- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Credit Controller Cover Letter Example

Writing a cover letter for a credit controller role can be a challenging task. To stand out from the competition and ensure your application is successful, it is important to put effort into creating an engaging and effective document. This guide will provide you with all the information you need to write a credit controller cover letter, including tips on content, formatting and structure. With the advice provided, you are sure to create a cover letter that will impress potential employers and help you take the next step towards a new career.

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Credit Controller Cover Letter Sample

Dear [Name],

I am writing to apply for the position of Credit Controller at [Company], as advertised on [Source].

I bring to the role a wealth of experience in financial operations and credit control, having worked as a Credit Controller at [Previous Company] for the last [Number] years. In this role, I was responsible for managing a portfolio of client accounts, ensuring they complied with the company’s credit policy, and providing accurate financial information to enable decision making.

I have excellent communication skills, and am able to build and maintain relationships with clients, suppliers and other stakeholders. I understand the importance of accurate financial reporting and am well versed in the use of a wide range of accounting software packages. I have a strong eye for detail, am organized and efficient, and have good problem solving and analytical skills.

I am confident that I possess the necessary skills and experience to make a valuable contribution to the role of Credit Controller at [Company] and look forward to discussing my suitability further.

Thank you for your time and consideration.

Yours sincerely,

[Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Credit Controller cover letter include?

A Credit Controller cover letter should provide a brief overview of the applicant’s qualifications and experience, as well as the reasons why they are a good fit for the position. It should address what makes the applicant stand out from other applicants, and explain why they would be an asset to the company.

The cover letter should also highlight the applicant’s knowledge of credit control processes, procedures, and software. It should also showcase the applicant’s understanding of effective customer service principles and strategies, as well as their familiarity with collection techniques and arbitration.

In addition, the cover letter should demonstrate the applicant’s ability to maintain accurate records and adhere to strict deadlines. It should also demonstrate the applicant’s ability to work effectively with other departments to manage accounts. Finally, the cover letter should demonstrate the applicant’s strong communication skills and ability to build relationships with customers.

Credit Controller Cover Letter Writing Tips

A successful credit controller cover letter is an essential part of any job application. It is your opportunity to make a good first impression and convince the employer that you are the best candidate for the role. With the right approach, you can make sure that your cover letter stands out from the rest. Here are some tips for writing a credit controller cover letter:

- Research the company: You need to make sure that your cover letter is tailored to the specific company you are applying to. Researching the company’s values, mission and objectives will provide you with the knowledge to craft a more effective cover letter.

- Highlight your qualifications: Make sure that your cover letter clearly indicates your relevant qualifications and experience. This will demonstrate to the employer that you have the skills and experience necessary to be successful in the role.

- Keep it concise and professional: A cover letter should be no longer than a single page. Make sure that you remain professional in your writing and avoid using jargon or slang.

- Proofread: Double- check your cover letter for any spelling and grammar errors. These may seem small, but can leave a lasting impression on the employer.

- Follow up: After submitting your cover letter, follow up with the employer. This will show your enthusiasm for the role and may help you to secure an interview.

Common mistakes to avoid when writing Credit Controller Cover letter

Writing a cover letter is an important part of the job application process. When applying for the position of Credit Controller, it is important to ensure that your cover letter is free of mistakes and properly conveys your enthusiasm and qualifications for the job. Here are some common mistakes to avoid when writing a cover letter for a Credit Controller position.

- Not including a professional greeting: It is important to address your cover letter to the hiring manager by name, if possible. You should also begin your cover letter with a professional greeting, such as “Dear Mr./Ms. [Name].”

- Not emphasizing your credentials: Your cover letter should focus on your qualifications and experience that are relevant to the position. Make sure to highlight your strengths and emphasize how your skills make you the ideal candidate for the position.

- Not including specific examples: It is important to provide specific examples of how you have exemplified the qualifications needed for the job. For example, you can mention a particular project or situation in which you demonstrated your ability to manage credit and collections.

- Not properly formatting the letter: Your cover letter should be formatted properly and be free of errors. Make sure to use proper grammar, spelling, and punctuation.

- Not including a call to action: You should always include a call to action at the end of the cover letter. This will encourage the hiring manager to contact you for an interview.

By avoiding these common mistakes, you can ensure that your cover letter stands out and presents you in the best possible light. By emphasizing your qualifications and providing specific examples, you can demonstrate your ability to succeed in the role of Credit Controller and increase your chances of receiving an interview.

