Small Business BC

Resources for entrepreneurs to start and grow successful businesses.

Accédez la page d'accueil dédiée aux ressources en française de SBBC

Utilisez notre outil de traduction pour le site entier

How To Write a Business Plan

Wondering how to write a business plan? Get Started on your business plan by downloading Small Business BC’s Business Plan Template and Cashflow Forecasting Tool.

Download Now

How to Write a Business Plan

You’ve no doubt heard the expression, “Failing to plan is planning to fail.”

Many entrepreneurs write a business plan only when they need to secure start-up financing. However, your plan is far more than a document for banks and investors to read; it’s an invaluable roadmap for launching and growing your business.

In order to put your business concept on paper, you need to think through and research the many factors that are needed to make sure your business is a success. With a plan, not only can you spot potential weaknesses, opportunities, and threats, your plan can help you make informed decisions about your venture before you commit yourself legally or financially.

Here, we’ve summarized the key sections in our guide to how to write a business plan.

The Seven Key Sections of a Business Plan

1. executive summary.

Your executive summary should be 1–2 pages long, and provide an overview of your business concept, key objectives of your business and your plan, ownership structure, management team, your product or service offering, target market(s), competitive advantages, marketing strategy, and a summary of your financial projections. Your executive summary should be written last, after you’ve written the rest of the plan; each paragraph should be a summary of the more detailed, related section of the plan.

2. Business Overview

In your overview, include details regarding your business’s history, vision and/or mission, objectives, and your ownership structure.

3. Products and Services

Expand upon your products and services, including features and benefits, competitive advantages, and, if marketing a product, how and where your products will be produced.

4. Industry overview

The industry overview is your opportunity to demonstrate the viability of your business by discussing the size and growth of your industry, the key markets within your industry, how your customers will buy your products or services, and which markets you’ll be targeting.

5. Marketing Strategy

Here you describe your target market segments, your competition, how you’ll differentiate your products or services, and your products’ or services’ unique selling proposition (USP).

- Discuss product or service pricing and promotion, including how your promotional programs will appeal to each of your target market segments.

- Provide a plan of traditional and guerrilla marketing tactics, such as tradeshows, press-magnet events, social media marketing (e.g. Facebook, Twitter, etc.), networking, and print, media, or online advertising. Include the cost associated with each tactic.

- Describe how your products or services will be sold (e.g. storefront, online, wholesalers), and your target markets’ buying cycle.

6. Operations Plan

Provide a profile of your management team, your human resources plan, your business location(s) and facilities, your production plan (if selling a product), and an overview of day-to-day operations.

7. Financial plan

Some believe this is the most important part of a plan – so much so, it’s worth dedicating up to 80% of your time to writing this section. You’ll need to show three years’ worth of projected financial statements, including income statements, pro-forma balance sheets, and monthly cash flow and annual cash flow statements. Summarize each statement into a few easy-to-understand sentences and put these in a cover page for the statements. Be sure to document all of the assumptions you used in forecasting your revenues and expenses.

Get Started on your business plan by downloading Small Business BC’s Business Plan Template and Cashflow Forecasting Tool.

No matter what stage of business, or what problem you face, Small Business BC offers a range of webinars , our on-demand E-Learning education , and one-on-one advisory sessions to suit any business.

View More Articles

Share this Story

Related articles:.

- 5 Signs You Need a Mentor

- Partnerships: To Be or Not To Be?

- Support for Canadian Forces Entrepreneurs and Veterans

About Small Business BC

When you find yourself asking "How do I...?" Give us a call. We'd be happy to help.

- Sign up for eNews to get the latest SBBC updates:

- Your Name * First Last

Note: you can withdraw your consent at any time - for more information see our Privacy Policy or Contact Us for more details.

- Email This field is for validation purposes and should be left unchanged.

We respectfully acknowledge our place of work is within the ancestral, traditional and unceded territories of the Xʷməθkʷəy̓əm (Musqueam), Sḵwx̱wú7mesh (Squamish) and səl̓ilwətaʔɬ/sel̓ílwitulh (Tsleil-Waututh) and that we serve the Peoples of the many Nations throughout British Columbia.

Find a Branch

- Call 1-800-769-2511

Create a Business Plan

Think of it as a playbook for your goals, priorities and growth opportunities., how to write a business plan.

Creating a business plan can feel like a huge undertaking when you are starting a new business . And while developing one does require careful thought, studies show that entrepreneurs who have a formal plan are often more successful than those who don’t. Keep reading to see how a business plan benefits you and the details you should include.

Prefer to just get started? Start creating your business plan with the RBC Business Plan Builder.

Content in this Article

What is a business plan? Benefits of writing a business plan Information to include in your business plan Create your plan with the RBC Business Plan Builder

What is a Business Plan?

Put simply, a business plan is a document that explains to others your vision for your business, the gap in the market your business will fill and the steps you will take to succeed. Creating a business plan is a crucial task for any business, and one which requires you to be thoughtful about the direction of your business, consider the goals most important to you, and how you will go about achieving them. A solid business plan will give you the confidence that you will find success, and may even reveal some gaps and risks. In fact, studies show entrepreneurs who start with a written business plan are more successful than those who don’t. Whether you’re creating a roadmap to follow as a new business owner, need a pitch to attract investors or a document to engage stakeholders, a business plan is a living document you’ll want to update regularly as your business, goals and circumstances evolve. While some business owners consider writing a business plan an overwhelming step, it doesn’t have to be. Creating the best business plan ever is a matter of breaking it down into individual steps — and then taking them one at a time.

Benefits of Writing a Business Plan

Writing a business plan can help you in several ways—here are just a few of the biggest benefits:

- Provides a roadmap. A business plan requires you to be thoughtful about the direction of your business, consider the goals most important to you and how you will achieve them. Think of it as your step-by-step guide for success!

- Reveals gaps or risks you need to address. By looking at your business critically, you’ll be able to identify your strengths as well as areas where you may be vulnerable.

- Shows potential investors, stakeholders or lenders that you’re serious. Attract and engage those who may be interested in your business with all the important information they need to know.

Information to Include in Your Business Plan

Create an executive summary Describe the current business environment Outline your marketing and pricing strategies Describe how your business will operate Detail your financing and cash flow needs Describe your team (even if it’s just you) Identify risks and how you’ll protect your business Write a conclusion Include your contact information

Create an Executive Summary

After your cover page and table of contents, include an executive summary. Since this is the first thing readers will see, it should be clear, grab their attention and identify what your business does.

What to include:

- Your industry, target market and how your business is different from the competition

- Your business structure (sole proprietorship, corporation, etc.)

- What stage your business is in

- Your experience and credentials, as well as your team’s, if applicable

- Financial projections for the business (or performance to date, if you’re already operating)

Tip: Write your executive summary last and keep it to one page. While it’s structurally the first section, it will summarize everything else in your plan.

