6.3 Steps in a Successful Marketing Research Plan

Learning outcomes.

By the end of this section, you will be able to:

- 1 Identify and describe the steps in a marketing research plan.

- 2 Discuss the different types of data research.

- 3 Explain how data is analyzed.

- 4 Discuss the importance of effective research reports.

Define the Problem

There are seven steps to a successful marketing research project (see Figure 6.3 ). Each step will be explained as we investigate how a marketing research project is conducted.

The first step, defining the problem, is often a realization that more information is needed in order to make a data-driven decision. Problem definition is the realization that there is an issue that needs to be addressed. An entrepreneur may be interested in opening a small business but must first define the problem that is to be investigated. A marketing research problem in this example is to discover the needs of the community and also to identify a potentially successful business venture.

Many times, researchers define a research question or objectives in this first step. Objectives of this research study could include: identify a new business that would be successful in the community in question, determine the size and composition of a target market for the business venture, and collect any relevant primary and secondary data that would support such a venture. At this point, the definition of the problem may be “Why are cat owners not buying our new cat toy subscription service?”

Additionally, during this first step we would want to investigate our target population for research. This is similar to a target market, as it is the group that comprises the population of interest for the study. In order to have a successful research outcome, the researcher should start with an understanding of the problem in the current situational environment.

Develop the Research Plan

Step two is to develop the research plan. What type of research is necessary to meet the established objectives of the first step? How will this data be collected? Additionally, what is the time frame of the research and budget to consider? If you must have information in the next week, a different plan would be implemented than in a situation where several months were allowed. These are issues that a researcher should address in order to meet the needs identified.

Research is often classified as coming from one of two types of data: primary and secondary. Primary data is unique information that is collected by the specific researcher with the current project in mind. This type of research doesn’t currently exist until it is pulled together for the project. Examples of primary data collection include survey, observation, experiment, or focus group data that is gathered for the current project.

Secondary data is any research that was completed for another purpose but can be used to help inform the research process. Secondary data comes in many forms and includes census data, journal articles, previously collected survey or focus group data of related topics, and compiled company data. Secondary data may be internal, such as the company’s sales records for a previous quarter, or external, such as an industry report of all related product sales. Syndicated data , a type of external secondary data, is available through subscription services and is utilized by many marketers. As you can see in Table 6.1 , primary and secondary data features are often opposite—the positive aspects of primary data are the negative side of secondary data.

There are four research types that can be used: exploratory, descriptive, experimental, and ethnographic research designs (see Figure 6.4 ). Each type has specific formats of data that can be collected. Qualitative research can be shared through words, descriptions, and open-ended comments. Qualitative data gives context but cannot be reduced to a statistic. Qualitative data examples are categorical and include case studies, diary accounts, interviews, focus groups, and open-ended surveys. By comparison, quantitative data is data that can be reduced to number of responses. The number of responses to each answer on a multiple-choice question is quantitative data. Quantitative data is numerical and includes things like age, income, group size, and height.

Exploratory research is usually used when additional general information in desired about a topic. When in the initial steps of a new project, understanding the landscape is essential, so exploratory research helps the researcher to learn more about the general nature of the industry. Exploratory research can be collected through focus groups, interviews, and review of secondary data. When examining an exploratory research design, the best use is when your company hopes to collect data that is generally qualitative in nature. 7

For instance, if a company is considering a new service for registered users but is not quite sure how well the new service will be received or wants to gain clarity of exactly how customers may use a future service, the company can host a focus group. Focus groups and interviews will be examined later in the chapter. The insights collected during the focus group can assist the company when designing the service, help to inform promotional campaign options, and verify that the service is going to be a viable option for the company.

Descriptive research design takes a bigger step into collection of data through primary research complemented by secondary data. Descriptive research helps explain the market situation and define an “opinion, attitude, or behavior” of a group of consumers, employees, or other interested groups. 8 The most common method of deploying a descriptive research design is through the use of a survey. Several types of surveys will be defined later in this chapter. Descriptive data is quantitative in nature, meaning the data can be distilled into a statistic, such as in a table or chart.

Again, descriptive data is helpful in explaining the current situation. In the opening example of LEGO , the company wanted to describe the situation regarding children’s use of its product. In order to gather a large group of opinions, a survey was created. The data that was collected through this survey allowed the company to measure the existing perceptions of parents so that alterations could be made to future plans for the company.

Experimental research , also known as causal research , helps to define a cause-and-effect relationship between two or more factors. This type of research goes beyond a correlation to determine which feature caused the reaction. Researchers generally use some type of experimental design to determine a causal relationship. An example is A/B testing, a situation where one group of research participants, group A, is exposed to one treatment and then compared to the group B participants, who experience a different situation. An example might be showing two different television commercials to a panel of consumers and then measuring the difference in perception of the product. Another example would be to have two separate packaging options available in different markets. This research would answer the question “Does one design sell better than the other?” Comparing that to the sales in each market would be part of a causal research study. 9

The final method of collecting data is through an ethnographic design. Ethnographic research is conducted in the field by watching people interact in their natural environment. For marketing research, ethnographic designs help to identify how a product is used, what actions are included in a selection, or how the consumer interacts with the product. 10

Examples of ethnographic research would be to observe how a consumer uses a particular product, such as baking soda. Although many people buy baking soda, its uses are vast. So are they using it as a refrigerator deodorizer, a toothpaste, to polish a belt buckle, or to use in baking a cake?

Select the Data Collection Method

Data collection is the systematic gathering of information that addresses the identified problem. What is the best method to do that? Picking the right method of collecting data requires that the researcher understand the target population and the design picked in the previous step. There is no perfect method; each method has both advantages and disadvantages, so it’s essential that the researcher understand the target population of the research and the research objectives in order to pick the best option.

Sometimes the data desired is best collected by watching the actions of consumers. For instance, how many cars pass a specific billboard in a day? What website led a potential customer to the company’s website? When are consumers most likely to use the snack vending machines at work? What time of day has the highest traffic on a social media post? What is the most streamed television program this week? Observational research is the collecting of data based on actions taken by those observed. Many data observations do not require the researched individuals to participate in the data collection effort to be highly valuable. Some observation requires an individual to watch and record the activities of the target population through personal observations .

