Ready to take your trading to the next level and become a pro?

Check out all our courses for stock & options traders.

Learn detailed trading strategies & options setups to make a consistent monthly income

or click here to learn more...

Ep 127: Technical Analysis Case Studies & ABCD Patterns

Hey, this is Sasha Evdakov.

Today we’re going to take a look at technical analysis case study as far as Tesla goes. And we’ll do a little bit of practice.

This is great if you’re getting started with technical analysis or you want to learn a little more about technical analysis. You want to break apart a chart in great detail.

That’s what we’re going to do is we’re going to take a look at this chart. And we’re going to break it apart in detail.

If you’re reading this, I highly recommend you take a look at the video. I will give you some critical insights on what to watch for as well even if you’re reading this.

Before we go in detail onto this keep in mind that none of the stocks here are recommendations to buy or sell. Consult with your financial advisor before taking on any trade.

Illustration of the Example – Tesla

Let’s take a look at the chart. I’m going to use a drawing program here to illustrate this example. I believe you want to understand investing and looking at charts.

It’s essential that when you’re studying and evaluating charts the point behind it is to predict future price movements.

But to predict future price movements, you need to:

- understand how a stock moves

- understand how a stock behaves

- understand how it acts

- know what it’s done in the past

- see what you’re expecting to do in the future

For example, you might be looking at Michael Jordan when he was very popular. He was able to score a certain amount of points every single game.

Then more than likely the next game or the next game after that you would expect a specific type of result. Time and time again because that’s what that type of player or person did.

With stocks is the same story. Tesla has a specific type of group of traders. Not only because it trades at a particular price range, but because of the people that are attracted to trading this type of stock.

There are some day traders, swing traders, longer-term investors, but in general. It attracts a specific type of person. If you’re looking for like a Microsoft or a Bank of America, those attract a different kind of person.

Sometimes those things overlap, but in general, you have a type of person that gets attracted to these types of stocks. In either case, when we start evaluating these charts, you’re looking at human behavior.

The price tells you:

- about human behavior,

- what people want

- what people don’t want

- how things are acting

- when things are running out of fuel

Take a look at this upward trend right here. As you look at Tesla here and you’re looking for this uptrend that we’ve had eventually these things run out of gas. The steeper these things move eventually they run out of gas.

You can’t keep pushing a rocket ship to the moon without giving something back. Eventually, it runs out of gas. At least in our current environment and state that we live in.

In this case, the same concept as you continue to move higher eventually this is why you need pullbacks. When you see things continuing to move higher, that’s why finally you get these pullbacks. These pullbacks allow that stock to continue to move higher, digest or consolidate.

Stocks don’t go straight up. I think if you’ve been trading for a little bit of time you know and understand that. In either case, one of the things that I look at when I first look at charts is I tell myself a story.

Especially when I didn’t understand how stocks moved and behaved. I used to tell myself a little story, and when it comes to that, it’s an exciting concept. When you tell yourself a story, it makes things easier. Humans think in terms of stories.

When it comes to Tesla and we start looking at this you can see this stock was moving sideways. It was under the $50 range. The story here is this stock was the first company. It was getting started and building energy and momentum.

It’s getting its exposure, the marketing – that was happening. And people started to build into buying this stock. As they continue to develop into this eventually right around early 2013, you had some catalyst. You had a news catalyst, some awareness that started to happen. More people got excited about what this company was doing.

There was a lot more to the forefront of this company. And when this happened, this stock started to explode. You can see that by this big candle bar that happened. When this happened, more buyers continued to step in. There’s more excitement, and we continue to move higher to the upside.

You could discuss every bar and every tick here but in our sake for our examples of evaluating a stock chart we’re looking at the bigger picture.

The stock had a great movement to the upside up until about the end of 2013. In 2013 it made its presence known. Once its existence was known so many people got into the stock and then it needed a pullback. It was too far extended, and it was starting to run on fumes. The evaluation for how far it went in a short amount of time was far stretched.

If you look at the moving average here that we have and compare it to at the highs the distance, there is much greater than if we look at somewhere in June. The distance is a lot smaller. In either case, you can see it’s quite stretched.

- What are the stocks do when they get overextended?

Well, they pull back, and that’s what happened.

This stock needed a calming down period to acquire new investments to get more value. Also, people who got into the stock at these earlier points started taking some profits.

We loaded the gun back up and then we got more gas. After we got more gas, we continued higher. And a stock continued to power to the upside once more.

Over time things get a little extended. We’re coming towards the end of our tank, and we need a little bit of the breather.

- What does the stock do?

Towards mid-2014 we have a slight pullback. This is what you do if you’re telling yourself a story. Now the stock continued to move in this wave-like pattern for over the next year or two. But we slowly start running into roadblocks at higher prices. This is where the problem begins to lie with this stock.

We’re starting to move, but we’re not moving as fast. The stock now becomes a lot more known. It becomes more available to the public as far as news goes and as far as awareness goes. The price that it’s priced in. It needs to start hitting things in perfection for it to continue to grow. And that becomes a lot more difficult because they are innovating.

Over the next 2015 and 2016, we’ve been moving in a sideways pattern between the 175 and 270 level. And in there we’ve had some ups and downs. But on a bigger picture scope, we’ve had some sideways action.

If you break this apart once more, you can see that at the beginning we had an accumulation stage. Then in the next part, we had that growth stage. The stage where we had that upward movement. The initial investor started to come in. And then from then on, we’ve been in a distribution or consolidation stage. Or we are moving sideways.

You can see that this is how you’re looking at a stock when you’re starting to break it down.

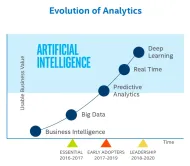

ABCD Patterns – What to pay attention to?

When we start looking at some more technical patterns and technical evaluations you can start looking at things like ABCD patterns.

As you start getting more specific, you can look at ABCD patterns on the weekly. Or you can look at it on the daily, and you can look at it on the monthly. I’m doing it right now on the weekly because it’s easier to see, especially as a teaching example.

Basic questions:

- Where are ABCD patterns?

- How are they formed?

They’re usually based on swing points – where the stock changes directions. That’s what a swing point is.

Look at where a stock changes directions. You get an idea of the swing points. When we start looking at ABCD patterns what’s interesting about them is they talk about human behavior.

They’re telling you about the cyclical moves in stock and rhythm in a pattern. Like you have a sleep pattern. Typically most humans go to bed at 10 p.m. and wake up by 7 or 8 a.m.

You have that sleep pattern that you continue to go through day in and day out. You have that pattern, and ABCD patterns are very similar. If I plop A where the stock changed movement, then we go to the B at the next point where we had a change.

That would go to B to C. We have that little pullback and the C to D. You can see how that works out in terms of the patterns. If you start drawing things together and connecting these you can see that pattern standing out – ABCD patterns.

I’ll draw a couple more patterns so that you’re aware that ABCD patterns don’t have to happen to the upside.

Also, you have them to the downside. Sometimes they’re not as clean, but I will still share with you how those look. That way you get an idea, so we had a downward ABCD pattern and 2015 to about 2016 – Tesla. You can see there are another nice and clean ABCD patterns. Yes, there are other ABCD patterns in between that, but right now I’m showing you the clean patterns.

That way you learn what you’re looking for. And once you discover what you’re looking for you can search for subtle little ABCD patterns. It’s better to focus on cleaner patterns. That way you understand what’s going on. Once you know what’s going on with ABCD patterns, then you can modify these. You can manipulate these and use them on your terms and your chart.

Now here’s the other exciting fact behind ABCD patterns. When you’re looking at ABCD patterns, you’re looking for the volume to confirm this pattern.

Essential question: How is that volume coming into the stock?

From the A to B pattern you have massive volume coming in or good volume. When you have the volume, you have gas in the gas tank. In this case, you can see that we have volume coming in. And we have the full price spread that follows through.

That’s why you continue to get the follow through on that movement. When you start getting a pullback on the B to C leg, this is typically lower volume.

As you get into the next stage, it might even appear that it’s higher volume. The thing is if you compare it to the previous volume it should be lighter volume. Then finally the next leg (C to D) you want to see the more substantial volume to the upside from the C to D leg.

It’s more massive than the B to C leg. This is not always the case I found over the years. You may see some lighter volume, but the expansion can still be pretty good. Or you still want an increase in volume.

If you notice here in Tesla in 2014 even though we don’t have heavier volume than the retracement B to C, we still have an incline in volume. Or the volume starts to grow. As you can see it’s not always the case, but that’s what you want to see.

What’s Happening to The Downside?

This is the same thing when it happens to the downside. If we take the 2015 movement to the downside, the A to B you can see that it’s the slightly red volume is picking up.

The bearish volume or the big sticks on the red bars are picking up. As we get this retracement which is the B to C you can see the volume is very light. The B to C moves to the upside because this is a bearish pattern.

It’s contracting, and when we’re talking about the bullish volume, you can see it’s a lot lighter. Then as we get our next break lower again which is the C to D, you can see that volume picking up again on the bearish end.

That’s what you like to see on these charts. And that’s what makes a significant price movement. That’s healthy. If you see a stock moving in a direction with lighter volume that means there’s less gas. That means that there’s less conviction. It’s less likely to stand the test of time. It’s less likely to continue moving in that direction.

It doesn’t mean it can’t. It means it’s less likely to continue. That’s why we always look at volume as a clear sign or indicator for future price movements and actions and behaviors.

When we start evaluating at this chart, you’re combining multiple things.

You’re combining:

- ABCD pattern

- the price action

When we’re talking about price action, it’s essential how the price is moving, which means these wide bars from the open to the close.

You’re putting those together to create and evaluating that chart. At least that’s the simple and basic form.

Pro tip: You could use other indicators to help with this, but I find that the more complicated you make things, the more cluttered your mind becomes. Keep things simple.

As we look at the chart as a whole one of the things that I always like to stress is you start comparing these charts. You start comparing them to the previous volumes.

The other thing is when you look at retracements and pullbacks a typical retracement is 50%. That means nothing is wrong with the stock. You can get other retracements which are 61.8 or 38.2, but it’s based on the Fibonacci sequence.

