- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Value a Company: 6 Methods and Examples

- 21 Apr 2017

Determining the fair market value of a company can be a complex task. There are many factors to consider, but it's an important financial skill businesses leaders need to succeed. So, how do finance professionals evaluate assets to identify one number?

Below is an exploration of some common financial terms and methods used to value businesses, and why some companies might be valued highly, despite being relatively small.

What Is Company Valuation?

Company valuation, also known as business valuation, is the process of assessing the total economic value of a business and its assets. During this process, all aspects of a business are evaluated to determine the current worth of an organization or department. The valuation process takes place for a variety of reasons, such as determining sale value and tax reporting.

Access your free e-book today.

How to Valuate a Business

One way to calculate a business’s valuation is to subtract liabilities from assets. However, this simple method doesn’t always provide the full picture of a company’s value. This is why several other methods exist.

Here’s a look at six business valuation methods that provide insight into a company’s financial standing, including book value, discounted cash flow analysis, market capitalization, enterprise value, earnings, and the present value of a growing perpetuity formula.

1. Book Value

One of the most straightforward methods of valuing a company is to calculate its book value using information from its balance sheet . Due to the simplicity of this method, however, it’s notably unreliable.

To calculate book value, start by subtracting the company’s liabilities from its assets to determine owners’ equity. Then exclude any intangible assets. The figure you’re left with represents the value of any tangible assets the company owns.

As Harvard Business School Professor Mihir Desai mentions in the online course Leading with Finance , balance sheet figures can’t be equated with value due to historical cost accounting and the principle of conservatism. Relying on basic accounting metrics doesn't paint an accurate picture of a business’s true value.

2. Discounted Cash Flows

Another method of valuing a company is with discounted cash flows. This technique is highlighted in the Leading with Finance as the gold standard of valuation.

Discounted cash flow analysis is the process of estimating the value of a company or investment based on the money, or cash flows, it’s expected to generate in the future . Discounted cash flow analysis calculates the present value of future cash flows based on the discount rate and time period of analysis.

Discounted Cash Flow =

Terminal Cash Flow / (1 + Cost of Capital) # of Years in the Future

The benefit of discounted cash flow analysis is that it reflects a company’s ability to generate liquid assets. However, the challenge of this type of valuation is that its accuracy relies on the terminal value, which can vary depending on the assumptions you make about future growth and discount rates.

3. Market Capitalization

Market capitalization is one of the simplest measures of a publicly traded company's value. It’s calculated by multiplying the total number of shares by the current share price .

Market Capitalization = Share Price x Total Number of Shares

One of the shortcomings of market capitalization is that it only accounts for the value of equity, while most companies are financed by a combination of debt and equity.

In this case, debt represents investments by banks or bond investors in the future of the company; these liabilities are paid back with interest over time. Equity represents shareholders who own stock in the company and hold a claim to future profits.

Let's take a look at enterprise values—a more accurate measure of company value that takes these differing capital structures into account.

4. Enterprise Value

The enterprise value is calculated by combining a company's debt and equity and then subtracting the amount of cash not used to fund business operations.

Enterprise Value = Debt + Equity - Cash

To illustrate this, let’s take a look at three well-known car manufacturers: Tesla, Ford, and General Motors (GM).

In 2016, Tesla had a market capitalization of $50.5 billion. On top of that, its balance sheet showed liabilities of $17.5 billion. The company also had around $3.5 billion in cash in its accounts, giving Tesla an enterprise value of approximately $64.5 billion.

Ford had a market capitalization of $44.8 billion, outstanding liabilities of $208.7 billion, and a cash balance of $15.9 billion, leaving an enterprise value of approximately $237.6 billion.

Lastly, GM had a market capitalization of $51 billion, balance sheet liabilities of $177.8 billion, and a cash balance of $13 billion, leaving an enterprise value of approximately $215.8 billion.

While Tesla's market capitalization is higher than both Ford and GM, Tesla is also financed more from equity. In fact, 74 percent of Tesla’s assets have been financed with equity, while Ford and GM have capital structures that rely much more on debt. Nearly 18 percent of Ford's assets are financed with equity, and 22.3 percent of GM's.

When examining earnings, financial analysts don't like to look at the raw net income profitability of a company. It’s often manipulated in a lot of ways by the conventions of accounting, and some can even distort the true picture.

To start with, the tax policies of a country seem like a distraction from the actual success of a company. They can vary across countries or time, even if nothing actually changes in the company’s operational capabilities. Second, net income subtracts interest payments to debt holders, which can make organizations look more or less successful based solely on their capital structures. Given these considerations, both are added back to arrive at EBIT (Earnings Before Interest and Taxes), or “ operating earnings .”

In normal accounting, if a company purchases equipment or a building, it doesn't record that transaction all at once. The business instead charges itself an expense called depreciation over time. Amortization is the same thing as depreciation but for things like patents and intellectual property. In both instances, no actual money is spent on the expense.

In some ways, depreciation and amortization can make the earnings of a rapidly growing company look worse than a declining one. Behemoth brands, like Amazon and Tesla, are more susceptible to this distortion since they own several warehouses and factories that depreciate in value over time.

With an understanding of how to arrive at EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for each company, it’s easier to explore ratios.

According to the Capital IQ database , Tesla had an Enterprise Value to EBITDA ratio of 36x. Ford's is 15x, and GM's is 6x. But what do these ratios mean?

6. Present Value of a Growing Perpetuity Formula

One way to think about these ratios is as part of the growing perpetuity equation. A growing perpetuity is a kind of financial instrument that pays out a certain amount of money each year—which also grows annually. Imagine a stipend for retirement that needs to grow every year to match inflation. The growing perpetuity equation enables you to find out today’s value for that sort of financial instrument.

The value of a growing perpetuity is calculated by dividing cash flow by the cost of capital minus the growth rate.

Value of a Growing Perpetuity = Cash Flow / (Cost of Capital - Growth Rate)

So, if someone planning to retire wanted to receive $30,000 annually, forever, with a discount rate of 10 percent and an annual growth rate of two percent to cover expected inflation, they would need $375,000—the present value of that arrangement.

What does this have to do with companies? Imagine the EBITDA of a company as a growing perpetuity paid out every year to the organization’s capital holders. If a company can be thought of as a stream of cash flows that grow annually, and you know the discount rate (which is that company’s cost of capital), you can use this equation to quickly determine the company’s enterprise value.

To do this, you’ll need some algebra to convert your ratios. For example, if you take Tesla with an enterprise to EBITDA ratio of 36x, that means the enterprise value of Tesla is 36 times higher than its EBITDA.

If you look at the growing perpetuity formula and use EBITDA as the cash flow and enterprise value as what you’re trying to solve for in this equation, then you know that whatever you’re dividing EBITDA by is going to give you an answer that is 36 times the numerator.

