- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Successful Business Plan for a Loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does a loan business plan include?

What lenders look for in a business plan, business plan for loan examples, resources for writing a business plan.

A comprehensive and well-written business plan can be used to persuade lenders that your business is worth investing in and hopefully, improve your chances of getting approved for a small-business loan . Many lenders will ask that you include a business plan along with other documents as part of your loan application.

When writing a business plan for a loan, you’ll want to highlight your abilities, justify your need for capital and prove your ability to repay the debt.

Here’s everything you need to know to get started.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

A successful business plan for a loan describes your financial goals and how you’ll achieve them. Although business plan components can vary from company to company, there are a few sections that are typically included in most plans.

These sections will help provide lenders with an overview of your business and explain why they should approve you for a loan.

Executive summary

The executive summary is used to spark interest in your business. It may include high-level information about you, your products and services, your management team, employees, business location and financial details. Your mission statement can be added here as well.

To help build a lender’s confidence in your business, you can also include a concise overview of your growth plans in this section.

Company overview

The company overview is an area to describe the strengths of your business. If you didn’t explain what problems your business will solve in the executive summary, do it here.

Highlight any experts on your team and what gives you a competitive advantage. You can also include specific details about your business such as when it was founded, your business entity type and history.

Products and services

Use this section to demonstrate the need for what you’re offering. Describe your products and services and explain how customers will benefit from having them.

Detail any equipment or materials that you need to provide your goods and services — this may be particularly helpful if you’re looking for equipment or inventory financing . You’ll also want to disclose any patents or copyrights in this section.

Market analysis

Here you can demonstrate that you’ve done your homework and showcase your understanding of your industry, current outlook, trends, target market and competitors.

You can add details about your target market that include where you’ll find customers, ways you plan to market to them and how your products and services will be delivered to them.

» MORE: How to write a market analysis for a business plan

Marketing and sales plan

Your marketing and sales plan provides details on how you intend to attract your customers and build a client base. You can also explain the steps involved in the sale and delivery of your product or service.

At a high level, this section should identify your sales goals and how you plan to achieve them — showing a lender how you’re going to make money to repay potential debt.

Operational plan

The operational plan section covers the physical requirements of operating your business on a day-to-day basis. Depending on your type of business, this may include location, facility requirements, equipment, vehicles, inventory needs and supplies. Production goals, timelines, quality control and customer service details may also be included.

Management team

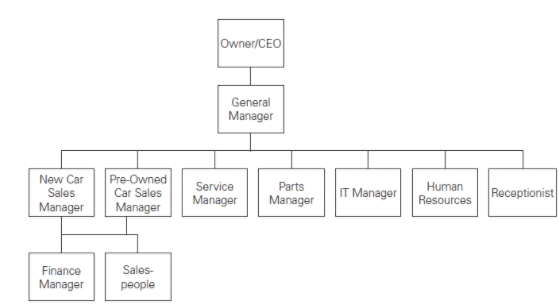

This section illustrates how your business will be organized. You can list the management team, owners, board of directors and consultants with details about their experience and the role they will play at your company. This is also a good place to include an organizational chart .

From this section, a lender should understand why you and your team are qualified to run a business and why they should feel confident lending you money — even if you’re a startup.

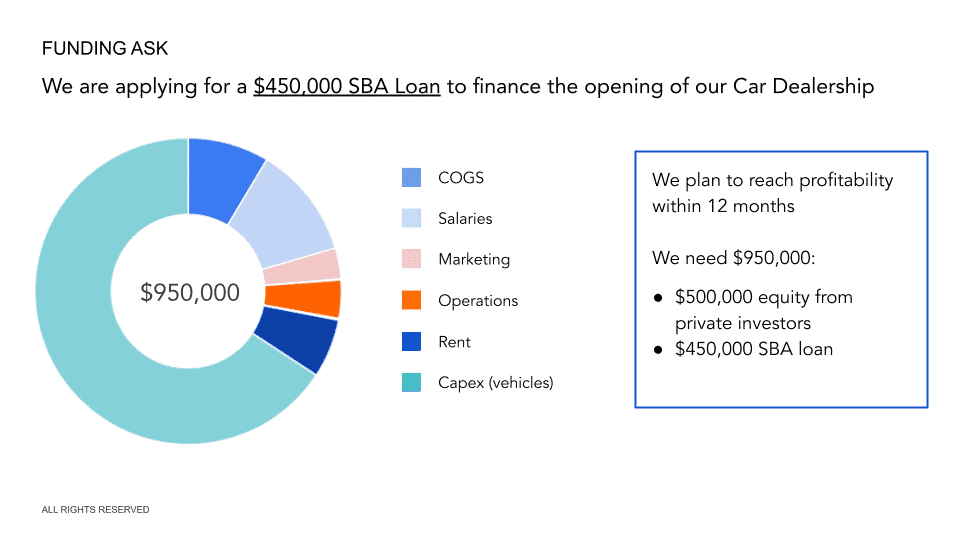

Funding request

In this section, you’ll explain the amount of money you’re requesting from the lender and why you need it. You’ll describe how the funds will be used and how you intend to repay the loan.

You may also discuss any funding requirements you anticipate over the next five years and your strategic financial plans for the future.

» Need help writing? Learn about the best business plan software .

Financial statements

When you’re writing a business plan for a loan, this is one of the most important sections. The goal is to use your financial statements to prove to a lender that your business is stable and will be able to repay any potential debt.

In this section, you’ll want to include three to five years of income statements, cash flow statements and balance sheets. It can also be helpful to include an expense analysis, break-even analysis, capital expenditure budgets, projected income statements and projected cash flow statements. If you have collateral that you could put up to secure a loan, you should list it in this section as well.

If you’re a startup that doesn’t have much historical data to provide, you’ll want to include estimated costs, revenue and any other future projections you may have. Graphs and charts can be useful visual aids here.

In general, the more data you can use to show a lender your financial security, the better.

Finally, if necessary, supporting information and documents can be added in an appendix section. This may include credit histories, resumes, letters of reference, product pictures, licenses, permits, contracts and other legal documents.

Lenders will typically evaluate your loan application based on the five C’s — or characteristics — of credit : character, capacity, capital, conditions and collateral. Although your business plan won't contain everything a lender needs to complete its assessment, the document can highlight your strengths in each of these areas.

A lender will assess your character by reviewing your education, business experience and credit history. This assessment may also be extended to board members and your management team. Highlights of your strengths can be worked into the following sections of your business plan:

Executive summary.

Company overview.

Management team.

Capacity centers on your ability to repay the loan. Lenders will be looking at the revenue you plan to generate, your expenses, cash flow and your loan payment plan. This information can be included in the following sections:

Funding request.

Financial statements.

Capital is the amount of money you have invested in your business. Lenders can use it to judge your financial commitment to the business. You can use any of the following sections to highlight your financial commitment:

Operational plan.

Conditions refers to the purpose and market for your products and services. Lenders will be looking for information such as product demand, competition and industry trends. Information for this can be included in the following sections:

Market analysis.

Products and services.

Marketing and sales plan.

Collateral is an asset pledged to a lender to guarantee the repayment of a loan. This can be equipment, inventory, vehicles or something else of value. Use the following sections to include information on assets:

» MORE: How to get a business loan

Writing a business plan for a loan application can be intimidating, especially when you’re just getting started. It may be helpful to use a business plan template or refer to an existing sample as you’re going through the draft process.

Here are a few examples that you may find useful:

Business Plan Outline — Colorado Small Business Development Center

Business Plan Template — Iowa Small Business Development Center

Writing a Business Plan — Maine Small Business Development Center

Business Plan Workbook — Capital One

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on NerdWallet's secure site

U.S. Small Business Administration. The SBA offers a free self-paced course on writing a business plan. The course includes several videos, objectives for you to accomplish, as well as worksheets you can complete.

SCORE. SCORE, a nonprofit organization and resource partner of the SBA, offers free assistance that includes a step-by-step downloadable template to help startups create a business plan, and mentors who can review and refine your plan virtually or in person.

Small Business Development Centers. Similarly, your local SBDC can provide assistance with business planning and finding access to capital. These organizations also have virtual and in-person training courses, as well as opportunities to consult with business experts.

Business plan software. Although many business plan software platforms require a subscription, these tools can be useful if you want a templated approach that can break the process down for you step-by-step. Many of these services include a range of examples and templates, instruction videos and guides, and financial dashboards, among other features. You may also be able to use a free trial before committing to one of these software options.

A loan business plan outlines your business’s objectives, products or services, funding needs and finances. The goal of this document is to convince lenders that they should approve you for a business loan.

Not all lenders will require a business plan, but you’ll likely need one for bank and SBA loans. Even if it isn’t required, however, a lean business plan can be used to bolster your loan application.

Lenders ask for a business plan because they want to know that your business is and will continue to be financially stable. They want to know how you make money, spend money and plan to achieve your financial goals. All of this information allows them to assess whether you’ll be able to repay a loan and decide if they should approve your application.

On a similar note...

500+ business plans and financial models

Car Dealership Business Plan: Complete Guide

- January 11, 2023

Whether you’re looking to raise funding from private investors or to get a loan from a bank (like a SBA loan) for your car dealership, you will need to prepare a solid business plan.

In this article we go through, step-by-step, all the different sections you need in your car dealership business plan. Use this template to create a complete, clear and solid business plan that get you funded.

1. Executive Summary

The executive summary of a business plan gives a sneak peek of the information about your business plan to lenders and/or investors.

If the information you provide here is not concise, informative, and scannable, potential lenders and investors may lose interest.

Though the executive summary is the first and the most important section, it should normally be the last section you write because it will have the summary of different sections included in the entire business plan below.

Why do you need a business plan for your car dealership?

The purpose of a business plan is to secure funding through one of the following channels:

- Obtain bank financing or secure a loan from other lenders (such as a SBA loan )

- Obtain private investments from investment funds, angel investors, etc.

- Obtain a public or a private grant

How to write an executive summary for your car dealership?

Provide a precise and high-level summary of every section that you have included in the business plan. The information and the data you include in this segment should grab the attention of potential investors and lenders immediately. Also make sure that the executive summary doesn’t exceed 2 pages.

The executive summary usually consists of the 5 main paragraphs:

- Business overview : introduce your car dealership: what is your business model (franchise vs. independent business ; new vs. used car dealership), how many cars will you have in inventory? Are you partnering with any car manufacturer(s)? Where would your store be located? Etc.

- Market overview : briefly analyze the car dealership industry in your area ( market size and growth), your competitors and target customers: average income of your target audience , demographic distribution, customer preferences etc.

- Management & people : introduce the management team and their industry experience. Mention your business partner(s), if any. Also give here an overview of the different teams, roles and their reporting lines

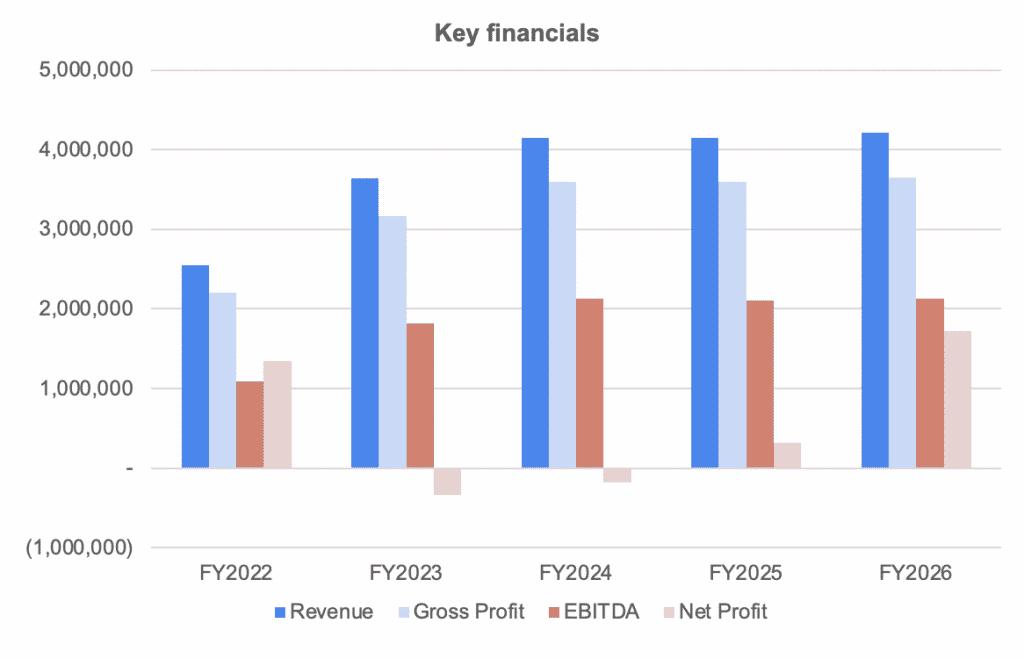

- Financial plan : how much profit and revenue do you expect in the next 5 years? When will you reach the break-even point and start making profits? Also include here a small chart with your key financials (revenue, net profit )

- Funding ask : what loan/investment/grant are you seeking? How much do you need? How long will this last? How will you spend the money?

Car Dealership Financial Model

Download an expert-built 5-year Excel financial model for your business plan

2. Business Overview

In the business overview section of your car dealership business plan, you should expand on what your company sells, to whom, and how it is structured. A few examples of questions you must answer here are:

- The history behind the project: why did you choose to open a car dealership today?

- Your business model : Are you franchising or is this an independent store? Are you selling new or used vehicles?

- Products & services : What vehicles / brands do you plan to sell? Are you planning to add any additional services (e.g. car repair & checkups, etc.)

- What is the legal structure of your company? Who are the directors / shareholders?

a) History of the Project

Briefly explain how did you come up with the plan to start a car dealership business. What motivated you to get into this business venture?

Also try to demonstrate to investors your interest and passion for the car industry and car dealership in general.

For example, you might have worked in a car dealership and/or at a car manufacturer sales department in the past, and found immense growth potential for this type of business in your area.

b) Business Model

Explain in this section what business model you chose for your car dealership. Here are a few questions you must answer:

- Will you start an independent dealership, franchise model, chain store, etc.?

