Our education system is losing relevance. Here's how to unleash its potential

Our education system was founded to supply workers with a relatively fixed set of skills and knowledge

.chakra .wef-spn4bz{transition-property:var(--chakra-transition-property-common);transition-duration:var(--chakra-transition-duration-fast);transition-timing-function:var(--chakra-transition-easing-ease-out);cursor:pointer;text-decoration:none;outline:2px solid transparent;outline-offset:2px;color:inherit;}.chakra .wef-spn4bz:hover,.chakra .wef-spn4bz[data-hover]{text-decoration:underline;}.chakra .wef-spn4bz:focus-visible,.chakra .wef-spn4bz[data-focus-visible]{box-shadow:var(--chakra-shadows-outline);} Karthik Krishnan

- Our current education system is built on the Industrial Revolution model and focuses on IQ, in particular memorization and standardization;

- We must update education with job readiness, the ability to compete against smart machines and the creation of long-term economic value in mind;

- Education access, equity and quality must be improved to solve the global education crisis – 72 million children of primary education age are not in school.

Education today is in crisis. Even before the coronavirus pandemic struck, in many parts of the world, children who should be in school aren’t; for those who are, their schools often lack the resources to provide adequate instruction. At a time when quality education is arguably more vital to one’s life chances than ever before, these children are missing out on the education needed to live fulfilling lives as adults and to participate in and contribute to the world economy.

Historically, education has been the shortest bridge between the haves and the have-nots, bringing progress and prosperity for both individuals and countries, but the current education system is showing its age. Founded at a time when industries needed workers with a relatively fixed set of skills and knowledge, it is losing its relevance in an era of innovation, disruption and constant change, where adaptability and learning agility are most needed.

Have you read?

Two things that need to change for the future of education, the world is failing miserably on access to education. here's how to change course, how higher education can adapt to the future of work.

Our current education system, built on the Industrial Revolution model, focuses on IQ, in particular memorization and standardization – skills that will be easily and efficiently supplanted by artificial and augmented intelligence (AI), where IQ alone isn’t sufficient. A good blend of IQ (intelligence) + EQ (emotional intelligence) + RQ (resilience) is critical to unleashing a student’s potential.

Evaluating our current education system against three criteria – job readiness, ability to compete against smart machines for jobs and creating long-term economic value – reveals the following:

- 34% of students believe their schools are not preparing them for success in the job market . We need to fix the bridge from education to employability;

- 60% of future jobs haven’t been developed yet and 40% of nursery-age children (kindergarteners) in schools today will need to be self-employed to have any form of income (Source: WEF Future of Jobs Report). We need to prepare students for jobs that haven’t been created yet and to become entrepreneurs. What we need to learn, how we learn, and the role of the teacher are all changing.

The $1.5 trillion in student debt in the US is the second highest debt after home mortgages . With tuition fees expected to break $100,000 per year , student debt will be crushing for future generations. Even Barack Obama was reportedly paying off student loans in his 40s . With the average new college graduate making $48,400 , many people will be paying off their student loans well into their retirement, hurting their ability to save, buy homes, support their families and contribute to philanthropic efforts.

While we work to transform education, we also need to make it more accessible. According to UNICEF, more than 72 million children of primary education age are not in school, while 750 million adults are illiterate and do not have the ability to improve their and their children’s living conditions . As we take on education transformation, daisy-chaining across three crucial categories (access, equity, quality/impact) is critical for unleashing potential.

Access means ensuring learners everywhere are not prevented by circumstances from being in school and getting an education. Access to education is low in many developing nations, but inequalities also exist within developed countries that are highly stratified socially , for example, in the UK . How do we make education/learning more accessible? What role can technology play? How can countries, particularly developing ones, hold on to top talent to ensure economic progress?

Equity means ensuring every child has the resources needed to get to school and to thrive, regardless of circumstance. While equality means treating every student the same; equity means making sure every student has the support they need to be successful. The essential drivers are fairness (ensuring that personal and social circumstances do not prevent students from achieving their academic potential); and inclusion (setting a basic minimum standard for all students regardless of background, gender or location). This leads to several questions: how do you raise awareness in communities? What role can technology play in creating personalized and differentiated learning so all students get the kind of instruction they need to succeed?

The definition of quality and success has to move beyond standardized test scores to a more holistic measurement tied to life improvements and societal impact. Quality education would provide learners with capabilities and competencies required to make them economically productive, develop sustainable livelihoods, enhance individual well-being and contribute to community. The impact orientation will help shift our gaze away from behaviour and activities (attending school and checking the box) to value-creation environments (from personalized learning and career counselling to job readiness and becoming responsible global citizens).

It’s in everybody’s best interest to solve the global education crisis:

- 13 million US students are likely to drop out of school during the next decade costing the country $3 trillion;

- Compared to high-school dropouts, graduates pay more taxes, draw less from social welfare programmes and are less likely to commit a crime;

- An 8% improvement in US PISA scores in the next 20 years would boost GDP by about $70 trillion in the next 80 years.

“Investing in education is the most cost-effective way to drive economic development, improve skills and opportunities for young women and men, and unlock progress on all 17 Sustainable Development Goals," says United Nations Secretary-General António Guterres .

So let us reset education and learning to meet 21st-century needs , shaping a path from education to employability and economic independence.

Let’s all commit to collectively helping to break a link in the shackles holding education back. Let’s blend the lessons of the past with the technology of the present and future to truly transform education, giving students the ability to think, learn and evolve no matter what the challenges that await them tomorrow and unleash their potential to benefit the world.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Education, gender and work.

.chakra .wef-1v7zi92{margin-top:var(--chakra-space-base);margin-bottom:var(--chakra-space-base);line-height:var(--chakra-lineHeights-base);font-size:var(--chakra-fontSizes-larger);}@media screen and (min-width: 56.5rem){.chakra .wef-1v7zi92{font-size:var(--chakra-fontSizes-large);}} Explore and monitor how .chakra .wef-ugz4zj{margin-top:var(--chakra-space-base);margin-bottom:var(--chakra-space-base);line-height:var(--chakra-lineHeights-base);font-size:var(--chakra-fontSizes-larger);color:var(--chakra-colors-yellow);}@media screen and (min-width: 56.5rem){.chakra .wef-ugz4zj{font-size:var(--chakra-fontSizes-large);}} Education, Gender and Work is affecting economies, industries and global issues

.chakra .wef-19044xk{margin-top:var(--chakra-space-base);margin-bottom:var(--chakra-space-base);line-height:var(--chakra-lineHeights-base);color:var(--chakra-colors-uplinkBlue);font-size:var(--chakra-fontSizes-larger);}@media screen and (min-width: 56.5rem){.chakra .wef-19044xk{font-size:var(--chakra-fontSizes-large);}} Get involved with our crowdsourced digital platform to deliver impact at scale

The agenda .chakra .wef-dog8kz{margin-top:var(--chakra-space-base);margin-bottom:var(--chakra-space-base);line-height:var(--chakra-lineheights-base);font-weight:var(--chakra-fontweights-normal);} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:flex;align-items:center;flex-wrap:wrap;} More on Education and Skills .chakra .wef-17xejub{flex:1;justify-self:stretch;align-self:stretch;} .chakra .wef-2sx2oi{display:inline-flex;vertical-align:middle;padding-inline-start:var(--chakra-space-1);padding-inline-end:var(--chakra-space-1);text-transform:uppercase;font-size:var(--chakra-fontSizes-smallest);border-radius:var(--chakra-radii-base);font-weight:var(--chakra-fontWeights-bold);background:none;box-shadow:var(--badge-shadow);align-items:center;line-height:var(--chakra-lineHeights-short);letter-spacing:1.25px;padding:var(--chakra-space-0);white-space:normal;color:var(--chakra-colors-greyLight);box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width: 37.5rem){.chakra .wef-2sx2oi{font-size:var(--chakra-fontSizes-smaller);}}@media screen and (min-width: 56.5rem){.chakra .wef-2sx2oi{font-size:var(--chakra-fontSizes-base);}} See all