To find the enterprise value to EBITDA ratio, use this formula: enterprise value equals EBITDA divided by one over ratio. Plug in the enterprise value and EBITDA values to solve for the ratio.

Enterprise Value = EBITDA / (1 / Ratio)

In other words, the denominator needs to be one thirty-sixth, or 2.8 percent. If you repeat this example with Ford, you would find a denominator of one-fifteenth, or 6.7 percent. For GM, it would be one-sixth, or 16.7 percent.

Plugging it back into the original equation, the percentage is equal to the cost of capital. You could then imagine that Tesla might have a cost of capital of 20 percent and a growth rate of 17.2 percent.

The ratio doesn't tell you exactly, but one thing it does highlight is that the market believes Tesla's future growth rate will be close to its cost of capital. Tesla's first quarter sales were 69 percent higher than this time last year.

The Power of Growth

In finance, growth is powerful. It explains why a smaller company like Tesla carries a high enterprise value. The market has taken notice that, while Tesla is much smaller today than Ford or GM in total enterprise value and revenues, that may not always be the case.

If you want to advance your understanding of financial concepts like company valuation, explore our six-week online course Leading with Finance and other finance and accounting courses to discover how you can develop the intuition to make better financial decisions.

This post was updated on April 22, 2022. It was originally published on April 21, 2017.

About the Author

Here's How to Value a Company [With Examples]

Published: May 24, 2023

What's your company worth? It's an important question for any entrepreneur , business owner , or potential investor.

What's more, knowing how to value your business becomes increasingly important as it grows, especially if you want to raise capital, sell a portion of the business, or borrow money.

Here, we'll take a look at different factors to consider when valuing your business, common equations you can use, and high-quality tools that will help you crunch the numbers.

Table of Contents

How to value a business.

Public vs. Private Valuations

Business Valuation Methods

Business Valuation Calculators

Company valuation example, what is a business valuation.

As the name suggests, a business valuation determines the value of a business or company. During the process, all areas of a business are carefully analyzed, including its financial performance, assets and liabilities, market position, and future growth potential.

Ultimately, the goal is to arrive at a fair and objective estimate which can be useful in making business decisions and negotiating.

- Company Size

- Profitability

- Market Traction and Growth Rate

- Sustainable Competitive Advantage

- Future Growth Potential

1. Company Size

Company size is a commonly used factor when valuing a company. Typically, the larger the business, the higher the valuation will be. This is because smaller companies have little market power and are more negatively impacted by the loss of key leaders. In addition, larger businesses likely have a well-developed product or service and, as a result, more accessible capital.

2. Profitability

Is your company earning a profit?

If so, this a good sign, as businesses with higher profit margins will be valued higher than those with low margins or profit loss. The primary strategy for valuing your business based on profitability is through understanding your sales and revenue data.

Valuing a Company Based On Sales and Revenue

Valuing a business based on sales and revenue uses your totals before subtracting operating expenses and multiplying that number by an industry multiple. Your industry multiple is an average of what businesses typically sell for in your industry so, if your multiple is two, companies usually sell for 2x their annual sales and revenue.

3. Market Traction and Growth Rate

When valuing a company based on market traction and growth rate, your business is compared to your competitors. Investors want to know how large your industry market share is, how much of it you control, and how quickly you can capture a percentage of the market. The quicker you reach the market, the higher your business’ valuation will be.

4. Sustainable Competitive Advantage

What sets your product, service, or solution apart from competitors?

With this method, the way you provide value to customers needs to differentiate you from the competition. If this competitive advantage is too difficult to maintain over time, this could negatively impact your business' valuation.

A sustainable competitive advantage helps your business build and maintain an edge over competitors or copycats in the future, pricing you higher than your competitors because you have something unique to offer.

5. Future Growth Potential

Is your market or industry expected to grow? Or is there an opportunity to expand the business' product line in the future? Factors like these will boost the valuation of your business. If investors know your business will grow in the future, the company valuation will be higher.

The financial industry is built on trying to accurately define current growth potential and future valuation. All the characteristics listed above have to be considered, but the key to understanding future value is determining which factors weigh more heavily than others.

Depending on your type of business, there are different metrics used to value public and private companies.

Public Versus Private Valuation

.png?width=2000&height=900&name=How%20to%20Value%20a%20Business%20Public%20vs%20Private%20valuation%20(1).png)

Public Company Valuation

For public companies, valuation is referred to as market capitalization (which we’ll discuss below) — where the value of the company equals the total number of outstanding shares multiplied by the price of the shares.

Public companies can also trade on book value, which is the total amount of assets minus liabilities on your company balance sheet. The value is based on the asset’s original cost less any depreciation, amortization, or impairment costs made against the asset.

Private Company Valuation

Private companies are often harder to value because there's less public information, a limited track record of performance, and financial results are either unavailable or might not be audited for accuracy.

Let's take a look at the valuations of companies in three stages of entrepreneurial growth.

1. Ideation Stage

Startups in the ideation stage are companies with an idea, a business plan, or a concept of how to gain customers, but they're in the early stages of implementing a process. Without any financial results, the valuation is based on either the track record of the founders or the level of innovation that potential investors see in the idea.

A startup without a financial track record is valued at an amount that can be negotiated. Most startups I've reviewed created by a first-time entrepreneur start with a valuation between $1.5 and $6 million.

All the value is based on the expectation of future growth. It's not always in the entrepreneur’s best interest to maximize its value at this stage if the goal is to have multiple funding rounds. The valuation of early-stage companies can be challenging due to these factors.

2. Proof of Concept

Next is the proof of concept stage. This is when a company has a handful of employees and actual operating results. At this stage, the rate of sustainable growth becomes the most crucial factor in valuation. Execution of the business process is proven, and comparisons are easier because of available financial information.

Companies that reach this stage are either valued based on their revenue growth rate or the rest of the industry. Additional factors are comparing peer performance and how well the business is executing in comparison to its plan. Depending on the company and the industry, the company will trade as a multiple of revenue or EBITDA (earnings before interest, taxed, depreciation, and amortization).

3. Proof of Business Model

The third stage of startup valuation is the proof of the business model. This is when a company has proven its concept and begins scaling because it has a sustainable business model.

At this point, the company has several years of actual financial results, one or more products shipping, statistics on how well the products are selling, and product retention numbers.

Depending on your company, there are a variety of equations to use to value your business.

Company Valuation Methods

Let’s take a look at some of the formulas for business valuation.

Market Capitalization Formula

Market Value Capitalization is a measure of a company’s value based on stock price and shares outstanding. Here is the formula you would use based on your business’ specific numbers:

Multiplier Method Formula

You would use this method if you’re hoping to value your business based on specific figures like revenue and sales. Here is the formula:

.png?width=2345&name=Blue_Opt01%20(2).png)

Discounted Cash Flow Method

Discounted Cash Flow (DCF) is a valuation technique based on future growth potential. This strategy predicts how much return can come from an investment in your company. It is the most complicated mathematical formula on this list, as there are many variables required. Here is the formula:

Image Source

Here are what the variables mean:

- CF = Cash flow during a given year (can include as many years as you’d like, simply follow the same structure).

