Stock Assignment Separate from Certificate Transferring Stock to Revocable Trust | Practical Law

Stock Assignment Separate from Certificate Transferring Stock to Revocable Trust

Practical law standard document w-036-2266 (approx. 9 pages).

Stock Assignment: Transferring Ownership Rights with Stock Power

1. introduction to stock assignment and stock power, 2. understanding ownership rights in stock, 3. the role of stock power in transferring ownership, 4. ways to obtain stock power, 5. filling out a stock power form, 6. executing a stock assignment, 7. legal considerations in stock assignment, 8. common mistakes to avoid in stock assignment, 9. conclusion and final thoughts on stock power and stock assignment.

Stock Assignment and Stock Power are two terms that are commonly used in the world of stocks and investments. They are often used interchangeably, but they refer to two different things. Stock assignment is the process of transferring ownership rights of a stock from one party to another, while Stock Power is a legal document that authorizes the transfer of ownership rights from one party to another. In this section, we will discuss in detail what Stock Assignment and Stock Power are, how they work, and why they are important.

1. What is Stock Assignment?

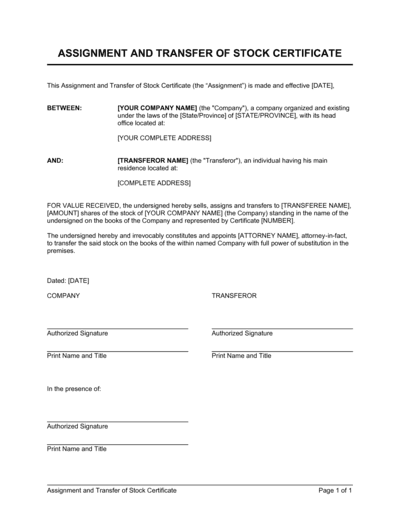

Stock Assignment refers to the transfer of ownership rights of a stock from one party to another. This process is typically used when an investor wants to sell their shares to someone else. The seller must sign an Assignment of Stock Certificate form, which is a legal document that transfers ownership rights to the buyer . The buyer must then present the form to the company's transfer agent, who will update the company's records to reflect the change in ownership.

2. What is Stock Power?

Stock Power is a legal document that authorizes the transfer of ownership rights from one party to another. It is typically used when an investor wants to transfer their shares to a family member or a trust. The seller must sign a stock Power form , which is a legal document that authorizes the transfer of ownership rights to the buyer. The buyer must then present the form to the company's transfer agent, who will update the company's records to reflect the change in ownership.

3. What are the differences between Stock Assignment and Stock Power?

The main difference between Stock Assignment and Stock Power is the purpose for which they are used. Stock Assignment is used when an investor wants to sell their shares to someone else, while Stock Power is used when an investor wants to transfer their shares to a family member or a trust. Another difference is the legal document that is used. Stock Assignment uses an Assignment of Stock Certificate form, while Stock Power uses a Stock Power form.

4. What are the benefits of Stock Assignment and Stock Power?

The main benefit of Stock Assignment and Stock Power is that they provide a legal framework for transferring ownership rights of a stock from one party to another. This ensures that the transfer is done legally and that the new owner has full ownership rights to the stock. It also ensures that the company's records are updated to reflect the change in ownership, which is important for tax purposes.

5. What are the risks of Stock Assignment and Stock Power?

The main risk of Stock Assignment and Stock Power is that they can be used for fraudulent purposes. For example, someone could forge an Assignment of Stock Certificate or a Stock Power form to transfer ownership rights of a stock to themselves. To mitigate this risk, it is important to use a reputable transfer agent and to verify the authenticity of the legal documents.

6. Which option is better: Stock Assignment or Stock Power?

The choice between Stock Assignment and Stock Power depends on the purpose for which they are being used. If an investor wants to sell their shares to someone else, then Stock Assignment is the better option. If an investor wants to transfer their shares to a family member or a trust, then Stock Power is the better option. It is important to use the correct legal document and to ensure that the transfer is done legally to avoid any potential risks .

Introduction to Stock Assignment and Stock Power - Stock Assignment: Transferring Ownership Rights with Stock Power

When it comes to owning stock, it's important to understand the concept of ownership rights. Ownership rights refer to the various privileges that come with owning stock, such as voting rights and the ability to receive dividends. Understanding these rights is crucial for investors who want to make informed decisions about their investments. In this section, we'll take a closer look at ownership rights in stock and what they mean for investors.

1. Voting Rights

One of the most important ownership rights in stock is the right to vote. When you own stock in a company, you are entitled to vote on certain matters that affect the company. These matters can include electing members to the board of directors, approving mergers or acquisitions, and making changes to the company's bylaws. The number of votes you have is typically based on the number of shares you own. For example, if a company has 1,000 shares outstanding and you own 100 shares, you would have 10% of the voting power.

2. Dividend Rights

Another ownership right in stock is the right to receive dividends. Dividends are payments made by a company to its shareholders, usually on a quarterly basis. The amount of the dividend is typically based on the company's profits and can vary from year to year. If you own stock in a company that pays dividends, you are entitled to a portion of those payments based on the number of shares you own.

3. Liquidation Rights

If a company goes bankrupt or is liquidated, shareholders have the right to a portion of the company's assets. This is known as liquidation rights. However, in most cases, shareholders are the last in line to receive payment after creditors and other stakeholders have been paid.

4. Preemptive Rights

Preemptive rights refer to the right of existing shareholders to purchase additional shares in a company before they are offered to the public. This allows shareholders to maintain their ownership percentage in the company and prevent dilution of their shares.

5. Transferability of Ownership Rights

Ownership rights in stock are transferable, meaning you can sell your shares to another investor. When you sell your shares, you transfer your ownership rights to the buyer. However, it's important to note that some ownership rights, such as voting rights, may be restricted for a period of time after the sale.

Understanding ownership rights in stock is crucial for investors who want to make informed decisions about their investments. Voting rights, dividend rights, liquidation rights, preemptive rights, and transferability of ownership rights are all important concepts to understand. When considering investing in a company, it's important to evaluate these ownership rights and consider the potential risks and rewards .

Understanding Ownership Rights in Stock - Stock Assignment: Transferring Ownership Rights with Stock Power

Stock power plays a crucial role in transferring ownership of stocks from one person to another. Without it, the process would be more complicated and time-consuming. In this section, we will explore the different aspects of stock power and its importance in transferring ownership.

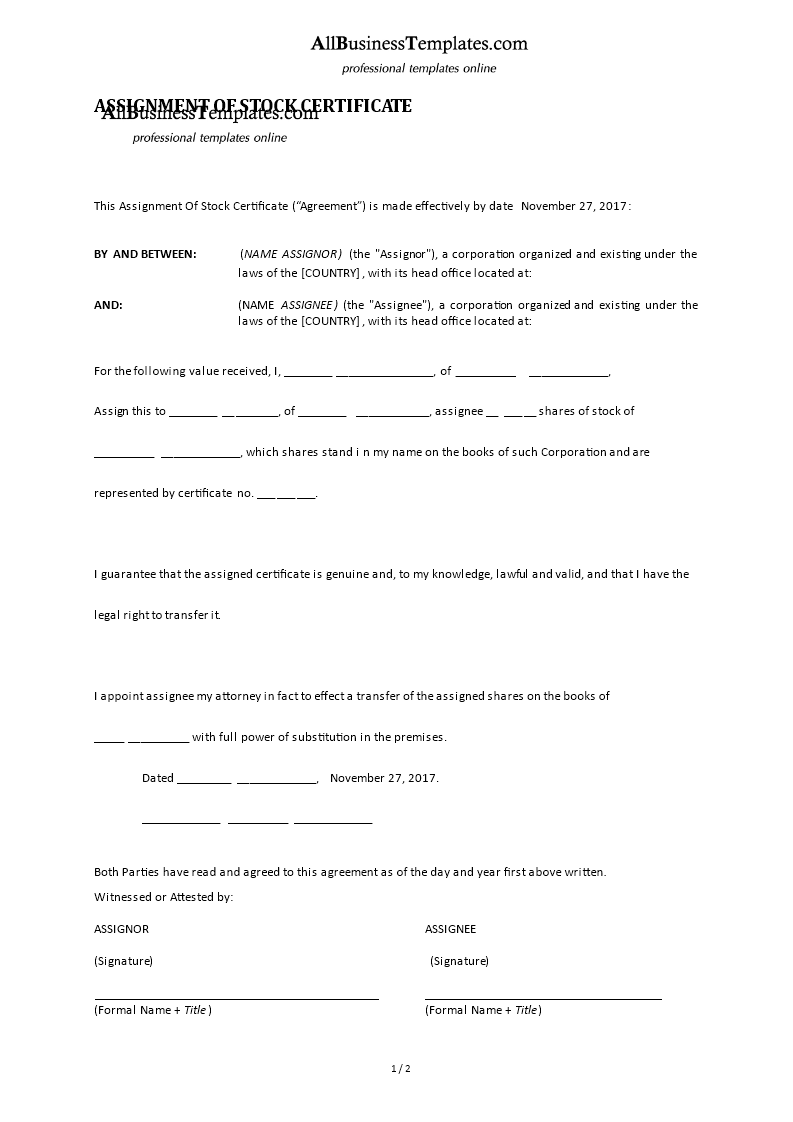

1. Definition of Stock Power: A stock power is a legal document that authorizes the transfer of ownership of a stock from the owner (the "grantor") to another person or entity (the "grantee"). It is also known as a stock assignment or a stock power form. The stock power form contains the details of the stock being transferred, the name of the grantee, and the signature of the grantor.