Key takeaways

A well- written credit controller cover letter can be the difference between getting an interview or being overlooked by an employer. Whether you are an experienced credit controller or a recent college graduate, there are certain key points to keep in mind when crafting your cover letter. Here are some key takeaways for writing an impressive credit controller cover letter:

- Highlight your relevant experience: Your cover letter should be tailored to the job you are applying for. Mentioning any experience in accounts receivable, credit analysis, or credit collections is a great way to demonstrate that you have the necessary skills to perform the job.

- Demonstrate your analytical skills: Credit controllers are required to review financial information and make decisions. Make sure to highlight any analytical skills or experience you have in your cover letter.

- Emphasize your ability to communicate: One of the most important qualities of a successful credit controller is their ability to communicate. Make sure you emphasize any written or verbal communication skills you have in your cover letter.

- Showcase your problem- solving skills: Credit controllers must be able to resolve any issues that arise. Use examples from past experience to demonstrate your problem- solving skills.

- Discuss your attention to detail: Credit controllers are often required to review financial documents and make decisions based on their findings. Make sure to mention your attention to detail in your cover letter.

Following these key takeaways will help you create an impressive credit controller cover letter that will help put you ahead of other applicants and give you the best chance for success!

Frequently Asked Questions

1. how do i write a cover letter for an credit controller job with no experience.

Writing a cover letter for a Credit Controller job with no experience can be challenging but with the right approach, you can make a great impression on potential employers. Start by demonstrating your understanding of the Credit Controller role and its responsibilities. Showcase your attention to detail, and explain why you are the best candidate for the job. Additionally, highlight any skills or experience that could be beneficial for the role, such as customer service or data analysis.

Next, express your enthusiasm for the role, and focus on how you can bring a fresh perspective and valuable skills to the job. Finally, thank the employer for taking the time to consider you and end with a call to action. With this approach, you can create an impactful cover letter that will give you an edge in your job search.

2. How do I write a cover letter for a Credit Controller job with experience?

When writing a cover letter for a Credit Controller job with experience, you should focus on your achievements and successes. Begin your letter by expressing your appreciation for the opportunity and briefly summarizing why you are a great fit for the job.

Next, provide details about your relevant experience and accomplishments. Where possible, give specific examples of how you have improved credit processes in previous roles. Also, be sure to focus on how you can continue to be an asset to the company.

Finally, thank the employer for their time and consideration, and express your excitement for the role. With this approach, you can create a compelling cover letter that will set you apart from the competition.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

2 Credit Controller Cover Letter Samples

Credit controllers work in the financial industry and are expected to perform credit management services.

Their primary role is to check up on the company’s clients’ existing cover ratings and help the management decide if they should be offered credit.

This position requires quite some experience in a financial setting.

What is a Credit Controller Cover Letter?

Credit controller cover letters are short, conversational documents that serve as the candidate’s introduction to prospective employers.

Just like the resume, your cover letter must also be customized, showcasing your relevant skills and talents.

In order to be effective, your cover letter must be easy to read.

Keep it short and format it in a simple and clear manner.

Also, leave some white spaces and divide your cover letter into meaningful paragraphs.

Here are 2 good examples of cover letters for the credit controller position:

Credit Controller Cover Letter Sample 1

John Smithson 1579 Northfield Drive Mineral Ridge, OH 40212 (000) 521-9674

March 22, 2022

Mr. Louis Rodriguez Manager Human Resources Acme Financial Control 90 Market Street Mineral Ridge, OH 44410

Re: Credit Controller Position

Dear Mr. Rodriquez:

I was excited to see the position of Credit Controller at Acme Financial Control in the Daily Adverts. I am a graduate in finance and have heard about the reputation of your company as being one of the best companies in the financial sector. With strong negotiation skills and a firm grasp of financial control strategies, I am confident that I will make a substantial contribution to your company.

Since I have been trained to act and think creatively, I possess the capacity to ensure that cash collection targets are met proficiently. I am competent at communicating proactively with both external and internal customers, and this skill helps me immensely when I perform balance settlement tasks. Additionally, my ability to plan and organize daily credit control activities and promote strong collaborative relationships with internal sources will be an asset to your firm.

I am eager to learn more about your company and would welcome the opportunity to discuss this position with you in detail. Thank you for your time and consideration.