Unobtrusive observation happens when those being observed aren’t aware that they are being watched. An example of an unobtrusive observation would be to watch how shoppers interact with a new stuffed animal display by using a one-way mirror. Marketers can identify which products were handled more often while also determining which were ignored.

Other methods can use technology to collect the data instead. Instances of mechanical observation include the use of vehicle recorders, which count the number of vehicles that pass a specific location. Computers can also assess the number of shoppers who enter a store, the most popular entry point for train station commuters, or the peak time for cars to park in a parking garage.

When you want to get a more in-depth response from research participants, one method is to complete a one-on-one interview . One-on-one interviews allow the researcher to ask specific questions that match the respondent’s unique perspective as well as follow-up questions that piggyback on responses already completed. An interview allows the researcher to have a deeper understanding of the needs of the respondent, which is another strength of this type of data collection. The downside of personal interviews it that a discussion can be very time-consuming and results in only one respondent’s answers. Therefore, in order to get a large sample of respondents, the interview method may not be the most efficient method.

Taking the benefits of an interview and applying them to a small group of people is the design of a focus group . A focus group is a small number of people, usually 8 to 12, who meet the sample requirements. These individuals together are asked a series of questions where they are encouraged to build upon each other’s responses, either by agreeing or disagreeing with the other group members. Focus groups are similar to interviews in that they allow the researcher, through a moderator, to get more detailed information from a small group of potential customers (see Figure 6.5 ).

Link to Learning

Focus groups.

Focus groups are a common method for gathering insights into consumer thinking and habits. Companies will use this information to develop or shift their initiatives. The best way to understand a focus group is to watch a few examples or explanations. TED-Ed has this video that explains how focus groups work.

You might be asking when it is best to use a focus group or a survey. Learn the differences, the pros and cons of each, and the specific types of questions you ask in both situations in this article .

Preparing for a focus group is critical to success. It requires knowing the material and questions while also managing the group of people. Watch this video to learn more about how to prepare for a focus group and the types of things to be aware of.

One of the benefits of a focus group over individual interviews is that synergy can be generated when a participant builds on another’s ideas. Additionally, for the same amount of time, a researcher can hear from multiple respondents instead of just one. 11 Of course, as with every method of data collection, there are downsides to a focus group as well. Focus groups have the potential to be overwhelmed by one or two aggressive personalities, and the format can discourage more reserved individuals from speaking up. Finally, like interviews, the responses in a focus group are qualitative in nature and are difficult to distill into an easy statistic or two.

Combining a variety of questions on one instrument is called a survey or questionnaire . Collecting primary data is commonly done through surveys due to their versatility. A survey allows the researcher to ask the same set of questions of a large group of respondents. Response rates of surveys are calculated by dividing the number of surveys completed by the total number attempted. Surveys are flexible and can collect a variety of quantitative and qualitative data. Questions can include simplified yes or no questions, select all that apply, questions that are on a scale, or a variety of open-ended types of questions. There are four types of surveys (see Table 6.2 ) we will cover, each with strengths and weaknesses defined.

Let’s start off with mailed surveys —surveys that are sent to potential respondents through a mail service. Mailed surveys used to be more commonly used due to the ability to reach every household. In some instances, a mailed survey is still the best way to collect data. For example, every 10 years the United States conducts a census of its population (see Figure 6.6 ). The first step in that data collection is to send every household a survey through the US Postal Service (USPS). The benefit is that respondents can complete and return the survey at their convenience. The downside of mailed surveys are expense and timeliness of responses. A mailed survey requires postage, both when it is sent to the recipient and when it is returned. That, along with the cost of printing, paper, and both sending and return envelopes, adds up quickly. Additionally, physically mailing surveys takes time. One method of reducing cost is to send with bulk-rate postage, but that slows down the delivery of the survey. Also, because of the convenience to the respondent, completed surveys may be returned several weeks after being sent. Finally, some mailed survey data must be manually entered into the analysis software, which can cause delays or issues due to entry errors.

Phone surveys are completed during a phone conversation with the respondent. Although the traditional phone survey requires a data collector to talk with the participant, current technology allows for computer-assisted voice surveys or surveys to be completed by asking the respondent to push a specific button for each potential answer. Phone surveys are time intensive but allow the respondent to ask questions and the surveyor to request additional information or clarification on a question if warranted. Phone surveys require the respondent to complete the survey simultaneously with the collector, which is a limitation as there are restrictions for when phone calls are allowed. According to Telephone Consumer Protection Act , approved by Congress in 1991, no calls can be made prior to 8:00 a.m. or after 9:00 p.m. in the recipient’s time zone. 12 Many restrictions are outlined in this original legislation and have been added to since due to ever-changing technology.

In-person surveys are when the respondent and data collector are physically in the same location. In-person surveys allow the respondent to share specific information, ask questions of the surveyor, and follow up on previous answers. Surveys collected through this method can take place in a variety of ways: through door-to-door collection, in a public location, or at a person’s workplace. Although in-person surveys are time intensive and require more labor to collect data than some other methods, in some cases it’s the best way to collect the required data. In-person surveys conducted through a door-to-door method is the follow-up used for the census if respondents do not complete the mailed survey. One of the downsides of in-person surveys is the reluctance of potential respondents to stop their current activity and answer questions. Furthermore, people may not feel comfortable sharing private or personal information during a face-to-face conversation.

Electronic surveys are sent or collected through digital means and is an opportunity that can be added to any of the above methods as well as some new delivery options. Surveys can be sent through email, and respondents can either reply to the email or open a hyperlink to an online survey (see Figure 6.7 ). Additionally, a letter can be mailed that asks members of the survey sample to log in to a website rather than to return a mailed response. Many marketers now use links, QR codes, or electronic devices to easily connect to a survey. Digitally collected data has the benefit of being less time intensive and is often a more economical way to gather and input responses than more manual methods. A survey that could take months to collect through the mail can be completed within a week through digital means.

Design the Sample

Although you might want to include every possible person who matches your target market in your research, it’s often not a feasible option, nor is it of value. If you did decide to include everyone, you would be completing a census of the population. Getting everyone to participate would be time-consuming and highly expensive, so instead marketers use a sample , whereby a portion of the whole is included in the research. It’s similar to the samples you might receive at the grocery store or ice cream shop; it isn’t a full serving, but it does give you a good taste of what the whole would be like.

