What is the history of corporate governance and how has it changed?

The history of corporate governance is long, rich and packed with twists and turns. It’s a topic that touches on managerial accountability, board structure and shareholder rights — including both periods of shareholder passivity and shareholder power. Governance began with the rise of corporations, dating back to the East India Company, the Hudson’s Bay Company, the Levant Company and other major chartered companies during the 16th and 17th centuries.

While the concept of corporate governance has existed for centuries, the name didn’t come into vogue until the 1970s. The United States was the only country using the term at the time. The balance of power and decision-making between board directors, executives and shareholders has been evolving for centuries. The issue has been a hot topic among academic experts, regulators, executives, and investors, making corporate governance history critical to understanding why corporate governance is so important .

This article will highlight key milestones in the history of corporate governance, including:

- A complete corporate governance timeline

- The growing emphasis on corporate governance

- The impact of economic activity on corporate governance history

- How technology has influenced modern governance

- Trends that point to the future of corporate governance

Corporate governance history at a glance

The history of corporate governance dates back to World War II when robust economic growth put massive power in the hands of corporate managers. Review a timeline of critical events before diving into each corporate governance evolution in-depth.

World War II - 1980s: Corporate growth emphasizes developing corporate governance

Post-world war ii.

After World War II, the United States experienced strong economic growth, which strongly impacted the history of corporate governance. Corporations were thriving and proliferating. Managers primarily called the shots and expected board directors and shareholders to follow. In most cases, they did. This was an interesting dichotomy since managers highly influenced the selection of board directors. Unless it came to matters of dividends and stock prices, investors tended to steer clear of governance matters.

In the 1970s, corporate governance history began to change as the Securities and Exchange Commission (SEC) brought the issue of corporate governance to the forefront when they brought a stance on official corporate governance reforms. In 1976, the term corporate governance first appeared in the Federal Register, the official journal of the federal government.In the 1960s, the Penn Central Railway diversified by starting pipelines, hotels, industrial parks and commercial real estate. Penn Central filed for bankruptcy in 1970, and the public scrutinized the board. In 1974, the SEC brought proceedings against three outside directors for misrepresenting the company’s financial condition and a wide range of misconduct by Penn Central executives.Around the same time, the SEC caught on to widespread payments by corporations to foreign officials over falsifying corporate records. Corporations formed audit committees and appointed more outside directors during this era. In 1976, the SEC prompted the New York Stock Exchange (NYSE) to require each listed corporation to have an audit committee composed of all independent board directors, and they complied. Advocates pushed to get governance right by requiring audit committees, nomination committees, compensation committees and only one managerial appointee.

The 1980s: A corporate governance reform counter-reaction

The 1980s ended the 1970s movement for corporate governance reform due to a political shift to the right and a more conservative Congress. This era brought much opposition to deregulation, another significant change in the history of corporate governance. Lawmakers advanced The Protection of Shareholders’ Rights Act of 1980 , but it stalled in Congress.Debates on corporate governance focused on a new project called the Principles of Corporate Governance by the American Law Institute (ALI) in 1981. The NYSE had previously supported this project but changed their stance after they reviewed the first draft. The Business Roundtable also opposed ALI’s attempts at reform. Advocates for corporations felt they were strong enough to oppose regulatory reform outright without the restrictive ALI-led reforms.

Businesses had concerns about some of the issues in Tentative Draft No. 1 of the Principles of Corporative Governance. The draft recommended that boards appoint mostly independent directors and establish audit and nominating committees. Corporate advocates were concerned that if companies implemented these measures, it would increase liability risks for board directors .Law and economic scholars also heavily criticized the initial ALI proposals. They expressed concerns that the proposals didn’t account for the pressures of the market forces and didn’t consider empirical evidence. In addition, they didn’t believe that fomenting litigation would serve a purpose in advancing effective corporate governance .In the end, the final version of ALI’s Principles of Corporate Governance was so watered down that it had little impact on the history of corporate governance by the time it was approved and published in 1994. Scholars maintained that market mechanisms would keep managers and shareholders aligned.

The ‘Deal Decade’ leads to shareholder activism

The 1980s was also referred to as the ‘Deal Decade.’ Institutional shareholders grabbed more shares, which gave them more control. They stopped selling out when times got tough. Executives went on the defensive and struck deals to prevent hostile takeovers.State legislators countered takeovers with anti-takeover statutes at the state level. That, combined with an increased debt market and an economic downturn, discouraged merger activity. The Institutional Shareholder Services (ISS) was formed to help with voting rights. Shareholders fought with legal defenses, but judges often favored corporate decisions when outside directors supported board decisions. Investors started to advocate for more independent directors and to base executive pay on performance rather than corporate size.

2008: Financial crisis changes corporate governance history

By 2007, banks had been taking excessive risks, and there was growing concern about a possible collapse of the world financial system. Governments sought to prevent fallout by offering massive bailouts and other financial measures.

The collapse of the Lehman Brothers Bank developed into a major international banking crisis, which became the worst financial crisis since the Great Depression in the 1930s. Congress passed the Dodd-Frank Wall Street Reform and Consumer Act in 2010 to promote economic stability in the United States, a significant milestone in corporate governance history.

2010s: Corporate governance surges as risks are on the rise

The fallout from the financial crisis placed a heavier focus on best practices for corporate governance principles throughout the 2010s. Boards of directors felt more pressure than ever before to implement good governance practices like transparency and accountability. Strong governance principles encouraged corporations to have a majority of independent directors and well-composed, diverse boards. Advancements in technology improved efficiency in governance and created new risks as well. Data breaches were a new and genuine concern for corporations. The first targets were banks and financial institutions. As these institutions have bolstered the security measures in their governance framework , hackers have turned their efforts to smaller corporations within various industries, including governments.

2020s: Global economic uncertainty rattles stakeholders — and the board room

Uncertainty has so far characterized the 2020s, a decade that will surely go down in the history of corporate governance. Kicked off by the COVID-19 pandemic and the subsequent breakdown of the supply chain, 2020 pushed many Americans to question the purpose of corporations. Global geopolitics like the war in Ukraine and the Israel-Palestine conflict have only further galvanized consumers to press corporations to make a stand.

Many corporations increasingly turned to a stakeholder model of corporate governance , which equally weighs and prioritizes the interests of all people affected by corporate activity — investors, employees, and the communities in which they operate. Consumers’ focus on environmental, social, and governance (ESG) partly drove that shift, but so did regulations like the SEC’s new Climate Disclosure Rules, which up the ante on accountability .

The 2023 adoption of the universal proxy rules also gave shareholders a new voice in the boardroom. That rule put shareholders’ director nominations on the same proxy card as the corporations’ nominations, affirming shareholders’ power to influence decision-making.

2024: The history of corporate governance in the making

In 2024, boards of corporations and organizations of all sizes are finding that the best way for them to protect themselves, their shareholders and their stakeholders is to use technology to their advantage by taking a centralized approach to governance that helps boards put their best foot forward. However, the history of corporate governance continues to be rewritten. How we define corporate governance will continue to evolve in the coming years. See our list of top corporate governance trends for 2024 and beyond to master the current governance landscape and the changes that may be on the horizon.

Solutions Solutions

- Board Management

- Enterprise Risk Management

- Audit Management

- Market Intelligence

Resources Resources

- Research & Reports

Company Company

Your data matters.

Corporate Governance in America: A Brief History

Entrepreneurial, managerial, and fiduciary capitalism.

In the first part of the twentieth century, large U.S. corporations were controlled by a small number of wealthy entrepreneurs—Morgan, Rockefeller, Carnegie, Ford, and DuPont, to name a few. These “captains of industry” not only owned the majority of the stock in companies, such as Standard Oil and U.S. Steel, but they also exercised their rights to run these companies.