2. importance of Stock power : Stock power is important because it provides proof of ownership transfer and protects both the grantor and the grantee. With a stock power, the grantor can transfer ownership of the stock without physically delivering the stock certificate. This avoids the risk of loss or theft of the stock certificate. On the other hand, the grantee can prove ownership of the stock through the stock power, which is crucial for selling the stock or receiving dividends.

3. Types of stock Power forms : There are two types of stock power forms: "blank" and "special." A blank stock power form is unsigned and does not specify the name of the grantee. It is commonly used for transferring ownership of stocks to a brokerage firm or for depositing the stocks into a trust account. A special stock power form is signed and specifies the name of the grantee. It is used for transferring ownership of stocks to a specific person or entity.

4. How to Fill Out a Stock Power Form: Filling out a stock power form is a simple process. The grantor needs to sign the form and specify the name of the grantee. The grantee also needs to sign the form to acknowledge receipt of the stock. The completed form should be sent to the transfer agent or the brokerage firm that handles the stock.

5. Alternatives to Stock Power: While stock power is the most common way to transfer ownership of stocks, there are alternatives. One option is to use a trust. The grantor can transfer the stock to a trust and name the grantee as the beneficiary. The grantee will receive the stock upon the grantor's death. Another option is to use a will. The grantor can specify in the will that the stock should be transferred to the grantee upon the grantor's death.

Stock power plays an important role in transferring ownership of stocks. It provides proof of ownership transfer and protects both the grantor and the grantee. There are different types of stock power forms, and filling them out is a simple process. While there are alternatives to stock power, it is the most common way to transfer ownership of stocks.

The Role of Stock Power in Transferring Ownership - Stock Assignment: Transferring Ownership Rights with Stock Power

When it comes to transferring ownership rights with stock power , there are various ways to obtain this crucial document. Whether you are a shareholder looking to transfer your ownership or a company seeking to issue new shares, understanding the different methods available can help streamline the process and ensure a smooth transition of ownership. In this section, we will explore some common ways to obtain stock power, providing insights from different perspectives and comparing several options to determine the best approach.

1. Directly from the Transfer Agent:

One of the most straightforward ways to obtain stock power is by contacting the transfer agent directly. The transfer agent is responsible for maintaining the shareholder records and managing the transfer of ownership. They can provide you with the necessary stock power forms, which typically need to be completed, signed, and notarized before submitting them back to the transfer agent. This method ensures that the required documentation is obtained directly from the authorized party, reducing the risk of errors or fraudulent activity.

2. Online Stock Power Forms:

In today's digital era, many companies offer the convenience of online stock power forms. Shareholders can access these forms through the company's website or a designated platform. Online forms often include step-by-step instructions and may even provide a notary service. This option can save time and effort, as there is no need for physical paperwork or mailing documents. However, it is essential to ensure the online platform is secure and trustworthy, protecting sensitive information from potential cyber threats.

3. Brokerage Firms:

If you hold your shares through a brokerage account, you can obtain stock power through your broker. Brokerage firms typically have their own procedures for transferring ownership and may require specific forms or documentation. Contact your broker to inquire about the process and any associated fees. While this option may be convenient for shareholders who already have a brokerage account, it may not be the best choice for those who prefer a direct relationship with the transfer agent or have shares held outside of a brokerage account.

4. In-person at a Financial Institution:

Some shareholders may prefer to obtain stock power in person, either at their bank or another financial institution . This option allows for face-to-face interaction and immediate access to the necessary forms. However, not all financial institutions offer this service, so it is important to check beforehand. Additionally, consider any associated fees and potential time constraints when opting for this method.

Comparing the different ways to obtain stock power, the best option ultimately depends on your specific circumstances and preferences. If you have a direct relationship with the transfer agent, obtaining stock power directly from them ensures accuracy and eliminates potential intermediaries. On the other hand, online stock power forms can offer convenience and ease of use, particularly for tech-savvy individuals. Brokerage firms provide a viable option for those already utilizing their services, while in-person visits to financial institutions may be preferred by individuals seeking a personal touch.

Understanding the various ways to obtain stock power is crucial for shareholders and companies alike. By exploring the options available and considering the specific requirements and preferences, individuals can choose the most suitable method to transfer ownership rights efficiently and securely.

Ways to Obtain Stock Power - Stock Assignment: Transferring Ownership Rights with Stock Power

When transferring ownership rights with a stock power, there are several important steps to follow. Filling out the stock power form is one of the most crucial steps in this process, as it legally transfers ownership of the stock from one party to another. In this section, we will explore the process of filling out a stock power form, including what information is required, how to properly fill it out, and what to do after it is completed.

1. Understanding the Stock Power Form

A stock power form is a legal document that is used to transfer ownership of stock from one party to another. It is typically used in situations where the actual stock certificate is not available, such as when the stock is held in a brokerage account. The stock power form contains important information about the stock, such as the name of the company, the number of shares being transferred, and the name of the current owner.

2. Gathering the Required Information

Before filling out the stock power form, it is important to gather all of the necessary information. This may include the name of the company that issued the stock, the number of shares being transferred, and the name and contact information of the current owner. It is also important to have the recipient's information on hand, including their name and contact information.

3. Filling Out the Form

When filling out the stock power form, it is important to be accurate and thorough. The form will typically ask for the name and address of the current owner, as well as the name and address of the recipient. It may also ask for the number of shares being transferred, the date of the transfer, and other relevant information. It is important to double-check all of the information before submitting the form.

4. Submitting the Form

Once the stock power form has been filled out, it should be signed and dated by the current owner. Depending on the situation, the form may need to be notarized or witnessed by a third party. The completed form should be submitted to the appropriate parties, such as the brokerage firm or transfer agent.

5. Considerations When Filling Out a Stock Power Form

When filling out a stock power form, it is important to consider several factors. For example, if the stock is being transferred as a gift, it may be subject to gift taxes. It is also important to consider any restrictions or limitations on the transfer of the stock, such as those imposed by the company or by applicable laws and regulations.

6. Best Practices for Filling Out a Stock Power Form

To ensure that the stock power form is filled out correctly and completely, it is important to follow best practices. This may include reviewing the form carefully before submitting it, double-checking all of the information, and seeking professional advice if necessary. It is also important to keep copies of all relevant documents, such as the stock power form and any supporting documentation.

Filling out a stock power form is an important step in transferring ownership rights with a stock power. By following the steps outlined above and considering the relevant factors, it is possible to ensure that the transfer is completed correctly and legally.

Filling out a Stock Power Form - Stock Assignment: Transferring Ownership Rights with Stock Power

Executing a stock assignment is a process that involves transferring ownership rights from one party to another. It is a crucial step in the stock transfer process, and it requires both the assignor and the assignee to follow specific procedures to ensure a smooth transfer of ownership . In this section, we will explore the steps involved in executing a stock assignment and some insights from different points of view.

1. Review the Stock Power Form

Before executing a stock assignment, it is essential to review the stock power form carefully. This document is a legal instrument that transfers ownership rights from the assignor to the assignee. It contains important information, such as the name of the assignor, the name of the assignee, the number of shares being transferred, and the date of the transfer. Both the assignor and the assignee must sign the stock power form in the presence of a notary public.

2. Choose the Right Type of Stock Assignment

There are two types of stock assignments: a full assignment and a limited assignment. A full assignment transfers all ownership rights from the assignor to the assignee, while a limited assignment transfers only specific ownership rights, such as the right to vote or receive dividends. The type of stock assignment you choose depends on your specific needs and circumstances.