John Smithson (000) 521-9674

Enc. Resume

Credit Controller Cover Letter Sample 2

Joshua Kristen 116 Galaxy Square Houston, TX 45833 (004) 333-2222 Joshua . kristen @ email . com

Mr. Robert Guilford HR Manager Bank of America 56 Alexander Avenue Houston, TX 45833

Dear Mr. Guilford:

If you are seeking a competent Credit Controller who has 8 years of firsthand experience in general ledger balancing, risk mitigation, and lease drafting, then I am your candidate.

The following are some highlights of my qualifications that uniquely qualify me for this role:

- Proficient in reviewing and analysing transactions, sheet balancing, and financial auditing.

- Expert in conducting ratio trends and cash flow analysis.

- Known for understanding, following, and implementing the company’s financial policies.

- Demonstrated ability to interact with customers for data collection and account verification.

- Track record of reducing lease default rate by implementing thorough background check protocols prior to loan sanctioning.

Throughout my career as a Credit Controller, my employers have highly commended my ability to manage multiple tasks with accuracy. My strength lies in my expertise to collaborate effectively with the relevant departments to speed up given tasks and cross-verify all financial data before transaction processing.

Please call me now at (004) 333-2222 to set up an interview. I will follow up on this application next Monday.

Thank you for your time and consideration.

(Signature) Joshua Kristen

- 2 Credit Controller Resume Examples

- Assistant Controller Cover Letter Sample

- Assistant Controller Resume Sample

- Accounting Controller Job Description, Duties, and Responsibilities

A Convincing Credit Controller Cover Letter Example

For a business to stay afloat, they must ensure that customer accounts are paid promptly. In addition to this, they must take great care when extending credit. As a skilled credit controller, it’s your job to oversee these efforts. At the same time, you must do so while maintaining excellent customer relations. You have the abilities to do this job well, now you need a great cover letter to include in your application packet. Keep reading for a credit controller cover letter sample and some great writing tips.

Highlight Your Negotiating and Customer Service Skills

The job of a credit controller requires a delicate balance of skills. On one hand, you want to motivate customers to keep their accounts current and avoid extending credit when the risk is too high. On the other hand, a customer in arrears is still a customer, and you must handle credit accounts to maintain excellent customer relations . Also, you are more likely to keep a profitable relationship with a firm, but friendly approach.

In your cover letter, show that you know how to create credit agreements, and obtain payments while giving your VIP customers incentive to continue doing business with your company. Here’s an example:

“In my current position, I am in charge of personally handling VIP and complex accounts. I am proud to say that I have been able to successfully negotiate payments while achieving a 100% customer retention rate.”

Show You Understand Regulations and Procedures

A credit controller must understand both banking and credit regulations. In addition to this, there may be industry best practices to follow to maintain an excellent reputation. Use your cover letter to detail that you are familiar with the common compliance requirements and can carry out your duties in line with the latest regulations.

Quantify Your Previous Successes

Ultimately, your job is to ensure that monies owed are paid to your company and that accounts are organized for ease of reporting and tracking. If you can prove you can accomplish these things, you will increase your chances of landing the job. However, you must be specific. It’s not enough to state that you ‘ successfully manage accounts while maintaining successful risk metrics’ . Instead, you should bring some meaningful detail to show exactly what you’ve done for previous employers. For example:

“I am in charge of credit approvals for customer accounts with a value of more than 100K annually. Since I have taken over this task, I have increased the percentage of current accounts in this category by more than 15%.”

Detail Your Technical Skills

As part of your job, you must understand how to use ERP software as well as automated credit control software. Knowledge of different apps, tools, and software systems will win you some extra points with the employer. So consider adding a short, bulleted list of any relevant tools or software you can use. For example SAP, Microsoft Dynamics , CreditForce , Credica , etc.

Credit Controller Cover Letter Sample in .docx Format

Download example (Word version)