By the 1930s, however, the ownership of U.S. corporations had become much more widespread. Capitalism in the United States had made a transition from entrepreneurial capitalism , the model in which ownership and control had been synonymous, to managerial capitalism , a model in which ownership and control were effectively separated—that is, in which effective control of the corporation was no longer exercised by the legal owners of equity (the shareholders) but by hired, professional managers.

With the rise of institutional investing in the 1970s, primarily through private and public pension funds, the responsibility of ownership became once again concentrated in the hands of a relatively small number of institutional investors who act as fiduciaries on behalf of individuals. This large-scale institutionalization of equity brought further changes to the corporate governance landscape. Because of their size, institutional investors effectively own a major fraction of many large companies. And because this can restrict their liquidity, the de facto may have to rely on active monitoring (usually by other, smaller activist investors) than trading. This model of corporate governance, in which monitoring has become as or more important than trading, is sometimes referred to as fiduciary capitalism . [1]

The 1980s: Takeovers and Restructuring

As the ownership of American companies changed, so did the board-management relationship. For the greater part of the 20th century, when managerial capitalism prevailed, executives had a relatively free rein in interpreting their responsibilities toward the various corporate stakeholders and, as long as the corporation made money and its operations were conducted within the confines of the law, they enjoyed great autonomy. Boards of directors, mostly selected and controlled by management, intervened only infrequently, if at all. Indeed, for the first half of the last century, corporate executives of many publicly held companies managed with little or no outside control.

Example 2.9 – Modern Takeovers

In a recent takeover case, Walt Disney Co. announced it would take over 21st Century Fox at the price of $71.3 billion. The deal unites both companies Marvel franchises and adds Fox’s Deadpool to Disney’s Star Wars in addition to Fox television, FX Networks, and National Geographic. The now smaller Fox Corp. will operate as a stand alone company and retain ownership of a broadcast network and its affiliates as well as Fox News, Fox Business, and Fox Sports. Disney hopes to position itself against increasing competition from Netflix, Amazon, and possibly Apple. Unfortunately, as Disney consolidates its properties thousands of people are likely to lose their jobs.

Source: NPR.org, Disney Officially Owns 21st Century Fox , Zeqing Liu, 2019Sp

In the 1970s and 1980s, however, serious problems began to surface, such as exorbitant executive payouts, disappointing corporate earnings, and ill-considered acquisitions that amounted to little more than empire building, and depressed shareholder value. Led by a small number of wealthy, activist shareholders seeking to take advantage of the opportunity to capture underutilized assets, takeovers surged in popularity. Terms, such as leveraged buyout, dawn raids, poison pills, and junk bonds, became household words, and individual corporate raiders, including Carl Icahn, Irwin Jacobs, and T. Boone Pickens, became well known. The resulting takeover boom exposed underperforming companies and demonstrated the power of unlocking shareholder value.

Of lasting importance from this era was the emergence of institutional investors who knew the value of ownership rights, had fiduciary responsibilities to use them, and were big enough to make a difference. [2] And with the implicit assent of institutional investors, boards substantially increased the use of stock option plans that allowed managers to share in the value created by restructuring their own companies. Shareholder value, therefore, became an ally rather than a threat. [3]

The Meltdown of 2001

The year 2001 will be remembered as the year of corporate scandals. The most dramatic of these occurred in the United States—in companies such as Enron, WorldCom, Tyco, and others—but Europe also had its share, with debacles at France’s Vivendi, the Netherlands’ Ahold, Italy’s Parmalat, and ABB, a Swiss-Swedish multinational company. Even before these events fully unfolded, a rising number of complaints about executive pay, concerns about the displacement of private-sector jobs to other countries through offshoring, and issues of corporate social responsibility had begun to fuel emotional and political reactions to corporate news in the United States and abroad.

Most of these scandals involved deliberately inflating financial results, either by overstating revenues or understating costs, or diverting company funds to the private pockets of managers. Two of the most prominent examples of fraudulent “earnings management” include Enron’s creation of off–balance sheet partnerships to hide the company’s deteriorating financial position and to enrich Enron executives and WorldCom’s intentional misclassification of as much as $11 billion in expenses as capital investments—perhaps the largest accounting fraud in history.

The Enron scandal came to symbolize the excesses of corporations during the long economic boom of the 1990s. [4] Hailed by Fortune magazine as “America’s Most Innovative Company” for six straight years from 1996 to 2001, Enron became one of the largest bankruptcies in U.S. history. Its collapse in December 2001 followed the disclosure that it had reported false profits, using accounting methods that failed to follow generally accepted procedures. Both internal and external controls failed to detect the financial losses disguised as profits for a number of years. At first, Enron’s senior executives, whose activities brought the company to the brink of ruin, escaped with millions of dollars as they retired or sold their company stock before its price plummeted. Enron employees were not so lucky. Many lost their jobs and a hefty portion of retirement savings invested in Enron stock. Because the company was able to hide its losses for nearly five years, the Enron scandal shook the confidence of investors in American governance around the world.

Outside agencies, such as accounting firms, credit rating businesses, and stock market analysts had failed to warn the public about Enron’s business losses until they were obvious to all. Internal controls had not functioned, either. And Enron’s board of directors, especially its audit committee, apparently did not understand the full extent of the financial activities undertaken by the firm and, consequently, had failed in providing adequate oversight. Some experts believed that the federal government also bore some responsibility. Politicians in both the legislative and executive branches received millions of dollars in campaign donations from Enron during the period when the federal government decided to deregulate the energy industry, removing virtually all government controls. Deregulation was the critical act that made Enron’s rise as a $100 billion company possible.

In June 2002, shortly after the Enron debacle, WorldCom admitted that it had falsely reported $3.85 billion in expenses over 5 quarterly periods to make the company appear profitable when it had actually lost $1.2 billion during that period. [5] Experts said it was one of the biggest accounting frauds ever. In its aftermath, the company was forced to lay off about 17,000 workers, more than 20% of its workforce. Its stock price plummeted from a high of $64.50 in 1999 to 9 cents in late July 2002 when it filed for bankruptcy protection. In March 2004, in a formal filing with the SEC, the company detailed the full extent of its fraudulent accounting. The new statement showed the actual fraud amounted to $11 billion and was accomplished mainly by artificially reducing expenses to make earnings appear larger. After restructuring its debt and meeting other requirements imposed by a federal court, the company emerged from bankruptcy protection in April 2004 and formally changed its name to MCI Inc.

Even as it emerged from bankruptcy, industry observers anticipated that MCI would need to merge with another telecommunications firm to compete against larger companies that offered a broader range of telecommunications services. The merger materialized less than a year later, in February 2005, when Verizon Communications Inc. announced its acquisition of MCI for about $6.7 billion in cash, stocks, and dividend payments. MCI ceased to exist as an independent company under the terms of the merger, which was completed in 2006.

As Edwards (2003) notes, these scandals raised fundamental questions about the motivations and incentives of executives and about the effectiveness of existing corporate governance practices, not just in the United States, but globally. What motivated executives to engage in fraud and earnings mismanagement? Why did boards either condone or fail to recognize and stop managerial misconduct and allow managers to deceive shareholders and investors? Why did external gatekeepers, for example, auditors, credit rating agencies, and securities analysts, fail to uncover the financial fraud and earnings manipulation, and alert investors to potential discrepancies and problems? Why were shareholders themselves not more vigilant in protecting their interests, especially large institutional investors? What does this say about the motivations and incentives of money managers? [6]

Because of the significance of these questions and their influence on the welfare of the U.S. economy, the government, regulatory authorities, stock exchanges, investors, ordinary citizens, and the press all started to scrutinize the behavior of corporate boards much more carefully than they had before. The result was a wave of structural and procedural reforms aimed at making boards more responsive, more proactive, and more accountable, and at restoring public confidence in our business institutions. The major stock exchanges adopted new standards to strengthen corporate governance requirements for listed companies; then Congress passed the Sarbanes-Oxley Act of 2002, which imposes significant new disclosure and corporate governance requirements for public companies, and also provides for substantially increased liability under the federal securities laws for public companies and their executives and directors; and the SEC adopted a number of significant reforms.