- r = discount rate, sometimes referred to as weighted average cost of capital ( WACC ). This is the rate that a business expects to pay for its assets.

This method, along with others on this list, requires accurate math calculations. To ensure you’re on the right track, it may be helpful to use a calculator tool. Below we’ll recommend some high-quality options.

Below are business valuation calculators you can use to estimate your companies value.

This calculator looks at your business' current earnings and expected future earnings to determine a valuation. Other business elements the calculator considers are the levels of risk involved (e.g., business, financial, and industry risk) and how marketable the company is.

2. EquityNet

EquityNet's business valuation calculator looks at various factors to create an estimate of your business’s value. These factors include:

- Odds of the business' survival

- Industry the business operates in

- Assets and liabilities

- Predicted future revenue

- Estimated profit or loss

3. ExitAdviser

ExitAdviser's calculator uses the discounted cash flow (DCF) method to determine a business’s value. To determine the valuation, "it takes the expected future cash flows and ‘discounts' them back to the present day.”

It may be helpful to have an example of company valuation, so we’ll go over one using the market capitalization formula displayed below:

Shares Outstanding x Current Stock Price = Market Capitalization

For this equation, I need to know my business’s current stock price and the number of outstanding shares. Here are some sample numbers:

Shares Outstanding: $250,000

Current Stock Price: $11

Here is what my formula would look like when I plug in the numbers:

250,000 x 11

Based on my calculations, my company’s market value is 2,750,000.

Back to You

Whether you’re looking to borrow money, sell a portion of your company, or simply understand your market value, understanding how much your business is worth is important for your business’ growth.

Don't forget to share this post!

Related articles.

The Business of Helping Gen Alpha Manage Their Millions

Sound Investment: Tap Into The $2 Billion Audiobook Market

How This Swag Startup Made $3.3 Million in Year One

Fast and Fabulous: Tap into The Billion-Dollar Gourmet Convenience Market

8 Seaweed Startups Riding the $18.4B Green Wave

10 Best Etsy Alternatives to Sell Your Crafts

4 Opportunities in The $884B Home Improvement Business

How Dylan Jacob Scaled BrüMate to $100m+ in 5 Years

7 Opportunities to Make Life Easier for New Moms (and Make Money)

Digital Scent: A $1.2B Market Primed for Innovation

P&L Statement, Cash Flow Statement, Balance Sheet, and more.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Business Valuation

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on February 26, 2024

Are You Retirement Ready?

Table of contents, what is business valuation.

Business valuation is the process of estimating the economic value of a business or its ownership interest which involves taking into account its financial performance, assets, liabilities, and other relevant factors.

Business valuation is crucial for several reasons, including providing an accurate understanding of a company's value, facilitating informed decision-making, and ensuring transparency in financial transactions like mergers and acquisitions, sales, taxation, and legal disputes.

An accurate business valuation can help business owners and investors make strategic decisions about growth, financing, and exit strategies.

Additionally, business valuation is often required for legal purposes, such as taxation, estate planning, and dispute resolution. In these cases, a thorough and accurate valuation can help ensure compliance with legal requirements and protect the interests of all parties involved.

Read Taylor's Story

Taylor Kovar, CFP®

CEO & Founder

(936) 899 - 5629

[email protected]

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning.

In my early consulting days, I encountered a family-run bakery facing a difficult decision regarding selling their business. Their uncertainty about the value of their business was compounded by emotional attachments. By conducting a thorough cash flow analysis, we were able to identify and highlight less obvious aspects of value, such as their unique recipes and loyal customer base. Adjusting their valuation to take these intangibles into account, they were able to secure a deal that surpassed their expectations.

Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives.

