ESSAY SAUCE

FOR STUDENTS : ALL THE INGREDIENTS OF A GOOD ESSAY

Essay: Break Even Analysis – Profit, Revenue and Costs

Essay details and download:.

- Subject area(s): Accounting essays

- Reading time: 3 minutes

- Price: Free download

- Published: 21 June 2012*

- File format: Text

- Words: 535 (approx)

- Number of pages: 3 (approx)

Text preview of this essay:

This page of the essay has 535 words. Download the full version above.

Break Even Analysis – Profit, Revenue and Costs

Break Even Analysis

The break-even point (BEP) is the point at which the cost of producing a product or providing a service exactly matches the revenue gained from selling that product or service. For example, if a firm’s total annual costs are £1m and in the same year it generates £1m of revenue, then the firm is said to have broken-even, as it hasn’t made any more or less than it has invested:

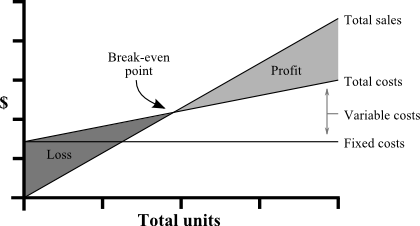

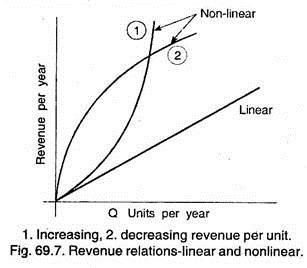

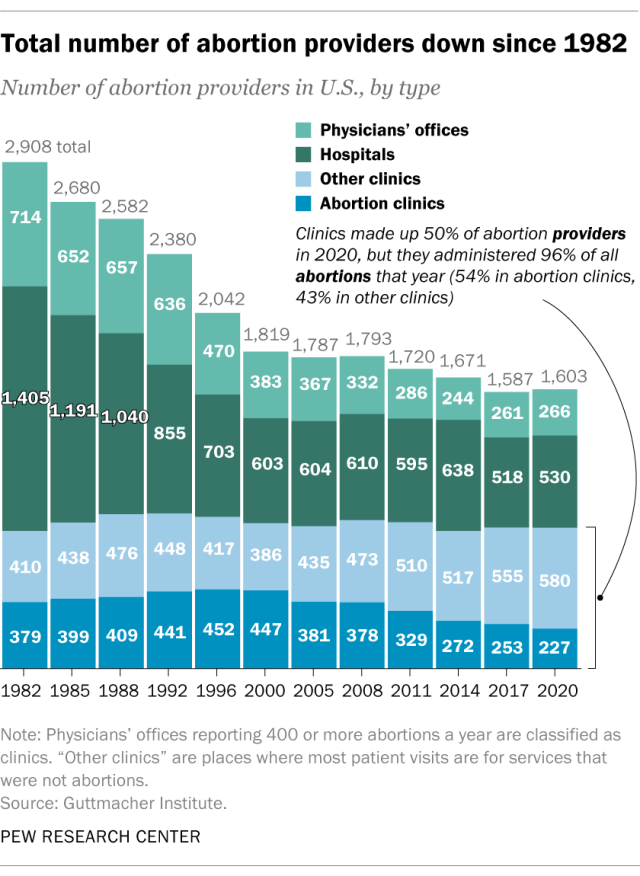

Image source: http://www.chegg.com/homework-help/definitions/break-even-point-37

Figure 1. Break Even Point

The fixed costs (horizontal line) do not vary with output – they are the costs of running the business. The variable costs (line starting on top of fixed costs) are directly related to volume and increase or decrease as production and sales increase or decrease. Together they add up to give total costs. The revenue line (starting from zero) shows the total sales at a given price and volume. The BEP is the point at which the revenue and total cost lines cross.

A working example:

A designer mug costs £10 to buy. The variable costs are £6 per mug which makes the contribution to fixed costs £4 per unit. The total fixed costs are £12,000. The BEP point is calculated as follows:

Fixed costs / contribution per unit 12,000 / 4

Fixed costs / price – variable costs = BEP = 300 units

Or in terms of value

BEP in units x price per unit 300 x £10 = £30,000

This is a simple and straight-forward technique that is widely used. It will show the profit or loss made at different levels of output, the BEP at different prices and the effect on the BEP and profit if costs change.

The BEP analysis is often used as a tool in price setting. A company can produce several variations of this chart to compare the revenue, total cost and BEP for different price scenarios. Whilst it won’t give an absolute answer it will highlight the options that should be avoided.

The major disadvantage with break-even analysis is that demand is assumed to be inelastic. It suggests that a higher price will make the revenue curve steeper and therefore lower the BEP. However in reality there will often be a maximum price that customers will pay. This will vary by customer and be dependent on many factors including the cost of switching and the availability of alternatives. The BEP is therefore more about whether a company can sell enough to break-even rather than about what volume they can expect to sell. It must be remembered that this is a revenue curve, not a demand curve.

Another downside of break-even analysis is that it focuses on how to break-even rather than achieve a specific objective, such as percentage market share or a specific return on investment (ROI).

That said, analysing the BEP can help to determine whether a new product has enough critical mass to make a profit and is feasible to be launched. It can also be used to support business cases where funding is needed by demonstrating that a product can be made and sold profitably.

As a result, we can see that BEP analysis should be used for evaluation purposes rather than to base decisions on.

...(download the rest of the essay above)

About this essay:

If you use part of this page in your own work, you need to provide a citation, as follows:

Essay Sauce, Break Even Analysis – Profit, Revenue and Costs . Available from:<https://www.essaysauce.com/accounting-essays/break-even-analysis/> [Accessed 20-04-24].

These Accounting essays have been submitted to us by students in order to help you with your studies.

* This essay may have been previously published on Essay.uk.com at an earlier date.

Essay Categories:

- Accounting essays

- Architecture essays

- Business essays

- Computer science essays

- Criminology essays

- Economics essays

- Education essays

- Engineering essays

- English language essays

- Environmental studies essays

- Essay examples

- Finance essays

- Geography essays

- Health essays

- History essays

- Hospitality and tourism essays

- Human rights essays

- Information technology essays

- International relations

- Leadership essays

- Linguistics essays

- Literature essays

- Management essays

- Marketing essays

- Mathematics essays

- Media essays

- Medicine essays

- Military essays

- Miscellaneous essays

- Music Essays

- Nursing essays

- Philosophy essays

- Photography and arts essays

- Politics essays

- Project management essays

- Psychology essays

- Religious studies and theology essays

- Sample essays

- Science essays

- Social work essays

- Sociology essays

- Sports essays

- Types of essay

- Zoology essays

- Search Search Please fill out this field.

What Is Break-Even Analysis?

Break-even point formula.

- Calculating BEP and Contribution Margin

Who Calculates the BEP?

Why break-even analysis matters, the bottom line.