The Financial Crisis of 2008

Just as investor confidence had (somewhat) been restored and the avalanche of regulatory reform that followed the 2001 meltdown digested, a new, even more damaging crisis, global in scale and scope, emerged. While it has not (yet) been labeled as a “corporate governance” crisis, the “financial crisis of 2008” once again raises important questions about the efficacy of our economic and financial systems, board oversight, and executive behavior.

Specifically, as the economic news worsened—rising inflation and unemployment, falling house prices, record bank losses, a ballooning federal deficit culminating in a $10 trillion national debt, millions of Americans losing their homes, a growing number of failures of banks and other financial institutions—CEOs, investors, and creditors are walking away with billions of dollars, while American taxpayers are being asked to pick up the tab (Freddie Mac’s chairman earned $14.5 million in 2007; Fannie Mae’s CEO earned $14.2 million that same year). Ordinary citizens who had seen the value of their 401K investment plans shrink by 40% or more.

Example 2.10 – Financial Regulation

Since 2002, companies in the United States have had to comply with the Sarbanes Oxley Act which requires that executives personally certify their company’s accounts. If the executive misrepresents something they are subject to criminal penalties. External auditors — companies other than ones that maintain record of accounts — must certify the validity of the books.

Source: The Balance, Do Regulations Keep Your Money Safer? , 2019Wi

Certainly, the 2008 crisis was complicated and even ten years later, answers remain evasive. Many believe bankers, central banks, and regulators did indeed mishandle the crisis by failing to foresee the coming disaster and for failing to impose checks and balances on financial institutions. Following the repeal of Glass-Steagall (a rule that separated commercial and investment banking) in 1999, banks needed to find ever more risky vehicles for growth. Many gave risky mortgage loans to people who could not afford them. The central bank ignored warnings signs as the emerging disaster was building up. Regulators were understaffed and overwhelmed to the point where they could not read what was available to them.

While the causes of the crisis will be debated for some time—Did we rely too much on free markets or not enough? Did special interests shape public policy? Did greed rule once again? Where were the boards of Bear Stearns, Lehman Brothers, and AIG? Were regulators asleep at the wheel? Incompetent? One thing is for sure, another wave of regulatory reform—this time possibly global in reach—is around the corner. And once again we will be asking those familiar questions: What will be the impact on investor confidence? On corporate behavior? On boards of directors? On society?

- This section is based on the essay by Hawley and Williams (2001). ↵

- Romano (1994). ↵

- Holmstrom and Kaplan (2003). ↵

- Lindstrom (2008). ↵

- “MCI, Inc.,” Microsoft® Encarta® Online Encyclopedia (2008). ↵

- Edwards (2003). ↵

Strategic Management Copyright © 2020 by John Morris is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License , except where otherwise noted.

Share This Book

- Review Article

- Open access

- Published: 22 January 2019

A literature review of the history and evolution of corporate social responsibility

- Mauricio Andrés Latapí Agudelo ORCID: orcid.org/0000-0002-7157-4015 1 ,

- Lára Jóhannsdóttir 1 &

- Brynhildur Davídsdóttir 1

International Journal of Corporate Social Responsibility volume 4 , Article number: 1 ( 2019 ) Cite this article

415k Accesses

309 Citations

70 Altmetric

Metrics details

There is a long and varied history associated with the evolution of the concept of Corporate Social Responsibility (CSR). However, a historical review is missing in the academic literature that portrays the evolution of the academic understanding of the concept alongside with the public and international events that influenced the social expectations with regards to corporate behavior. The aim of this paper is to provide a distinctive historical perspective on the evolution of CSR as a conceptual paradigm by reviewing the most relevant factors that have shaped its understanding and definition, such as academic contributions, international policies and significant social and political events. To do so, the method used is a comprehensive literature review that explores the most relevant academic contributions and public events that have influenced the evolutionary process of CSR and how they have done so. The findings show that the understanding of corporate responsibility has evolved from being limited to the generation of profit to include a broader set of responsibilities to the latest belief that the main responsibility of companies should be the generation of shared value. The findings also indicate that as social expectations of corporate behavior changed, so did the concept of Corporate Social Responsibility. The findings suggest that CSR continues to be relevant within the academic literature and can be expected to remain part of the business vocabulary at least in the short term and as a result, the authors present a plausible future for CSR that takes into consideration its historical evolution. Finally, this paper gives way for future academic research to explore how CSR can help address the latest social expectations of generating shared value as a main business objective, which in turn may have practical implications if CSR is implemented with this in mind.

Introduction

The current belief that corporations have a responsibility towards society is not new. In fact, it is possible to trace the business’ concern for society several centuries back (Carroll 2008 ). However, it was not until the 1930’s and 40’s when the role of executives and the social performance of corporations begun appearing in the literature (Carroll 1999 ) and authors begun discussing what were the specific social responsibilities of companies. In the following decades, the social expectations towards corporate behavior changed and so did the concept of Corporate Social Responsibility (CSR). The aim of this article is to find out which have been the main factors and/or events that have influenced the evolutionary process of CSR and how they have shaped the understanding of the concept. This will allow to recognize CSR as a concept that reflects the social expectations of each decade and be able to explore if it will remain relevant in the near future.

This review focuses on the most relevant academic publications and historical events that have influenced the evolution of CSR as a conceptual paradigm. The review begins with the historical roots of social responsibility and then explores the early stages of the formal and academic writing about the social responsibilities of corporations and goes through its evolution to the latest understanding of CSR. Considering that the history of CSR is long and vast, it is necessary to point out that this article focuses on publications that have provided an original perspective and understanding to the concept of CSR along with the most significant papers with regards to the evolution of the social expectations of corporate behavior (see Appendix for additional recommended readings). Along with these papers, the review takes into consideration articles that have been cited the most and can be considered as significant contributors to the evolution of the concept as well as publications that provide new definitions and frameworks. It is relevant to point out that this paper will focus on the development of CSR as a definitional construct and will not explore in detail alternative concepts that emerged in the late twentieth century.