Skills for the future: 4 ways to help workers transition to the digital economy

Simon Torkington

October 21, 2024

From herding to coding: the Mongolian NGO bridging the digital divide

World University Rankings 2025: Elite universities go increasingly global

What to know about generative AI: insights from the World Economic Forum

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

About half of Americans say public K-12 education is going in the wrong direction

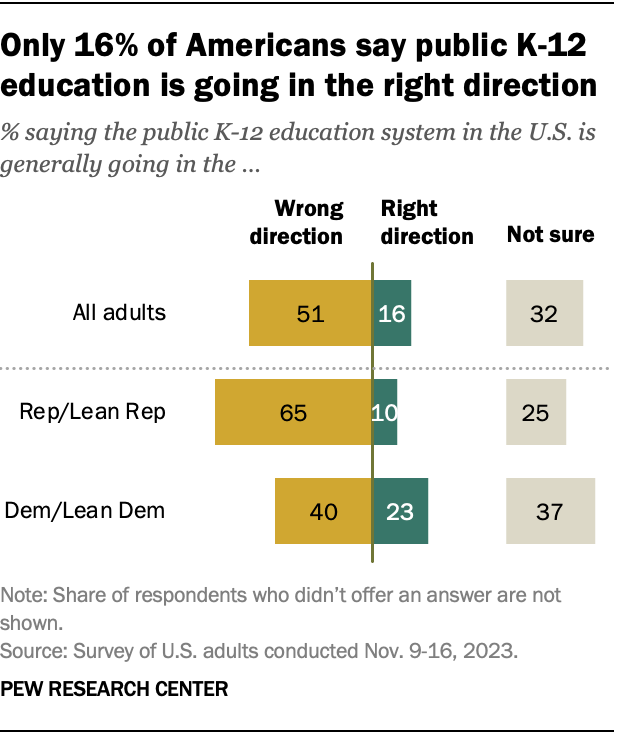

About half of U.S. adults (51%) say the country’s public K-12 education system is generally going in the wrong direction. A far smaller share (16%) say it’s going in the right direction, and about a third (32%) are not sure, according to a Pew Research Center survey conducted in November 2023.

Pew Research Center conducted this analysis to understand how Americans view the K-12 public education system. We surveyed 5,029 U.S. adults from Nov. 9 to Nov. 16, 2023.

The survey was conducted by Ipsos for Pew Research Center on the Ipsos KnowledgePanel Omnibus. The KnowledgePanel is a probability-based web panel recruited primarily through national, random sampling of residential addresses. The survey is weighted by gender, age, race, ethnicity, education, income and other categories.

Here are the questions used for this analysis , along with responses, and the survey methodology .

A majority of those who say it’s headed in the wrong direction say a major reason is that schools are not spending enough time on core academic subjects.

These findings come amid debates about what is taught in schools , as well as concerns about school budget cuts and students falling behind academically.

Related: Race and LGBTQ Issues in K-12 Schools

Republicans are more likely than Democrats to say the public K-12 education system is going in the wrong direction. About two-thirds of Republicans and Republican-leaning independents (65%) say this, compared with 40% of Democrats and Democratic leaners. In turn, 23% of Democrats and 10% of Republicans say it’s headed in the right direction.

Among Republicans, conservatives are the most likely to say public education is headed in the wrong direction: 75% say this, compared with 52% of moderate or liberal Republicans. There are no significant differences among Democrats by ideology.

Similar shares of K-12 parents and adults who don’t have a child in K-12 schools say the system is going in the wrong direction.

A separate Center survey of public K-12 teachers found that 82% think the overall state of public K-12 education has gotten worse in the past five years. And many teachers are pessimistic about the future.

Related: What’s It Like To Be A Teacher in America Today?

Why do Americans think public K-12 education is going in the wrong direction?

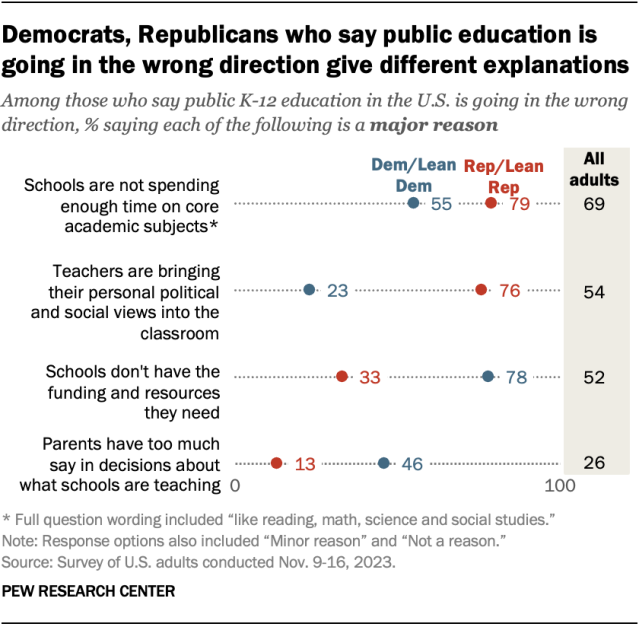

We asked adults who say the public education system is going in the wrong direction why that might be. About half or more say the following are major reasons:

- Schools not spending enough time on core academic subjects, like reading, math, science and social studies (69%)

- Teachers bringing their personal political and social views into the classroom (54%)

- Schools not having the funding and resources they need (52%)

About a quarter (26%) say a major reason is that parents have too much influence in decisions about what schools are teaching.

How views vary by party

Americans in each party point to different reasons why public education is headed in the wrong direction.

Republicans are more likely than Democrats to say major reasons are:

- A lack of focus on core academic subjects (79% vs. 55%)

- Teachers bringing their personal views into the classroom (76% vs. 23%)

In turn, Democrats are more likely than Republicans to point to:

- Insufficient school funding and resources (78% vs. 33%)

- Parents having too much say in what schools are teaching (46% vs. 13%)

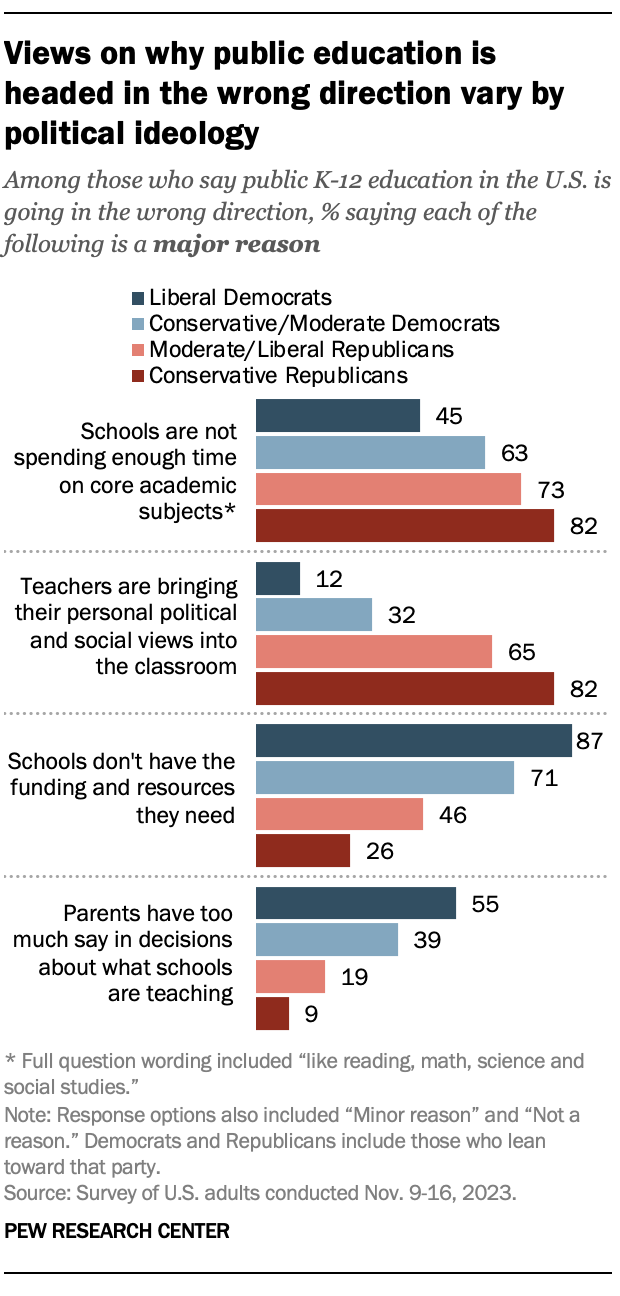

Views also vary within each party by ideology.