- Investing Basics

Break-Even Analysis: Formula and Calculation

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

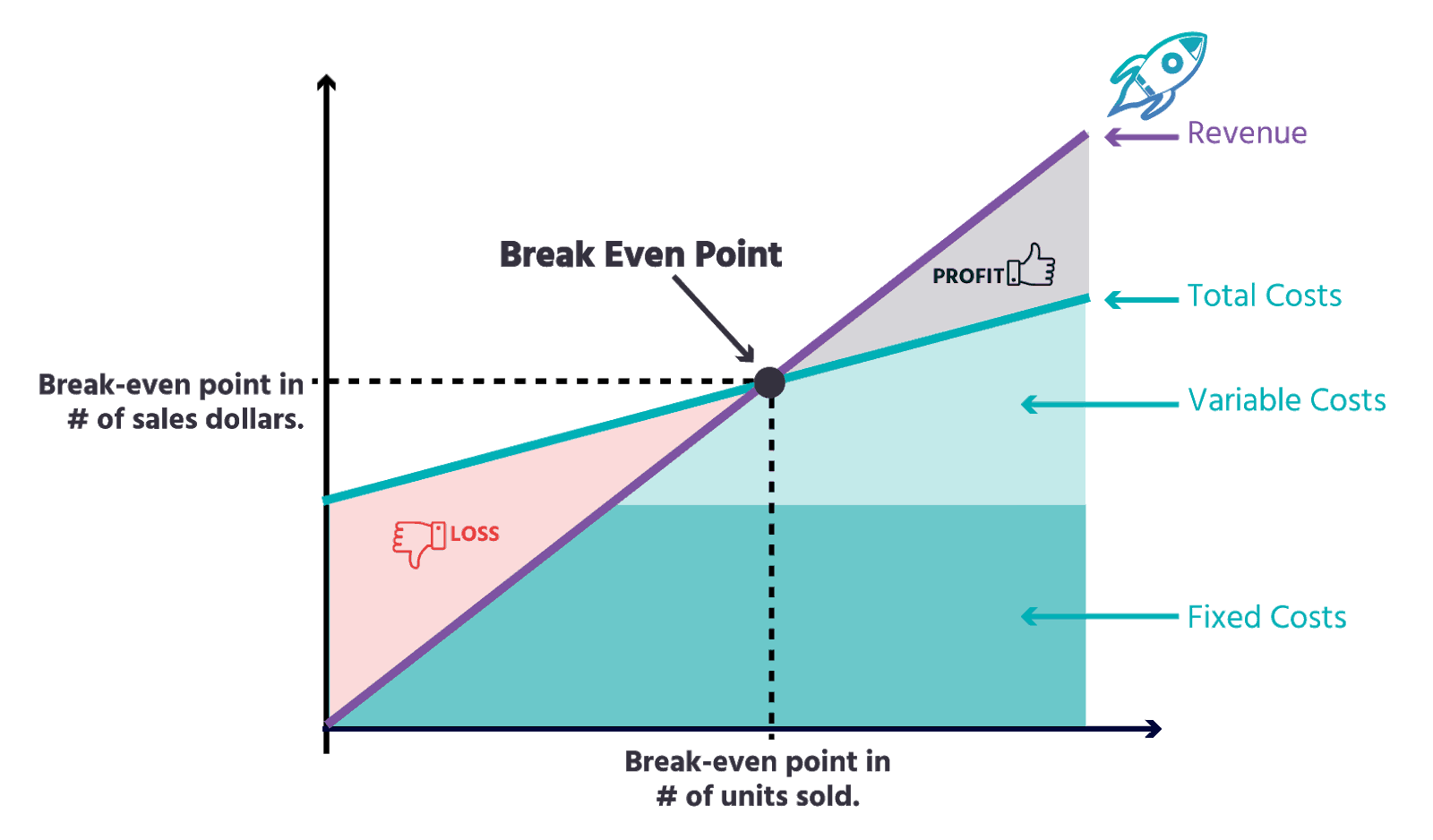

Break-even analysis compares income from sales to the fixed costs of doing business. Five components of break-even analysis include fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP). When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs to begin generating a profit. The break-even point formula can help find the BEP in units or sales dollars.

Key Takeaways:

- Using the break-even point formula, businesses can determine how many units or dollars of sales cover the fixed and variable production costs.

- The break-even point (BEP) is considered a measure of the margin of safety.

- Break-even analysis is used broadly, from stock and options trading to corporate budgeting for various projects.

Investopedia / Paige McLaughlin

Break-even analysis involves a calculation of the break-even point (BEP) . The break-even point formula divides the total fixed production costs by the price per individual unit, less the variable cost per unit.

BEP = Fixed Costs / (Price Per Unit - Variable Cost Per Unit)

Break-even analysis looks at the fixed costs relative to the profit earned by each additional unit produced and sold. A firm with lower fixed costs will have a lower break-even point of sale and $0 of fixed costs will automatically have broken even with the sale of the first product, assuming variable costs do not exceed sales revenue. Fixed costs remain the same regardless of how many units are sold. Examples of fixed and variable costs include:

Calculating the Break-Even Point and Contribution Margin

Break-even analysis and the BEP formula can provide firms with a product's contribution margin. The contribution margin is the difference between the selling price of the product and its variable costs. For example, if an item sells for $100, with fixed costs of $25 per unit, and variable costs of $60 per unit, the contribution margin is $40 ($100 - $60). This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin.

Contribution Margin = Item Price - Variable Cost Per Unit

To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Assume total fixed costs are $20,000. With a contribution margin of $40 above, the break-even point is 500 units ($20,000 divided by $40). Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0.

BEP (Units) = Total Fixed Costs / Contribution Margin

To calculate the break-even point in sales dollars, divide the total fixed costs by the contribution margin ratio. The contribution margin ratio is the contribution margin per unit divided by the sale price.

Contribution Margin Ratio = Contribution Margin Per Unit / Item Price

BEP (Sales Dollars) = Total Fixed Costs / Contribution Margin Ratio

The contribution margin ratio is 40% ($40 contribution margin per item divided by $100 sale price per item). The break-even point in sales dollars is $50,000 ($20,000 total fixed costs divided by 40%).

In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable.

- Entrepreneurs

- Financial Analysts

- Stock and Option Traders

- Government Agencies

Although investors are not interested in an individual company's break-even analysis on their production, they may use the calculation to determine at what price they will break even on a trade or investment. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product.

- Pricing : Businesses get a comprehensible perspective on their cost structure with a break-even analysis, setting prices for their products that cover their fixed and variable costs and provide a reasonable profit margin.

- Decision-Making : When it comes to new products and services, operational expansion, or increased production, businesses can chart their profit to sales volume and use break-even analysis to help them make informed decisions surrounding those activities.

- Cost Reduction : Break-even analysis helps businesses find areas to reduce costs to increase profitability.

- Performance Metric: Break-even analysis is a financial performance tool that helps businesses ascertain where they are in achieving their goals.

What Are Some Limitations of Break-Even Analysis?

Break-even analysis assumes that the fixed and variable costs remain constant over time. Costs may change due to factors such as inflation, changes in technology, or changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences.

What Are the Components of Break-Even Analysis?

There are five components of break-even analysis including fixed costs, variable costs, revenue, contribution margin, and the break-even point (BEP).

Why Is the Contribution Margin Important in Break-Even Analysis?

The contribution margin represents the revenue required to cover a business' fixed costs and contribute to its profit. Through the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit.

How Do Businesses Use the Break-Even Point in Break-Even Analysis?

The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even to measure its repayment of debt or how long that repayment will take to complete.

Break-even analysis is a tool used by businesses and stock and option traders. Break-even analysis is essential in determining the minimum sales volume required to cover total costs and break even. It helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps find the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions.

U.S. Small Business Administration. " Break-Even Point ."

Professor Rosemary Nurre, College of San Mateo. " Accounting 131: Chapter 6, Cost-Volume-Profit Relationships ."

:max_bytes(150000):strip_icc():format(webp)/BreakevenPoint-b6ed6dc69b2742358a937e280a3fc103.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- HR & Payroll

Break-Even Analysis Explained - Full Guide With Examples

Did you know that 30% of operating small businesses are losing money? Running your own business is trickier than it sounds. You have to plan ahead carefully to break-even or be profitable in the long run.

Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

To start and sustain a small business it is important to know financial terms and metrics like net sales, income statement and most importantly break-even point .

Performing break-even analysis is a crucial activity for making important business decisions and to be profitable in business.

So how do you do it? That is what we will go through in this article. Some of the key takeaways for you when you finish this guide would be:

- Understand what break-even point is

- Know why it is important

- Learn how to calculate break-even point

- Know how to do break-even analysis

- Understand the limitations of break-even analysis

So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on.

What is Break-Even Point?

Small businesses that succeeds are the ones that focus on business planning to cross the break-even point, and turn profitable .

In a small business, a break-even point is a point at which total revenue equals total costs or expenses. At this point, there is no profit or loss — in other words, you 'break-even'.

Break-even as a term is used widely, from stock and options trading to corporate budgeting as a margin of safety measure.