3. Consider the Tax Implications

Executing a stock assignment may have tax implications for both the assignor and the assignee. The assignor may be subject to capital gains tax if the stock has appreciated in value since it was acquired. The assignee may be subject to income tax if they receive dividends or sell the stock at a profit. It is important to consult with a tax professional to understand the tax implications of executing a stock assignment.

4. Choose the Right Method of Transfer

There are several methods of transferring ownership rights, including physical delivery, book-entry transfer, and electronic transfer. Physical delivery involves the physical delivery of stock certificates from the assignor to the assignee. Book-entry transfer involves the transfer of ownership rights through an intermediary, such as a stock transfer agent . Electronic transfer involves the transfer of ownership rights through an electronic network, such as the Depository Trust Company (DTC). The method of transfer you choose depends on your specific needs and circumstances.

5. seek Professional assistance

Executing a stock assignment can be a complex process, and it is advisable to seek professional assistance. A stock transfer agent can help you navigate the transfer process and ensure that all necessary procedures are followed. A tax professional can help you understand the tax implications of executing a stock assignment. Seeking professional assistance can help ensure a smooth transfer of ownership rights.

Executing a stock assignment is an essential step in transferring ownership rights from one party to another. It requires careful consideration of the stock power form, the type of stock assignment, the tax implications, the method of transfer, and professional assistance. By following these steps, you can ensure a smooth transfer of ownership rights.

Executing a Stock Assignment - Stock Assignment: Transferring Ownership Rights with Stock Power

When transferring ownership rights with a stock power, legal considerations must be taken into account to ensure a smooth and legally valid transaction. These considerations can vary depending on the type of stock being transferred and the parties involved. Here are some of the key legal considerations to keep in mind:

1. Type of Stock: The type of stock being transferred will impact the legal requirements for the transfer . For example, transferring common stock may require different legal documentation than transferring preferred stock. It's important to understand the specific requirements for the type of stock being transferred.

2. Parties Involved: The parties involved in the transfer will also impact the legal considerations . For example, transferring stock between family members may require different documentation than transferring stock between unrelated parties. It's important to understand the legal requirements based on the parties involved.

3. Tax Implications: The transfer of stock ownership can have tax implications for both the transferor and transferee. It's important to understand the tax consequences of the transfer and to consult with a tax professional if necessary.

4. Securities Laws: The transfer of stock ownership is subject to certain securities laws, including the securities act of 1933 and the Securities Exchange Act of 1934. These laws regulate the sale and transfer of securities and may require certain disclosures or filings.

5. State Laws: State laws may also impact the transfer of stock ownership. For example, some states require specific documentation or filings for stock transfers. It's important to understand the state laws that apply to the transfer.

When considering the legal considerations for stock assignment, it's important to consult with a legal professional to ensure compliance with all applicable laws and regulations. A legal professional can also help determine the best option for transferring ownership rights with a stock power.

Options for transferring ownership rights with a stock power include:

1. Direct Transfer: A direct transfer involves transferring the stock from one party to another without the involvement of a broker or intermediary. This option may be simpler and less expensive, but may require more legal documentation and may not be available for all types of stock.

2. Broker-Assisted Transfer: A broker-assisted transfer involves using a broker to facilitate the transfer of stock ownership. This option may be more expensive, but may be easier and more efficient, particularly for larger transfers or transfers involving multiple parties.

3. Gift Transfer: A gift transfer involves transferring ownership of the stock as a gift. This option may have tax implications for the transferor and transferee and may require additional legal documentation.

Ultimately, the best option for transferring ownership rights with a stock power will depend on the specific circumstances of the transfer. Consulting with a legal professional can help determine the most appropriate option and ensure compliance with all applicable legal requirements.

Legal Considerations in Stock Assignment - Stock Assignment: Transferring Ownership Rights with Stock Power

When it comes to stock assignment, there are several mistakes that people make which can lead to legal and financial complications. It is important to understand the process of transferring ownership rights with stock power and avoid these common mistakes.

1. Failing to Complete the Stock Assignment Form Correctly

One of the most common mistakes made in stock assignment is failing to complete the stock assignment form correctly. This can lead to delays in the transfer of ownership rights and can result in legal complications. It is important to ensure that all the required fields are filled out correctly and that the form is signed and dated by the appropriate parties.

2. Not Having a Properly Endorsed Stock Certificate

Another mistake that people make is not having a properly endorsed stock certificate. This is important because the stock certificate is the physical representation of the ownership rights of the stock. It is important to ensure that the certificate is properly endorsed by the seller and that the buyer has the certificate in their possession.

3. Not understanding the Tax implications of Stock Assignment

Another mistake that people make is not understanding the tax implications of stock assignment. Depending on the circumstances, there may be tax implications for both the buyer and the seller. It is important to consult with a tax professional to understand the tax implications before completing the stock assignment.

4. Not Using a Broker or Transfer Agent

Some people try to complete the stock assignment themselves without using a broker or transfer agent. This can lead to complications and delays in the transfer of ownership rights. It is recommended to use a broker or transfer agent to ensure that the process is completed correctly and efficiently.

5. Not Verifying the Identity of the Buyer or Seller

Finally, it is important to verify the identity of the buyer or seller before completing the stock assignment. This can help to prevent fraud and ensure that the transfer of ownership rights is legitimate. It is recommended to use a reputable broker or transfer agent who can help with this process.

Stock assignment can be a complicated process, but by avoiding these common mistakes, it can be completed successfully. It is important to ensure that the stock assignment form is completed correctly, that the stock certificate is properly endorsed, that the tax implications are understood, and that a reputable broker or transfer agent is used. By following these guidelines, the transfer of ownership rights can be completed efficiently and without complications.

Common Mistakes to Avoid in Stock Assignment - Stock Assignment: Transferring Ownership Rights with Stock Power

Stock Power and Stock Assignment are important concepts in the world of finance and investment. These concepts help investors transfer ownership rights of their stocks to another party. In this blog post, we have discussed the details of these concepts and their implications. We have also analyzed the different perspectives and provided insights on how to use these concepts effectively.

1. Importance of Stock Power and Stock Assignment

Stock Power and Stock Assignment are essential tools for investors who want to transfer ownership rights of their stocks to another party. These concepts enable investors to transfer their stocks without having to go through the hassle of selling them. This is particularly useful in cases where the investor wants to gift the stocks to someone or transfer them to another account.

2. Understanding Stock Power

Stock Power is a legal document that enables the transfer of ownership rights of a stock from one party to another. It is an endorsement that is required by the brokerage firm to transfer the ownership of the stock. The stock power must be signed by the owner of the stock and must be submitted along with the certificate of the stock to the brokerage firm.

3. Understanding Stock Assignment

Stock Assignment is a process where the ownership rights of a stock are transferred from one party to another. The process involves filling out a transfer form and submitting it to the brokerage firm. The transfer form must be signed by the owner of the stock and must be submitted along with the certificate of the stock.

4. pros and Cons of stock Power and Stock Assignment

Stock Power and Stock Assignment have their own advantages and disadvantages. Stock Power is a simpler process that requires the submission of a single document, whereas Stock Assignment involves filling out a transfer form. However, Stock Power can only be used if the certificate of the stock is in the possession of the owner, whereas Stock Assignment can be used even if the certificate is lost or misplaced.

5. Best Option

The best option depends on the situation. If the certificate of the stock is in the possession of the owner, Stock Power is the best option. However, if the certificate is lost or misplaced, Stock Assignment is the better option. In any case, it is important to consult with the brokerage firm to determine the best option.

Stock Power and Stock Assignment are important concepts that enable investors to transfer ownership rights of their stocks. These concepts have their own advantages and disadvantages, and the best option depends on the situation. It is important to consult with the brokerage firm to determine the best option.

Conclusion and Final Thoughts on Stock Power and Stock Assignment - Stock Assignment: Transferring Ownership Rights with Stock Power

Read Other Blogs

Hijjama Center Community is a network of entrepreneurs, mentors, investors, and experts who share a...

Equity financing and equity swaps are two essential components of alternative funding solutions in...

Why Mentorship Matters for Junior Companies For junior companies, having a mentor can be the...

Loyalty programs have become an integral part of modern business strategies, aiming to foster...

First aid is not only a moral obligation, but also a legal one for businesses. According to the...

1. Economic indicators play a crucial role in understanding the overall health and performance of...

When it comes to investment, there are various options available out there. One of them is tontine...