Among Republicans, conservatives are particularly likely to cite a lack of focus on core academic subjects and teachers bringing their personal views into the classroom.

Among Democrats, liberals are especially likely to cite schools lacking resources and parents having too much say in the curriculum.

Note: Here are the questions used for this analysis , along with responses, and the survey methodology .

- Partisanship & Issues

- Political Issues

Rachel Minkin is a research associate focusing on social and demographic trends research at Pew Research Center .

5 facts about child care costs in the U.S.

Most hispanic americans say increased representation would help attract more young hispanics to stem, most americans back cellphone bans during class, but fewer support all-day restrictions, a look at historically black colleges and universities in the u.s., key facts about public school teachers in the u.s., most popular.

901 E St. NW, Suite 300 Washington, DC 20004 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan, nonadvocacy fact tank that informs the public about the issues, attitudes and trends shaping the world. It does not take policy positions. The Center conducts public opinion polling, demographic research, computational social science research and other data-driven research. Pew Research Center is a subsidiary of The Pew Charitable Trusts , its primary funder.

© 2024 Pew Research Center

Transforming education systems: Why, what, and how

- Download the full policy brief

- Download the executive summary

- Baixe o resumo executivo

- Baixar o resumo da política

تنزيل موجز السياسة

تنزيل الملخص التنفيذي

- Descargar el PDF en Español

- Descargar el resumen de políticas

Subscribe to the Center for Universal Education Bulletin

Rebecca winthrop and rebecca winthrop director - center for universal education , senior fellow - global economy and development the hon. minister david sengeh the hon. minister david sengeh minister of education and chief innovation officer - government of sierra leone, chief innovation officer - directorate of science, technology and innovation in sierra leone.

June 23, 2022

Today, the topic of education system transformation is front of mind for many leaders. Ministers of education around the world are seeking to build back better as they emerge from COVID-19-school closures to a new normal of living with a pandemic. The U.N. secretary general is convening the Transforming Education Summit (TES) at this year’s general assembly meeting (United Nations, n.d.). Students around the world continue to demand transformation on climate and not finding voice to do this through their schools are regularly leaving class to test out their civic action skills.

It is with this moment in mind that we have developed this shared vision of education system transformation. Collectively we offer insights on transformation from the perspective of a global think tank and a national government: the Center for Universal Education (CUE) at Brookings brings years of global research on education change and transformation, and the Ministry of Education of Sierra Leone brings on-the-ground lessons from designing and implementing system-wide educational rebuilding.

This brief is for any education leader or stakeholder who is interested in charting a transformation journey in their country or education jurisdiction such as a state or district. It is also for civil society organizations, funders, researchers, and anyone interested in the topic of national development through education. In it, we answer the following three questions and argue for a participatory approach to transformation:

- Why is education system transformation urgent now? We argue that the world is at an inflection point. Climate change, the changing nature of work, increasing conflict and authoritarianism together with the urgency of COVID recovery has made the transformation agenda more critical than ever.

- What is education system transformation? We argue that education system transformation must entail a fresh review of the goals of your system – are they meeting the moment that we are in, are they tackling inequality and building resilience for a changing world, are they fully context aware, are they owned broadly across society – and then fundamentally positioning all components of your education system to coherently contribute to this shared purpose.

- How can education system transformation advance in your country or jurisdiction? We argue that three steps are crucial: Purpose (developing a broadly shared vision and purpose), Pedagogy (redesigning the pedagogical core), and Position (positioning and aligning all components of the system to support the pedagogical core and purpose). Deep engagement of educators, families, communities, students, ministry staff, and partners is essential across each of these “3 P” steps.

Related Content

Rebecca Winthrop, Adam Barton, Mahsa Ershadi, Lauren Ziegler

September 30, 2021

Jenny Perlman Robinson, Molly Curtiss Wyss, Patrick Hannahan

July 7, 2021

Emiliana Vegas, Rebecca Winthrop

September 8, 2020

Our aim is not to provide “the answer” — we are also on a journey and continually learning about what it takes to transform systems — but to help others interested in pursuing system transformation benefit from our collective reflections to date. The goal is to complement and put in perspective — not replace — detailed guidance from other actors on education sector on system strengthening, reform, and redesign. In essence, we want to broaden the conversation and debate.

Download the full policy brief»

Download the executive summary»

Baixe o resumo executivo»

Baixar o resumo da política»

Descargar el PDF en Español»

Descargar el resumen de políticas»

Global Education

Global Economy and Development

Center for Universal Education

Online only

Wednesday, 9:00 am - 10:00 am EST

October 30, 2024

Mary Burns, Rebecca Winthrop, Michael Trucano, Natasha Luther

October 15, 2024

- Share full article

Advertisement

Supported by

current events conversation

What Students Are Saying About How to Improve American Education

An international exam shows that American 15-year-olds are stagnant in reading and math. Teenagers told us what’s working and what’s not in the American education system.

By The Learning Network

Earlier this month, the Program for International Student Assessment announced that the performance of American teenagers in reading and math has been stagnant since 2000 . Other recent studies revealed that two-thirds of American children were not proficient readers , and that the achievement gap in reading between high and low performers is widening.

We asked students to weigh in on these findings and to tell us their suggestions for how they would improve the American education system.

Our prompt received nearly 300 comments. This was clearly a subject that many teenagers were passionate about. They offered a variety of suggestions on how they felt schools could be improved to better teach and prepare students for life after graduation.

While we usually highlight three of our most popular writing prompts in our Current Events Conversation , this week we are only rounding up comments for this one prompt so we can honor the many students who wrote in.

Please note: Student comments have been lightly edited for length, but otherwise appear as they were originally submitted.

Put less pressure on students.

One of the biggest flaws in the American education system is the amount of pressure that students have on them to do well in school, so they can get into a good college. Because students have this kind of pressure on them they purely focus on doing well rather than actually learning and taking something valuable away from what they are being taught.

— Jordan Brodsky, Danvers, MA

As a Freshman and someone who has a tough home life, I can agree that this is one of the main causes as to why I do poorly on some things in school. I have been frustrated about a lot that I am expected to learn in school because they expect us to learn so much information in such little time that we end up forgetting about half of it anyway. The expectations that I wish that my teachers and school have of me is that I am only human and that I make mistakes. Don’t make me feel even worse than I already am with telling me my low test scores and how poorly I’m doing in classes.

— Stephanie Cueva, King Of Prussia, PA

I stay up well after midnight every night working on homework because it is insanely difficult to balance school life, social life, and extracurriculars while making time for family traditions. While I don’t feel like making school easier is the one true solution to the stress students are placed under, I do feel like a transition to a year-round schedule would be a step in the right direction. That way, teachers won’t be pressured into stuffing a large amount of content into a small amount of time, and students won’t feel pressured to keep up with ungodly pacing.

— Jacob Jarrett, Hoggard High School in Wilmington, NC

In my school, we don’t have the best things, there are holes in the walls, mice, and cockroaches everywhere. We also have a lot of stress so there is rarely time for us to study and prepare for our tests because we constantly have work to do and there isn’t time for us to relax and do the things that we enjoy. We sleep late and can’t ever focus, but yet that’s our fault and that we are doing something wrong. School has become a place where we just do work, stress, and repeat but there has been nothing changed. We can’t learn what we need to learn because we are constantly occupied with unnecessary work that just pulls us back.