So how do you know who should be included in the sample? Researchers identify parameters for their studies, called sample frames . A sample frame for one study may be college students who live on campus; for another study, it may be retired people in Dallas, Texas, or small-business owners who have fewer than 10 employees. The individual entities within the sampling frame would be considered a sampling unit . A sampling unit is each individual respondent that would be considered as matching the sample frame established by the research. If a researcher wants businesses to participate in a study, then businesses would be the sampling unit in that case.

The number of sampling units included in the research is the sample size . Many calculations can be conducted to indicate what the correct size of the sample should be. Issues to consider are the size of the population, the confidence level that the data represents the entire population, the ease of accessing the units in the frame, and the budget allocated for the research.

There are two main categories of samples: probability and nonprobability (see Figure 6.8 ). Probability samples are those in which every member of the sample has an identified likelihood of being selected. Several probability sample methods can be utilized. One probability sampling technique is called a simple random sample , where not only does every person have an identified likelihood of being selected to be in the sample, but every person also has an equal chance of exclusion. An example of a simple random sample would be to put the names of all members of a group into a hat and simply draw out a specific number to be included. You could say a raffle would be a good example of a simple random sample.

Another probability sample type is a stratified random sample , where the population is divided into groups by category and then a random sample of each category is selected to participate. For instance, if you were conducting a study of college students from your school and wanted to make sure you had all grade levels included, you might take the names of all students and split them into different groups by grade level—freshman, sophomore, junior, and senior. Then, from those categories, you would draw names out of each of the pools, or strata.

A nonprobability sample is a situation in which each potential member of the sample has an unknown likelihood of being selected in the sample. Research findings that are from a nonprobability sample cannot be applied beyond the sample. Several examples of nonprobability sampling are available to researchers and include two that we will look at more closely: convenience sampling and judgment sampling.

The first nonprobability sampling technique is a convenience sample . Just like it sounds, a convenience sample is when the researcher finds a group through a nonscientific method by picking potential research participants in a convenient manner. An example might be to ask other students in a class you are taking to complete a survey that you are doing for a class assignment or passing out surveys at a basketball game or theater performance.

A judgment sample is a type of nonprobability sample that allows the researcher to determine if they believe the individual meets the criteria set for the sample frame to complete the research. For instance, you may be interested in researching mothers, so you sit outside a toy store and ask an individual who is carrying a baby to participate.

Collect the Data

Now that all the plans have been established, the instrument has been created, and the group of participants has been identified, it is time to start collecting data. As explained earlier in this chapter, data collection is the process of gathering information from a variety of sources that will satisfy the research objectives defined in step one. Data collection can be as simple as sending out an email with a survey link enclosed or as complex as an experiment with hundreds of consumers. The method of collection directly influences the length of this process. Conducting personal interviews or completing an experiment, as previously mentioned, can add weeks or months to the research process, whereas sending out an electronic survey may allow a researcher to collect the necessary data in a few days. 13

Analyze and Interpret the Data

Once the data has been collected, the process of analyzing it may begin. Data analysis is the distillation of the information into a more understandable and actionable format. The analysis itself can take many forms, from the use of basic statistics to a more comprehensive data visualization process. First, let’s discuss some basic statistics that can be used to represent data.

The first is the mean of quantitative data. A mean is often defined as the arithmetic average of values. The formula is:

A common use of the mean calculation is with exam scores. Say, for example, you have earned the following scores on your marketing exams: 72, 85, 68, and 77. To find the mean, you would add up the four scores for a total of 302. Then, in order to generate a mean, that number needs to be divided by the number of exam scores included, which is 4. The mean would be 302 divided by 4, for a mean test score of 75.5. Understanding the mean can help to determine, with one number, the weight of a particular value.

Another commonly used statistic is median. The median is often referred to as the middle number. To generate a median, all the numeric answers are placed in order, and the middle number is the median. Median is a common statistic when identifying the income level of a specific geographic region. 14 For instance, the median household income for Albuquerque, New Mexico, between 2015 and 2019 was $52,911. 15 In this case, there are just as many people with an income above the amount as there are below.

Mode is another statistic that is used to represent data of all types, as it can be used with quantitative or qualitative data and represents the most frequent answer. Eye color, hair color, and vehicle color can all be presented with a mode statistic. Additionally, some researchers expand on the concept of mode and present the frequency of all responses, not just identifying the most common response. Data such as this can easily be presented in a frequency graph, 16 such as the one in Figure 6.9 .

Additionally, researchers use other analyses to represent the data rather than to present the entirety of each response. For example, maybe the relationship between two values is important to understand. In this case, the researcher may share the data as a cross tabulation (see Figure 6.10 ). Below is the same data as above regarding social media use cross tabulated with gender—as you can see, the data is more descriptive when you can distinguish between the gender identifiers and how much time is spent per day on social media.

Not all data can be presented in a graphical format due to the nature of the information. Sometimes with qualitative methods of data collection, the responses cannot be distilled into a simple statistic or graph. In that case, the use of quotations, otherwise known as verbatims , can be used. These are direct statements presented by the respondents. Often you will see a verbatim statement when reading a movie or book review. The critic’s statements are used in part or in whole to represent their feelings about the newly released item.

Infographics

As they say, a picture is worth a thousand words. For this reason, research results are often shown in a graphical format in which data can be taken in quickly, called an infographic .

Check out this infographic on what components make for a good infographic. As you can see, a good infographic needs four components: data, design, a story, and the ability to share it with others. Without all four pieces, it is not as valuable a resource as it could be. The ultimate infographic is represented as the intersection of all four.

Infographics are particularly advantageous online. Refer to this infographic on why they are beneficial to use online .

Prepare the Research Report

The marketing research process concludes by sharing the generated data and makes recommendations for future actions. What starts as simple data must be interpreted into an analysis. All information gathered should be conveyed in order to make decisions for future marketing actions. One item that is often part of the final step is to discuss areas that may have been missed with the current project or any area of further study identified while completing it. Without the final step of the marketing research project, the first six steps are without value. It is only after the information is shared, through a formal presentation or report, that those recommendations can be implemented and improvements made. The first six steps are used to generate information, while the last is to initiate action. During this last step is also when an evaluation of the process is conducted. If this research were to be completed again, how would we do it differently? Did the right questions get answered with the survey questions posed to the respondents? Follow-up on some of these key questions can lead to additional research, a different study, or further analysis of data collected.