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

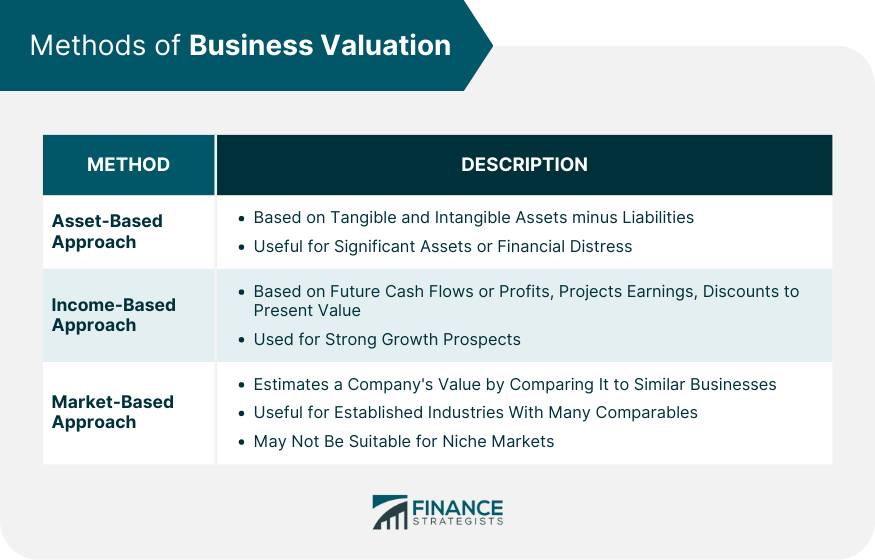

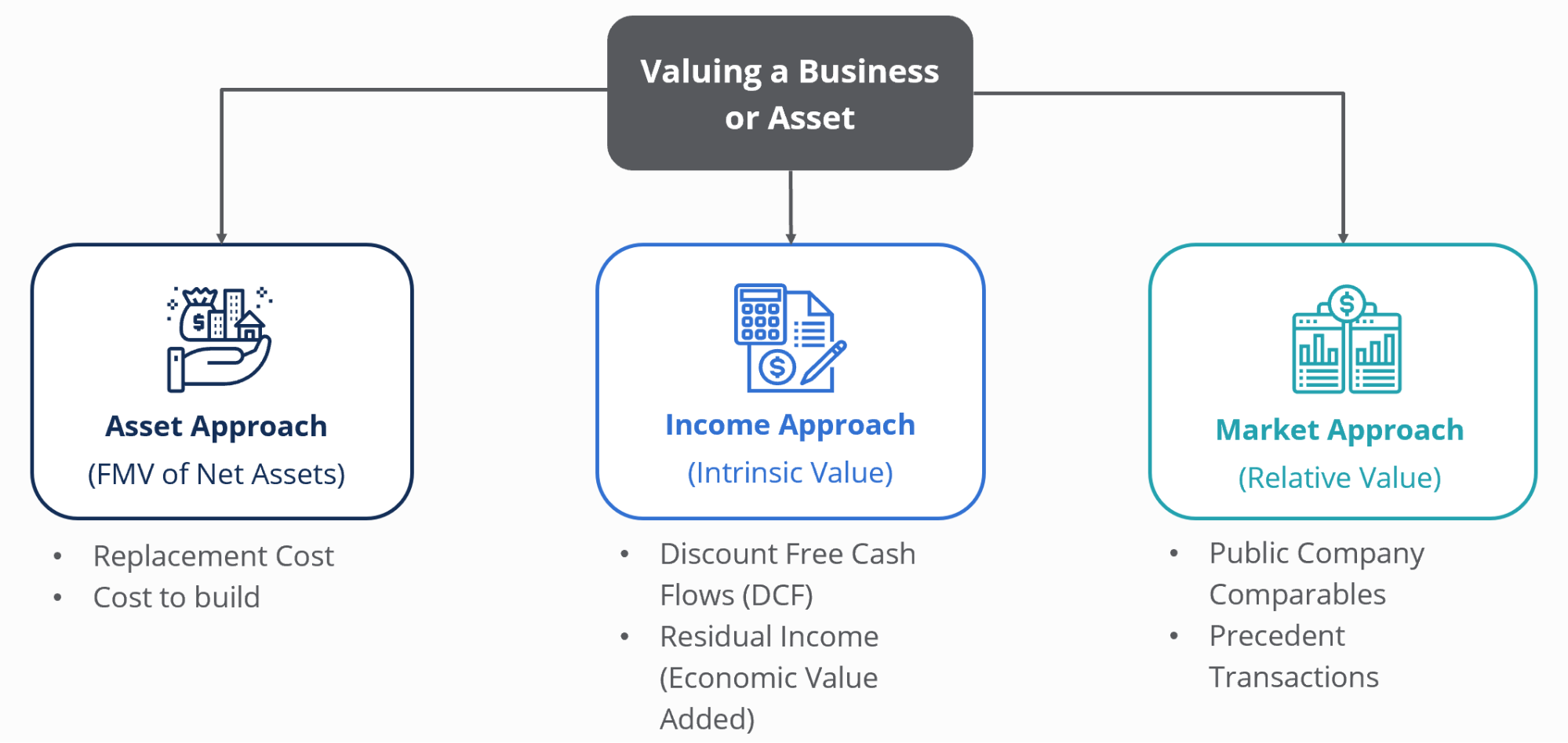

Methods of Business Valuation

Asset-based approach.

The asset-based approach to business valuation focuses on determining the value of a company based on the value of its tangible and intangible assets .

This approach involves identifying and valuing the company's assets , then deducting its liabilities to arrive at the net asset value . The asset-based approach is particularly useful for companies with significant assets, as well as for those in financial distress or facing liquidation.

However, this approach has its limitations, as it does not take into account the company's future earnings potential or the value of its intangible assets, which may be significant for some businesses.

Income-Based Approach

The income-based approach to business valuation focuses on estimating the company's value based on its ability to generate future cash flows or profits .

This approach involves projecting the company's future earnings, then discounting those earnings to their present value using a discount rate that reflects the risks associated with the company's operations.

The income-based approach is often used for valuing companies with strong growth prospects or those that derive a significant portion of their value from their ability to generate future cash flows.

However, this approach relies heavily on assumptions about future earnings and can be subject to significant uncertainty and subjectivity.

Market-Based Approach

The market-based approach to business valuation estimates the value of a company by comparing it to similar businesses in the market.

This approach involves analyzing comparable companies or transactions to determine valuation multiples, such as price-to-earnings or price-to-sales ratios , which are then applied to the company being valued.

The market-based approach is useful for valuing companies in well-established industries with a large number of comparable businesses or transactions. However, it may not be suitable for companies in niche markets or industries with limited comparables.

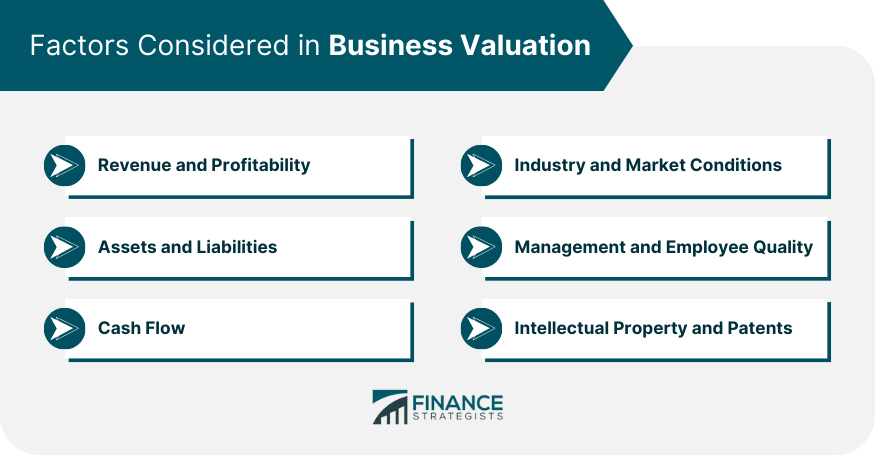

Factors Considered in Business Valuation

Revenue and profitability.

Revenue and profitability are critical factors in determining a company's value, as they reflect the company's ability to generate income and maintain sustainable growth.

A company with consistently strong revenue and profitability is likely to be valued more highly than a company with weaker financial performance.

In business valuation, analysts typically review historical financial statements to assess a company's revenue and profitability trends, as well as to identify any anomalies or patterns that may impact the company's value.

Assets and Liabilities

A company's assets and liabilities play a significant role in its valuation , as they represent the resources available to generate income and the obligations that must be met.

Assets, both tangible and intangible, can contribute to a company's overall value, while liabilities can reduce it.

In the valuation process, analysts review a company's balance sheet to identify and value its assets and liabilities, taking into account factors such as depreciation , market conditions, and potential future growth or decline in asset values.

Cash flow is a critical factor in business valuation, as it represents the company's ability to generate cash from its operations, which can be used to fund growth, pay dividends , or meet debt obligations.

A company with strong, consistent cash flows is generally considered more valuable than a company with volatile or weak cash flows.

Analysts typically examine a company's cash flow statement to assess its cash generation and use patterns, as well as to identify any potential issues or opportunities that may impact its value.

Industry and Market Conditions

Industry and market conditions can have a significant impact on a company's value, as they influence factors such as demand for products or services, competitive dynamics, and regulatory environment.

A company operating in a growing industry with strong market demand may be valued more highly than a company in a stagnant or declining industry.

During the valuation process, analysts consider the company's industry and market conditions, as well as any trends or external factors that may influence its future performance and value.

Management and Employee Quality

The quality of a company's management and employees can also impact its value, as it influences the company's ability to execute its strategies, adapt to changes, and maintain a competitive edge.