One of the most crucial factors that determines the success or failure of an entrepreneurial...

Embarking on the journey of establishing a motorbike repair business is akin to preparing for a...

- Search Search Please fill out this field.

Stock Power: What it is, How it Works, Requirements

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

What Is Stock Power?

Stock power is a legal power of attorney form that transfers the ownership of certain shares of a stock to a new owner. A stock power transfer form usually is only required when an owner opts to take physical possession of securities certificates, rather than holding securities with a broker. A stock power form includes the previous owner's name, a description of the shares to be transferred, the stock certificates, and the cost basis of the shares.

Key Takeaways

- Stock power is a power of attorney form that transfers share ownership to a new owner.

- Stock power is sometimes referred to as a security power form and generally requires a signature guarantee to protect against fraudulent transfers.

- This form is usually only needed when physical possession of security certificates is taken.

- A stock power form includes the previous owner's name, a description of the shares to be transferred, the stock certificates, and the cost basis of the shares.

How Stock Power Works

A stock power usually requires a signature guarantee to protect against fraudulent transfers. A stock power form is sometimes referred to as a security power form. As mentioned, it’s generally only needed for the transfer of physically held shares, but it may also be needed to change the name on the account or add a transfer of death beneficiary.

Stock powers can be used in secured lending transactions, where securities are used as collateral for a loan. When this happens, the stock power is signed by the borrower and delivered to the lender, but is not dated or completed. A stock power, in this instance, protects the lender’s interest, allowing them to foreclose on the shares if the loan is not repaid.

Special Considerations

Most often, when buying or selling shares of stock, a retail investor uses a brokerage firm that will take care of any legal documentation required for the transfer of shares to the new owner. Thus, in the vast majority of cases, the owner of the shares of a stock does not take possession of the share certificates and does not have to complete legal paperwork to buy and sell shares.

The shares are held in an electronic record with the broker's custodian eliminating the need for physical possession of the shares. However, before technology allowed records to be kept entirely electronically, physical stock certificates were the norm, and it was ubiquitous to use stock powers when transferring ownership of shares from one party to another.

Requirements for a Stock Power

Stock powers are needed for each account and each security being transferred. All owners must sign the form and generally have their signatures guaranteed with a medallion signature guarantee . In some cases, if a stock power is too old, it might be rejected.

If the owner of a stock is unable to complete a needed stock power form, the legal representative of that person must sign the form. This can include the Power of Attorney or custodian for someone that is incapacitated or a minor.

:max_bytes(150000):strip_icc():format(webp)/medallionsignatureguarantee.asp-final-176cd7245eba44b4b47b85baff9668a4.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Stock Certificate

Jump to section, what is a stock certificate.

A stock certificate is a legal document that verifies an investor’s ownership of common stock shares, a type of security. A stock certificate is usually a physical paper record that identifies the investor as the owner of the shares and the number of shares owned. It also contains the issuer’s name, signature, and official company seal.

This web page also defines stock certificates.

How Do You Get a Stock Certificate?

It can be challenging to obtain a physical stock certificate directly from the company. An effort to eliminate waste means that most brokers don’t offer a physical stock certificate or charge high fees for one and rely solely on digital records. However, it is not impossible, so you will want to inquire with your stockbroker or the issuing company.

Electronic Format

Stock certificates typically feature an intricate design that may change over time to prevent replication, a corporate seal, and multiple signatures. They usually prove entitlement to dividend payments, with a payment receipt attached to the back. However, stock ownership is typically recorded electronically using a depositary securities system in modern times.

Uncertificated Shares

While some investors may request paper or electronic certificates on occasion, the vast majority accept or even prefer uncertificated shares. Access to equity management software has also made it easier for businesses to issue and administer uncertificated shares. When a corporation gives uncertificated shares, no paper or electronic certificate is delivered to the stockholder.

Instead, the issuer tracks share issuances and transfers in an electronic stock register. However, some industry practices state that an uncertified stock issuing corporation should provide investors access to a ledger for equity monitoring. A corporation can manually maintain its stock ledger using a simple shared spreadsheet. Corporations with many stockholders or a complex equity structure will need to find another solution.

5 Parts of a Stock Certificate

Most stock certificates come in electronic format, while some companies offer physical, embossed paper stock certificates. A stock certificate is a unique piece of paper that certifies your ownership of a company. Although they are considered an archaic method, some traders purchase the physical stock certificates as collector’s items.

Stock certificates include all of the information necessary to identify the stock and its owners, including:

Part 1. Certificate Number

A stock certificate’s face typically contains a series of numbers. The issuing company assigns each certificate a unique number for accounting and tracking purposes.

Part 2. CUSIP Number

A separate tracking number known as a Committee on Uniform Securities Identification Procedures (CUSIP) number is a unique identifier assigned to stocks and convertible debts, such as SAFE Notes and Convertible Notes, in the United States and Canada.

They contain nine alphanumeric characters and were first introduced in 1964 for greater oversight and accountability standards. If you are dealing in investment contracts, you should also note the CUSIP number to assure compliance.

Part 3. Share Count

The stock certificate should also indicate the number of shares purchased to reflect the stock’s value. Some certificates even list the share price at which the stock was purchased.

Part 4. Name and Issuance Date

A stock certificate lists a series of names, including the buyer and seller. In addition, the certificate should include your name, certifying that you are the stock’s owner. Finally, the certificate will be dated to reflect the date you acquired ownership of the shares.

Part 5. Signature and Company Seal

While some stock certificates are plain, others are highly decorative, with artwork representing their branding. The majority of certificates are signed by a company representative and the individual responsible for their registration. They may also include an authenticity seal.

Today, most businesses only issue stock certificates upon request. Still, you could request a copy directly from the company or through a lawyer. In addition, the company may have a transfer agent responsible for managing the company’s stocks as well. However, you should be able to obtain an electronic copy of your stock certificates in case you need to print them out for verification purposes.

Who Issues Stock Certificates?

Corporations no longer issue stock certificates. Instead, numerous companies encourage investors to surrender their stock certificates for newer forms. However, suppose you’re a business owner wanting to issue physical certificates. In that case, you can work with securities lawyers to create the documents you need while avoiding legal errors entirely.

Image via Pexels by Burak Kebapci

Is a Stock Certificate Worth Anything?

A stock certificate’s worth equals the number of ownership shares reflected by the current stock price, provided they haven’t been sold. You should avoid discarding physical stock certificates as they could also be physically worth something as a collector’s item, especially from well-known, nostalgic brands. A little research can assist you in determining the value of your old paper stock certificate, if any.

Here are eight steps that you can take to determine if your stock certificate is still worth something:

- Conduct a Preliminary Search. Determine if the issuing company still trades publicly on the stock mark. You can accomplish this by searching major financial websites. If the stock has been split over the years, the value listed may differ from your certificate.

- Get In Touch With the Transfer Agent. Contact the transfer agent for the stock certificate, the person who is responsible for maintaining records for stockholders. The agent should be identified on the certificate. You can then search for this individual or company online to learn more about the stock certificates.

- Contact the State. If the transfer agent does not exist, contact the state agency that handles incorporations in which the corporation was legally formed. You could also try researching the state in which the business is headquartered.

- Conduct an Exhaustive Search. If none of the preceding steps work, search the company’s history. A few excellent resources include Capital Changes, Moody’s Manual of Industrial and Miscellaneous Securities, and the U.S. Library of Congress. In addition, there are volumes of information available, which could take some time to review.

- Reach Out to Investor Relations. If a search of the new company’s history reveals that it merged with or was acquired by another company, contact its investor relations department. They could offer you the relevant information and details you need to determine your stock certificate’s value.

- Perform a CUSIP Number Search. If the previous steps yield no results, contact a startup lawyer to conduct a CUSIP number search on the stock printed on the back. This information associated with this number should tell you about the issuer.

- Hire a Securities Law Attorney. If the previous steps yield no results, use a securities law attorney to research your stock’s history. They can also offer you additional legal resources to get to the bottom of your stock’s value.

- Appraise the Stock Certificate’s Collectible Value. Determine the value of your certificate if it has lost its value as viable security. A stock’s value can be determined by who signed it, its historical significance, or the engraving. This value can be determined by contacting dealers, conducting library research, or online listings.

Post a project in ContractsCounsel’s marketplace to get flat fee bids from lawyers for your legal project. All lawyers are vetted by our team and peer-reviewed by our customers for you to explore before hiring.

Meet some of our Stock Certificate Lawyers

Benjamin W.