Describe the Current Business Environment

This should be a detailed history and summary of your business, identifying the product(s) or service(s) you’re offering and how you will solve a problem or need in the market. Be sure to include any pre-market research or testing you’ve conducted that speaks to the viability of your idea.

When you’re starting a business , your bank and potential investors don’t have historical data to review. Your plan must clearly convey your strategy, competencies and the reasons your venture will succeed. (If your business is already established, you’ll want to cover where you started and how you got here.)

- Where you want your business to go—and how you’ll get there. What are your goals? How will you generate sales?

- What your business does. What needs does your business fulfill? Where will you sell your products or services?

- Your business set up. How is your business structured ? Are there other owners or shareholders?

- How you know your business will work. What market research or testing have you done? Are there trends?

Tip: Revisit your business idea by asking yourself these 7 key questions or use our business idea checklist to see the steps you may need to take to get to opening day.

Outline Your Marketing and Pricing Strategies

This is your opportunity to explain how you’re going to get customers to buy your products or services. This section involves identifying your ideal customers, your pricing strategy and more.

- Your products, service and unique selling proposition. What are the features of your product or service and what makes it unique compared to what your competitors offer? How will you draw customers away from competitors?

Tip: Completing a strengths, weaknesses, opportunities and threats (SWOT) analysis may help you write this section. Download a FREE SWOT Analysis Template

- Your pricing strategy. How will your pricing be competitive, but still allow you to make a profit? See our factsheet: Pricing and Costing Accurately

- Your sales and delivery strategy. How will you will generate sales? Will you sell directly to customers or through other businesses? How much will it cost to produce and ship your product?

- Advertising and promotion strategy. Which advertising and promotion tactics (website, digital marketing, social media, email) will reach your audience most effectively?

Tip: Choose a few channels to do well instead of pursuing all of them at once. That way, you’ll be better able to direct your focus and monitor your progress.

Describe How Your Business Will Operate

The operations section of your business plan should describe what’s physically necessary for your business, as well as any partners who help keep things running smoothly.

This section contains four main categories:

- Your stage of development. This should highlight what you’ve done to date to get the business operational, then follow up with an explanation of what still needs to be done.

- The production process. This lays out the details of your day-to-day operations, manufacturing details, inventory, costs, outsourcing and more.

- Getting products and services to customers. What is your supply chain and distribution strategy?

- Partners and allies. Who are the people and organizations that support you? Who are key suppliers and vendors?

Third-party groups may be able to help you in your journey. For example, Futurpreneur serves entrepreneurs age 18-39 who want access to business resources, financing and mentoring.

Detail Your Financing and Cash Flow Needs

Use this section to determine how strong your business is financially. Be realistic about expenses and projected income so you can properly assess your financial health early on and make sure you have enough cash for the first year.

- Startup costs. What are your one-time and ongoing expenses? How will you cover the costs? Learn more with our factsheet: Deciding How Much Money You Need to Start or use our Startup Costs Calculator .

- Profit margin and break-even point. How will you make a profit and calculate margins? What is your break-even point? Suggested reading: The Difference Between Cash Flow and Profit

- Balance sheet. What assets, liabilities and capital do you have at this point in time?

- Financing. What are your sources of financing —savings, loans, grants? What are your repayment terms, if any?

- Cash flow forecast. What is your 12-month cash flow forecast? Estimate it now: Cash Flow Forecast Template

Describe Your Team (Even if It’s Just You)

This section should describe your current team as well as anyone you might need to hire to round out your company.

- Skills and strengths. What skills do you and/or your team have that are critical to the business?

- Management style and structure. How will you manage your team? Who will employees report to?

Identify Risks and How You’ll Protect Your Business

Every business comes with some risk, so it’s better to be prepared for them now rather than be surprised later. Use this section to explore potential risks and how you’ll protect your business.

- Obstacles your business may face. How could the economy, your competition, supply chain or another circumstance affect your business? How do you plan to minimize and handle these and other risks?

- How you’ll protect against losing market share (new competition). Do you have any agreements or vendors you’ll rely on?

- How you’ll prevent critical data loss. Outline what you will do to reduce the impact of data loss, such as backing up all computer data regularly, using cloud providers, employee rules on installing software and other policies.

- How you’ll protect intellectual assets. Will employees sign confidentiality agreements to protect processes, trade secrets and other intellectual property? See How Intellectual Property (IP) in Canada Works .

- Compliance requirements. What rules, regulations and licenses will you need to comply with to operate?

- Insurance needs. Does your industry require specific coverage, such as professional liability or other insurance?

Write a Conclusion

This is the last thing readers will see, so you want it to be strong. Use your conclusion to reinforce your goals and objectives. If you need financing, clearly state the amount you need and how it will be used. As with your executive summary, your conclusion should be succinct, clear and leave a positive impression.

Include Your Contact Information

Potential investors and lenders need to know how to reach you. Don’t forget to include your business name, contact information, website and social media presence in your plan.

Create Your Plan with the RBC Business Plan Template

This comprehensive template will guide you through a series of questions, resources and tips to help you write your plan. Best of all, you can go at your own pace and come back to work on it anytime.

Want to Talk Business?

Get help clarifying your goals, setting up, opening an account and more.

We look forward to meeting with you! Here’s how to get in touch:

Call us 24/7: 1-800-769-2511

Thanks for stopping by. We’re here to help when you’re ready. In the meantime:

Use our FREE step-by-step guide to help make your dream of starting a business a reality.

Stay up-to-date on the latest resources, money-saving offers and business advice.

See How an Advisor Can Help You

RBC business advisors can help your company at every stage—from starting up to simplifying operations and funding growth. An RBC business advisor will work with you to:

- Understand your vision and business goals

- Set up the right financial products and solutions

- Explore options to effectively manage cash flow, pay employees and get paid

- Connect you to a suite of business advice and solutions that go beyond traditional banking

View Legal Disclaimers Hide Legal Disclaimers

Learn how Microsoft uses ads to create a more customized online experience tailored for you. About our ads

How to Write a Business Plan for Your Small Business

Your business plan is the most important document you’ll ever write for your business. Whether you’re opening a suburban coffee shop or starting up a tech company, you need a business plan.

At a minimum, writing a business plan helps you formalize your project and state your business purpose, goals, strategy, competitive strengths and financial forecasts and funding.

The federal government’s Business Development Bank of Canada (BDC) is devoted to helping Canadian entrepreneurs. BDC.ca’s business plan resources offer an exhaustive collection of articles on building business plans, including examples and templates. You’ll also find expert advice on every aspect of starting, buying and running a business, as well as consulting services and expert advice.

What is a business plan?

A basic business plan should explain a business’s strategy and direction. It should cover which customers you want to sell to and which needs you’ll address, the size of the market you want to target and what your marketing strategy is. It also includes your financial data and forecasts, including revenue and cost estimates for the 2 years and any funding you’ll need to ramp up.

