Building an R&D strategy for modern times

The global investment in research and development (R&D) is staggering. In 2019 alone, organizations around the world spent $2.3 trillion on R&D—the equivalent of roughly 2 percent of global GDP—about half of which came from industry and the remainder from governments and academic institutions. What’s more, that annual investment has been growing at approximately 4 percent per year over the past decade. 1 2.3 trillion on purchasing-power-parity basis; 2019 global R&D funding forecast , Supplement, R&D Magazine, March 2019, rdworldonline.com.

While the pharmaceutical sector garners much attention due to its high R&D spending as a percentage of revenues, a comparison based on industry profits shows that several industries, ranging from high tech to automotive to consumer, are putting more than 20 percent of earnings before interest, taxes, depreciation, and amortization (EBITDA) back into innovation research (Exhibit 1).

What do organizations expect to get in return? At the core, they hope their R&D investments yield the critical technology from which they can develop new products, services, and business models. But for R&D to deliver genuine value, its role must be woven centrally into the organization’s mission. R&D should help to both deliver and shape corporate strategy, so that it develops differentiated offerings for the company’s priority markets and reveals strategic options, highlighting promising ways to reposition the business through new platforms and disruptive breakthroughs.

Yet many enterprises lack an R&D strategy that has the necessary clarity, agility, and conviction to realize the organization’s aspirations. Instead of serving as the company’s innovation engine, R&D ends up isolated from corporate priorities, disconnected from market developments, and out of sync with the speed of business. Amid a growing gap in performance between those that innovate successfully and those that do not, companies wishing to get ahead and stay ahead of competitors need a robust R&D strategy that makes the most of their innovation investments. Building such a strategy takes three steps: understanding the challenges that often work as barriers to R&D success, choosing the right ingredients for your strategy, and then pressure testing it before enacting it.

Overcoming the barriers to successful R&D

The first step to building an R&D strategy is to understand the four main challenges that modern R&D organizations face:

Innovation cycles are accelerating. The growing reliance on software and the availability of simulation and automation technologies have caused the cost of experimentation to plummet while raising R&D throughput. The pace of corporate innovation is further spurred by the increasing emergence of broadly applicable technologies, such as digital and biotech, from outside the walls of leading industry players.

But incumbent corporations are only one part of the equation. The trillion dollars a year that companies spend on R&D is matched by the public sector. Well-funded start-ups, meanwhile, are developing and rapidly scaling innovations that often threaten to upset established business models or steer industry growth into new areas. Add increasing investor scrutiny of research spending, and the result is rising pressure on R&D leaders to quickly show results for their efforts.

R&D lacks connection to the customer. The R&D group tends to be isolated from the rest of the organization. The complexity of its activities and its specialized lexicon make it difficult for others to understand what the R&D function really does. That sense of working inside a “black box” often exists even within the R&D organization. During a meeting of one large company’s R&D leaders, a significant portion of the discussion focused on simply getting everyone up to speed on what the various divisions were doing, let alone connecting those efforts to the company’s broader goals.

Given the challenges R&D faces in collaborating with other functions, going one step further and connecting with customers becomes all the more difficult. While many organizations pay lip service to customer-centric development, their R&D groups rarely get the opportunity to test products directly with end users. This frequently results in market-back product development that relies on a game of telephone via many intermediaries about what the customers want and need.

Projects have few accountability metrics. R&D groups in most sectors lack effective mechanisms to measure and communicate progress; the pharmaceutical industry, with its standard pipeline for new therapeutics that provides well-understood metrics of progress and valuation implications, is the exception, not the rule. When failure is explained away as experimentation and success is described in terms of patents, rather than profits, corporate leaders find it hard to quantify R&D’s contribution.

Yet proven metrics exist to effectively measure progress and outcomes. A common challenge we observe at R&D organizations, ranging from automotive to chemical companies, is how to value the contribution of a single component that is a building block of multiple products. One specialty-chemicals company faced this challenge in determining the value of an ingredient it used in its complex formulations. It created categorizations to help develop initial business cases and enable long-term tracking. This allowed pragmatic investment decisions at the start of projects and helped determine the value created after their completion.

Even with outcomes clearly measured, the often-lengthy period between initial investment and finished product can obscure the R&D organization’s performance. Yet, this too can be effectively managed by tracking the overall value and development progress of the pipeline so that the organization can react and, potentially, promptly reorient both the portfolio and individual projects within it.

Incremental projects get priority. Our research indicates that incremental projects account for more than half of an average company’s R&D investment, even though bold bets and aggressive reallocation of the innovation portfolio deliver higher rates of success. Organizations tend to favor “safe” projects with near-term returns—such as those emerging out of customer requests—that in many cases do little more than maintain existing market share. One consumer-goods company, for example, divided the R&D budget among its business units, whose leaders then used the money to meet their short-term targets rather than the company’s longer-term differentiation and growth objectives.

Focusing innovation solely around the core business may enable a company to coast for a while—until the industry suddenly passes it by. A mindset that views risk as something to be avoided rather than managed can be unwittingly reinforced by how the business case is measured. Transformational projects at one company faced a higher internal-rate-of-return hurdle than incremental R&D, even after the probability of success had been factored into their valuation, reducing their chances of securing funding and tilting the pipeline toward initiatives close to the core.

As organizations mature, innovation-driven growth becomes increasingly important, as their traditional means of organic growth, such as geographic expansion and entry into untapped market segments, diminish. To succeed, they need to develop R&D strategies equipped for the modern era that treat R&D not as a cost center but as the growth engine it can become.

Would you like to learn more about our Strategy & Corporate Finance Practice ?

Choosing the ingredients of a winning r&d strategy.

Given R&D’s role as the innovation driver that advances the corporate agenda, its guiding strategy needs to link board-level priorities with the technologies that are the organization’s focus (Exhibit 2). The R&D strategy must provide clarity and commitment to three central elements: what we want to deliver, what we need to deliver it, and how we will deliver it.

What we want to deliver. To understand what a company wants to and can deliver, the R&D, commercial, and corporate-strategy functions need to collaborate closely, with commercial and corporate-strategy teams anchoring the R&D team on the company’s priorities and the R&D team revealing what is possible. The R&D strategy and the corporate strategy must be in sync while answering questions such as the following: At the highest level, what are the company’s goals? Which of these will require R&D in order to be realized? In short, what is the R&D organization’s purpose?

Bringing the two strategies into alignment is not as easy as it may seem. In some companies, what passes for corporate strategy is merely a five-year business plan. In others, the corporate strategy is detailed but covers only three to five years—too short a time horizon to guide R&D, especially in industries such as pharma or semiconductors where the product-development cycle is much longer than that. To get this first step right, corporate-strategy leaders should actively engage with R&D. That means providing clarity where it is lacking and incorporating R&D feedback that may illuminate opportunities, such as new technologies that unlock growth adjacencies for the company or enable completely new business models.

Secondly, the R&D and commercial functions need to align on core battlegrounds and solutions. Chief technology officers want to be close to and shape the market by delivering innovative solutions that define new levels of customer expectations. Aligning R&D strategy provides a powerful forum for identifying those opportunities by forcing conversations about customer needs and possible solutions that, in many companies, occur only rarely. Just as with the corporate strategy alignment, the commercial and R&D teams need to clearly articulate their aspirations by asking questions such as the following: Which markets will make or break us as a company? What does a winning product or service look like for customers?

When defining these essential battlegrounds, companies should not feel bound by conventional market definitions based on product groups, geographies, or customer segments. One agricultural player instead defined its markets by the challenges customers faced that its solutions could address. For example, drought resistance was a key battleground no matter where in the world it occurred. That framing clarified the R&D–commercial strategy link: if an R&D project could improve drought resistance, it was aligned to the strategy.

The dialogue between the R&D, commercial, and strategy functions cannot stop once the R&D strategy is set. Over time, leaders of all three groups should reexamine the strategic direction and continuously refine target product profiles as customer needs and the competitive landscape evolve.

What we need to deliver it. This part of the R&D strategy determines what capabilities and technologies the R&D organization must have in place to bring the desired solutions to market. The distinction between the two is subtle but important. Simply put, R&D capabilities are the technical abilities to discover, develop, or scale marketable solutions. Capabilities are unlocked by a combination of technologies and assets, and focus on the outcomes. Technologies, however, focus on the inputs—for example, CRISPR is a technology that enables the genome-editing capability.

This delineation protects against the common pitfall of the R&D organization fixating on components of a capability instead of the capability itself—potentially missing the fact that the capability itself has evolved. Consider the dawn of the digital age: in many engineering fields, a historical reliance on talent (human number crunchers) was suddenly replaced by the need for assets (computers). Those who focused on hiring the fastest mathematicians were soon overtaken by rivals who recognized the capability provided by emerging technologies.

The simplest way to identify the needed capabilities is to go through the development processes of priority solutions step by step—what will it take to produce a new product or feature? Being exhaustive is not the point; the goal is to identify high-priority capabilities, not to log standard operating procedures.

Prioritizing capabilities is a critical but often contentious aspect of developing an R&D strategy. For some capabilities, being good is sufficient. For others, being best in class is vital because it enables a faster path to market or the development of a better product than those of competitors. Take computer-aided design (CAD), which is used to design and prototype engineering components in numerous industries, such as aerospace or automotive. While companies in those sectors need that capability, it is unlikely that being the best at it will deliver a meaningful advantage. Furthermore, organizations should strive to anticipate which capabilities will be most important in the future, not what has mattered most to the business historically.