Credit Controller Cover Letter Example – Text Format

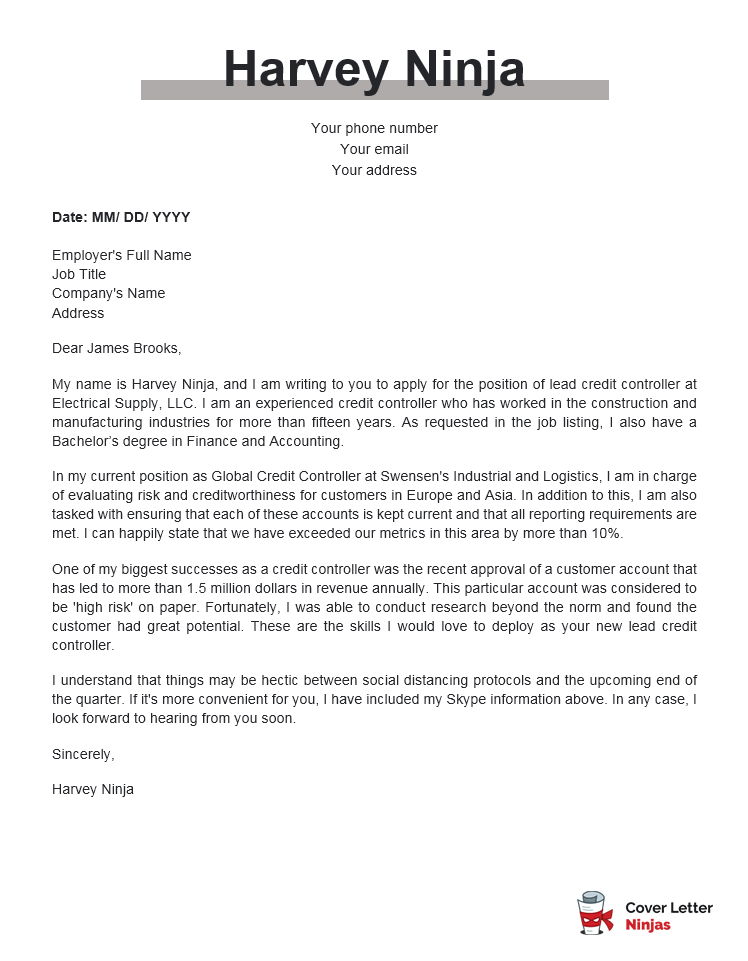

Dear James Brooks,

My name is Harvey Ninja, and I am writing to you to apply for the position of lead credit controller at Electrical Supply, LLC. I am an experienced credit controller who has worked in the construction and manufacturing industries for more than fifteen years. As requested in the job listing, I also have a Bachelor’s degree in Finance and Accounting.

In my current position as Global Credit Controller at Swensen’s Industrial and Logistics, I am in charge of evaluating risk and creditworthiness for customers in Europe and Asia. In addition to this, I am also tasked with ensuring that each of these accounts is kept current and that all reporting requirements are met. I can happily state that we have exceeded our metrics in this area by more than 10%.

One of my biggest successes as a credit controller was the recent approval of a customer account that has led to more than 1.5 million dollars in revenue annually. This particular account was considered to be ‘high risk’ on paper. Fortunately, I was able to conduct research beyond the norm and found the customer had great potential. These are the skills I would love to deploy as your new lead credit controller.

I understand that things may be hectic between social distancing protocols and the upcoming end of the quarter. If it’s more convenient for you, I have included my Skype information above. In any case, I look forward to hearing from you soon.

Harvey Ninja

Final Tip: Share a Quick Story to Prove Your Expertise

There’s more to the job of credit controller than simply reading credit reports and calculating risk scores. This is a customer service position as well, and one that allows you to increase the employer’s profitability. Consider sharing a brief story that showcases how you used your skills and experience to improve customer relations or collect on a difficult account. If possible, back up some of your claims with data.

Other Cover Letter Samples

School nurse cover letter example and tips, cover letter for nurse educator: example + tips, cover letter example for school counselors and education professionals, software engineer cover letter example to help you make your mark.

A huge collection of cover letters created by a ninja team of writers and career advisors. Learn how to write, style and file cover letters that employers actually enjoy reading.

© Copyright 2023 Cover Letter Ninjas

- Privacy Policy

- Cookie Policy

- Terms and Conditions

- Disclosure Policy

COMMENTS

By knowing how to put together a good cover letter for this position, you increase your chances of getting an interview. In this article, we look at what a credit controller cover …

Looking for Credit Controller Cover Letter Example? Check out our sample and learn how to create a job winning cover letter that showcases your qualifications and experience.

Discover over 15 credit controller cover letter examples to help you craft the perfect job application. Learn essential tips, see sample cover letters, and access customizable …

Credit controller cover letters are short, conversational documents that serve as the candidate’s introduction to prospective employers. Just like the resume, your cover letter …

Studying high-quality cover letter samples and incorporating effective tips can help you stand out and capture the interest of prospective employers. In this article, we offer …

In your cover letter, show that you know how to create credit agreements, and obtain payments while giving your VIP customers incentive to continue doing business with your company. Here’s an example: “In my current position, I am …

Use our Credit Controller Cover Letter Example that highlights Job Responsibilities, Skills & Education for your Job search. Download Free Sample Template now.