On the other hand, break-even analysis lets you predict, or forecast your break-even point. This allows you to course your chart towards profitability.

Managers typically use break-even analysis to set a price to understand the economic impact of various price and sales volume calculations.

The total profit at the break-even point is zero. It is only possible for a small business to pass the break-even point when the dollar value of sales is greater than the fixed + variable cost per unit.

Every business must develop a break-even point calculation for their company. This will give visibility into the number of units to sell, or the sales revenue they need, to cover their variable and fixed costs.

Importance of Break-Even Analysis for Your Small Business

A business could be bringing in a lot of money; however, it could still be making a loss. Knowing the break-even point helps decide prices, set sales targets, and prepare a business plan.

The break-even point calculation is an essential tool to analyze critical profit drivers of your business, including sales volume, average production costs, and, as mentioned earlier, the average sales price. Using and understanding the break-even point, you can measure

- how profitable is your present product line

- how far sales drop before you start to make a loss

- how many units you need to sell before you make a profit

- how decreasing or increasing price and volume of product will affect profits

- how much of an increase in price or volume of sales you will need to meet the rise in fixed cost

How to Calculate Break-Even Point

There are multiple ways to calculate your break-even point.

Calculate Break-even Point based on Units

One way to calculate the break-even point is to determine the number of units to be produced for transitioning from loss to profit.

For this method, simply use the formula below:

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

Fixed costs are those that do not change no matter how many units are sold. Don't worry, we will explain with examples below. Revenue is the income, or dollars made by selling one unit.

Variable costs include cost of goods sold, or the acquisition cost. This may include the purchase cost and other additional costs like labor and freight costs.

Calculate Break-Even Point by Sales Dollar - Contribution Margin Method

Divide the fixed costs by the contribution margin. The contribution margin is determined by subtracting the variable costs from the price of a product. This amount is then used to cover the fixed costs.

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

Let’s take a deeper look at the some common terms we have encountered so far:

- Fixed costs: Fixed costs are not affected by the number of items sold, such as rent paid for storefronts or production facilities, office furniture, computer units, and software. Fixed costs also include payment for services like design, marketing, public relations, and advertising.

- Contribution margin: Is calculated by subtracting the unit variable costs from its selling price. So if you’re selling a unit for $100 and the cost of materials is $30, then the contribution margin is $70. This $70 is then used to cover the fixed costs, and if there is any money left after that, it’s your net profit.

- Contribution margin ratio: is calculated by dividing your fixed costs from your contribution margin. It is expressed as a percentage. Using the contribution margin, you can determine what you need to do to break-even, like cutting fixed costs or raising your prices.

- Profit earned following your break-even: When your sales equal your fixed and variable costs, you have reached the break-even point. At this point, the company will report a net profit or loss of $0. The sales beyond this point contribute to your net profit.

Small Business Example for Calculating Break-even Point

To show how break-even works, let’s take the hypothetical example of a high-end dressmaker. Let's assume she must incur a fixed cost of $45,000 to produce and sell a dress.

These costs might cover the software and materials needed to design the dress and be sure it meets the requirement of the brand, the fee paid to a designer to design the look and feel of the dress, and the development of promotional materials used to advertise the dress.

These costs are fixed as they do not change per the number of dresses sold.

The variable costs would include the materials used to make each dress — embellishment’s for $30, the fabric for the body for $20, inner lining for $10 — and the labor required to assemble the dress, which amounted to one and a half hours for a worker earning $50 per hour.

Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). If she sells the dress for $150, she’ll make a unit margin of $40.

Given the $40 unit margin she’ll receive for each dress sold, she will cover her $45,500 total fixed cost will be covered if she sells:

Break-Even Point (Units) = $45,000 ÷ $40 = 1,125 Units

You can see per the formula , on the right-hand side, that the Break-even is 1,125 dresses or units

In other words, if this dressmaker sells 1,125 units of this particular dress, then she will fully recover the $45,000 in fixed costs she invested in production and selling. If she sells fewer than 1,125 units, she will lose money. And if she sells more than 1,125 units, she will turn a profit. That’s the break-even point.

What if we change the price?

Suppose our dressmaker is worried about the current demand for dresses and has concerns about her firm’s sales and marketing capabilities, calling into question her ability to sell 1,125 units at a price of $150. What would be the effect of increasing the price to $200?

This would increase the unit margin to $90.Then the number of units to be sold would decline to 500 units. With this information, the dressmaker could assess whether she was better off trying to sell 1,125 dresses at $150 or 500 dresses at $200, and priced accordingly.

What if we want to make an investment and increase the fixed costs?

Break-even analysis also can be used to assess how sales volume would need to change to justify other potential investments. For instance, consider the possibility of keeping the price at $150, but having a celebrity endorse the dress (think Madonna!) for a fee of $20,000.

This would be worthwhile if the dressmaker believed that the endorsement would result in total sales of $66,000 (the original fixed cost plus the $20,000 for Ms. Madonna).

With the Fixed Costs at $66,000 we see, it would only be worthwhile if the dressmaker believed that the endorsement would result in total sales of 1,650 units.

In other words, if the endorsement led to incremental sales of 525 dress units, the endorsement would break-even. If it led to incremental sales of greater than 525 dresses, it would increase profits.

What if we change the variable cost of producing a good?

Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good.

Imagine that our dressmaker could switch from using a rather plain $20 fabric for the dress to a higher-end $40 fabric, thereby increasing the variable cost of the dress from $110 to $130 and decreasing the unit margin from $40 to $20. How much would your sales need to increase to compensate for the extra cost?

Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). It would make better sense to switch to the nicer fabric if the dressmaker thought it would result in sales of 2,250 units, an additional 1125 dresses, which is double the number of initial sale numbers.

You likely aren’t a dressmaker or able to get a celebrity endorsement from Ms. Madonna, but you can use break-even analysis to understand how the various changes of your product, from revenue, costs, sales, impact your small business’s profitability .

What Are the Benefits of Doing a Break-even Analysis?

Smart Pricing : Finding your break-even point will help you price your products better. A lot of effort and understanding goes into effective pricing, but knowing how it will affect your profitability is just as important. You need to make sure you can pay all your bills.

Cover Fixed Costs : When most people think about pricing, they think about how much their product costs to create. Those are considered variable costs. You will still need to cover your fixed costs like insurance or web development fees. Doing a break-even analysis helps you do that.

Avoid Missing Expenses : When you do a break-even analysis, you have to lay out all your financial commitments to figure out your break-even point. It’s easy to forget about expenses when you’re thinking through a business idea. This will limit the number of surprises down the road.

Setting Revenue Targets : After completing a break-even analysis, you know exactly how much you need to sell to be profitable. This will help you set better sales goals for you and your team.

Decision Making : Usually, business decisions are based on emotion. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to decide when you’ve put in the work and have useful data in front of you.

Manage Financial Strain : Doing a break-even analysis will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes by being aware of the risks and knowing when to avoid a business idea.

Business Funding : For any funding or investment, a break-even analysis is a key component of any business plan. You have to prove your plan is viable. It’s usually a requirement if you want to take on investors or other debt to fund your business.

When to Use Break-even Analysis

Starting a new business.

If you’re thinking about a small online business or e-commerce, a break-even analysis is a must. Not only does it help you decide if your business idea is viable, but it makes you research and be realistic about costs, as well as think through your pricing strategy.

Creating a new product

Especially for a small business, you should still do a break-even analysis before starting or adding on a new product in case that product is going to add to your expenses. There will be a need to work out the variable costs related to your new product and set prices before you start selling.

Adding a new sales channel

If you add a new sales channel, your costs will change. Let's say you have been selling online, and you’re thinking about opening an offline store; you’ll want to make sure you at least break-even with the brick and mortar costs added in. Adding additional marketing channels or expanding social media spends usually increases daily expenses. These costs need to be part of your break-even analysis.

Changing the business model

Let's say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis. Your costs might vary significantly, and this will help you figure out if your prices need to change too.