— Theodore Loshi, Masterman School

As a student of an American educational center let me tell you, it is horrible. The books are out dated, the bathrooms are hideous, stress is ever prevalent, homework seems never ending, and worst of all, the seemingly impossible feat of balancing school life, social life, and family life is abominable. The only way you could fix it would be to lessen the load dumped on students and give us a break.

— Henry Alley, Hoggard High School, Wilmington NC

Use less technology in the classroom (…or more).

People my age have smaller vocabularies, and if they don’t know a word, they just quickly look it up online instead of learning and internalizing it. The same goes for facts and figures in other subjects; don’t know who someone was in history class? Just look ‘em up and read their bio. Don’t know how to balance a chemical equation? The internet knows. Can’t solve a math problem by hand? Just sneak out the phone calculator.

My largest grievance with technology and learning has more to do with the social and psychological aspects, though. We’ve decreased ability to meaningfully communicate, and we want everything — things, experiences, gratification — delivered to us at Amazon Prime speed. Interactions and experiences have become cheap and 2D because we see life through a screen.

— Grace Robertson, Hoggard High School Wilmington, NC

Kids now a days are always on technology because they are heavily dependent on it- for the purpose of entertainment and education. Instead of pondering or thinking for ourselves, our first instinct is to google and search for the answers without giving it any thought. This is a major factor in why I think American students tests scores haven’t been improving because no one wants to take time and think about questions, instead they want to find answers as fast as they can just so they can get the assignment/ project over with.

— Ema Thorakkal, Glenbard West HS IL

There needs to be a healthier balance between pen and paper work and internet work and that balance may not even be 50:50. I personally find myself growing as a student more when I am writing down my assignments and planning out my day on paper instead of relying on my phone for it. Students now are being taught from preschool about technology and that is damaging their growth and reading ability. In my opinion as well as many of my peers, a computer can never beat a book in terms of comprehension.

— Ethan, Pinkey, Hoggard High School in Wilmington, NC

Learning needs to be more interesting. Not many people like to study from their textbooks because there’s not much to interact with. I think that instead of studying from textbooks, more interactive activities should be used instead. Videos, websites, games, whatever might interest students more. I’m not saying that we shouldn’t use textbooks, I’m just saying that we should have a combination of both textbooks and technology to make learning more interesting in order for students to learn more.

— Vivina Dong, J. R. Masterman

Prepare students for real life.

At this point, it’s not even the grades I’m worried about. It feels like once we’ve graduated high school, we’ll be sent out into the world clueless and unprepared. I know many college students who have no idea what they’re doing, as though they left home to become an adult but don’t actually know how to be one.

The most I’ve gotten out of school so far was my Civics & Economics class, which hardly even touched what I’d actually need to know for the real world. I barely understand credit and they expect me to be perfectly fine living alone a year from now. We need to learn about real life, things that can actually benefit us. An art student isn’t going to use Biology and Trigonometry in life. Exams just seem so pointless in the long run. Why do we have to dedicate our high school lives studying equations we’ll never use? Why do exams focusing on pointless topics end up determining our entire future?

— Eliana D, Hoggard High School in Wilmington, NC

I think that the American education system can be improved my allowing students to choose the classes that they wish to take or classes that are beneficial for their future. Students aren’t really learning things that can help them in the future such as basic reading and math.

— Skye Williams, Sarasota, Florida

I am frustrated about what I’m supposed to learn in school. Most of the time, I feel like what I’m learning will not help me in life. I am also frustrated about how my teachers teach me and what they expect from me. Often, teachers will give me information and expect me to memorize it for a test without teaching me any real application.

— Bella Perrotta, Kent Roosevelt High School

We divide school time as though the class itself is the appetizer and the homework is the main course. Students get into the habit of preparing exclusively for the homework, further separating the main ideas of school from the real world. At this point, homework is given out to prepare the students for … more homework, rather than helping students apply their knowledge to the real world.

— Daniel Capobianco, Danvers High School

Eliminate standardized tests.

Standardized testing should honestly be another word for stress. I know that I stress over every standardized test I have taken and so have most of my peers. I mean they are scary, it’s like when you take these tests you bring your No. 2 pencil and an impending fail.

— Brennan Stabler, Hoggard High School in Wilmington, NC

Personally, for me I think standardized tests have a negative impact on my education, taking test does not actually test my knowledge — instead it forces me to memorize facts that I will soon forget.

— Aleena Khan, Glenbard West HS Glen Ellyn, IL

Teachers will revolve their whole days on teaching a student how to do well on a standardized test, one that could potentially impact the final score a student receives. That is not learning. That is learning how to memorize and become a robot that regurgitates answers instead of explaining “Why?” or “How?” that answer was found. If we spent more time in school learning the answers to those types of questions, we would become a nation where students are humans instead of a number.

— Carter Osborn, Hoggard High School in Wilmington, NC

In private school, students have smaller class sizes and more resources for field trips, computers, books, and lab equipment. They also get more “hand holding” to guarantee success, because parents who pay tuition expect results. In public school, the learning is up to you. You have to figure stuff out yourself, solve problems, and advocate for yourself. If you fail, nobody cares. It takes grit to do well. None of this is reflected in a standardized test score.

— William Hudson, Hoggard High School in Wilmington, NC

Give teachers more money and support.

I have always been told “Don’t be a teacher, they don’t get paid hardly anything.” or “How do you expect to live off of a teachers salary, don’t go into that profession.” As a young teen I am being told these things, the future generation of potential teachers are being constantly discouraged because of the money they would be getting paid. Education in Americans problems are very complicated, and there is not one big solution that can fix all of them at once, but little by little we can create a change.

— Lilly Smiley, Hoggard High School

We cannot expect our grades to improve when we give teachers a handicap with poor wages and low supplies. It doesn’t allow teachers to unleash their full potential for educating students. Alas, our government makes teachers work with their hands tied. No wonder so many teachers are quitting their jobs for better careers. Teachers will shape the rest of their students’ lives. But as of now, they can only do the bare minimum.

— Jeffery Austin, Hoggard High School

The answer to solving the American education crisis is simple. We need to put education back in the hands of the teachers. The politicians and the government needs to step back and let the people who actually know what they are doing and have spent a lifetime doing it decide how to teach. We wouldn’t let a lawyer perform heart surgery or construction workers do our taxes, so why let the people who win popularity contests run our education systems?

— Anders Olsen, Hoggard High School, Wilmington NC

Make lessons more engaging.

I’m someone who struggles when all the teacher does is say, “Go to page X” and asks you to read it. Simply reading something isn’t as effective for me as a teacher making it interactive, maybe giving a project out or something similar. A textbook doesn’t answer all my questions, but a qualified teacher that takes their time does. When I’m challenged by something, I can always ask a good teacher and I can expect an answer that makes sense to me. But having a teacher that just brushes off questions doesn’t help me. I’ve heard of teachers where all they do is show the class movies. At first, that sounds amazing, but you don’t learn anything that can benefit you on a test.

— Michael Huang, JR Masterman

I’ve struggled in many classes, as of right now it’s government. What is making this class difficult is that my teacher doesn’t really teach us anything, all he does is shows us videos and give us papers that we have to look through a textbook to find. The problem with this is that not everyone has this sort of learning style. Then it doesn’t help that the papers we do, we never go over so we don’t even know if the answers are right.

— S Weatherford, Kent Roosevelt, OH

The classes in which I succeed in most are the ones where the teachers are very funny. I find that I struggle more in classes where the teachers are very strict. I think this is because I love laughing. Two of my favorite teachers are very lenient and willing to follow the classes train of thought.

— Jonah Smith Posner, J.R. Masterman

Create better learning environments.

Whenever they are introduced to school at a young age, they are convinced by others that school is the last place they should want to be. Making school a more welcoming place for students could better help them be attentive and also be more open minded when walking down the halls of their own school, and eventually improve their test scores as well as their attitude while at school.