I am a California-barred attorney specializing in business contracting needs. My areas of expertise include contract law, corporate formation, employment law, including independent contractor compliance, regulatory compliance and licensing, and general corporate law. I truly enjoy getting to know my clients, whether they are big businesses, small start-ups looking to launch, or individuals needing legal guidance. Some of my recent projects include: -drafting business purchase and sale agreements -drafting independent contractor agreements -creating influencer agreements -creating compliance policies and procedures for businesses in highly regulated industries -drafting service contracts -advising on CA legality of hiring gig workers including effects of Prop 22 and AB5 -forming LLCs -drafting terms of service and privacy policies -reviewing employment contracts I received my JD from UCLA School of Law and have been practicing for over five years in this area. I’m an avid reader and writer and believe those skills have served me well in my practice. I also complete continuing education courses regularly to ensure I am up-to-date on best practices for my clients. I pride myself on providing useful and accurate legal advice without complex and confusing jargon. I look forward to learning about your specific needs and helping you to accomplish your goals. Please reach out to learn more about my process and see if we are a good fit!

I absolutely love helping my clients buy their first home, sell their starters, upgrade to their next big adventure, or transition to their next phase of life. The confidence my clients have going into a transaction and through the whole process is one of the most rewarding aspects of practicing this type of law. My very first class in law school was property law, and let me tell you, this was like nothing I’d ever experienced. I remember vividly cracking open that big red book and staring at the pages not having the faintest idea what I was actually reading. Despite those initial scary moments, I grew to love property law. My obsession with real estate law was solidified when I was working in Virginia at a law firm outside DC. I ran the settlement (escrow) department and learned the ins and outs of transactions and the unique needs of the parties. My husband and I bought our first home in Virginia in 2012 and despite being an attorney, there was so much we didn’t know, especially when it came to our HOA and our mortgage. Our real estate agent was a wonderful resource for finding our home and negotiating some of the key terms, but there was something missing in the process. I’ve spent the last 10 years helping those who were in the same situation we were in better understand the process.

Attorney Gaudet has worked in the healthcare and property management business sectors for many years. As an attorney, contract drafting, review, and negotiation has always been an area of great focus and interest. Attorney Gaudet currently works in Massachusetts real estate law, business and corporate law, and bankruptcy law.

I am a NY licensed attorney experienced in business contracts, agreements, waivers and more, corporate law, and trademark registration. My office is a sole member Law firm therefore, I Take pride in giving every client my direct attention and focus. I focus on getting the job done fast while maintaining high standards.

A twenty-five year attorney and certified mediator native to the Birmingham, Alabama area.

Samantha B.

Samantha has focused her career on developing and implementing customized compliance programs for SEC, CFTC, and FINRA regulated organizations. She has worked with over 100 investment advisers, alternative asset managers (private equity funds, hedge funds, real estate funds, venture capital funds, etc.), and broker-dealers, with assets under management ranging from several hundred million to several billion dollars. Samantha has held roles such as Chief Compliance Officer and Interim Chief Compliance Officer for SEC-registered investment advisory firms, “Of Counsel” for law firms, and has worked for various securities compliance consulting firms. Samantha founded Coast to Coast Compliance to make a meaningful impact on clients’ businesses overall, by enhancing or otherwise creating an exceptional and customized compliance program and cultivating a strong culture of compliance. Coast to Coast Compliance provides proactive, comprehensive, and independent compliance solutions, focusing primarily on project-based deliverables and various ongoing compliance pain points for investment advisers, broker-dealers, and other financial services firms.

Experienced General Counsel/Chief Legal Officer

Find the best lawyer for your project

How it works.

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Corporate lawyers by top cities

- Austin Corporate Lawyers

- Boston Corporate Lawyers

- Chicago Corporate Lawyers

- Dallas Corporate Lawyers

- Denver Corporate Lawyers

- Houston Corporate Lawyers

- Los Angeles Corporate Lawyers

- New York Corporate Lawyers

- Phoenix Corporate Lawyers

- San Diego Corporate Lawyers

- Tampa Corporate Lawyers

Stock Certificate lawyers by city

- Austin Stock Certificate Lawyers

- Boston Stock Certificate Lawyers

- Chicago Stock Certificate Lawyers

- Dallas Stock Certificate Lawyers

- Denver Stock Certificate Lawyers

- Houston Stock Certificate Lawyers

- Los Angeles Stock Certificate Lawyers

- New York Stock Certificate Lawyers

- Phoenix Stock Certificate Lawyers

- San Diego Stock Certificate Lawyers

- Tampa Stock Certificate Lawyers

related contracts

- 501c3 Application

- Advisory Board Member Contract

- Annual Report

- Articles of Association

- Articles of Incorporation

- Articles of Organization

- Board Minutes

- Board Resolution

- Business Entity

other helpful articles

- How much does it cost to draft a contract?

- Do Contract Lawyers Use Templates?

- How do Contract Lawyers charge?

- Business Contract Lawyers: How Can They Help?

- What to look for when hiring a lawyer

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

Stock Assignment Agreement: Everything You Need to Know

A stock assignment agreement is the transfer of ownership of stock shares. 3 min read updated on January 01, 2024

Updated November 2, 2020:

A stock assignment agreement is the transfer of ownership of stock shares. It occurs when one party legally transfers their shares of stock property to another party or to a business. It's like the type of assignment agreement that happens when one person sells a car to another, which can also be referred to as assigning the vehicle's title to a new owner.

Examples of Assignment of Shares

In the first example of assignment of shares, the seller is assigning a certain number of shares to the buyer. That number includes the percentage of the shares that the buyer can potentially forfeit. This is only to the extent that the underwriter over-allowed an option, which is described in the company's statement of registration using Form S-1 and amended under the 1933 Securities Act.

Part of those shares the buyer holds can equal up to 25 percent of the total shares. Those shares are referred to as the "buyer earnout" shares and are potentially forfeited by the buyer in the following manner:

- Half of the buyer earnout shares are potentially forfeited if the last price that the company stock sells at doesn't equal or exceed a specified amount, such as $12 per share. This number is arrived at after any stock splits, reorganization, stock dividends are paid, and any recapitalization. These things may have occurred during any 20-day trading period within the past 30 days of trading. It also may have been within the past two years after the company's initial business combination closing.

- Information on the initial business combination closing date is found in the registration statement of the company. In this example, the buyers pay the seller the aggregated amount for all of the shares. The purchase price is what the seller receives as consideration in exchange for the assignment of the company shares.

- At the time of closing the sale, the seller assigns, conveys, and delivers to the company all rights, titles, and interests that the seller holds. This is done by assigning the shares of stock.

Vague Employer Promises to Employees

Before filing for incorporation, some business founders and some business leaders who are promoting a corporation based on a vision might make promises to employees or attorneys that are a bit vague. These promises might focus on offering the other party a share in the business in exchange for their work.

It's also common for a corporation's owner to offer employees a deal where they can earn some share of ownership in the company for working a certain amount of time. It also happens sometimes that, after the employee has fulfilled their part of the deal by working, that main shareholder or company founder might come to regret the deal made earlier. At that time, the shareholder or founder might delay issuing the shares that were promised or flat-out refuse to issue the shares to the employee.

An Example That Went to Court

This example of an employer making vague promises ended up in court. The defendant was the corporation's only shareholder . The defendant entered into a contract with the plaintiff in which he offered to relinquish the existing business and transfer all of his employees and his customers to the plaintiff. The plaintiff was to get one-quarter ownership of the incorporated business when it reached a specific amount of earnings.

- Then, the defendant regretted the decision to make the agreement after finding out it cost more than he had expected and that the business was losing money. At that time, the defendant went to the plaintiff and insisted that the plaintiff start acting like one of the owners by contributing funds and assuming some of the debt.

- The defendant was angry when the plaintiff wouldn't do that. So, he decided to delay the stock issue that had been promised and even got the plaintiff to agree to the delay. The defendant agreed on the condition that the defendant would get the tax write-off from the losses of the S-corporation .

- In the end, the defendant fired the plaintiff without ever issuing the shares that had been promised. As a result, the judgment for the plaintiff regarding the breach of fiduciary duty, referring the debts of the business that the plaintiff hadn't paid off, was reversed by the Supreme Court on the basis that the plaintiff had no duties because the plaintiff was never a shareholder as had been promised.

If you need help with a stock assignment agreement, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- How to Issue Shares in a Company

- Authorized Shares

- Authorized Stock

- How to Issue More Shares

- How to Transfer Shares of Stock Within a Corporation?