A good business plan should include:

- Your business name and an overview of what it does.

- An analysis of your target market, its size, who your competitors are and how much market share you think you can gain.

- Your product’s key differentiators that make you stand out from your competitors.

- A marketing plan, covering which customers you want to target first and how you will get them to buy.

- Your estimated 12-24 month cash and working capital needs for equipment, office space, supplies, materials, staffing, etc.

- Your sources of funding, including your own money and business loans, lines of credit and money from investors.

- Your business’s form of ownership (corporation, sole proprietorship) and staffing plan.

How to write a business plan

To get started, have a look at BDC’s free business plan template and kit . The kit includes a Word template, an example business plan and financial presentation, and a financials Excel file that you can plug your numbers into. The spreadsheet is set up to calculate your pro-forma numbers (forecasts). The kit includes a link to BDC’s How to write a business plan page and a user guide.

Here are some tips to help you write a winning business plan:

- Be brief, concise and simple, but thorough. Your business plan doesn’t have to be long, but it should communicate your drive, commitment and expertise.

- You should cover all the basic information that a lender needs to evaluate your project.

- Start by describing your business; what you offer, who your customer is, how fast you hope to grow and how.

- Explain what’s unique about you, your business and most importantly, what it offers customers that your competitors don’t.

- You should have a section describing your competitors and your strengths and weaknesses. How are you going to take market share from competitors, or is the market you’re targeting big enough for several competitors? What is the total potential market?

- Summarize your marketing plan and costs.

- Describe your business type, your staffing needs for the next 12 months, and your expected capital and fixed costs, such as equipment and computers, rent and utilities, etc.

- Present your detailed financial information, sources of funding and personal assets, plus any funding or investments you’ve already secured. Investors are interested in costs and margins. Higher margins are more appealing.

- Include a one-page executive summary, your background and a mission statement.

- Be conservative and transparent with your estimates and project timeframe and milestones. UPOD (under-promise, over-deliver) makes everyone happy. If your plan and financials suggest you can ramp up with less revenue and lower costs than you conservatively expect, then your nominal and best-case scenarios should get an enthusiastic response.

- Check and recheck your plan. Make sure it’s complete and well-written. Don’t exaggerate and make sure you know your numbers and plan by heart before meeting with a lender.

There are hundreds of online resources to help you write a great business plan. Small Business BC has a simple recap and links to other resources. Scotiabank has an automated Plan writer for business that creates a business plan for you. Just follow the instructions and add your information in each section. You can see sample content in each field by checking a box. There’s also a financial information section.

You can also use business plan software, although Scotiabank’s tool might get you the same result for free. If you’re interested, visit business .org to read about their top 5 picks for business plan software.

What do banks want to see in a business plan?

If you’re going to convince an investor or a bank to give you funding, you need to know your numbers. OK, so maybe you’re no financial analyst, or worse, you hate math and numbers altogether. Unfortunately, if you own and operate a business, you need to understand the basic numbers that matter. A lot of companies go out of business because they run out of cash. And that includes businesses with revenues and customers.

Don’t run out of cash ! To launch a business, you need to understand and properly estimate the amount of cash you’ll burn through before your business is profitable enough to sustain itself and pay you also. Unless you’re extremely frugal and disciplined, you’ll probably need more cash for a longer period. Your financial forecast should show what happens if revenue is only 50% or a third of what you expected.

If you aren’t good with numbers, you could ask an accountant for advice or talk to a business owner you know who’s been there, done that. You could also call your bank and ask to meet with a small business advisor before you prepare your business plan. They should be able to tell you what to expect, and maybe even give you specific advice and sample small business plans and templates.

But no matter how much collateral you have, if you want to get a bank loan or a line of credit for a new business, you’ll need a solid business plan that’s realistic and based on good research.

Money, money, money mo–ney! Small businesses often rely on the owners’ savings and loans from family members to get off the ground. If your business has no revenue yet, a bank won’t lend to you unless put your assets up as collateral. That usually means using your home or retirement savings to guarantee the loan.

If you can’t pay it back for some reason, the lender will sell your assets to repay what you owe. Not a pretty situation! Make sure your business plan is solid, because even if you have collateral, banks won’t be lining up to lend you money. Why? Because selling your assets at auction isn’t a good outcome for anyone. You lose all your possessions and the lender has to liquidate your assets to recover their capital, which can take a long time.

You need to impress the bank with your business chops and business plan if you want to borrow. “I’ve always wanted to own a pet shop and I love dogs” isn’t good enough.

The same applies to investors who give you money in exchange for part ownership of a company. If you only need a few thousand dollars from close relatives, you can probably skip the PowerPoint presentation. But if a seasoned investor is considering a large cash infusion, a great business plan will be critical to attract them.

About the author

The Microsoft 365 team is focused on sharing resources to help you start, run, and grow your business.

Get started with Microsoft 365

It’s the Office you know, plus the tools to help you work better together, so you can get more done—anytime, anywhere.

5 reasons to consolidate your cloud apps

A guide to creating a facebook business page for your sme, what’s a marketing strategy and why does my business need one, reputation management for small businesses.

Business Insights and Ideas does not constitute professional tax or financial advice. You should contact your own tax or financial professional to discuss your situation..