- Will you open a brand-specific dealership?

- Would your car dealership deal in new cars, used cars, or both?

- Do you plan to open an online dealership?

- Would you offer service and repairs in your car dealership?

c) Products & Services

Now that we have briefly introduced what your business model is, you must explain in detail what exactly you intend to sell. There are 2 things here:

- Products (cars): what vehicles and brands do you intend to sell? Why did you choose these vehicles / brands?

- Services : if you offer additional services (e.g. car repairs, checkups), explain what they are

In addition to the products and services , you should also include a list of prices for each. Of course, this doesn’t need to be exact. Car prices fluctuate based on various factors. Yet, you must be able to provide a range of prices for each category (e.g. sedan, luxury cars, vans, etc.).

If you specialize in a specific brand, you can provide a list of prices per model in appendix as well.

The prices are important as they will allow investors to tie your product offering with your financial projections later on.

d) Legal Structure

Explain the legal structure of your nursing home in this section. Are you starting a corporation, a limited liability company, or a partnership? Who are the investors? How much equity do they actually own? Is there a board of directors? Do they have prior industry experience?

3. Car Dealership Market Overview

A complete understanding of the car dealership industry is important for the success of your business.

Therefore, you must cover here 3 important areas:

- Status quo : how big is the car dealership industry in your area? How fast is the market growing? What are the trends fuelling this growth (or decline)?

- Competition overview : how many car dealership competitors are there? How do they compare vs. your business? How can you differentiate yourself from them?

- Customer analysis : what are your target customers? What are their customer preferences?

a) Status quo

When looking at the car dealership industry, try to start at the national level (US) and narrow it down to your service area (a city for example). You should answer 2 important questions here:

How big is the car dealership industry in your area?

How fast is the car dealership industry growing in your area, how big is the car dealership industry in the us.

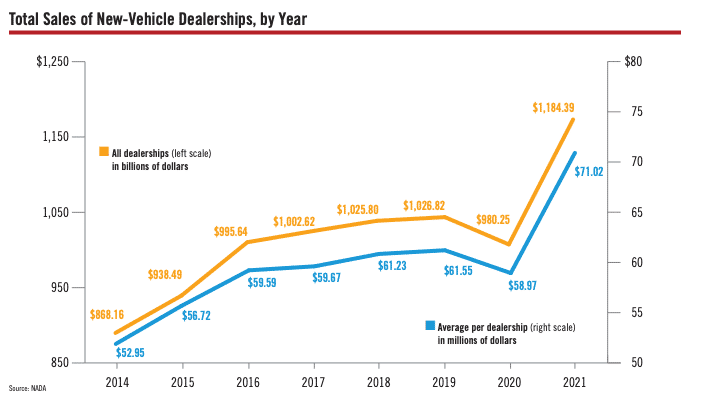

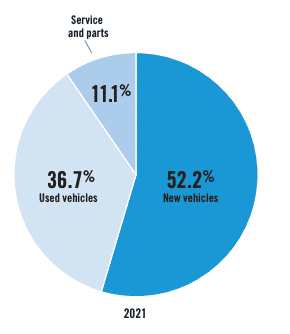

The auto parts and car dealership industry in the US is huge: it was worth $1.18 trillion in 2021 as per the National Automobile Dealers Association . As per the same report, there were 16,676 light vehicles car dealerships in the US in 2021 which generate an average revenue of $71 million.

Sales are divided between new (52%) and used vehicles (37%) as well as services and parts (11%).

After the US, assess the size of the car wash industry in your city or area. Focus on the zone where you plan to offer your services.

Naturally, you might not be able to get the data for your specific city or region. Instead, you can estimate the size of your market, for more information on how to do it, read our article on how to estimate TAM, SAM and SOM for your startup .

Luckily, NADA publishes statistics per state so you can narrow it down easily. For your city instead, you will need to do work out some estimates. To give you an example, let’s assume you plan to operate in an area where there are already 30 car dealership businesses (in a 25 miles radius for example).

Assuming our business is based in Connecticut, we can use the state’s average annual turnover of $49,661 : we can reasonably assume that the car dealership industry is worth $1.5 million in your area . In other words, there are over 35,100 light vehicles (new and used) being sold in your area each year (assuming the average retail price of $43,000).

Now that we know your area’s market size, let’s look at growth instead.

Fortunately, you can use NADA’s number again as they publish annual reports. Just use your state’s market size growth, and explain the growth (or decline). This can be due to average car prices, or volume.

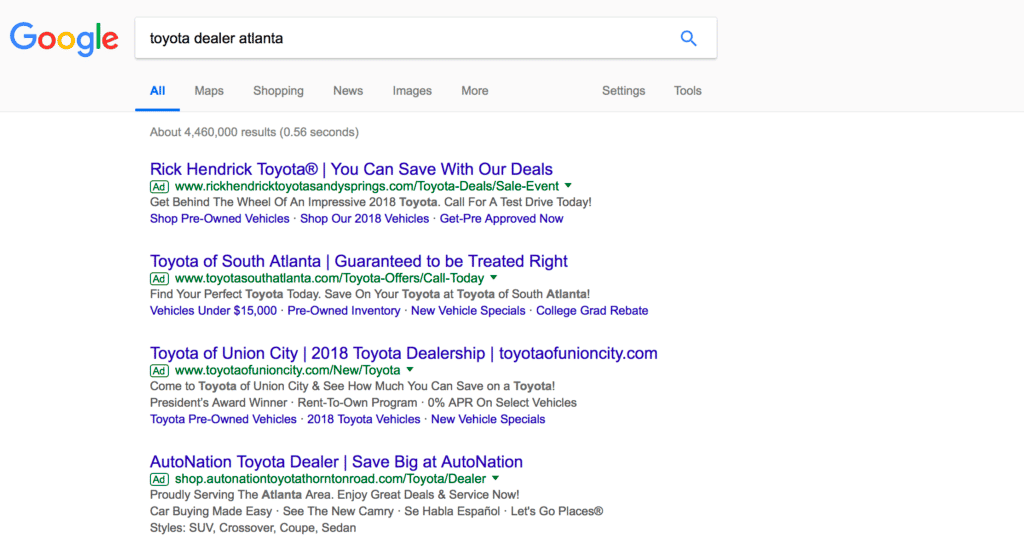

b) Competition overview

You should discuss both your direct and indirect competition in your business plan. Other car dealerships in the region will be your immediate competitors. Internet auctions, individual dealers, etc., will be your indirect competitors.

In this section, you should also discuss the essential components of the business models of your main competitors. Your research should be focused on their clientele, the kinds of cars they offer, and their strengths and weaknesses .

A thorough competitive analysis is crucial as it may allow you to discover and address a customer need or preference that none of your rivals is addressing today.

Here are some of the questions that you must answer in this section:

- How many competitors are there in the area where you want to open your car dealership?

- Are they franchises or independent stores?

- Do they partner with specific car manufacturers?

- What type of cars do they offer (luxury, economy, used, new, etc.)?

- What is the average price range of the cars they sell?

- How many employees do they have?

- Do they offer services and repairs?

- Do your competitors offer buyback on the cars sold by them previously to the client?