Once capabilities are prioritized, the R&D organization needs to define what being “good” and “the best” at them will mean over the course of the strategy. The bar rises rapidly in many fields. Between 2009 and 2019, the cost of sequencing a genome dropped 150-fold, for example. 2 Kris A. Wetterstrand, “DNA sequencing costs: Data,” NHGRI Genome Sequencing Program (GSP), August 25, 2020, genome.gov. Next, the organization needs to determine how to develop, acquire, or access the needed capabilities. The decision of whether to look internally or externally is crucial. An automatic “we can build it better” mindset diminishes the benefits of specialization and dilutes focus. Additionally, the bias to building everything in-house can cut off or delay access to the best the world has to offer—something that may be essential for high-priority capabilities. At Procter & Gamble, it famously took the clearly articulated aspiration of former CEO A. G. Lafley to break the company’s focus on in-house R&D and set targets for sourcing innovation externally. As R&D organizations increasingly source capabilities externally, finding partners and collaborating with them effectively is becoming a critical capability in its own right.

How we will do it. The choices of operating model and organizational design will ultimately determine how well the R&D strategy is executed. During the strategy’s development, however, the focus should be on enablers that represent cross-cutting skills and ways of working. A strategy for attracting, developing, and retaining talent is one common example.

Another is digital enablement, which today touches nearly every aspect of what the R&D function does. Artificial intelligence can be used at the discovery phase to identify emerging market needs or new uses of existing technology. Automation and advanced analytics approaches to experimentation can enable high throughput screening at a small scale and distinguish the signal from the noise. Digital (“in silico”) simulations are particularly valuable when physical experiments are expensive or dangerous. Collaboration tools are addressing the connectivity challenges common among geographically dispersed project teams. They have become indispensable in bringing together existing collaborators, but the next horizon is to generate the serendipity of chance encounters that are the hallmark of so many innovations.

Testing your R&D strategy

Developing a strategy for the R&D organization entails some unique challenges that other functions do not face. For one, scientists and engineers have to weigh considerations beyond their core expertise, such as customer, market, and economic factors. Stakeholders outside R&D labs, meanwhile, need to understand complex technologies and development processes and think along much longer time horizons than those to which they are accustomed.

For an R&D strategy to be robust and comprehensive enough to serve as a blueprint to guide the organization, it needs to involve stakeholders both inside and outside the R&D group, from leading scientists to chief commercial officers. What’s more, its definition of capabilities, technologies, talent, and assets should become progressively more granular as the strategy is brought to life at deeper levels of the R&D organization. So how can an organization tell if its new strategy passes muster? In our experience, McKinsey’s ten timeless tests of strategy apply just as well to R&D strategy as to corporate and business-unit strategies. The following two tests are the most important in the R&D context:

- Does the organization’s strategy tap the true source of advantage? Too often, R&D organizations conflate technical necessity (what is needed to develop a solution) with strategic importance (distinctive capabilities that allow an organization to develop a meaningfully better solution than those of their competitors). It is also vital for organizations to regularly review their answers to this question, as capabilities that once provided differentiation can become commoditized and no longer serve as sources of advantage.

- Does the organization’s strategy balance commitment-rich choices with flexibility and learning? R&D strategies may have relatively long time horizons but that does not mean they should be insulated from changes in the outside world and never revisited. Companies should establish technical, regulatory, or other milestones that serve as clear decision points for shifting resources to or away from certain research areas. Such milestones can also help mark progress and gauge whether strategy execution is on track.

Additionally, the R&D strategy should be simply and clearly communicated to other functions within the company and to external stakeholders. To boost its clarity, organizations might try this exercise: distill the strategy into a set of fill-in-the-blank components that define, first, how the world will evolve and how the company plans to refocus accordingly (for example, industry trends that may lead the organization to pursue new target markets or segments); next, the choices the R&D function will make in order to support the company’s new focus (which capabilities will be prioritized and which de-emphasized); and finally, how the R&D team will execute the strategy in terms of concrete actions and milestones. If a company cannot fit the exercise on a single page, it has not sufficiently synthesized the strategy—as the famed physicist Richard Feynman observed, the ultimate test of comprehension is the ability to convey something to others in a simple manner.

Cascading the strategy down through the R&D organization will further reinforce its impact. For example, asking managers to communicate the strategy to their subordinates will deepen their own understanding. A useful corollary is that those hearing the strategy for the first time are introduced to it by their immediate supervisors rather than more distant R&D leaders. One R&D group demonstrated the broad benefits of this communication model: involving employees in developing and communicating the R&D strategy helped it double its Organizational Health Index strategic clarity score, which measures one of the four “power practices” highly connected to organizational performance.

R&D represents a massive innovation investment, but as companies confront globalized competition, rapidly changing customer needs, and technological shifts coming from an ever-wider range of fields, they are struggling to deliver on R&D’s full potential. A clearly articulated R&D strategy that supports and informs the corporate strategy is necessary to maximize the innovation investment and long-term company value.

Explore a career with us

Related articles.

The innovation commitment

The eight essentials of innovation

The Committed Innovator: An interview with Salesforce’s Simon Mulcahy

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, what is research and development .

Research and development provides businesses with the information they need to successfully bring their products or services to market.

In any industry, even the most revolutionary products and services are rarely fully conceptualized on day 1. Most often, success in the market stems from extensive, effective research and development (R&D). This is especially true for small businesses, which contribute a significantly higher percentage of sales to R&D work than larger businesses.

Here’s everything you need to know about R&D and why it’s well worth the investment.

What is research and development?

R&D refers to the various activities businesses conduct to prepare new products or services for the marketplace. Businesses of all sizes and sectors can partake in R&D activities, though the amount of investment can vary. For example, technology and health care companies tend to have higher R&D expenses , as do enterprises with larger budgets.

Typically the first step in the development process, R&D is not expected to yield immediate profits. Rather, it focuses on innovation and setting up a company for long-term profitability. During this process, businesses may secure patents, copyrights, and other intellectual property associated with their products and services.

At larger companies, R&D activities are often handled in-house by a designated R&D department. However, some smaller companies may opt to outsource R&D to a third-party research firm, a specialist, or an educational institution.

[Read more: 7 Ways to Find Small Business Grant Opportunities ]

Types of research and development

R&D activities typically fall into one of three main categories:

- Basic research: Basic research, sometimes called fundamental research, aims to provide theoretical insight into specific problems or phenomena. For example, a company looking to develop a new toy for children might conduct basic research into child play development.

- Applied research: This type of research is practical and conducted with a specific goal in mind, most often discovering new solutions for existing problems. The children’s toy company from the previous example might conduct applied research into developing a toy that facilitates play development in a new or improved way.

- Development research: In development research, researchers focus exclusively on applied research to develop new products and improve existing ones. For example, a team of development researchers may test the hypothetical company’s new toy or implement feedback obtained from customers.

Small businesses have limited resources. They don’t have that endless budget that the Fortune 500 company has, which means the small business will have to get creative to conduct worthwhile research and development.

Becca Hoeft, CEO and Founder of Morris Hoeft Group

Why invest in research and development?

While R&D can require a significant investment, it also yields several advantages. Below are four specific areas where your business can benefit by conducting R&D.

New products

R&D supports businesses in developing new offerings or improving existing ones based on market demand. By conducting research and applying your findings to your final product, companies are more likely to develop something that meets customers’ needs and performs well in the marketplace.

R&D can help businesses understand their place in the market as well as identify inefficiencies in their workflows. Insights from R&D activities can illuminate ways to improve operations as well as where to most effectively allocate resources, increasing overall efficiency.

Cost reductions

While developing a well-researched product or service that performs well is likely to maximize profit, R&D aimed at improving internal processes and technologies can reduce the cost of bringing products and services to market.

Businesses that invest in R&D may be eligible for specific tax incentives. For one, the federal R&D tax credit offers a dollar-for-dollar reduction in tax liability for businesses that partake in various research-based activities. Eligible companies can apply for this credit by submitting Form 6765 with their business taxes.

[Read more: How to Seek Funding for Your Invention ]

Overcoming the challenges of small business R&D

According to Becca Hoeft, CEO and Founder of Morris Hoeft Group , small businesses may face numerous challenges related to R&D that their larger counterparts might not experience.

“Small businesses have limited resources,” said Hoeft. “They don’t have that endless budget that the Fortune 500 company has, which means the small business will have to get creative to conduct worthwhile research and development.”

While R&D funding is available through various government grants, university programs, and research institutions, Hoeft noted that it may take some time and strategic planning to obtain it. She recommended that small business owners start talking publicly about what kind of research they are doing and what they need to conduct it.

“Don’t hide under a rock and expect money to magically appear,” Hoeft told CO—. “Get on a stage at a relevant conference [or] start a blog series about your idea.”

Keep in mind that once you start sharing your ideas and what you want to research, “it’s out there in the universe,” said Hoeft. Therefore, protecting your intellectual property before you begin and during the research process is extremely important.

“Ensure your trademarks, patents, and copyrights are in place to protect you and your small business,” Hoeft added.

[Read more: How to Qualify for and Claim the R&D Tax Credit ]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Join us for our Small Business Day event!