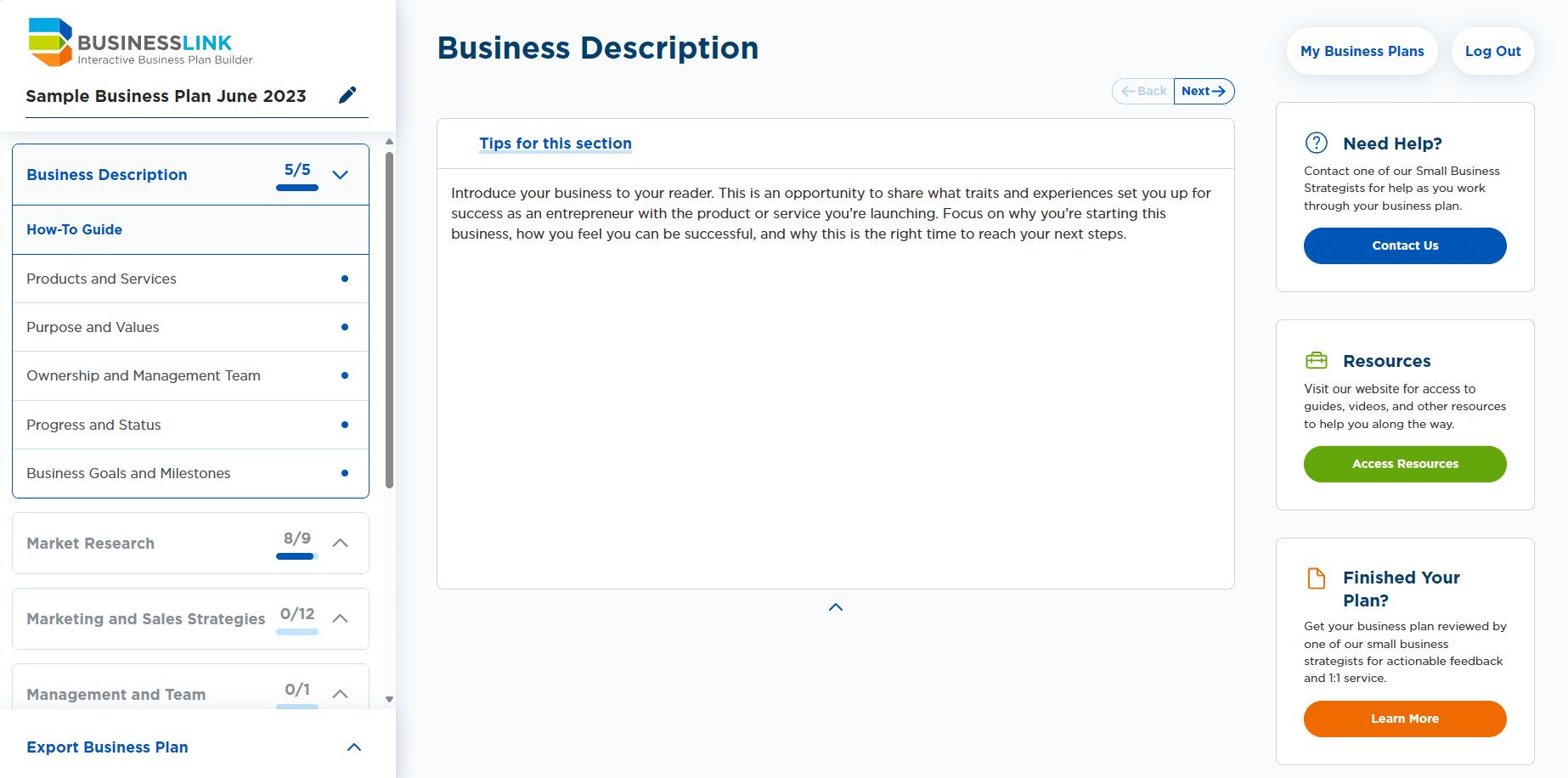

Interactive Business Plan Builder

We understand that creating a business plan might be a new territory, our Interactive Business Plan Builder helps streamline the writing process and offers aspiring entrepreneurs and established business owners the guidance and support they need from the beginning to the end of the planning process.

What is a Business Plan?

A business plan is a strategic document that provides a detailed overview of a company’s goals, objectives, business structure, and strategies it will implement to achieve them. A business plan is crucial and beneficial to both startups and established small businesses.

Why is a Business Plan Important for Small Businesses?

Make informed business decisions

Set clear goals & strategy

Understand your customers & target market

Identify potential risks & mitigation

Secure funding & manage cash flow

Build & enhance credibility

What is Included in the Business Plan Builder?

The Business Plan Builder tool simplifies the process of developing your plan by breaking it down into essential topics and providing reference examples for each section

Executive summary & business description

Market research

Sales & marketing

Financial projections

Team structure

Why Use the Business Plan Builder?

Create a new business idea

Shift your existing business model

Develop a detailed business plan

Secure funding

Ready to Write a Compelling Business Plan?

Receive dedicated support from our Business Strategists as you go through each section.

Look Inside

Frequently Asked Questions:

Is there a time commitment to complete my business plan.

No, there is no specific time commitment. Take the time you need to conduct thorough research and complete your business plan at your own pace. The Interactive Business Plan Builder allows you to save your work at any point, allowing you the flexibility to complete it at your convenience.

Should I complete all sections in chronological order?

While the business plan is structured to guide you through the process, you have the flexibility to work on the sections in any order that suits you.

Can I create a copy of my business plan?

Certainly! Navigate to “My Business Plans,” locate the desired plan, and click on the “Duplicate” button to create a copy. You can then rename the duplicated business plan.

Can I invite another user or my business partner to be a collaborator on my business plan?

Unfortunately, the current tool doesn’t support this feature. However, you can export your plan as a Microsoft Word, PDF, or Google Drive and collaborate with others outside the platform if needed.

What if I need some help writing my business plan?

Business Link offers various resources and supports to assist you in crafting a business plan:

- Within each business plan section of the Business Plan Builder, you’ll find tips and examples to guide you.

- Check the right-hand side navigation bar for additional resources to help in your business plan development, including the option to download our Cashflow Template .

- If you need personalized assistance or have specific questions, our experienced business strategists, many of whom have entrepreneurial backgrounds, are available for one-on-one support. Feel free to reach out to us for assistance if needed!

Am I able to customize my business plan, such as adding a logo?

Absolutely! Export your business plan as a Word Doc or Google Doc to begin further customization, including the addition of a logo.

Will my business plan be shared with anyone?

Rest assured that your business plan is treated as your intellectual property (IP), and confidentiality is a priority. We will never share your data or business plan without explicit permission.

Did you have a business plan in our old Business Plan Builder? As of September 30th, 2023, access to your Business Link user account for exporting previous business plans has been discontinued due to the removal of this function. For copies of any plans created in the original builder, please contact our team, and we’ll gladly assist you.

Cash Flow Templates

Do you plan on asking for funding for your small business? Access the cash flow template you need to go with your funding request.

Have your business plan reviewed

Our small business strategists can review your business plan and provide you with feedback and coaching to get it to where it needs to be – whether you’re looking for financing, or just need to work out the details of your business idea.

Don’t have a business plan yet? Get started with our free interactive Business Plan Builder . The tool will walk you through the business planning process with details on what to include in each section, helpful tips, and examples. When you’re done, export your plan and submit it for review!

Business Link acknowledges and respects that we are on traditional land, meeting grounds, territories, gathering places, and travelling routes of Treaty 4, 6, 7, 8, and 10 and the home to many First Nations, Métis, and Inuit people. In the spirit of reconciliation, we acknowledge the lands of those who have come before us, reside here now and in the future.

Privacy Policy | Terms and Conditions | Cancellation and Refund Policy | Service Standards

© 2024 Business Link. All Rights Reserved. Website Hosted by YEG Digital .

Subscribe to our Newsletter

- Small Business

- English Selected

Create a business plan

Explore the ways tailored advice from TD can help your business, today.

Starting a Business in Canada

Starting a business can be a challenging and rewarding endeavour. With the right planning, resources, and groundwork you'll enjoy a better chance of success.

Find out if your business idea will work

Clarify your idea and get it in writing

Find the money and manage your cashflow

Think about the legal stuff

TD Business Accounts, lines of credit, and more

Write a Business Plan

Clarify your idea and get it in writing.

There's a lot of work involved in writing a business plan but it prepares you for the even bigger task of starting a business.