Companies with strong, experienced management teams and skilled employees are often valued more highly than those with weaker leadership or workforce capabilities.

In business valuation, analysts may assess the company's management and employee quality through factors such as executive and employee backgrounds, turnover rates, and organizational structure .

Intellectual Property and Patents

Intellectual property (IP) and patents can significantly contribute to a company's value, particularly in industries such as technology, pharmaceuticals, or creative sectors, where innovation and unique assets are critical.

Companies with strong IP portfolios or valuable patents are often valued more highly than those with limited or less valuable IP assets.

During the valuation process, analysts may assess the value of a company's IP and patents by considering factors such as the potential future cash flows generated from those assets, the competitive advantages provided, and the remaining life of the patents.

Types of Business Valuation

Fair market value.

Fair market value is a type of business valuation that estimates the price at which a company would change hands between a willing buyer and a willing seller, with both parties having reasonable knowledge of the relevant facts and neither being under any compulsion to buy or sell.

This is often used in legal contexts, such as taxation and estate planning, as well as for setting transaction prices in business sales or acquisitions .

Investment Value

Investment value is a type of business valuation that estimates the value of a company to a specific investor, taking into account the investor's unique circumstances, objectives, and risk tolerance .

This type of valuation may differ from the fair market value, as it reflects the individual investor's perspective rather than the broader market.

Investment value is often used by investors when evaluating potential investments or determining the value of their existing holdings in a company.

Liquidation Value

Liquidation value is a type of business valuation that estimates the net amount a company would realize if it were to sell its assets and settle its liabilities immediately.

Liquidation value is typically lower than other types of valuation, as it assumes a rapid sale of assets, often at a discount to their fair market value.

This is often used in situations where a company is facing financial distress or bankruptcy and needs to quickly monetize its assets to satisfy its obligations.

Uses of Business Valuation

Sale of business.

Business valuation is essential in the sale of a business, as it provides an objective estimate of the company's worth, which can be used as a basis for negotiating the transaction price.

A thorough and accurate valuation can help business owners ensure they receive a fair price for their company and enable potential buyers to make informed decisions about the investment.

Mergers and Acquisitions

In mergers and acquisitions , business valuation plays a crucial role in determining the value of the target company and assessing the potential benefits and risks of the transaction.

A comprehensive valuation can help acquirers identify synergies, assess the target company's financial health, and determine a fair offer price.

Likewise, for the target company, a thorough valuation can help its owners understand their company's worth and negotiate favorable terms in the transaction.

Taxation and Estate Planning

Business valuation is often required for taxation and estate planning purposes, such as determining the value of a company for tax reporting, gift tax , or inheritance tax purposes.

An accurate valuation ensures compliance with tax regulations and helps business owners and their heirs plan for future tax obligations.

In estate planning , business valuation can also assist business owners in developing succession plans and strategies to preserve and transfer their company's value to future generations.

Litigation and Dispute Resolution

In litigation and dispute resolution, business valuation is often necessary to determine damages, quantify losses, or assess the value of a company in the context of legal disputes, such as shareholder disputes, divorce proceedings, or contractual disputes.

A thorough and accurate business valuation can help parties in a dispute reach a fair resolution and support their legal claims or defenses.

Business Valuation Process

Preparing for valuation.

Before beginning the business valuation process, it is essential to gather all necessary information about the company, including its financial statements , business plan, and other relevant documents.

This information will be used to analyze the company's financial performance , assets, and liabilities, as well as to assess its growth prospects and industry position.

It is also crucial to engage the services of a qualified business valuation professional or firm, who can provide an objective, expert assessment of the company's worth.

Selecting a Valuation Method

Once the necessary information has been gathered, the next step is to select the appropriate valuation method based on the company's characteristics and the purpose of the valuation.

The choice of method will depend on factors such as the company's industry, size, growth prospects, and the availability of comparable transactions or companies.

The selected valuation method should be appropriate for the company's unique circumstances and provide an accurate, objective estimate of its worth.

Collecting and Analyzing Data

After selecting a valuation method, the next step is to collect and analyze the relevant data, such as financial statements, industry reports, and market data.

This analysis will inform the valuation process by providing insights into the company's financial performance, market position, and growth prospects. The data analysis should be thorough and accurate to ensure a reliable valuation.

Applying Discounts and Premiums

In some cases, it may be necessary to apply discounts or premiums to the company's valuation to account for factors such as liquidity , marketability, or control. Discounts and premiums should be applied judiciously, based on objective criteria and supported by empirical evidence.

Finalizing Valuation Report

Once the valuation process is complete, the valuation professional or firm will prepare a comprehensive valuation report that outlines the methodology, data, and assumptions used in the valuation, as well as the final valuation result.

This report should be clear, well-organized, and supported by relevant data and analysis.

The Bottom Line

Business valuation is the process of estimating a company's worth by analyzing its financial performance, assets, liabilities, and other relevant factors. It is essential for various purposes, including sales, mergers and acquisitions, taxation, and legal disputes.

There are several methods of business valuation, including asset-based, income-based, and market-based approaches. Each method has its unique characteristics and is suitable for different situations and types of businesses.

The choice of the valuation method depends on factors such as the company's industry, size, growth prospects, and the availability of comparable transactions or companies.

Various factors are considered in business valuation, including revenue and profitability, assets and liabilities, cash flow, industry and market conditions, management and employee quality, and intellectual property and patents.

Understanding the different valuation methods, factors, and types of valuation can help business owners, investors, and other stakeholders navigate the complex world of business valuation and ensure that they have an accurate, objective assessment of a company's value.

Business Valuation FAQs

What is business valuation.

Business valuation is the process of determining the economic value of a business or company.

What are the methods used in business valuation?

There are three methods used in business valuation: asset-based approach, income-based approach, and market-based approach.

What factors are considered in business valuation?

The financial factors considered in business valuation include revenue and profitability, assets and liabilities, and cash flow. Non-financial factors include industry and market conditions, management and employee quality, and intellectual property.

What are the types of business valuation?

The three types of business valuation are fair market value, investment value, and liquidation value.

What are the uses of business valuation?

Business valuation is used for a variety of purposes, including the sale of a business, merger and acquisition, taxation and estate planning, and litigation and dispute resolution.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- AML Regulations for Cryptocurrencies

- Advantages and Disadvantages of Cryptocurrencies

- Aggressive Investing

- Asset Management vs Investment Management

- Becoming a Millionaire With Cryptocurrency

- Burning Cryptocurrency

- Cheapest Cryptocurrencies With High Returns

- Complete List of Cryptocurrencies & Their Market Capitalization

- Countries Using Cryptocurrency

- Countries Where Bitcoin Is Illegal

- Crypto Investor’s Guide to Form 1099-B

- Cryptocurrency Airdrop

- Cryptocurrency Alerting

- Cryptocurrency Analysis Tool

- Cryptocurrency Cloud Mining

- Cryptocurrency Risks

- Cryptocurrency Taxes

- Depth of Market

- Digital Currency vs Cryptocurrency

- Fiat vs Cryptocurrency

- Fundamental Analysis in Cryptocurrencies

- Global Macro Hedge Fund

- Gold-Backed Cryptocurrency

- How to Buy a House With Cryptocurrencies

- How to Cash Out Your Cryptocurrency

- Inventory Turnover Rate (ITR)

- Largest Cryptocurrencies by Market Cap

- Pros and Cons of Asset-Liability Management

- Types of Fixed Income Investments

Ask a Financial Professional Any Question

Discover wealth management solutions near you, our recommended advisors.