— Hart P., Bryant High School

Students today feel voiceless because they are punished when they criticize the school system and this is a problem because this allows the school to block out criticism that can be positive leaving it no room to grow. I hope that in the near future students can voice their opinion and one day change the school system for the better.

— Nico Spadavecchia, Glenbard West Highschool Glen Ellyn IL

The big thing that I have struggled with is the class sizes due to overcrowding. It has made it harder to be able to get individual help and be taught so I completely understand what was going on. Especially in math it builds on itself so if you don’t understand the first thing you learn your going to be very lost down the road. I would go to my math teacher in the morning and there would be 12 other kids there.

— Skyla Madison, Hoggard High School in Wilmington, NC

The biggest issue facing our education system is our children’s lack of motivation. People don’t want to learn. Children hate school. We despise homework. We dislike studying. One of the largest indicators of a child’s success academically is whether or not they meet a third grade reading level by the third grade, but children are never encouraged to want to learn. There are a lot of potential remedies for the education system. Paying teachers more, giving schools more funding, removing distractions from the classroom. All of those things are good, but, at the end of the day, the solution is to fundamentally change the way in which we operate.

Support students’ families.

I say one of the biggest problems is the support of families and teachers. I have heard many success stories, and a common element of this story is the unwavering support from their family, teachers, supervisors, etc. Many people need support to be pushed to their full potential, because some people do not have the will power to do it on their own. So, if students lived in an environment where education was supported and encouraged; than their children would be more interested in improving and gaining more success in school, than enacting in other time wasting hobbies that will not help their future education.

— Melanie, Danvers

De-emphasize grades.

I wish that tests were graded based on how much effort you put it and not the grade itself. This would help students with stress and anxiety about tests and it would cause students to put more effort into their work. Anxiety around school has become such a dilemma that students are taking their own life from the stress around schoolwork. You are told that if you don’t make straight A’s your life is over and you won’t have a successful future.

— Lilah Pate, Hoggard High School in Wilmington, NC

I personally think that there are many things wrong with the American education system. Everyone is so worried about grades and test scores. People believe that those are the only thing that represents a student. If you get a bad grade on something you start believing that you’re a bad student. GPA doesn’t measure a students’ intelligence or ability to learn. At young ages students stop wanting to come to school and learn. Standardized testing starts and students start to lose their creativity.

— Andrew Gonthier, Hoggard High School in Wilmington, NC

Praise for great teachers

Currently, I’m in a math class that changed my opinion of math. Math class just used to be a “meh” for me. But now, my teacher teachers in a way that is so educational and at the same time very amusing and phenomenal. I am proud to be in such a class and with such a teacher. She has changed the way I think about math it has definitely improve my math skills. Now, whenever I have math, I am so excited to learn new things!

— Paulie Sobol, J.R Masterman

At the moment, the one class that I really feel supported in is math. My math teachers Mrs. Siu and Ms. Kamiya are very encouraging of mistakes and always are willing to help me when I am struggling. We do lots of classwork and discussions and we have access to amazing online programs and technology. My teacher uses Software called OneNote and she does all the class notes on OneNote so that we can review the class material at home. Ms. Kamiya is very patient and is great at explaining things. Because they are so accepting of mistakes and confusion it makes me feel very comfortable and I am doing very well in math.

— Jayden Vance, J.R. Masterman

One of the classes that made learning easier for me was sixth-grade math. My teacher allowed us to talk to each other while we worked on math problems. Talking to the other students in my class helped me learn a lot quicker. We also didn’t work out of a textbook. I feel like it is harder for me to understand something if I just read it out of a textbook. Seventh-grade math also makes learning a lot easier for me. Just like in sixth-grade math, we get to talk to others while solving a problem. I like that when we don’t understand a question, our teacher walks us through it and helps us solve it.

— Grace Moan, J R Masterman

My 2nd grade class made learning easy because of the way my teacher would teach us. My teacher would give us a song we had to remember to learn nouns, verbs, adjectives, pronouns, etc. which helped me remember their definitions until I could remember it without the song. She had little key things that helped us learn math because we all wanted to be on a harder key than each other. She also sang us our spelling words, and then the selling of that word from the song would help me remember it.

— Brycinea Stratton, J.R. Masterman

Report | Budget, Taxes, and Public Investment

Public education funding in the U.S. needs an overhaul : How a larger federal role would boost equity and shield children from disinvestment during downturns

Report • By Sylvia Allegretto , Emma García , and Elaine Weiss • July 12, 2022

Download PDF

Press release

Share this page:

Summary

Education funding in the United States relies primarily on state and local resources, with just a tiny share of total revenues allotted by the federal government. Most analyses of the primary school finance metrics—equity, adequacy, effort, and sufficiency—raise serious questions about whether the existing system is living up to the ideal of providing a sound education equitably to all children at all times. Districts in high-poverty areas, which serve larger shares of students of color, get less funding per student than districts in low-poverty areas, which predominantly serve white students, highlighting the system’s inequity. School districts in general—but especially those in high-poverty areas—are not spending enough to achieve national average test scores, which is an established benchmark for assessing adequacy. Efforts states make to invest in education vary significantly. And the system is ill-prepared to adapt to unexpected emergencies.

These challenges are magnified during and after recessions. Following the Great Recession that began in December 2007, per-student education revenues plummeted and did not return to pre-recession levels for about eight years. The recovery in per-student revenues was even slower in high-poverty districts. This report combines new data on funding for states and for districts by school district poverty level, and over time, with evidence documenting the positive impacts of increasing investment in education to make a case for overhauling the school finance system. It calls for reforms that would ensure a larger role for the federal government to establish a robust, stable, and consistent school funding plan that channels sufficient additional resources to less affluent students in good times and bad. Furthermore, spending on public education should be retooled as an economic stabilizer, with increases automatically kicking in during recessions. Such a program would greatly mitigate cuts to public education as budgets are depleted, and also spur aggregate demand to give the economy a needed boost.

Following are key findings from the report:

Our current system for funding public schools shortchanges students, particularly low-income students. Education funding generally is inadequate and inequitable; It relies too heavily on state and local resources (particularly property tax revenues); the federal government plays a small and an insufficient role; funding levels vary widely across states; and high-poverty districts get less funding per student than low-poverty districts.

Those problems are magnified during and after recessions. Funding inadequacies and inequities tend to be aggravated when there is an economic downturn, which typically translates into problems that persist well after recovery is underway. After the 2007 onset of the Great Recession, for example, funding fell, and it took until 2015–2016, on average, to return to their pre-recession per-student revenue and spending levels. For high-poverty school districts, it took even longer—until 2016–2017—to rebound to their pre-recession revenue levels. And even after catching up with pre-recession levels, revenue levels in high-poverty districts lag behind the per-student funding in low-poverty districts. The general, long-standing funding inadequacies and inequities combined with the worsening of these problems during and in the aftermath of recessions have both short- and long-term repercussions that are costly for the students as well as for the country.

Increased federal spending on education after recessions helps mitigate funding shortfalls and inequities. Without increased federal education spending after recessions, school districts would suffer from an even greater decline in funding and even wider gaps between funding flowing to low-poverty and high-poverty districts.

Increased spending on education could help boost economic recovery. While Congress has enacted one-time education spending increases in difficult economic times, spending on public education should be considered one of the automatic stabilizers in our economic policy toolkit, designed to automatically increase and thus spur aggregate demand when private spending falls. Deployed this way, education spending becomes part of a set of large, broadly distributed programs that are countercyclical, i.e., designed to kick in when the economy overall is contracting and thus stave off or lessen the severity of a downturn. Along with other automatic stabilizers such as unemployment insurance, education spending thus would provide a stimulus to boost economic recovery.