The simple thing behind the Bonacci sequence is it’s a way to gauge retracement. Fibonacci numbers are mathematical numbers. When you add the first two, you get the next one. Then you add the following two you reach the next number and so forth.

They continue moving along those lines. But as you put them in charts, it allows us to predict human behavior better. These are not magic numbers or formulas that are going to give you perfect answers whenever a pullback is going to stop. But it’ll give you a guideline of what’s a healthy pullback and retracement.

If we take this initial movement and we look at this stock, overall you can see our pullbacks here are 50%, 38.2%, 23.6%, and 61.8%.

I focus on 50%, 61.8%, and 38.2% – those are the main ones that you want to focus on. Something like 23.6% doesn’t hit as often. But if you look at this and we drew the line from the lows or the swing point to the highs you can see what these lines tell you.

Our pullback comes right at 50%. You can see if I draw that line all the way across you can see we’re hitting right at 50%.

The other important thing you can remember is the projected move. How far you expect the next step to go from the C point or after you get the retracement?

Well, if you measure A to B, you will get the distance from C to D.

In this case, if we take our numbers (call it $40), you get about 155 points on the left.

If you draw the same thing from the lows of point C and you go all the way to D, you get about 148 points. About five points off which is not a big deal when it comes to stocks.

You can see it’s close when it comes to the projected move. It’s interesting how this works out.

Next example – ABCD pattern:

If you look at the next leg or the next stage, we have our ABCD pattern. We look at this measure move right there. You can see from here to here we have 147 and then from here to here we also have 114. It’s a little bit less, but the move is still in that range. It’s not going to be perfect in the market.

Take a Look at Retracement

From the retracement of 2014 on that movement the pullback we went from about $130 to about $264.

And we pulled back to about 180-190. You can see that it pulls back right into that 61.8% level. It’s fascinating how things work out in those ways.

Bearish Example

Take a look at the bearish example that we had in 2016. Here’s our projected ABCD pattern. It’s a little bit different looking it’s not as clean. But it gives you the same concept.

You could even say that you had a smaller ABCD pattern right here. That’s another one as well to look at. You can see we’re coming in on this retracement right there to the 50%. Notice that we have 50%, and there are our resistance and retracement.

Our pullback is into 50%. The measured move from A to B – we call it 78 points. And from highs to the end is about 92 points. It’s about 20 off, but it’s very similar. It’s not going to be perfect, but it’s very similar.

If we look at the volume of these movements, you can see the volume is building right here on the downward leg. Then if you look at retracement and you go straight down and look at the volume our volume is drawing up. And then all of a sudden on the break the volume picks up.

That’s what we’re watching on these moves and these measured price moves. And that’s what you get. You get a subtle clean movement in the stock when you’re watching these things.

When you’re looking at ABCD patterns, swing points, and measured moves, this is your money leg. The C to D is your money leg. Once you find the A to B and B to C pattern, the C to D is that money leg.

Whether that’s to the upside or whether that’s to the downside – that’s your money leg.

You can play things in ranges. We have sideways patterns right here in the stock. You can play things in ranges, but these ranges are not as big in terms of price movement as a C to D or an ABCD pattern.

I often find beginners struggle finding ABCD patterns. This is partly due to the stocks that they’re looking at, but also their understanding of ABCD patterns. If you struggle to find ABCD patterns, it’s crucial that you move on to another stock. That is because you’re either looking for something that’s not there. Or you’re forcing the trade.

If you can’t find an ABCD pattern, move on to another stock. Let me show you some examples of some famous companies. The reason why they’re popular is that they move in the appropriate behavior.

They have enough volume. If you’re trading stocks with low volume (penny stocks), sometimes it’s challenging to find ABCD pattern. But in general, with most stocks, you can discover ABCD patterns.

Let’s take a look at a few quick companies, and you’ll get an idea. I’ll backtrack this to Apple. Precisely the same thing what we discussed. If you take a look here is our A to B and then B to C and C to D pattern.

If we take the measured move from A to B, it should be equal similar to C to D. This pullback from B to C should be about 50% give or take.

Let’s take the measured move:

- A to B (about 90 points)

- C to D (about 80 points)

It’s very close and similar. If we calculate this pullback, there is a 50% pullback. It hits that line entirely and then takes off to the upside.

Now we’re looking at this next price movement that we have.

- Can this be forming another ABCD pattern?

Absolutely.

Let’s take a look from A to B. We have right there it’s coming in it’s hitting right around 50%. It’s similar on the pullback. There’s our line of support. It’s also hitting the line of resistance right here of the previous one. It was coming back to retest it. And if you do the measured move, you can see that we get about 80 points.

We’re looking for potentially a target of 172 for this stock. That’s how you get a necessary target for the upside.

Focus on this: pay close attention to the volume. I usually want to see a larger volume to the upside here. Now with this stock, unfortunately, we got a little bit lighter volume than here on some of the pullbacks.

This is not one thing I like to see. It can happen, but it’s not something I like. The main reason is that I always want to see the volume going with it.

If I go into the weekly chart, you want to see more volume coming in as we’re moving higher. On these pullbacks, you want to see the lighter volume. This is not the case when it comes to Apple. And you can see the volume is also dying down as we continue moving higher.

That’s not usually a good case. But it doesn’t mean the stock can’t go higher. It means I’m more cautious about these stocks as they continue to move higher especially if they have less volume.

You have smaller ABCD patterns within this. Because even to the downside if you’re doing calculations so you could trade those but usually keeping a bear market. The downside movements are generally smaller in terms of time frame.

Amazon – ABCD patterns

Let’s take a look at Amazon. Amazon also had quite a handful of good ABCD patterns. Here we are on a weekly chart. There’s an ABCD pattern from 2016 to 2017. It’s a great stock.

Measured move calculation:

At the start, we got 390 points. I would expect from the pullback we also would get about 390 points. And you can see we got about 365.

When we take a look at the pullback at how the pullback came in – what was it?

Well, you can see we came right into about 50% into that pullback and bounced at the 50%. Almost directly at the $500 price level.The stock made a classic move and what did we get later?

You got volume coming in on the break. Notice these high peaks at the highs we have the excellent volume on the bullish side. You did have this drawing up in volume slowly after the little pullback.

Then finally you got more massive buyers coming in the right after that. This stock looks like a classic ABCD pattern. Just like we’ve shown with Tesla and Apple. If you look at the monthly, you can see it from 2015.

GoPro Technical Analysis – ABCD Pattern

You could take about any stock, and we can do the same thing even with GoPro. As you start evaluating items take a look at a 2 or 3 day in this stock.

That way it’s going to be a little bit easier to evaluate it and see the chart. We look at GoPro, and we look at it to the upside. We could say this started very similar to Tesla. There’s consolidation pattern for a few months – July and August we moved sideways.

Then we had to come in volume. Exceptional bullish volume is coming into the stock. People got excited about it and then finally we had a slight little pullback.

We needed to take a gas break, and you can see the volume drawing up right there. Right under the stock, they’re drying up. And then finally we have more volume coming in and further extension of prices.

We had a slight distribution at the top and then the stock continued to head lower. In this chart, you have the accumulation and the upward move.

We have an upward move of about 33 points. Then let’s look at how far the pullback was. The pullback came into (the lighter pullback) 23.6% and then the stock bounce. We went into a 23.6% Fibonacci sequence and then the stock bounce.

Overall the movement was right around 30 to 33 points. If we take the lows of that B point and we go to the highs, you can see we hit it nearly perfectly 33 points. Look at that, and there is your classic ABCD pattern. If you don’t know much about technical analysis and you want to keep it simple, you could do what I’ve shown you here.

This is what you need to do:

- look for the A to B classic pattern

- look for that volume to come in

- wait for the drawing up of volume

- get in on the C to D leg

- take most of your profits as you approach closer to the D leg

This works the same way in reverse. And this is why GoPro is an excellent example. You can see it to the upside which you could also see it to the downside.

Let’s go into the moment when we’re getting into the stock, and it starts to sell off. And then the counter-trend bounce.

- Can you calculate what’s going to happen?

Well, here as we have the stock moving lower you can see we moved down about 58 points from the highs. We also had this retracement right here to the upside.

We had 58 points; then we got a retracement of about 26 points. If you do this Fibonacci calculation, you can see we don’t hit this perfect at the 50% or 38.2%.

If you do it more around the distribution area rather than the wicks, you’ll get it a little closer. That’s because sometimes here was euphoric buying. It depends on the stock movement. But here when we do this calculation for 2015, you can see we’re hitting it right at 50%.

We have some resistance right there, drying up, trying to break higher. It couldn’t do it, so stocks continue to roll over.

- What do I estimate?

As you go down, you’ll see what happens to the stock. We go 53, 54, 55 and we’ve got a price of $8. That is where we hit.

- What’s going to happen to the stock?

We’re back into this accumulation stage, and often I find that they’re tough to break out of these ranges.

Sometimes it takes multiple years – 3, 5, 10 years. It’s difficult, but you can see the patterns here in this stock. We’re very classic when it comes to the ABCD to the upside and the ABCD to the downside.

I hope this was helpful for you in understanding these price movements. Keep in mind you’re looking for the ABCD pattern first. You’re looking for the swing points and volume.

As the volume starts picking up here was the selling pressure that picked up. Then we had a retracement with lighter volume. And then more selling volume picked up.

The selling pressure stayed there until we hit this low point in early 2016 with GoPro. Now we’re distributing sideways and continuing to sell these stocks short.

Looking at these evaluations, stocks, prices and ABCD patterns, you can see you don’t need a lot of fancy indicators to be able to evaluate a stock on a simple level.

However, there are other things that you’ll go in detail as you continue to get better. But if you’re getting started this is an excellent starting point for you to begin evaluating charts.

What If You Can’t Find ABCD Pattern?

If you go to a specific stock (PepsiCo) and you can’t find an ABCD pattern then move on to another stock.

I’ll show you this right here. Sometimes C and D leg is a little more extended.

If you go to Goldman Sachs, you’ll notice the same thing. If you can’t find ABCD patterns move on to another stock. Especially in the more recent time frame because that’s where you’re trading with.

Maybe you’re trading in the more recent time frame, and you can’t find those ABCD patterns move on to another stock. That’s the case with Bank of America as well.

Important note: ABCD patterns are there, but they’re not there shining red lights at you. They’re not so obvious. You have to be the one that looks for them.

You have to be the one that shows up and listen to the stock. If you have this massive volume, that’s a vital sign. When you have a lot of volume coming in that usually helps find ABCD pattern.

What’s interesting is that the B to C might be sideways. Keep in mind that B to C doesn’t have to go down. It can also be sideways. You’re looking for an expansion move on these stocks. The targets don’t always get hit. It’s giving you some ideas and examples but look for those patterns. It doesn’t matter what company you’re looking for.

I hope that I’ve helped you when it comes to technical analysis case studies and ABCD patterns. Use everything you’ve seen here and keep practicing technical analysis.

Throughout this post, you’ve seen what the right way of understanding price movements, swing points, and volume is. Also, you’ve seen how to break apart a chart in details. That is crucial when it comes to technical analysis.

ONE-ON-ONE COACHING

Want to work with me for 3+ months and learn how to trade options like a pro?

I want to learn

- Passive Dividend Investing

- Day Trading

- Swing Trading

- Options Trading

- Penny Stocks

- Shorting Stocks

- Technical Analysis

OPTIONS MASTERY - IRON CONDORS

Struggling to consistently trade options profitability? Learn how to increase your success rate with your iron condor option trading in our new Options Mastery: Iron Condor course

Video recaps on the recent market trends

Summary of recent market activity looking at swing chart opportunities, potential setups, and technicals.

Stock market picture charts annotated

Quickly review screen captured stock charts with annotations. Includes support, resistance, ABCD patterns, and possible breakouts.

How to Trade

Covered Calls

Learn how to make Weekly and Monthly Income by Trading Covered Calls , with our new mini-course.

FREE MINI COURSE!

HOW TO SELL

OPTION PUTS

Maximize your profits by mastering the art of selling option puts with our free mini course.

COVERED CALLS

Make consistent monthly income trading

options on stocks you own

FOR BEGINNERS

Ready to Learn Profitable

Strategies to Trade Stocks?

If you are serious to learn how to trade stocks more profitably, make more money, and trade with confidence...

Then sign up to get our free educational videos!

FREE NEWSLETTER

5 DIFFERENT IRON

CONDOR SETUPS

In this free video, I'll show you 5 powerful iron condor setups & strategies you can use.

3 POWERFUL OPTION

VERTICAL STRATEGIES

Discover 3 super powerful vertical

strategies & how to set them up.

NEW TO OPTIONS TRADING?

Unlock the World of Trading Options in just 4 Weeks , with our FREE Options Trading

for Beginners Mini Course!

FREE MINI COURSE

BUYING OR BUILDING A

TRADING COMPUTER

In this FREE video series we cover exactly what kind of trading computer or workstation you should buy or build. From the number of monitors to the processor and more.

HOW TO FIND

HOT STOCKS!

Get the free checklist to help you find

the best stocks to trade, quick & easy.

FREE CHECKLIST

Get Access to All Secret Files & Libraries for FREE!

To get access to all of my freebies, enter your email below & I will send you a list of all my freebies.

ALL FREEBIES

Unlock the World of Trading Options in just 5 Days , with our FREE Options Trading

OPTION STRATEGIES

Enter your email address below and get access to our video strategy session on 25+ option strategies and how to set them up.

OPTION TRADING GEEKS CHEATSHEET

Download my options greeks worksheet and I will also send you 6+ other freebies as well!

Enter your email below to get the secret link!

Reaching $1,000,000 in The Stock Market!

Want to see for yourself how long it will take you to reach $1,000,000 based on your personal return? Then download my Excel cheatsheet for FREE to see and play with the numbers.

FREE SPREADSHEET

Top 15 Dividend Stocks for Retirement in 2023

Download our list of the best stocks for retirement. Simply enter your email address below to get the PDF.

THINKORSWIM

OPTIONS PLATFORM

Learn to see how I personally use the ThinkorSwim platform to trading options and what are some of the tips and tricks to using this platform efficiently.

VIDEO TRAINING

FREE 20 MIN CALL WITH SASHA

Want to work with Sasha for 3+ months & learn how to trade options the right way?

DISCOVERY CALL!

To get started, enter your email address and we will send you details on how to book your session!!

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Trading & Investing Guides

Technical Analysis – A Beginner’s Guide

A trading approach that helps investors and traders make decisions by studying statistical patterns derived from trading activities, like price changes and trading volumes.

Prior to accepting a position as the Director of Operations Strategy at DJO Global, Manu was a management consultant with McKinsey & Company in Houston. He served clients, including presenting directly to C-level executives, in digital, strategy, M&A , and operations projects.

Manu holds a PHD in Biomedical Engineering from Duke University and a BA in Physics from Cornell University.

What Is Technical Analysis?

Understanding technical analysis.

- Technical Analysis Using Candlestick Charts

Candlestick Patterns - Bullish

Candlestick patterns - bearish.

- Technical Analysis Based On Moving Averages

Using Moving Averages

- MACD: The Key Indicator Of Technical Analysis

- Other Indicators For Technical Analysis

- Fundamental Vs. Technical Analysis

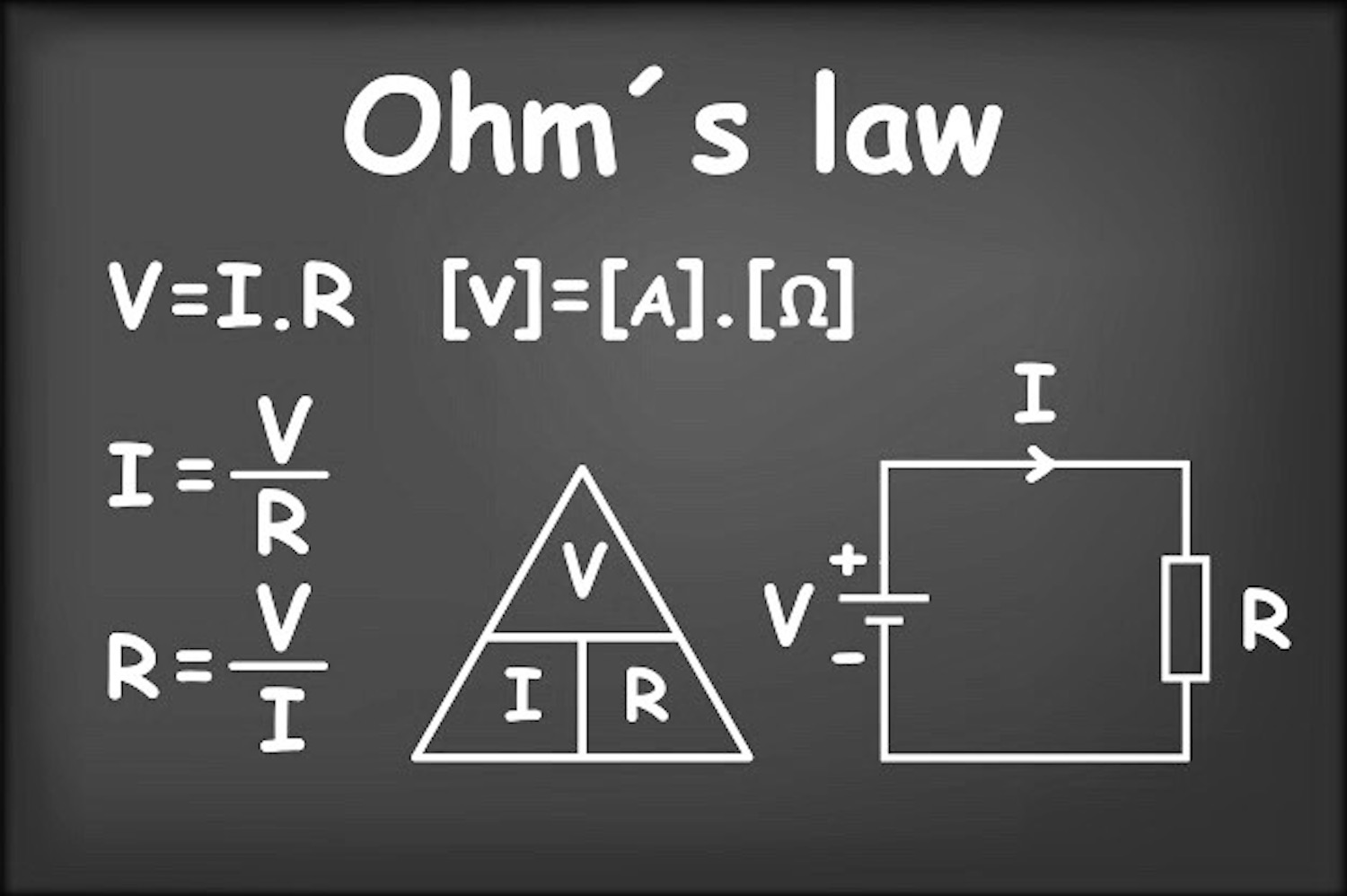

Technical analysis is a widely practiced trading approach that helps investors and traders make decisions by studying statistical patterns derived from trading activities, like price changes and trading volumes.

Unlike fundamental analysis , which focuses on a company's financial performance , technical analysis concentrates on analyzing price and volume movements in the market.

It has a long history and is widely accepted among professionals, regulators, and academics, especially in behavioral finance. While technical analysis follows specific rules, its interpretation is subjective and depends on the analyst's style and approach.

This method aims to predict future price movements of securities, such as stocks or currency pairs , by analyzing market data.

The underlying principle is that market participants' collective buying and selling actions accurately reflect all relevant information, establishing a fair market value for the security. It is a valuable tool for traders and investors seeking insights into market trends and potential trading opportunities.

Key Takeaways

- Technical analysis is a trading approach that relies on historical price and volume data to predict future price movements, making it a valuable tool for traders and investors.