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website.

Select a product to get started.

Personal Loans

Student loan refinancing.

Credit Card

Private Student Loans

Credit Score & Budgeting

Auto Loan Refinancing

Or just create an account.

How to Value a Business: Seven Valuation Methods

By Rebecca Lake · August 01, 2023 · 8 minute read

We’re here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey. Read more We develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide. We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right. Read less

Business valuation refers to the process of determining the economic value of a business. There are different business valuation methods that can be used to establish a business’s worth. Understanding how to value a company can be helpful for investors and business owners, but creditors and potential buyers may need to value a company as well.

What Is a Business Valuation?

Business valuation means determining what a business is worth. Again, there are different scenarios where the valuation of a business becomes important. For instance, business owners may be interested in knowing what their business is worth if:

• They hope to sell it to a new owner

• A merger with another business is in the works

• They’re creating an employee stock purchase plan (ESPP)

• They’re working on a succession plan that includes a buy-sell agreement

• They plan to apply for loans or lines of credit using business assets as security

• They need it for tax purposes

• The business is being sued

• It’s required for the division of assets in a divorce proceeding

• Determining an IPO price

•Valuing shares in an equity crowdfunding round

Venture capitalists and angel investors may also be interested in how a company is valued if they’re planning to invest before an IPO. 💡 Quick Tip: Look for an online brokerage with low trading commissions as well as no account minimum. Higher fees can cut into investment returns over time.

How Are Companies Valued?

The business valuation process involves a detailed look at the company and its key financial characteristics . A professional business appraiser or an accountant that holds an Accredited in Business Value designation (ABV) typically completes a business valuation. These professionals have specially trained in calculating the valuation of a business. There are also business valuation software programs available that you can use to estimate your company’s value yourself.

Finding the valuation of a business can involve a number of factors, including:

• Ownership structure

• Company management

• Combined value of company assets

• Combined total of company liabilities

• Cash flow

• Revenues

• Projected earnings

That’s a general explanation of how business valuation works. To understand the valuation of a company at an individual level, it helps to know more about the different business valuation methods that can be used.

7 Business Valuation Methods

There’s more than one way to approach how to value a business. The method chosen reflects the reasons for determining a business valuation in the first place. For example, the methods used for company valuation ahead of an IPO may be very different from the valuation methods used for an existing company.

It can be helpful to use multiple business valuation methods when evaluating the same business. This makes it possible to see how the numbers compare, based on different metrics. Here are some of the most common ways the valuation of a company can be determined.

1. Market Capitalization

Market capitalization is a simplified way to find the valuation of a business, based on its stock share price. To find market capitalization, you’d multiply a company’s stock share price by the number of shares outstanding.

For example, if a company has 100 million shares outstanding priced at $10 each, its market capitalization value is $1 billion. Market cap is a fluid number, as share pricing can change day to day or even hour to hour.

Investors might use a company’s market capitalization when choosing stocks to invest in. For instance, if those interested in adding large-cap companies to your portfolio then they’d look for ones that have a market valuation of $10 billion or more. On the other hand, investors interested in small-cap companies would look for those with a valuation under $2 billion.

2. Asset-Based Valuation

The asset-based valuation method determines the value of a company based on its assets . Specifically, this involves looking at a business’s balance sheet and subtracting total liabilities from total assets. For example, if a company has $10 million worth of assets and $3 million worth of liabilities, its valuation would be $7 million.

This valuation method offers a fair market value of a company or business using assets as the key metric. It’s also referred to as a book value .

Businesses can use asset-based valuation to get an estimate of current value or what the business would be valued at after a liquidation event. Using the liquidation-based approach, the business’s value is measured by any net cash remaining after all assets are sold and liabilities are paid off.

3. Discounted Cash Flow Method

The discounted cash flow method for finding a company valuation estimates the value of an asset today using projected cash flows. Business owners use this business valuation method when they expect cash flow to fluctuate in the future.

A discounted cash flow method for finding the valuation of a business includes four elements:

• Time period for analyzing cash flows

• Cash flow projections

• A discount rate, which represents a projected rate of return from a hypothetical investment

• Estimated future growth

Discounted cash flow can help businesses get a sense of what their business is worth now, based on future cash flows. This can be helpful for businesses that are considering making investments in growth and want to gauge the estimated return on that investment.

4. Earnings Multiplier Business Valuation

With the earnings multiplier method, you’re finding the valuation of a business as measured by its current share price and earnings per share (EPS) ratio. Earnings per share represents the profit per common share compared to the company’s profits as a whole.

To calculate the earnings multiplier, you divide the market value per share by the earnings per share. So if a stock is worth $10 and earnings per share are $2, the earnings multiplier would be 5. That means that it would take five years of earnings at the current rate to get to the stock price. You can compare this data point to other companies in the same industry to get a sense of how its value compares to its peers.

The earnings multiplier method can be helpful for comparing the valuation of a company to its competitors. Essentially, what it tells you is how expensive a company’s stock is relative to the earnings per share it’s reporting.

Businesses can use the earnings multiplier approach to compare a company’s current earnings to projected future earnings. This method for how to value a business may be considered to be more accurate than methods that rely on revenues or assets alone.

5. Return on Investment (ROI) Valuation Method

Return on investment refers to the return an investor can expect from placing their capital into a specific investment vehicle. In terms of business valuation methods, this option bases value on what type of ROI an investor could receive from putting money into the business.

This type of valuation method might be useful for newer businesses that are trying to attract the attention of venture capitalist or angel investors. Using the ROI method, it’s possible to provide investors with a tangible number to use as the basis for estimating what type of return they could get on their money.

The formula for ROI-based valuation is simple:

ROI = (Current value investment – Cost of investment)/ Cost of investment

Similar to market capitalization this can be a very simple way to get an estimate of a company’s value.

6. Times-Revenue Method

The times-revenue method for business valuation helps find the value of a company on a range. This method applies a multiplier to the revenues generated over a set time period. The multiplier chosen depends on the industry the company or business belongs to and/or overall market conditions.

Compared to other valuation methods, the times-revenue method is not as precise since the multiplier used may be different each time the calculations are run. It also looks at revenues, rather than profits, which may paint a truer picture of a company’s value. This method of valuation can, however, be helpful for newer businesses that aren’t generating consistent revenues or profits yet.