We need an overhaul of the school finance system, with reforms ensuring a larger role for the federal government. In light of the concerns outlined in this report, policymakers must think differently both about school funding overall and about school funding during recessions. Public education is a public good, and as noted in this report, one that helps to stabilize the entire economy at critical points. Therefore, public spending on education should be treated as the public investment it is. While we leave it to policymakers to design specific reforms, we recommend an increased role for the federal government grounded in substantial, well targeted, consistent investment in the children who are our future, the professionals who help these children attain that future, and the environments in which they work. To establish a robust, stable, and consistent school funding plan that supports all children, investments need to be proportional to the size of the problems and to the societal and economic importance of the sector.

Introduction

The hope for the public education system in the United States is to provide a sound education equitably to all children regardless of where they live or into which families they are born. However, the COVID-19 pandemic exposed four interrelated, long-standing realities of U.S. public education funding that have long made that excellent, equitable education system impossible to achieve. First, inadequate levels of funding leave too many students unable to reach established performance benchmarks. Second, school funding is inequitable, with low-income students often and communities of color consistently lacking resources they need to meet their needs. Third, the level of funding reflects an overall underinvestment in education—that is, the U.S. is not spending as much as it could afford to spend in normal times. Fourth, given that educational investments are not sufficient across many districts even during normal times, schools are unable to make preparations to cope with emergencies or other unexpected circumstances. An added, less known feature is that economic downturns make all four of these problems worse. Downturns exacerbate funding inadequacies, inequities, underinvestment, and unpreparedness, causing cumulative harm to students, communities, and the public education system, and clawing back any prior progress. The severity of these problems varies widely across states and districts, as do the strength of states’ and localities’ economic and social protection systems, which may either compensate for or compound the problems.

The pandemic-led recession made these four major financial barriers to an excellent, equitable education system more visible, leading to serious questions about the U.S. education-funding model, which relies heavily on local and state revenues and draws only a small share of funding from the federal government. While public education is one of our greatest ideals and achievements—a free, quality education for every child regardless of means and background—the U.S. educational system is in need of significant improvements.

As the report will show, the core barriers to delivering universally excellent U.S. public education for all children—funding inadequacies and inequities that are exacerbated during tough economic times—were present in the system from the very start. They are the outcomes of a funding system that is shaped by many layers of policies and legal decisions at the local, state, and federal levels, creating widespread disparities in school finance realities across the thousands of districts across the country in all 50 states and the District of Columbia. This complex funding puzzle speaks to the need for a funding overhaul to attain meaningful and widely shared improvements.

In this report, we first provide an overview of the characteristics of the U.S. education funding system. We present data analyses on school finance indicators, such as equity, adequacy, and effort, that expose the shortcomings of funding policies and decisions across the country. We also discuss factors behind some of these shortcomings, such as the heavy reliance on local and state sources of funding.

Second, we illustrate that recessions exacerbate the funding challenges schools face. We parse a multitude of data to present trends in school finance indicators both during and after the Great Recession, demonstrating that the immediate effects of federally targeted funds helped schools navigate recession-induced budget cuts. We also look at the shortfalls and inequitable nature of those investments. We explore how increased federal investments—in good economic times and bad—could help address these long-standing problems. We argue that public education funding is not only an investment in our societal present and future, but also is a ready-made mechanism for countering economic downturns. Economic theory and evidence both demonstrate that large, broadly distributed programs providing public support serve as cushions during economic downturns: they spur overall spending and thus aggregate demand when private spending falls. As we note, there are strong arguments for placing public education spending within the broader category of effective fiscal responses to recessions that are countercyclical—designed to increase spending when spending in the economy overall is contracting and thus stave off or lessen the severity of a downturn. Increases in public education spending during downturns work as automatic stabilizers for schools and provide stimulus to boost economic recovery. We review existing research on the consequences of funding in general and of funding changes—evidence that supports a larger role for the federal government.

Third, we discuss the benefits of rethinking public education funding, along with the societal and economic advantages of a robust, stable, and consistent U.S. school funding plan, both generally and as a countercyclical policy. We show that federal investment that sustains school funding throughout recessions and recoveries would provide three major advantages: It would help boost educational instruction and standards, it would provide continued high-quality instruction for students and employment to the public education workforce, and it would stimulate economic recovery. Education funding, in particular, would blanket the country while also targeting areas with the most need, making the recovery more equitable.

We conclude the report with final thoughts and next steps.

This paper uses several terms to refer to investments in education and to define the U.S. school finance system. Below, we explain how these terms are used in the report:

Revenue indicates the dollar amounts that have been raised through various sources (at the local, state, and federal levels) to support elementary and secondary education. We distinguish between federal, state, and local revenue. Local revenue, in some of our charts, is further divided into local revenue from property taxes and from other sources.

Spending or expenditures indicates the dollar amount devoted to elementary and secondary education. Expenditures are typically divided by function and object (instruction, support services , and noninstructional education activities). We rely on data on current expenditures (instead of total expenditures; see footnotes 2 and 30).

Funding generically refers in this report to the educational investments or educational resources. Mostly, when we use funding we refer to revenue, i.e., to resources available or raised, but funding is also used to refer to the school finance system more broadly, and in that case it could be either referring to revenue or expenditures, depending on the context.

For more information on the list of components under each term, see the glossary in the Documentation for the NCES Common Core of Data School District Finance Survey (F-33), School Year 2017–18 (Fiscal Year 2018) (NCES CCD 2020).

A funding primer

The American education system relies heavily on state and local resources to fund public schools. In the U.S. education has long been a local- and state-level responsibility, with states typically concerned with administration and standards, and local districts charged with raising the bulk of the funds to carry those duties and standards out.

The Education Law Center notes that “states, under their respective constitutions, have the legal obligation to support and maintain systems of free public schools for all resident children. This means that the state is the unit of government in the U.S. legally responsible for operating our nation’s public school systems, which includes providing the funding to support and maintain those systems” (Farrie and Sciarra 2021). Bradbury (2021) explains that state constitutions assign responsibility for “adequate” (“sound,” “basic”) and/or “equitable” public education to the state government. Most state governments delegate responsibility for managing and (partially) funding public pre-K–12 education to local governments, but courts mandate that states remain responsible.

States meet this responsibility by funding their schools “through a statewide method or formula enacted by the state legislature. These school funding formulas or school finance systems determine the amount of revenue school districts are permitted to raise from local property and other taxes and the amount of funding or aid the state is expected to contribute from state taxes. In annual or biannual state budgets, legislatures also determine the actual amount of funding districts will receive to operate their schools” (Farrie and Sciarra 2020).

A quick note on data sources

Some of our analyses rely on district-level data, i.e., the revenues and expenditures use the district as the unit of analysis. We rely on metrics of per-student revenue or per-student spending, i.e., taking into consideration the number of students in the districts. Other analyses use data either by state or for the country, which are typically readily available from the Digest of Education Statistics online. Sometimes the variables of interest are total revenue or expenditures, whereas on other occasions we rely on per-student values. All data sources are explained under each figure and table, and some are also briefly explained in the Methodology.

The federal government seeks to use its limited but targeted funding to promote student achievement, foster educational excellence, and ensure equal access. The major federal agency channeling funding to school districts (sometimes through the states) is the U.S. Department of Education. 1

Figure A shows the percentage distribution of total revenue for U.S. public elementary and secondary schools for the 2017–2018 school year, on average. As illustrated, revenues collected from state and local sources are roughly equal (46.8% and 45.3%, respectively). Two other factors also stand out. First, revenue from property taxes accounts for more than one-third of total revenue (36.6 %). Second, federal funding plays a minimal role, providing less than 8% of total revenue (7.8%). As discussed later in the report, this heavy reliance on local funding is a major driver in the funding challenges districts face.

More than 90% of school funding comes from state and local sources : Revenues for public elementary and secondary schools by source of funds, 2017–2018

The data below can be saved or copied directly into Excel.

The data underlying the figure.

Source: National Center for Education Statistics’ Digest of Education Statistics (NCES 2020a).

Copy the code below to embed this chart on your website.

Key metrics reveal the four major financial barriers to an excellent, equitable education system

Fully comprehending how school funding works and how it contributes to systemic problems requires drawing on key metrics and characteristics that define the education investments or education funding. Understanding these metrics is the first step toward designing a comprehensive solution.