It will help refine your idea, outline goals, and make it easier to explain what you hope to accomplish. This comes in handy when you're looking for money.

Download our business plan template which addresses product and service information, competitive analyses, the financial feasibility of starting up, and more.

Why You Need a Plan

If you're pitching your idea to banks or other financial institutions for a loan, you'll need a business plan because people want to see that you've put serious thought into your idea.

Thinking about the details will help you make decisions about your business, and will open you up to new ideas or approaches you might not have considered.

Writing out a business plan will give you an action plan to work with, but if you need help getting started use our interactive checklist .

Why You Need a Unique Selling Point

One of the most important aspects to consider when writing your business plan is asking why customers would buy your product or service .

Will it be better quality? Better price? Is it backed by a guarantee? Will it have more features? Will you be able to provide outstanding customer service?

Once you establish what differentiates you from the competition, it's essential to communicate it consistently when you go to market.

Use our interactive checklist to define your unique selling point.

Determine Demand & Profit Potential

Once you know (or are reasonably sure) that customers are likely to buy your product or service, figure out if you'll be able to make a profit.

Determine what you need in sales to cover costs plus a profit margin. Also ensure you have capacity - the physical ability to work a certain number of hours in a week or produce the required amount of product.

Use our interactive checklist for more ideas on determining demand and profit including ways to research, test marketing, and future trends.

Tools & Calculators

Download our business plan template.

Download our start-up costs template.

Figure out your income vs expenses.

Determine your monthly interest and payments.

Products and services to help get you started

Small business bank accounts.

Discover the benefits of a TD Small Business Bank Account to meet your business needs.

See our accounts

- Business Credit Cards

Choose the cash back, travel rewards, or low interest rate credit card that fits your business needs.

See all cards

Receiving & Making Payments

Keep your cash flow moving successfully and stay on top of things.

Articles on Starting Your Business

Four Steps to Find Out if Your New Idea Will Work

Research, validate, talk to industry insiders, and test your idea to ensure it has what it takes to succeed.

Selling Online and Other Ways to Expand Your Business

Marketplaces, subscription models, drop-shipping, and freemium offers are four ways to expand your business online.

Sources of Small Business Funding

Ways to fund your business include: self-financing, partnering with another business, angel investors, grants.

Breaking Barriers — A series on women entrepreneurs

Get inspired with our first article in a series highlighting successful women entrepreneurs who have overcome challenges to build successful businesses.

Breaking barriers — Spotlighting female entrepreneurs

Get inspired with our latest article in a series highlighting successful women entrepreneurs.

Celebrate Pride with Florence Gagnon

Her journey was so inspirational it was adapted to the silver screen, but it started with a focus on her local community.

Spotlighting Female Entrepreneurs — Gloria Kim, Gloryous Productions

A series of articles that highlight various successful women entrepreneurs who bank with TD Small Business Banking. Discover their success.

Get in touch

Contact an account manager.

Talk to an Account Manager Small Business (AMSB) to discuss your business needs.

Talk to a Small Business Specialist at our Small Business Advice Centre.

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan Miles

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Saving and Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking?

- TD Bank Small Business Banking?

- TD Bank Commercial Banking?

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

WxT Language switcher

Dropdown language (interface text).

- Português, Brasil

- Canada.ca |

- Services |

- Departments

- Business plan guide

What is a business plan and why do I need one?

A business plan is a written document that describes your business, its objectives and strategies, the market you are targeting and your financial forecast. It is important to have a business plan because it helps you set realistic goals, secure external funding, measure your success, clarify operational requirements and establish reasonable financial forecasts. Preparing your plan will also help you focus on how to operate your new business and give it the best chance for success.

Securing financial assistance to start your new business will be directly related to the strength of your business plan. To be considered a viable candidate to receive funds from a financial institution or investors, you must demonstrate that you understand every aspect of your business and its ability to generate profit.

A business plan is more than just something to show lenders and investors, it is also necessary to help you plan for the growth and progress of your business. Your business’s success can depend on your plans for the future.

Listed below are examples of questions to ask yourself when writing your business plan:

- How will I generate a profit?

- How will I run the business if sales are low or if profits are down?

- Who is my competition, and how will we coexist?

- Who is my target market?

What should be included in a business plan?

Although business plans can vary in length and scope, all successful business plans contain common elements. The following points should be included in any business plan:

- Executive summary (business description)

Identifying your business opportunity

Marketing and sales strategy of a business plan, financial forecasts of a business plan, other useful documentation, the executive summary (business description).

The executive summary is an overview of the main points in your business plan and is often considered the most important section. It is positioned at the front of the plan and is usually the first section that a potential investor or lender will read. The summary should:

- Include the main points from each of the other sections to explain the basics of your business

- Be sufficiently interesting to motivate the reader to continue reading the rest of your business plan

- Be brief and concise – no more than two pages long

Although the executive summary is the first section of the plan, it is a good idea to write it last – after the other parts of the plan have been finalized.

In this section of your business plan, you will describe what your business is about – its products and/or services – and your plans for the business. This section usually includes:

- Who you are

- What you do

- What you have to offer

- What market you want to target

Remember that the person reading the plan may not understand your business and its products and services as well as you do, so try to avoid using complicated terms. It is also a good idea to get someone who is not involved in the business to read this section of your plan to make sure that anyone can understand it.

Some of the things you should explain in your plan include:

- Whether it is a new business venture, a purchase of an existing business or the expansion of an existing business

- The industry sector your business is in

- The uniqueness of your product or service

- The advantages that your business has over your competition

- The main objectives of your business

- Your legal business structure (sole proprietorship, partnership, corporation)

You can also include the date the business was registered/incorporated, the name of the business, its address and all contact information.

A strong business plan will include a section that describes specific activities that you will use to promote and sell your products or services. A strong sales and marketing section demonstrates that you have a clear idea of how you will get your product or service into market and can answer the following questions for the reader:

- Who are your customers? Do some research and include details of the types of customers who have shown an interest in your product or service. You can describe how you are going to promote yourself to potential customers.

- How are you going to reach your customers? You should know your customers and the best methods to reach them. Research will help you identify the most effective way to connect with your selected audience, whether it is through the Internet, over the telephone or by in-person contact.

- Who is your competition? Once you understand this, you need to research their strengths and weaknesses and use this information to assess potential opportunities and threats to your business.

- How are you going to position your product or service? Describe what makes your product or service unique to the market you are trying to target.

- How are you going to price your product or service? This information will outline your pricing strategy, including incentives, bulk pricing and/or group sales.

Don't underestimate the importance of this part of your plan. Investors need to know that you and your staff have the necessary balance of skills, motivation and experience to succeed. This section describes the people working in your business and how you plan to manage your activities. Information in this section can include:

- A brief organizational layout or chart of the business

- Biographies of the managers (including yourself)

- Who does what, with a brief job description of each position

- The needed skills of each position

- Any other relevant information related to personnel

It is also a good idea to outline any recruitment or training plans, including the cost and the amount of time required.