- It involves interpreting price movements and patterns, allowing investors to make informed decisions.

- Technical analysis tools include candlestick charts, moving averages, MACD indicators, support/resistance levels, Bollinger Bands, and RSI, offering a comprehensive overview of methods to analyze market trends and potential investment opportunities.

- Technical analysis offers additional tools like Bollinger Bands and the Relative Strength Index (RSI) to help traders assess market conditions and make informed decisions.

Technical analysis is a discipline investors use to evaluate investment opportunities.

If you’re a university student who has recently gained some interest in capital markets but is a complete amateur, this article is perfect for you. Technical analysis is an extremely helpful tool to assist you in making investment decisions.

Many retail day traders make a living purely off investing or trading in the stock exchange and post outrageous daily returns. However, this analysis is not limited to retail investors, as many finance professionals rely on technical indicators to improve their investment decisions.

Unfortunately, nothing generates absolutely risk-free returns as with all investment strategies . You are still taking a risk with every trade you make, and whatever analysis you carry out is merely attempting to minimize that risk and maximize potential return.

When evaluating stocks, technical analysis takes a different approach than fundamental analysis. But, generally speaking, there will be clear differences in the beliefs, attitudes, and mindsets toward investment decisions.

Most sophisticated investors understand both viewpoints and will likely use a mix of both. Therefore, if you are new to investing, you need to have a feel for the mentality of investors who use technical analysis before you decide it is the right way to invest.

So, what are you doing when technically analyzing a stock? You’re looking at historical data (often prices), analyzing it, and computing particular mathematical formulas that allow you to see how the stock has been trading from a unique standpoint.

Subsequently, you will use your analysis to predict how the stock price will move. For example, if the company’s 50-day moving average share price trades below its 200-day moving average, some traders may interpret it as a potential sell signal, although interpretations can vary.

technical analysis using Candlestick charts

The New York Stock Exchange (NYSE) has trading hours between 9:30 am and 4:00 pm Eastern Time from Monday to Friday. During this time, the market prices of stocks are updated every time a trade takes place, and there are ~12,000 million shares exchanging hands daily.

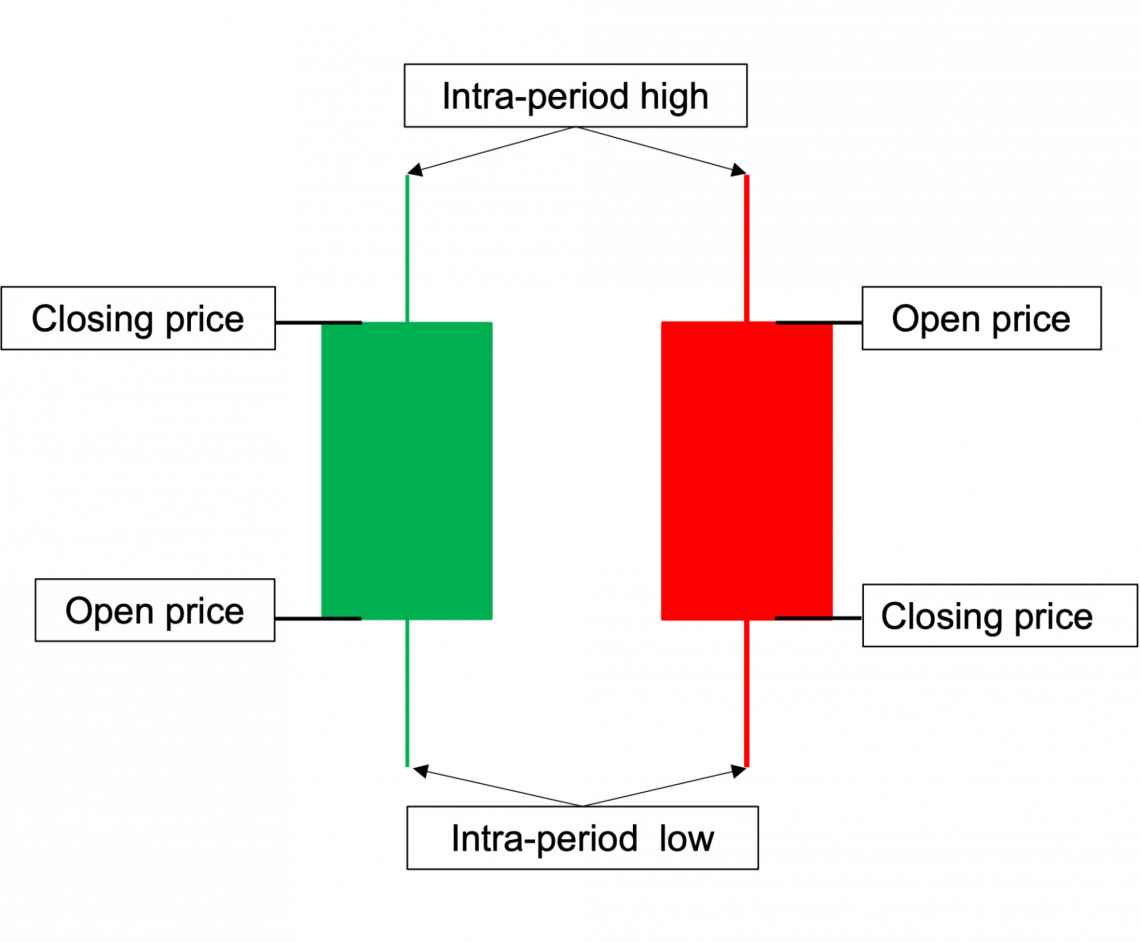

It is safe to say that the market prices of shares fluctuate considerably during trading hours. Therefore, when trading stocks , a candlestick chart is one method to incorporate all that fluctuation into a company’s share price. Here is what a typical candlestick looks like:

A candlestick will show how the price has fluctuated based on the selected period (Eg. 15-minute, 1-hour, or 1-day intervals). For example, if you decide to choose the 1-day interval candlestick , then it will show you:

- The open price

- The highest price it traded at during the day

- The lowest price it traded at during the day

- The closing price

The candlestick will take on either a green or red color depending on whether the stock’s price has gone up or down during that period. If the stock price increases during the chosen period, the candlestick will be green. If the price has decreased, the candlestick will be red.

Once you’ve looked at candlesticks for some time, you will start to get very comfortable reading them because they are extremely intuitive and simple to understand. In addition, the benefits of using a candlestick chart over a simple line chart are pretty straightforward.

For example, if you were researching a company’s stock and decided to plot its daily share price using a line chart, you’d only see its closing prices and nothing about how it traded during the day. That would not be an issue with the candlestick chart.

However, a candlestick is not without flaws. For example, although you’d be able to get a feel for how prices have fluctuated, you wouldn’t be able to see at what price the stock was mostly traded or the Volume-Weighted Average Price (VWAP) of that stock.

For example, if a stock opened at $2, closed at $5, mostly traded around $3, and reached an intra-day high of $7, you would see a green candlestick with a tiny upper shadow only if the closing price was higher than the opening price. If the closing price was lower, the candlestick would be red.

You can think of the volume-weighted average price that calculates the average price that the stock has traded based on every single time a trade has happened. The VWAP can reduce noise and display the price that most investors are buying the stock at.

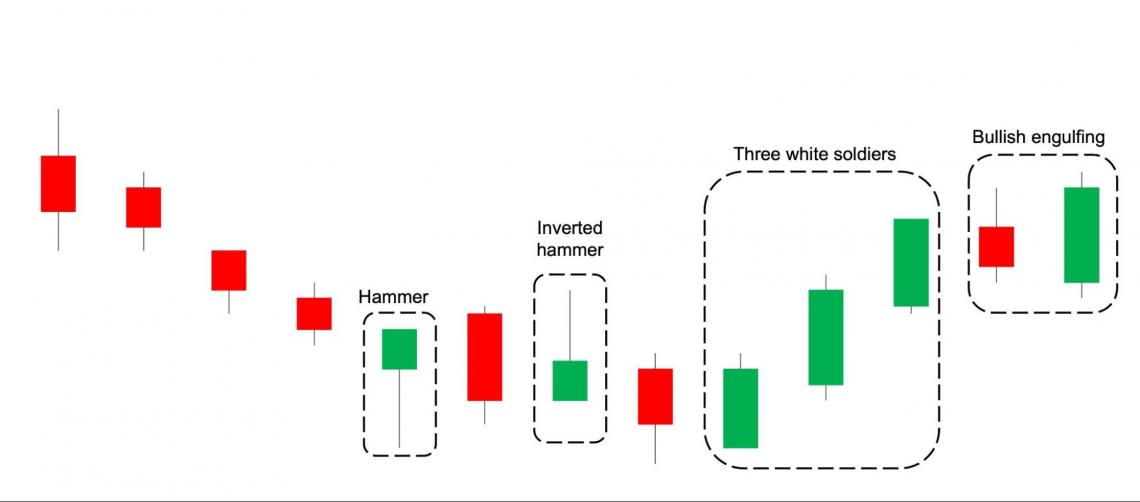

Now that you understand candlesticks, there have been patterns that investors use to determine whether there is a bullish or bearish signal based on how a stock has been trading. Then, depending on the signal, investors would decide whether to long or short that stock.

If there is a bullish signal, it is a sign to buy the stock and open a long position .

A long position is where an investor buys a stock anticipating an increase in the price. In contrast, short-selling involves selling borrowed shares with the expectation of buying them back at a lower price, profiting from the price difference.

There are many bullish indicators, with some requiring just one candlestick and others requiring 2-3 candlesticks. It is seen here as follows:

- Hammer: Has a short candle with a long lower shadow. Despite the induced selling pressure, the price has managed to close above open, suggesting more buying power.

- Inverted hammer: Has a short candle with a long upper shadow. This shows that some selling pressure followed strong buying power. The overall indicator is more buyers than sellers because the price has closed above open. This is the exact opposite of a normal bullish hammer candle.

- Bullish engulfing: Formed when a large green candle “engulfs” the prior trading day red candle. The bullish engulfing pattern typically forms when a stock opens lower and closes higher than the prior trading day.

- Three white soldiers: Often occur after a string of selling days and is a reversal from the previous lows. The pattern is indicated by three consecutive days where the price has closed substantially from its open price.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

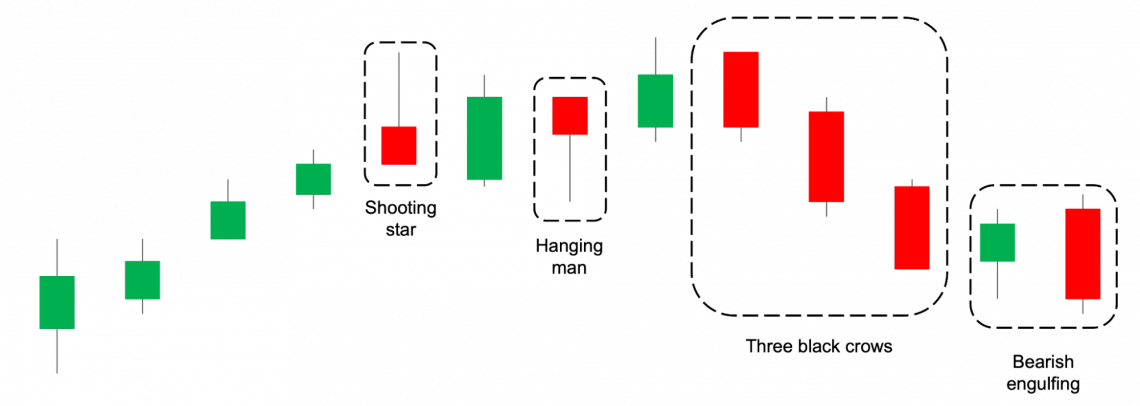

Subsequently, bearish indicators signal that it might be a good idea for investors to sell their current open positions or open a new short position .

Although there are many candlestick indicators, one (general) rule of thumb is that the bearish candlesticks take the opposite shape of the bullish candlesticks, requiring 1-3 candlesticks to form a signal. It is demonstrated as follows:

- Shooting star : Opposite of an inverted hammer (in terms of price movement, not the look of the candle); has a small candle with a long upper shadow. This shows that buying pressure is running out, and investors are starting to take profits.

- Hanging man: Opposite of a hammer; has a small candle with a long lower shadow. Even though prices closed above their low intraday, selling has overpowered buying pressure.

- Bearish engulfing: Opposite of the bullish engulfing; this pattern can be seen when a stock opens higher and closes lower than its prior green trading day. The result is a much larger red candle going downwards, indicating strong selling pressure.

- Three black crows: The opposite of the three white soldiers. Usually seen as the end of a bull run, prices are expected to trend downwards from thereon. This pattern is formed after 3 consecutive red candles that are considerably large.

The examples above are by no means an exhaustive list. There are many candlestick patterns out there, and you should dive deeper into this topic yourself if this is something that you find appealing.

However, please do not rely purely on candlestick patterns to invest your hard-earned money. That would be considered more gambling than investing. Instead, use more technical indicators alongside other fundamental indicators.

If you are ever confused between the term “bull” and “bear”, think about how these animals attack. A bull charges by swinging its horns upwards (go up), while a bear attacks by swiping its claws downwards (go down). This reflects the direction of the stocks.

technical analysis based on Moving averages

It was concluded above that stocks experience daily volatility and, as a result, adjust frequently. Sometimes, these prices can fluctuate to a strangely large extent although there is no catalyst driving the share price.

What does “no catalyst” mean? Without going too much into detail, a company’s share price is expected only to adjust dramatically when new relevant information is released (see the efficient market hypothesis ).

When there is no new information, the stock’s price is not expected to move very much because there is no reason for it to do so - prices have reflected all presently available information and are considered “efficient”.

Therefore, many investors consider these unjustified fluctuations in the stock price as noise. Essentially, noise can be characterized as deviations from the share price’s efficient value—the greater the daily volatility, the noisier the market.

The candlestick chart will capture all the noise in a company’s share price. So you’d be able to see all the prices that the stock has traded at, and in some cases, investors might find the noise misleading. Therefore, this is where the moving average will come in.

The moving average calculates the average share price that a company has traded during the specified period. For example, a company’s 50-day moving average share price will show the average closing price of the last 50 days.

Calculation

Calculating a company’s moving average price has the benefit of reducing the amount of noise that goes on during trading hours. There are two moving averages:

- Simple moving average (SMA)

- Exponential moving average ( EMA )

The simple moving average calculates a company’s average closing price for a specified duration. The formula can be seen as:

SMA = (P t + P t-1 + P t-2 +... + P t-n+1 ) / n

- P = Closing price

- n = Number of days

Don’t overthink this formula too much, and understand its intuition. A company’s 5-day simple moving average share price represents its average closing price for the last 5 days. It is simple arithmetic math.

The exponential moving average reacts more quickly to price changes due to the exponential smoothing technique, which places greater weight on recent trading days, making it more responsive to recent price movements than the simple moving average (SMA).

In the interest of space, the formula for the exponential moving average will not be shown here. Either way, most stock information websites (Yahoo Finance, Market Watch, etc.) can calculate these formulas automatically.

How are moving averages useful? Aside from tuning out the noise in capital markets, moving averages can also be used to indicate bull or bear signals and calculate certain indicators. Let’s start with the simplest signals.

The simplest strategy that investors use is crossovers. Investors do this by computing two moving averages (one long & one short period) and decide to buy or sell company stock based on the interaction between both moving averages. A crossover strategy looks like this:

- Calculate a long simple moving average (commonly 200 days)

- Calculate a short, simple moving average (commonly 50 days)

- It is a bullish sign when the short SMA intersects and crosses ABOVE the long SMA. This is considered the formation of a golden cross , and investors should go long or close existing short positions .

- It is a bearish sign when the short SMA intersects and crosses BELOW the long SMA. This is considered a death cross formation, and investors should go short or close open long positions .

The chart below shows a clear example using Apple stock, with the orange line referring to its 50-day SMA and the purple line referring to its 200-day SMA.

As you can see, selling after the Death Cross did help investors cut some losses, while buying after the Golden Cross provided some returns to investors. This is why crossovers are a useful reference for investors.

However, one massive flaw in the crossover strategy is that they are inherently lagging. Therefore, there is a potential that investors may have missed the boat as markets have already moved before the crossover strategy picks it up.

There isn’t really any hard and fast rule behind deciding the number of days into the SMA calculations. That really depends on your time frame as an investor.

Some people also compare the short SMA to the trading price of the company stock. If the daily share price crosses above the short SMA, then investors would consider that as a buy signal, and vice versa.

MACD: the key indicator of technical analysis

The MACD indicator really takes your technical analysis ability to the next level. As with all technical indicators, the MACD aims to identify buy and sell signals. There are 3 parts to the MACD:

- The MACD line

- The signal line

- The histogram

The MACD line essentially aims to simplify the interpretation of the crossover strategy explained above by comparing a long and a short moving average. The formula for the MACD is as follows:

MACD = 12 day EMA - 26 day EMA

Perhaps the long-period moving average isn’t very long, but this is the commonly used formula. The benefit of using 12 & 26 days and the EMA over SMA is that this indicator is much more reactive to market movement.

Because of this formula, you can expect the MACD to oscillate above and below the value 0. The following are some key interpretations regarding the MACD value:

- When the MACD takes on a positive value, the 12-day EMA is greater than the 26-day EMA

- When the MACD takes on a negative value, the 26-day EMA exceeds the 12-day EMA.

- When the MACD is 0, it can be interpreted similarly as either a golden cross or a death cross because when the MACD is 0, the 12-day EMA and 26-day EMA intersect.

Everything You Need To Master Financial Statement Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

How does the MACD differ from the crossover strategy?

Well, not only does an increasing (decreasing) MACD indicate that the market is in a bull (bear) run, but there is more to the MACD.

This would be where the signal line comes in. The signal line is calculated as the 9-day exponential moving average by default . Without going into too much detail, the crossovers between the signal & the MACD line would be your bull and bear signals. Basically:

- When the MACD line crosses ABOVE the signal line, it is a buy signal

- When the MACD line crosses BELOW the signal line, it is a sell signal

The last part of this indicator is the histogram. The main purpose of the histogram is to measure the distance between the MACD line and the signal line. Therefore, traders will use the trend in the histogram to identify patterns and potential crossovers.

Let us look at the example of Apple once again:

The purple line here represents the MACD line, whereas the orange one represents the signal line. When the MACD crosses above (below) the signal line, investors are recommended to buy (sell) Apple stock. From this chart itself, there is one very clear benefit to using the MACD.

You can notice that the buy or sell signals are indicated much earlier than when the MACD line hits 0. Therefore, this model does predict earlier movement.

Remember, using easier moving average crossovers had an issue of being too slow due to inherent lag in the indicator. In this scenario, the 26-day and 12-day EMA intersect and form either a golden or death cross when the MACD line hits 0.

As with regular crossovers, there isn’t any hard and fast rule behind the number of days used to form the MACD indicator- it is simply the default formula. In most cases, you can change the number of days calculated in this formula as you see fit.

Because the number of days chosen in the MACD is of a relatively short time frame (and the indicator uses EMA over SMA), the MACD is considered more useful to short-term day traders than long-term investors.

Other indicators for technical analysis

So far, this article should have done well in introducing you to the basics of this concept. However, there are many more indicators for you to dive deeper into. Therefore, here are some indicators to look at alongside basic descriptions.