The adequacy metric tells us that funding is inadequate

Adequacy, one of the most widely used school finance indicators, measures whether the amount raised and spent per student is sufficient to achieve a certain level of output (typically a benchmark of student performance or an educational outcome).

We use the adequacy data provided by Baker, Di Carlo, and Weber (2020). These authors, who use the School Finance Indicators Database, compare current education spending by poverty quintile with spending levels required for students to achieve national average test scores—typically accepted as an educationally meaningful benchmark. The authors’ estimates account for factors that could affect the cost of providing education, including student characteristics, labor-market costs (differences in costs given the regional cost of living), and district characteristics (larger districts for example may enjoy economics of scale).

Figure B reveals that spending is not nearly enough, on average, to provide students with an adequate education. As this figure illustrates, relative to the wealthiest districts, the highest-poverty districts need more than twice as much spending per student to provide an adequate education. As the figure also shows, the gaps between what is spent on each student and what would be required for those students to achieve at the national level widen as the level of poverty increases. Medium- and high-poverty districts are spending, respectively, $700 and $3,078 per student less than what would be required. For the highest-poverty districts, that gap is $5,135, meaning districts there are spending about 30% less than what would be required to deliver an adequate level of education to their students. (Conversely, the two low-poverty quintiles are spending more than they need to reach that benchmark, another indication that funds are being poorly allocated.)

U.S. education spending is inadequate : Per-pupil spending compared with estimated spending required to achieve national average test scores, by poverty quintile of school district, 2017

Notes: District poverty is measured as the percentage of children (ages 5–17) living in the school district with family incomes below the federal poverty line, using data from the U.S. Census Bureau. The figure shows how much is spent in each of the five types of districts and how much they would need to spend for students to achieve national average test scores.

Source: Adapted from The Adequacy and Fairness of State School Finance Systems , Second Edition (Baker, Di Carlo, and Weber 2020).

The equity metric tells us that funding is inequitable

An equitable funding system ensures that, all else being equal, schools serving students with greater needs—whether for extra academic, socioemotional, health, or other supports—receive more resources and spend more to meet those needs than schools with a lower concentration of disadvantaged students. Across districts, states, and the country as a whole, this means allocating relatively more funding to districts serving larger shares of high-poverty communities than to wealthier ones. While our funding system does allocate additional funds based on need (e.g., to students officially designated as eligible for “special education” services under the federal Individuals with Disabilities Education Act and to children from low-income families through the federal Title I program), in practice, more funding overall goes to lower-needs districts than to those with high levels of student needs.

Figure C compares districts’ per-student revenues and expenditures by poverty level, and shows gaps relative to low-poverty districts. The figure is based on data from what was, when this research was conducted, the most recent version of the Local Education Agency Finance Survey (known as the F-33) (NCES-LEAFS, various years). As shown in the figure, on average, per-student revenue and spending in school districts serving wealthier households exceed revenue and spending in all other districts. In low-poverty districts (i.e., districts with a poverty rate in the bottom fourth of the poverty distribution), per-student revenues averaged $19,280 in the 2017–2018 school year, and per-student expenditures averaged $15,910. In the high-poverty districts (i.e., in the top fourth of the poverty distribution), per-student revenues were just $16,570, and per-student expenditures were $14,030. High-poverty districts raise $2,710 less in per-student revenue than the lowest–poverty school districts, reflecting a 14.1% revenue gap—meaning high-poverty districts receive 14.1% less in revenue. Per-student spending in high-poverty districts is $1,880 less than in low-poverty districts, an 11.8% gap. 2 In other words, rather than funding districts to address student needs, we are channeling fewer resources—about 14% less, per student—into districts with greater needs based on their student population.

Districts serving poorer students have less to spend on education than those serving wealthier students

: total per-student revenues by district poverty level, and revenue gaps relative to low-poverty districts, 2017–2018, : total per-student expenditures by district poverty level, and spending gaps relative to low-poverty districts, 2017–2018.

Notes: Amounts are in 2019–2020 dollars and rounded to the closest $10 and adjusted for each state’s cost of living. Low-poverty districts are districts whose poverty rate (for children ages 5 through 17) is in the bottom fourth of the poverty distribution; high-poverty districts are districts whose poverty rate is in the top fourth of the poverty distribution.

Extended notes: Sample includes districts serving elementary schools only, secondary schools only, or both; districts with nonmissing and nonzero numbers of students; and districts with nonmissing charter information. Amounts are in 2019–2020 dollars using the consumer price index from the Bureau of Labor Statistics (BLS CPI 2021) and rounded to the closest $10. Amounts are adjusted for each state’s cost of living using the historical Regional Price Parities (RPPs) from the Bureau of Economic Analysis (BEA 2021). Low-poverty districts are districts whose poverty rate (for children ages 5 through 17) is in the bottom fourth of the poverty distribution; medium-low-poverty districts are districts whose poverty rate (for children ages 5 through 17) is in the second fourth of the poverty distribution; medium-high-poverty districts are districts whose poverty rate (for children ages 5 through 17) is in the third fourth of the poverty distribution; high-poverty districts are districts whose poverty rate is in the top fourth of the poverty distribution. Amounts are unweighted across districts.

Sources: Authors’ analysis of 2017–2018 Local Education Agency Finance Survey (F-33) microdata from the National Center for Education Statistics (NCES-LEAFS 2021) and Small Area Income and Poverty Estimates (SAIPE) data from the U.S. Census Bureau (Urban Institute 2021a).

Adequacy and equity are closely intertwined

In recent decades, researchers have explored challenges to both adequacy and equity in U.S. public education. For example, Baker and Corcoran (2012) analyzed the various policies that drive inequitable funding. Likewise, lawsuits that have challenged state funding systems have tended to focus on either the inadequacy or inequity of those schemes. 3

But in reality, especially given extensive variation across states and districts, the two are closely linked and interact with one another. At the state level, for example, apparently adequate levels of funding can mask disparities across districts that innately mean inadequate funding for many, or even most, districts within that state (Farrie and Schiarra 2021). 4

In addition, disparate levels of public investments in education are often made in a context that correlates positively with disparate levels of parents’ private investments in their children’s education and related support (Caucutt et al. 2020; Duncan and Murnane 2016; Kornrich 2016; Schneider, Hastings, and LaBriola 2018). Substantial research on income-based gaps in achievement demonstrates that large and growing wealth inequality plays a role. Parents at the top of the income or wealth ladders, who can and do pour extensive resources into their children’s human capital, constantly set a baseline of performance that can be hard for children and schools without such investment to attain (Reardon 2011; García and Weiss 2017). 5

The “effort” metric tells us that many states are underinvesting in education relative to their capacity

“Effort” describes how generously each state funds its schools relative to its capacity to do so. Researchers measuring effort determine capacity to spend based on state gross domestic product (GDP), which can vary widely (just as wealthier neighborhoods can raise more revenues even with lower tax rates, states with higher GDP and thus greater revenue-raising capacity can attain higher revenue with a lower effort, i.e., generate more resources at a lower cost). The map ( Figure D ), reproduced from Farrie and Sciarra 2021, shows state funding effort from the 2017–2018 school year.

School funding ‘effort’ varies widely across states : Pre-K through 12th grade education revenues as a percentage of state GDP, 2017–2018

This interactive feature is not supported in this browser.

Please use a modern browser such as Chrome or Firefox to view the map.

- Click here to download Google Chrome.

- Click here to download Firefox.

Click here to view a limited version of the map.

Note: “Effort is measured as total state and local [education] revenue (including [revenue for] capital outlay and debt service, excluding all federal funds) divided by the state’s gross domestic product. GDP is the value of all goods and services produced by each state’s economy and is used here to represent the state’s economic capacity to raise funds for schools” (Farrie and Sciarra 2020).

Source: Adapted from Making the Grade 2020: How Fair is School Funding in Your State? (Farrie and Sciarra 2020).