The operations section of your business plan will outline your daily operational requirements, facility requirements, management information systems, information technology requirements and any improvements you may have planned. This section usually includes information like:

- Daily operations – descriptions of hours of operation, seasonality of business, suppliers and their credit terms, etc.

- Facility requirements – this includes things like size and location, information on lease agreements, supplier quotations and any licensing documentation

- Management information systems – inventory control, management of accounts, quality control and customer tracking

- Information technology (IT) requirements – your IT systems, any consultants or support service and an outline of any planned IT developments

Your financial forecast turns your plan into numbers. As part of any good business plan, you need to include financial projections for the business that provide a forecast for the next three to five years. The first 12 months of forecasts will have the most details about costs and revenues, so investors can understand your strategy.

Your financial forecasts should include:

- Cash flow statements – cash balance and the cash flow pattern for the first 12-18 months, including working capital, salaries and sales

- Profit and loss forecast – projected level of profit based on your projected sales, the costs of providing goods and services and your overhead costs

- Sales forecast – the money you expect to make from sales of your product or service

Some other things to consider include:

- How much capital do you need (if you are seeking external funding)?

- What security can you offer to lenders?

- How do you plan to repay your debts?

- What are your sources of revenue and income?

- Forecasts should be covering a range of scenarios

- Reviewing risks and developing contingency plans to offset the risks

- Reviewing industry benchmarks/averages for your type of business

It is important to do your research to find out how your business compares to other small businesses in your industry.

The following sections are not always required, but can enhance any business plan:

- Implementation plan – this section lists estimated dates of completion for different aspects of your business plan, targets for your business and accomplishments. Appendices – these should include supporting material, such as licences and permits, agreements, contracts and other documentation that support your business plan.

Who should write my business plan?

Your business plan should be prepared by you, the entrepreneur. It is your business and your plan, but do not hesitate to ask for help from your management team, consultants, accountants, bookkeepers, copy editors or other experienced people.

1-888-576-4444

Contact us by email

Related Topics

- Business planning success

- Sample business plans and templates

Top business essentials

- Business regulations guide

- Employment regulations: Hiring

- Financing a business guide

- Marketing plan outline

- Starting a business

- Taxation guide

Multilingual documents

- Developing a company brochure

- Consulting a lawyer for your business

- Setting up a pay system

- Managing a family-owned business

- Determining your profit

- Business structure: Which one is right for you?

- Naming your business

- Understanding your business lease

- Home-based business

- Choosing and setting up a location

- Franchising

- Buying a business

- Buy a business or start your own

- Developing your ideas

- Introduction to market research

- Small Business

- Ways to Bank

- More Scotiabank Sites

- English selected

- Scotia OnLine Mobile

- ScotiaConnect

- Cash & Coin Service

- Advice Centre

Need a business plan? Try our template.

Invest in the future of your business by taking the time to create or update your business plan using our free template.

The importance of your business plan

Perhaps the most important document for any new business is a business plan. Yet too many business owners fail to sit down and prepare or update one.

A business without a plan is adrift. Decisions are made reactively based on the owner’s emotions, rather than prudent research. Employees, vendors, investors and other stakeholders (as well as the owner) are unclear about the direction of the company. That lack of focus results in wasted dollars, energies and resources as the company zigzags along instead of following a well-planned straight line to its goals.

Writing a business plan can seem a daunting task. Many entrepreneurs simply don’t have the time, inclination or the proper tools.

Business planning template

We have developed a template that makes creating your Business Plan easy. And it’s free !

This template guides you through all of the steps required to complete a proper business plan. It has explanations of the terms and definitions. It lets you add your own thoughts and comments.

Once you’ve completed the steps, you’ll have a business plan complete with cover page, contact information, financial tables, product descriptions and marketing details. You can save and print the plan, or send it electronically to anyone.

Use your plan to move your business forward with confidence, to motive your team, or to present to investors or lenders.

Depending on how much research and preparation you’ve already completed, creating your plan won’t consume much time at all. While it’s very easy, don’t worry if you get stuck because help is available throughout the process.

Take your plan to the bank

Once you’ve completed your business plan, you may take it to a Scotiabank Small Business Advisor . The advisor can review your plan, supply feedback, and, if requested, help you to explore your financing options.

Get feedback on your plan

Asking people to review your plan will make it stronger because you’ll receive valuable feedback. Share it with your accountant, lawyer, financial advisor and trusted businesspeople so they can offer their suggestions to improve your plan. If you are really worried about someone reading your secrets, consider attaching a Non-Disclosure Agreement (NDA) to the plan. An NDA is a legal document that prevents others from sharing your information with unauthorized parties.

Try our free business plan template

Related articles

Is your business taking advantage of the low canadian dollar.

Now may be a good time for you to explore introducing your business to potential customers south of the border.

A business plan is key to your success

Business plans are an important tool for all businesses, no matter how big or small.

Path to Impact 2023: Resilient Small Business Owners optimistic for the future despite headwinds

The challenges and opportunities that lie ahead for small businesses in 2024 are not one-size-fits-all.

Ontario.ca needs JavaScript to function properly and provide you with a fast, stable experience.

To have a better experience, you need to:

- Go to your browser's settings

- Enable JavaScript

2. Prepare business plan

A business plan explains your business idea, short and long-term business goals and what resources are available to start and operate your business.

A business plan explains your business idea, short and long-term business goals and what resources are available to start and operate your business. If you need help writing a business plan:

- contact your local Small Business Enterprise Centre or, if you are a technology or innovation company, a Regional Innovation Centre

- check available online resources, such as BDC , Futurpreneur , or BPlans for sample business plans talk to your local bank to see what tools they have to help you start your business

Business Plan Tools for Producers

A business plan is like a road map. It helps you define your ag operation’s core objectives and build a detailed plan for how to achieve them.

Free business plan bundle for farmers

We want to help make writing your business plan easier. The FCC business plan bundle was designed specifically for farm operations and anyone involved in Canadian agriculture.

The bundle includes:

Business plan guide with instructions and resources

Blank business plan template

Sample business plan

Why you need a business plan

There's a lot involved in writing a business plan, but it’s a worthwhile investment. It can help secure financing from a lender, attract investment or act as an internal guide, keeping your management team focused on the same goals.

Related business plan tools

Analyzing cash flow drivers

Assessing your liquidity

Assessing your management ability

Building and sensitizing financial projections

Creating an organizational chart/job description

Financial Asset Analysis

Foundational financial ratios

Net worth template

Bringing our best business management content to your inbox.

Business Plans Writing Services

SUV Business Plan Starting price C$3,200

* Includes up to five applicants

Days until first draft: 10 – 15 days

Number of pages: Depending on Designated Organization Requirements *Subject To Designated Organization Reqs.

SUV Pitch Deck Starting price C$2,600

Pages: 20 – 25 Slides

- Multilingual Team

- Flat Rate Pricing

- 3 Revisions

- Personalized Business Plan

- Professional Graphic Design

SUV - Start-Up Visa Program Business Plan

- First Name *

- Last Name *

- Email Address *

- Country Code *

- Phone Number *

- How did you hear about us? * How did you hear about us? (Required) Immigration Attorney Friend Google Ads Google Search Webinar Tradeshow French Founders AILA FACC Consultant Real Estate Agent Accountant/CPA Business Broker LinkedIn Facebook BBB Other

- What is the attorney's name?

- What is the tradeshows name?

- What is the consultant name?

- What is the real estate agent name?

- What is the accountant/CPA name?

- What is the business broker name?

- Company Name

- Do you have a website? (Optional) Do you have a website? (Optional) Yes, I do. No, I don't.

- What is your website address? (Optional)

- Do you need help with branding/logo, website, or marketing services? (Optional) Would you like help building a website for your business? (Optional) Yes, please! No, thank you.

- When would you expect to need to start these services? (Optional) How soon would you like to be contacted about building a website? (Optional) ASAP! Once I start my business plan. After my business plan is finalized. After my visa is approved. I'll reach out when I'm ready.

- Other Industry

- How Do you Prefer To Be Contacted? * How Do you Prefer To Be Contacted? (Required) Phone Email Whatsapp Skype Wechat

- What Language Do You Prefer To Speak? (Optional) What Language Do You Prefer To Speak? (Optional) English Spanish Portuguese French Chinese Russian Other

- Other Language

- Visa Type? Visa Type? (Optional) E2 L1 EB2 NIW EB5 Direct EB-5 Regional Center H1B O1 EB1A EB1C Canada I am not sure

- Are you the Visa Applicant? Are you the Visa Applicant? (Optional) Yes, I am the visa applicant No, I'm not the visa applicant

- What is your relationship to the visa applicant? What is your relationship to the visa applicant? (Optional) Family Friend Attorney Other

- Other relationship

- Is this a New Application, RFE, Renewal or Denial? Is this a New Application, RFE, Renewal or Denial? (Optional) New Visa Application RFE Renewal Denial I don't know

- Do you have a visa application deadline? Do you have a visa application deadline? (Optional) Yes, I have an application deadline No, I don't have an application deadline

- By When? MM slash DD slash YYYY

- Details/Notes?

- Google Re-Captcaha

- Comments This field is for validation purposes and should be left unchanged.

Business Plan Content:

- Business Description

- Industry Analysis

- Market Analysis

- Marketing Plan

- Personnel Plan

- Financial Projections (5 years)

Pitch Deck Content:

- Executive Summary

- Market Opportunity

- The Solution – Service Description

- Market Approach & Strategy

- Deal description / Structure/ Details

- High-level snapshot of key figures

- Description of problem

- Business Model – Revenue Streams

- Team and Key Stakeholders

- Competition

Canada has always provided great opportunity for foreign entrepreneurs and innovators. The federal government seeks to attract qualified entrepreneurs with bold and globally competitive business ideas through the Start-Up Visa Program with the overarching goal of creating new jobs and spurring economic development in the country.

Unlike the regional provincial nominee programs aimed at entrepreneurs, the federal Start-Up Visa program requires a Letter of Support from a designated organization ( Find the full list here ). These organizations consist of investors (venture capital and angel) as well as incubators who may be interested in supporting your idea.

Investors see countless pitches and business plans daily. They have demanding expectations and highly selective criteria for business ventures they choose to fund. It’s difficult enough to capture their attention let alone convince them to invest. It will require a strong idea showcased in a well-prepared business plan and/or pitch deck.

Our team of business plan writers are well-versed in writing and editing business plans and other documents for these audiences. Our experience in investment banking, venture capital firms, and other funding organizations will work in your favor so you can feel confident you are putting forward the most optimized document for your application.

We Are Multilingual

SUV - Start-Up Visa Program Business Plan Samples

SUV - Start-Up Visa Program Pitch Deck Samples

Disclaimer Joorney Business Plans Canada Inc. is not a law firm nor an immigration consulting firm and all information provided in this document should not be considered as legal advice or any advice or recommendation on any immigration application program. All information provided in this document should be verified by a licensed or certified immigration professional before the reader can act on this information. As such, it is understood that Joorney Business Plans Canada Inc. shall not be liable for any loss or damage of whatever nature (direct, indirect, consequential, or other) whether arising in contract, tort, or otherwise, which may arise as a result of your use of (or inability to use) this document, or from your use of (or failure to use) the information on this document.

in the Press:

- Immigration

- Testimonials

- Start-up Advisory

- M&A Advisory

- Premium Market Research

- Joorney Digital

- Partner Program

- Joorney Blog

- Ask the Joorney Expert

We Offer Services. Built On Trust

1-844 (829-8639) CALL US

Miami 1688 Meridian Ave Ste 700 Miami Beach, FL 33139

Canada 1200 McGill College Avenue Suite 1100, Montreal, QC, H3B4G7

France 11 rue de Rouvray 92200 Neuilly sur Seine

Serbia Bulevar Kralja Aleksandra 28 Floor 2, 11000 Belgrade

Australia Unit A1 / 35-39 Bourke Road, Alexandria NSW 2015

Immigration | Commercial | Start-Up Advisory | M&A Advisory |

Copyright © 2024 Joorney. All rights reserved. | Privacy Policy

- Do you have a website? Do you have a website? (Optional) Yes, I do. No, I don't.

- Do you need help with branding/logo, website, or marketing services? Would you like help building a website for your business? (Optional) Yes, please! No, thank you.

- I am....(Required) * I am....(Required) Applying For A Visa An Immigration Attorney A Start-Up An Established Business An M&A Firm A Business Broker Other

- Select A Business Stage (Optional) Select A Business Stage (Optional) Idea Pre-revenue Post-revenue I'm not sure

- What Is Your Average Deal Size (Optional) What Is Your Average Deal Size (Optional) Under $1M $1-10M $10-20M Over $20M

- What Service Are You Interested In? - ALL (Required) * What Service Are You Interested In? (Required) Immigration Business Plan SBA/Bank Loan Business Plan Franchise Business Plan Grant Business Plan Landlord Deck Market Research Marketing & Sales Plan Financial Model Investor Business Plan Pitch Deck Feasibility Study Idea Selection Capital Raise Strategic Business Plan Debt Financing Confidential Information Memorandum (CIM) Executive Summary Teaser Other

- What Service Are You Interested In? - Startup (Required) * What Service Are You Interested In? (Required) SBA/Bank Loan Business Plan Grant Business Plan Market Research Marketing & Sales Plan Financial Model Investor Business Plan Pitch Deck Feasibility Study Idea Selection Capital Raise Strategic Business Plan Debt Financing Executive Summary Teaser

- What Service Are You Interested In? - M&A Advisor & Business Broker (Required) * What Service Are You Interested In? (Required) Confidential Information Memorandum (CIM) Executive Summary Teaser

- What Service Are You Interested In? - Established Business What Service Are You Interested In? (Required) SBA/Bank Loan Business Plan Franchise Business Plan Grant Business Plan Landlord Deck Market Research Marketing & Sales Plan Financial Model Investor Business Plan Pitch Deck Feasibility Study Idea Selection Capital Raise Strategic Business Plan Debt Financing Executive Summary Teaser

- Other Service

- Visa Type? * What Immigration Business Plan Visa Type Do You Need? (Required) E2 L1 EB2 NIW EB5 Direct EB-5 Regional Center H1B O1 EB1A EB1C Canada I am not sure

- Do you have a deadline? * Do you have a visa application deadline? (Optional) Yes, I have a deadline No, I don't have a deadline

- Name This field is for validation purposes and should be left unchanged.