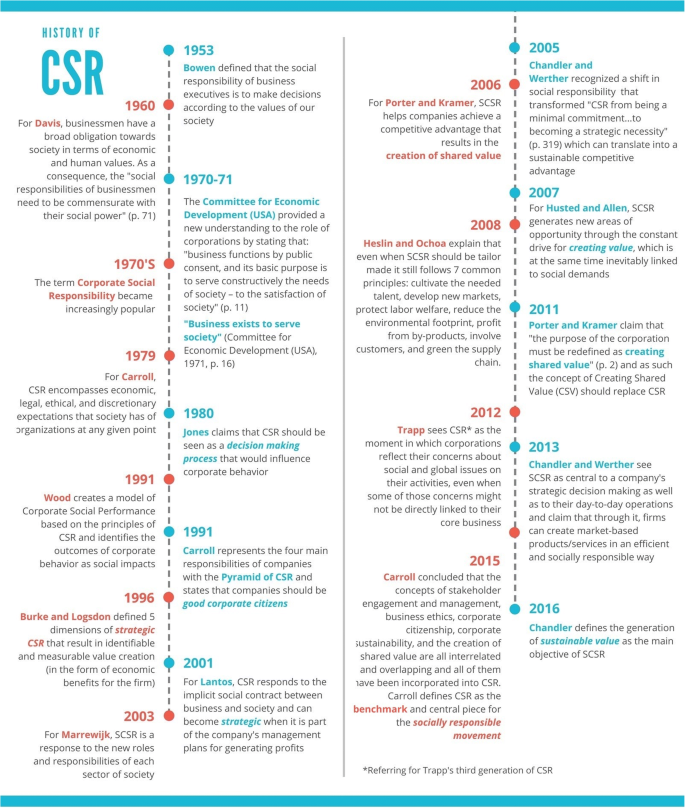

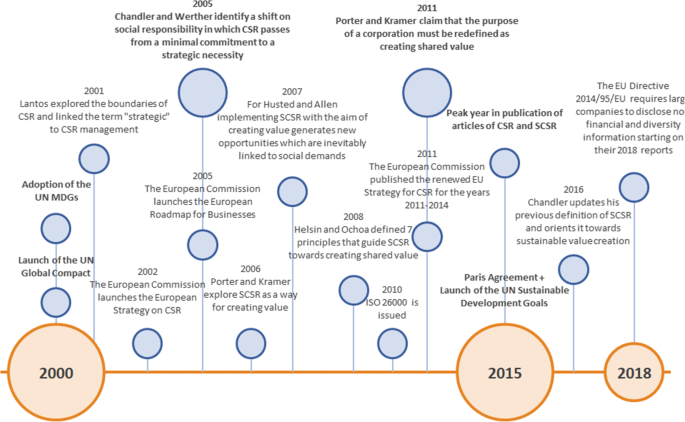

This article reviews the key historical events that played a role in the evolution of CSR. In particular, the paper focuses on events that influenced to a certain extent corporations to assume broader social responsibilities Accordingly, this article focuses on the relevant inputs to the definitional construct of the concept, most of which are of Anglo-American character, but it also considers that the growing attention on CSR has been influenced by specific calls for better business practices, such as the European CSR Strategy. As such, this paper does not portray the entire literature on the subject but highlights the key factors that shaped the evolution of CSR. Accordingly, the authors provide a summary of the evolution of the concept through a chronological timeline that allows the reader to follow the history of CSR by pointing out the most relevant academic contributions as well as the most significant events that played a role in shaping it as a conceptual paradigm.

The main contribution of this paper is a structured historical review that is accompanied with a chronological timeline of the evolution of CSR. Accordingly, the article contributes to the literature by exploring how the societal expectations of corporate behavior of each period have influenced the understanding and definitional construct of CSR. Furthermore, this article contributes to the literature on CSR by providing an innovative review of the evolution of the concept that contextualizes its development with a connection to the wider changes happening in each period. This paper also contributes to the current understanding of CSR by including a review of the development of CSR in the early twenty-first century, a period that has not been reviewed as much as earlier periods of the development of the concept.

Research method

The formal publications and literature on CSR begun as early as the 1930’s and continues to be relevant among academic journals, business magazines, books, and reports from international bodies as well as from non-governmental organizations and associations. This means that the literature on the subject is broad and a specific method is needed to achieve a comprehensive review. Given these aspects, the research was carried out following a systematic literature review (SLR) as understood by Okoli and Schabram ( 2010 ) who built on from Fink’s ( 2005 ) definition of a research literature review to define it as a systematic, explicit, comprehensive and reproducible method. The motivation for following a SLR is because it is commonly used to summarize the existing literature and identify gaps, to describe the available body of knowledge to guide professional practice, to identify effective research and development methods, to identify experts within a given field and to identify unpublished sources of information (Fink 2005 ; Okoli and Schabram 2010 ).

The extensive nature of the CSR literature required to limit the scope of the research to thematic areas directly related to the evolution and history of the concept and also limited to publications of academic or institutional character considering that they have already undergone a rigorous peer review that indicates a suitable quality for this SLR. The initial search was conducted for published journal articles using the search words “corporate social responsibility”, “history of CSR” and “evolution of CSR” on the online databases of Science Direct, ProQuest and Web of Science along with the search engine of Google Scholar. The searches were made within the search windows of the website of each database in the titles, abstracts and body of the articles and the results were provided in order of relevance. The first selection was limited to the titles of the publications and was followed by a review of the keywords and abstracts of the preferred articles. To determine the suitability of some of the articles it was necessary to review their introduction and scope. The next step in the selection of articles was focused on their quality and relevance which was determined by reviewing the level of impact factor of the journal of publication as well as the amount of citations the article has had, looking specifically for a high impact factor for each individual paper. Each article was then reviewed to determine its relevance for the research. Some articles pointed to additional references outside the initial search scope which were then searched online for their review. This included business magazines, books, and reports from international bodies and non-governmental organizations and associations. These references were reviewed and selected according to their pertinence and contribution for this paper. Following this systematic strategy allowed to review published journal articles with high impact factors along with publications of relevance mentioned by the authors of such articles. Some publications with regards to CSR had to be excluded from this review because they did not contribute directly to the evolution of the concept but we believe they are of interest in the CSR literature and thus they are listed in Appendix . Finally, the paper is structured in a way that each section corresponds to a particular period making it easier to follow the evolutionary process of CSR.

Historical roots of social responsibility

For Chaffee ( 2017 ), the origins of the social component in corporate behavior can be traced back to the ancient Roman Laws and can be seen in entities such as asylums, homes for the poor and old, hospitals and orphanages. This notion of corporations as social enterprises was carried on with the English Law during the Middle Ages in academic, municipal and religious institutions. Later, it expanded into the sixteenth and seventeenth centuries with the influence of the English Crown, which saw corporations as an instrument for social development (Chaffee 2017 ). In the following centuries, with the expansion of the English Empire and the conquering of new lands, the English Crown exported its corporate law to its American colonies where corporations played a social function to a certain extent Footnote 1 (Chaffee 2017 ).

During the eighteenth and nineteenth centuries, the Christian religious philosophy and approach to the abiding social context were seen as a response to the moral failure of society, which was visible in terms of poverty of the overall population in the English Empire and some parts of Europe (Harrison 1966 ). This religious approach gave way to social reforms and to the Victorian philanthropy which perceived a series of social problems revolving around poverty and ignorance as well as child and female labor (Carroll 2008 ; Harrison 1966 ). The religious roots of the Victorian social conscience gave Victorian Philanthropists a high level of idealism and humanism, and by the late 1800’s, the philanthropic efforts focused on the working class and the creation of welfare schemes with examples that could be seen in practice both in Europe as in the United States of America (USA) (Carroll 2008 ; Harrison 1966 ). A clear case was the creation of the Young Men’s Christian Association (YMCA), a movement that begun in London in 1844 with the objective of applying Christian values to the business activities of the time, a notion that quickly spread to the USA (see: Heald 1970 ).

During the late 1800’s and early 1900’s, the creation of welfare schemes took a paternalistic approach aimed at protecting and retaining employees and some companies even looked into improving their quality of life (Carroll 2008 ; Heald 1970 ). For Heald ( 1970 ), there were clear examples that reflected the social sensitivity of businessmen, such as the case of Macy’s in the USA, which in 1875 contributed funds to an orphan asylum and by 1887 labeled their charity donations as Miscellaneous Expenses within their accounting books, and the case of Pullman Palace Car Company which created a model industrial community in 1893 with the aim of improving the quality of life of its employees.

Also during this period, there was a growing level of urbanization and industrialization marked by large-scale production. This brought new concerns to the labor market such as: new challenges for farmers and smalls corporations to keep up with the new interdependent economy, the creation of unions of workers looking for better working conditions, and a middle class worried for the loss of religious and family values in the new industrial society (Heald 1970 ). As a response to these new challenges, and with the aim of finding harmony between the industry and the working force, some business leaders created organizations for the promotion of values and improvement of the working conditions. Such was the case of the Civic Federation of Chicago, an organization created to promote better working conditions and where religious values merged with economic objectives with a sense of civic pride (Heald 1970 ).

By the 1920’s and early 1930’s, business managers begun assuming the responsibility of balancing the maximization of profits with creating and maintaining an equilibrium with the demands of their clients, their labor force, and the community (Carroll 2008 ). This led to managers being viewed as trustees for the different set of external relations with the company, which in turn translated into social and economic responsibilities being adopted by corporations (Carroll 2008 ; Heald 1970 ). Later, with the growth of business during World War II and the 1940’s, companies begun to be seen as institutions with social responsibilities and a broader discussion of such responsibilities began taking place (Heald 1970 ). Some early examples of the debate of the social responsibilities of corporations can be found in The Functions of the Executive by Barnard ( 1938 ) and the Social Control of Business by Clark ( 1939 ).