- Authorized Shares vs Issued Shares

- Issued Shares vs Outstanding Shares

- What is Stock Corporation?

- Issuance of Stock

- Corporate Stock Transfer Agreement

- Monday - Friday 11am - 7pm Eastern

- Contact - 800 698 8423

- Side Tab Dividers

- Bottom Tab Dividers

- Will Supplies

- Trust and Estate

- Stock Certificates & Forms

- Roman Numerals

- Exhibit Labels / Exhibit Stickers

- Legal Papers

- Custom Printed Tabs

- File Pockets

- Wide Width Dividers

- Binding Supplies

- Landscape Tabs

- Specialty Stamps for Attorneys

- Digital Seals

- Copier Tabs

- Odds + Ends

- Court Reporter Supplies

- Legal Size (8 1/2 X 14)

- Custom Printed Envelopes

- Classification/Partition Folders

- Bates Stamps / Bates Numbering Machines

- Avery Style Legal Dividers

- All-State Style Legal Tabs

- Blumberg Exhibit Tabs

- Create an Account

- My Cart items - $0.00

4th Jun 2019

Your Guide To Filling Out A Stock Certificate

Have you ever wondered what a stock certificate actually is? Do you have a clear answer in mind, yet have no idea how to fill one out?

Today you're going to learn how a simple form can make every difference in your business. It only takes a few moments to calculate how to fill out a stock certificate and a short amount of time to deal with one. So how do you take the next step exactly?

It's time you found out. If you're interested in how a simple certificate can make a world of difference in your company's behavior, keeping reading to find out.

What is A Stock Certificate?

Stock certificates are like receipts that declare a person's partial ownership in a company.

As with a receipt, a stock certificate describes information about the new owner, their transaction, and the company they made their exchange with. Here are the items listed on a certificate you should know about before going further:

- The total number of shares

- The exact date

- The cert identification number

- At times, a corporate seal and present signatures

A non-digital stock certificate comes in a piece of paper complete with printed signatures from higher-ups. This form of receipt/contract between an owner and a company comes in different forms depending on the owner and the type of company being represented.

Corporate Stock

A corporate stock certificate declares that a company penned-in a shareholder into their company. Financial details and the amount of ownership are all determined and clarified on the certificate. This piece of paper also defines the credit an owner now has for voting rights.

All of this is key to understand, but this process also defines the ability for a corporation to transfer rights and shares.

How LLC's Differ

An LLC (limited liability company) doesn't give out stocks, so their certificate looks different and stands for another list of abilities. For an LLC, shareholders are described as "members", as they receive membership bonuses, assets, and degrees of control over the functions of said company.

Here's the quickest way to tell the difference between LLC's and Corporations in the way they handle stock certificates.

- A corporation deals out "shares" in ownership of a given company

- LLC's ascribe "memberships" and assets to a member of a company and financial rights to non-members

Exploring How Businesses Give Out Stock Certificates

For starters, your business needs to determine its exact number of authorized shares. This keeps track of previous owners and leaves availability for owners in the future.

Once you've tallied your ownership, it's time to figure out who owns what and by how much compared to other owners. In short, define the percentages of shares among owners in your company.

A stock certificate should include all the public information of an owner and their relationship to your company in shares and position. This allows you to give out a physical certificate.

How Shares Work

Shares describe the degree of ownership one has in a company. Ownership isn't just defined by action available in a corporation, but the percentage of profit one has once joined and active.

All corporations function as a collective of shareholders and their respective percentage of values. There are subscribers and members, generally, that make up the total pool of shareholders. A subscriber registers and starts up a corporation - a so-called original shareholder - and members are those that come afterward.

There is no limit on the total number of shareholders a corporation can have, which sometimes brings up caveats. This is part of the reason why a corporate stock certificate and ledger and useful. As the member count increases so do the needs for managing the number of members and their profit shared.

Members portion of ownership is both their credit and their debt - as is often the case with the flipped-term. Therefore, all owe an amount of business debt they must pay through the years. Certificates regulate this process to some degree as well.

Shares vary in value depending on two variables.

- The market value of a share upon purchase

- The nominal value, or amount a shareholder paid for a portion of a corporation

There are also share structures, that describe the percentage of ownership one gets when buying a segment of a company. This depends on the corporations choice.

Shares are also described in different classes and with different actions attached. For example, an equal share grants shareholders equal profits and choice in a company to the next shareholder. In many cases, an original shareholder will own a substantial amount of total shares.

In short, shares and shareholders are in-corporation regulated slices of the total profits and values of a company. As the values and their profits shift, so do the amounts of profit shareholders receive. However, the approximate fraction thanks to a share do not change unless specified.

How to Fill One Out

If you choose to fill out a paper form certificate, you can find one online or in your articles of incorporation book. You can find templates online simply by searching for the type of certificate you need to be specified.

The first items list your company's name and address. If these aren't already printed, do so. As a connecting item, list the buyer's address and the number of shares they're purchasing.

Once again, if you're working from an LLC, almost all of this process is kept the same, minus a few upcoming exceptions.

You need signatures from at least two corporate officers to keep moving forward. Once you've done this, it's time to emboss the area where you add your corporate stamp. You can again find this in your incorporation book.

Generally, there is only one step remaining. You need to put down the SC number and names, shares, and prices involved in the transaction. This allows the management of ledgers and tracks transfers and transactions on a corporate level.

LLC Membership Certificate

A membership certificate is an LLCs version of a stock certificate. It's used when a member is inactive or wants to change their place in an LLC.

The baseline items on an LLC membership certificate involve stating the location of the LLC, the member, and their approximate interest in the company. The articles of organization will be your source of describing members rights at this point.

In a sense, an LLCs signing process is informal and a non-legal binding effort compared to corporations. At the very least, a membership certificate signing requires some form of witness and an agent. You can also use your authorized manager to act as the signing witnesses.

A membership certificate requires a legend that can be included separately or cohesively with the original form. The legend lists and defines restrictions to a memberships interest and the transferal process.

The certificate itself includes a bunch of variables ranging from issue date, member name, and a statement of benefits. In simplest terms, a membership certificate is a contract that clearly points towards the change of interest in a company and the members and managers involved in the exchange.

Getting Stock Certificates

Often one of the quickest ways to obtain a stock certificate is to ask your broker for one. You can also contact any business and ask for own - in many cases, you'll receive one digitally. Lastly, transfer agents are a good way to go if all else fails.

Asking your broker is straightforward and only requires doing some research to ask the right questions. Transfer agents essentially keep track of changes in ownership. Their job is to maintain and cancel certificates as ownership shifts.

These agents also work as middle-men for businesses to deal with mergers, brokerages, and exchanges of interest. You can contact your personal agent or the agent of an outside business easily. First, contact the business where an agent is attached, then ask for a direction that route.

However, you might have some difficulty reaching an agent just by contacting a business. You can access any businesses annual report so that you can find the legal name of a transfer agent.

There are also online marketplaces that receive certificate requests if you want to take that route.

Caveats to Consider

For starters, paper form declarations of ownership and valuation are often seen as antiquated. This view makes it especially hard sometimes to get a paper copy out of an agent. If you have this issue, you can always go digital or refer to another transfer agent.

Paper certificates aren't only seen as antiquated, they're treated as such. Many large businesses have actually discontinued their certificates in exchange for easier to store and receive digital files.

Both physical and digital realms include certified stocks, however, only digital included uncertified stocks as a variable. This leads to a different discussion about digital shares and the associations therein.

Another caveat: paper certificates risk damage and general durability. A digital certificate doesn't have either of these issues. However, digital files are at security risks to a pretty high degree unless precautions are taken (corrupted files are a great example).

There is a debate between auditors perspective on paper stocks. Some still believe that paper stocks are easier to manage and record. Prepare to run into some minor confusions with auditors if you're still taking the paper route.

A Lasting Proof of Ownership

Paper stocks or certificates are a powerful symbol of ownership for any shareholder. They show in physical forms, like a diploma, someone's involvement in a successful pursuit.

Even outdated stocks are still worth some amount of money, and many dealers find antique value in certificates that belong to no longer existing companies. There is also, again, the issue of security. Where digital documents can be easily corrupted, paper certificates have a weight of proof that doesn't quite compare.

What Should I Do With My Certificates?

If you don't have an investors account already, it's a good idea to get one so you can deposit your certificates. This keeps your stocks in one place and proves some reliability if you ever need to show your piece of a company.

The same thing can be applied to brokerage accounts. This is highly recommended for older investors - ones who have more experience with brokers. This makes inheritances and posthumous recording much easier.