Limitations of Break-even Analysis

- The Break-even analysis focuses mostly on the supply-side (i.e., costs only) analysis. It doesn't tell us what sales are actually likely to be for the product at various prices.

- It assumes that fixed costs are constant. However, an increase in the scale of production is likely to lead to an increase in fixed costs.

- It assumes average variable costs are constant per unit of output, per the range of the number of sales

- It assumes that the number of goods produced is equal to the number of goods sold. It believes that there is no change in the number of goods held in inventory at the beginning of the period and the number of goods held in inventory at the end of the period

- In multi-product companies, the relative proportions of each product sold and produced are fixed or constant.

So that's a wrap. Hope you found this article interesting and informative. Feel free to subscribe to our blog to get updates on awesome new content we publish for small business owners.

Key Takeaways

Break-even analysis is infinitely valuable as it sets the framework for pricing structures, operations, hiring employees, and obtaining future financial support.

- You can identify how much, or how many, you have to sell to be profitable.

- Identify costs inside your business that should be alleviated or eliminated.

Remember, any break-even analysis is only as strong as its underlying assumptions.

Like many forecasting metrics, break-even point is subject to it's limitations; however it can be a powerful and simple tool to provide a small business owner with an idea of what their sales need to be in order to start being profitable as quickly as possible.

Lastly, please understand that break-even analysis is not a predictor of demand .

If you go to market with the wrong product or the wrong price, it may be tough to ever hit the break-even point. To avoid this, make sure you have done the groundwork before setting up your business.

Head over to our small business guide on setting up a new business if you want to know more.

Want to calculate break even point quickly? Use our handy break-even point calculator.

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

A Quick Guide to Breakeven Analysis

It’s a simple calculation, but do you know how to use it?

In a world of Excel spreadsheets and online tools, we take a lot of calculations for granted. Take breakeven analysis. You’ve probably heard of it. Maybe even used the term before, or said: “At what point do we break even?” But because you may not entirely understand the math — and because understanding the formula can only deepen your understanding of the concept — here’s a closer look at how the concept works in reality.

- Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast , and the author of two books: Getting Along: How to Work with Anyone (Even Difficult People) and the HBR Guide to Dealing with Conflict . She writes and speaks about workplace dynamics. Watch her TEDx talk on conflict and follow her on LinkedIn . amyegallo

Partner Center

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

Breakeven Analysis—Fixed Cost, Variable Cost, & Profit

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Fixed Costs

Variable costs, sample computation, using breakeven calculations.

A breakeven analysis determines the sales volume your business needs to start making a profit, based on your fixed costs, variable costs, and selling price. It often is used in conjunction with a sales forecast when developing a pricing strategy, either as part of a marketing plan or a business plan .

The formula for a breakeven analysis is:

Fixed costs/(Revenue per unit-Variable costs per unit)

Fixed costs are expenses that must be paid whether or not any units are produced. They are fixed over a specified period of time or range of production, and examples include:

- Business premises lease (or mortgage) costs over the contract period

- Startup loan payments (if you financed the business startup costs )

- Property taxes

- Vehicle leases (or loan payments if the vehicle is purchased)

- Equipment (machinery, tools, computers, etc.)

- Payroll (if employees are on salary)

- Accounting fees

Fixed costs are easy to calculate for existing businesses, but new businesses must do research to get the most accurate figures available.

Unit costs vary depending on the number of products produced and other factors. For instance, the cost of the materials needed and the labor used to produce units isn't always the same. Examples of variable costs include:

- Wages for commission-based employees (such as salespeople) or contractors

- Utility usage—electricity, gas, or water—that increases with activity

- Raw materials

- Advertising (can be fixed or variable)

- Equipment repair

- Sales tools such as credit card processing fees

Suppose that your fixed costs for producing 30,000 widgets are $30,000 a year.

Your variable costs are $2.20 for materials, $4 for labor, and $0.80 for overhead for a total of $7.

If you choose a selling price of $12.00 for each widget, then:

$30,000/($12-$7)=6,000 units .

This means that selling 6,000 widgets at $12 apiece covers your costs of $30,000. Each unit sold beyond 6,000 generates $5 worth of profit. A sample breakdown leading to this calculation might look soething like this:

A breakeven analysis allows you to apply various scenarios to your breakeven point and possibly increase profits. Some reasons to calculate the analysis include:

- Increasing the selling price : Staying with the example of $12 widgets, increasing the selling price by $1 reduces the number of units you need to sell by 1,000 based on a new calculation: $30,000/($13-$7)=5,000. However, increasing the selling price often is not an option in a highly competitive environment.

- Reducing your fixed costs : If you were able to reduce your fixed costs by $5,000, you also would reduce the breakeven point to 5,000 units sold. Reducing rent and payroll are common ways for businesses to reduce fixed costs, as is relocating to other jurisdictions that have lower business taxes or utility costs.

- Reducing variable costs : Reducing variable costs by $1 also would lower the breakeven point by 5,000 units. Variable costs typically are lowered by reducing material or labor costs. For example, a builder could source lumber from a lower-cost supplieror take advantage of equipment and/or technology to automate production.

- Increasing sales: Assuming breakeven unit sales of 6,000, increasing the number of units sold to 10,000 would boost profits by $20,000 (4,000 units at $5 per unit). This calculation can be used when considering the benefits of advertising. Raising your advertising budget by $5,000 per year would raise your fixed costs to $35,000 and your breakeven point to 7,000. If such an ad campaign raised your unit sales from 6,000 to more than 7,000, it would be considered successful.

What Is Break-Even Analysis and How to Calculate It for Your Business?

You may have an idea that spurs you to open a business or launch a new product on little more than a hope and a dream. Or, you might just be thinking about expanding a product offering or hiring additional personnel. It’s wise, however, to limit your risk before jumping in. A break-even analysis will reveal the point at which your endeavor will become profitable—so you can know where you’re headed before you invest your money and time.

A break-even analysis will provide fodder for considerations such as price and cost adjustments. It can tell you whether you may need to borrow money to keep your business afloat until you’re pocketing profits, or whether the endeavor is worth pursuing at all.

What Is Break-Even Analysis?

A break-even analysis is a financial calculation that weighs the costs of a new business, service or product against the unit sell price to determine the point at which you will break even. In other words, it reveals the point at which you will have sold enough units to cover all of your costs. At that point, you will have neither lost money nor made a profit.

Key Takeaways

- A break-even analysis reveals when your investment is returned dollar for dollar, no more and no less, so that you have neither gained nor lost money on the venture.

- A break-even analysis is a financial calculation used to determine a company’s break-even point (BEP). In general, lower fixed costs lead to a lower break-even point.

- A business will want to use a break-even analysis anytime it considers adding costs—remember that a break-even analysis does not consider market demand.

- There are two basic ways to lower your break-even point: lower costs and raise prices.

How Break-Even Analysis Works

A break-even analysis is a financial calculation used to determine a company’s break-even point (BEP). It is an internal management tool, not a computation, that is normally shared with outsiders such as investors or regulators. However, financial institutions may ask for it as part of your financial projections on a bank loan application.

The formula takes into account both fixed and variable costs relative to unit price and profit. Fixed costs are those that remain the same no matter how much product or service is sold. Examples of fixed costs include facility rent or mortgage, equipment costs, salaries, interest paid on capital, property taxes and insurance premiums.

Variable costs rise and fall according to changes in sales. Examples of variable costs include direct hourly labor payroll costs, sales commissions and costs for raw material, utilities and shipping. Variable costs are the sum of the labor and material costs it takes to produce one unit of your product.

Total variable cost is calculated by multiplying the cost to produce one unit by the number of units you produced. For example, if it costs $10 to produce one unit and you made 30 of them, then the total variable cost would be 10 x 30 = $300.

What is Contribution Margin?

The contribution margin is the difference (more than zero) between the product’s selling price and its total variable cost. For example, if a suitcase sells at $125 and its variable cost is $15, then the contribution margin is $110. This margin contributes to offsetting fixed costs.