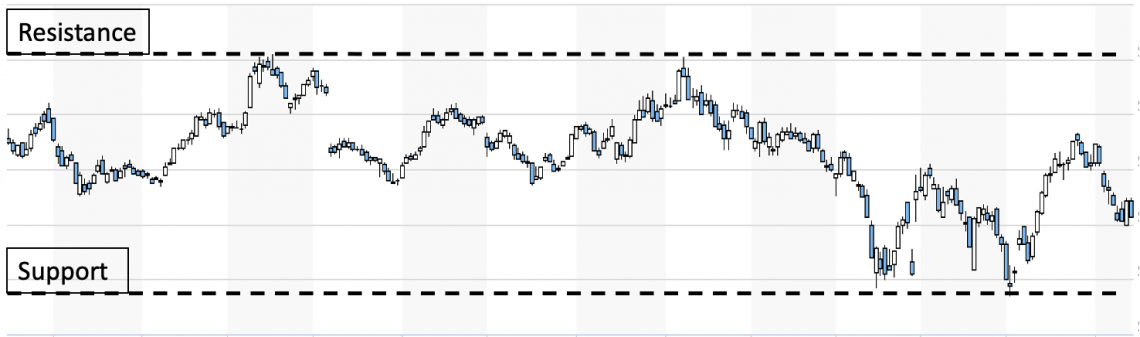

Support and resistance levels

Support and resistance levels are among the most common indicators in technical analysis. By looking at candlestick charts, investors can see points where the share price always experiences reversals.

The support level can be characterized as the “lowest possible” price at which a company stock will trade. Investors view support levels as an opportunity to open a long position because there is little downside, as prices are expected to bounce back after hitting their support level.

The resistance level can be characterized as the “highest possible” price at which company stock will trade. Investors view resistance levels as an opportunity to take profits and sell their positions to realize the maximum upside because prices won’t go up any higher.

However, support and resistance levels aren’t invincible and can be broken. If support levels are broken, it is a bearish sign that investors have lost hope in the stock, and it is expected to trend further downward. The opposite applies to broken resistance levels.

There is no ideal methodology for determining support and resistance levels. For example, some investors may look at a company’s all-time high and conclude that to be the resistance level.

Aside from that, investors may notice that a stock has never traded below a certain price for the past year and determine that the support level should be around that price point.

Bollinger bands

Bollinger bands were developed by John Bollinger and were designed to capture most of a company’s share price movement. This is done by constructing an upper and lower band around a company’s 20-day simple moving average.

Although it is customizable, Bollinger bands are generally constructed two standard deviations away from the default 20-day simple moving average. You can see this from the image above, where the blue lines represent the bands while the dotted orange line is the 20-day SMA.

Therefore, if the share price is trading near the lower (upper) band, there is some indication that the stock may have been oversold (overbought), and a reversal is expected to occur.

Investors who believe in the likelihood of this reversal should then capitalize on this opportunity by taking the appropriate action - buy when prices are near the lower band and sell when prices are near the upper band.

The Bollinger band also has the additional benefit of indicating market volatility. The greater the volatility in a company’s share price, the wider the Bollinger bands would be.

If they are very far apart, investors could trade the stock more conservatively or aggressively depending on their goal, thus making Bollinger bands a useful tool for investors and traders.

Relative strength index (RSI)

The relative strength index is often compared to the MACD because it is also displayed as an oscillator. Although often compared to the MACD, the process of deriving the RSI is significantly different and should, therefore be treated as a different indicator.

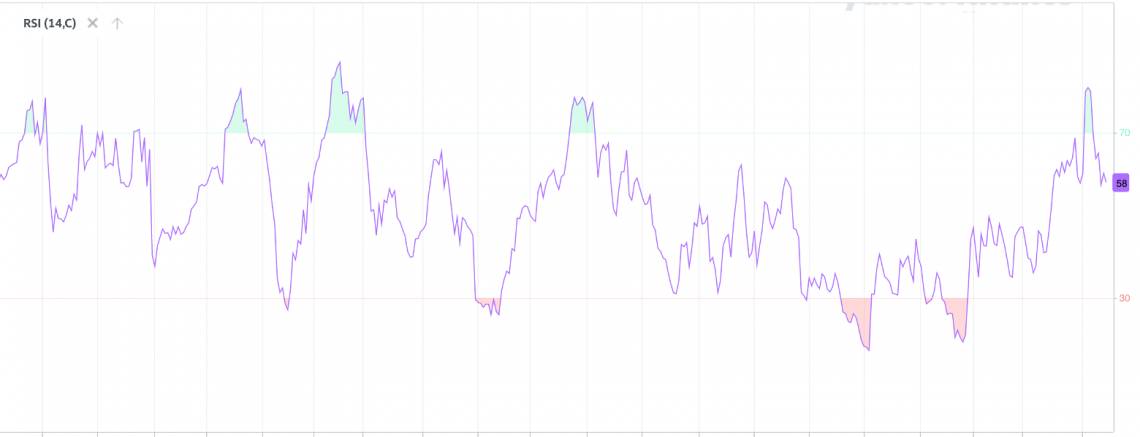

The RSI is designed to oscillate between the numbers 0 to 100. Any number below 30 is an indicator that a stock has been oversold, and any number above 70 is an indicator that a stock has been overbought. You can see an example using the image below:

The RSI is calculated by comparing the average gain to the average losses over a default 14-day period. If a company’s share price appreciates too much over 14 days, that will tempt many investors to take a profit. A high RSI value will capture this.

The RSI will also capture oversold conditions when the share price drops too much over 14 days. Because markets are cyclical, investors who take a long position in company stock when its RSI value is 30 or lower will often see their position appreciate in value.

Fundamental Vs. Technical analysis

Capital markets play a big part in the economy, from helping individuals generate passive income to giving corporations access to financing for various expenditure types. Therefore, it would be safe to say there isn’t only one way to invest in markets.

As mentioned earlier, technical analysis follows a completely different approach from fundamental analysis.

Investors who fundamentally analyze company stock will attempt to establish its intrinsic value, which essentially means how much money the company can generate and, thus, how much you should be paying for the company.

To fundamentally analyze a company, you’d need to understand its industry, its financial statements, revenue drivers, etc. Furthermore, you’d have to understand how this company will operate in the future and what its earnings will look like.

In contrast, investors who technically analyze a company don’t bother much about that type of information. Instead, they’d focus more on the company’s price charts and relevant indicators.

To understand better, let's take a look at the difference table below:

Everything You Need To Master Excel Modeling

Banner that leads users to the Excel Modeling Course landing page.

Researched and authored by Jasper Lim | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Advanced Technical Analysis

- ADX Indicator – Technical Analysis

- Bollinger Bands®

- Candlestick Patterns

- MACD Oscillator – Technical Analysis

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

How To Write A Great Technical Case Study In Three Hours

August 31, 2022

Good technical writing can often seem like magic. It’s not.

Over the last seven years, tons of “best practices” have bubbled up from the Gatsby community to user-facing engineers, product managers, customer success and support teams. We’ve built a culture of documentation so that tribal knowledge isn’t gated by the content team’s bandwidth.

One type of content can be a bit trickier: case studies. Case studies showcase the success of Gatsby users, and let community members see how a “best practice” might work in a real-world scenario. But sometimes non-marketers aren’t sure how to do this, or where to start.

Over the last five years, we’ve written about fifty case studies, and developed a technique to write and publish a case study in three to four hours. I wrote this blog post to share that technique. If you’re interested in telling user or customer stories, you’ll be interested to read this.

Let’s dive in.

Setting Up The Interview

Once someone’s agreed to let you write a case study, there are three guidelines that make for a successful interview. Engineers and product managers may recognize these, because they’re similar to what makes for good open-ended user interviews.

Make sure your interviewees are familiar with both the business and technical site of things. Sometimes a tech lead will be able to do both. Other times, you will need to make sure both an engineering manager and a marketing director, say, are in the room.

Schedule 45-60 minutes, and record the call, and use an auto-transcribing service. If you have less time, you are unlikely to capture the full story. After the initial chit-chat, I ask if I can record the conversation, and then turn it on. For auto-transcription, we use Rewatch internally which offers this functionality.

Establish yourself as an interested listener. In this conversation, you are a curious listener — not a subject matter authority. Pair your status to their status — and go lower if possible! (This can be very difficult for some people.) If you present as an authority figure, your interviewees may focus on whether they did something “right”, they are unlikely to open up, and you’ll struggle to piece the story together.

Conducting The Interview

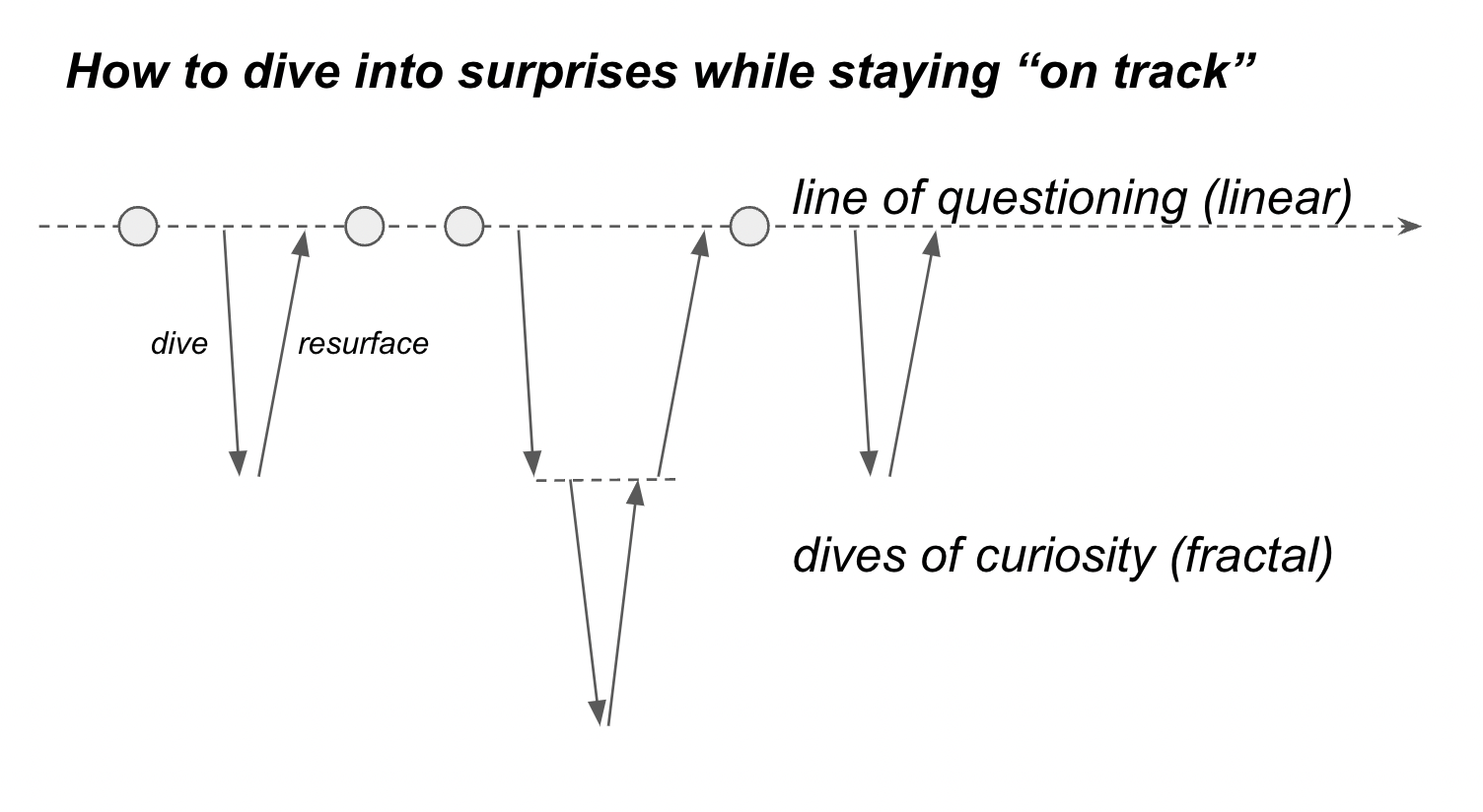

The interview is the place where you are going to be able to get the highest-bandwidth information. You need to see the story you’re writing as an onion to unpeel. A great interview is a conversation staged as a sequence of “angles” to explain a complex event.

Angles of attack

Highlight & Lowlights. This a great lead-in to the interview and a natural place to start. You’ll ask questions that trigger people’s emotional memory — the types of things that they might relay to coworkers.

- Goal : Build rapport while starting to get the story.

- Types of questions : “Freeform” questions that you might ask in a user interview.

- Question examples : “What went well?” “What didn’t go well?” “What was surprising?” “Were there any big bumps in the road?”

Project Chronology. Once you’ve gotten the emotional overview of the project, it’s to plumb people’s factual memory. At its core, a case study is a story.

- Goal : get a project timeline skeleton that you can relay to your readers — hopefully with some meat on the bones.

- Types of questions : Focus on what happened, when, and why — and what events caused other events. If your subjects have to pause a couple of times to recall some detail that’s floating around in long-term memory, it’s not a bad thing.

- Question examples : “So how did you hear about Gatsby?” “So what happened then?” “How did the project start?” “How did you decide to use Gatsby for this project?” “What was the client’s feedback?” “How long did the project take?” “What were the different stages?” “How did the launch go?” “How did the client react?” “What were the business metrics?”

Detail Spotlight. Interspersed with project chronology and highlights / lowlights you can point out parts of their website that they liked, as an invitation for them to tell you more.

- Before the call: Take a look at what they’ve built, and note 2-3 things they did a great job on, especially if it clearly took a lot of time and effort.

- Goal: Get the backstory behind particularly interesting parts of the website, so you can relay them to the reader.

- Question example: “I thought the way you did [X thing] was really interesting.” (followed by a pause)

Big Picture. As the interview starts drawing to a close, you’ll want to return to the most important pieces of information you collected earlier and get the “so what”. You’ll use these details to write the first couple sentences of your case study (the lede) and the headline.

- Goal: understand why this project was significant — to the agency, to the client, to the team, perhaps to the world.

- Types of questions: Return to the most “important” pieces of information you collected earlier and get the “so what.”

- Question examples: For Little Caesars the “story” was a Super Bowl ad traffic without team stress, so we asked about how the team felt. For Jaxxon it was an e-commerce site launch that doubled conversions, so we asked about the business impact.

Important Interview Techniques

Stay present, stay curious. You can’t ask these questions perfunctionarily. People notice. You have to be listening very closely. You have to care.

Capture a multi-disciplinary perspective. At the very least, you should be getting both the developer experience and the business results — for each angle of attack! Websites are incredibly cross-functional projects, so there may be another perspective you want to capture as well (design, content architecture, e-commerce, illustration, animation, performance optimization, copywriting…)

Ask good questions, then shut up and listen. You can see this in podcasts recorded by great narrative interviewers like Guy Raz (How I Built This) or Jeff Meyerson (RIP) at Software Engineering Daily.

Dive into interesting details (but remember where you were). When people mention things that are surprising or interesting, don’t wait for them to stop talking — express interest or curiosity, right then, in a way that feels authentic to you. Then, you need to balance two things:

- figure out how to dive deeper right there and then (otherwise the moment will pass)

- remember where you were, so you can bring the conversation back there afterwards (otherwise the conversation will feel fragmented)

Writing Up The Case Study

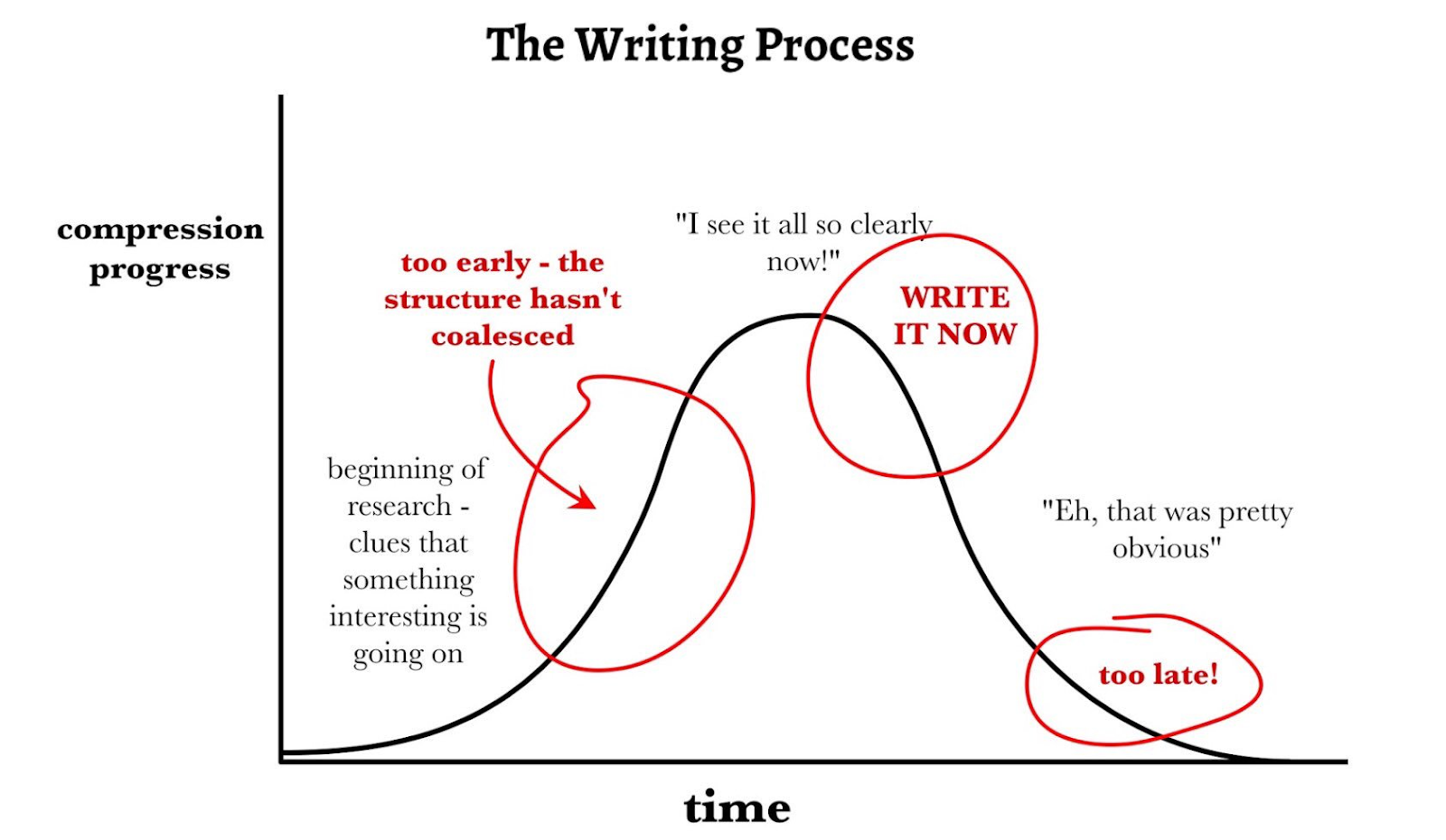

Block 2 hours of writing time after the interview.

One evening in college doing a journalism internship, I went to a community event remembering a local high school senior who tragically passed away. I got back to the office around 7:30pm, and needed to have a story on my editor’s desk by 9, so I furiously pounded out 500 print-ready words in an hour and a half — in the process apparently oblivious to a colleague who wandered over to ask me something. Like coding, writing rewards blocks of uninterrupted time.

This process works the same way for case studies. Immediately after conducting an interview, you will have an emotional memory of the conversation, along with a sense of the 2-3 most important parts. If you wait, that memory will fade.

Block time immediately after the interview (mornings are best) — so if you had a 9-10am interview, block 10am to noon.

(credit to Sarah Perry )

Step 1: Braindump

The first thing you need to do is brain dump.

Throw your video into whatever tool you’re using to auto-transcribe. Flesh out the notes you were taking during the interview with all the details that come to mind as important but you didn’t capture. Copy and paste all of the notes from your note taking software into a Google Doc.

When your video finishes auto-transcribing (hopefully within 10-15 minutes), search through the transcribed interview to copy paste a bunch of passages in from the interview, to supplement the notes

Step 2: Organize

The technique you need to write quickly is middle-out composition (thanks, Silicon Valley).