- What type of offers and discounts do they offer to attract customers?

- How many cars / vehicles do they sell on average per month?

c) Customer analysis

Now that we have a good idea of the car dealership industry in your area as well as competition, now is time to focus on your target audience: customers.

Knowing your customer is extremely important before you get into any business. This is all the more relevant for car dealership where customer preferences and tastes are very different.

For example, if you are planning to get into a luxury car dealership business, you should look into:

- The estimated population of high-income people in your area

- Types of luxury cars that are in demand (hatchback, sedan, SUV, etc.)

- Shopping preference of your target customers (online or offline)

- How frequently do they buy (or exchange) new cars?

- Is their buying decision influenced by offers or discounts?

- What features do your target customers want in their new luxury cars?

- What type of additional services do they expect from their dealers?

4. Sales & Marketing Strategy

This is the section of your business plan where you outline your customer acquisition strategy. Try to answer the following questions:

- What are the different marketing strategies you will use?

- What are your Unique Selling Points (USPs)? In other words, how do you differentiate from your competitors?

- How do you intend to track the success of your marketing strategy ?

- What is your CAC or customer acquisition cost?

- What is your marketing budget?

What marketing channels do car dealerships use?

A few marketing channels that car dealership businesses typically use are:

- Signage, billboards

- PPC ads, Facebook ads, etc.

- Print media

- Loyalty programs

- Online local listing (Google Business)

- Content marketing (share content like vehicle maintenance tips, safe driving tips, etc.) on platforms like blogs, social media, etc.

- Word of mouth, recommendations

You must have a fair and nearly accurate estimate of your marketing budget. Therefore, make sure to budget for marketing accordingly in your financial projections.

What are your Unique Selling Propositions (USPs)?

In other words, how do you differentiate yourself vs. competitors? This is very important as you might need to win customers from competitors.

A few examples of USPs are:

- Products: you may be the exclusive distributor or a car make in your area for example

- Services : you may offer repairs and regular checkups for your customers

- Location : you store is closer to a busy road and/or to where your customers live

Your USPs will depend on your business model, competitor analysis, and target audience. Whatever your USPs are, it should appeal to your potential customers and attract them.

5. Management & People

You must address 2 things here:

- The management team and their experience/track record

- The organizational structure: the different team members and who reports to whom

Small businesses often fail because of managerial weaknesses. Thus, having a strong management team is vital. Highlight the experience and education of senior managers that you intend to hire to oversee your car dealership.

Describe their duties, responsibilities, and roles. Also, highlight their previous experience and explain how they succeeded in their previous roles.

Organization Structure

Even if you haven’t already hired a VP of sales, sales managers, support staff and any other relevant staff members, you must provide a chart of the organizational structure outlining the different teams, roles and their reporting lines.

6. Financial Plan

The financial plan is perhaps, with the executive summary, the most important section of any business plan.

Indeed, a solid financial plan tells lenders that your business is viable and can repay the loan you need from them. If you’re looking to raise equity from private investors, a solid financial plan will prove them your car dealership is an attractive investment.

There should be 3 sections to your financial plan section:

- Your historical financials (only if you already operate the business and have financial accounts to show)

- The startup costs of your project (if you plan to start a new car dealership, or purchase new inventory, expand your store, etc.)

- The 5-year financial projections

a) Historical Financials (if any)

In the scenario where you already have some historical financials (a few quarters or a few years), include them. A summary of your financial statements in the form of charts e.g. revenue, gross profit and net profit is enough, save the rest for the appendix.

If you don’t have any, don’t worry, most new businesses don’t have any historical financials and that’s ok. If so, jump to Startup Costs instead.

b) Startup Costs

Before we expand on 5-year financial projections in the following section, it’s always best practice to start with listing the startup costs of your project. For a car dealership, startup costs are all the expenses you incur before you open your shop and starting making sales. These expenses typically are:

- The lease deposit for the commercial space you rent (if you don’t buy it)

- The design and renovation of the existing facilities

- The inventory costs (the initial stock of vehicles you must buy to sell them at opening)

For example, let’s assume you want to buy 30 light vehicles as a start for inventory, and you take on a loan where you need to put down 15% upfront. Now, assuming these vehicles each cost $50,000 on average, this means you must put down $300,000 yourself. This comes in addition with any other startup cost mentioned above (lease deposit, renovation costs, etc.).

c) 5-Year Financial Projections

In addition to startup costs, you will now need to build a solid 5-year financial model as part of your business plan for your car dealership .

Your financial projections should be built using a spreadsheet (e.g. Excel or Google Sheets) and presented in the form of tables and charts in your business plan.

As usual, keep it concise here and save details (for example detailed financial statements, financial metrics, key assumptions used for the projections) for the appendix instead.

Your financial projections should answer at least the following questions:

- How much revenue do you expect to generate over the next 5 years?

- When do you expect to break even?

- How much cash will you burn until you get there?

- What’s the impact of a change in pricing (say 20%) on your margins?

- What is your average customer acquisition cost?

You should include here your 3 financial statements (income statement, balance sheet and cash flow statement). This means you must forecast:

- The number of vehicles you sell over time ;

- Your expected revenue ;

- Operating costs to run the business ;

- Any other cash flow items (e.g. capex, debt repayment, etc.).

When projecting your revenue, make sure to sensitize pricing and the number of customers as a small change in these assumptions will have a big impact on your revenues.

7. Funding Ask

This is the last section of the business plan of your car dealership. Now that we have explained what type of vehicles your company sells to whom and at what price, but also what’s your marketing strategy, where you go and how you get there, this section must answer the following questions:

- How much funding do you need?

- What financial instrument(s) do you need: is this equity or debt, or even a free-money public grant?

- How long will this funding last?

- Where else does the money come from? If you apply for a SBA loan for example, where does the other part of the investment come from (your own capital, private investors?)

If you raise debt:

- What percentage of the total funding the loan represents?

- What is the corresponding Debt Service Coverage Ratio ?

If you raise equity

- What percentage ownership are you selling as part of this funding round?

- What is the corresponding valuation of your business?

Use of Funds

Any business plan should include a clear use of funds section. This is where you explain how the money will be spent.

Will you spend most of the loan / investment to acquire the cost for the inventory (the vehicles)? Or will it cover mostly the cost of buying the land and building the store?

Those are very important questions you should be able to answer in the blink of an eye. Don’t worry, this should come straight from your financial projections. If you’ve built solid projections like in our car dealership financial model template , you won’t have any issues answering these questions.

For the use of funds, we recommend using a pie chart like the one we have in our financial model template where we outline the main expenses categories as shown below.

Privacy Overview

How to Request an Invoice?

How to create an invoice: invoice template, subscription billing versus recurring billing: understanding the key differences, automated payment for small businesses, what is subscription billing, automated invoice processing, what is recurring billing, what is automation in billing.

- Subscription Billing Management Software

What is an Automated Payment System?

- Business Finance

What is Auto-Financing? How to Start an Auto Finance Business

- - Business Finance

- - January 30, 2024

- - No Comments

Speaking of the perfect auto finance business you could have, here is a guide to a comprehensive business plan that can significantly contribute to the success of your venture.

Let’s dive into the key elements of an effective auto finance business plan, the meaning of auto-financing, and the success u could have through an auto finance business loan.

Meaning of Auto Financing Business

Auto financing refers to the process of obtaining a loan to purchase a vehicle, typically a car, truck, or motorcycle. Instead of paying the full purchase price upfront, individuals can use auto financing to spread the cost of the vehicle over some time.

The most common type of auto financing is through a car loan , where a lender provides the borrower with a specific amount of money to buy a vehicle. In turn, the borrower agrees to repay the loan amount, along with interest, in regular installments over an agreed-upon term.

Here are some key elements of auto financing:

- Down Payment: Many auto financing agreements require a down payment, which is an upfront payment made by the buyer. The down payment is usually a percentage of the vehicle’s total cost and can affect the loan terms.

- Loan Term: The loan term is the duration over which the borrower agrees to repay the loan. Auto loans typically have terms ranging from 24 to 72 months, although longer terms are becoming more common.

- Interest Rate: Lenders charge interest on the loan amount as compensation for providing the funds. The interest rate can vary based on factors such as the borrower’s credit score, the loan term, and the economic environment.

- Monthly Payments: Borrowers make regular monthly payments to repay the loan. These payments include both the principal amount (the original loan amount) and the interest.

- Secured Loan: Auto loans are usually secured loans, meaning that the vehicle itself serves as collateral. If the borrower fails to repay the loan, the lender has the right to repossess the vehicle.

- Credit Score: A borrower’s credit score plays a crucial role in determining the interest rate and loan terms. Higher credit scores often result in lower interest rates and better loan terms.

- Dealership Financing vs. Direct Lending: Auto financing can be obtained through the dealership or direct lending institutions such as banks, credit unions, or online lenders. Dealership financing is convenient, but it’s essential to compare rates and terms with other lenders to ensure the best deal.

The Three Sources of Finance

- Short-term financing – This involves taking out a loan for a purchase, usually with a loan term of less than one year. Examples of short-term financing include “Buy Now, Pay Later,” “Unsecured Personal Loans,” and “Payday Loans.”

- Medium-term financing – In this case, a business may take out a bank loan.

- Long-term financing – Longer-term funding offers the most favorable borrowing terms for businesses.

How to Start an Auto Finance Business

Starting an auto finance business involves several key steps, and it requires careful planning, compliance with regulations, and financial acumen. Now that you have an understanding of what an auto financing business is, let’s look at how to start an auto finance business.

Here’s a general guide on how to start an auto finance business:

Research and Industry Knowledge

Gain a deep understanding of the auto finance industry, including market trends, regulations, and competition. Familiarize yourself with the various types of auto financing, such as direct lending, dealership financing, and subprime lending.

Create a Business Plan

Develop a comprehensive business plan that outlines your business goals, target market, competitive analysis, marketing strategy, financial projections, and operational plan. A well-thought-out business plan will serve as a roadmap for your venture and may be required if you seek financing.

Legal Structure and Registration

Choose a legal structure for your auto finance business, such as a sole proprietorship, partnership, corporation, or limited liability company (LLC). Register your business with the appropriate authorities and obtain any necessary licenses or permits.

Compliance with Regulations

Auto financing is heavily regulated to protect consumers. Familiarize yourself with federal and state regulations governing auto loans and consumer lending. Ensure that your business operations comply with these regulations to avoid legal issues.

Secure Funding

Determine the capital needed to start and operate your auto finance business. This may include funds for lending, technology infrastructure, marketing, and operating expenses. Explore financing options such as personal savings, loans, investors, or partnerships.

Build Relationships with Lenders

If your business model involves partnering with banks or financial institutions to secure funds for lending, establish relationships with these lenders. Negotiate terms and conditions that are favorable for both parties.

Develop Technology Infrastructure

Invest in a robust technology infrastructure for loan processing, customer management, and compliance tracking. This may include software for credit scoring, loan origination, and document management.

Create Underwriting Criteria

Establish clear underwriting criteria to evaluate the creditworthiness of borrowers. Define factors such as credit scores, income levels, and debt-to-income ratios that will influence lending decisions.

Marketing and Branding

Develop an eCommerce marketing strategy to attract borrowers. Create a strong brand presence through online and offline channels. Consider advertising, digital marketing, and partnerships with dealerships to increase your visibility in the market.

Employee Hiring and Training

Hire experienced professionals with knowledge of the auto finance industry and compliance requirements. Provide ongoing training to keep your team informed about changes in regulations and best practices.

Implement Risk Management Strategies

Develop risk management strategies to minimize potential losses. This includes monitoring and addressing delinquencies, default rates, and economic factors that may impact the auto finance industry.

Launch and Monitor Performance

Launch your auto finance business and closely monitor its performance. Analyze key performance indicators (KPIs) such as loan portfolio quality, customer satisfaction, and financial metrics. Make adjustments to your strategies based on performance data.

Customer Service and Relationship Management

Provide excellent customer service and establish strong relationships with borrowers. A positive customer experience can lead to repeat business and referrals.

How Does Auto Financing Work?

Auto financing works by allowing individuals to borrow money to purchase a vehicle and repay the loan over a specified period.

Here’s a step-by-step overview of how auto financing typically works:

Offering Financing Options

Businesses offering auto financing provide customers with various financing options to purchase vehicles. This may include loans, leases, or other financing arrangements. The goal is to make it easier for customers to afford vehicles by spreading out the cost over time.

Credit Evaluation

When a customer applies for auto financing, the business evaluates their creditworthiness. This involves reviewing the customer’s credit history, income, employment status, and other relevant financial information. The credit evaluation helps the business determine the customer’s ability to repay the loan and assess the level of risk involved.

Loan Approval

Based on the credit evaluation, the business decides whether to approve the customer’s loan application. If approved, the business determines the loan terms, including the loan amount, interest rate, down payment requirement, and repayment schedule. These terms may vary depending on factors such as the customer’s credit score, the vehicle’s price, and market conditions.

Closing the Deal

Once the loan terms are finalized and agreed upon by the customer, the business completes the financing arrangement. This may involve signing a loan agreement or lease contract outlining the terms and conditions of the financing arrangement. The customer may also need to provide documentation such as proof of insurance and identification.

Disbursement of Funds

After the financing arrangement is finalized, the business disburses the funds to complete the vehicle purchase. This may involve paying the dealership for a new or used vehicle or transferring funds to the customer to purchase a vehicle from a private seller.

Loan Servicing

Throughout the loan term, the business manages the loan account, including collecting payments from the customer, maintaining records, and providing customer service. This may involve sending monthly statements, processing payments, and addressing any customer inquiries or concerns.

Risk Management

Businesses offering auto financing also engage in risk management to mitigate the potential for loan defaults or losses. This may involve monitoring loan performance, implementing collection strategies for delinquent accounts, and repossessing vehicles in cases of default.

Top 5 Auto Finance Business Examples

Auto finance businesses, also known as car finance companies, offer financial products allowing people to acquire cars through arrangements other than full-cash payments.

Here are the top 5 auto finance businesses:

- Toyota Financial Services

- Ally Financial

- GM Financial

- Capital One Auto Finance

Auto Finance Business Loan

Auto finance business loans are an excellent option for companies to finance a new or used vehicle . Also, auto finance business loans let you finance a vehicle for company use and these loans are available through banks, credit unions, and online lenders.

If you are determined to enter into the car loan business, you should know what a car equity loan is. Car equity is a loan where a paid-off vehicle is used as the collateral for a loan.

The value of the car is what you use to calculate the maximum amount the borrowers can get. Auto finance business loans can get you profit owing to the attractiveness brought because there is no requirement borrowers need to comply with.

How to Start a Car Loan Business

- Arrange for a perfect credit line

This is the most important thing you need when starting a car loan business. You should first have your personal budget before deciding to make the loans yourself.

If you have enough starting capital you can partner with different banks between the bank and your business. Make sure you have a good relationship with them on the credit line so that they can give you capital to run your business through its initial stage.

- Obtain business license

Obtaining a license from the country and the state where your business is established is very important to operate as an auto finance lender . Check the regulations put in the price for banking and insurance that you need to operate.

Also, take some time to research to know the documentation you need to pursue before launching business operations.

- Install computer software to operate your business

Installing computers to track different aspects of your business including the payment method and application used.

This can be overwhelming for using automated systems that can group data well with a good software system, tracking of payments and balances, and print out the report of the growth of the business.

- Marketing your car loan business

Marketing your business is a good authority that will help you reach your target audience. You can launch a marketing campaign directly to consumers while targeting a small area and a large segment.

As the business expands, you can move the business to digital marketing and media outlets. You can also talk to leadership to refer potential customers to your auto loan business.

Starting an auto finance business is not as challenging as one might think. One of the challenges people might face is access to capital to operate smoothly.

It is important to ensure your business is licensed and registered both with the local and state authorities. Also, make sure you invest in digital marketing strategies that will help your auto finance business attract the right customers.

Hey there! This website is sponsored by affiliate partners.

We are proud affiliates for some of these tools. Affiliate links are used for each tool that we are an affiliate of, which means that if you click that link and subsequently make a purchase, we will earn a commission. You pay nothing extra – any commission we earn comes at no additional cost to you.

Raphael Ojo

Writer & blogger.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Budget Tips

- Business Funding

- Investments & Savings

- Making Money Online

Payment Solutions

Personal Finance

What is NFC Contactless Payments?

How to Invest in Real Estate Online

8 Ways to Generate Revenues to Fund Your Business Ideas in 2024

Getting Started With Online Invoicing Software

How to Create a Personal Budget

PayCape is your go-to destination for all things financial technology! Dive into the future with trending topics, expert tips, and exclusive hacks for fintech enthusiasts and businesses.

Sponsored Content

Do you have a product or service you want us to promote or review? We are here for you. Shoot our advertising team a message. We’ll get back to you within 2 days. The PayCape team can’t wait to partner with you!

Explore Topics

- Blog (12)

- Budget Tips (8)

- Business Finance (3)

- Business Funding (1)

- Guides (3)

- How-To (3)

- Investments & Savings (9)

- Making Money Online (2)

- Payment Solutions (27)

- Personal Finance (7)

Join 70,000 subscribers!

By signing up, you agree to our Privacy Policy

- 50-30-20 Rule

- 50/30/20 Rule

- Best Budgeting App

- best budgeting method

- Best Expense Tracker

- biometric payments

- Budget Template

- Budgeting App

- budgeting apps

- Capital Budgeting

- contactless payments

- Expense Tracker

- Facebook ads

- free expense tracker

- Google Sheets

- how to create a budget

- how to create a personal budget

- how to invest online

- How to Save

- Investment in Cryptocurrency

- Mutual Funds Online for Beginners

- Passive Income

- Payment methods

- Payment systems

- paypal in nigeria

- personal budget

- personal finance

- Recurring Billing

- Recurring Billing Software

- Recurring payments

- Stock broker

- Subscription

- Subscription Billing

- Subscription Billing Software

- Subscription Billing Tools

- Subscription Business Model

- Subscription Management

- Subscription payment business model

- Subscription payment methods

- Subscription Payments

- Subscription-Based Business

- the best way to create a budget

- what is a budget

How to Pay Online

Investments & Savings

Write For PayCape

Our Gift Store

Advertise With Us

Internship Program

Privacy Policy

Terms & Conditions

© 2024 Powered By Tech Della Solutions LTD

Press ESC to close

End of Content.

- Search Search Please fill out this field.

Why Do I Need a Business Plan?

Sections of a business plan, the bottom line.

- Small Business

How to Write a Business Plan for a Loan

How to secure business financing

Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture.

:max_bytes(150000):strip_icc():format(webp)/smda1_crop-f0c167dd2b2144f68f352c63d17f7db5.jpg)

A business plan is a document that explains what a company’s objectives are and how it will achieve them. It contains a road map for the company from a marketing, financial, and operational standpoint. Some business plans are more detailed than others, but they are used by all types of businesses, from large, established companies to small startups.

If you are applying for a business loan , your lender may want to see your business plan. Your plan can prove that you understand your market and your business model and that you are realistic about your goals. Even if you don’t need a business plan to apply for a loan, writing one can improve your chances of securing finance.

Key Takeaways

- Many lenders will require you to write a business plan to support your loan application.

- Though every business plan is different, there are a number of sections that appear in every business plan.

- A good business plan will define your company’s strategic priorities for the coming years and explain how you will try to achieve growth.

- Lenders will assess your plan against the “five Cs”: character, capacity, capital, conditions, and collateral.

There are many reasons why all businesses should have a business plan . A business plan can improve the way that your company operates, but a well-written plan is also invaluable for attracting investment.

On an operational level, a well-written business plan has several advantages. A good plan will explain how a company is going to develop over time and will lay out the risks and contingencies that it may encounter along the way.

A business plan can act as a valuable strategic guide, reminding executives of their long-term goals amid the chaos of day-to-day business. It also allows businesses to measure their own success—without a plan, it can be difficult to determine whether a business is moving in the right direction.

A business plan is also valuable when it comes to dealing with external organizations. Indeed, banks and venture capital firms often require a viable business plan before considering whether they’ll provide capital to new businesses.

Even if a business is well-established, lenders may want to see a solid business plan before providing financing. Lenders want to reduce their risk, so they want to see that a business has a serious and realistic plan in place to generate income and repay the loan.

Every business is different, and so is every business plan. Nevertheless, most business plans contain a number of generic sections. Common sections are: executive summary, company overview, products and services, market analysis, marketing and sales plan, operational plan, and management team. If you are applying for a loan, you should also include a funding request and financial statements.

Let’s look at each section in more detail.

Executive Summary

The executive summary is a summary of the information in the rest of your business plan, but it’s also where you can create interest in your business.

You should include basic information about your business, including what you do, where you are based, your products, and how long you’ve been in business. You can also mention what inspired you to start your business, your key successes so far, and your growth plans.

Company Overview

In this section, focus on the core strengths of your business, the problem you want to solve, and how you plan to address it.

Here, you should also mention any key advantages that your business has over your competitors, whether this is operating in a new market or a unique approach to an existing one. You should also include key statistics in this section, such as your annual turnover and number of employees.

Products and Services

In this section, provide some details of what you sell. A lender doesn’t need to know all the technical details of your products but will want to see that they are desirable.

You can also include information on how you make your products, or how you provide your services. This information will be useful to a lender if you are looking for financing to grow your business.

Market Analysis

A market analysis is a core section of your business plan. Here, you need to demonstrate that you understand the market you are operating in, and how you are different from your competitors. If you can find statistics on your market, and particularly on how it is projected to grow over the next few years, put them in this section.

Marketing and Sales Plan

Your marketing and sales plan gives details on what kind of new customers you are looking to attract, and how you are going to connect with them. This section should contain your sales goals and link these to marketing or advertising that you are planning.

If you are looking to expand into a new market, or to reach customers that you haven’t before, you should explain the risks and opportunities of doing so.

Operational Plan

This section explains the basic requirements of running your business on a day-to-day basis. Your exact requirements will vary depending on the type of business you run, but be as specific as possible.

If you need to rent office space, for example, you should include the cost in your operational plan. You should also include the cost of staff, equipment, and any raw materials required to run your business.

Management Team

The management team section is one of the most important sections in your business plan if you are applying for a loan. Your lender will want reassurance that you have a skilled, experienced, competent, and reliable senior management team in place.

Even if you have a small team, you should explain what makes each person qualified for their position. If you have a large team, you should include an organizational chart to explain how your team is structured.

Funding Request

If you are applying for a loan, you should add a funding request. This is where you explain how much money you are looking to borrow, and explain in detail how you are going to use it.

The most important part of the funding-request section is to explain how the loan you are asking for would improve the profitability of your business, and therefore allow you to repay your loan.

Financial Statements

Most lenders will also ask you to provide evidence of your business finances as part of your application. Graphs and charts are often a useful addition to this section, because they allow your lender to understand your finances at a glance.

The overall goal of providing financial statements is to show that your business is profitable and stable. Include three to five years of income statements, cash flow statements, and balance sheets. It can also be useful to provide further analysis, as well as projections of how your business will grow in the coming years.

What Do Lenders Look for in a Business Plan?

Lenders want to see that your business is stable, that you understand the market you are operating in, and that you have realistic plans for growth.

Your lender will base their decision on what are known as the “five Cs.” These are:

- Character : You can stress your good character in your executive summary, company overview, and your management team section.

- Capacity : This is, essentially, your ability to repay the loan. Your lender will look at your growth plans, your funding request, and your financial statements in order to assess this.

- Capital : This is the amount of money you already have in your business. The larger and more established your business is, the more likely you are to be approved for finance, so highlight your capital throughout your business plan.

- Conditions : Conditions refer to market conditions. In your market analysis, you should be able to prove that your business is well-positioned in relation to your target market and competitors.

- Collateral : Depending on your loan, you may be asked to provide collateral , so you should provide information on the assets you own in your operational plan.

How Long Does It Take to Write a Business Plan?

The length of time it takes to write a business plan depends on your business, but you should take your time to ensure it is thorough and correct. A business plan has advantages beyond applying for a loan, providing a strategic focus for your business.

What Should You Avoid When Writing a Business Plan?

The most common mistake that business owners make when writing a business plan is to be unrealistic about their growth potential. Your lender is likely to spot overly optimistic growth projections, so try to keep it reasonable.

Should I Hire Someone to Write a Business Plan for My Business?

You can hire someone to write a business plan for your business, but it can often be better to write it yourself. You are likely to understand your business better than an external consultant.

Writing a business plan can benefit your business, whether you are applying for a loan or not. A good business plan can help you develop strategic priorities and stick to them. It describes how you are going to grow your business, which can be valuable to lenders, who will want to see that you are able to repay a loan that you are applying for.

U.S. Small Business Administration. “ Write Your Business Plan .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

U.S. Small Business Administration. “ Fund Your Business .”

Navy Federal Credit Union. “ The 5 Cs of Credit .”

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for April 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Business auto loans: What they are & how to get one

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Mortgages

- Connect with Allison Martin on LinkedIn Linkedin

- • Personal loans

- • Auto loans

- Connect with Pippin Wilbers on LinkedIn Linkedin

- Get in contact with Pippin Wilbers via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Key retirement financial advisor takeaways

- Business auto loans let you finance a vehicle for company use.

- These loans are available through banks, credit unions and online lenders.

- Like standard auto loans, they are secured and use the vehicle as collateral.

- If you can’t get approved for a business auto loan or prefer to explore alternatives, try leasing a car or taking out a small business loan to fund the purchase.

If you can’t pay cash for your company car, it’s worth exploring business auto loans. These loans and the application process share many similarities with personal auto loans. As with standard auto loans, your vehicle secures the loan — the lender can repossess it if you fail to make loan payments.

Lenders will want reassurance that you’re using the vehicle for business purposes, but the upside is you could qualify for a few tax breaks. Here’s what to know about business auto loans, how to get one and if you should consider alternative funding sources.

What is a business auto loan?

A business auto loan is a secured loan . It can finance purchasing a new or used vehicle for business purposes. Banks, credit unions and online lenders offer these loans. The cost of borrowing varies by lender and your financial profile.

Lenders set their approval guidelines for these loans. They may require your business credit score, personal credit score or both to meet certain thresholds. They may also set a minimum time in business and annual revenue.

Some will allow you to take out the loan in your company’s name, but you may need to provide a personal guarantee , which means your assets could be at risk if you default on the payments. Depending on the lender, you may be required to use the vehicle solely for your business.

This restriction has an upside. You can deduct more of your interest on a vehicle you use only for a business than one used partially for personal needs. Plus, you may be eligible for the standard mileage deduction to get a break at tax time. Consult with a reputable tax professional to learn more and determine your eligibility.

Should I lease or buy a business vehicle?

Instead of buying, you can also lease a vehicle for your business. Leasing could be better if you don’t plan to keep the vehicle long-term and qualify for a lower monthly payment. Leasing still allows you to access certain tax benefits .

But if you know you’ll need to make significant alterations to the vehicle or plan to drive it a ton, a lease likely isn’t a good fit. This is also the case if you prefer to own the vehicle for an extended period and may want to explore the possibility of an extended loan term to make the monthly auto loan payments more affordable. Consider if the mileage and usage restrictions work for your situation.

How to get a business auto loan

- Set a budget: Whether you’re buying a new or used vehicle, calculate how large of a monthly payment your company can afford. It’s equally important to factor in the overall cost of the vehicle so you’ll know what to expect. Use the business loan and interest rate calculator to simplify the process.

- Review your credit: Check your personal and business credit scores and reports to identify errors. File disputes with the respective credit reporting agencies to ensure your score accurately reflects your credit history when you apply for financing. It can take up to 30 days for a creditor to respond, so review your credit well before you want to buy. Higher scores and a clean credit history can help you qualify for a lower interest rate.

- Choose a vehicle: Look at available options and decide on the type of company vehicle that best suits your needs. Remember that some lenders may only finance new vehicles, while others may have tight restrictions on the used vehicles they finance. It’s best to know exactly what you’re looking for before exploring lenders.