Unit Contribution Margin = Sales Price – Variable Costs

The average variable cost is calculated as your total variable cost divided by the number of units produced.

In general, lower fixed costs lead to a lower break-even point—but only if variable costs are not higher than sales revenue.

Why Does Your Business Need to Perform Break-Even Analysis?

A break-even analysis has broad uses on its own merit. But it’s also a critical element of financial projections for startups and new or expanded product lines. Use it to determine how much seed money or startup capital you’ll need, and whether you’ll need a bank loan.

More mature businesses use break-even analyses to evaluate their risks in a variety of activities such as moving innovative ideas to production, adding or deleting products from the product mix and other scenarios. One example is in budgeting the addition of a new employee. A break-even analysis will reveal how many additional sales it will take to break even on expenses associated with the new hire.

What Is a Standard Break-Even Time Period?

An acceptable break-even window is six to 18 months. If your calculation determines a break-even point will take longer to reach, you likely need to change your plan to reduce costs, increase pricing or both. A break-even point more than 18 months in the future is a strong risk signal.

When to Use a Break-Even Analysis

Basically, a business will want to use a break-even analysis anytime it considers adding costs. These additional costs could come from starting a business, a merger or acquisition, adding or deleting products from the product mix, or adding locations or employees.

In other words, you should use a break-even analysis to determine the risk and value of any business investment, especially when one of these three events occurs:

1. Expanding a business

Break-even points (BEP) will help business owners/CFOs get a reality check on how long it will take an investment to become profitable. For example, calculating or modeling the minimum sales required to cover the costs of a new location or entering a new market.

2. Lowering pricing

Sometime businesses need to lower their pricing strategy to beat competitors in a specific market segment or product. So, when lowering pricing, businesses need to figure out how many more units they need to sell to offset or makeup a price decrease.

3. Narrowing down business scenarios

When making changes to the business, there are various scenarios and what-ifs on the table that complicate decisions about which scenario to go with. BEP will help business leaders reduce decision-making to a series of yes or no questions.

How Do You Calculate the Break-Even Point?

ERP and accounting software with managerial accounting features will typically calculate your BEP for you, but you may want to understand what goes into that equation.

Break-even analysis formula

Break-even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

You can also use our break-even analysis template.

Use Our Break-Even Analysis Template

Find your break-even point by using this break-even analysis template, customizable to your business.

Get the template

Break-even analysis example

Beth has dreams of opening a gourmet cupcake store. She does a break-even analysis to determine how many cupcakes she’ll have to sell to break even on her investment. She’s done the math, so she knows her fixed costs for one year are $10,000 and her variable cost per unit is $.50. She’s done a competitor study and some other calculations and determined her unit price to be $6.00.

$10,000 / ($6 – $0.50) = 1,819 cupcakes that Beth must sell in one year to break even

The Limitations of a Break-Even Analysis

The most important thing to remember is that break-even analysis does not consider market demand. Knowing that you need to sell 500 units to break even does not tell you if or when you can sell those 500 units. Don’t let your passion for the business idea or new product cause you to lose sight of that basic truth.

On the flip side, you’ll need to decide how much effort and time you’re willing to expend to reach the break-even point. For example, are you willing to invest a substantial percentage of your sales team’s time and effort over several months to reach the break-even point? Or, is producing and selling something else a better and more profitable use of time and effort?

If you find demand for the product is soft, consider changing your pricing strategy to move product faster. However, discounted pricing can actually raise your break-even point. If you’re not careful, you’ll move product faster at the lower price but will incur more variable costs to produce more units in order to reach your break-even point.

Plan & Forecast More Accurately

How to Lower Your Break-Even Point

There are two basic ways to lower your break-even point: lower costs and raise prices. But neither should be done in a vacuum. Weigh your options carefully in pricing methods and consumer psychology to make sure you don’t sell more product but lose money in the bargain.

Further, consider all elements of costs, such as the associated quality and delivery, before slashing them to prevent damage to your brand. Outsourcing products or service can also reduce costs when demand or volume increase.

Financial Management

Cash Flow Analysis: Basics, Benefits and How to Do It

Cash flow is the amount of cash and cash equivalents, such as securities, that a business generates or spends over a set time period. Cash on hand determines a company’s runway—the more cash on hand and the lower…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

The Break Even Analysis Concept in Business Essay

Breakeven analysis, interpretation of the breakeven analysis.

Breakeven analysis is a procedure used by business owners, auditors, accountants, and management staff. It depends on sorting and classifying costs that change when the production yield varies and costs not straightforwardly identified with the volume of generation production (Choudhary, Patnaik, Singh, & Kaushal, 2013). By implication, accountants can classify the firm’s cost of operations based on fixed costs and variable costs.

Thus, total variable costs and fixed costs are equated with the services revenue to ascertain the level of sales at which the hospital makes a profit or loss. This technique is called the breakeven analysis. The contribution margin is a cost bookkeeping technique that gives the organization a chance to decide the benefit of its assets and services (Bai et al., 2017). The expression “contribution margin” refers to a unit measurement of the hospital’s service operating margin. It is computed as the service value minus its aggregate variable expenses per unit. This metric enables an organization to assess distinctive zones of the business to decide the productivity of each service.

This technique is also used to decide when the investment will have the capacity to fund the majority of its costs and make a profit. With a goal to become active and streamline the utilization of assets with decreasing repayments, healthcare facilities are always probing for profitable endeavors (Finkler, Jones, & Kovner, 2013). Accountants utilized this analysis to ascertain if an underlying business will be an effective utilization of capital and a productive resource.

After a broad market examination, the associates discovered there is a unique requirement for a fertility facility in the territory. The start-up costs for the fertility and treatment facility was set at $9,788,000, which incorporates the contracting of doctors, anesthesiologists, medical caretakers, staff attendants, compensations, wages, payment for high-innovation hardware, and miscellaneous expenditures.

Based on the above assumption, different operating variables will be computed.

The breakeven point of the hospital sales = Fixed cost of operation / Service price per unit – Variable cost of operations.

Consequently, the breakeven point = Fixed cost of operations / Contribution margin per unit.

Mathematically, breakeven point per unit X = Fixed cost / (Price – Variable cost).

- X = Breakeven point

- F = Fixed costs

- V = Variable cost per patient

- Therefore, X = F / (P-V).

The patient acuity of the facility is clarified under simple, moderate and complex. Based on this classification, the number of visits is charged and the percentages recorded.

The descriptive demographics are computed below.

The contribution margin is a cost bookkeeping technique that gives the organization a chance to decide the benefit of its assets and services. The expression “contribution margin” refers to a unit measurement of the hospital’s service operating margin. It is computed as the service value minus its aggregate variable expenses per unit. This metric enables an organization to assess distinctive zones of the business to decide the productivity of each service.

Therefore, contribution margin = Services revenue – Variable expenditures.

Please note, the hospital’s variable costs per patient = $500.

The contribution margin can be calculated using the variable cost and the cost of service per patient.

Thus, simple service = 2000 – 500 = 1500.

The contribution margin for Simple patient acuity = $1,500.

Moderate service = 6,500- 500 = 6,000

The contribution margin for Moderate patient acuity = $6,000.

Complex service = 10,000 – 500 = 9,500

The contribution margin for Complex patient acuity = $9,500.

The descriptive result of the contribution margin is presented below.

The weighted average contribution margin can be used to calculate the cost per visit. The weighted average contribution margin = Percentage patients visit x contribution margin. Thus, the patient acuity service will be used to determine the weighted average contribution margin.

Simple service = 15% x 1500 = $225

Moderate service = 60% x 6000 = $3600

Complex service = 25% x 9500 = $2375

The descriptive result of the weighted contribution margin is presented below.

Based on the result, the total weighted average contribution margin = Sum of each weighted average contribution margin.

Total weighted average contribution margin = 225 + 3600 + 2375 = $6,200

Thus, the breakeven analysis is computed using the number of visits.