Join us at our next event on Wednesday, May 1, at 12:00 p.m., where we’ll be kicking off Small Business Month alongside business experts and entrepreneurs. Register to attend in person at our Washington, D.C., headquarters, or join us virtually!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business strategies

How startups contribute to innovation in emerging industries, how entrepreneurs can find a business mentor, 5 business metrics you should analyze every year.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

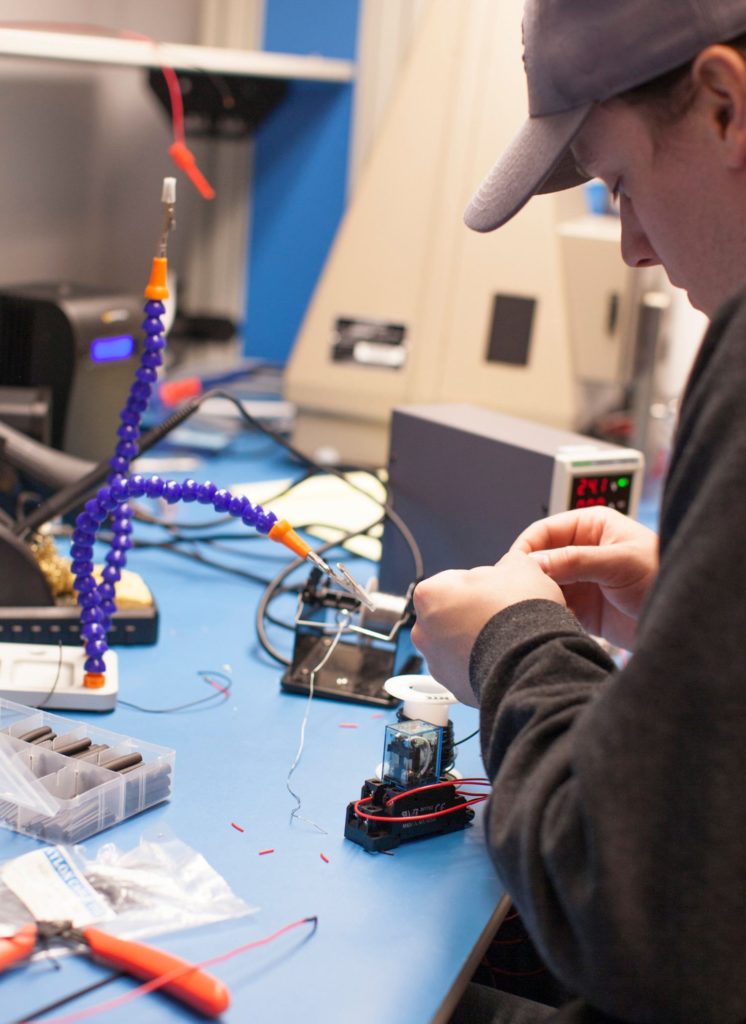

Hardware - R&D Services

Speed is one of the last competitive advantages and the technology landscape is more conducive to quickly building novel concepts than ever. Fresh offers a deep history of research and development services, and our engineers are equipped to build products that position you on your industry’s leading edge.

Have a project?

Connect with our R&D team to discuss your challenge and how we can help.

- First Name * Name

- Tell us more about your project... *

- How did you hear about us *

- By submitting this form, you agree to Fresh Consulting’s Privacy Policy

Core competencies for R&D Services

- Acceptance criteria development

- Assembly lab

- Assembly procedures

- Bill of Materials (BOM) management

- Business plan and case development

- Certification management

- Competitive analysis

- Complete system interface definition

- Configuration management

- Critical path mapping

- Design verification test and engineering planning

- End-to-end architecture development

- Failure mode elemental analysis (FMEA)

- Gauge R&R planning and execution

- In-house build support

- Integration and dependency management

- Market analysis and requirements documentation

- Mechanical drawings

- New Unique and different product risk identification and management

- Offshore automation and manufacturing partner site

- Packaging development

- Partner, supplier and vendor management

- Performance and reliability testing

- Proactive risk identification, mitigation, and contingency planning

- Product brochures

- Product cost of goods analysis

- Product feature documentation

- Prototyping support (in-house and managed)

- Release and change control management

- Resource, schedule, scope, and budget management

- Requirement definition and management

- Risk and Issue identification, management and mitigation

- Safety and compliance

- Schematics, layouts, footprints, symbols

- Scenario and user experience definition

- Technology landscape analysis

- Test planning and procedure development

- Test suite development planning and execution

- Time to market analysis

- Training material

- User manuals, how to guides

- User profiling and user journeys

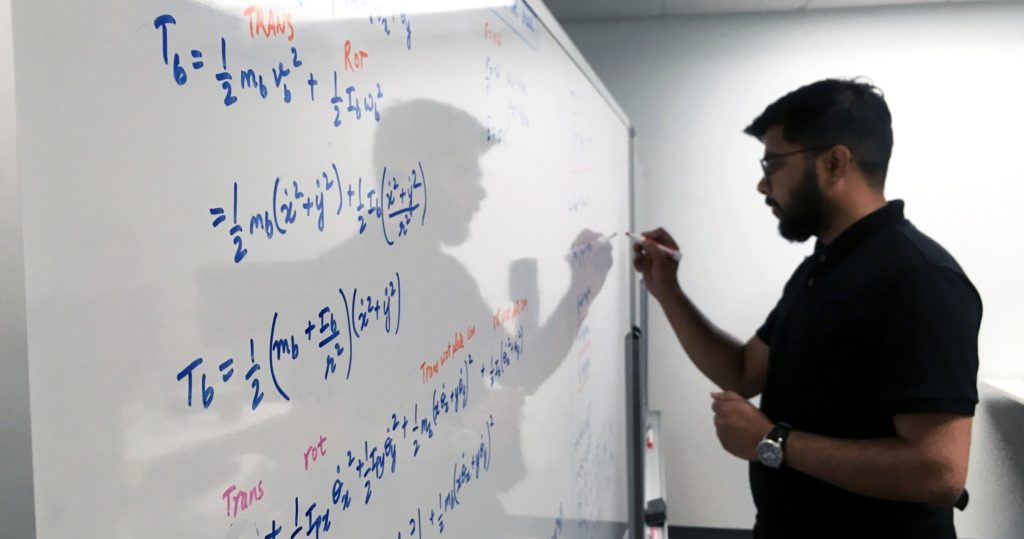

Comprehensive research & development

Fresh engineers will help you conduct research, develop concepts, create prototypes, and execute tests that accelerate your speed to market. After validating designs, we’ll develop a plan for getting them into production.

Building on a 20-year history of R&D from our integration with SiTech RTD, we’re equipped to build advanced technology solutions and iterate on your current products and services. Our depth and breadth of experience spans various markets and industries, situating us to bring innovation to any engineering challenge.

From early prototypes to finished products

A Multi-Disciplinary Team: An end-to-end process staffed by versatile, analytical engineers who tackle projects of different sizes, scopes, and industries.

A Scalable Approach: Generalists and specialists combine forces to take your project from an idea to a market-accepted, finished product, adapting our approach based on your needs, timeline, and budget.

Identify Unlimited Opportunity: Our R&D engineers identify new business opportunities for clients, bringing ideas to fruition in the marketplace tied into your core organizational strategy.

Hire a Fresh R&D Specialist

Fresh R&D engineers provide a variety of related services to design products and increase speed to market.

Fresh’s engineering team is equipped to handle projects of all sizes. There’s no effort too big or too small. If you have an innovative, complex project that pushes the boundaries of what’s possible, we want to hear about it and help you accelerate product development.

Fresh provides dedicated engineering teams, but with our cross-disciplinary focus as an organization, the insight and expertise you receive will account for every dimension of your project. From user experience design to software applications and customer experience strategy, we approach projects holistically.

Most organizations have some of the pieces in place to begin developing products but are understaffed. Our team onramps quickly, providing engineering, development, and design augmentation so your productivity never stops, with recommendations about technology integrations that will further increase project speed.

Related hardware capabilities

Explore our other engineering services, which allow our team to solve challenges for your organization and others, regardless of size, industry vertical, or product category.