Methods of Quantifying Marketing Research

One of the ways of sharing information gained through marketing research is to quantify the research . Quantifying the research means to take a variety of data and compile into a quantity that is more easily understood. This is a simple process if you want to know how many people attended a basketball game, but if you want to quantify the number of students who made a positive comment on a questionnaire, it can be a little more complicated. Researchers have a variety of methods to collect and then share these different scores. Below are some of the most common types used in business.

Is a customer aware of a product, brand, or company? What is meant by awareness? Awareness in the context of marketing research is when a consumer is familiar with the product, brand, or company. It does not assume that the consumer has tried the product or has purchased it. Consumers are just aware. That is a measure that many businesses find valuable. There are several ways to measure awareness. For instance, the first type of awareness is unaided awareness . This type of awareness is when no prompts for a product, brand, or company are given. If you were collecting information on fast-food restaurants, you might ask a respondent to list all the fast-food restaurants that serve a chicken sandwich. Aided awareness would be providing a list of products, brands, or companies and the respondent selects from the list. For instance, if you give a respondent a list of fast-food restaurants and ask them to mark all the locations with a chicken sandwich, you are collecting data through an aided method. Collecting these answers helps a company determine how the business location compares to those of its competitors. 17

Customer Satisfaction (CSAT)

Have you ever been asked to complete a survey at the end of a purchase? Many businesses complete research on buying, returning, or other customer service processes. A customer satisfaction score , also known as CSAT, is a measure of how satisfied customers are with the product, brand, or service. A CSAT score is usually on a scale of 0 to 100 percent. 18 But what constitutes a “good” CSAT score? Although what is identified as good can vary by industry, normally anything in the range from 75 to 85 would be considered good. Of course, a number higher than 85 would be considered exceptional. 19

Customer Acquisition Cost (CAC) and Customer Effort Score (CES)

Other metrics often used are a customer acquisition cost (CAC) and customer effort score (CES). How much does it cost a company to gain customers? That’s the purpose of calculating the customer acquisition cost. To calculate the customer acquisition cost , a company would need to total all expenses that were accrued to gain new customers. This would include any advertising, public relations, social media postings, etc. When a total cost is determined, it is divided by the number of new customers gained through this campaign.

The final score to discuss is the customer effort score , also known as a CES. The CES is a “survey used to measure the ease of service experience with an organization.” 20 Companies that are easy to work with have a better CES than a company that is notorious for being difficult. An example would be to ask a consumer about the ease of making a purchase online by incorporating a one-question survey after a purchase is confirmed. If a number of responses come back negative or slightly negative, the company will realize that it needs to investigate and develop a more user-friendly process.

Knowledge Check

It’s time to check your knowledge on the concepts presented in this section. Refer to the Answer Key at the end of the book for feedback.

- Defining the problem

- Developing the research plan

- Selecting a data collection method

- Designing the sample

- you are able to send it to all households in an area

- it is inexpensive

- responses are automatically loaded into the software

- the data comes in quickly

- Primary data

- Secondary data

- Secondary and primary data

- Professional data

- It shows how respondents answered two variables in relation to each other and can help determine patterns by different groups of respondents.

- By presenting the data in the form of a picture, the information is easier for the reader to understand.

- It is an easy way to see how often one answer is selected by the respondents.

- This analysis can used to present interview or focus group data.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-marketing/pages/1-unit-introduction

- Authors: Dr. Maria Gomez Albrecht, Dr. Mark Green, Linda Hoffman

- Publisher/website: OpenStax

- Book title: Principles of Marketing

- Publication date: Jan 25, 2023

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-marketing/pages/1-unit-introduction

- Section URL: https://openstax.org/books/principles-marketing/pages/6-3-steps-in-a-successful-marketing-research-plan

© Jan 9, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Marketing Planning and Marketing Research

- First Online: 09 March 2023

Cite this chapter

- Ralf T. Kreutzer 2

1353 Accesses

In this chapter, the reader learns to understand the importance of planning for companies, to apply different planning concepts, to recognize the importance of strategic business units, to distinguish between strategic and operational planning in their contents and their maturities, and to confidently master cognitive goals, tasks, and methods of marketing analysis in the context of marketing research.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

agma. (2021). Datenerhebung der TV-Nutzung . https://www.agma-mmc.de/media-analyse/fernsehen/datenerhebung . Accessed on 07.04.2021

Altobelli, C. F. (2017). Marktforschung. Methoden – Anwendungen – Praxisbeispiele (3. Aufl.). UVK.

Google Scholar

Backhaus, K., Erichson, B., Gensler, S., Weiber, R., & Weiber, T. (2021). Multivariate Analysemethoden: Eine anwendungsorientierte Einführung (16. Aufl.). Springer Gabler.

Braunberger, G. (2005, Dezember). Kaufen und Kopieren. Wie China mit Airbus spielt. Frankfurter Allgemeine Sonntagszeitung, 11 , S. 50.

Bruhn, M., & Hadwich, K. (2017). Produkt- und Servicemanagement (2. Aufl.). Vahlen.

Concept M. (2021). Das Alltagsstudio . https://conceptm.eu/alltagsstudio/ . Accessed on 07.04.2021.

Daimler. (2021a). Daimler im Überblick . https://www.daimler.com/konzern/ueberblick.html . Accessed on 06.04.2021.

Daimler. (2021b). Daimler plant Aufteilung des Geschäfts in zwei unabhängige Unternehmen . https://www.daimler.com/investoren/berichte-news/finanznachrichten/20210203-projekt-focus.html . Accessed on 06.04.2021.

Dillerup, R., & Stoi, R. (2021). Unternehmensführung. Management & Leadership (6. Aufl.). Vahlen.

DIW. (2021). Kurzporträt . https://www.diw.de/de/diw_01.c.615551.de/forschungsbasierte_infrastruktureinrichtung__sozio-oekonomisches_panel__soep.html . Accessed on 17.05.2021.

GfK. (2021a). GfK Shopper Behavior. Das Wer, Was und Wo des Kaufverhaltens. https://www.gfk.com/de/produkte/markt-und-retail-intelligence/gfk-shopper-behavior . Accessed on 12.04.2021.

GfK. (2021b). GfK Why2Buy . https://www.gfk.com/de/produkte/The-Why-behind-the-Buy . Accessed on 12.04.2021.

Go2market. (2021). Wir sehen Produkte mit den Augen der Konsumenten . https://go2.markets/industriepartner . Accessed on 12.04.2021.

Homburg, C. (2020). Marketingmanagement. Strategie – Instrumente – Umsetzung – Unternehmensführung (7. Aufl.). Springer Gabler.

Kaplan, K. (2016). When and how to create customer journey maps . https://www.nngroup.com/articles/Customer Journey Mapping/ . Accessed on 12.04.2021.

Kilian, K., & Kreutzer, R. (2022). Digitale Markenführung . Springer Gabler.

Book Google Scholar

Koch, J., & Riedmüller, F. (2021). Marktforschung. Grundlagen und praktische Anwendungen (8. Aufl.). de Gruyter.

Kreutzer, R. T. (2018). Toolbox für Marketing und Management. Kreativkonzepte – Analysewerkzeuge – Prognoseinstrumente . Springer Gabler.

Kreutzer, R. T. (2021a). Kundendialog online und offline, Das große 1x1 der Kundenakquisition , Kundenbindung und Kundenrückgewinnung. .

Kreutzer, R. T. (2021b). Praxisorientiertes Online-Marketing. Konzepte – Instrumente – Checklisten (4. Aufl.). Springer Gabler.

Kreutzer, R. T. (2022). Toolbox Digital Business. Leadership, Business Models, Technologies and Change . Springer Gabler.

Kreutzer, R. T., & Sirrenberg, M. (2019). Künstliche Intelligenz verstehen. Grundlagen – Use-Cases – unternehmenseigene KI-Journey . Springer Gabler.

Kroeber-Riel, W., & Gröppel-Klein, A. (2019). Konsumentenverhalten (11. Aufl.). Vahlen.

Kuß, A., Wildner, R., & Kreis, H. (2018). Marktforschung. Grundlagen der Datenerhebung und Datenanalyse (6. Aufl.). Springer Gabler.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7 (1), 77–91.

Mayring, P. (2015). Qualitative Inhaltsanalyse. Grundlagen und Techniken (12. Aufl.). Beltz.

Mayring, P. (2019). Qualitative Inhaltsanalyse – Abgrenzungen, Spielarten, Weiterentwicklungen. Forum Qualitative Sozialforschung, 20 (3) http://www.qualitative-research.net/ . Accessed on 07.03.2021

McKeown, G. (2014). Essentialism: The disciplined pursuit of less . Random House.

Müller, H.-E., & Wrobel, M. (2021). Unternehmensführung. Strategie – Management – Praxis (4. Aufl.). Oldenbourg.

NielsenIQ. (2021). Entscheiden Sie mit Überzeugung . https://nielseniq.com/global/de/solutions/ . Accessed on 07.04.2021.

Pepels, W. (2016). Produktmanagement: A. Neue Produkte am Markt einführen – B. Marken erfolgreich managen – C. Produktprogramme planen und kontrollieren – D. Strukturen und Prozesse implementieren (7. Aufl.). Duncker & Humblot.

Porter, M. E. (1999). Wettbewerbsstrategie . Campus.

Porter, M. E. (2004). Wettbewerbsvorteile . Campus.

POSpulse. (2021). Wer wir sind und was wir tun . https://www.pospulse.com/ueber-uns?hsCtaTracking=0d4c020b-06b2-4c11-93fa-6d518e65ea0d%7C51b1e2b5-1921-4b13-91ce-5cfa9a1af7c7 . Accessed on 12.04.2021.

Raab, G., Unger, A., & Unger, F. (2018). Methoden der Marketing-Forschung: Grundlagen und Praxisbeispiele (3. Aufl.). Springer Gabler.

Rechtien, W. (1999). Angewandte Gruppendynamik (3. Aufl.). Beltz.

Reidel, M. (2021). Ein Jahr in vier Grafiken. Horizont, 21 , 60.

Siemens. (2021). Management. https://new.siemens.com/global/de/unternehmen/ueber-uns/management.html . Accessed on 06.04.2021.

Statista. (2021). Global no. 1 business data platform . https://de.statista.com/ . Accessed on 07.04.2021.

Steffen, A., & Doppler, S. (2019). Einführung in die Qualitative Marktforschung, Design – Datengewinnung – Datenauswertung . Springer Gabler.

Tomczak, T., Kuß, A., & Reinecke, S. (2014). Marketingplanung. Einführung in die marktorientierte Unternehmens- und Geschäftsfeldplanung (7. Aufl.). Springer Gabler.

Weis, H. C., & Steinmetz, P. (2012). Marktforschung (8. Aufl.). Kiehl.

Welge, M., Al-Laham, A., & Eulerich, M. (2017). Strategisches Management. Grundlagen – Prozess – Implementierung (7. Aufl.). Springer Gabler.

Zerr, K. (2021). Irrweg customer centricity. Planung & Analyse, 2 , 4–6.

Download references

Author information

Authors and affiliations.

Hochschule für Wirtschaft und Recht, Berlin, Germany

Ralf T. Kreutzer

You can also search for this author in PubMed Google Scholar

Rights and permissions

Reprints and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Fachmedien Wiesbaden GmbH, part of Springer Nature

About this chapter

Kreutzer, R.T. (2023). Marketing Planning and Marketing Research. In: Practice-Oriented Marketing. Springer, Wiesbaden. https://doi.org/10.1007/978-3-658-39717-3_2

Download citation

DOI : https://doi.org/10.1007/978-3-658-39717-3_2

Published : 09 March 2023

Publisher Name : Springer, Wiesbaden

Print ISBN : 978-3-658-39716-6

Online ISBN : 978-3-658-39717-3

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Brought to you by:

Analyzing the Target Market, Part 1: Marketing Research

By: Ho Yin Wong, Kylie Radel, Roshnee Ramsaran-Fowdar

Building a Marketing Plan: A Complete Guide is a 10-chapter book written by three marketing faculty at Central Queensland University, Australia: Ho Yin Wong, senior lecturer, Kylie Radel, lecturer,…

- Length: 16 page(s)

- Publication Date: Jan 31, 2011

- Discipline: Marketing

- Product #: BEP117-PDF-ENG

What's included:

- Educator Copy

$4.50 per student

degree granting course

$7.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Building a Marketing Plan: A Complete Guide is a 10-chapter book written by three marketing faculty at Central Queensland University, Australia: Ho Yin Wong, senior lecturer, Kylie Radel, lecturer, and Roshnee Ramsaran-Fowdar, senior lecturer. The book was written to provide both marketing students and business professionals with a comprehensive and practical framework for developing a marketing plan. Drawing together theoretical concepts, strategic thinking processes, and recent research findings, the text helps the reader conduct in-depth situational analyses, develop a deep understanding of target markets, set measurable and timely marketing objectives, develop a series of marketing strategies based on four key elements of marketing, and ensure that appropriate implementation and control mechanisms have been considered. To show how to apply the marketing planning framework discussed in chapters 2-10, the authors provide a comprehensive example in the appendix. Chapter 3 examines the fundamentals of marketing research: a process used to identify the needs of consumers, types of consumers, and consumer buying behavior in the target market. Strategies for planning effective market research, developing research designs to collect and analyze information, implementing a continuous information process, and building marketing intelligence are discussed.

Jan 31, 2011

Discipline:

Business Expert Press

BEP117-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Business Research

- Company Information

- Annual Reports

- Competitors

- Financial Information

- Financial Ratios

- Investment Reports

- Mission Statement

- Leadership Information

- Finding or Creating SWOT Analyses

- Using Hoovers to Create Lists

- Industry Overviews

- Trends and Projections

- Major Companies

- Market Research

- Marketing Plans

Creating a Marketing Plan

I. executive summary, ii. situation analysis, iii. market analysis, iv. market strategy, v. financial analysis, vi. implementation and control, additional sources of information.

- Market Share

- Market Size

- Demographics/Psychographics

- Product Reviews

- Products/Brands

- Business Plans

- Case Studies

- Country Information

- NAICS Codes

A marketing plan is one component of a business plan. Marketing plans contain information about a company's products and/or services and discuss how potential customers will be identified and how the company's products and/or services will be marketed to them.

Putting together a marketing plan is a time-intensive process that involves conducting a great deal of research using a variety of different resources and then synthesizing that research into one cohesive document that provides a detailed discussion of a company's target market, its competitors, industry trends, etc.

Below is a list of some of the elements generally included in a marketing plan, as well as -- for some of the elements -- suggestions on where to find more information regarding that element.

A brief synopsis of the marketing plan that provides highlights about a company's offerings and marketing strategies

Presents pertinent information about a company. Commonly included sections include:

- Mission statement - explains a company's purpose, goals, and/or strategy. See Finding a Company's Mission Statement for more information about how to find existing company mission statements and how to write a mission statement.

- Product or service description - provides a detailed description of a company's products and/or services

- Value proposition - explains the benefits that customers will receive from a company's products and/or services. For more information, see How to Create an Effective Value Proposition .

- SWOT analysis - explains a company's internal strengths and weaknesses, as well as its external opportunities and threats. For more information, see SWOT Analysis Research .

- Critical issues - outlines the strategy that would best utilize a company's strengths and opportunities while minimizing the effects of its weaknesses and threats

includes information about market trends and dynamics, as well as about the target market and the competitive environment. Commonly included sections are:

- Macro environment - includes information about the political, economic, social, and technological factors affecting a company, as well as information about the industry in which the company operates Suggested resources: For information about establishing a company in another country, see Finding Country Information . For information about establishing a company in a U.S. city or town, use Google, Bing, or another search engine to find the city's or town's chamber of commerce, which will provide information about existing area businesses and may provide information about establishing a new business in a particular locale, etc. For economic information, see Economic Surveys in the Economic Census and/or Economic Indicators and/or Federal Reserve Economic Data . For demographic and psychographic information, see Finding Demographic or Psychographic Information . For technology research, search in some of the Library's Marketing databases , using a search strategy such as [your topic] AND technolog* For industry research, see Finding Industry Overviews and Finding Industry Trends and Projections .

- Market size - discusses current market size as well as expected growth rate. See Finding Market Size Information .

- Market trends - discusses the market factors that may affect purchasing behavior. See Conducting Market Research and/or Finding Industry Trends and Projections.

- Target market analysis - explains which particular population will be the focus of a company's marketing efforts and why the population's characteristics are relevant to the company's marketing plans

- Consumer analysis - discusses demographic, psychographic, and behavior characteristics of the target market identified above. Search in some of the Library's Marketing databases , using a search strategy such as [your target market] AND (demograph* OR psychograph* OR "consumer behavior")

- Need analysis - explains what needs the target market has and how a company's products and/or services could meet those needs. Target market needs may be identified from the consumer analysis conducted above.

- Competitive analysis - lists a company's major competitors and their marketing strategies. See Finding a Company's Competitors to find a company's major competitors. To find those companies' marketing strategies, search in some of the Library's Marketing databases , using a search strategy such as [company name] AND "market* strategy"

Provides measurable information about how a company will meet its objectives and the time frame in which it will do this

- Marketing objectives - describes a company's goals, usually in terms of sales (units or dollars) or market share

- Financial objectives - describes a company's expected profits or revenue

- Positioning strategy - discusses how a company's products or services will be introduced to the marketplace and differentiated from the products or services of its competitors

- Product strategy - provides detailed information about a company's products or services, including potential future offerings

- Price strategy - explains how a company's products or services will be priced, taking into account internal as well as external factors that may affect supply and demand, etc.

- Distribution strategy - describes where and how a company's products or services will be provided to customers

- Integrated marketing communications strategy - discusses how customers will be informed about a company's products or services

- Branding strategy - describes how a company's name, logo, slogan, design, etc. will be marketed so that they will be increasingly recognized by members of the company's target market. For more information, see Brand Management .

- Marketing research - describes the market research activities that will be conducted during the period for which the marketing plan is being written -- for example, consumer research, industry research, forecasting, competitive analysis, etc.

Provides detailed information about a company's projected financial situation

- Break-even analysis - estimates how much of a company's products or services need to be sold in order to cover the company's costs

- Sales forecast - estimates a company's sales for a given period of time. For more information, see Business Forecasting .