7. IPO Valuation Methods

Some of the business valuation methods included so far are best for established businesses that are publicly traded on an exchange. In the case of a private company that’s preparing to launch an IPO, valuation requires additional strategies, since there’s no stock price to use.

When finding the valuation of a business for an IPO, the IPO underwriting team can use several strategies, including:

• Comparing the company to similar companies

• Looking at precedent transactions, such as mergers and acquisitions

• Running financial models, including a discounted cash flow analysis

If you’re interested in IPO investing, it’s helpful to understand how an IPO’s price is set. Pricing matters because if it’s too low, the company may not realize its goals for raising capital. If it’s too high, it may put off investors. Accurate valuation and pricing also comes into play during the IPO lock-up period , in which early stage investors are prohibited from selling their shares initially. 💡 Quick Tip: Investment fees are assessed in different ways, including trading costs, account management fees, and possibly broker commissions. When you set up an investment account, be sure to get the exact breakdown of your “all-in costs” so you know what you’re paying.

The Takeaway

Knowing how to value a company matters if you own a business but it can be just as important for retail investors. If you’re a value investor, for instance, your strategy may revolve around finding the hidden gem companies, undervalued by the market as a whole.

Investing is, in many ways, all about value. Again, that’s what makes business valuation so critical to investors and business owners alike. In fact, as an investor, you are a business owner – remember to keep that in mind. And knowing how businesses are valued can help further your understanding of the markets at large.

Ready to invest in your goals? It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply ( full fee disclosure here ).

Photo credit: iStock/SeventyFour

SoFi Invest® INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE SoFi Invest encompasses two distinct companies, with various products and services offered to investors as described below: Individual customer accounts may be subject to the terms applicable to one or more of these platforms. 1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC. 2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation. For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal. Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform. Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances. Claw Promotion: Customer must fund their Active Invest account with at least $25 within 30 days of opening the account. Probability of customer receiving $1,000 is 0.028%. See full terms and conditions .

SOIN0723045

See what SoFi can do for you and your finances.

Select a product below and get your rate in just minutes.

Online Investments

Terms and conditions apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. To qualify, a borrower must be a U.S. citizen or other eligible status, be residing in the U.S., and meet SoFi's underwriting requirements. Not all borrowers receive the lowest rate. Lowest rates reserved for the most creditworthy borrowers. If approved, your actual rate will be within the range of rates at the time of application and will depend on a variety of factors, including term of loan, evaluation of your creditworthiness, income, and other factors. If SoFi is unable to offer you a loan but matches you for a loan with a participating bank, then your rate may be outside the range of rates listed above. Rates and Terms are subject to change at any time without notice. SoFi Personal Loans can be used for any lawful personal, family, or household purposes and may not be used for post-secondary education expenses. Minimum loan amount is $5,000. The average of SoFi Personal Loans funded in 2023 was around $33K. Information current as of 2/26/24. SoFi Personal Loans originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org) . See SoFi.com/legal for state-specific license details. See SoFi.com/eligibility for details and state restrictions.

✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

7 Business Valuation Methods

Whether you’re thinking of selling your business or you’re looking for new investors, there may come a time where you need to evaluate the economic worth of your business—in other words, when you need a business valuation.

As you might imagine, determining the value of a business isn’t simple—it requires accounting for a number of factors within your business finances . Because this process is so complex, many business owners choose to work with a professional to receive an objective, thorough evaluation of what their business is worth.

This being said, if you need to determine the value of your business, it’s worth understanding how this process works—even if you ultimately decide to hire a professional. In this guide, therefore, we’ll break down the seven most common business valuation methods, how they work, and how each approach may (or may not) be beneficial to your small business.

What Is Business Valuation?

At the most basic level, business valuation is the process by which the economic worth of a company is determined.

As we mentioned, there are different approaches to evaluating the value of a small business, but generally, each method will involve a full and objective assessment of every piece of your company. This being said, business valuation calculations typically include the worth of your equipment, inventory, property, liquid assets, and anything else of economic value that your company owns. Other factors that might come into play are your management structure, projected earnings, share price, revenue, and more.

Why Would You Need a Business Valuation?

Due to the complexity of the business valuation process, these calculations are probably not something you’ll be doing every day—so, when would you need a business valuation?

Overall, there are a handful of common reasons why business owners need to evaluate the worth of their company:

- When looking to sell your business

- When looking to merge or acquire another company

- When looking for business financing or investors

- When establishing partner ownership percentages

- When adding shareholders

- For divorce proceedings

- For certain tax purposes

Ultimately, different small business valuation methods will be preferable in different scenarios. Generally, the best approach will depend on why the valuation is needed, the size of your business, your industry, and other factors.

As an example, in a sale scenario, the majority of private small businesses are sold as asset sales, whereas the majority of middle-market transactions involve the sale of equity—each of these sales would require a different business valuation method.

With all of this in mind, let’s explore some of the most common business valuation methods. Once again, depending on your specific situation, one approach may be more beneficial than another; however, you’ll generally want to work with a business appraisal professional to get the most objective assessment of what your company is worth.

1. Market Value Valuation Method

First, the market value business valuation formula is perhaps the most subjective approach to measuring a business’s worth. This method determines the value of your business by comparing it to similar businesses that have sold.

Of course, this method only works for businesses that can access sufficient market data on their competitors. In this way, the market value method is a particularly challenging approach for sole proprietors , for instance, because it’s difficult to find comparative data on the sale of similar businesses (as sole proprietorships are individually owned).

This being said, because this small business valuation method is relatively imprecise, your business’s worth will ultimately be based on negotiation, especially if you’re selling your business or seeking an investor. Although you may be able to convince a buyer of your business’s worth based on immeasurable factors, it’s unlikely that this approach will be particularly useful for gaining investors .

Nevertheless, this valuation method is a good preliminary approach to gain an understanding of what your business might be worth, but you’ll likely want to bring another, more calculated approach to the negotiation table.

2. Asset-Based Valuation Method

Next, you might use an asset-based business valuation method to determine what your company is worth. As the name suggests, this type of approach considers your business’s total net asset value, minus the value of its total liabilities, according to your balance sheet.

There are two main ways to approach asset-based business valuation methods:

Going Concern

Businesses that plan to continue operating (i.e., not be liquidated) and not immediately sell any of their assets should use the going-concern approach to asset-based business valuation. This formula takes into account the business’s current total equity—in other words, your assets minus liabilities .

Liquidation Value

On the other hand, the liquidation value asset-based approach to valuation is based on the assumption that the business is finished and its assets will be liquidated. In this case, the value is based on the net cash that would exist if the business was terminated and the assets were sold. With this approach, the value of a business’s assets will likely be lower than usual—as liquidation value often amounts to much less than fair market value.

Ultimately, the liquidation value asset-based method operates with a sort of urgency that other formulas don’t necessarily take into account.

3. ROI-Based Valuation Method

An ROI-based business valuation method evaluates the value of your company based on your company’s profit and what kind of return on investment (ROI) an investor could potentially receive for buying into your business.

Here’s an example: If you’re pitching your business to a group of investors to get equity financing, they’ll start with a valuation percentage of 100%. If you’re asking for $250,000 in exchange for 25% of your business, then you’re using the ROI-based method to determine the value of your business as you present this offer to the investors. To explain, if you divide the amount by the percentage offered, so $250,000 divided by 0.25, you receive your quick business valuation—in this case, $1 million.

From a practical standpoint, the ROI-method makes sense—an investor wants to know what their return on investment will look like before they invest. This being said, however, a “good” ROI ultimately depends on the market, which is why business valuation is so subjective.

Plus, with this approach, you’ll often need more information to convince an investor or buyer of the result. An investor or buyer will want to know:

- How long will it take to recover my original investment?

- After that, when I look at my share of the expected net income, compared with my investment, what does my return look like?

- Is that number realistic? Ambitious? Conservative?

- Does it make me want to invest in this company?

All of these questions will inform an ROI-based business valuation.

To learn more about this method, watch the short video below.

4. Discounted Cash Flow (DCF) Valuation Method

Although the three business valuation methods above are sometimes considered the most common, they’re not the only options out there. In fact, whereas the ROI-based and market value-based methods are extremely subjective, some alternate approaches (as we’ll discuss) use more of your business’s financial data to get a better evaluation of its worth.

The discounted cash flow valuation method, also known as the income approach, for example, values a business based on its projected cash flow , adjusted (or discounted) to its present value.

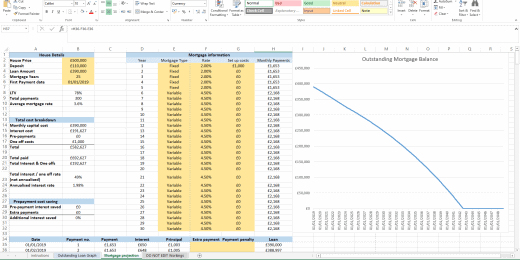

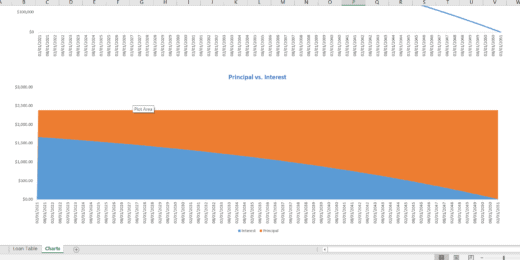

The DCF method can be particularly useful if your profits are not expected to remain consistent in the future. As you’ll see in the CFI business valuation example below, however, the DCF method requires significant detail and careful calculations: [1]

This spreadsheet shows the DCF method in use to evaluate the value of a business. Image source: CFI

5. Capitalization of Earnings Valuation Method

Next, the capitalization of earnings valuation method calculates a business’s future profitability based on its cash flow, annual ROI, and expected value.

This approach, unlike the DCF method, works best for stable businesses, as the formula assumes that calculations for a single time period will continue. In this way, this method bases a business’s current value on its ability to be profitable in the future.

6. Multiples of Earnings Valuation Method

Similar to the capitalization of earnings valuation method, the multiple of earnings valuation method also determines a business’s value by its potential to earn in the future.

This being said, however, this small business valuation method, also known as the time revenue method, calculates a business’s maximum worth by assigning a multiplier to its current revenue. Multipliers vary according to industry, economic climate, and other factors.

7. Book Value Valuation Method

Finally, the book value method calculates the value of your business at a given moment in time by looking at your balance sheet .

With this approach, your balance sheet is used to calculate the value of your equity— or total assets minus total liabilities—and this value represents your business’s worth.

The book value approach may be particularly useful if your business has low profits, but valuable assets.

Finding a Business Valuation Professional

Although understanding the different business valuation methods is important, if you do need to evaluate the worth of your business, it’s best to work with a professional. Although the approaches may seem simple enough on the surface, as we saw with the DCF example above, there are extensive and complex calculations involved in determining the value of a business.

This being said, not only will a professional be able to offer you an objective examination of your business, but they’ll likely be able to combine multiple business valuation methods to get you the most thorough sense of what your business is worth.

Therefore, if you need a business valuation professional, you’ll want to know where to find one. Generally, you’ll want to look for an individual who is a certified business valuation professional. The American Society of Appraisers ( ASA ) offers this certification, as does the American Institute of CPAs ( AICPA ). You might use either of these organizations as a resource for finding an appraiser to perform your business valuation. You also might consult your CPA or business accountant to see if they have any recommendations.

The Bottom Line

At the end of the day, business valuation is complicated—especially considering the different methods that are available to evaluate your business and determine its economic worth.

Overall, it’s safe to say that one approach isn’t necessarily better than another, instead, the best assessment of your company will likely come as a result of combining multiple business valuation methods.

This being said, if the time comes where you do need a small business valuation, your best course of action will be to hire a professional appraiser—as we’ve discussed, this individual will be able to offer the most thorough and objective evaluation of your company.

Article Sources:

- CorporateFinanceInstitute.com. “ Financial Analyst Courses and Training Online “

Seth David is the chief nerd and president of Nerd Enterprises, Inc. which provides consulting and training services in accounting and productivity based software. Consulting services range from basic bookkeeping to CFO-level services such as financial modeling.

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Value a Small Business if You’re Looking to Sell

Meredith is a freelance writer and editor with more than a decade of experience. Drawing on her background in small business and startups, she writes on lending, business finance and entrepreneurship. Her writing has also appeared in the New Republic, BBC, Time Inc, The Paris Review Daily, JPMorgan Chase and more.

Sally Lauckner is an editor on NerdWallet's small-business team. She has over 15 years of experience in print and online journalism. Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing. Her prior experience includes two years as a senior editor at SmartAsset, where she edited a wide range of personal finance content, and five years at the AOL Huffington Post Media Group, where she held a variety of editorial roles. She is based in New York City.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A small-business valuation represents a company’s total worth based on its business assets, earnings, industry and any debt or losses. Conducting a valuation is an excellent opportunity to assess the financial health and potential of your business, or of a business you’re hoping to buy .

Whether you are planning to sell your business or you already have an offer, knowing how to value a business can help inform your company’s road map and future exit strategies. Entrepreneurs looking to buy an existing business should also be familiar with valuations and feel comfortable estimating value independently of the business owner or broker’s asking price.

How to value a small business

There are some key steps to begin valuing your business. In addition to doing your own research, consider consulting a professional.

1. Understand the terms

Unless you’re a natural-born business or numbers person (or, say, an accountant), business valuation isn’t the easiest process. You'll need to understand some key definitions first.

Seller’s discretionary earnings