- Mechanical Engineering

- Electrical Engineering

- Firmware Engineering

- Robotics Engineering

- RF Engineering

- IoT Product Development

- LabVIEW Services

- Cloud Architecture

- Machine Learning Consulting

- AI Software Development

- AR Development

- VR Development

Related Insights

The Future Of Drone Delivery

Everyday opportunities in the space economy

Building a Robust Perception Library for Robots

MLOps for Robots: A Primer

White Papers

Why Robotics Companies Fail

Process Docs

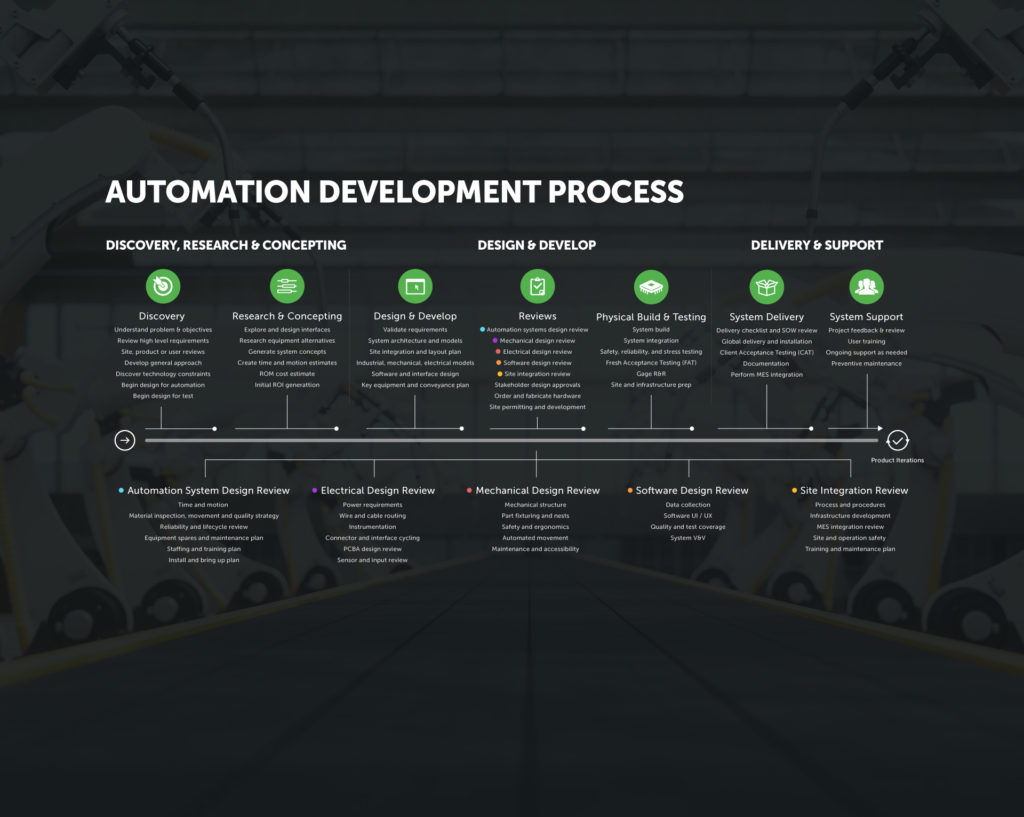

Automation Development

Subscribe to our newsletter

R&D Centers

Discovering the future. Powering the possibilities.

In this section

Long-term partnerships anchored in our public-interest mission

As an independent, leading technology and research and development company, MITRE serves as a trusted national resource. We apply our cross-domain technical knowledge and expertise to deliver a data-driven, system-of-systems engineering approach with a single shared mission: solving problems for a safer world.

Through our public-private partnerships and federally funded research and development centers (FFRDCs), we work across government and in partnership with industry and academia to tackle challenges on behalf of our nation’s agencies in both the civil and defense domains.

As a not-for-profit institution committed to the public interest, MITRE operates six FFRDCs, sponsored by the following government agencies:

- Department of Defense | National Security Engineering Center

- Federal Aviation Administration | Center for Advanced Aviation System Development

- Department of the Treasury and Internal Revenue Service , and co-sponsored by the Department of Veterans Affairs , Social Security Administration , and Department of Commerce | Center for Enterprise Modernization

- Department of Homeland Security | Homeland Security Systems Engineering and Development Institute™

- Department of Health and Human Services | The Health FFRDC

- National Institute of Standards and Technology | National Cybersecurity FFRDC

MITRE operates six FFRDCs on behalf of government agency sponsors.

FFRDC Fact Sheet

Founded in 1958, the National Security Engineering Center is sponsored by the U.S. Department of Defense.

Collaborating across government, academia, and industry to advance America’s position as the foremost global power.

Founded in 1990, the Center for Advanced Aviation System Development is sponsored by the Federal Aviation Administration.

Providing ground-breaking research and trusted partnership to improve aviation and transportation safety and security.

Founded in 1998, the Center for Enterprise Modernization is sponsored by the Dept. of Treasury and the Internal Revenue Service, and co-sponsored by the Dept. of Veterans Affairs, Social Security Administration, and the Department of Commerce.

Partnering to transform how agencies serve the public.

Founded in 2009, the Homeland Security Systems Engineering and Development Institute ™ is sponsored by the Department of Homeland Security.

Driving discoveries that improve our nation’s safety and make our institutions more resilient in the face of threats.

Health FFRDC

Founded in 2012, the Health FFRDC is sponsored by the Department of Health and Human Services.

Addressing complex structural, technical, behavioral, and social challenges that affect health and healthcare delivery.

Founded in 2014, the National Cybersecurity FFRDC is sponsored by the National Institute of Standards and Technology.

Focusing on the serious and growing risk cyber attacks pose to economic prosperity, public safety, and national security.

Our work is as varied as it is significant

We pioneer together for a better future, get the latest subscribe to our newsletter.

R&D Solutions

Driving faster innovation, greater productivity and transformative patient outcomes

Billions to millions: Improving R&D productivity

Capabilities

We’ve been delivering R&D solutions to the world’s leading biopharma companies for 20+ years. We help our clients converge around the patient, connecting expertise with insights into the patient experience, powered by intelligent platform technology.

Intelligent Operations

Patient experience lab, research services, clinical services, regulatory services, pharmacovigilance services, patient services.

INTIENT platform

Lab informatics.

Podcast Series

Helping biopharma companies focus on the patient

We help the world’s leading biopharma companies bring their vision to life – enabling them to improve outcomes by converging around the patient, connecting scientific expertise with unique insights into the patient experience.

Our services span across the entire life sciences enterprise, from research laboratories, clinical trials, and regulatory services, to pharmacovigilance and patient services solutions. Delivered by biopharma and biotech experts, our services are powered by an integrated, intelligent technology solution – the Accenture INTIENT platform .

INTIENT Summit, Boston 2019.

Explore our intelligent operations services.

A Life Sciences industry leader

Leader in strategic consulting

Leader for Third Consecutive Time in the IDC MarketScape: Worldwide Life Sciences Research & Development Vendor Assessment for Strategic Consulting

Leader in digital services

Leader in Everest Group 2019 PEAK Matrix® for Life Sciences Digital Services, examining the changing dynamics of the digital landscape

Leader in Life Sciences Operations Services

Leader in the Everest Group Life Sciences Operations -- Services PEAK Matrix® Assessment 2020 due to Accenture’s "deep domain knowledge…"

New Science is driving biopharma growth

Biopharma companies are finding ways to delivery exceptional growth amidst tremendous disruption by embracing New Science – an evolving, unique combination of the best in science and health technology that is filling an unmet need and raising the standard of care.

of sales between 2017 and 2022 are expected to be driven by New Science, up from 47% between 2012 and 2017.

more investment is being made in digital, data and genomics by leaders in New Science compared to their peers.

higher Probability of Technical and Regulatory Success (PTRS) with New Science compared to other treatments.

Knowledge of trends and insights are important to Accenture. Join our live thought leader-hosted events and watch on-demand sessions.

What we think

Connecting patients to the services they need

Good chemistry: Synthesizing quality control labs

New science: a new economic reality for growth, but why the curious question of azurii collier, annie harris and women of color in pharma, our leaders.

Thomas Lehmann

Petra Jantzer, Ph.D.

Brad Michel

Anthony Romito

Geoff Schmidt

Accenture and google cloud collaborate to help life sciences companies advance innovative therapies, ucb and accenture collaborate to accelerate data processing and help improve patient safety, voices of life sciences.

Our Life Sciences experts weigh in on how pharma, biotech and medtech companies can improve patient outcomes.

Empowering women to lean in and listen

Our Global Head of Research Sara Cortese talks about being a female leader in the Life Sciences industry.

Imagine – better connected cancer patients

After surveying more than 1000 cancer patients Accenture identified opportunities for biopharma companies to help with patient challenges.

The E suite of Ecosystems: Ease of access

A partner ecosystem can make decentralized clinical trials more mainstream. Accenture talks about how.

The E suite of Ecosystems: E for efficacious

Read how INTIENT ecosystem provides life sciences companies access synthetic control arm data, enabling adoption of a new, innovative R&D model.

The E suite of Ecosystems: E for efficiencies

Accenture discusses how the Accenture Life Sciences ecosystem partner provides life sciences companies access to synthetic control arm data.

- Topics ›

- Research and development worldwide ›

The World’s Biggest R&D Spenders

It may come as no surprise that the companies spending the most on research and development are the tech giants. According to data collected by Nasdaq.com , Amazon wins the title of the world’s biggest spender, with R&D investments that amounted to nearly $43 billion in 2020, or about 11 percent of its revenue. Completing the podium are Alphabet and Huawei, which spent $27.6 billion and $22 billion, respectively, on innovation that year, or around 15 percent of their revenues. As our chart also shows, Meta Group (formerly Facebook) was the company in the top 7 that spent the most relative to its revenue, at 21 percent ($18.5 billion).

Nasdaq reports that the final big players to round off the top 10 include companies in the automotive and pharmaceutical industries, with Volkswagen, Intel, Roche and Johnson & Johnson occupying those spots. According to the National Science Board , the majority of global R&D investments are performed by just a few countries, with the U.S. accounting for 27 percent of the global share (or $656 billion) and China making up 22 percent (or $526 billion) in 2019.

Description

This chart shows the companies that spent the most on research and development in 2020.

Can I integrate infographics into my blog or website?

Yes, Statista allows the easy integration of many infographics on other websites. Simply copy the HTML code that is shown for the relevant statistic in order to integrate it. Our standard is 660 pixels, but you can customize how the statistic is displayed to suit your site by setting the width and the display size. Please note that the code must be integrated into the HTML code (not only the text) for WordPress pages and other CMS sites.

Infographic Newsletter

Statista offers daily infographics about trending topics, covering: Economy & Finance , Politics & Society , Tech & Media , Health & Environment , Consumer , Sports and many more.

Related Infographics

Whatsapp fails to capture a hold in the us, which countries are best prepared for the green tech transition, global innovation index, climbing the ladder in the global innovation race, meta leads the way in vr headsets, greater china dominates global microchip exports, infectious diseases, has the world forgotten about malaria, the world’s biggest r&d spenders, tesla: innovation over advertising, covid-19 outbreak, the countries funding covid-19 vaccine r&d, coronavirus vaccine, vaccine hesitancy by group, trust in science, has trust in science become a partisan issue, covid-19 outbreak, europe dominates global vaccine production.

- Who may use the "Chart of the Day"? The Statista "Chart of the Day", made available under the Creative Commons License CC BY-ND 3.0, may be used and displayed without charge by all commercial and non-commercial websites. Use is, however, only permitted with proper attribution to Statista. When publishing one of these graphics, please include a backlink to the respective infographic URL. More Information

- Which topics are covered by the "Chart of the Day"? The Statista "Chart of the Day" currently focuses on two sectors: "Media and Technology", updated daily and featuring the latest statistics from the media, internet, telecommunications and consumer electronics industries; and "Economy and Society", which current data from the United States and around the world relating to economic and political issues as well as sports and entertainment.

- Does Statista also create infographics in a customized design? For individual content and infographics in your Corporate Design, please visit our agency website www.statista.design

Any more questions?

Get in touch with us quickly and easily. we are happy to help.

Feel free to contact us anytime using our contact form or visit our FAQ page .

Statista Content & Design

Need infographics, animated videos, presentations, data research or social media charts?

More Information

The Statista Infographic Newsletter

Receive a new up-to-date issue every day for free.

- Our infographics team prepares current information in a clear and understandable format

- Relevant facts covering media, economy, e-commerce, and FMCG topics

- Use our newsletter overview to manage the topics that you have subscribed to

Research and Development sparks innovative solutions

Achieve business goals by implementing cutting-edge R&D products

.jpeg?width=2560&height=1708&name=Research%20and%20development%20solutions%20(1).jpeg)

Outpace the competition with new or improved offerings

Utilize an effective research and development strategy to enhance existing products, launch new services and technologies, and avoid obsolescence, while gaining an innovative edge and satisfying unmet needs .

Validate your idea quickly with fast prototyping

Discover solutions.

Identify challenges, validate feasibility, and develop innovative fixes

Prototype in weeks

Rapidly model ideas, features, and technologies to test usability

Research challenges

Understand potential objections and create an R&D strategy accordingly

Activate your resources

Utilize client expertise to discover problems and possible solutions

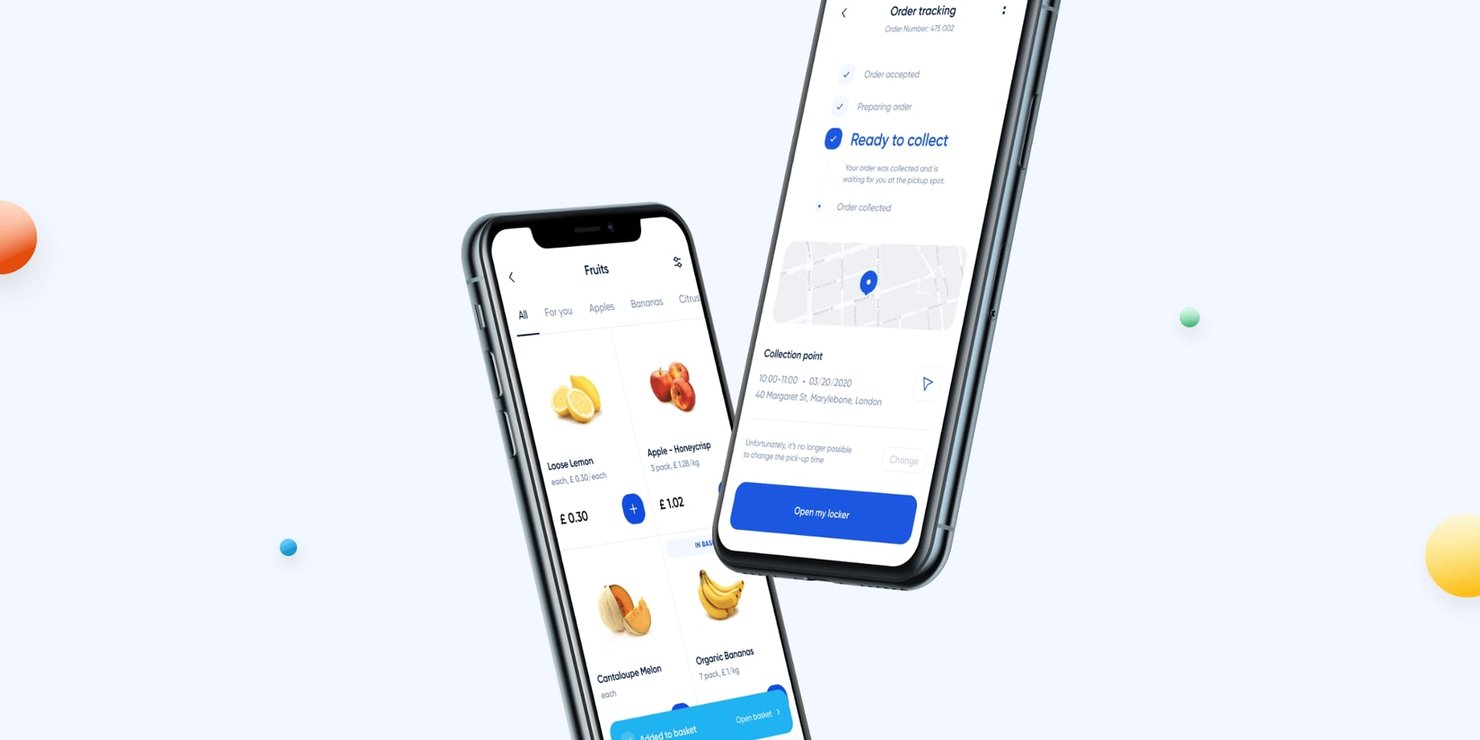

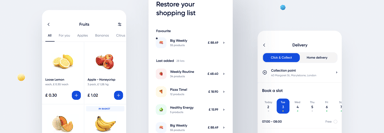

Click and collect grocery shopping revamped for both retailers and end-users

Leverage prototyping and technology to build a seamless, safe, and flexible experience.

Starting with thorough research and using a data-based approach, we determined what creates a quality online shopping trip.

Our rapid prototyping took just one month using two developers to implement three innovative features, offering a personalized user experience.

Netguru has been the best agency we've worked with so far. The team is able to design new skills, features, and interactions within our model, with a great focus on speed to market. Adi Pavlovic Director of Innovation at Keller Williams

Research & Development - from idea to working prototype

- R&D Sprint

Empower clients with knowledge, expert solution design, and roadmap recommendations

Rapid prototyping

Deliver an end-to-end working prototype that will take your products to the next level

Hackathon by Netguru

Facilitate a client event to creatively uncover ideas and collectively establish solutions

Run quick experiments to verify technologies and ideas, and determine expected value

What Is Research and Development (R&D)?

Also known as research and technical or technological development (RTD), R&D is all about engaging in activities to innovate. By doing that, an organization presents new products and services to market or enhances its existing offering.

Research and development objectives? Typically the primary stage in the product life cycle, R&D aims to gain companies a competitive edge and generate long-term profit. R&D may lead to entirely new product discoveries and associated patents, copyrights, and trademarks.

R&D departments are generally well-funded, with capital risk, lack of immediate payoff, and uncertain ROI weighed up against estimated risk-adjusted returns. Greater R&D investment equates to increased capital risk, meaning some businesses choose to outsource R&D functions.

The role of research and development? Without R&D entrepreneurship or an effective strategy, a business may become obsolete, unless it uses other methods such as M&A to survive.

Who’s investing in research and development? Tech companies are among the top R&D investors, with pharmaceuticals and semiconductors also high up the rankings.

Examples of research and development activities include Netguru’s R&D project with Roboteam and Alphabet’s Waymo self-driving cars.

Why is Research and Development important?

R&D solutions differentiate businesses from the competition, yielding critical technologies from which new products, services, and models spawn.

Technology progresses quickly, and if organizations are to keep up, R&D is key. With R&D, the chances of building successful products and services increase. It can also enhance employee productivity and boost profits.

Research and development companies or departments devise innovative products, services, and solutions that dominate the market and are tricky to imitate.

A modern R&D division connects technical teams with marketing, sales, and customer service. That way, challenges and opportunities are fully understood.

An effective research and development team defines the right business opportunity and performs rapid tests to validate business value assumptions.

Then, successive solution prototypes and usability testing realize that value by identifying user habits, problems, and expectations, as well as anticipating demands and trends.

Types of Research & Development

There are several types of R&D. First up, there’s the model where engineers undertake extensive research to develop new products and services with no real objective in mind.

That falls under basic research, whereby the aim is to grasp fuller fundamental knowledge of a subject, process, or technology, as opposed to a specific application.

The second type of R&D? Industrial scientists or researchers carry out applied research to support the development of future products and/or enhance existing product and service offerings – there’s a specific target in mind.

Basic research is time-consuming. Applied R&D is more expensive, meticulous, and complex.

Business incubators and accelerators are types of R&D, whereby companies invest in startups in the hope they’ll come up with usable innovations.

Mergers and acquisitions (M&As) and partnerships are also varieties of R&D, with corporations making the most of each other’s expertise and skills.

Who spends the most on R&D?

Based on yearly reports, Amazon is the top R&D spender, forking out $42.74 billion in 2020. Calling it ‘technology and content’ the multinational behemoth spent more than in 2019 ($35.93 billion), with 2,244 patents granted – most of which in technologies like AI, machine learning, and computer vision.