- Expense forecast - lists the marketing expenses needed to achieve a company's marketing objectives

Explains how a company's marketing plan will be implemented and what measures the company could in place in order to handle unexpected events

- Implementation - provides a detailed timeline for the execution of the various activities described in the company's marketing plan

- Controls - discusses the benchmarks a company will use to chart its progress against its implementation schedule

- Marketing organization chart - outlines the structure of a company's marketing team, specifying which person is responsible for which marketing activity

- Contingency planning - explains how a company will handle unexpected events

The print books, ebooks, and websites listed below are good sources of additional information about marketing plans and the various elements that make up such plans.

Print books

- 30-minute social media marketing: Step-by-step techniques to spread the word about your business fast and free

- Guerrilla marketing in 30 days

- How to make money with social media: An insider's guide on using new and emerging media to grow your business

- Marketing plan handbook: Develop big picture marketing plans for pennies on the dollar

- The procrastinator's guide to marketing, or how to get off your butt and develop your marketing plan!

- 30 minutes to write a marketing plan

- Direct marketing: Strategy, planning, execution

- How to write a successful marketing plan: A disciplined and comprehensive approach

- The marketing plan: How to prepare and implement it

- Understanding consumer decision making: The means-end approach to marketing and advertising strategy

- Entrepreneur: How to create a marketing plan This site, affiliated with the print Entrepreneur magazine, explains what marketing plans are and how to do the research needed to write one.

- Mplans: How to write a marketing plan This site contains links to articles that describe the planning process for creating a marketing plan and that give tips for writing effective plans.

- Mplans: Sample marketing plans This site provides access to hundreds of free sample marketing plans in a variety of categories.

- U.S. Small Business Administration: Developing a marketing plan This site provides numerous links related to creating a marketing plan.

- << Previous: Market Research

- Next: Market Share >>

- Last Updated: Apr 24, 2024 3:11 PM

- URL: https://libguides.umgc.edu/business-research

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![marketing plan research pdf → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

Don't forget to share this post!

Related articles.

What is a Competitive Analysis — and How Do You Conduct One?

![marketing plan research pdf SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

20+ Tools & Resources for Conducting Market Research

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![marketing plan research pdf How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![marketing plan research pdf 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![marketing plan research pdf 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Market Research Plan

In 1970, food and drink sales of the US restaurant industry reached only 42.8 billion US dollars, which is way behind the 745.61 billion US dollar sales of 2015. According to the statistic posted in statista, this number should grow in the next few years. In fact, the website reported that from the 2015’s over 14 million employees of the restaurant industry, it should increase up to 16 million in 2026. However, as a result of this growth, there will be possibilities that the market will be saturated and more competitive. Thus, as a business owner, you will need to gear up and gain an edge to stand out in the market. By conducting market research for a restaurant, you can prepare your business to become more competitive and strategic, which will ensure its success.

What Do You Need to Know About Market Research?

Market research is an essential component of a business plan which aims to get information concerning the target market of a business. Through this study, you will determine the chances of a proposed service or new product to survive in the market. As part of market research, you need to develop a research plan.

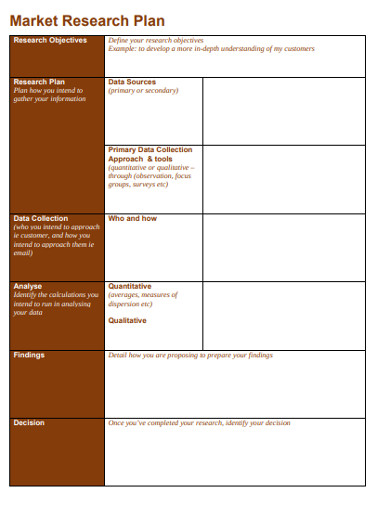

What is Market Research Plan?

In general, market research plan is the foundation of a detailed research proposal . This document contains the initial thoughts about the research project that you are planning to take place logically and concisely, which is a crucial content of market research. Simply put, by obtaining a market research plan, you can thoroughly examine how your product or service will proceed in a specific domain.

2+ Market Research Plan Examples

Conducting market research will give significant benefits to your business. However, to materialize it, you may need to ensure that you build your market research plan correctly. Below is a list of the market research plan samples and templates that you can use as a guide.

1. Market Research Plan Template

- Google Docs

- Apple Pages

Size: 19 KB

2. Sample Market Research Plan Example

Size: 68 KB

3. Basic Market Research Plan Example

Size: 151 KB

4. Market Research Business Plan Example

Size: 600 KB

How to Develop a Strong Market Research Project Plan?

Now that you know how a marketing research plan should look, make a secure market research plan by following the steps below:

1. Set Goals and Objectives

What do you want to attain with your research? Your goals and objectives should answer that question. You can start by forming a general marketing goal . You will, then, make it more specific. This goal will help you focus and direct the entire research process to make the best data-driven marketing decisions. To determine the most critical issue, you may conduct qualitative research . This research methodology ensures that you address the issue that really requires an urgent solution.

2. Determine Your Target Respondents and Appropriate Distribution Method

In this step, you will identify the right people to get the information that you need to create the right decision for your marketing goals. After that, list down the best possible ways for the data gathering. For example, your target market is veterans. You may want to use more appropriate channels such as direct mails, phone, or personal interview. Once you have chosen the most appropriate data collection method, create an outline that will allow your team to get the most relevant information from your target market or audience.

4. Brainstorm for the Right Questions

In deciding the right questions for your marketing research, it is crucial to keep your study goals in mind. Only include items that are relevant to the study to come up with the best business decisions. Asking the wrong questions may lead to inadequate conclusions. Data-driven solutions mostly obtained through quantitative research questions. You can still use qualitative research questions but make it minimal to avoid making the respondents bored and held up, which can lead to survey abandonment. As much as possible, make your survey short and answerable in less than 5 minutes. Otherwise, you may want to find an alternative option in getting the desired data. Also, it would help if you will consider other factors in building the right questions. Refrain from asking sensitive, personal, and offensive questions. To do it, research your target audience.

5. Analyze the Data

Start this step by cleaning your survey data. To do it, filter out any low-quality responses. These items can affect your decision-making negatively. Basing on the set standards, remove the outlier responses. To do that, determine if the respondents answered in the desired format. If not, especially if it has become a trend, disqualify the question or conduct another data-gathering or investigation for this question. In this process, you will also find out if the answers of the participants are contributing to your research goals. At the end of this stage, you will, then, share your findings. To effectively show your results, you can use data visualization methods such as charts, graphs, and infographics.

6. Create a Data-Driven Marketing Decisions

Now that you have the necessary market research data, you can come up with a data-driven decision. Whether you are running a pharmaceutical firm or a corporal business such as Coca Cola, you can develop a new marketing campaign and other relevant business actions without unnecessary worries since you have directly reached out to your target market.

In a market that is becoming more competitive, creating a market research plan for a new product of your business can give you an advantage and an edge over your opponents. This type of method will also save your time, effort, and money because it allows you to determine the proper actions that you can take towards the corporate goals in terms of marketing and other relevant sectors.

Text prompt

- Instructive

- Professional

Create a study plan for final exams in high school

Develop a project timeline for a middle school science fair.

IMAGES

VIDEO

COMMENTS

specific objectives: (a) to develop a framework through which to assess the current state of. research conducted within marketing strategy; (b) to illuminate and illustrate the "state of. knowledge" in core sub-domains of marketing strategy development and execution; and (c), to.

According to the dictionary, the word 'research' means to search or investigate exhaustively or in detail. The thesaurus gives as a synonym for 'research' the word 'inquiry', which means the act of seeking truth, information or knowledge. So market research can be defined as a detailed search for the truth.

1.3.1 Marketing research today 9 1.4 Marketing Research and the Development of the Marketing Plan 10 1.4.1 The relationship between data, infor mation and knowledge 12 1.5 Ethics in Marketing Resear ch 13 1.5.1 Ethical research issues 13 1.5.2 Guidelines for conducting ethical r esearch 14 2 RESEARCH AS A PROCESS 19 2.1 The Uses of Marketing ...

Our mission is to improve educational access and learning for everyone. OpenStax is part of Rice University, which is a 501 (c) (3) nonprofit. Give today and help us reach more students. Help. OpenStax. This free textbook is an OpenStax resource written to increase student access to high-quality, peer-reviewed learning materials.

Abstract. Marketing strategy is a construct that lies at the conceptual heart of the field of strategic marketing and is central to the practice of marketing. It is also the area within which many ...

6. Discuss the considerations involved in selecting marketing scales. 7. Explain ways researchers can ensure the reliability and validity of scales. Introduction . Marketing scales are used extensively by marketing researchers to measure a wide array of beliefs, attitudes, and behaviors.

1. Discuss the basic types and functions of marketing research. 2. Identify marketing research studies that can be used in making marketing decisions. 3. Discuss how marketing research has evolved since 1879. 4. Describe the marketing research industry as it exists today. 5. Discuss the emerging trends in marketing research. INTRODUCTION

2. Environmental analysis and marketing research 3. Generating viable research ideas 4. Key components of a research plan 5. A research proposal versus a marketing research brief 6. Linking data collection with data analysis 7. From proposals to full-scale projects 02_BENZO_ET_AL_Ch 02.indd 31 11/13/2017 11:18:49 AM

2.1.2 Formation of Strategic Business Units. Planning requires the ability to plan, especially in companies with a broad international or supply-specific structure.To achieve this, companies strive to reduce complexity.Companies like Alphabet, Amazon, BASF, Siemens or Volkswagen cannot be planned as a whole. Therefore, a reduction of this complexity is strived for.

MARKET RESEARCH T. he first step in planning a market research study is to spend some time identifying and articulating the underlying decision problem that makes a research study seem necessary. The importance of this initial step cannot be over emphasized. The more secure the researcher's grasp of the decision problem, the

PDF | In general, the use of plans conveys a number of advantages: (1) consistency, (2) responsibility, (3) communication, and (4) commitment. | Find, read and cite all the research you need on ...

Building a Marketing Plan: A Complete Guide is a 10-chapter book written by three marketing faculty at Central Queensland University, Australia: Ho Yin Wong, senior lecturer, Kylie Radel, lecturer, and Roshnee Ramsaran-Fowdar, senior lecturer. The book was written to provide both marketing students and business professionals with a comprehensive and practical framework for developing a ...

price. Your market research will also assist you in developing a marketing plan for your business. Existing businesses may require market research to ensure that they can continue to serve their clients by remaining current with the trends, keeping ahead of their competition, or in seeking out new markets for growth potential.

Abstract. This is the fifth edition of Marketing Research and the first that also takes a United Kingdom, European perspective. It continues to reflect the importance of social media, 'big data ...

The objectives of the marketing strategy will be to enable the new product's entry to the market more efficiently, gaining a market share with old and new customers faster than with the case company's conventional marketing activities, and creating a positive brand image for the product in question. 1.3 Thesis process.

A marketing plan is usually presented as a PDF document, but you can also whip up a more creative version of it. For example, ... Creating an effective product marketing plan requires in-depth research of your target market, company strengths and weaknesses, as well as an effective marketing plan design. ...

Creating a Marketing Plan. A marketing plan is one component of a business plan. Marketing plans contain information about a company's products and/or services and discuss how potential customers will be identified and how the company's products and/or services will be marketed to them. Putting together a marketing plan is a time-intensive ...

Download HubSpot's free, editable market research report template here. 1. Five Forces Analysis Template. Use Porter's Five Forces Model to understand an industry by analyzing five different criteria and how high the power, threat, or rivalry in each area is — here are the five criteria: Competitive rivalry.

The Marketing Plan is an ongoing tool designed to help the business compete in the market for customers. It should be re-visited, re-worked, and re-created often. There is no single "right" way to approach a marketing plan. Your marketing plan should be part of an ongoing self-evaluation process and unique to your business. 1. State the purpose ...

To create an effective marketing budget, th e plan needs to align with the marketing go als and focus needs to be given to. the key priorities. Moreover, evaluation needs to be carried out in ...

The strategic marketing planning objective is aimed at controlling and retaining 75% of the. consumer-based target population of the market; and the extent to which the group needs or. would ...

However, to materialize it, you may need to ensure that you build your market research plan correctly. Below is a list of the market research plan samples and templates that you can use as a guide. 1. Market Research Plan Template. Details. File Format. Word. Google Docs. Apple Pages.

Developing a. good marketing plan wil l help y ou identify a nd. quantify co sts, set price goals, determine po-. tential price outlook, examine production and. price risk, and develop a strategy ...