- E2 Visa Business Plan

Language selection

- Français fr

Business plans

From: Financial Consumer Agency of Canada

- Future-Oriented Statement of Operations 2023-2024

- Future-Oriented Statement of Operations 2022-2023

- Future-Oriented Statement of Operations 2021-2022

- Future-Oriented Statement of Operations 2020-2021

- Future-Oriented Statement of Operations 2019-2020

- Future-Oriented Statement of Operations 2018-2019 (PDF - 799 KB)

- 2018 to 2019 Fees Report

- Future-Oriented Statement of Operations 2017-2018 (PDF - 860 KB)

- Amendment to 2017-18 Business Plan (PDF - 356 KB)

- 2017 to 2018 Fees Report

- Business Plan 2016-2017 (PDF - 423 KB)

Page details

IMAGES

VIDEO

COMMENTS

Entrepreneurs. Create a business plan that will serve as a roadmap for your business and help you make a successful pitch to lenders. Fill in the form to get your tool. It's 100% free. We allow you to use these templates only as part of your business activities, but we do not guarantee that they fit your needs.

Find out how to write a business plan and access templates, sample business plans, market research information and statistics.

Business development organizations and Canadian banks have free templates, writing guides, sample plans, and even interactive tools available online. These resources allow you to walk through a plan line by line. You will get a sense of the information you might be asked to provide when you are looking for financing, for example.

Sample pages from How to Write a Business Plan: Your Template in 10 Steps. Note: Review your mission statement often to make sure it matches your company purpose as it evolves. A statement that doesn't fit your core values or what you actually do can undermine your marketing efforts and credibility. 3.

A business plan is a framework a business owner can complete in order to make starting or optimizing a business easier. Whether you're working on your business idea or you're an established entrepreneur, creating a business plan can help you map out your values and overall approach. It's one of the best ways to develop or refine your ...

The Seven Key Sections of a Business Plan. 1. Executive summary. Your executive summary should be 1-2 pages long, and provide an overview of your business concept, key objectives of your business and your plan, ownership structure, management team, your product or service offering, target market (s), competitive advantages, marketing strategy ...

Create Your Plan with the RBC Business Plan Template. This comprehensive template will guide you through a series of questions, resources and tips to help you write your plan. Best of all, you can go at your own pace and come back to work on it anytime. Start Your Business Plan.

The federal government's Business Development Bank of Canada (BDC) is devoted to helping Canadian entrepreneurs. BDC.ca's business plan resources offer an exhaustive collection of articles on building business plans, including examples and templates. You'll also find expert advice on every aspect of starting, buying and running a business ...

Interactive Business Plan Builder. We understand that creating a business plan might be a new territory, our Interactive Business Plan Builder helps streamline the writing process and offers aspiring entrepreneurs and established business owners the guidance and support they need from the beginning to the end of the planning process. Create ...

7 business plan examples: section by section. The business plan examples in this article follow this example template: Executive summary. An introductory overview of your business. Company description. A more in-depth and detailed description of your business and why it exists. Market analysis.

Write a Business Plan. Clarify your idea and get it in writing. There's a lot of work involved in writing a business plan but it prepares you for the even bigger task of starting a business. It will help refine your idea, outline goals, and make it easier to explain what you hope to accomplish. This comes in handy when you're looking for money.

A business plan is a written document that describes your business, its objectives and strategies, the market you are targeting and your financial forecast. It is important to have a business plan because it helps you set realistic goals, secure external funding, measure your success, clarify operational requirements and establish reasonable ...

If you still need help preparing your business plan, call 1-888-576-4444 to contact the Business Information Services centre of the Atlantic Canada Opportunities Agency. ACOA's Business Information Services also offers a series of business plan templates. Click here to view adresses and contact information for the ACOA office nearest you.

We have developed a template that makes creating your Business Plan easy. And it's free! This template guides you through all of the steps required to complete a proper business plan. It has explanations of the terms and definitions. It lets you add your own thoughts and comments. Once you've completed the steps, you'll have a business ...

An Insider's Look - Business Plan Example. Gain insight from Entrepreneur-in-Residence, Dominik Loncar, on what people reading your business plan are looking for. We understand that writing a business plan can feel daunting, there's so many pieces it's hard to know where to start. So, to help you get started we've created a business ...

2. Prepare business plan. A business plan explains your business idea, short and long-term business goals and what resources are available to start and operate your business. If you need help writing a business plan: contact your local Small Business Enterprise Centre or, if you are a technology or innovation company, a Regional Innovation Centre.

The FCC business plan bundle was designed specifically for farm operations and anyone involved in Canadian agriculture. Bundle includes: Word documents and pdfs. By accessing, downloading, and using the FCC Business Tool Template, you acknowledge and agree that any use of the materials and their contents is entirely at your own risk.

How to Write a Business Plan. The Atlantic Communications Committee is pleased to release the following infographic on How to Write a Business Plan. The document is intended to be used by CBDCs, clients and stakeholders as a quick reference guide when completing a business plan.

Business Plan. Obtaining a Start-Up Visa in Canada requires support from an incubator, angel investor, or venture capital firm. This will require a solid, concise, and enticing Start-Up Visa business plan and/or pitch deck. Joorney's team of business and immigration professionals have the experience to ensure your business plan and/or pitch ...

Business Plan 2017-2018 (PDF - 883 KB) Future-Oriented Statement of Operations 2017-2018 (PDF - 860 KB) Amendment to 2017-18 Business Plan (PDF - 356 KB) 2017 to 2018 Fees Report. Business Plan 2016-2017 (PDF - 423 KB) Date modified: 2023-10-04. Business plans provide information on the Financial Consumer Agency of Canada's planned activities ...

Business Plan Writer. Our interactive Business Plan Writer has been designed to simplify the business planning process. Not only is this tool dynamic, allowing you to customize your plan, we've also provided tips & tricks and plenty of examples to guide you as you write. We understand that writing a business plan can be a daunting experience.