Number two? Alphabet, at $27.57 billion. The multinational conglomerate formed in 2015 via a restructuring of Google, becoming the parent company of the search engine and several former subsidiaries. R&D expenditure has more than doubled since 2016.

Coming in third is Huawei, with R&D investment in 2020 totaling $22.04 billion. The year 2020 saw 2,761 patents granted, an increase of 14% compared to 2019. Huawei R&D employees amount to around 105,000 – more than half the total workforce.

The list goes on as follows in billions:

- Microsoft: $19.27

- Apple: $18.75

- Samsung: $18.75

- Facebook: $18.45

The remainder of the top 10: Volkswagen, Intel, Roche, and Johnson & Johnson.

Why to hire Netguru R&D Consultants?

At Netguru, R&D is multipurpose, and the benefits are meaningful:

- Developing new skills

- Steering strategic direction

- Innovation consulting

To maximize success, we have four types research and development services:

- Rapid Prototyping

We start with a problem, then implement effective solutions, rather than “attractive” solutions that merely offer technological advancements but aren’t actually fit for purpose.

We also embrace agile development principles and record and distribute lessons learned.

Our R&D experts are world-class professionals, including Innovation Consultants, Design Consultants, R&D Experts, Engineers, and Developers who are open source contributors with over 220 repositories on GitHub .

We invest in developing new technologies and testing R&D solutions, offering a first-rate and expert service to clients.

Unveil imaginative solutions that eclipse competitors

Our competent team of experts deliver innovative products across various industries, from fintech to retail. With 900+ projects implemented and 12+ years in the market, we offer a wealth of experience.

Creating Temi, a state-of-the-art personal assistant robot combining sight, touch, and hearing

Designing and delivering a premium yet affordable device to dominate the home robotics market.

A prime R&D example and three years in development, Temi plays music, answers calls, and provides the weather forecast, offering users a cutting edge experience.

We focused on R&D: scoping and testing, to suggest the best possible technology stack for the project before building Temi from scratch, including hardware, design, and software. As part of the R&D process and iterative cycles, we revised code to deliver upgrades and an iconic product.

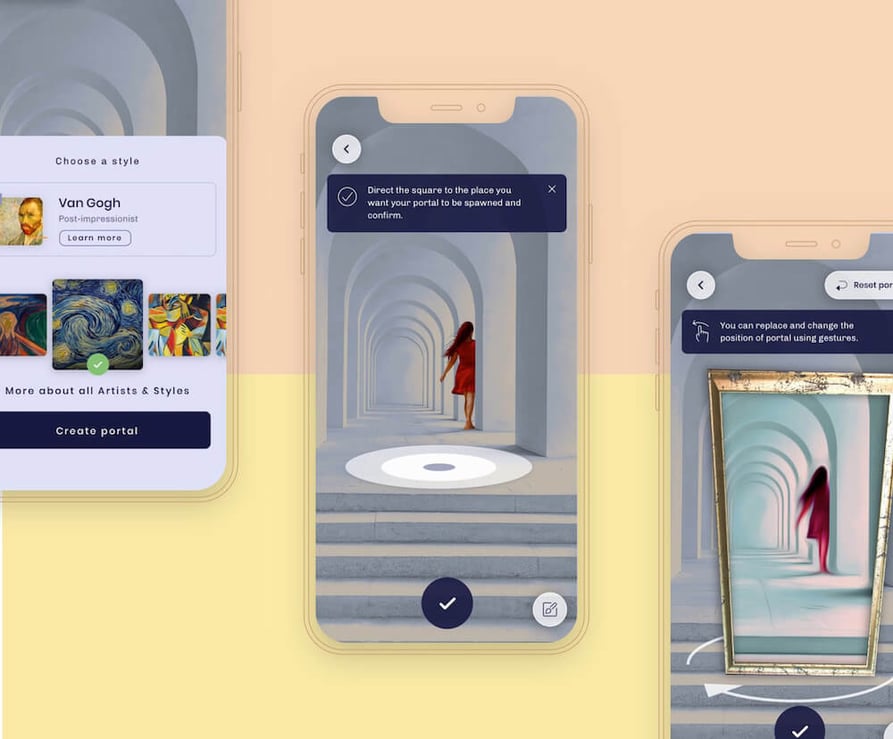

Kunster: An R&D project to build an augmented reality mobile app

Using research skills to create an art-focused app.

Cross-generational app Kunster brings art closer to people. Users see their surroundings through the eyes of painters such as Van Gogh and Da Vinci.

Using PyTorch and Core ML tools throughout our R&D process, we developed a pipeline to experiment with real-time style transfer and integrate models into the application.

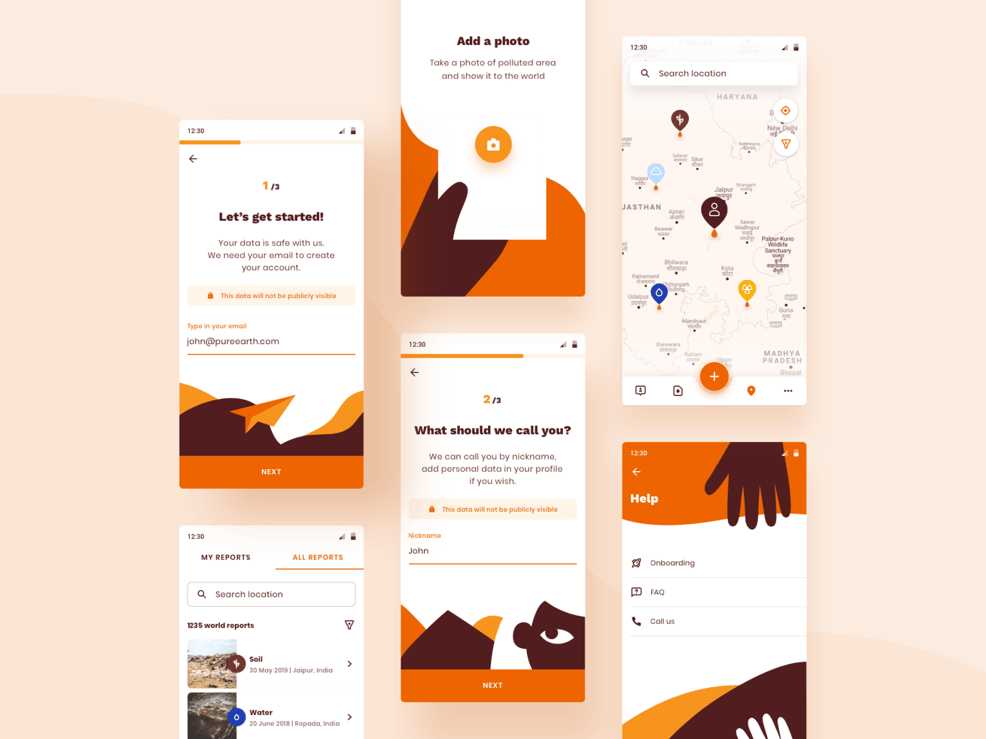

R&D for Good: Partnering with non-profit Pure Earth to help the environment

Developing a pollution app to raise awareness and connect government officials.

Leveraging our innovation expertise, we worked with Pure Earth as part of our R&D for Good program. Aiming to support NGO organizations in their digital journeys, we helped Pure Earth by investigating new technologies.

Our solution? Expanding their existing offering by creating the inventive Report Pollution app to document and report polluted sites.

Devising CarLens, a slick mobile app to detect car models with AR

Researching, prototyping, and implementing new technologies including tensorflow and ml.

CarLens recognizes cars using your smartphone’s camera. During this experimental R&D project, we used image recognition and machine learning to test and create a fun and cutting-edge solution.

How? By building a precise algorithm to detect vehicle models. CarLens is a proof of concept iOS and Android app exploring the capabilities of ML-based image recognition.

Our partners about the cooperation with Netguru

My experience working with Netguru has been excellent. Outstanding software teams are resilient, and our developers at Netguru have certainly proven to be that. Our Netguru friends have become as close to team members as possible, and I am grateful for the care and excellence they have provided. Gerardo Bonilla Product Manager at Moonfare

Whenever we faced challenges this year, we could rely on Netguru for our urgent staffing needs and time-critical deliverables. The Netguru team has gone above and beyond any expectations of what a strong and reliable partner can be. Hima Mandali CTO at Solarisbank

Working with Netguru has been a fantastic experience. We received a lot of support in terms of thinking about how we track metrics, how we design this properly, and how we build the architecture. We are extremely grateful for making our platform what it is today. Manon Roux Founder at Countr

Netguru in numbers

Years on the market

People on Board

Projects Delivered

Our Current NPS Score

Delivered by Netguru

Self-care mobile app that lets users practice gratitude.

$5M Granted in funding

Investment platform that enable to invest in private equity funds

$28M Granted in funding

Data-driven SME lending platform provider

$20M Granted in funding

Lead generation tool that helps travelers to make bookings

$47M Granted in funding

Hand to answer your R&D concerns

According to McKinsey, pharmaceuticals are traditionally known for R&D spending, but these days, high tech, automotive, and consumer sectors invest even more – greater than 20% of earnings EBITDA.

Amazon’s research and development programs amounted to 11.1% of net sales in 2020, Alphabet laid out 15.1% of revenue, and Huawei invested 15.9% of revenue. In 2019, companies spent $2.3 trillion on R&D globally – around 2% of global GDP. Annual R&D investment has grown at around 4% a year since 2010.