1950’s and 1960’s: the early days of the modern era of social responsibility

It was not until the early 1950’s that the notion of specifically defining what those responsibilities were was first addressed in the literature and can be understood as the beginning of the modern definitional construct of Corporate Social Responsibility. In fact, it was during the 1950’s and 1960’s that the academic research and theoretical focus of CSR concentrated on the social level of analysis (Lee 2008 ) providing it with practical implications.

The period after World War II and the 1950’s can be considered as a time of adaptation and changing attitudes towards the discussion of corporate social responsibility, but also a time where there were few corporate actions going beyond philanthropic activities (Carroll 2008 ). Perhaps the most notable example of the changing attitude towards corporate behavior came from Bowen ( 1953 ), who believed that the large corporations of the time concentrated great power and that their actions had a tangible impact on society, and as such, there was a need for changing their decision making to include considerations of their impact.

As a result of his belief, Bowen ( 1953 ) set forth the idea of defining a specific set of principles for corporations to fulfill their social responsibilities. For him, the businessman ’s Footnote 2 decisions and actions affect their stakeholders, employees, and customers having a direct impact on the quality of life of society as a whole (Bowen 1953 ). With this in mind, Bowen defined the social responsibilities of business executives as “the obligations of businessmen to pursue those policies, to make those decisions, or to follow those lines of action which are desirable in terms of the objectives and values of our society” (Bowen 1953 , p. 6). As Carroll ( 2008 ) explains, it seems that Bowen ( 1953 ) was ahead of his time for his new approach to management which aimed at improving the business response to its social impact and by his contributions to the definition of corporate social responsibility. Furthermore, the relevance of Bowen’s approach relies on the fact that this was the first academic work focused specifically on the doctrine of social responsibility, making Bowen the “Father of Corporate Social Responsibility” (Carroll 1999 ).

After Bowen, other authors were concerned with corporate behavior and its response to the social context of the time. For example, in the book Corporation Giving in a Free Society published in 1956, Eells ( 1956 ) argued that the large corporations of the time were not living up to their responsibility in a time of generalized inflation. In a similar way, with the book A moral philosophy for management published in 1959, Selekman ( 1959 ) explored the evolution of the moral responsibility of corporations as a response to the labor expectations of the time.

These early explorations of CSR as a definitional construct, along with the social context of the time, gave way to a growing interest of scholars to define what CSR was and what it meant (Carroll 2008 ). Naturally, it is understandable that the interest in CSR during 1960’s was influenced by growing awareness in society and social movements of the time. However, it is necessary to point out that the effect of this growing interest was perhaps more visible in the USA, which is why some examples of the following sections might seem to center on this particular country.

Some of society’s main concerns during this period revolved around rapid population growth, pollution, and resource depletion (Du Pisani 2006 ) and were accompanied with social movements with respect to the environment and human and labor rights (Carroll 1999 ). At the same time, books such as The Silent Spring by Carson ( 1962 ) and The Population Bomb by Ehrlich ( 1968 ) begun raising questions with regards to the limits of economic growth and the impact that society and corporations were having on the environment.

During the 1960’s there was also a new social context marked by a growing protest culture that revolved mainly around civil rights and anti-war protests. In the case of the USA, the protests transformed from being student-led sit-ins, walk-outs and rallies, to more radical political activism which, in most cases, saw business corporations as an integral part of the “establishment” they wanted to change (Waterhouse 2017 ). These protests put pressure on companies that, in the protestors’ view, represented the “establishment” (i.e. banks and financial institutions as well large scale corporations) but had a strong focus on those with direct links to war. An example is the case of the Dow Chemical Company which produced napalm used in the Vietnam War and as a result faced constant protests and accusations (Waterhouse 2017 ).

Accordingly, during the 1960’s scholars approached CSR as a response to the problems and desires of the new modern society. A notable example of this period was Keith Davis ( 1960 ), who explained that the important social, economic and political changes taking place represented a pressure for businessmen to re-examine their role in society and their social responsibility. Davis ( 1960 ) argued that businessmen have a relevant obligation towards society in terms of economic and human values, and asserted that, to a certain extent, social responsibility could be linked to economic returns for the firm (Carroll 1999 ; Davis 1960 ). The significance of Davis’ ideas is that he indicated that the “social responsibilities of businessmen need to be commensurate with their social power” (p. 71) and that the avoidance of such would lead to a decrease of the firm’s social power (Davis 1960 ).

Other influential contributors of the time were Frederick ( 1960 ), McGuire ( 1963 ) and Walton ( 1967 ). Frederick ( 1960 ) saw the first half of the twentieth century as an intellectual and institutional transformation that changed the economic and social thinking and brought with it an increased economic power to large scale corporations. To balance the growing power of businessmen, Frederick ( 1960 ) proposed a new theory of business responsibility based on five requirements: 1) to have a criteria of value (in this case for economic production and distribution), 2) to be based on the latest concepts of management and administration, 3) to acknowledge the historical and cultural traditions behind the current social context, 4) to recognize that the behavior of an individual businessmen is a function of its role within society and its social context, and, 5) to recognize that responsible business behavior does not happen automatically but on the contrary, it is the result of deliberate and conscious efforts; then McGuire ( 1963 ), who reviewed the development of business institutions and observed changes in the scale and type of corporations, changes in public policies, and regulatory controls for businesses as well as changes in the social and economic conditions of the time. As a response to these changes, McGuire ( 1963 ) argued that the firm’s responsibility goes beyond its legal and economic obligations, and that corporations should take an interest in politics, the social welfare of the community, and the education and happiness of its employees; and Walton ( 1967 ), who explored the ideological changes taking place during the 1950’s and 60’s which were reflected in public policies, some of which saw corporations as potential contributors to the improvement of the social and economic conditions of the time (see: Walton 1967 ; Walton 1982 ). Accordingly, he provided a definition of social responsibility with which he acknowledged the relevance of the relationship between corporations and society.

It is relevant to point out that even when some scholars begun applying a wider scope to the social responsibilities of corporations, there were others who were skeptical of the notion of CSR. Notably, Milton Friedman, a renowned economist and later a Nobel laurate in economics (1976), gave in 1962 a particular perspective of the role of corporations in a free capitalist system in which firms should limit to the pursuit of economic benefits (see: Friedman 1962 ). Friedman would further explore this notion in the article The Social Responsibility of Business is to Increase its Profits published in (Friedman 1970 ) in which he sees CSR activities as an inappropriate use of company’s resources that would result in the unjustifiable spending of money for the general social interest.

Even when the social context of the 1960’s was, to some extent, reflected in the academic approach to CSR, its practical implementation remained mostly with a philanthropic character (Carroll 2008 ). Nonetheless, by the end of the decade the overall social context was reflected in the form of a strong pressure on corporations to behave according to the social expectations of the time, most of which were vividly expressed in protests and environmental and antiwar campaigns (Waterhouse 2017 ).

The 1970’s: CSR and management

The antiwar sentiment, the overall social context, and a growing sense of awareness in society during the late 1960’s translated into a low level of confidence in business to fulfill the needs and wants of the public (Waterhouse 2017 ). In fact, the low level of confidence in the business sector reached a significant point when in 1969 a major oil spill in the coast of Santa Barbara, California led to massive protests across the USA and eventually resulted in the creation of the first Earth Day celebrated in 1970. During the first Earth Day, 20 million people across the USA joined protests to demand a clean and sustainable environment and to fight against pollution, which was caused mainly by corporations (e.g. oil spills, toxic dumps, polluting factories and power plants) (Earth Day 2018 ). The first Earth Day influenced the political agenda of the USA in such a significant manner that it played a role in pushing forward the creation of the Environmental Protection Agency (EPA) by the end of 1970 (Earth Day 2018 ) and translated into a new regulatory framework that would later influence corporate behavior and create additional responsibilities for corporations.