In short, whenever you've actually gotten your stock certificates together, start thinking about the places you can store them. Furthermore, always consider the effectiveness of digital and paper copies for the future.

Take Stock in Your Company's Future

A stock certificate is a powerful tool at your disposal. With one, you can make longlasting changes in your company and in the lives of everyone involved. This simple digital form or paper document is a gateway to major movements in top-tier businesses.

After reading this article you should have a clearer idea of what stock certificates are, how they work, and why they're important to you regardless of your role in a business. With that said, it's time you got ahead on your competition and any obstacles in your future.

It's time you got a head start on the materials that keep your documents and exhibits clean and organized. It's time you figured out why legal products matter .

Let's face it. Making changes to your company can be a long ordeal and even a legal circus. Why not make things easier?

Your next step to action is simple. Start ordering the right tabs, exhibit dividers, and other materials key to holding your business together today.

Subscribe to our newsletter

Copyright © 2024 ExhibitIndexes.com

This site uses cookies to deliver and enhance the quality of its services and to analyze traffic.

Assignment and Transfer of Stock Certificate Template

Document description.

This assignment and transfer of stock certificate template has 1 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our assignment and transfer of stock certificate template:

ASSIGNMENT AND TRANSFER OF STOCK CERTIFICATE This Assignment and Transfer of Stock Certificate (the �Assignment�) is made and effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Company"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [TRANSFEROR NAME] (the "Transferor"), an individual having his main residence located at: [COMPLETE ADDRESS] FOR VALUE RECEIVED, the undersigned hereby sells, assigns and transfers to [TRANSFEREE NAME], [AMOUNT] shares of the stock of [YOUR COMPANY NAME] (the Company) st

Related documents

3,000+ templates & tools to help you start, run & grow your business, all the templates you need to plan, start, organize, manage, finance & grow your business, in one place., templates and tools to manage every aspect of your business., 8 business management modules, in 1 place., document types included.

Assignment Of Stock Certificate

Save, fill-In The Blanks, Print, Done!

Download Assignment Of Stock Certificate

Available premium file formats:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (36.31 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

DISCLAIMER Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Certificate Template

How to create a professional-looking Certificate? Browse through our impressive database of great looking Certificate templates and find a suitable one!

Related templates

- Share Certificate Of Common Stock

- Articles Of Incorporation Of Company template

- Agreement For Extension Of Lease

- Assignment Of Option To Purchase Real Estate

Latest templates

- GDPR Breach Notification to Data Subjects

- warranty deed with spouse release

- claim for damage

- Real Estate General Partnership Agreement

Latest topics

- GDPR Compliance Templates What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly...

- Easter Templates What is the true meaning of Easter? Check out some fun facts about the Easter Bunny and download nice Easter templates here.

- Google Docs How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs...

- Excel Templates Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly!

- Letter of interest How to write a letter of interest? What is a letter of interest? Check out and download here several professional and formal letters of interest:

Winners take time to relish their work, knowing that scaling the mountain is what makes the view from the top so exhilarating. | Denis Waitley

ONLY TODAY!

Receive the template in another format, for free!

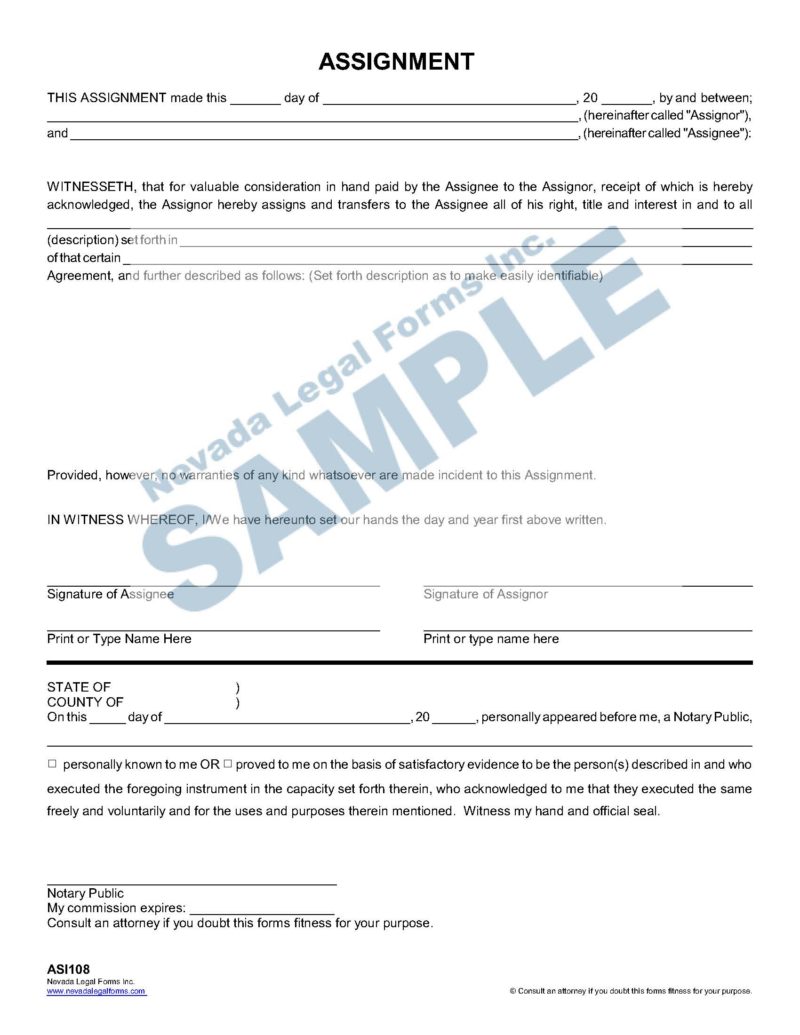

ASSIGNMENT AND TRANSFER (of Stock Certificate)

Description.