As Farrie and Sciarra (2021) note, states fall naturally into four groups:

- High-effort, high-capacity: States such as Alaska, Connecticut, New York, and Wyoming are high- capacity states with high per-capita GDP, and they are also high-effort states: They use a larger-than-average share of their overall GDP to support pre-K–12 education, which generates high funding levels.

- High-effort, low-capacity : States such as Arkansas, South Carolina, and West Virginia have lower-than-average capacity, with low GDP per-capita, but they are high-effort states. Even with above- average efforts, they yield only average or below-average funding levels.

- Low-effort, high-capacity : States such as California, Delaware, and Washington are high-capacity states that exert low effort toward funding schools. If these states increased their effort even to the national average, they could significantly increase funding levels.

- Low-effort, low-capacity : States such as Arizona, Florida, and Idaho are low-capacity states that also make lower-than-average efforts to fund schools, generating very low funding levels.

Evidence shows that districts and schools lack the resources to cope with emergencies

As the COVID-19 pandemic has made clear, our subpar level of preparation to cope with emergencies or other unexpected needs reflects another aspect of underinvestment. As García and Weiss (2020) not about the COVID-19 pandemic, “Our public education system was not built, nor prepared, to cope with a situation like this—we lack the structures to sustain effective teaching and learning during the shutdown and to provide the safety net supports that many children receive in school.”

Whether due to lack of resources, planning, or other factors, districts, schools, and educators struggled to adapt to the pandemic’s requirements for teaching. Schools were unprepared not only to support learning but also to deliver the supports and services they were accustomed to providing, which go far beyond instruction (García and Weiss 2020). This lack of preparation was the result of both a lack of contingency planning as well as a failure to build up resources to be ready “to adequately address emergency needs and to compensate for the resources drained during the emergencies, as well as to afford the provision of flexible learning approaches to continue education” (García and Weiss 2021).

A lack of established contingency plans to ensure the provision of education in emergency and post-emergency situations, whether caused by pandemics, other natural disasters, or conflicts and wars (as examined by the education-in-emergencies research), prevents countries from being able to mitigate the negative consequences of these emergencies on children’s development and learning. The lack of contingency plans also leaves systems unprepared to help children handle the trauma and stress that come from the most serious events. This body of literature has also shown that access to education and services—and an equitable and compensatory allocation of them—helps reduce the damage that students experience during the crisis and beyond, since such emergencies carry long-term consequences (Anderson 2020; Özek 2020).

Public education’s over-reliance on local funding is a key factor behind the troubling funding metrics

The heavy reliance on local funding described above is at the core of the school finance problems. Extensive research has exposed the challenges associated with this unique American system for funding public schools. 6 The myriad factors that drive school funding—politics and political affiliation, state legislative and judicial decisions, property values, tax rates, and effort, among others—vary substantially from one community to another. Thus, it is not surprising that this system has contributed to institutionalizing inequities, especially in the absence of a strong federal effort to counter them.

It is well understood that the local sources of revenues on which school districts heavily rely are often distributed in a highly inequitable way. Revenues from property taxes, which make up a hefty share of local education revenues, innately favor wealthier communities, as these areas have a much larger capacity to raise funds based on higher property values despite their lower tax rates. 7 These higher property-tax revenues in wealthier areas lead to greater revenues for their districts’ schools, since property-tax revenues account for such a significant share of the total.

State and federal funding are insufficient to compensate for these locally driven inequities

State funding of public education is the largest budget line item for most states. 8 Along with federal funding, state funding is expected to make up for local funding disparities and gaps. 9 Federal funding, in particular through Title I of the Elementary and Secondary Education Act (ESEA), is specifically designed to compensate low-income schools and districts for their lack of sufficient revenues to meet their students’ needs. 10 Similarly, state funding is intended to offset some of the disparities caused by the dependence on local revenues. However, in reality, state and federal sources do not provide enough to less-wealthy school districts to make up for the gap in funding at the local level, as shown in Figure E .

As the figure shows, the U.S. systematically funds schools in wealthier areas at higher levels than those with higher rates of poverty, even after accounting for funding meant to remedy these gaps. On average, local property-tax funding per student is $5,260 lower in the poorest districts than in the wealthiest districts.

Federal and state revenues fail to offset the funding disparities caused by relying on local property tax revenues : How much more or less school districts of different poverty levels receive in revenues than low-poverty school districts receive, all and by revenue source, 2017–2018

Notes: Amounts are in 2019–2020 dollars, rounded to the closest $10, and adjusted for each state's cost of living. Low-poverty districts are districts whose poverty rate for school-age children (children ages 5 through 17) is in the bottom fourth of the poverty distribution; high-poverty districts are districts whose poverty rate is in the top fourth of the poverty distribution.

Extended notes: Sample includes districts serving elementary schools only, secondary schools only, or both; districts with nonmissing and nonzero numbers of students; and districts with nonmissing charter information. Amounts are in 2019–2020 dollars using the consumer price index from the Bureau of Labor Statistics (BLS-CPI 2021) and rounded to the closest $10. Amounts are adjusted for each state’s cost-of living using the historical regional Price Parities (RPPs) from the Bureau of Economic Analysis (BEA 2021). Low-poverty districts are districts whose poverty rate for school-age children (children ages 5 through 17) is in the bottom fourth of the poverty distribution for that group; medium-low-poverty districts are districts whose school-age children’s poverty rate is in the second fourth (25th–50th percentile); medium-high-poverty districts are districts whose school-age children’s poverty rate is in the third fourth (50th–75th percentile); in high-poverty districts, the rate is in the top fourth. Amounts are unweighted across districts.

Sources: 2017–2018 Local Education Agency Finance Survey (F-33) microdata from the National Center for Education Statistics (NCES-LEAFS 2021) and Small Area Income and Poverty Estimates (SAIPE) data from the U.S. Census Bureau (Urban Institute 2021a).

While state revenues are a significant portion of funding, they only modestly counter the large locally based inequities. And while federal funding, by far the smallest source of revenue, is being deployed as intended (to reduce inequities), it inevitably falls short of compensating for a system grounded in highly inequitable local revenues as its principal source of funding. As such, although states provide their highest-poverty districts with $1,550 more per student than to their lowest-poverty districts, and federal sources provide their highest-poverty districts with $2,080 more per student than to their lowest-poverty districts, states and the federal government jointly compensate for only about half of the revenue gap for high-poverty districts (which receive a per-student average of $6,330 less in property tax and other local revenues). That large gap in local funding leaves the highest-poverty districts still $2,710 short per student relative to the lowest-poverty districts, reflecting the 14.1% revenue gap shown in Figure C. Even though high-poverty districts get more in federal and state dollars, they get so much less in property taxes that it still puts them in the negative category overall.

Disparities shortchange states’ (and districts’) ability to access and allocate the resources needed for effective education

Given the heavy reliance on highly varied local funding, it is no surprise that there is similarly significant variation across states with respect to almost every aspect of funding discussed here. Table 1 reports federal, state, and local funding for each state and for the District of Columbia, with local funding broken down into three categories.

Revenues for public elementary and secondary schools, by source of funds and by state : Share of each source in total revenue, 2017–2018

Source: National Center for Education Statistics' Digest of Education Statistics (NCES 2020b).

Nationally, in 2017–2018, local and state sources accounted for 45.3% and 46.8% of total revenue, respectively; just 7.8% comes from the federal government. However, these averages mask substantial variation in the shares of revenue apportioned by each source across states. Local revenue, for example, ranges from just 3.7% of total public-school revenue in Vermont and 18.2% in New Mexico, on the lower end, to a high of 63.4% in New Hampshire. The same is true with respect to state revenue. The state that contributes the smallest share to its education budget is New Hampshire at 31.3%, with Vermont contributing the largest share (89.9%). There is also quite a bit of variation in the share represented by federal funds—from just 4.1% in New Jersey to 15.9% in Alaska. (The cited values are highlighted in the table. We omit the District of Columbia and Hawaii from these rankings because of the unusual composition of their funding streams, but we provide their values in the table.)