It is equally important to mention that in the year 1970 there was a recession in the USA that was marked by a high inflation and very low growth followed by a long energy crisis (Waterhouse 2017 ). As a response to this context, and as a result of the social movements of the 1960’s and early 1970’s, the federal government of the USA made significant advances with regards to social and environmental regulations. The most notable examples were the creation of the EPA, the Consumer Product Safety Commission (CPSC), the Equal Employment Opportunity Commission (EEOC) and the Occupational Safety and Health Administration (OSHA), all of which addressed and formalized to some extent, the responsibilities of businesses with regards to the social concerns of the time (Carroll 2015 ).

Similarly, two relevant contributions from the early 1970’s that responded to the social expectations of the time came from the Committee for Economic Development (CED) of the USA, first with the publication of A New Rationale for Corporate Social Policy which explored to what extent it is justified for corporations to get involved in social problems (Baumol 1970 ) and then with the publication of the Social Responsibilities of Business Corporations which explored the new expectations that society begun placing on the business sector (Committee for Economic Development 1971 ). These publications are of relevance because they advanced the public debate around CSR by acknowledging that “business functions by public consent, and its basic purpose is to serve constructively the needs of society – to the satisfaction of society” (Committee for Economic Development 1971 , p. 11).

As Carroll ( 1999 ) and Lee ( 2008 ) point out, these publications reflect a new rationale with regards to the roles and responsibilities of corporations. Furthermore, the Committee for Economic Development ( 1971 ) acknowledged that the social contract between business and society was evolving in substantial and important ways and specifically noted that: “Business is being asked to assume broader responsibilities to society than ever before and to serve a wider range of human values. Business enterprises, in effect, are being asked to contribute more to the quality of American life than just supplying quantities of goods and services. Inasmuch as business exists to serve society, its future will depend on the quality of management’s response to the changing expectations of the public” (Committee for Economic Development 1971 , p. 16).

The Club of Rome, formed in 1968 by a group of researchers that included scientists, economists and business leaders from 25 different countries, published in 1972 the report The Limits to Growth (World Watch Institute n.d. ), a study led by the Massachusetts Institute of Technology (MIT) which questioned the viability of continued growth and its ecological footprint (The Club of Rome 2018 ). The report became of relevance for the international community because it brought the attention towards the impact of population growth, resource depletion and pollution, and pointed out the need of responsible business practices and new regulatory frameworks.

The 1970’s saw the creation of some of today’s most renowned companies with respect to social responsibility. Such is the case of the Body Shop, which was created in 1976 in the United Kingdom and Ben & Jerry’s founded in 1978 in the USA. Whether as a response to the new social expectations, a new regulatory framework, or due to a first-mover strategy, these are two notable examples of companies that begun formalizing and integrating policies that addressed the social and public issues of the time, and as a result the 1970’s entered into what Carroll ( 2015 , p. 88) called an era of “managing corporate social responsibility”. This meant that the term Corporate Social Responsibility became increasingly popular which resulted in its use under many different contexts and to such an extent that its meaning became unclear, and as a consequence it meant something different for everybody (Sethi 1975 ; Votaw 1973 ).

For instance, for Preston and Post ( 1975 ), corporations have a public responsibility that is limited by clear boundaries, meaning that anything outside is not an obligation for the firm and explained that going beyond those limits offers no clear direction for achieving the company’s main goals and can translate into an inefficient re-orientation of activities. In fact, Preston and Post stated that companies are not responsible for improving social conditions or addressing social problems and argued that a firm’s responsibility extends only to the direct consequences of their decisions and activities in which they engage (Preston and Post 1975 ). A different perception came from Sethi ( 1975 ), for whom social responsibility entails that corporate behavior should be coherent with the social norms, values and expectations, and as a result it should be prescriptive.

The unrestricted use of the term Corporate Social Responsibility during the 1970’s created an uncertainty with regards to its definition. This lasted until 1979, when Carroll proposed what is arguably the first unified definition of Corporate Social Responsibility stating that: “The social responsibility of business encompasses the economic, legal, ethical, and discretionary expectations that society has of organizations at a given point in time” (Carroll 1979 , p. 500). Even when Carroll’s ( 1979 ) approach to social responsibility corresponded to the discussion on corporate behavior of the time, and was mainly driven by the social movements of the 1960’s and the new legislations in the USA, its relevance relies on the fact that his definition builds on from the work of other scholars (including the CED) to provide a clear and concise conceptualization that could be applicable under any context, which was not the case of previous definitions of CSR (see previous definitions from: Davis 1973 ; Frederick 1960 ; M. Friedman 1962 ; McGuire 1963 ; Walton 1967 ). Another relevant contribution of Carroll’s understanding of CSR is that it does not see the economic and social objectives as incompatible trade-offs but rather as an integral part of the business framework of total social responsibility (Lee 2008 ).

During the 1970’s, the understanding of CSR was influenced by social movements and new legislations. This was reflected in the academic publications which provided companies with an approach that looked into how to comply with the new responsibilities that have been given to them by the new legislations that now covered environmental aspects as well as product safety, and labor rights (Carroll 2008 ). This gave way to the 1980’s where the discussion revolved on the ways for implementing CSR.

The 1980’s: the operationalization of CSR

During the 1970’s, there were a growing number of legislations that attended the social concerns of the time and gave a broader set of responsibilities to corporations. By contrast, during the 1980’s the Reagan and Thatcher administrations brought a new line of thought into politics with a strong focus on reducing the pressure on corporations and aiming to reduce the high levels of inflation that the USA and the United Kingdom (UK) were facing (see: Feldstein 2013 ; Wankel 2008 ). For Reagan and Thatcher, the growth and strength of the economies of their countries depended on their ability to maintain a free market environment with as little as possible state intervention (Pillay 2015 ). To do so, Reagan’s main economic goals focused on reducing the regulations on the private sector complemented with tax reductions (Feldstein 2013 ).

With governments reducing their role in regulating corporate behavior, managers were faced with a need to answer to different interest groups that still expected corporations to fulfill the social expectations of the time. Notably, the reduced regulatory framework led scholars to look into business ethics and the operationalization of CSR as a response to groups such as shareholders, employees and consumers, and the term stakeholder became common (Carroll 2008 ; Wankel 2008 ). However, scholars also begun looking into alternative or complementary concepts to CSR, some of which include corporate social performance, corporate social responsiveness, and stakeholder theory and management (Carroll 2008 ). For the purpose of this paper we will continue to focus our attention on the development of CSR as a definitional construct.

In 1980, Thomas M. Jones ( 1980 ) was arguably the first author to consider CSR as a decision making process that influence corporate behavior. Jones’ ( 1980 ) contribution gave way to a new area of debate around CSR which focused more on its operationalization than on the concept itself. This translated into the creation of new frameworks, models, and methods aimed at evaluating CSR from an operational perspective. Some notable examples of the 1980’s came from Tuzzolino and Armandi ( 1981 ), who presented a need-hierarchy framework through which the company’s socially responsible performance can be assessed based on five criteria (profitability, organizational safety, affiliation and industry context, market position and competitiveness, and self-actualization); Strand ( 1983 ), who proposed a systems model to represent the link between an organization and its social responsibility, responsiveness and responses and who identified internal and external effects of company’s behavior; Cochran and Wood ( 1984 ), who used the combined Moskowitz list Footnote 3 , a reputation index, to explore the relation between CSR and financial performance; and Wartick and Cochran ( 1985 ) who reorganized Carroll’s understanding of CSR (1979) into a framework of principles, processes, and social policies.

Perhaps the best way to understand the operationalization approach to CSR during the 1980’s is by keeping in mind that during this time there were new societal concerns. Notably, these concerns can be observed in a series of events that reflected the approach of the international community towards sustainable development and to a certain extent, to corporate behavior. The most relevant include: the creation of the European Commission’s Environment Directorate-General (1981), the establishment of the World Commission on Environment and Development chaired by the Norwegian Prime Minister Gro Harlem Brundtland (1983), the Chernobyl nuclear disaster (1986), the publication of the report Our Common Future presented by the Brundtland Commission which provided a definition of sustainable development (1987), the United Nations (UN) adoption of the Montreal Protocol (1987), and the creation of the Intergovernmental Panel on Climate Change (IPCC) (1988).

Even when these events did not relate directly to CSR, and hence did not influence directly the evolution of the concept, they reflected a growing sense of awareness of the international community with regards to environmental protection and sustainable development, and indirectly to corporate behavior. In fact, for Carroll ( 2008 ), the most relevant societal concerns and expectations of corporate behavior during the 1980’s revolved around “environmental pollution, employment discrimination, consumer abuses, employee health and safety, quality of work life, deterioration of urban life, and questionable/abusiveness practices of multinational corporations” (p. 36). As Carroll ( 2008 ) explained, this context gave way for scholars to begin looking into alternative themes, and during the 1980’s the concepts of business ethics and stakeholder management became part of the business vocabulary being part of a wider discussion around the corporate behavior of the time.

The 1990’s: globalization and CSR

During the 1990’s, significant international events influenced the international perspective towards social responsibility and the approach to sustainable development. The most relevant include: the creation of the European Environment Agency (1990), the UN summit on the Environment and Development held in Rio de Janeiro which led to the Rio Declaration on Environment and Development, the adoption of Agenda 21 and the United Nations Framework Convention on Climate Change (UNFCCC) (1992), and the adoption of the Kyoto Protocol (1997). The creation of these international bodies and the adoption of international agreements represented international efforts for setting higher standards with regards to climate-related issues and, indirectly to corporate behavior (see: Union of Concerned Scientists 2017 ).

The 1990’s were no exception to the growing interest in CSR, and in fact, it was during this decade that the concept gained international appeal, perhaps as the result of the international approach to sustainable development of the time in combination to the globalization process taking place. As Carroll ( 2015 ) explained, during the 1990’s the globalization process increased the operations of multinational corporations which now faced diverse business environments abroad, some of them with weak regulatory frameworks. For these global corporations it meant new opportunities that came along with a rising global competition for new markets, an increased reputational risk due to a growth in global visibility, and conflicting pressures, demands, and expectations from the home and the host countries (Carroll 2015 ).

Many multinational corporations understood that being socially responsible had the potential to be a safe pathway to balance the challenges and opportunities of the globalization process they were experiencing and as a result, the institutionalization of CSR became stronger (Carroll 2015 ). The most notable example of the institutionalization of CSR was the foundation in 1992 of the association Business for Social Responsibility (BSR) which initially included 51 companies with the vision of a becoming a “force for positive social change - a force that would preserve and restore natural resources, ensure human dignity and fairness, and operate transparently” (Business for Social Responsibility 2018 , para. 2).

The European Commission (EC) also played a relevant role in encouraging the implementation of CSR and begun promoting it as early as 1995 when 20 business leaders adopted the European Business Declaration against Social Exclusion in response to the EC’s call to combat social exclusion and unemployment (CSR Europe n.d. ). This resulted 1 year later, in the launch of the European Business Network for Social Cohesion (later renamed CSR Europe) which gathered business leaders with the aim of enhancing CSR within their organizations (CSR Europe n.d. ).

Even when the institutionalization of CSR grew stronger in the 1990’s, the concept itself didn’t evolve as much (Carroll 1999 ). Nevertheless, there are three contributions to CSR that are relevant to point out: Donna J. Wood ( 1991 ), driven by what she saw as a need for a systematical integration of conceptual aspects into a unified theory, built on the models of Carroll ( 1979 ) and Wartick and Cochran ( 1985 ) to create a model of Corporate Social Performance (CSP). Wood ( 1991 ) defined three dimensions of CSP: first, the principles of Corporate Social Responsibility, which include legitimacy (institutional level), public responsibility (organizational level), and managerial discretion (individual level). Second, she defined the processes of corporate social responsiveness as environmental assessment, stakeholder management, and issues management. Third, she specified the outcomes of corporate behavior as social impacts, social programs, and social policies. As a result, Wood’s model (1991) was broader and more comprehensive than the ones presented earlier by Carroll ( 1979 ) and Wartick and Cochran ( 1985 ), and its relevance relies on its contextualization of aspects of CSR within the business-social interaction by emphasizing explicitly the outcomes and performance of firms (Carroll 1999 ).

Also in 1991, Carroll ( 1991 ) presented the “Pyramid of Corporate Social Responsibility” with the aim of providing a useful approach to CSR for the executives that needed to balance their commitments to the shareholders with their obligations to a wider set of stakeholders which originated from the new governmental bodies and regulations of the USA, mainly from the establishment of the EPA, the Equal Employment Opportunity Commission (EEOC), the Occupational Safety and Health Administration (OSHA) and the Consumer Product Safety Commission (CPSC) (Carroll 1991 ). With the Pyramid of CSR, Carroll ( 1991 ) represented what he defined as the four main responsibilities of any company: 1) the economic responsibilities which are the foundation for the other levels of the pyramid; 2) the legal responsibilities of the firm; 3) the ethical responsibilities that shape the company’s behavior beyond the law-abiding duties, and; 4) the philanthropic responsibilities of the corporation with regards to its contribution to improve the quality of life of society. Besides the graphical representation of CSR in terms of responsibilities , Carroll ( 1991 ) asserted that a firm should be a good corporate citizen , a concept that he would develop further at the end of the 1990’s (see: Carroll 1998 ).

The third notable contribution of the 1990’s to the concept came from Burke and Logsdon ( 1996 ), who aimed to find evidence to link CSR to a positive financial performance of the firm, and by doing so they were arguably the first to evaluate the benefits of the strategic implementation of CSR. For them, CSR can be used with a strategic approach with the aim of supporting the core business activities and as a result improve the company’s effectiveness in achieving its main objectives (Burke and Logsdon 1996 ).

Moreover, Burke and Logsdon ( 1996 ) identified five dimensions of strategic CSR which, for them, are essential for achieving the business objectives as well as for value creation:1) centrality, which represents how close or fit is CSR to the company’s mission and objectives; 2) specificity, which represents the ability to gain specific benefits for the firm; 3) proactivity, in terms of being able to create policies in anticipation of social trends; 4) voluntarism, explained as the discretionary decision making process that is not influenced by external compliance requirements, and; 5) visibility, which refers to the relevance of the observable and recognizable CSR for internal and external stakeholders (Burke and Logsdon 1996 ). Furthermore, Burke and Logsdon ( 1996 ) argued that the implementation of strategic CSR through these five dimensions would translate into strategic outcome in the form of value creation that can be identifiable and measurable, but limited to economic benefits for the firm.

Another key contribution to the debate around corporate behavior came from the concept of “The Triple Bottom Line”, first conceived by Elkington in 1994 as a sustainability framework that balances the company’s social, environmental and economic impact. Later, Elkington ( 1998 ) explained that the way to achieve an outstanding triple bottom line performance (social, environmental, and economic) is through effective and long-term partnerships between the private and public sectors, and also among stakeholders. The triple bottom line concept became popular in the late 1990’s as a practical approach to sustainability and it has remained relevant in the CSR discussion because it indicates that corporations need to have socially and environmental responsible behavior that can be positively balanced with its economic goals. Footnote 4

As mentioned before, the globalization process of the 1990’s increased the global reach of multinational corporations and capitalism expanded rapidly, which meant that corporations began having concerns with regards to competitiveness, reputation, global visibility and an expanded network of stakeholders (Carroll 2015 ). This gave way to alternative subjects such as stakeholder theory (see: Donaldson and Preston 1995 ; Freeman 1994 ), corporate social performance (see: Swanson 1995 ), and corporate citizenship (see: Carroll 1998 ). The introduction of new themes, even when almost all of them were consistent with, and built on the existing CSR definitions and understanding (Carroll 1999 ), created an uncertainty with regards to the definition of CSR to the extent that the concept ended up having “unclear boundaries and debatable legitimacy” (Lantos 2001 , p. 1). This meant that by the end of the 1990’s there was a lack of a globally accepted definition of CSR (Lantos 2001 ), which was accompanied by a social and institutional impetus for making companies become good corporate citizens (see: Carroll 1998 ).

2000’s: recognition and implementation of CSR

The decade of the 2000’s is divided in two sections due to the amount of relevant events around CSR. The first section is focused on the recognition and expansion of CSR and its implementation, while the second section is focused on the strategic approach to CSR provided by the academic publications of the time.

The debate around CSR has been brought forward several times by public figures. Footnote 5 Such was the case of President Reagan who, with the aim of stimulating the economy and generating economic growth in the 1980’s, called upon the private sector for more responsible business practices and emphasized that corporations should take a leading role in social responsibility (Carroll 2015 ). During the 1990’s, it was President Clinton who brought the attention towards the notion of corporate citizenship and social responsibility with the creation of the Ron Brown Corporate Citizenship Award for companies that were good corporate citizens (Carroll 1998 ).

However, it was not until 1999 that CSR gained global attention with the landmark speech of then Secretary General of the United Nations, Kofi Annan, who at the World Economic Forum said: “I propose that you, the business leaders gathered in Davos, and we, the United Nations, initiate a global compact of shared values and principles, which will give a human face to the global market” (United Nations Global Compact n.d. , para. 5). As a result, the United Nations Global Compact (UNGC) was launched on July 2000 gathering 44 global companies, 6 business associations, and 2 labor and 12 civil society organizations (United Nations Global Compact n.d. ). Notably, the idea behind the creation of the UNGC was to create an instrument that would fill the gaps in governance of the time in terms of human rights and social and environmental issues and to insert universal values into the markets (United Nations Global Compact n.d. ).

Perhaps the most notable achievement of the UNGC was the definition of ten principles that guide the corporate behavior of its members, who are expected to incorporate them into their strategies, policies and procedures with the aim of creating a corporate culture of integrity with long term aims (United Nations Global Compact n.d. ). Even when the UNGC was never directly linked to CSR, it can be understood that the ten principles, with their focus on human rights, labor, environment, and anti-corruption, brought the global attention towards social responsibility.

It was also in the year 2000 when the United Nations adopted the Millennium Declaration with its eight Millennium Development Goals (MDGs) and set the international agenda for the following 15 years. Even when the MDGs and the debate around them was not directly linked to CSR, the United Nations Development Program (UNDP) pointed it out as a framework for the UN – private sector cooperation with the aim of achieving its goals (Murata n.d. ) and as a result the global recognition of the concept became stronger.

The promotion of CSR as a distinct European strategy begun 1 year after the adoption of the MDGs and the creation of the UNGC, when the EC presented a Green Paper called Promoting a European framework for Corporate Social Responsibility (2001) which derived from the new social expectations and concerns of the time, including the growing concern about the environmental impact of economic activities (Commission of the European Communities 2001 ). Notably, the Green Paper presented a European approach to CSR that aimed to reflect and be integrated in the broader context of international initiatives such as the UNGC (Commission of the European Communities 2001 ). This was the first step towards the European Strategy on CSR adopted in 2002 and since then, the EC has led a series of campaigns for promoting the European approach to CSR which derives from the understanding that CSR is: “the responsibility of enterprises for their impacts on society and outlines what an enterprise should do to meet that responsibility” (European Commission 2011 , para. 2).

Between 2001 and 2004 the EC held a series of conferences for discussing CSR (“What is CSR” in Brussels, “Why CSR” in Helsinki, and “How to promote and implement CSR” in Venice) which resulted in its adoption as a strategic element for the Plan of the General Direction of Business of the European Commission (Eberhard-Harribey 2006 ). Accordingly, in 2005 the EC launched the “European Roadmap for Businesses – Towards a Competitive and Sustainable Enterprise” that outlined the European objectives with regards to CSR for the following years (CSR Europe n.d. ). In practical terms, these events translated into a unified vision and understanding of CSR that would be promoted around European businesses.

In 2011, the EC published the renewed European Union (EU) strategy for CSR for the years 2011–2014 followed by a public consultation in 2014 with regards to its achievements, shortcomings, and future challenges. The 2014 consultation showed that 83% of the respondents believed that the EC should continue engaging in CSR policy and 80% thought that CSR played an important role for the sustainability of the EU economy (European Commission 2014a ). In 2015, the EC held a multi-stakeholder forum on CSR which concluded that the Commission should continue to play an important role in the promotion of CSR and help embed social responsibility into company’s strategies (European Commission 2015 ).

In 2015, CSR Europe launched the Enterprise 2020 Manifesto which aimed to set the direction of businesses in Europe and play a leading role in developing an inclusive sustainable economy (CSR Europe 2016 ) and can be understood as a response to the EU Strategy on CSR as well as to the United Nations Sustainable Development Goals. The Manifesto is perhaps the most relevant contribution from CSR Europe in the second half of the 2010’s mainly because it has a strategic approach that aims to ensure value creation for its stakeholders through the 10,000 companies reached through its network (CSR Europe 2016 ). The Manifesto focuses on the generation of value on five key areas: 1) societal impact through the promotion of responsible and sustainable business practices; 2) membership engagement and satisfaction which is meant to guarantee the continuity in the work of CSR Europe to achieve its mission and societal impact; 3) financial stability; 4) employee engagement focused on the investment of individual development as well as organizational capacity, and; 5) environmental impact assessment to determine areas of improvement (CSR Europe 2016 ).

The global recognition of CSR has also been influenced by international certifications designed to address social responsibility. Such is the case of the ISO 26000 which history can be traced to 2002 when the Committee on Consumer Policy of the International Organization for Standardization (ISO) proposed the creation of CSR guidelines to complement the quality and environmental management standards (ISO 9001 and ISO 14001) (ISO n.d.-a ). A working group led by Brazil and Sweden collaborated with stakeholders and National Standards Bodies for a period of 5 years (2005–2010) and came up with the approved ISO 26000 – Social Responsibility in September 2010 (ISO n.d.-a ).

The development of the ISO 26000 is of relevance for the CSR movement not only because it serves as a guideline for the way in which businesses can operate in a socially responsible way, but more so because it was developed by 450 experts of 99 countries and 40 international organizations and so far it has been adopted by more than 80 countries as a guideline for national standards (ISO n.d.-b , n.d.-c ).

2000’s: strategic approach to CSR

Beyond the institutional and public influence in the implementation of CSR, the 2000’s saw relevant contributions to the concept through the academic literature. In the early years of the twenty-first century, Craig Smith ( 2001 ) explained that corporate policies had changed as a response to public interest and as a result this often had a positive social impact. This meant that the scope of social responsibility (from a business perspective) was now inclusive to a broader set of stakeholders and a new definition was set forward: “Corporate social responsibility (CSR) refers to the obligations of the firm to its stakeholders – people affected by corporate policies and practices. These obligations go beyond legal requirements and the firm’s duties to its shareholders. Fulfillment of these obligations is intended to minimize any harm and maximize the long-run beneficial impact of the firm on society” (Smith 2001 , p. 142).

Smith’s definition of CSR (2001) gave hints of the need of making CSR part of a company’s strategic perspective in order to be able to fulfill its long term obligations towards society. This was reaffirmed by Lantos ( 2001 ) that same year, who pointed out that during the twenty-first century society would demand corporations to make social issues part of their strategies (see also: Carroll 1998 ).