Don’t start by writing your lede, or your conclusion. Just group your text together by similarity and then write some headers on top of the information groups that seem important or interesting. These might be important business results, parts of the DX that the developers loved, or the project timeline skeleton. Find the 3 or 4 important takeaways, and write draft subheads (H2).

The skill you’re using here is the ability to create an information hierarchy.

Step 3: Move to notes, re-add, copy, paste, condense

At this point you’ll have some very roughly organized information with subheads, along with a lot of clutter that is out of place. Put a “Notes” section, perhaps topped by a horizontal line, at the bottom of your document, and start moving all the information that feels less-important or out of place into the Notes section. Your document will now feel right but incomplete. Start supplementing the important points — with quotes from your interview, screenshots from a website, photos of people, and so on.

Try to avoid writing . Instead, copy and paste from notes and transcript. Then condense three or four sentences a subject said into a one-sentence summary. Rinse and repeat.

Step 4: Add the lede and conclusion

Once you’ve got the skeleton mostly done, you can add a draft lede and conclusion. That’s where you pull in the information you have about the big-picture so-what. Hopefully, that information is in your notes.

Step 5: Edit until it shines

Now, you’ve got the whole case study. You also probably have run-on sentences, jumbled together, poorly organized sections, a mediocre lede, and so on. That’s okay.

There’s a simple algorithm here: run through the whole story, section by section. Polish whatever’s obvious. Then, return to the start, and do it again.

This avoids the most frequent time sucks of the editing process — perfectionism and overthinking. If you know something’s wrong but don’t know how to fix it, don’t worry. You’ll get it on the next run-through.

Focus on condensing complex ideas. Break long sentences up. Get rid of extraneous details. “Omit needless words.”

If you’re a newer writer, this is a great time to pair with a more experienced writer. Tell them they are the editor and ask them to rewrite confusing sentences or sections. Make it clear that they are driving.

Step 6: Spend a few minutes on the lede and title

People will read the title and first sentence more than anything else, so spend some extra effort. Consider a couple different approaches. Figure out what’s most catchy.

Step 7: Publish, then seek comments

In an ideal world, this is where you throw it into WordPress and hit publish. You should do this unless you have a very good reason not to! Doing otherwise risks getting stuck in endless review traps waiting for third-party approvals.

Instead, publish it first — and then send it to third-parties to ask if there are any details that need fixing before you publicize it.

Step 8: Go get some lunch

If you’ve done all the previous steps in three to four hours, your brain is probably pretty tired. Be kind to yourself. Go somewhere you really like and think about non-work related stuff for a while.

Writing great case studies isn’t magic. It’s a skill just like any other. And if you’re in a user- or customer-facing role, you’d do well to learn it. Sharing success stories internally is great, but sharing them externally will multiply your impact.

- Public relations

- Inbound marketing

- Inbound sales

- Marketing onboarding

- CRM implementation

- Sales onboarding

- Guides & downloads

What is a technical case study?

Unless you've been hiding under a rock, chances are you’ve heard all about case studies and application stories being used for marketing purposes, especially in a technical, industrial and engineering context. But the mere idea of producing almost a thousand words of good quality copy and then getting them approved by all parties involved sounds like an insurmountable amount of work. Nonetheless, the task can be easily managed if you know what exactly a case study is and how to tackle each step in developing one.

A technical case study is an analysis of a customer project that used your company’s products and services. It tells the story of how the customer approached the company, what the situation was and what issue they wanted to solve. The foundation of the case study is identifying the customer problem and then recommending and implementing the solution. The conclusion focuses on how the solution was implemented, talks about improvements and overall results and shows why the project was successful.

Characteristics:

- They require approval from other parties involved. Unlike other types of content you create, case studies require that third party endorsement. This is why before putting pen to paper you should first speak to the customer or the end user and get their approval to proceed with the case study. This prior approval is essential, as without explicit approval from the customer the case study does not have a leg to stand on.

- They are longer than other pieces of content and structured to tell a compelling story. Normally case studies contain more information than press releases and as such, they are double in size and require details about the context, the problem you company solved on behalf of the clients, installation journey, outcomes and long-term results.

- They focus on two paradigms: problem-solution-conclusion and feature-benefit relationships. These two facets are the most interesting to your target audience.

Every good case study should be built around the third-party endorsement and as such, quotes and personal testimonies from decision makers are crucial. They give extra weight to the story and allow the reader to put themselves into your customer’s shoes.

Size/format

As explained before, written case studies are about 700-1000 words long and they follow the traditional story format: introduction, problem and context, discussion, solution and outcomes. For information that is not essential to the case study but adds additional details, box outs and graphs are suitable. They can contain facts and figures, information about the customer, the boiler plate (information about your company), quotes and useful website links. Essential for any application story are pictures and if possible videos of the product in action. Some companies use interview-style videos with talking heads explaining the technology or even giving verbal testimonies.

We've created a roadmap to help you share your company's customer success stories.

You May Also Like

These Related Stories

Five things you should do when writing technical copy

Five common mistakes in writing technical copy

Technical media moves - Q3 2019 digest

Get email notifications.

- Login Sign Up

English English (Global)

English English (EU)

English English (UK)

English English (AU)

English English (ZA)

English English (St. Vincent)

Deutsch German

Español Spanish (Latam)

Español Spanish (Spain)

Français French

Dansk Danish

Italiano Italian

Nederlands Dutch

العربية Arabic

Svenka Swedish

Tiếng việt Vietnamese

Bahasa Melayu Malay

ภาษาไทย Thai

繁體中文 Traditional Chinese

简体中文 Simplified Chinese

Tagalog Tagalog

தமிழ் Tamil

हिन्दी Hindi

Português Portuguese

Bahasa Indonesia Indonesian

Commodities

Web Platform

Social Trading

CFD Trading Calculator

Forex Margin Calculator

Commodities Profit Calculator

Forex Profit Calculator

Economic Calendar

CFD Trading

CFD Asset List

Trading Conditions

Trading Hours

Expiration Dates

Upcoming Trading Holidays

Weekly Expiration Rollover

Depth of Market

Education Centre

Trading Basics

Video library

Trader's clinic

- Promo marketsClub Welcome Bonus Loyal Bonus Referral Bonus

- Partnership Affiliation IB

Why markets.com

Global Offering

Help Centre

Contact Support

Safety Online

Cookie Disclosure

We use cookies to do things like offer live chat support and show you content we think you’ll be interested in. If you’re happy with the use of cookies by markets.com, click accept.

Friday Nov 24 2023 10:11

What is technical Analysis: A comprehensive guide

In the complex landscape of financial markets, making informed trading decisions is a critical skill. One of the key methodologies employed by traders worldwide to guide these decisions is technical analysis . This approach involves the systematic study of past market data, primarily price and volume, to forecast future price movements of financial instruments.

Whether you are an experienced trader aiming to sharpen your strategy or a novice trader seeking a foundational understanding of this analysis method, this comprehensive guide is designed to equip you with the knowledge and tools necessary for success.

What is technical analysis?

Technical analysis is a type of financial analysis that looks at historical price movements and trading volumes to predict future price movements in the market.

It involves studying trends, chart patterns, momentum indicators, and other factors to make informed decisions about trading.

Technical analysis can help traders gain insight into market sentiment, timing their trades for optimal returns.

Why is technical analysis important?

Technical analysis is a critical component of successful financial and trading strategies. It helps investors understand the past performance of a security, identify current trends and anticipate future price movements.

Technical analysis relies on mathematical calculations and charting techniques to evaluate securities, which can be an invaluable tool for traders to optimize returns and manage risk.

Here are several reasons why technical analysis is considered important by traders and investors:

- Technical analysis helps traders to identify and confirm existing price trends in a security. Recognizing trends early can allow traders to take positions that are in line with the trend, increasing the likelihood of a profitable trade.

- By studying historical price data, traders can identify potential entry and exit points for trades. This is done through various chart patterns and technical indicators, which signal when a security might be overbought or oversold.

- Technical analysis can be a key part of a risk management strategy. For example, traders can set stop-loss orders based on a security's technical profile, helping them to limit potential losses on a trade.

- By focusing on chart patterns and technical indicators, traders can base their decisions on data rather than emotion. This can lead to more rational and potentially more profitable trading decisions.

- Technical analysis can be applied to virtually any security that has historical trading data. This makes it a versatile tool for traders and investors with diverse portfolios.

- While some traders use technical analysis exclusively, others use it in conjunction with fundamental analysis (which evaluates securities based on factors like earnings, valuation, and economic indicators). Combining these two approaches can give traders a more complete picture of a security's prospects.

Start to trade now

Join the 100.000s that have made markets.com their home for trading. Learn about trading as you grow your portfolio.

More power in our platforms

Ready to trade? Create an account!

Enter valid email

Please enter a valid password

By creating an account, you agree to our Privacy Policy , Cookie Policy and receive marketing emails. Subscriptions can be managed under Notifications settings in your account.

Trading CFDs carries a considerable risk of capital loss.

Which tool is best for technical analysis?

There are many tools that can be used for technical analysis, and different traders may have different preferences. Some commonly used tools include:

- These charts visually represent price movements in a specific time period, with the 'body' of the candlestick showing the opening and closing prices, and the 'wicks' showing the highest and lowest prices. Traders use various candlestick patterns (e.g., Doji, Hammer, Engulfing) to predict future price movements based on past patterns.

- Moving averages, such as the Simple Moving Average (SMA) and Exponential Moving Average (EMA), help to smooth out price action and identify the direction of the trend. For example, a common strategy is to look for crossovers between a short-term MA and a long-term MA as potential buy or sell signals.

- The RSI indicator is a momentum oscillator that ranges from 0 to 100. It is generally used to identify overbought or oversold conditions in a traded security. A common interpretation is that an RSI above 70 suggests a security is overbought, while an RSI below 30 suggests it is oversold.

- Created by John Bollinger, these bands consist of a middle band (a simple moving average), and an upper and lower band, which are typically two standard deviations away from the middle band. The bands expand and contract based on market volatility. Price touching the upper band is often interpreted as overbought, and touching the lower band as oversold.