- Get preapproved: Shop around with at least three different lenders . If the lenders offer preapproval, apply to view potential loan offers. Doing so helps you compare offers to find the best deal on commercial vehicle financing. Some lenders may require that you provide documentation proving you own the company before issuing loan preapproval.

- Provide documentation: You may need to provide your employer identification number , Social Security number, business license and financial information. The lender will also likely request personal documents proving your personal income and creditworthiness.

Where to get a business auto loan

If you’re ready to research business lenders, you have two primary options: brick-and-mortar lenders and online lenders.

Brick-and-mortar lenders

Traditional banks, like Bank of America , offer loans with competitive rates and repayment terms between 48 and 72 months. These loans typically come with mileage and vehicle age restrictions.

Credit unions also feature commercial vehicle loans, and the rates are often more competitive than those of a traditional bank. The process can be lengthy with either option, and you’ll typically need to provide a lot of paperwork.

Online lenders

While not as strict as bank lenders, online lenders generally still require that you have a reasonable credit score and meet the minimum time in business guidelines. Some also impose restrictions on vehicles that can be financed. Still, you may find it easier to qualify, and the interest rate ranges are often comparable to a bank or credit union.

One such lender is National Funding — it offers loans for commercial vehicle purchases and leases to business owners with a credit score over 600 who’ve been in business for at least six months.

Alternatives to business auto loans

Going with a business auto loan isn’t your only option, though. Here are three alternatives that could help you secure the car your business needs.

- Small business loan: You can finance a vehicle with a small business loan or business line of credit .

- Consumer auto loan: A consumer auto loan could be better if you use the vehicle for personal and business purposes. These can be easier to secure, but you put your personal credit on the line rather than your company’s.

- Leasing: The car won’t be an asset your business can claim, but there are ways to incorporate the cost into your taxes to save money when you file. It may also be less expensive on a month-to-month basis, depending on the financing terms you qualify for.

The bottom line

When you’re ready to finance a vehicle for your business, take time to compare your options and get rate quotes from at least three lenders. Interest rates have significantly increased in the past years, but by doing your homework, you give yourself the best chance at finding a business auto loan with terms that work for your company’s financial situation.

Related Articles

How to get a car loan with bad credit: 10 tips for finding the best

Vroom auto loan alternatives: Try these online shopping platforms

How to get the best auto loan rates: Your 6-step guide

What is an auto loan? Where do you find them? And how do they work?

Auto Loan Business Idea Description in 5 W’s and 1 H Format

By henry sheykin, resources on auto loan.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

Are you looking to jump into the lucrative auto loan business? Wondering who are the key players, what's the market size, and how to get started? Look no further, as we unpack the Auto Loan business idea for you, answering the crucial questions of who, what, where, when, why, and how. Get ready to dive into this booming industry as we break down the numbers, statistics, and strategies that will give you an edge in the US market. Whether you're an aspiring entrepreneur or a curious investor, this article will guide you through the ins and outs of the auto loan business, revealing the potential for success and the path to becoming a leader in the industry. Don't miss out on this opportunity to revolutionize the way people obtain auto loans!

Key Takeaways

- The Auto Loan Business Plan startup is led by CEO John Smith and consists of experienced financial professionals in the auto loan industry.

- The company aims to provide auto loans to individuals seeking to purchase personal vehicles and establish partnerships with local vehicle dealerships.

- Based in Los Angeles, California, the startup plans to become a leader in the auto loan industry within the area by 2025.

- The company aims to address the need for a reliable and trustworthy auto loan provider by offering competitive interest rates and exceptional customer service.

- The startup achieves its goals through partnerships with banks and credit unions, collaboration with local dealerships, and a skilled team of loan underwriters and servicers.

The Auto Loan Business Plan startup is led by CEO John Smith, a highly experienced financial professional with a strong background in the auto loan industry. John Smith has assembled a team of skilled individuals with expertise in various roles within the industry, including loan underwriters, servicers, and customer service representatives.

Major Players

The major players in the Auto Loan Business Plan startup include CEO John Smith, who drives the overall vision and strategic direction of the company. The team consists of skilled loan underwriters who assess loan applications and determine the terms and conditions of each loan. Servicers manage the ongoing relationship with borrowers, including loan repayments and customer support. Additionally, customer service representatives provide exceptional service to borrowers, addressing inquiries and concerns promptly.

The Auto Loan Business Plan startup is owned by CEO John Smith and any other owners who may be involved. These owners play a key role in decision-making and financial planning for the company.

In addition to the CEO and owners, the Auto Loan Business Plan startup employs a team of skilled professionals across various roles. These include loan underwriters, servicers, and customer service representatives. Each team member brings a wealth of experience and expertise to their respective roles, ensuring the efficient operation of the company.

The Auto Loan Business Plan startup may also seek guidance from industry advisors, such as financial consultants or legal professionals who specialize in the auto loan industry. These advisors provide valuable insights and help the company navigate any complex legal or financial landscape.

Customers and Target Audience

The primary customers of the Auto Loan Business Plan startup are individuals seeking financing to purchase a personal vehicle. The target audience includes individuals who may not have sufficient funds to purchase a vehicle outright or prefer to finance their purchase. The company aims to serve customers in the Los Angeles area and establish itself as a reliable and trustworthy auto loan provider for the local community.

Competition

In the auto loan industry, the Auto Loan Business Plan startup faces competition from other financial institutions that offer similar services. This includes banks, credit unions, and other specialized auto loan providers. However, the startup differentiates itself through its competitive interest rates, exceptional customer service, and a seamless loan approval process. By addressing the need for a reliable and trustworthy auto loan provider in the region, the company aims to stand out among its competitors and attract a loyal customer base.

The Auto Loan Business Plan startup aims to provide financing to individuals seeking to purchase a personal vehicle. The primary service offered by the company is auto loans, with the vehicle serving as collateral for the loan. The startup also focuses on establishing partnerships with local vehicle dealerships to expand its customer base.

What do you want to achieve?

The Auto Loan Business Plan startup aims to become a leader in the auto loan industry within the Los Angeles area. By offering competitive interest rates, exceptional customer service, and a seamless loan approval process, the company wants to address the need for a reliable and trustworthy auto loan provider in the region.

What is your sustainable advantage?

The sustainable advantage of the Auto Loan Business Plan startup lies in its team of experienced financial professionals with a strong background in the auto loan industry. The skilled loan underwriters, servicers, and customer service representatives ensure a seamless loan approval and servicing process. Additionally, the company's strategic partnerships with banks, credit unions, and local vehicle dealerships allow it to provide competitive interest rates and reach a wider customer base.

What do you offer? What do you produce?

The Auto Loan Business Plan startup offers auto loans to individuals looking to purchase a personal vehicle. The loans are secured by the vehicle itself, serving as collateral. The company produces a reliable and streamlined loan approval and servicing process, providing customers with the financial means to purchase their desired personal vehicles.

What is the nature of your product or service?

The nature of the Auto Loan Business Plan startup's product or service is financial. The company provides auto loans, allowing individuals to finance the purchase of personal vehicles. The loan approval process is carried out by a skilled team of professionals who assess the eligibility of customers and secure the loan using the vehicle as collateral. The company's emphasis on exceptional customer service sets it apart from other auto loan providers in the market.

What are your business objectives?