Therefore, number of patient visits to the fertility clinic = Fixed cost / Total weighted average contribution margin.

Mathematically, Q = F/TWACM

Where Q = Number of patient visits

F = Fixed cost of visits per year

TWACM = Total weighted average contribution margin

Fixed cost = $9,788,000

Total weighted average contribution margin = $6,200.

Q = 9788000/6200

Number of patients visit to breakeven = 1579.

This figure can be used to compute the breakeven value for each patient acuity.

Simple patient acuity = 1579 x 15% = 237

Moderate patient acuity = 1579 x 60% = 947

Complex patient acuity = 1579 x 25% = 395

From the case study, the management of the fertility clinic expects 7488 visits per year.

Working days = 312 days

The planned visits and the number of working operating days can be used to calculate the number of patient visits per day.

Patients visits per day = 7488/312 = 24

Thus, 24 patients are treated daily.

The number of patient visits per year = 1579

Therefore, the breakeven per day = 1579/24 = 66 days.

To propel the hospital’s mission and objectives the fertility facility can breakeven in the first year of business with extra income in the preceding fiscal year. While the clinic’s patient acuity can be anticipated, volume levels can be realized and expanded through advertising and a robust referral framework that would balance any budgetary risk. Given these situations, it is suggested that this fertility clinic continues with the plans to execute an outpatient facility in this service territory.

Given the above business proposition, the fertility facility will take 66 days to break even, leaving 246 extra days to generate profit for future undertakings. Based on this analysis, the business is viable and profitable. If the hospital operates for 66 days, they will make the costs of operation. By implication, the remaining number of days would be used to accumulate profit.

Bai, Y., Gu, C., Chen, Q., Xiao, J., Liu, D., & Tang, S. (2017). The challenges that head nurses confront on financial management today: A qualitative study. International Journal of Nursing Sciences, 4 (1), 122-127. Web.

Choudhary, P., Patnaik, S., Singh, M., & Kaushal, G. (2013). Break-even analysis in healthcare setup. International Journal of Research Foundation of Hospital and Health Care Administration, 1 (1), 29-32. Web.

Finkler, S. A., Jones, C., & Kovner, C. (2013). Financial management for nurse managers and executives . (4th ed.) St. Louis: Elsevier.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, February 6). The Break Even Analysis Concept in Business. https://ivypanda.com/essays/the-break-even-analysis-concept-in-business/

"The Break Even Analysis Concept in Business." IvyPanda , 6 Feb. 2024, ivypanda.com/essays/the-break-even-analysis-concept-in-business/.

IvyPanda . (2024) 'The Break Even Analysis Concept in Business'. 6 February.

IvyPanda . 2024. "The Break Even Analysis Concept in Business." February 6, 2024. https://ivypanda.com/essays/the-break-even-analysis-concept-in-business/.

1. IvyPanda . "The Break Even Analysis Concept in Business." February 6, 2024. https://ivypanda.com/essays/the-break-even-analysis-concept-in-business/.

Bibliography

IvyPanda . "The Break Even Analysis Concept in Business." February 6, 2024. https://ivypanda.com/essays/the-break-even-analysis-concept-in-business/.

- Christian Missions in Japan and China

- Therapeutic Relationships and Sensory Acuity

- Christian Missions in Japan and Imperial China

- The Maternal Child Unit: Triage Acuity System

- Hearing and Vision Acuity in Human Participants

- Increasing Sales Volume With Break-Even Analysis

- Nurse-to-Patient Ratio and Acuity-Based Staffing Model

- Nursing Staffing Matrix Analysis

- Nursing Diagnosis: Poor Visual Acuity in an Eye

- Management Accounting: Break-Even Analysis

- Culture Influences on Financial Services Management

- General Machinery Company: Ratio and Performance Analysis

- Apple Company: Project Financing

- Value Creation & Conflict Resolution in Management

- Managerial Finance and Its Principles

- Subscriber Services

- For Authors

- Publications

- Archaeology

- Art & Architecture

- Bilingual dictionaries

- Classical studies

- Encyclopedias

- English Dictionaries and Thesauri

- Language reference

- Linguistics

- Media studies

- Medicine and health

- Names studies

- Performing arts

- Science and technology

- Social sciences

- Society and culture

- Overview Pages

- Subject Reference

- English Dictionaries

- Bilingual Dictionaries

Recently viewed (0)

- Save Search

- Share This Facebook LinkedIn Twitter

Related Content

Related overviews.

management accounting

cost behaviour

above-the-line

contribution

See all related overviews in Oxford Reference »

More Like This

Show all results sharing these subjects:

- Business and Management

breakeven analysis

Quick reference.

The study of the interrelationships between costs, sales volume, and prices at various levels of activity. The breakeven point is the time at which the fixed and variable costs involved in the production and distribution of a product are matched by its overall sales: the point at which total costs are exactly equal to revenues. Beyond this point, when revenues exceed total costs, there lies profitability.

To understand the breakeven analysis it is necessary to appreciate fixed and variable costs:

Examples of costs that are typically ‘fixed’: • salaries of personnel • sales administration • advertising investments (‘*above-the-line’) • capital costs, such as building and plant

• salaries of personnel

• sales administration

• advertising investments (‘*above-the-line’)

• capital costs, such as building and plant

Examples of costs that are typically ‘variable’: • commissions to agents and brokers and salesmen • delivery costs • after-sales maintenance and service • credit • order processing • invoicing • non-advertising marketing costs (‘*below-the-line’)

• commissions to agents and brokers and salesmen

• delivery costs

• after-sales maintenance and service

• order processing

• invoicing

• non-advertising marketing costs (‘*below-the-line’)

In physical volume terms, the usual formula for the breakeven point is:breakeven point=Fixed cost(Sales revenue-Variable cost)/Units sold

The main purposes of a breakeven analysis for a marketer are to provide information about cost behaviour for new product marketing activities and to determine specific decision-making. A marketer of a new product needs to know what volume of sales is needed at any given budgeted sales price in order to break even. The product marketer needs to identify the ‘risk’ in the budget by measuring the margin and to calculate the effects on profit of changes in variable cost, cost of sales ratios, sales price, and volume and product mix.

Care should be taken in applying the breakeven analysis to real-life marketing, particularly in a dynamic market environment. The breakeven point contains some risky assumptions: for example, sales prices are assumed to be constant and fixed costs are assumed to remain stable. A breakeven calculation only holds for circumstances where efficiency remains constant, notwithstanding increased productivity. Since there is a direct relationship between purchases and sales, then all that is manufactured can actually be sold and the sales and marketing mix will be maintained at the same levels throughout the initial launch.

Although the breakeven analysis lends itself to product marketing, it can also be applied to services. For example, if a company is arranging a large entertainment event, it is important to know how the fixed and variable costs of producing and marketing the event are linked to the sale of tickets to the event. Dividing the fixed and variable costs of an event will give an indication of how many tickets need to be sold and at what price in order to make the event break even.

Breakeven analysis

From: breakeven analysis in A Dictionary of Marketing »

Subjects: Social sciences — Business and Management

Related content in Oxford Reference

Reference entries, break-even analysis.

View all reference entries »

View all related items in Oxford Reference »

Search for: 'breakeven analysis' in Oxford Reference »

- Oxford University Press

PRINTED FROM OXFORD REFERENCE (www.oxfordreference.com). (c) Copyright Oxford University Press, 2023. All Rights Reserved. Under the terms of the licence agreement, an individual user may print out a PDF of a single entry from a reference work in OR for personal use (for details see Privacy Policy and Legal Notice ).

date: 20 April 2024

- Cookie Policy

- Privacy Policy

- Legal Notice

- Accessibility

- [66.249.64.20|185.194.105.172]

- 185.194.105.172

Character limit 500 /500

Break-Even Analysis: Introduction, Assumptions and Limitations

In this article we will discuss about:- 1. Introduction to Break-Even Analysis 2. Assumptions of Break-Even Analysis 3. Limitations.