Assignment and transfer of stock certificates

Related products

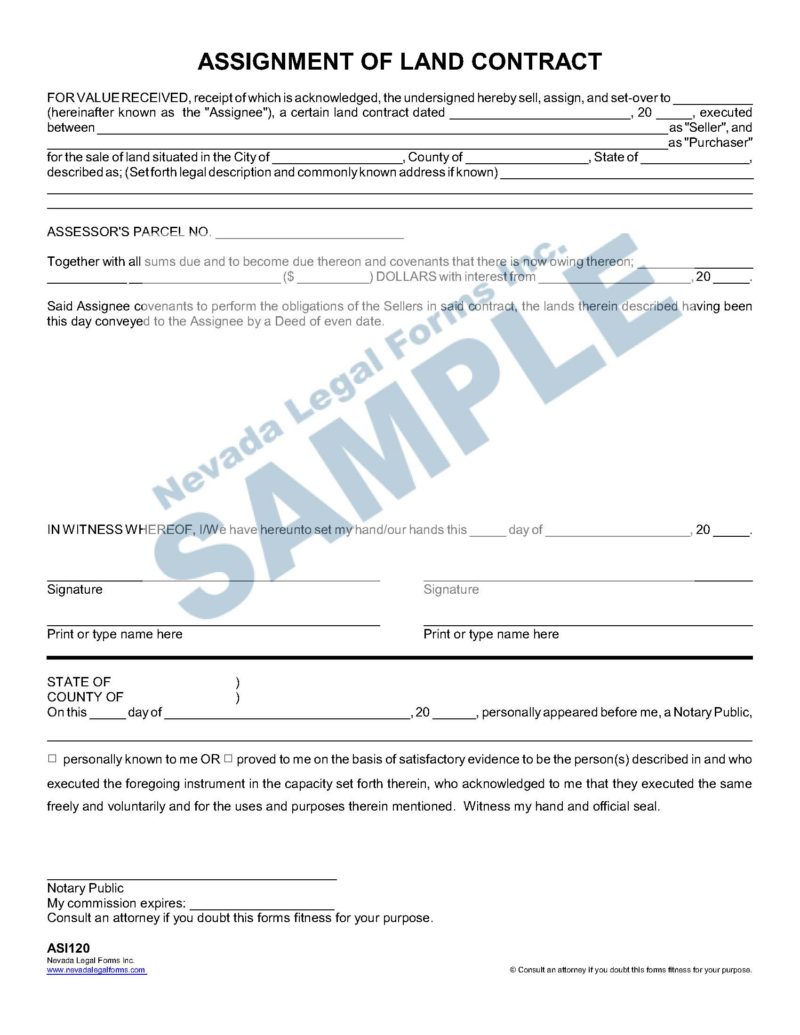

ASSIGNMENT OF LAND CONTRACT

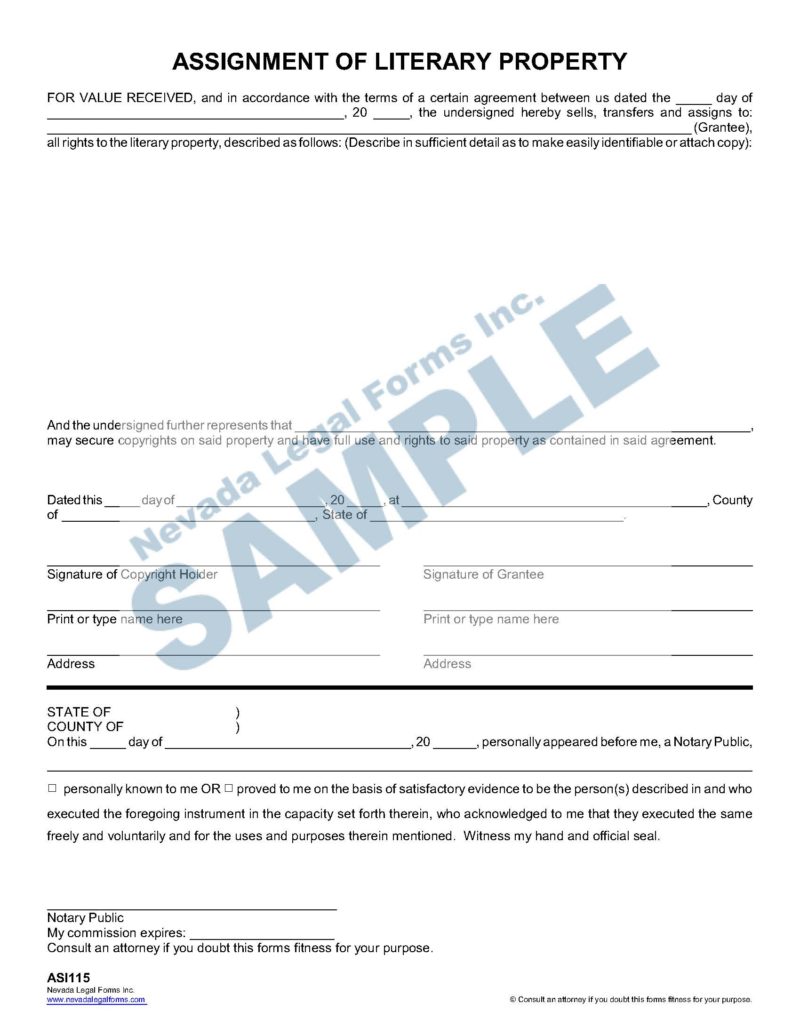

ASSIGNMENT OF LITERARY PROPERTY

Search Forms

Legal forms categories.

- Acknowledgements

- Applications

- Assignments

- Bills of Sale

- Certificates

- Contractor/Construction

- Declarations

- Entertainment

- Powers of Attorney

- Real Estate

- Uncategorized

Get Started

Our services includes the preparation of all documents required by Family Court.

SEPARATE MAINTENANCE SERVICES

TERMINATION OF DOMESTIC PARTNERSHIP

Joint Petition for Divorce – Both parties agree to ALL of the terms of divorce.

Complaint for Divorce by Summons – Parties do not agree to ALL terms of the divorce and one party will be served divorce papers.

Complaint for Divorce by Publication – When one spouse is unable to locate the other spouse. You must have a last known address.

*Starting price depending on the complexity of the estate.

*Renewed Annually $165.00 Ask about our Expedite options

*Renewed Annually $765.00 **Renewed Annually $1150.00 Ask about our Expedite options

*Renewed Annually $465.00 **Renewed Annually $850.00 Ask about our Expedite options

Minor Child(ren) Information

Seminar for separating parents (“cope” class).

To help lessen the impact of the separation for any minor child(ren), the District Court requires separating parents to attend a co-parenting seminar, sometimes called the “COPE” Class.

The parents do not have to go to the class together, but both parents must take the class at some point before the court case is finished and file a certificate of completion with the court. Usually, the judge will not sign a final order until both parents have taken the class.

Classes are offered in English and Spanish. Parents can attend a 3 hour class in person, or can sign up for an online class that takes about 3-5 hours to finish. The class costs around $40-45/person. At the end of the class, parents will get a Certificate of Completion to file with the Court.

There are six Court approved class providers, listed bellow. Contact them to find out class schedules and to sign up.

- Family Solutions (in person and online class): http://familysolutionslv.org/learn/#cope-online

- Sagebrush Counseling Center (in person class): https://www.sagebrushcounselingservices.com/

- BOSS Court Education (online class): https://bosscourteducation.com/

- Online Parenting Classes (online class): https://nevada.onlineparentingprograms.com/

- The Center for Divorce Education (online class): https://www.divorce-education.com/nv/clark/

- Two Families Now (online class): https://www.twofamiliesnow.com/

GUARDIANSHIP . Before You Begin.

Who Cannot Be a Guardian A person cannot be appointed a guardian if:

• The person is incompetent (for instance, the person cannot take care of himself). • The person is a minor. • The person has filed for bankruptcy within the last 7 years. The court may appoint a person who has filed for bankruptcy if the guardianship is over the person only (meaning no money will be handled), or if there are no other suitable candidates to serve as guardian. The court may order additional safeguards to protect the person’s money. • The person has been convicted of a felony. The court may appoint a person convicted of a felony if the court determines that the conviction should not disqualify the person from serving as a guardian. • The person has been suspended or disbarred from the practice of law, accounting, or any other profession that involves the management of money and requires a state license. • The person has committed a crime of domestic violence, abuse, neglect, exploitation, isolation, or abandonment of a child, spouse, parent, or other adult. The court may appoint someone who has committed such a crime if the court finds it is in the best interest of the protected person to appoint that person the guardian.

For Non-Nevada Residents: There may be extra requirements for non-resident guardians to ensure the safety of the protected person. Of note, non-Nevada guardians must designate a “registered agent” in the State of Nevada to accept service of legal documents.

READY TO START? 1. Complete the appropriate worksheet as best as you can, then we can assist you further if needed. • Guardianship for an Adult • Guardianship for a Minor Child(ren) 2. Submit to NLF for preparation. 3. We will contact you upon completion of your documents for your review and approval. 4. We will schedule an appointment to sign all documents and go over any questions you may have. 5. We will then start filing your documents with Family Court and keep you informed as your case progresses through court.

DIVORCE. Before You Begin.

Nevada Residency Nevada has a residency requirement in order for file for divorce. One of the parties must live in Nevada for at least 6 weeks prior to filing for divorce and intend to remain in the state indefinitely.

Grounds for Divorce Husbands and wives who are divorcing usually are suffering enough without adding more fuel to the emotional fires by trying to prove who-did-what-to-whom. The laws of no-fault divorce recognize that human relationships are complex and that it is difficult to prove that a marriage broke down solely because of what one person did. Nevada is a “no fault” state, meaning there doesn’t have to be any particular reason why a person wants a divorce other than the parties are incompatible in marriage.

READY TO START? 1. Choose the appropriate worksheet and complete. Joint Petition for Divorce – when both parties agree on all terms of the divorce including: • Division of community property and community debt • Child Custody/Visitation/Support

• If there are children involved, you must complete the additional appropriate worksheet to determine child support. Please complete as best you can, then we can assist you further if needed. • Worksheet A if the parties are requesting Primary Physical Custody of the child(ren). • Worksheet B if the parties are requesting Joint Physical Custody of the child(ren).

Complaint for Divorce – when the parties do not agree on all terms of the divorce. Divorce by Publication – when your spouse cannot be located.

2. Submit to NLF for preparation. 3. We will contact you upon completion of your documents for your review. 4. We will schedule an appointment to sign all documents and go over any questions you may have. 5. We will then start filing your documents with Family Court and keep you informed as your case processes through court.

CHILD CUSTODY, PATERNITY, CHILD SUPPORT. Before You Begin.

Jurisdiction For a Nevada court to make any custody, visitation orders, Nevada must be considered the “home state” of the child(ren). This means the child(ren) must have lived in the State of Nevada for at least 6 months prior to filing for custody.

Child Custody When parents are married, custody, visitation, child support, visitation provisions are handled within the proceedings of a divorce. When parents are not married to each other, these provisions are handled within a custody or paternity case.