As a result of R&D, new products are designed and existing ones revamped. R&D is part of the product development life cycle – the ideation stage. For example, let’s say a client has a challenge to solve or isn’t sure how to approach a problem.

Via R&D, it’s possible to make recommendations, impacting solution design and the roadmap.

Following the R&D phase where feasibility is validated and prototyping takes place, the groundwork is in place for further design work.

R&D project management involves taking the lead in designing processes, sharing knowledge, and tracking the overall value of R&D via metrics. A top-notch strategy combines:

- Comprehending what an organization wants to (and can) deliver

- Alignment of R&D and corporate initiatives

- Determining and prioritizing capabilities and technologies for delivery

- Deciding how to deliver – operating model and organizational design

- Testing the strategy for robustness

- Clear communication of the strategy

Read more on our Blog

What Will the Life Sciences Industry Look Like in 2030?

Comparing Llama and GPT: Open-Source Versus Closed-Source AI Development

New Era of Collaboration with AI Agents

How Can Organizations Leverage Their Data to Use It with ChatGPT?

Kotlin Multiplatform Examples in Mobile Projects: Netguru Way

What's Key In User Research To Drive Product-Market Fit?

How to Avoid Common Mistakes When Validating Digital Products

What Is a Blockchain and How Does It Work?

IoT in Commercial Real Estate: How LoRa Makes Buildings Smarter

Click and Collect - Case Study

Our work was featured on, start your project with us or take existing one to next level.

Need extra services?

Product design, cybersecurity.

- Search Search Please fill out this field.

- Investing in R&D

- What R&D Offers

- The R&D Tax Credit

Buyouts and Mergers

- R&D Benefits

The Bottom Line

- Business Essentials

Why You Should Invest in Research and Development (R&D)

:max_bytes(150000):strip_icc():format(webp)/picture-53893-1440688982-5bfc2a88c9e77c005143c705.png)

Research and development (R&D) is the part of a company's operations that seeks knowledge to develop, design, and enhance its products, services, technologies, or processes. Along with creating new products and adding features to old ones, investing in research and development connects various parts of a company's strategy and business plan.

According to the latest Business Enterprise Research and Development survey by the National Center for Science and Engineering and the U.S. Census Bureau, businesses spent $32.5 billion to support their R&D activities in 2020.

Here are some reasons your business should invest in research and development.

Key Takeaways

- Research and development (R&D) is an essential driver of economic growth as it spurs innovation, invention, and progress.

- R&D spending can lead to breakthroughs that can drive profits and well-being for consumers.

- Today, R&D is present in nearly every business sector as companies jockey for position in their respective markets.

- Smaller firms engaged in R&D can offset some of these costs and attract investors thanks to a federal tax break.

Investing in Research and Development (R&D)

The Internal Revenue Service's definition of research and development is investigative activities that a person or business chooses to do with the desired result of a discovery that will create an entirely new product, product line, or service.

However, the activities don't only need to be for disovering new products or services—this is only for tax purposes.

R&D isn’t just about creating new products; it can be used to strengthen an existing product or service with additional features.

Research refers to any new science or thinking that will result in a new product or new features for an existing product. Research can be broken down into either basic research or applied research. Basic research seeks to delve into scientific principles from an academic standpoint, while applied research aims to use that basic research in a real-world setting.

The development portion refers to the actual application of the new science or thinking so that a new or increasingly better product or service can begin to take shape.

Research and development is essentially the first step in developing a new product, but product development is not exclusively research and development. An offshoot of R&D, product development can refer to the entire product life cycle , from conception to sale to renovation to retirement.

R&D Offers Productivity, Product Differentiation

Firms gain a competitive advantage by performing in some way that their rivals cannot easily replicate. If R&D efforts lead to an improved type of business process—cutting marginal costs or increasing marginal productivity—it is easier to outpace competitors.

R&D often leads to a new type of product or service—for example, without research and development, cell phones or other mobile devices would never have been created. The internet, and even how people live today, would be completely different if businesses had not conducted R&D in the past.

Research results give businesses a means to find issues people have and ways to address them, and development allows companies to find unique and different ways to fix the problems.

This leads to many different product and service variations, which gives consumers choices and keeps the markets competitive. Some examples of companies that carry out R&D activities are auto manufacturers, software creators, cutting-edge tech companies, and pharmaceutical firms.

The R&D Tax Credit

In 1981, the IRS started offering tax breaks for companies to spend money and hire employees for research and development. Qualifying companies include startups and other small ventures with qualified research expenses. Such expenses can be used to offset tax liabilities , along with an impressive 20-year carry-forward provision for the credit.

Many entrepreneurs and small businesses have made a large sum of money in a short time by selling good ideas to established firms with many resources. Buyouts are particularly common with online companies, but they can be seen wherever there is a lot of incentive to innovate.

Research and development can help your ideas or business become more attractive to investors and other companies looking to expand.

Advertising and Marketing R&D Benefits

Advertising is full of claims about revolutionary new techniques or never-before-seen products and technologies. Consumers demand new and improved products, sometimes simply because they are new. R&D departments can act as advertising wings in the right market.

R&D strategies let companies create highly effective marketing strategies around releasing a new or existing product with new features. A company can create marketing campaigns to match innovative products and market participation.

What Are the Reasons for R&D?

Research and development keep your business competitive. Without R&D, you risk losing your competitive advantage and falling behind other companies researching and developing new products in your industry.

Why Is R&D Important for Startups?

R&D is essential because it helps you keep your business momentum going. New products and services help you attract more customers, make sales, and give you something to talk about with your investors.

What Factors are Essential in Successful R&D?

Successful research and development depend on many factors, but the most important is a strong interest from your customer base and investors. If you spend money and time researching and developing something no one wants, it's being wasted.

Increased market participation, cost management benefits, advancements in marketing abilities, and trend-matching are all reasons companies invest in R&D. R&D can help a company follow or stay ahead of market trends and keep the company relevant.

Although resources must be allocated to R&D, the innovations gained through this research can actually work to reduce costs through more efficient production processes or more efficient products. R&D efforts can also reduce corporate income tax, thanks to the deductions and credits they generate.

National Center for Science and Engineering. " Businesses Invested $32.5 Billion in Assets to Support Their R&D Activities in the United States in 2020 ."

Tax Foundation. " Reviewing the Federal Tax Treatment of Research & Development Expenses ."

Internal Revenue Service. " About Form 6765, Credit for Increasing Research Activities ."

Internal Revenue Service. " Instructions for Form 3800 (2022) ," Page 2.

:max_bytes(150000):strip_icc():format(webp)/randd.asp-fb436cb94bed4c8a8032f732887153db.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Go to US Navigation

- Go to 3M United States Navigation

- Go to Page Content

- Go to Search

- Go to Contact Information

- Go to Site Map

- 3M United States

- Research and Development

3M Research & Development

Designed to be a LEED Certified building

100+ 3M products used in the construction

Under the parking lot is a 640,000 gallon storm water retention system (size of an Olympic Pool).

We are a new group, working on new products for new markets – like optical films that can go into augmented-reality wearable devices. It’s exciting that we are investing in higher-risk, higher-reward innovation. – Susan Kent

I am working on an adhesive for a new dry erase surface with my counterparts in the New Platform group, who were in another building. Now, I can see them face-to-face and collaborate much easier. This fits perfectly into 3M’s core culture. –Ying-Yuh Lu

This space represents an opportunity to work differently. Sometimes that’s enough to cause you to think in a different way. Just like visiting customers, you see things in new ways. We don’t know yet what can happen. – Lee Stanek

This building is beautiful and future-oriented. This is the ideal environment to brainstorm together and with our customers. We will work on solutions to reduce emissions, improve safety lighting and develop advancements for automotive. – Terry Ceulemans

There are 414 trees, 2,730 shrubs and 4,366 perennials planted on the site

Technologies

The company owns 51 technology platforms, which range from adhesives and abrasives, to ceramics and nanotechnology. Our scientists around the world share and combine these technologies across all our businesses to invent and manufacture cutting-edge products. Roughly one-third of 3M’s sales come from products introduced in the last five years.

3M R&D at a Glance

Wanted: insatiable curiosity. 3M’s work – with integrity, collaboration and innovation at its core – changes lives, homes and businesses in real ways every day. Here, you can explore your talents and reinvent your career – all with one company.

3M applies science to life around the world. The Carlton Society is our science hall of fame, honoring the very best among our scientific community for extraordinary work as scientists and mentors.

Science in Action

- Investor Relations

- Partners & Suppliers

- Sustainability / ESG

- Equity and Community

- Ethics & Compliance

- News Center

- Press Releases

- SDS, RDS, More Regulatory & Compliance Information

- Transport Information Search

- CPSIA Certification Search

- Lithium Battery UN 38.3 Test Summary Search

- Transparency in Supply Chains and Modern Slavery Disclosures

- US Ingredient Communication

- Help Center

- Where to Buy

List of Research And Development Companies

List of the top research and development companies in the world, listed by their prominence with corporate logos when available. This list of major research and development companies includes the largest and most profitable research and development businesses, corporations, agencies, vendors and firms in the world. If you are wondering what the biggest research and development companies are, then this list has you covered. This list includes the most famous research and development companies in the industry, so if you're thinking of working in the research and development industry you might want to look to these companies for jobs. This list includes names of both small and big research and development businesses.

A factual list, featuring companies like Microsoft Corporation and Applied Minds.

Applied Minds

At&t laboratories.

Axis Communications

Benchmark systems.

Boeing Phantom Works

Center for Assistive Technology and Environmental Access

Clear Channel Outdoor

Coral group.

Digital Heaven

ENSCO, Inc.

FSA Corporation

Georgia Tech Research Institute

Global CyberSoft

Market leader inc., ideaconnection.

Industrial Technology Research Institute

Innocentive.

Integrated Microelectronics, Inc.

Jasomi networks, language computer corporation.

Lawrenceville Plasma Physics

MERA Networks

Microsoft Corporation

JOIN SOMEKA BUSINESS: Subscribe to Business Membership for exclusive benefits! Dismiss

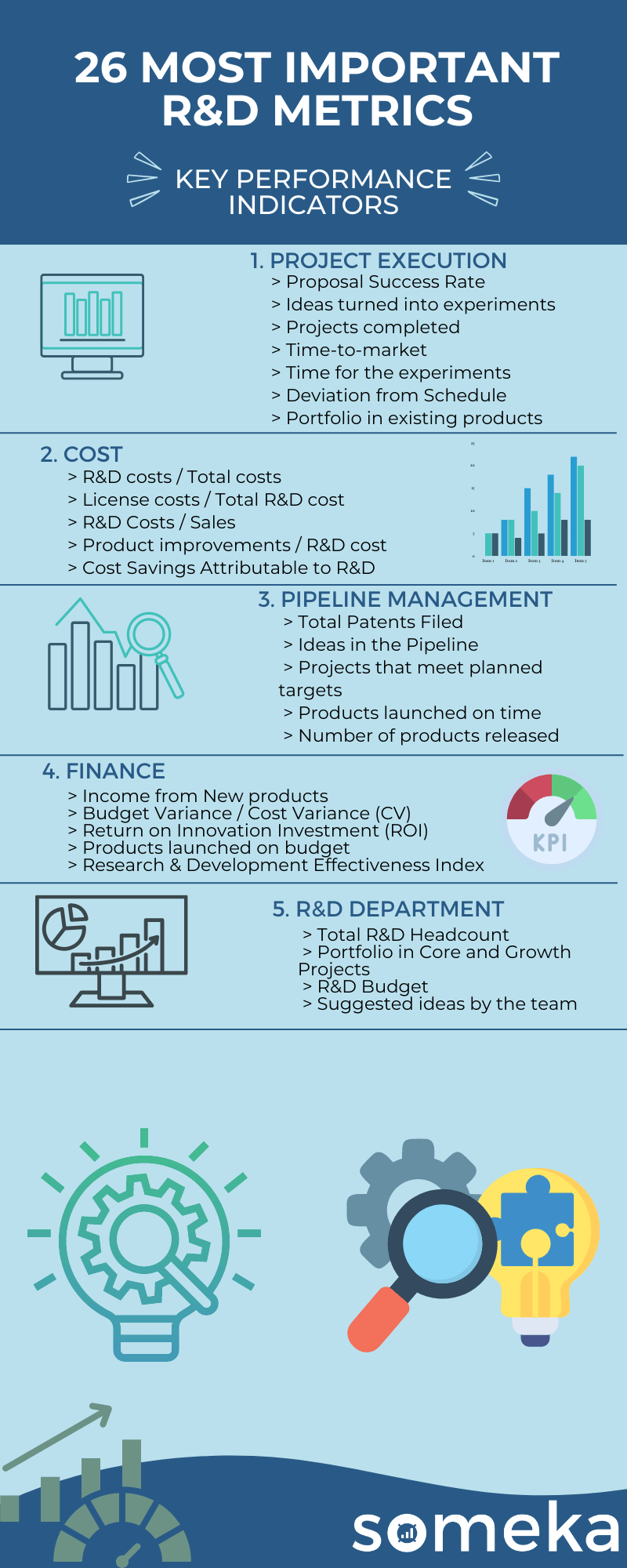

26 Most Important R&D KPIs and Metrics

- Updated on July 13, 2023

If you want to accurately measure your Research and Development performance but don’t where to start, we collected all the necessary R&D KPIs and metrics for you!

Also, we are proud to present our R&D Dashboard templates if you need to make the analysis and recording within you Research and Development department. But first, you can learn more about the R&D key metrics!

What is KPI in research and development?

Research and development KPIs or key performance indicators are used to determine the performance of research and development departments in businesses.

Why should you track r&d KPIs?

You should track research and development key metrics to have a clear point of view about the state of your R&D department. That way, you can improve and anvance your R&D department in an organized manner.

What are the most important KPIs in r&d?

Research and development departments deal with different issues in each other company, so there are various metrics you can use. However, you can see the top 26 research and development KPIs below to get a better idea.

Research and Development Metrics

1. Proposal Success Rate

R&D Metrics / Project Progress / Work Effectiveness

Description: Percentage of grant applications that successfully received funding and can go further with the R&D.

Calculation Method / Formula: number of applications that were accepted and got funds / number of all applications

Should be High or Low?: The higher % the better. Otherwise there is needed extra work time on creating or redefining ideas.

2. Ideas turned into experiments

Description: This shows of how many ideas within some period of time went into the experimental phase. It depends on how many ideas there is; has granted funds and if the R&D team is managing the time given properly.

Calculation Method / Formula: number of ideas within some period of time went into the experimental phase / number of ideas that were supposed to be in the experimental phase within specified period of time

Should be High or Low?: If the % is going down it may indicate not enough resources in people or equipment.

3. Projects completed

R&D Metrics / Project Progress / Work Effectiveness / Time Management

Description: Shows the ratio of completed within all started projects. But in case there are some changes, or the grant funds are frozen or for some other seasons the project cannot continue it can have influence on the completion ratio. This metrics allows you to track if you have enough resources and capability to open more tasks and manage to stay on time with the work planned.

Calculation Method / Formula: completed projects / all planned projects

Should be High or Low?: If the % is going down it may indicate not enough resources in people or equipment or some changes in a project or requirement that may close the project not completed.

4. Time-to-market

Description: This metrics stands for how quickly your company plan and execute the projects. It is the duration from Phase 0 to Market Release. Average number of days per project

Calculation Method / Formula: It can be calculated as simple average: Cumulative number of days of all finished projects / number of projects

Should be High or Low?: If the time to market exceed planned days, it can give some indication about incorrect assumptions or some unexpected problems

5. Time for the experiments

Description: This is metrics shows time spent only for the experiment phase. That time can be very different depending on a sector of the R&D department. The unit of time may be measured in Days as default, but it can be also adjusted for your needs.

Calculation Method / Formula: cumulative experimental time of number of projects / number of projects

Should be High or Low?: If the time goes over a target this may indicate problems that weren’t predicted in the planning phase.

6. Deviation from Schedule

Description: This metrics measures how accurate planned project schedules are. And may indicate if there is some need for changing the system of planning or find some bottleneck of the process.

Calculation Method / Formula: (Actual Time to Make – Planned Time to make) / Planned Time to Make.

Should be High or Low?: Based on the equation if the value is below zero it means the projects’ time are overcalculated and probably the time evaluation should be restructured. The same if the value goes above zero but it means the predicted time probably was too small for the available resources.

7. Portfolio in existing products

R&D Metrics / Product Investment / Budget Management

Description: Percentage of R&D Budget which keep the existing products.

Calculation Method / Formula: Cost of sustaining the exisiting products / total R&D budget

8. R&D costs / Total costs

R&D Metrics / Product Investment / Budget Management / Cost

Description: This metrics shows what is the percentage of exactly the R&D cost among Total Costs of the R&D department. (or among total cost of the company)?

Calculation Method / Formula: R&D cost / Total cost of R&D dept.

Should be High or Low?: This is just an orientation information.

9. License costs / Total R&D cost

Description: Shows how big part of Total costs is License Costs.

Calculation Method / Formula: Licence cost / Total cost od R&D dept.

10. R&D Costs / Sales

R&D Metrics / Product Investment / Budget Management / Cost / Sales / Performance

Description: It shows the ratio between money spend on R&D and the money earned from Total Sales

Calculation Method / Formula: Total R&D cost / Total sales

Should be High or Low?: First of all, R&D cost should not be higher than total sales, but also the higher difference there will be the higher profit will be observed

11. Product improvements / R&D cost

Description: Shows how big part of R&D costs is Product Improvements.

Calculation Method / Formula: Improvement Costs / R&D Costs

Should be High or Low?: This is an orientation information. There might be some target to reduce that cost, but it depends on the characteristics of R&D projects.

12. Cost Savings Attributable to R&D

R&D Metrics / Product Investment / Budget Management / Cost / Savings

Description: This metrics helps to calculate the cost savings because of the R&D Department’s improvements. Cost savings in given period of time.

Calculation Method / Formula: Might be calculated by (time needed to compleete some task before – time needed after improvenents) * workinghour cost in some period of time

Should be High or Low?: Based on that measurement we can measure how long it will take to “pay back” the cost of improvement.

13. Total Patents Filed

R&D Metrics / Cost / R&D Investment / Product Investment / Brand Value

Description: This metrics shows the number of patents waiting to be approved by the patent institution.

Should be High or Low?: If the patents are unique or it is predicted that they will bring income higher than cost of keeping patent itself then the higher number is better but the target should be set based on how much valuable they can be.

14. Ideas in the Pipeline

Description: It helps to track the number of ideas that were completed and put in a schedule in an assumed time or period.

Should be High or Low?: Target depends on the R&D sector and taken period of time.

15. Projects that meet planned targets

Description: It helps to track the number of projects which follow to the plan schedule in each time or period.

16. Products launched on time