Introduction to Break-Even Analysis:

Break-even analysis is of vital importance in determining the practical application of cost functions. It is a function of three factors, i.e., sales volume, cost and profit. It aims at classifying the dynamic relationship existing between total cost and sale volume of a company.

Hence it is also known as “cost-volume-profit analysis”. It helps to know the operating condition that exists when a company ‘breaks-even’, that is when sales reach a point equal to all expenses incurred in attaining that level of sales.

Assumptions of Break-Even Analysis:

The break-even analysis is based on the following set of assumptions:

ADVERTISEMENTS:

(i) The total costs may be classified into fixed and variable costs. It ignores semi-variable cost.

(ii) The cost and revenue functions remain linear.

(iii) The price of the product is assumed to be constant.

(iv) The volume of sales and volume of production are equal.

(v) The fixed costs remain constant over the volume under consideration.

(vi) It assumes constant rate of increase in variable cost.

(vii) It assumes constant technology and no improvement in labour efficiency.

(viii) The price of the product is assumed to be constant.

(ix) The factor price remains unaltered.

(x) Changes in input prices are ruled out.

(xi) In the case of multi-product firm, the product mix is stable.

Limitations of Break-Even Analysis:

We may now mention some important limitations which ought to be kept in mind while using break-even analysis:

1. In the break-even analysis, we keep everything constant. The selling price is assumed to be constant and the cost function is linear. In practice, it will not be so.

2. In the break-even analysis since we keep the function constant, we project the future with the help of past functions. This is not correct.

3. The assumption that the cost-revenue-output relationship is linear is true only over a small range of output. It is not an effective tool for long-range use.

4. Profits are a function of not only output, but also of other factors like technological change, improvement in the art of management, etc., which have been overlooked in this analysis.

5. When break-even analysis is based on accounting data, as it usually happens, it may suffer from various limitations of such data as neglect of imputed costs, arbitrary depreciation estimates and inappropriate allocation of overheads. It can be sound and useful only if the firm in question maintains a good accounting system.

6. Selling costs are specially difficult to handle break-even analysis. This is because changes in selling costs are a cause and not a result of changes in output and sales.

7. The simple form of a break-even chart makes no provisions for taxes, particularly corporate income tax.

8. It usually assumes that the price of the output is given . In other words, it assumes a horizontal demand curve that is realistic under the conditions of perfect competition.

9. Matching cost with output imposes another limitation on break-even analysis. Cost in a particular period need not be the result of the output in that period.

10. Because of so many restrictive assumptions underlying the technique, computation of a breakeven point is considered an approximation rather than a reality.

Related Articles:

- Break-Even Analysis : Methods, Margin of Safety and Uses

- Break-Even Analysis’s Chart | Profits | Economics

- Advantages of Break Even Analysis | Profits | Economics

- Top 10 Managerial Uses of Break-Even Analysis

Break-even Analysis

Cite this chapter.

- Roger Hussey 2

Part of the book series: Macmillan Professional Masters ((PRMA))

120 Accesses

2 Citations

Break-even analysis is concerned with predicting costs, volume and profit as the level of activity changes. The theory of break-even analysis is derived from the principles of marginal costing, and the assumptions and definitions of fixed and variable costs and their behaviours discussed in earlier chapters are used.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Institutional subscriptions

Unable to display preview. Download preview PDF.

Author information

Authors and affiliations.

Bristol Business School, UK

Roger Hussey ( Principal Lecturer )

You can also search for this author in PubMed Google Scholar

Copyright information

© 1989 Roger Hussey

About this chapter

Hussey, R. (1989). Break-even Analysis. In: Cost and Management Accounting. Macmillan Professional Masters. Palgrave, London. https://doi.org/10.1007/978-1-349-19930-3_15

Download citation

DOI : https://doi.org/10.1007/978-1-349-19930-3_15

Publisher Name : Palgrave, London

Print ISBN : 978-0-333-44249-4

Online ISBN : 978-1-349-19930-3

eBook Packages : Palgrave Business & Management Collection Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- List of Commerce Articles

- What Is Break Even Analysis

Break-Even Analysis

A break-even analysis is an economic tool that is used to determine the cost structure of a company or the number of units that need to be sold to cover the cost. Break-even is a circumstance where a company neither makes a profit nor loss but recovers all the money spent.

The break-even analysis is used to examine the relation between the fixed cost, variable cost, and revenue. Usually, an organisation with a low fixed cost will have a low break-even point of sale.

Importance of Break-Even Analysis

- Manages the size of units to be sold: With the help of break-even analysis, the company or the owner comes to know how many units need to be sold to cover the cost. The variable cost and the selling price of an individual product and the total cost are required to evaluate the break-even analysis.

- Budgeting and setting targets: Since the company or the owner knows at which point a company can break-even, it is easy for them to fix a goal and set a budget for the firm accordingly. This analysis can also be practised in establishing a realistic target for a company.

- Manage the margin of safety: In a financial breakdown, the sales of a company tend to decrease. The break-even analysis helps the company to decide the least number of sales required to make profits. With the margin of safety reports, the management can execute a high business decision.

- Monitors and controls cost: Companies’ profit margin can be affected by the fixed and variable cost. Therefore, with break-even analysis, the management can detect if any effects are changing the cost.

- Helps to design pricing strategy: The break-even point can be affected if there is any change in the pricing of a product. For example, if the selling price is raised, then the quantity of the product to be sold to break-even will be reduced. Similarly, if the selling price is reduced, then a company needs to sell extra to break-even.

Components of Break-Even Analysis

- Fixed costs: These costs are also known as overhead costs. These costs materialise once the financial activity of a business starts. The fixed prices include taxes, salaries, rents, depreciation cost, labour cost, interests, energy cost, etc.

- Variable costs: These costs fluctuate and will decrease or increase according to the volume of the production. These costs include packaging cost, cost of raw material, fuel, and other materials related to production.

Uses of Break-Even Analysis

- New business: For a new venture, a break-even analysis is essential. It guides the management with pricing strategy and is practical about the cost. This analysis also gives an idea if the new business is productive.

- Manufacture new products: If an existing company is going to launch a new product, then they still have to focus on a break-even analysis before starting and see if the product adds necessary expenditure to the company.

- Change in business model: The break-even analysis works even if there is a change in any business model like shifting from retail business to wholesale business. This analysis will help the company to determine if the selling price of a product needs to change.

Break-Even Analysis Formula

Break-even point = Fixed cost/-Price per cost – Variable cost

Example of break-even analysis

Company X sells a pen. The company first determined the fixed costs, which include a lease, property tax, and salaries. They sum up to ₹1,00,000. The variable cost linked with manufacturing one pen is ₹2 per unit. So, the pen is sold at a premium price of ₹10.

Therefore, to determine the break-even point of Company X, the premium pen will be:

Break-even point = Fixed cost/Price per cost – Variable cost

= ₹1,00,000/(₹12 – ₹2)

= 1,oo,000/10

Therefore, given the variable costs, fixed costs, and selling price of the pen, company X would need to sell 10,000 units of pens to break-even.

The above-mentioned is the concept of ‘Break-Even Analysis’. To know more, stay tuned to our website.

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

- Share Share

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

- Small Business Loans

- Working Capital Loans

- Short Term Business Loans

- Equipment Financing and Leasing

- Types of Funding Solutions

- Customer Reviews

- Meet Our Customers

- Sponsorships

- How We Work

- Search for: Search Button

- Financial Health

What Is a Break-Even Analysis?

- by James Woodruff James Woodruff has been a ... more

- November 14, 2019

- 2 Minute Read

- Home > Blog > Financial Health > What Is a Break-Even Analysis?

It can take time for your small business to turn a profit. When you near that stage, it’s critical to know your break-even sales volume. It’s a benchmark performance metric for every small business because it establishes the target needed to cover costs and make a profit.

A break-even analysis results in neither a profit nor a loss. Instead, it determines the number of sales needed to cover all variable and fixed costs. It calculates the minimum number of units to sell and the sales volume needed to pay all expenses before making a profit.

