004

Eddleston, K. A., & Kidwell, R. E. (2012). Parent–child relationships: Planting the seeds of deviant behavior in the family firm. Entrepreneurship Theory and Practice, 36 (2), 369–386. https://doi.org/10.1111/j.1540-6520.2010.00403.x

Eddleston, K. A., Kellermanns, F. W., & Sarathy, R. (2008). Resource configuration in family firms: Linking resources, strategic planning and technological opportunities to performance. Journal of Management Studies, 45 (1), 26–50. https://doi.org/10.1111/j.1467-6486.2007.00717.x

Eddleston, K. A., Kellermanns, F. W., & Zellweger, T. M. (2012). Exploring the entrepreneurial behavior of family firms: Does the stewardship perspective explain differences? Entrepreneurship Theory and Practice, 36 (2), 347–367. https://doi.org/10.1111/j.1540-6520.2010.00402.x

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14 (1), 57–74. https://doi.org/10.5465/amr.1989.4279003

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26 (2), 301–325. https://doi.org/10.1086/467037

Fama, E. F., & Jensen, M. C. (1985). Organisational forms and investment decisions. Journal of Financial Economics, 14 (1), 101–119. https://doi.org/10.1016/0304-405X(85)90045-5

Feranita, F., Kotlar, J., & De Massis, A. (2017). Collaborative innovation in family firms: Past research, current debates and agenda for future research. Journal of Family Business Strategy, 8 (3), 137–156. https://doi.org/10.1016/j.jfbs.2017.07.001

Forcadell, F. J., Úbeda, F., & Zúñiga-Vicente, J. Á. (2018). Initial resource heterogeneity differences between family and non-family firms: Implications for resource acquisition and resource generation. Long Range Planning, 51 (5), 693–719. https://doi.org/10.1016/j.lrp.2017.11.003

Gagne, M., Marwick, C., Brun de Pontet, S., & Wrosch, C. (2021). Family business succession: What’s motivation got to do with it? Family Business Review, 34 (2), 154–167. https://doi.org/10.1177/0894486519894759

Galvagno, M., & Pisano, V. (2021). Building the genealogy of family business internationalisation: A bibliometric mixed-method approach. Scientometrics, 126 (1), 757–783. https://doi.org/10.1007/s11192-020-03755-4

Goldstein, E. B. (2014). Cognitive psychology: Connecting mind, research and everyday experience: Nelson Education.

Gómez-Mejía, L. R., Cruz, C., Berrone, P., & De Castro, J. (2011). The bind that ties: Socioemotional wealth preservation in family firms. Academy of Management Annals, 5 (1), 653–707. https://doi.org/10.5465/19416520.2011.593320

Gómez-Mejía, L. R., Haynes, K. T., Núñez-Nickel, M., Jacobson, K. J., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52 (1), 106–137. https://doi.org/10.2189/asqu.52.1.106

Haag, K., Achtenhagen, L., & Grimm, J. (2023). Engaging With the Category: Exploring Family Business Longevity From a Historical Perspective. Family Business Review, 36 (1), 84–118. https://doi.org/10.1177/08944865231154835

Habbershon, T. G. (2006). Commentary: A framework for managing the familiness and agency advantages in family firms. Entrepreneurship Theory and Practice, 30 (6), 879–886. https://doi.org/10.1111/j.1540-6520.2006.00158.x

Habbershon, T. G., & Williams, M. L. (1999). A resource-based framework for assessing the strategic advantages of family firms. Family Business Review, 12 (1), 1–25. https://doi.org/10.1111/j.1741-6248.1999.00001.x

Hambrick, D. C., & Crossland, C. (2018). A strategy for behavioral strategy: Appraisal of small, midsize, and large tent conceptions of this embryonic community. In Behavioral strategy in perspective . Emerald Publishing Limited. Advances in Strategic Management, 39 , 23–39. https://doi.org/10.1108/S0742-332220180000039002

Harms, H. (2014). Review of family business definitions: Cluster approach and implications of heterogeneous application for family business research. International Journal of Financial Studies, 2 (3), 280–314. https://doi.org/10.3390/ijfs2030280

Hernández-Linares, R., Kellermanns, F. W., & López-Fernández, M. C. (2021). Dynamic capabilities and SME performance: The moderating effect of market orientation. Journal of Small Business Management, 59 (1), 162–195. https://doi.org/10.1111/jsbm.12474

Hiebl, M. R. (2017). Finance managers in family firms: An upper-echelons view. Journal of Family Business Management., 7 (2), 207–220. https://doi.org/10.1108/JFBM-07-2016-0014

Hodgson, G. M. (2012). The mirage of microfoundations. Journal of Management Studies, 49 (8), 1389–1394. https://doi.org/10.1111/j.1467-6486.2012.01079.x

Hoon, C., Brinkmann, J., & Baluch, A. M. (2023). Narrative Memory Work of Employees in Family Businesses: How Founding Stories Shape Organizational Identification. Family Business Review, 36 (1), 37–62. https://doi.org/10.1177/08944865231159475

Hu, J., & Zhang, Y. (2015). Research patterns and trends of Recommendation System in China using co-word analysis. Information Processing and Management, 51 (4), 329–339. https://doi.org/10.1016/j.ipm.2015.02.002

Huang, M. H., Shaw, W. C., & Lin, C. S. (2019). One category, two communities: Subfield differences in “Information Science and Library Science” in Journal Citation Reports. Scientometrics, 119 (2), 1059–1079. https://doi.org/10.1007/s11192-019-03074-3

Humphrey, R. H., Massis, A. D., Picone, P. M., Tang, Y., & Piccolo, R. F. (2021). The Psychological Foundations of Management in Family Firms: Emotions, Memories, and Experiences. Family Business Review, 34 (2), 122–131. https://doi.org/10.1177/08944865211012139

Huybrechts, J., Voordeckers, W., & Lybaert, N. (2013). Entrepreneurial risk taking of private family firms: The influence of a non-family CEO and the moderating effect of CEO tenure. Family Business Review, 26 (2), 161–179. https://doi.org/10.1177/0894486512469252

Issah, W. B., Anwar, M., Clauss, T., & Kraus, S. (2023). Managerial capabilities and strategic renewal in family firms in crisis situations: The moderating role of the founding generation. Journal of Business Research, 156 , 113486. https://doi.org/10.1016/j.jbusres.2022.113486

James, A. E., Jennings, J. E., & Breitkreuz, R. S. (2012). Worlds apart? Rebridging the distance between family science and family business research. Family Business Review, 25 (1), 87–108. https://doi.org/10.1177/0894486511414271

Janjuha-Jivraj, S., & Spence, L. J. (2009). The nature of reciprocity in family firm succession. International Small Business Journal, 27 (6), 702–719. https://doi.org/10.1177/0266242609344252

Jaskiewicz, P., Combs, J. G., & Rau, S. B. (2015). Entrepreneurial legacy: Toward a theory of how some family firms nurture transgenerational entrepreneurship. Journal of Business Venturing, 30 (1), 29–49. https://doi.org/10.1016/j.jbusvent.2014.07.001

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3 (4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Jones, O., Ghobadian, A., O’Regan, N., & Antcliff, V. (2013). Dynamic capabilities in a sixth-generation family firm: Entrepreneurship and the Bibby Line. Business History, 55 (6), 910–941. https://doi.org/10.1080/00076791.2012.744590

Kahneman, D. (2011). Thinking, fast and slow. Macmillan.

Kellermanns, F. W., Eddleston, K. A., Barnett, T., & Pearson, A. (2008). An exploratory study of family member characteristics and involvement: Effects on entrepreneurial behavior in the family firm. Family Business Review, 21 (1), 1–14. https://doi.org/10.1111/j.1741-6248.2007.00107.x

Khasseh, A. A., Soheili, F., Moghaddam, H. S., & Chelak, A. M. (2017). Intellectual structure of knowledge in iMetrics: A co-word analysis. Information Processing and Management, 53 (3), 705–720. https://doi.org/10.1016/j.ipm.2017.02.001

Klein, S., & Bell, F. A. (2007). Non-family executives in family businesses: A literature review. Electronic Journal of Family Business Studies , 1 (1), 19–37. http://urn.fi/URN:NBN:fi:jyu-200906041668

Laffranchini, G., Hadjimarcou, J. S., Kim, S. H., & Braun, M. (2016). The internationalization of family-firms: A signal detection approach. Journal of Family Business Management, 6 (3), 291–309. https://doi.org/10.1108/JFBM-11-2015-0039

Le Breton-Miller, I., & Miller, D. (2006). Why do some family businesses out–compete? Governance, long–term orientations, and sustainable capability. Entrepreneurship Theory and Practice, 30 (6), 731–746. https://doi.org/10.1111/j.1540-6520.2006.00147.x

Le Breton-Miller, I., & Miller, D. (2009). Agency vs. stewardship in public family firms: A social embeddedness reconciliation. Entrepreneurship Theory and Practice , 33 (6), 1169–1191. https://doi.org/10.1111/j.1540-6520.2009.00339.x

Leiß, G., & Zehrer, A. (2018). Intergenerational communication in family firm succession. Journal of Family Business Management, 8 (1), 75–90. https://doi.org/10.1108/JFBM-09-2017-0025

Lin, C. J., Wang, T., & Pan, C. J. (2016). Financial reporting quality and investment decisions for family firms. Asia Pacific Journal of Management, 33 (2), 499–532. https://doi.org/10.1007/s10490-015-9438-8

Llanos-Contreras, O., Baier-Fuentes, H., & González-Serrano, M. H. (2022). Direct and indirect effects of SEWi, family human capital and social capital on organizational social capital in small family firms. International Entrepreneurship and Management Journal, 18 (4), 1403–1418. https://doi.org/10.1007/s11365-020-00725-3

Lohe, F. W., & Calabrò, A. (2017). Please do not disturb! Differentiating board tasks in family and non-family firms during financial distress. Scandinavian Journal of Management, 33 (1), 36–49. https://doi.org/10.1016/j.scaman.2017.01.001

Luan, C. J., Chen, Y. Y., Huang, H. Y., & Wang, K. S. (2018). CEO succession decision in family businesses–A corporate governance perspective. Asia Pacific Management Review, 23 (2), 130–136. https://doi.org/10.1016/j.apmrv.2017.03.003

Lubatkin, M. H., Durand, R., & Ling, Y. (2007). The missing lens in family firm governance theory: A self-other typology of parental altruism. Journal of Business Research, 60 (10), 1022–1029. https://doi.org/10.1016/j.jbusres.2006.12.019

Ma, G., Xiao, Q., & Yang, X. (2023). The impact of equity pledge on inefficient investment: a perspective from family entrepreneurship. International Entrepreneurship and Management Journal , 1–31. https://doi.org/10.1007/s11365-023-00886-x

MacRoberts, M. H., & MacRoberts, B. R. (2010). Problems of citation analysis: A study of uncited and seldom-cited influences. Journal of the American Society for Information Science and Technology, 61 (1), 1–12. https://doi.org/10.1002/asi.21228

Maung, M., Miller, D., Tang, Z., & Xu, X. (2020). Value-enhancing social responsibility: Market reaction to donations by family vs. non-family firms with religious CEOs. Journal of Business Ethics , 163 (4), 745–758. https://doi.org/10.1007/s10551-019-04381-8

Mazzelli, A., De Massis, A., Petruzzelli, A. M., Del Giudice, M., & Khan, Z. (2020). Behind ambidextrous search: The microfoundations of search in family and non-family firms. Long Range Planning, 53 (6), 101882. https://doi.org/10.1016/j.lrp.2019.05.002

McAdam, M., Clinton, E., Hamilton, E., & Gartner, W. B. (2023). Learning in a Family Business Through Intermarriage: A Rhetorical History Perspective. Family Business Review, 36 (1), 63–83. https://doi.org/10.1177/08944865231157040

Memili, E., Fang, H. C., & Welsh, D. H. (2015). Value creation and value appropriation in innovation process in publicly-traded family firms. Management Decision, 53 (9), 1921–1952. https://doi.org/10.1108/MD-06-2014-0391

Michel, A., & Kammerlander, N. (2015). Trusted advisors in a family business’s succession-planning process—An agency perspective. Journal of Family Business Strategy, 6 (1), 45–57. https://doi.org/10.1016/j.jfbs.2014.10.005

Miller, D., Le Breton-Miller, I., & Lester, R. H. (2010). Family ownership and acquisition behavior in publicly-traded companies. Strategic Management Journal, 31 (2), 201–223. https://doi.org/10.1002/smj.802

Miller, D., Le Breton‐Miller, I., & Scholnick, B. (2008). Stewardship vs. stagnation: An empirical comparison of small family and non‐family businesses. Journal of Management Studies , 45 (1), 51–78. https://doi.org/10.1111/j.1467-6486.2007.00718.x

Miller, D., Le Breton-Miller, I., Minichilli, A., Corbetta, G., & Pittino, D. (2014). When do non-family CEO s outperform in family firms? Agency and behavioral agency perspectives. Journal of Management Studies, 51 (4), 547–572. https://doi.org/10.1111/joms.12076

Mussolino, D., & Calabrò, A. (2014). Paternalistic leadership in family firms: Types and implications for intergenerational succession. Journal of Family Business Strategy, 5 (2), 197–210. https://doi.org/10.1016/j.jfbs.2013.09.003

Nag, R., Hambrick, D. C., & Chen, M. J. (2007). What is strategic management, really? Inductive derivation of a consensus definition of the field. Strategic Management Journal, 28 (9), 935–955. https://doi.org/10.1002/smj.615

Neubaum, D. O., & Micelotta, E. (2021). WANTED—Theoretical Contributions: An Editorial on the Pitfalls and Pathways in Family Business Research. Family Business Review, 34 (3), 242–250. https://doi.org/10.1177/08944865211032503

Nordstrom, O. A., & Steier, L. (2015). Social capital: A review of its dimensions and promise for future family enterprise research. International Journal of Entrepreneurial Behavior & Research, 21 (6), 801–813. https://doi.org/10.1108/IJEBR-07-2015-0148

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge: University Press.

Ochoa, M. P. B., Sacristan-Navarro, M. A., & Pelechano-Barahona, E. (2020). A bibliometric analysis of dynamic capabilities in the field of family firms (2009-2019). European Journal of Family Business, 10 (2), 69–81. https://doi.org/10.24310/ejfbejfb.v10i2.10162

Park, H. Y., Misra, K., Reddy, S., & Jaber, K. (2019). Family firms’ innovation drivers and performance: A dynamic capabilities approach. Journal of Family Business Management, 9 (1), 4–23. https://doi.org/10.1108/JFBM-11-2017-0039

Pearson, A. W., Carr, J. C., & Shaw, J. C. (2008). Toward a theory of familiness: A social capital perspective. Entrepreneurship Theory and Practice, 32 (6), 949–969. https://doi.org/10.1111/j.1540-6520.2008.00265.x

Penrose, E. (1959). The Theory of the Growth of the Firm . Oxford University Press.

Picone, P. M., De Massis, A., Tang, Y., & Piccolo, R. F. (2021). The Psychological Foundations of Management in Family Firms: Values, Biases, and Heuristics. Family Business Review, 34 (1), 12–32. https://doi.org/10.1177/0894486520985630

Pierce, J. L., Kostova, T., & Dirks, K. T. (2001). Toward a theory of psychological ownership in organisations. Academy of Management Review, 26 (2), 298–310. https://doi.org/10.5465/amr.2001.4378028

Pittino, D., Barroso Martínez, A., Chirico, F., & Sanguino Galván, R. (2018). Psychological ownership, knowledge sharing and entrepreneurial orientation in family firms: The moderating role of governance heterogeneity. Journal of Business Research, 84 , 312–326. https://doi.org/10.1016/j.jbusres.2017.08.014

Ray, S., Mondal, A., & Ramachandran, K. (2018). How does family involvement affect a firm’s internationalisation? An investigation of Indian family firms. Global Strategy Journal, 8 (1), 73–105. https://doi.org/10.1002/gsj.1196

Reay, T., & Whetten, D. A. (2011). What Constitutes a Theoretical Contribution in Family Business? Family Business Review, 24 (2), 105–110. https://doi.org/10.1177/0894486511406427

Rexhepi, G., Ramadani, V., Rahdari, A., & Anggadwita, G. (2017). Models and strategies of family businesses internationalisation: A conceptual framework and future research directions. Review of International Business and Strategy, 27 (2), 248–260. https://doi.org/10.1108/RIBS-12-2016-0081

Rizzo, M. J. (1982). Mises and Lakatos: a reformulation of Austrian methodology. Method, Process, and Austrian Economics , 53–73.

Ronda-Pupo, G. A., & Guerras-Martin, L. Á. (2012). Dynamics of the evolution of the strategy concept 1962–2008: A co-word analysis. Strategic Management Journal, 33 (2), 162–188. https://doi.org/10.1002/smj.948

Rovelli, P., Ferasso, M., De Massis, A., & Kraus, S. (2022). Thirty years of research in family business journals: Status quo and future directions. Journal of Family Business Strategy, 13 (3), 100422. https://doi.org/10.1016/j.jfbs.2021.100422

Rubino, F. E., Tenuta, P., & Cambrea, D. R. (2017). Board characteristics effects on performance in family and non-family business: A multi-theoretical approach. Journal of Management & Governance, 21 (3), 623–658. https://doi.org/10.1007/s10997-016-9363-3

Salmon, U., & Allman, K. (2020). Innovation in family firms: An empirical taxonomy of owners using a mixed methods approach. Journal of Family Business Management, 10 (1), 20–39. https://doi.org/10.1108/JFBM-05-2019-0037

Sanchez-Famoso, V., Maseda, A., & Iturralde, T. (2014). The role of internal social capital in organisational innovation. An empirical study of family firms. European Management Journal , 32 (6), 950–962. https://doi.org/10.1016/j.emj.2014.04.006

Schellong, M., Kraiczy, N. D., Malär, L., & Hack, A. (2019). Family firm brands, perceptions of doing good, and consumer happiness. Entrepreneurship Theory and Practice, 43 (5), 921–946. https://doi.org/10.1177/1042258717754202

Schell, S., de Groote, J. K., Moog, P., & Hack, A. (2020). Successor selection in family business—A signaling game. Journal of Family Business Strategy, 11 (3), 100286. https://doi.org/10.1016/j.jfbs.2019.04.005

Schmidts, T., & Shepherd, D. (2015). Social identity and family business: Exploring family social capital. Journal of Family Business Management, 5 (2), 157–181. https://doi.org/10.1108/JFBM-04-2015-0018

Scholes, L., Wright, M., Westhead, P., & Bruining, H. (2010). Strategic changes in family firms post management buyout: Ownership and governance issues. International Small Business Journal, 28 (5), 505–521. https://doi.org/10.1177/0266242610370390

Scholes, M. L., Wright, M., Westhead, P., Burrows, A., & Bruining, H. (2007). Information sharing, price negotiation and management buy-outs of private family-owned firms. Small Business Economics, 29 (3), 329–349. https://doi.org/10.1007/s11187-006-9024-z

Schröder, E., & Schmitt-Rodermund, E. (2013). Antecedents and consequences of adolescents’ motivations to join the family business. Journal of Vocational Behavior, 83 (3), 476–485. https://doi.org/10.1016/j.jvb.2013.07.006

Schulze, W. S., Lubatkin, M. H., & Dino, R. N. (2003). Toward a theory of agency and altruism in family firms. Journal of Business Venturing, 18 (4), 473–490. https://doi.org/10.1016/S0883-9026(03)00054-5

Schulze, W. S., Lubatkin, M. H., Dino, R. N., & Buchholtz, A. K. (2001). Agency relationships in family firms: Theory and evidence. Organization Science, 12 (2), 99–116. https://doi.org/10.1287/orsc.12.2.99.10114

Sciascia, S., Mazzola, P., Astrachan, J. H., & Pieper, T. M. (2012). The role of family ownership in international entrepreneurship: Exploring nonlinear effects. Small Business Economics, 38 (1), 15–31. https://doi.org/10.1007/s11187-010-9264-9

Shahzad, F., Rehman, I. U., Colombage, S., & Nawaz, F. (2019). Financial reporting quality, family ownership, and investment efficiency: An empirical investigation. Managerial Finance, 45 (4), 513–534. https://doi.org/10.1108/MF-02-2018-0081

Shane, S. A. (1997). Who is publishing the entrepreneurship research? Journal of Management, 23 (1), 83–95.

Sharma, P. (2004). An overview of the field of family business studies: Current status and directions for the future. Family Business Review, 17 (1), 1–36. https://doi.org/10.1177/014920639702300105

Sharma, P. (2008). Commentary: Familiness: Capital stocks and flows between family and business. Entrepreneurship Theory and Practice, 32 (6), 971–977. https://doi.org/10.1111/j.1540-6520.2008.00266.x

Sharma, P., Chrisman, J. J., & Chua, J. H. (1997). Strategic management of the family business: Past research and future challenges. Family Business Review, 10 (1), 1–35. https://doi.org/10.1111/j.1741-6248.1997.00001.x

Sharma, P., Chrisman, J. J., & Chua, J. H. (Eds.). (2012). A review and annotated bibliography of family business studies . Kluver Academic Publishers.

Sharma, P., Melin, L., & Nordqvist, M. (2014). Introduction: Scope, Evolution and Future of Family Business Studies’. In L. Melin, M. Nordqvist, & P. Sharma (Eds.), The SAGE Handbook of Family Business (1st ed., pp. 1–22). SAGE Publications Ltd.

Chapter Google Scholar

Shen, N. (2018). Family business, transgenerational succession and diversification strategy: Implication from a dynamic socioemotional wealth model. Cross Cultural & Strategic Management., 25 (4), 628–641. https://doi.org/10.1108/CCSM-06-2017-0074

Siebels, J. F., & zu Knyphausen-Aufseß, D. (2012). A review of theory in family business research: The implications for corporate governance. International Journal of Management Reviews, 14 (3), 280–304. https://doi.org/10.1111/j.1468-2370.2011.00317.x

Sieger, P., Zellweger, T., Nason, R. S., & Clinton, E. (2011). Portfolio entrepreneurship in family firms: A resource-based perspective. Strategic Entrepreneurship Journal, 5 (4), 327–351. https://doi.org/10.1002/sej.120

Simon, A., Marquès, P., Bikfalvi, A., & Muñoz, M. D. (2012). Exploring value differences across family firms: The influence of choosing and managing complexity. Journal of Family Business Strategy, 3 (3), 132–146. https://doi.org/10.1016/j.jfbs.2012.05.003

Simon, H. A. (1947). Administrative behavior. A study of decision-making processes in administrative organisation (4th ed.). New York: The Free Press.

Sirmon, D. G., & Hitt, M. A. (2003). Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrepreneurship Theory and Practice, 27 (4), 339–358. https://doi.org/10.1111/1540-8520.t01-1-00013

Soleimanof, S., Singh, K., & Holt, D. T. (2019). Micro-foundations of corporate entrepreneurship in family firms: An institution-based perspective. Entrepreneurship Theory and Practice, 43 (2), 274–281. https://doi.org/10.1177/1042258718796076

Srivastava, A., & Bhatia, S. (2022). Influence of family ownership and governance on performance: Evidence from India. Global Business Review, 23 (5), 1135–1153. https://doi.org/10.1177/0972150919880711

Stevens, C. E., Kidwell, R. E., & Sprague, R. (2015). Bound by laws, or by values? A multi-level and cross-national approach to understanding the protection of minority owners in family firms. Corporate Governance: An International Review, 23 (3), 203–215. https://doi.org/10.1111/corg.12089

Suddaby, R., Silverman, B. S., Jaskiewicz, P., De Massis, A., & Micelotta, E. R. (2023). History-Informed Family Business Research: An Editorial on the Promise of History and Memory Work. Family Business Review, 36 (1), 4–16. https://doi.org/10.1177/08944865231157491

Suess, J. (2014). Family governance–Literature review and the development of a conceptual model. Journal of Family Business Strategy, 5 (2), 138–155. https://doi.org/10.1016/j.jfbs.2014.02.001

Thaler, R. H., & Sunstein, C. R. (2009). Nudge: Improving decisions about health, wealth, and happiness . Penguin.

Thornton, P. H., Ocasio, W., & Lounsbury, M. (2012). The institutional logics perspective: A new approach to culture, structure, and process. Oxford: Oxford University Press on Demand.

Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14 (3), 207–222. https://doi.org/10.1111/1467-8551.00375

Tsai, W. H., Kuo, Y. C., & Hung, J. H. (2009). Corporate diversification and CEO turnover in family businesses: Self-entrenchment or risk reduction? Small Business Economics, 32 (1), 57–76. https://doi.org/10.1007/s11187-007-9073-y

Üsdiken, B., & Wasti, S. A. (2002). Türkiye'de akademik bir inceleme alanı olarak personel veya" insan kaynakları" yönetimi, 1972–1999. Amme İdaresi Dergisi , 35 (3), 1–37. https://research.sabanciuniv.edu/id/eprint/11269

Van den Berghe, L. A., & Carchon, S. (2003). Agency relations within the family business system: An exploratory approach. Corporate Governance: An International Review, 11 (3), 171–179. https://doi.org/10.1111/1467-8683.00316

Van Eck, N. J., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84 (2), 523–538. https://doi.org/10.1007/s11192-009-0146-3

Vazquez, P., & Rocha, H. (2018). On the goals of family firms: A review and integration. Journal of Family Business Strategy, 9 (2), 94–106. https://doi.org/10.1016/j.jfbs.2018.02.002

Verbeke, A., & Kano, L. (2012). The transaction cost economics theory of the family firm: Family–based human asset specificity and the bifurcation bias. Entrepreneurship Theory and Practice, 36 (6), 1183–1205. https://doi.org/10.1111/j.1540-6520.2012.00545.x

Vogel, R., & Güttel, W. H. (2013). The dynamic capability view in strategic management: A bibliometric review. International Journal of Management Reviews, 15 (4), 426–446. https://doi.org/10.1111/ijmr.12000

Wang, D. (2006). Founding family ownership and earnings quality. Journal of Accounting Research, 44 (3), 619–656. https://doi.org/10.1111/j.1475-679X.2006.00213.x

Wang, D., & Zhang, Z. (2022). Disassembling the influences of perceived family relational conflict on business family offspring’s intrapreneurial intentions. International Entrepreneurship and Management Journal, 18 (1), 153–189. https://doi.org/10.1007/s11365-021-00747-5

Wasserman, N. (2003). Founder-CEO succession and the paradox of entrepreneurial success. Organization Science, 14 (2), 149–172. https://doi.org/10.1287/orsc.14.2.149.14995

Wasserman, N. (2006). Stewards, agents, and the founder discount: Executive compensation in new ventures. Academy of Management Journal, 49 (5), 960–976. https://doi.org/10.5465/amj.2006.22798177

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5 (2), 171–180. https://doi.org/10.1002/smj.4250050207

Williams, R. I., Jr., Pieper, T. M., Kellermanns, F. W., & Astrachan, J. H. (2018). Family firm goals and their effects on strategy, family and organisation behavior: A review and research agenda. International Journal of Management Reviews, 20 , 63–82. https://doi.org/10.1111/ijmr.12167

Wiseman, R. M., & Gomez-Mejia, L. R. (1998). A behavioral agency model of managerial risk taking. Academy of Management Review, 23 (1), 133–153. https://doi.org/10.5465/amr.1998.192967

Wood, R., & Bandura, A. (1989). Social cognitive theory of organisational management. Academy of Management Review, 14 (3), 361–384. https://doi.org/10.5465/amr.1989.4279067

Woodfield, P., & Husted, K. (2017). Intergenerational knowledge sharing in family firms: Case-based evidence from the New Zealand wine industry. Journal of Family Business Strategy, 8 (1), 57–69. https://doi.org/10.1016/j.jfbs.2017.01.001

Worek, M. (2017). Mergers and acquisitions in family businesses: Current literature and future insights. Journal of Family Business Management., 7 (2), 177–206. https://doi.org/10.1108/JFBM-04-2016-0009

Zahra, S. A. (2003). International expansion of US manufacturing family businesses: The effect of ownership and involvement. Journal of Business Venturing, 18 (4), 495–512. https://doi.org/10.1016/S0883-9026(03)00057-0

Zahra, S. A. (2005). Entrepreneurial risk taking in family firms. Family Business Review, 18 (1), 23–40. https://doi.org/10.1111/j.1741-6248.2005.00028.x

Zahra, S. A., & Newey, L. R. (2009). Maximising the impact of organisation science: Theory-building at the intersection of disciplines and/or fields. Journal of Management Studies, 46 (6), 1059–1075. https://doi.org/10.1111/j.1467-6486.2009.00848.x

Zahra, S. A., Hayton, J. C., Neubaum, D. O., Dibrell, C., & Craig, J. (2008). Culture of family commitment and strategic flexibility: The moderating effect of stewardship. Entrepreneurship Theory and Practice, 32 (6), 1035–1054. https://doi.org/10.1111/j.1540-6520.2008.00271.x

Zellweger, T., & Sieger, P. (2012). Entrepreneurial orientation in long-lived family firms. Small Business Economics, 38 (1), 67–84. https://doi.org/10.1007/s11187-010-9267-6

Zupic, I., & Čater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18 (3), 429–472. https://doi.org/10.1177/1094428114562629

Download references

Author information

Authors and affiliations.

Department of International Trade and Finance, Sakarya University of Applied Sciences, Sakarya, Türkiye

Mehmet Bağiş & Omer Yazici

University for Business and Technology-UBT, and Riinvest Institute, Prishtina, 10000, Kosovo

Li̇ri̇don Kryeziu

Department of Health Management, Duzce University, Duzce, Türkiye

Mehmet Nurullah Kurutkan

University of Prishtina “Hasan Prishtina”, and Kosova Academy of Sciences and Arts, Prishtina, 10000, Kosovo

Besni̇k A. Krasniqi

University of North Carolina-Greensboro, Greensboro, NC, USA

Esra Memili

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Li̇ri̇don Kryeziu .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Bağiş, M., Kryeziu, L., Kurutkan, M.N. et al. Topics, trends and theories in family business research: 1996–2020. Int Entrep Manag J 19 , 1855–1891 (2023). https://doi.org/10.1007/s11365-023-00904-y

Download citation

Accepted : 25 September 2023

Published : 14 October 2023

Issue Date : December 2023

DOI : https://doi.org/10.1007/s11365-023-00904-y

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Family business

- Research trends

- Theoretical foundations

- Bibliometric analysis

- Qualitative content analysis

- Find a journal

- Publish with us

- Track your research

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Culture in a Family Business: A Reflection of the Owning Family?

A significant part of the family business literature recognized that organizational culture in a family business is a reflection of the owning family – an important yet seldom tested assertion. This study investigated whether a relationship exists between the climate of the owning family and the culture in their organization. Participants were composed of 136 family members and 403 non-family employees from 33 family businesses in Cebu City, Philippines. Family members answered family climate questionnaires that measured emotional cohesion and cognitive cohesion within their families, while employees answered organizational culture questionnaires that measured sociability and solidarity within their organizations. Correlation analysis revealed that there is no direct relationship between family climate and organizational culture. Additionally, supplementary interviews provided support in understanding why an absence of direct relationship exists. Findings suggest that the organizational culture in any family business is not by default a reflection of the owning family’s climate. This insight serves as an invitation to reexamine widely-held views and renew the dialogue about organizational culture in family businesses.

Related Papers

Family Business Review

Daniel Denison

Mediterranean Journal of Social Sciences

Beskida Dorda

European Journal of Family Business

Danvila Del Valle

Theoretical Perspectives on Family Businesses

Rocky Adiguna

The paper reviews the literature on organisational culture in family business by tracing its origin in organization studies and its importation to family business field. Despite the vast literature in the last three decades, cultural inquiries in family business have not come a long way. To date, research on family business culture are heavily dominated by functionalist/integrationist perspective that assumes culture as coherent and shared values. The paper suggests future research to examine the multidimensionality of family business, utilize ethnographic methods to go ‘under-the-surface’ and achieve deeper immersion in the field, and take critical stances of culture to understand family business.

Nigel Nicholson

International Journal of Asian Business and Information Management

Nay Zar Aung

This article explores the concept of familiness in family-owned businesses (FOBs), identifying how families generate their own resources for business performance. Applying the resource-based view, the authors examined seven Myanmar businesses. Findings revealed that two factors influence familiness in Myanmar FOB: family unity and internal governance systems, which can be subdivided into traditional and collective systems. Moreover, evaluation revealed that FOB's business performance was affected by different family attitudes. A combination of family unity and a traditional internal governance system was conducive to controlling the internal business capabilities, whereas creating external opportunities were considered more effective for a combination of family unity and a collective internal governance system. Findings suggest that familiness emerges through embedded family resources that incorporates a sense of awareness with abilities for business advantages. These empirical ...

European Journal Of Family Business

Maribel rodriguez zapatero

Brazilian Business Review

Patrícia Amélia Tomei

Samuel Addae-Boateng

Organization studies

Susan Ainsworth

RELATED PAPERS

Francisco Arias

Estudios Sociales

Francisco José Zamudio Sánchez

Estudios pedagógicos (Valdivia)

Lizeth Martínez Forero

Ecología Austral

Journal of Health, Population and Nutrition

Cultura y Filosofía Oriental

Izumi Yaryu

Ciência Rural

Gustavo Migliorini de Oliveira

Ewerton Matias

Planta Medica

Kwanjai Kanokmedhakul

Revista Ingenierías Universidad de Medellín

Juan Barraza

João Pedro Lopes Salvador

Evidence-Based Communication Assessment and Intervention

Howard Goldstein

Jerzy Wiciak

Microorganisms

Pratik Joshi

Biochemistry Usa

Apostolos Gittis

Journal of Genetic Engineering and Biotechnology

Olowosoke B Christopher

Italian Journal of Animal Science

Silvester Zgur

Episteme. Revista de divulgación en estudios socioterritoriales

Episteme. Revista de divulgación en estudios socioterritoriales.

Blood Coagulation & Fibrinolysis

Nurit Rosenberg

Soft Matter

Joseph Maclennan

Patrick Meumeu Yomsi

Conference: Commemoration of the 1919 Land Settlement (Scotland) Act

Andrew G. Newby

ghkgf gfhrg

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

6 Traits of Strong Family Businesses

- Claudio Fernández-Aráoz,

- Sonny Iqbal,

- Jörg Ritter,

- René Sadowski

Based on a three-year study.

Although most family businesses fail to last through the third generation, some are able to thrive. Why? By following four rules: maintain good governance, identify and develop both family and nonfamily talent; pursue disciplined succession; and preserve family gravity. The last is perhaps the most difficult to get right. So Egon Zehnder and the Family Business Network International (FBNI), embarked on a three-year global study to discover what makes up family gravity. After interviewing more than 50 executives at 28 leading family businesses across the Americas, Europe, and Asia and surveying of 4,000 FBNI members, they concluded that gravity has six dimensions: values and vision, the right involvement, cohesion and interaction, family governance and clarity on leadership principles and roles.

Family businesses are the cornerstone of most national economies, according to a recent report by Credit Suisse Research. They can create jobs, spur innovation, and drive superior returns.

- Claudio Fernández-Aráoz is an advisor on Talent and Family Businesses, a frequent lecturer at Harvard Business School, and the author of It’s Not the How or the What but the Who .

- Sonny Iqbal is a partner at Egon Zehnder, and the former co-leader of its global family-business practice.

- Jörg Ritter is a partner at Egon Zehnder and coleader of its global family-business practice.

- René Sadowski is engagement leader at Egon Zehnder and a member of its global family-business practice.

Partner Center

65 Family Businesses Essay Topic Ideas & Examples

🏆 best family businesses topic ideas & essay examples, 📝 most interesting family businesses topics to write about, 👍 good research topics about family businesses.

- Owning & Operating a Family Business The uniqueness of family business is that members of family are affected by an overlap of family, business, and ownership subsystems, with owners playing simultaneous roles among these three subsystems. In sum, family business represents […]

- Family Business Succession in Asian Countries One of the most exciting challenges affecting family businesses is the succession of management, which results in the limited survival of transition businesses.

- Family Business Promoting Economic Growth The primary goal of the article is to assess the role of the family business in the economic growth of Saudi Arabia.

- Future of the Family Business in World Today, regardless of drastic alterations in the world of business and global marketplace, family business remains one of the most important spheres and play a central role in the development of the economy.

- Feasibility of Developing a Family Business There is no unambiguous position of the scientific economic and administrative community on the effect of the family on the development of business models.

- Culture and Family Business Management Far from the above, Moho can ask for a unique scenario where he agrees to perform on a contract basis whereby he will ask for the permission to apply his principles in a department of […]

- Succession Plan for a Family Business However, this passing on of the business to other individuals, who are the successors, is a crucial phase in the running of the business.

- Family Business Employees and Theory of Needs Specifically, the relationships of family members and the regular staff that is not related to the owner directly may involve tension due to the possibility of unfairness and biased judgment on the side of managers.

- Internationalization of Family Businesses The paper in question investigates the nature of the internationalization of family businesses and studies how different futures of the company affect the process.

- Can the Family Business Disintegrate the Family? The report explores the contemporary context of running a family business with the aim of the identification of threats concerning the integrity relationships between the family members involved in the same business.

- Family Business, Its Philosophy and Strategy In this regard, the leader may be confused because of the need to react in the most proper way to benefit both the family and business.

- Family Business in the UAE: Management and Dynamics In the meantime, it is critical to note that the only reason why Izat Raja’s business can be called “family” resides in the fact that his nephew, Waleed works for Raja’s company.

- Family Business: R&S Electronic Service Company The main issue in this company that needs to be resolved is the abuse of office by the general manager. In addition, Eddie threatens managers at the payroll department for questioning the illegal commissions awarded […]

- Gender Inequality in Family Business One of the problems that every woman faces in a family business is that of succession. In the model of Royal Families, the right to lead the business belongs to the oldest son.

- Family Business: Success or Challenge? A family business is different from the others due to the presence of the family. Since it is a family business, a Family Council is needed to manage the company.

- Mills Trading: Governance Issues in a Family Business The main business of the Group is connected to providing the markets and hypermarkets of the UAE, Qatar, Bahrain, and Oman with various agricultural and camping supplies and equipment.

- Wang Group Company: Family Business Changes Charles Wang after succeeding his father Alfred Wang brought in the following changes to the Wang Group in order to bring about change in the organization: Charles Wang changed the business model of the company […]

- How to Establish a New Family Business? This is because some members can either be owners and not involved in the daily running of the business while others may run the business but have no stake in ownership of the business it […]

- Criteria Used in Assessing the Relative Success of a Family Business The two strategies, which were employed in critical assessment of the success of Candy and Candy interior design and development Management Company, included overall assessment of business performance and the form of business governance practised.

- Family Business in the Middle East The business is run and controlled by the whole family, but may also be run by the person with the largest share holding in the enterprise. The family forms the management team for business and […]

- Effectiveness of Non-Family Member Leaders in Family Business How non-family member leaders can contribute for the development of family business and national economy; The extent to which family members accept the decisions of the leaders of non-family members; Assess the impact of non-family […]

- The Family Business: Gopher IT Gopher IT is a business owned by a family with different members of the family engaging in running of the business.

- Assessing the Relative Health of a Family Business Also, it is essential to ascertain that family members can differentiate the functions of such institutions and the governing units of the business, including the top management and the board of directors.

- Family Business and Its Governance Godfrey argues that the family in itself has substantial influence on the company’s assets and the economic success of the company. In the long run it becomes volatile of the family culture to challenge a […]

- Family Business on the Couch: A Psychological Perspective

- Advantages and Disadvantages of Running a Family Business

- Women’s Management Strategies and Growth in Rural Female-Owned Family Businesses

- Mission Statements for Small Family Businesses

- Pension Wealth and Intergenerational Succession in Family Businesses

- Tools for Strategy Development in Family Firms

- Goal Orientation and Performance of Family Businesses

- Managerial Behavior of Small and Medium-Sized Family Businesses

- Conflicts That Plague Family Businesses

- The Importance of Terms in Family Business

- Family Business Directed Study of the Walton Family

- The Importance of Strategic Planning in Family Business

- Capital Markets and the Evolution of Family Businesses

- Leadership Lessons From Great Family Businesses

- Internationalization via Strategic Alliances in Family Businesses

- Differences Between Family and Non-Family Businesses

- Family Businesses and Adaptation: A Dynamic Capabilities Approach

- Planning for Non-family Employees in the Family Business

- The Application and Role of Management Accounting and Controlling Methods in Family Businesses

- Corporate Social Responsibility in Family Firms

- The Problem With Family Businesses in the United Kingdom

- McDonald’s Ruining Family Business Environment

- Family Businesses: Can the Family and the Business Finances Be Separated

- Why Family Businesses Are Better at Weathering Economic

- The Role of Trust in a Family Business

- Succession in Small and Medium-Sized Family Businesses

- Internationalization and Corporate Governance in Family Businesses

- The Advantages and Disadvantages of the Family Business

- Managing the Trickiest Parts of a Family Business

- The Biggest Challenges for Family-Owned Businesses

- What You Can Learn From Family Business

- Functional Strategies and Practices of Small and Medium-Sized Family Businesses

- Do Family Firms Have Better Access to External Finance During Crises

- Analyzing Family Business Cases: Tools and Techniques

- Do Family Firms Outperform Non-family Ones

- Unemployment and Family Businesses in Hungary

- Family Entrepreneurship: Characteristics and Successful Cases

- Vietnamese Values, Networks, and Family Businesses in London

- How Family-Owned Businesses Benefit the Capital Markets

- The Growth and Performance of Family Businesses During the Global Financial Crisis

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, September 26). 65 Family Businesses Essay Topic Ideas & Examples. https://ivypanda.com/essays/topic/family-businesses-essay-topics/

"65 Family Businesses Essay Topic Ideas & Examples." IvyPanda , 26 Sept. 2023, ivypanda.com/essays/topic/family-businesses-essay-topics/.

IvyPanda . (2023) '65 Family Businesses Essay Topic Ideas & Examples'. 26 September.

IvyPanda . 2023. "65 Family Businesses Essay Topic Ideas & Examples." September 26, 2023. https://ivypanda.com/essays/topic/family-businesses-essay-topics/.

1. IvyPanda . "65 Family Businesses Essay Topic Ideas & Examples." September 26, 2023. https://ivypanda.com/essays/topic/family-businesses-essay-topics/.

Bibliography

IvyPanda . "65 Family Businesses Essay Topic Ideas & Examples." September 26, 2023. https://ivypanda.com/essays/topic/family-businesses-essay-topics/.

- Acquisition Essay Ideas

- Business Structure Titles

- Bureaucracy Paper Topics

- Agile Project Management Research Topics

- Employee Benefits Paper Topics

- Government Regulation Titles

- Auditing Paper Topics

- Family Relationships Research Ideas

More From Forbes

Family businesses need to tell their story better. here’s why..

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Radio Flyer earned Best In Class on 2024 Family Business VISibility Ranking for clearly sharing ... [+] their values, impact and story publicly. (Photo By Tom Williams/Roll Call/Getty Images)

According to Edelman Trust Barometer “Family business has always held a strong edge in trust over business in general.” But trust isn’t something family businesses can take for granted. Edelman reports that trust in family businesses has been eroding for years. A recent study saw a six point drop in trust for family business, while trust in general business is climbing. Why? Edelman sees that family businesses are not working to build trust with their customers: “Nearly 60 percent of companies do not communicate purpose externally. Eighty-four percent do not take a public stand on important issues.”

As corporate citizenship has become a greater expectation for companies, the business sector has stepped up. Yet, it can be a double-edged sword. Companies that profess their commitment to inclusion, environmental protection and other values, can be criticized for being “woke” or for engaging in “greenwashing.”

How do family businesses participate in this tricky, but necessary conversation? The answer is surprisingly simple: stories. Stories help share values and impact in context. They help inspire and recruit employees. They help connect with clients and customers in memorable and meaningful ways. Stories speak louder than jargon, louder than accolades and labels.

First Annual Family Business VISibility (Values, Impact, Story) Ranking

To understand how family businesses are communicating, we reviewed how well 30 family-owned B Corp businesses were sharing their values, impact and stories. We chose B Corp businesses as the certification process ensures the family businesses selected for review have proven to a third party that they are indeed values-driven businesses. Each business was graded on the eight point VISibility scale.

The VISibility Scale

8 Components of the VISibility Rankings help a company understand how well they are communicating ... [+] their values, impact and story.

Wells Fargo Championship 2024 Golf Betting Preview, Odds And PGA Picks

The minnesota timberwolves are suffocating everyone defensively, new fbi warning as hackers strike email senders must do this 1 thing.

Andy Crestodina, co-founder and CMO of Orbit Media , a B Corp certified digital marketing agency, reviewed the VISibility rankings. “This is very cool...I think this is a really interesting way to evaluate companies,” he said. Crestodina was not surprised to learn that only four companies ranked Best In Class, meeting every criteria and only eight achieved the Great Storytellers level (scoring at least 6 out 8 criteria).

Only 4 out of 30 family businesses reviewed scored Best In Class (8 out of 8) on the VISibility ... [+] Ranking

Nearly half of the companies reviewed did not use storytelling techniques to share their founding ... [+] store and values.

“Storytelling is not central to many brands. So there's lots of missing stories. This would be one of them,” said Crestodina. “For many brands, especially in their digital presence, it's not discussed in detail.” The majority of companies (18) met less than 65% of the criteria, showing the opportunity to improve or start storytelling.

How To Share Your Values, Impact & Story

Business leader and author Simon Sinek suggests that starting with why, before moving through how and what, is a much more persuasive way to communicate a brand. Similarly, when a company is trying to demonstrate their values, it’s important to start with character. Most companies share their credentials and competences and fail to reveal anything about their character.

The 3 C's of Communicating Values, Impact and Stories

For example, your company is B Corp certified. Your ingredients are organic and non-GMO. Your ice cream flavor won a blue ribbon at the state fair. These are your credentials. The action you’ve taken to reduce your carbon footprint, the quality of your products and the integrity of the supply chain show your competence. Your character is shared through your stories. Here’s an example from one of the B Corp companies we reviewed:

Amy’s Kitchen gives an intimate story of its founders, Rachel and Andy, while sharing their values and character: “In 1987, while Rachel was pregnant with Amy and on bed rest,” reads Amy's Kitchen website . “Andy went looking for ready-made meals at their local natural grocery store. When he couldn’t find anything organic and vegetarian that satisfied their taste buds, they decided to make their own.”

Overlaid with family photos of their first kitchen and baby Amy, the story continues: “The first dish Rachel and Andy created was a pot pie. They made them by hand, sold them locally and Amy’s Kitchen began right out of their home. They thought they would remain a small company simply making pot pies, but pretty soon handwritten letters of thanks started pouring in.”

Their family story of humble beginnings, growth through community support, becoming a leader in the organic movement, and using her grandmother’s recipes all tie back to the family’s values that food should not be manufactured, but cooked with love. And the ripple effect it had on them as family and as a business.

Top 3 Reasons Family Businesses Fail To Share Stories

1: they only share the stories internally.

Though B Corp companies have put in the enormous effort to become B Corp certified, 30% of companies reviewed (8) didn’t even mention it on their website. Some companies may believe B Corp certification is more for internal communications. For companies like Orbit, B Corp is frequently used internally like a compass when the team is struggling to find the right answer. “What would be the B-corpy thing to do?” Crestodina recalled asking when his team needed to reach a business decision with no clear, right answers. The B Corp certification serves as a guide for decision making and attracting like-minded talent, said Crestodina.

2: They don’t understand the power of their stories

For others, their family stories are so embedded into the company culture that it’s hard for them to extrapolate the stories and share. When asked why family companies have such a hard time intentionally sharing their stories, founder of Sankofa Legacy Advisors, Thomasina Williams shared that for many family enterprises, stories are the fabric of their lives, their work, their intergenerational communication. They can’t see the stories themselves, because they are living the stories. They don’t stop to reflect on their stories. They understand their role in the community, their commitment to stewarding natural resources. They assume everyone already knows and understands their stories and values too.

3: Generational Divides

There is also a generational divide. Previous generations of family-owned businesses have intentionally separated their private life from their business life. Robert Pasin , third-generation Chief Wagon Officer of B Corp certified Radio Flyer, knows this conflict first hand. “My grandpa and my dad were very averse to PR. They didn't want any media coverage,” shared Pasin. “So when we were getting ready for our 80th anniversary, in 1997, I had this huge fight with my dad.”

Pasin decided to hire a PR firm to the founding story of his grandpa coming to the U.S. from Italy in 1914 and the birth of the first iconic Little Red Wagon. Though his father didn’t want their name in the paper, Pasin went ahead with the plan. “I felt like the company was really struggling. I was looking for something that could kind of rejuvenate it,” said Pasin. He decided to go against his father’s wishes and celebrate the family’s founding story. Since the initial celebration, they’ve had several campaigns telling the family’s story. “We've gotten literally billions of media impressions from telling our story. I think the long-term power of brand building is incredible.”

The Takeaway

Family businesses are often a force for good, with values intrinsic to the founding generation. B Lab brings together this community through their certification process, helping them to reflect on how their business processes support their values.

But with the new social demands for businesses to be corporate citizens, it is no longer enough to simply do good. Businesses must share their values and impact through their stories.

What stories do you have to tell? Whether or not you are a family business or a B Corp, you can use the VISibility Ranking to understand how well your business is communicating its values, impact and stories.

- Editorial Standards

- Reprints & Permissions

Purdue Online Writing Lab Purdue OWL® College of Liberal Arts

Welcome to the Purdue Online Writing Lab

Welcome to the Purdue OWL

This page is brought to you by the OWL at Purdue University. When printing this page, you must include the entire legal notice.

Copyright ©1995-2018 by The Writing Lab & The OWL at Purdue and Purdue University. All rights reserved. This material may not be published, reproduced, broadcast, rewritten, or redistributed without permission. Use of this site constitutes acceptance of our terms and conditions of fair use.

The Online Writing Lab at Purdue University houses writing resources and instructional material, and we provide these as a free service of the Writing Lab at Purdue. Students, members of the community, and users worldwide will find information to assist with many writing projects. Teachers and trainers may use this material for in-class and out-of-class instruction.