What Is the Break-Even Analysis Formula?

The formula for break-even analysis is:

- Break-even volume in units = Fixed Costs/(Revenue per unit – Variable costs per unit)

Fixed costs include rent, utilities, insurance and administrative wages. Revenue is the selling price per unit. Variable costs are the materials and direct labor of production.

How Is Break-Even Calculated?

As an example, suppose your company manufactures sneakers and has the following production figures:

- Total fixed costs: $474,000

- Variable costs per pair of sneakers: $65

- Sales price per pair: $95

The break-even point in unit volume is:

- Break-even units = $474,000/($95 – $65) = 15,800 pairs of sneakers

The break-even sales volume is:

- Break-even sales = Unit sales price X break-even units = $95 X 15,800 = $1,501,000

How to Use Break-Even Calculations

A break-even analysis helps to manage other aspects of your business. For example, it can:

- Set budgets: Determine the effects of changes in fixed and variable costs.

- Motivate sales staff: With break-even as the original target, sales employees can see the results of extra sales on profits and the potential for more commissions.

- Monitor and control costs: Break-even sets cost control points.

- Decide a pricing strategy: With break-even charts, managers can gauge the impact of changing selling prices on sales volume and profitability.

What is a break-even analysis going to reveal for your business? Try out these formulas yourself, check out the SCORE break-even analysis template, or give your accountant a call to determine this critical calculation.

Tags: Business Budget , Business Financing , Business Growth , Retail

RECOMMENDED FOR YOU

Bottom Line vs. Top Line: What’s the Difference for Small Business Owners?

Net income vs. net revenue: what’s the difference, how to run a successful electrical business, fixed and working capital: what’s the difference.

You are leaving NationalFunding.com

You are now leaving the National Funding website, and are being connected to a third party website. Please note that National Funding is not responsible for the information, content, or product(s) found on third party websites.

Your Article Library

Essay on break-even analysis (bea) | microeconomics.

ADVERTISEMENTS:

In this essay we will discuss about Break-Even Analysis (BEA). After reading this essay you will learn about: 1. Meaning of Break-Even Analysis 2. The Graphical Method or Break-Even Chart 3. Margin of Safety 4. The Equation Method 5. The Contribution Margin 6. Assumptions 7. Limitations 8. Uses.

- Essay on the Uses of Break-Even Analysis

Essay # 1. Meaning of Break-Even Analysis :

The break-even analysis (BEA) indicates at what level total costs and total revenue are in equilibrium. It is an analytical technique that is used to identify the level of output and sales volume at which the firm ‘breaks- even’, i.e. the revenues are sufficient to cover all costs.

BEA establishes the relationship among fixed and variable costs of production, volume of production, value of output, sales value and profit. It is, therefore, also known as Cost-Volume-Project (CVP) analysis. Three approaches are commonly used to solve the BE problems.

Essay # 3. Margin of Safety :

This type of BEA can be used to calculate the level of sales which must be attained to avoid loss or to calculate the margin of safety (MS). MS is the difference between the firm’s actual level of sales and sales at the BE point, as shown in the Figure 1. It is expressed as: MS = Actual sales revenue-BE sales.

However, firms calculate the MS in terms of ratio as:

MS Ratio = MS/Actual Sales

The MS is an indicator of the strength of a firm. If the margin is large, it shows that the firm can make profit even if it has to face difficulties. On the other hand, if the margin is small, a small reduction in sales can lead to loss. MS is nil at the BE point because actual sales volume is equal to the cost.

Essay # 4. The Equation Method :

The same results can be arrived at by the equation method:

Profit = TR – TVC – TFC

where TR = Price x Quantity

TVC = AVC x Quantity TFC is a constant)

BE point is where profit = 0

And 0 = (Price x Quantity) – (AVC x Quantity) – TFC.

Rearranging the above equation:

BE Quantity = TFC /Price-AVC

Essay # 5. The Contribution Margin:

Price – AVC in the above equation represents the contribution margin. Thus the above equation can be written as

BE. Point = TFC/Contribution Margin

Fig. 2 illustrates the contribution margin where TVC is the total variable cost. TFC (total fixed cost) is added to TVC in order to arrive at TC (total cost). The difference between TR and TVC is the contribution margin.

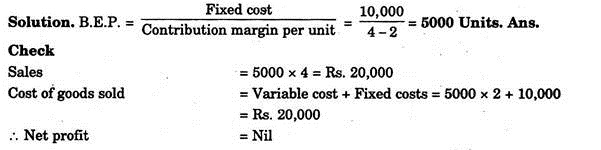

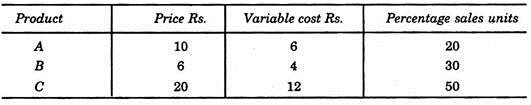

Suppose TFC = Rs150

AVC = Rs 12

(Price) P = Rs 15

BE Quantity = 150/15-12=150/3 =50 units

Now TR = P × Q= 15 × 50= Rs 750 TC = TFC + TVC = 150 + (12×50) = Rs 750 Thus BE point is 50 units where TR (Rs 750) = TC (Rs 750)

Essay # 6. Assumptions of Break-Even Analysis :

The break-even analysis is based on the following assumptions:

1. The cost and revenue functions are linear.

2. Total cost is divided into fixed and variable costs.

3. Fixed cost is constant.

4. Variable costs change proportionately with output.

5. The number of units produced and sold of the product is identical. It means that there is no opening or closing stock.

6. The sale price is constant.

7. Factor prices are constant.

8. Costs are affected only by the quantity produced.

9. There is no change in technology and productivity.

10. There is only one product. In case of multiproduct, the product-mix remains constant.

Essay # 7. Limitations of Break-Even Analysis :

The break-even analysis has certain limitations which are discussed as under:

a. Constant Price:

The straight line TR curve assumes that every level of output can be sold at the same price. This is unrealistic because product prices do not remain constant as output increases. In fact, they change frequently.

b. Constant Cost:

It is also assumed that whatever the level of output, AVC remains the same. This suggests that there is no limit to output which the firm can produce. This is again highly unrealistic. The above two assumptions make the BE analysis static in nature.

c. Limitless Profits:

This analysis assumes that profits are a function of output. This suggests that profits increase without limit as the level of output rises. In fact, this never happens because profits are influenced by technological changes, improved management, higher productivity, changes in the scale of fixed factors, etc.

d. Ignores Selling Costs:

It is based only on production costs and neglects selling costs.

e. Data Limitations:

As the BE analysis is based on accounting data, it suffers from such limitations of data as neglect of imputed costs, arbitrary depreciation estimates, inappropriate allocation of overhead costs etc.

f. Limited Products:

This analysis is based on a limited range of products and area. The present day firm produces many products and has many departments or plants which cannot be lumped together and presented on a single BE chart. So the scope of this analysis is limited to a single product of a particular business firm.

g. Short-Run Analysis:

The BEA can be used only during the short run. As such, it is not an effective tool for the long run.

h. Ignores Elasticity of Demand:

It ignores the concept of elasticity of demand and the possibility that different prices may lead to different levels of demand.

i. Ignores Diminishing Returns:

It ignores the principle of diminishing returns which every firm has to keep in view for breaking-even.

Essay # 8. Uses of Break-Even Analysis :

Despite the above noted limitations, the BEA is a useful device for decision making by a firm. It possesses the following advantages in planning and control of business activity.

(i) Product Planning:

It helps the firm in product planning based on its estimated revenue and costs. It can decide about adding a new product line or dropping an existing product line.

(ii) Activity Planning:

The firm can plan about the expansion or reduction of its plant capacity based on its BE analysis.

(iii) Profit Planning:

This analysis helps the firm to plan about the profit level to be earned. This estimate is based on the projections of revenue and costs for the future.

(iv) Safety Margin:

It can be used in determining the safety margin relating to decline in sales without incurring losses.

(v) Target Capacity:

It helps the firm in determining its target sales quantity in order to benefit from its minimum average variable costs of production.

(vi) Price and Cost Changes: