What is inflation?

Inflation refers to a broad rise in the prices of goods and services across the economy over time, eroding purchasing power for both consumers and businesses. In other words, your dollar (or whatever currency you use for purchases) will not go as far today as it did yesterday. To understand the effects of inflation, take a commonly consumed item and compare its price from one period with another. For example, in 1970, the average cup of coffee cost 25 cents; by 2019, it had climbed to $1.59. So for $5, you would have been able to buy about three cups of coffee in 2019, versus 20 cups in 1970. That’s inflation, and it isn’t limited to price spikes for any single item or service; it refers to increases in prices across a sector, such as retail or automotive—and, ultimately, a country’s economy.

Get to know and directly engage with senior McKinsey experts on inflation.

Ondrej Burkacky is a senior partner in McKinsey’s Munich office, Axel Karlsson is a senior partner in the Stockholm office, Fernando Perez is a senior partner in the Miami office, Emily Reasor is a senior partner in the Denver office, and Daniel Swan is a senior partner in the Stamford office.

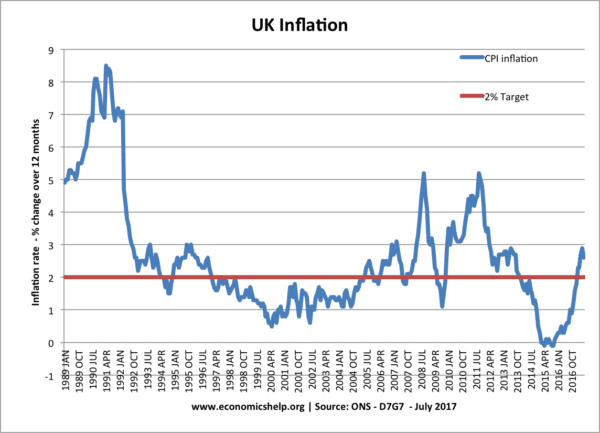

In a healthy economy, annual inflation is typically in the range of two percentage points, which is what economists consider a signal of pricing stability. And there can be positive effects of inflation when it’s within range: for instance, it can stimulate spending, and thus spur demand and productivity, when the economy is slowing down and needs a boost. Conversely, when inflation begins to surpass wage growth, it can be a warning sign of a struggling economy.

Inflation affects consumers most directly, but businesses can also feel the impact. Here’s a quick explanation of the differences in how inflation affects consumers and companies:

- Households, or consumers, lose purchasing power when the prices of items they buy, such as food, utilities, and gasoline, increase.

- Companies lose purchasing power, and risk seeing their margins decline , when prices increase for inputs used in production, such as raw materials like coal and crude oil , intermediate products such as flour and steel, and finished machinery. In response, companies typically raise the prices of their products or services to offset inflation, meaning consumers absorb these price increases. For many companies, the trick is to strike a balance between raising prices to make up for input cost increases while simultaneously ensuring that they don’t rise so much that it suppresses demand, which is touched on later in this article.

How is inflation measured?

Statistical agencies measure inflation by first determining the current value of a “basket” of various goods and services consumed by households, referred to as a price index. To calculate the rate of inflation, or percentage change, over time, agencies compare the value of the index over one period to another, such as month to month, which gives a monthly rate of inflation, or year to year, which gives an annual rate of inflation.

For example, in the United States, that country’s Bureau of Labor Statistics publishes its Consumer Price Index (CPI), which measures the cost of items that urban consumers buy out of pocket. The CPI is broken down by regions and is reported for the country as a whole. The Personal Consumption Expenditures (PCE) price index —published by the US government’s Bureau of Economic Analysis—takes into account a broader range of consumers’ expenditures, including healthcare. It is also weighted by data acquired through business surveys.

Introducing McKinsey Explainers : Direct answers to complex questions

What are the main causes of inflation.

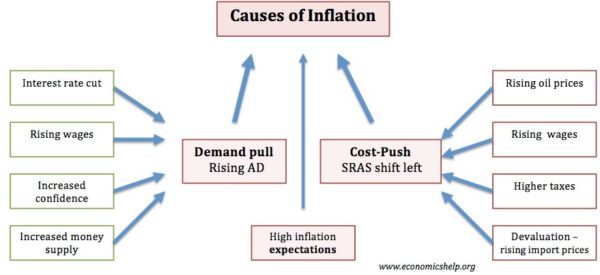

There are two primary types, or causes, of inflation:

- Demand-pull inflation occurs when the demand for goods and services in the economy exceeds the economy’s ability to produce them. For example, when demand for new cars recovered more quickly than anticipated from its sharp dip at the beginning of the COVID-19 pandemic, an intervening shortage in the supply of semiconductors made it hard for the automotive industry to keep up with this renewed demand. The subsequent shortage of new vehicles resulted in a spike in prices for new and used cars.

- Cost-push inflation occurs when the rising price of input goods and services increases the price of final goods and services. For example, commodity prices spiked sharply during the pandemic as a result of radical shifts in demand, buying patterns, cost to serve, and perceived value across sectors and value chains. To offset inflation and minimize impact on financial performance, industrial companies were forced to consider price increases that would be passed on to their end consumers.

Learn more about McKinsey's Pricing practice.

How does inflation today differ from historical inflation?

In January 2022, inflation in the United States accelerated to 7.5 percent, its highest level since February 1982, as a result of soaring energy costs , labor mismatches , and supply disruptions . But inflation is not a new phenomenon; countries have weathered inflation throughout history.

A common comparison to the current inflationary period is with that of the post–World War II era , when price controls, supply problems, and extraordinary demand fueled double-digit inflation gains—peaking at 20 percent in 1947—before subsiding at the end of the decade, according to the US Bureau of Labor Statistics. Consumption patterns today have been similarly distorted, and supply chains have been disrupted by the pandemic.

The period from the mid-1960s through the early 1980s, sometimes called “The Great Inflation,” saw some of the highest rates of inflation, with a peak of 14.8 percent in 1980. To combat this inflation, the Federal Reserve raised interest rates to nearly 20 percent. Some economists attribute this episode partially to monetary policy mistakes rather than to other purported causes, such as high oil prices. The Great Inflation signaled the need for public trust in the Federal Reserve’s ability to lessen inflationary pressures.

How does inflation affect pricing?

When inflation occurs, companies typically pay more for input materials . One way for companies to offset losses and maintain gross margins is by raising prices for consumers, but if price increases are not executed thoughtfully, companies can damage customer relationships, depress sales, and hurt margins. An exposure matrix that assesses which categories are exposed to market forces, and whether the market is inflating or deflating, can help companies make more informed decisions.

Done the right way, recovering the cost of inflation for a given product can strengthen relationships and overall margins. There are five steps companies can take to ADAPT (Adjust, Develop, Accelerate, Plan, and Track) to inflation:

- Adjust discounting and promotions and revisit other aspects of sales unrelated to the base price, such as lengthened production schedules or surcharges and delivery fees for rush or low-volume orders.

- Develop the art and science of price change . Don’t make across-the-board price changes; rather, tailor pricing actions to account for inflation exposure, customer willingness to pay, and product attributes.

- Accelerate decision making tenfold . Establish an “inflation council” that includes dedicated cross-functional, inflation-focused decision makers who can act nimbly and quickly on customer feedback.

- Plan options beyond pricing to reduce costs . Use “value engineering” to reimagine your portfolio and provide cost-reducing alternatives to price increases.

- Track execution relentlessly . Create a central supporting team to address revenue leakage and to manage performance rigorously.

Beyond pricing, a variety of commercial and technical levers can help companies deal with price increases in an inflationary market , but other sectors may require a more tailored response to pricing. In the chemicals industry, for instance, category managers contending with soaring prices of commodities can make the following five moves to save their companies money:

- Gain a full understanding of supply–market dynamics and outlook . Understand and track the elements that trigger price increases and rescind these increases once those drivers are no longer applicable.

- Ensure that suppliers can clearly articulate the impact that price increases in the market have on suppliers’ prices . In times of upward price pressure, sellers often overstate the share of raw materials in input costs, taking the opportunity to inflate their margins. Using cleansheet methodology to identify and challenge these situations is important.

- View unavoidable price increases as temporary surcharges, not the new future state . This mechanism, partly psychological in nature, is very effective in dealing with the stickiness of price increases because it shifts the burden of proof to the supplier.

- Prioritize cross-functional initiatives . When prices are high, the impact of yield improvements, waste reduction, or substitutions can be amplified. If any are available, now is the time to make them a priority.

- Work with sales to pass on price increases . Category managers work closely with finance and commercial teams to shed light on pure market effects and their impact on the prices of goods sold, while ensuring that the right arguments are advanced to pass market-price increases to customers.

Learn more about our Financial Services , Advanced Electronics , Operations , and Growth, Marketing & Sales practices.

What is the difference between inflation and deflation?

If inflation is one extreme of the pricing spectrum, deflation is the other. Deflation occurs when the overall level of prices in an economy declines and the purchasing power of currency increases. It can be driven by growth in productivity and the abundance of goods and services, by a decrease in aggregate demand, or by a decline in the supply of money and credit.

Generally, moderate deflation positively affects consumers’ pocketbooks, as they are able to purchase more with less money. However, deflation can be a sign of a weakening economy, leading to recessions and depressions. While inflation reduces purchasing power, it also reduces the value of debt. During a period of deflation, on the other hand, debt becomes more expensive. Additionally, consumers can protect themselves to an extent during periods of inflation. For instance, consumers who have allocated their money into investments can see their earnings grow faster than the rate of inflation. During episodes of deflation, however, investments, such as stocks, corporate bonds, and real-estate investments, become riskier.

A recent period of deflation in the United States occurred between 2007 and 2008, referred to by economists as the Great Recession. In December 2008, more than half of executives surveyed by McKinsey expected deflation in their countries, and 44 percent expected to decrease the size of their workforces.

When taken to their extremes, both inflation and deflation can significantly and negatively affect consumers, businesses, and investors.

For more in-depth exploration of these topics, see McKinsey’s Operations Insights collection. Learn more about Operations consulting , and check out operations-related job opportunities if you’re interested in working at McKinsey.

Articles referenced include:

- “ How business operations can respond to price increases: A CEO guide ,” March 11, 2022, Andreas Behrendt , Axel Karlsson , Tarek Kasah, and Daniel Swan

- “ Five ways to ADAPT pricing to inflation ,” February 25, 2022, Alex Abdelnour , Eric Bykowsky, Jesse Nading, Emily Reasor , and Ankit Sood

- “ How COVID-19 is reshaping supply chains ,” November 23, 2021, Knut Alicke , Ed Barriball , and Vera Trautwein

- “ Navigating the labor mismatch in US logistics and supply chains ,” December 10, 2021, Dilip Bhattacharjee , Felipe Bustamante, Andrew Curley, and Fernando Perez

- “ Coping with the auto-semiconductor shortage: Strategies for success ,” May 27, 2021, Ondrej Burkacky , Stephanie Lingemann, and Klaus Pototzky

Want to know more about inflation?

Related articles.

What is supply chain?

How business operations can respond to price increases: A CEO guide

Five ways to ADAPT pricing to inflation

Economic essays on inflation

- Definition – Inflation – Inflation is a sustained rise in the cost of living and average price level.

- Causes Inflation – Inflation is caused by excess demand in the economy, a rise in costs of production, rapid growth in the money supply.

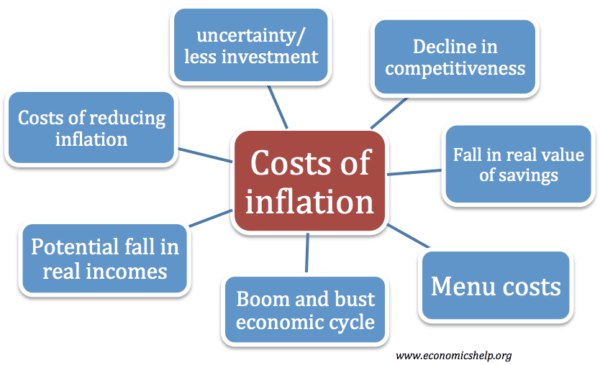

- Costs of Inflation – Inflation causes decline in value of savings, uncertainty, confusion and can lead to lower investment.

- Problems measuring inflation – why it can be hard to measure inflation with changing goods.

- Different types of inflation – cost-push inflation, demand-pull inflation, wage-price spiral,

- How to solve inflation . Policies to reduce inflation, including monetary policy, fiscal policy and supply-side policies.

- Trade off between inflation and unemployment . Is there a trade-off between the two, as Phillips Curve suggests?

- The relationship between inflation and the exchange rate – Why high inflation can lead to a depreciation in the exchange rate.

- What should the inflation target be? – Why do government typically target inflation of 2%

- Deflation – why falling prices can lead to negative economic growth.

- Monetarist Theory – Monetarist theory of inflation emphasises the role of the money supply.

- Criticisms of Monetarism – A look at whether the monetarist theory holds up to real-world scenarios.

- Money Supply – What the money supply is.

- Can we have economic growth without inflation?

- Predicting inflation

- Link between inflation and interest rates

- Should low inflation be the primary macroeconomic objective?

See also notes on Unemployment

- Environment

- Information Science

- Social Issues

- Argumentative

- Cause and Effect

- Classification

- Compare and Contrast

- Descriptive

- Exemplification

- Informative

- Controversial

- Exploratory

- What Is an Essay

- Length of an Essay

- Generate Ideas

- Types of Essays

- Structuring an Essay

- Outline For Essay

- Essay Introduction

- Thesis Statement

- Body of an Essay

- Writing a Conclusion

- Essay Writing Tips

- Drafting an Essay

- Revision Process

- Fix a Broken Essay

- Format of an Essay

- Essay Examples

- Essay Checklist

- Essay Writing Service

- Pay for Research Paper

- Write My Research Paper

- Write My Essay

- Custom Essay Writing Service

- Admission Essay Writing Service

- Pay for Essay

- Academic Ghostwriting

- Write My Book Report

- Case Study Writing Service

- Dissertation Writing Service

- Coursework Writing Service

- Lab Report Writing Service

- Do My Assignment

- Buy College Papers

- Capstone Project Writing Service

- Buy Research Paper

- Custom Essays for Sale

Can’t find a perfect paper?

- Free Essay Samples

Essays on Inflation

Several scholars have defined Shrinkflation as the process by which a good or a product is reduced by size or quantity while the price of the product is maintained. According to the study carried out by Furceri et al., Shrinkflation is an alternative means that sellers have assumed to increase...

Words: 3958

Although banks, credit unions, and saving and loan companies offer similar services, they have pertinent features that cater to specific financial needs of customers. Saving and current are the two basic types of accounts offered by financial institutions. Savings accounts accumulate interests, which vary depending on the prevailing market rates,...

Inverse Relationship between Inflation and Unemployment There exists an inverse relationship between inflation and unemployment in the short run. In economics, this relationship is referred to as Philip's curve. However, it is not a permanent tradeoff and ceases to exist in the long run. Policy makers have a tough choice to...

Monetary Policy Monetary policy is the action taken by the Federal Reserve to achieve specific economic goals. The main targets are the inflation and the unemployment rate. Some of the tools used to achieve the goals are open market operations, the reserve requirement and the discount rate. The policies the Fed...

Macroeconomics is the branch of economics which studies how the entire economy behaves. The key changing factors in macroeconomics are such as inflation, price levels, rate of growth, national income, gross domestic product (GDP) and changes in unemployment. These variables are very important in; determining the functioning of an economy,...

Found a perfect essay sample but want a unique one?

Request writing help from expert writer in you feed!

The Monetary Policy Committee (MPC) of the Bank of England has not been successful in maintaining inflation. Monetary policy refers to the use of interest rates and other tools to affect consumer spending and aggregate demand in the economy (Boneva, Weale and Wieladek 2016). Some of the monetary tools used...

Words: 1200

(a) Why do some economists claim that we should not worry too much about inflation? The economists claim that, as a result of the under-read measure of the inflation since they don’t take account of qualitative improvements over time. A small amount of inflation makes it possible to give adequate...

Words: 1518

Inflation tax is the financial loss of value incurred by a holder of cash. For example, if you hold a $1000 bill for one year, then it will purchase on what $980 would have bought a year ago. Inasmuch as excess bank reserves attract nominal interest, the value is still...

Inflation and Its Causes Inflation has been as a result of rapid increase in the quantity of money or general supply of money in the economy. Inflation has occurred in several different countries. By the nineteenth period, the economist has been able to separate various factors which cause increase or fall...

Words: 1403

Money plays a significant role in the economy. The purposes of money include as medium of exchange where money is used in exchange for goods and services. Money is also used as measures of value where it acts as a common denominator permitting every good or service to be priced...

Deflation and its Positive Effects Deflation is both a negative and a positive thing. Some of the positive effects of deflation include the fact that it reduces the burden of private and private debt. It also enables banks to adjust and control the interest rates of a product to stabilize the...

Related topic to Inflation

Essay on Inflation

Inflation is a term that resonates through the corridors of our daily lives, affecting decisions made by individuals, businesses, and governments alike. It refers to the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central banks attempt to limit inflation, and avoid deflation, to keep the economy running smoothly. This essay delves into the causes of inflation, its various effects on the economy and individuals, and the strategies employed to manage it, aiming to provide a comprehensive understanding suitable for a student participating in an essay writing competition.

The Causes of Inflation

Inflation is primarily caused by two factors: demand-pull and cost-push inflation. Demand-pull inflation occurs when demand for goods and services exceeds supply, causing prices to rise. This can happen due to increased consumer spending, government expenditure, or investment. Cost-push inflation, on the other hand, happens when the cost of production increases, leading producers to raise prices to maintain their profit margins. This increase in production costs can be due to rising wages, increased taxes, or higher prices for raw materials.

- Demand-pull inflation occurs when the overall demand for goods and services in an economy exceeds its supply. This excess demand leads to rising prices as businesses raise prices to capitalize on increased consumer demand.

- Factors contributing to demand-pull inflation include robust consumer spending, increased government spending, low-interest rates, and high levels of investment.

- Cost-push inflation is driven by rising production costs, which are then passed on to consumers in the form of higher prices. These rising costs can result from various factors, such as increased wages, higher energy prices, or supply chain disruptions.

- For example, if oil prices spike, it can lead to increased transportation costs, which may cause businesses to raise prices on their products.

- Built-in inflation, also known as the wage-price spiral, occurs when workers demand higher wages to keep up with rising prices. When businesses pay higher wages, they often pass those costs on to consumers, causing prices to rise further. This cycle can continue, perpetuating inflation.

- Expectations of future inflation can also contribute to built-in inflation, as people adjust their behavior and spending patterns in anticipation of rising prices.

- The policies of central banks, such as the Federal Reserve in the United States, can influence inflation. When central banks implement loose monetary policies, such as low-interest rates and quantitative easing, it can increase the money supply and potentially lead to demand-pull inflation.

- Central banks can also use tight monetary policies, such as raising interest rates, to combat inflation and reduce spending.

- Government fiscal policies, including changes in taxation and government spending, can affect inflation. An increase in government spending without corresponding revenue sources can stimulate demand and contribute to inflation.

- Tax cuts can also increase disposable income, leading to higher consumer spending and potential demand-pull inflation.

- Exchange rate fluctuations can impact inflation by influencing the prices of imported goods. A depreciating domestic currency can make imports more expensive, contributing to cost-push inflation.

- Conversely, a strengthening currency can lower import prices and help reduce inflation.

- Unforeseen events, such as natural disasters, geopolitical tensions, or disruptions in the supply chain, can cause sudden supply shortages or surpluses. These shocks can result in sharp price movements and contribute to inflation.

- For instance, a severe drought can reduce agricultural output, leading to higher food prices.

- Global economic conditions and trends, such as changes in international commodity prices or global economic growth, can influence inflation in individual countries.

- Economic policies in major trading partners can also have spill-over effects on domestic inflation.

The Effects of Inflation

Inflation impacts various facets of the economy and society. Moderate inflation is a sign of a growing economy, but high inflation can have detrimental effects.

Economic Effects

1. Reduced Purchasing Power: Inflation erodes the purchasing power of money, meaning consumers can buy less with the same amount of money. This reduction can impact living standards and consumer spending.

2. Income Redistribution: Inflation can act as a regressive tax, hitting harder on low-income families. Fixed-income recipients, such as pensioners, find their incomes do not stretch as far, while borrowers may benefit from repaying loans with money that is worth less.

3. Investment Uncertainty: High inflation can lead to uncertainty in the investment market. Investors become wary of long-term investments due to the unpredictability of future costs and returns.

Social Effects

1. Cost of Living: As the cost of goods and services increases, individuals may struggle to afford basic necessities, leading to a lower quality of life.

2. Wage-Price Spiral: Continuous inflation can lead to a wage-price spiral, where workers demand higher wages to keep up with rising prices, which in turn causes prices to rise further.

3. Access to Education and Healthcare: Rising costs can make education and healthcare less accessible to the general population, affecting long-term social and economic development.

Managing Inflation

Governments and central banks use various tools to manage inflation, aiming to maintain it at a level that promotes economic stability and growth.

Monetary Policy

The most common tool for managing inflation is monetary policy, which involves regulating the money supply and interest rates. Central banks can increase interest rates to reduce spending and borrowing, thereby slowing down the economy and reducing inflation. Conversely, lowering interest rates can stimulate spending and investment, increasing demand and potentially causing inflation.

Fiscal Policy

Governments can also use fiscal policy to control inflation by adjusting spending and taxation. Reducing government spending or increasing taxes can decrease the overall demand in the economy, lowering inflation. However, these measures can be unpopular politically as they may lead to reduced public services and higher taxes.

Supply-Side Policies

Improving efficiency and increasing supply can also combat inflation. This can be achieved through investment in technology, deregulation, and policies aimed at increasing productivity. By increasing the supply of goods and services, prices can stabilize or even decrease.

In conclusion, Inflation is a complex phenomenon with wide-ranging effects on the economy and society. Understanding its causes and impacts is crucial for effective management and policy-making. While moderate inflation is a sign of a healthy economy, unchecked inflation can lead to significant economic and social challenges. Through a combination of monetary, fiscal, and supply-side policies, governments and central banks strive to balance inflation to ensure economic stability and growth. As students delve into the intricacies of inflation, they gain insight into the delicate balance required to manage an economy, preparing them for informed citizenship and, possibly, roles in shaping economic policy in the future.

Essay Generator

Text prompt

- Instructive

- Professional

Generate an essay on the importance of extracurricular activities for student development

Write an essay discussing the role of technology in modern education.

Inflation Essay Examples and Topics

Keynesian theory of unemployment, increasing inflation impact on individuals, problem of china’s inflation.

- Words: 2174

Inflation in the United Kingdom

- Words: 1649

Inflation in Turkey: Contemporary and Past Episodes

- Words: 1609

The “Analyze This! Inflation” Video Reflection

The price deviations and inflation rates, the economic disparity and inflation, the inflation dynamics in the canadian context.

- Words: 1091

“Expected and Realized Inflation…” by Binder & Kamdar

Inflation at the international monetary fund, inflation: types and negative effects, “inflation hits the fastest pace since 1981, at 8.5% through march” by koeze.

- Words: 1112

Inflation Rates and the Value of the Dollar

Monetary union of latin american countries.

- Words: 1333

Inflation’s Impact on Fixed Income

Unemployment and inflation relation, unanticipated and participated inflation, securitization and the credit crisis of 2007, inflation and deflation effects on the us and saudi stock markets.

- Words: 1200

Significance of Inflation to Corporate Finance

History of the kenyan economy: stimulating the economic growth through various means, macroeconomics and hyperinflation in 1914-1923, dollar depreciation issue analysis.

- Words: 1931

Government Spending Stimulation in the Fight Against Inflation

Hyperinflation analysis in zimbabwe.

- Words: 1210

How Should Monetary Authorities React to Higher Inflation

Hyperinlfation in zimbabwe.

- Words: 1755

Gasoline Prices, Rates of Unemployment, Inflation, and Economic Growth

- Words: 1721

Federal Reserve System: Inflation

Impact of zimbabwe’s monetary policy on its economy.

- Words: 3271

Able Corporation: Management of Strategic Planning

- Words: 1674

Reasons for a Decrease of a Superannuation Assets Value

- Words: 2338

Interest Rate and Inflation in Netherlands

- Words: 1424

The Austrian Business Cycle Theory

- Words: 1390

“The Debt-Deflation Theory of Great Depressions” by Irving Fisher

Monetary policy in an economy: inflation, hyperinflations factors and eliminating strategies, “inflation rise hits us consumers” bbc article, hyperinflation in a real-life example, consumer price indices for gasoline and electricity in canada, money flows and financial repression in the us and china, inflation and deflation and their outcomes, maintenance of stable pricing, inflation expectations: households and forecasters, macroeconomic elements: the reduction of oil prices.

- Words: 1663

Inflation Targeting in Emerging Economies

Inflation in the 1970s.

- Words: 1116

Fall in Oil Prices in the mid 2014

- Words: 1943

United Arab Emirates and Norway Economies

- Words: 3493

International Financial Markets and Institutions

- Words: 3365

Inflation Causes: Structuralism and Monetarism

- Words: 2920

Why was Japan so unsuccessful in solving the problem of deflation over the past two decades?

- Words: 2260

The Effects of Inflation Targeting

The euro zone’s rising inflation and unemployment rate, inflation tax – printing more money to cover the war expenses.

- Words: 1683

Economic Condition of Singapore: Inflation Hits 5.2% in March

- Words: 1078

Unemployment Issue in Europe

Inflation is here to stay, as prices will always go up.

- Words: 1604

Exchange and Trade: Analyzing Market Movements

- Words: 2418

Economic Health of the Economy: Memo

The effect of global financial crisis on saudi arabian economy.

- Words: 2710

Keynesian Explanation of Recession

- Words: 1388

Effect of a Permanent Increase in Oil Price on Inflation and Output

Consumer price index: measuring inflation.

- Words: 2178

International Finance. Main Causes of Recent Financial Crisis

The cause of china’s inflation, china’s economic growth and inflation.

- Words: 1105

Deficit Spending

The current impact of inflation and unemployment on germany’s political/economic system.

- Words: 1686

Okun’s Law Associations

Pricing goods internationally.

- Words: 1151

Are you better off than you were four years ago?

Cause of the financial crisis.

- Words: 1675

Inflation in Saudi Arabia

- Words: 5524

Benefits Run Out for Spain’s Jobless: Theories of Unemployment

Unemployment rates in the united states, national unemployment & recession, the monetary and fiscal policy implemented during the great recession, the empirical project: turkey.

- Words: 3283

Inflation Rates in Sweden

Monetary and fiscal policies during the great recession.

- Words: 1419

Role of the Federal Reserve in the US Economy

- Words: 1348

Fiscal Policy and Monetary Policy

Scarcity and choice as economic issues.

- Words: 1351

China Currency Policy and Inflation

- Words: 1344

The Faults of the Consumer Price Index

- Words: 1836

Analysis of Unemployment and Inflation in the United States

Analysis of the performance of domestic & multinational us restaurants, saudi arabia’s oil sector.

Essay on Inflation with Quotations | Rising of Prices Essay with Outline

Rising prices essay with outline for matric, fa, fsc, 2nd year, ba and bsc (price hike).

Here is an essay on Inflation with Quotation s and Outline for students. The same essay could be written under the title Essya on Price Hike, Essay on Inflation, Essay on Rising of Prices and Essay on Increasing Prices. If you have essay content and you need only quotations, go here . For more Essays with Quotations visit this page . In this essay, we will discuss the Reasons of inflation and will end up with the solutions. Some other essays are also available here .

Price Hike or Inflation Essay with Quotations

“inflation makes the wealthiest people richer and the masses poorer.” – (james cook).

Inflation means a general increase in price or increase in the supply of money. Inflation is a broad, variable and complex term. Only economists can have its better comprehension from an economic point of view. It is hard to understand its various kinds for a layman.

There is “Creeping Inflation”. It is a healthy trend as it increases development. “Walking inflation” affects savings. “Running Inflation” is hard to control. It affects consumption and savings. It leads to economic recession “Galloping or Hyper Inflation” is disastrous and fatal to the economy. “Demand-pull” inflation is because of aggregate in demand of a commodity. “Cost-Push Inflation” occurs when the cost of production increases.

“Inflation is taxation without legislation.” – (Milton Friedman)

Inflation is not an unexpected and unpredictable phenomenon. Its seeds are sown because of mismanagement; weak or low market knowledge, indifferent attitude towards economic indicators, weak administrative machinery, absence or lack of check and balance, bureaucratic manipulation, inadvertent boarding and strong association of the market leaders. Disturbance in demand and supply ratio is yet another factor.

Inflation is a menace in the poor or underdeveloped or developing countries. It badly affects the living standard of the people. It increases poverty and decreases purchasing power. Inflation creeps slowly into the economic system and assumes magnitude by creating an alarming situation. Inflation destroys or disturbs market balance badly.

World’s richest investor Warren Buffet says,

“If you buy things you don’t need, soon you will have to sell things you need.”

Inflation increases unemployment and, as a result, not only skilled but also unskilled workers are laid off. It creates future social problems. It permeates into our social fabric and disturbs everything. Anxiety and depression are the immediate outcomes of inflation. It eats up the purchasing capacity of people. It belittles the efforts done by the bread earners to meet the growing needs of their families. Inflation gives rise to dishonesty and corruption.

“The safe way to double your money is to fold it over once and put it in your pocket.” (Frank Hubbard)

There is a popular believe that once prices increase, they never decrease. It is true to some extent. However, we can minimize the effects of inflation by concentrating efforts. Inflation can b controlled by the long term and short term sound economic planning. Market competition can bring about reduction in inflation. The local industry should be promoted to reduce inflation. Accessible and cheaper goods can minimize the adverse effects of inflation. These can also provide people with alternatives. This may affect the standard of living but people are protected against the adverse effects of inflation. Proper monitoring and regulatory control can help in reducing inflation. Retailers and hawkers sell things of daily use at their own swill. They do so because there is no check and balance. There is nobody to enforce the law and evaluate the prices at which things are sold.

Inflation can be viewed as an international phenomenon. Only should planning by the Government can avert it. Inflation is misery and people can be saved from this misery through mutual effort. To sum up, inflation, in any form, undermines the very foundations of a social set-up. It makes the rich richer and the poor poorer. It carries the social stigma that breeds dissatisfaction among all the factions of society.

The government should take adequate measures to control this social evil.

“Production is the only answer to inflation.” – (Chester Bowles)

You may also like essay on importance of education, essay on rising of prices | inflation essay with outline for class 10, class 12 and graduation.

- Introduction

- The problem of inflation in Pakistan

- Effect of rising prices on the life of common man

- Reasons behind the inflation

The prices of necessities of life are rising constantly. They are posing a serious problem for everybody in the country. The problem of rising prices has become a universal problem. This problem assumes an acute term in developing countries like Pakistan. The majority of people in our country belong to the low-income group. Usually, they have very meager sources of income. Very often the income of people is fixed. Therefore, they are hard hit by the high prices of essential goods which register a rise every week and every month. The result is that the standard of living of poor people is dwindling day by day.

Inflation has an adverse effect on different sections of society. Most of the people have not sufficient means to buy the necessities of life. They are compelled to use unfair means to have them. In this way, society is troubled by pick-pockets, thieves and robbers etc. Those government servants who cannot make both ends meet become corrupt. They abuse their powers and accept the bribe. In this way, they promote injustice and cruelty in the national life.

Rising prices also affect national life in the economic field. The businessmen think of adulteration black marketing and other methods to maximize their profits. Since the prices of goods are beyond the reach of common man, the standard of living goes on falling gradually.

There are many factors which cause a rise in prices.

First, the most important of these is the increase in population. The population of a country is increasing at a rapid rate. But the economic resources do not increase at the same rate. It results in inflation.

Second, if the demand is higher than the supply, the goods will be naturally sold at higher prices. Sometimes the government imposes higher taxes on certain commodities so that their prices go up. The wrong policies of government often lead to hoarding, smuggling and black marketing of the essential goods.

Third, if a businessman has a monopoly in the production and sale of a certain commodity, he can raise its price as and when he desires. In developing countries like Pakistan, developmental activities usually cause inflation. The funds and the loans that are acquired from foreign countries are invested in different projects. They increase the circulation of money in the country and cause inflation.

Our first duty should be to check the birth rate. We should make vigorous propaganda in favour of family planning. Second, the government should not impose so many taxes, levies, duties or surcharges on those commodities which are used by the common man and which are considered necessary for human life.

After this essay on Inflation, go for Poverty in Pakistan essay .

You should also visit:

- Essay on Importance of Education in Life with Quotes

- Essay On My First Day at College With Quotations

- Essay on My Last Day at College with Quotations

- Essay on My Favourite Pastime with Quotations

- Essay on My Aim in Life with Quotations

- Computer and Modern World Essay with Quotations

- Essay on Discipline with Quotations

- Essay on Terrorism with Quotes

- More In English Essays

Essay Writing 101: The Basics That Every Writer Should Know

Students and Social Service Essay with Quotations

Load Shedding in Pakistan Essay – 1200 Words

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

- Privacy Policty

- Terms of Service

- Advertise with Us

- Privacy Policy

Essay on inflation/Rising prices in Pakistan with quotations

Rising prices / inflation essay 300 - 400 words.

Inflation essay for 2nd year, class 12 PDF download

Inflation is taxation without legislation - Milton Friedman

Inflation is the crabgrass in your savings - Robert Orben

Inflation is the parent of unemployment and the unseen robber of those who have saved - Margret Thatcher

Production is the only answer to inflation - Anonymous

8 comments:

Just better butnit good

Nice Good effort

It's short a little bit but the content is good

Post a Comment

Trending Topics

Latest posts.

- 9th class Urdu guess paper 2024 pdf download

- 9th class pak study guess paper 2024 pdf download

- 9th class maths guess paper 2024

- 9th class guess paper 2024 pdf

- 9th class Urdu Notes PDF Download

- 9th class general maths guess paper 2024 urdu medium

- 2nd year English guess paper 2024 for Punjab Boards

- 2nd Year English Complete Notes in PDF

- 9th class Pak Studies Urdu Medium Notes PDF

- 2nd year guess paper 2024 Punjab board

- 9th class English guess paper 2024 pdf download

- 9th class physics guess paper 2024 pdf download

- 10th class guess paper 2024 pdf download

- 9th class general science guess paper 2024 pdf download

- 10th class physics guess paper English Medium 2024

- Islamiat compulsory guess paper for 10th class 2024

- 9th class biology guess paper 2024 for All Punjab Boards

- BISE Hyderabad

- BISE Lahore

- bise rawalpindi

- BISE Sargodha

- career-counseling

- how to pass

- Punjab Board

- Sindh-Board

- Solved mcqs

- Student-Guide

Inflation: Types, Causes and Effects (With Diagram)

Inflation and unemployment are the two most talked-about words in the contemporary society.

These two are the big problems that plague all the economies.

Almost everyone is sure that he knows what inflation exactly is, but it remains a source of great deal of confusion because it is difficult to define it unambiguously.

1. Meaning of Inflation:

Inflation is often defined in terms of its supposed causes. Inflation exists when money supply exceeds available goods and services. Or inflation is attributed to budget deficit financing. A deficit budget may be financed by the additional money creation. But the situation of monetary expansion or budget deficit may not cause price level to rise. Hence the difficulty of defining ‘inflation’.

ADVERTISEMENTS:

Inflation may be defined as ‘a sustained upward trend in the general level of prices’ and not the price of only one or two goods. G. Ackley defined inflation as ‘a persistent and appreciable rise in the general level or average of prices’. In other words, inflation is a state of rising prices, but not high prices.

It is not high prices but rising price level that constitute inflation. It constitutes, thus, an overall increase in price level. It can, thus, be viewed as the devaluing of the worth of money. In other words, inflation reduces the purchasing power of money. A unit of money now buys less. Inflation can also be seen as a recurring phenomenon.

While measuring inflation, we take into account a large number of goods and services used by the people of a country and then calculate average increase in the prices of those goods and services over a period of time. A small rise in prices or a sudden rise in prices is not inflation since they may reflect the short term workings of the market.

It is to be pointed out here that inflation is a state of disequilibrium when there occurs a sustained rise in price level. It is inflation if the prices of most goods go up. Such rate of increases in prices may be both slow and rapid. However, it is difficult to detect whether there is an upward trend in prices and whether this trend is sustained. That is why inflation is difficult to define in an unambiguous sense.

Let’s measure inflation rate. Suppose, in December 2007, the consumer price index was 193.6 and, in December 2008, it was 223.8. Thus, the inflation rate during the last one year was

223.8- 193.6/ 193.6 x 100 = 15.6

As inflation is a state of rising prices, deflation may be defined as a state of falling prices but not fall in prices. Deflation is, thus, the opposite of inflation, i.e., a rise in the value of money or purchasing power of money. Disinflation is a slowing down of the rate of inflation.

2. Types of Inflation:

As the nature of inflation is not uniform in an economy for all the time, it is wise to distinguish between different types of inflation. Such analysis is useful to study the distributional and other effects of inflation as well as to recommend anti-inflationary policies. Inflation may be caused by a variety of factors. Its intensity or pace may be different at different times. It may also be classified in accordance with the reactions of the government toward inflation.

Thus, one may observe different types of inflation in the contemporary society:

A. On the Basis of Causes:

(i) Currency inflation:

This type of inflation is caused by the printing of currency notes.

(ii) Credit inflation:

Being profit-making institutions, commercial banks sanction more loans and advances to the public than what the economy needs. Such credit expansion leads to a rise in price level.

(iii) Deficit-induced inflation:

The budget of the government reflects a deficit when expenditure exceeds revenue. To meet this gap, the government may ask the central bank to print additional money. Since pumping of additional money is required to meet the budget deficit, any price rise may the be called the deficit-induced inflation.

(iv) Demand-pull inflation:

An increase in aggregate demand over the available output leads to a rise in the price level. Such inflation is called demand-pull inflation (henceforth DPI). But why does aggregate demand rise? Classical economists attribute this rise in aggregate demand to money supply. If the supply of money in an economy exceeds the available goods and services, DPI appears. It has been described by Coulborn as a situation of “too much money chasing too few goods.”

Keynesians hold a different argument. They argue that there can be an autonomous increase in aggregate demand or spending, such as a rise in consumption demand or investment or government spending or a tax cut or a net increase in exports (i.e., C + I + G + X – M) with no increase in money supply. This would prompt upward adjustment in price. Thus, DPI is caused by monetary factors (classical adjustment) and non-monetary factors (Keynesian argument).

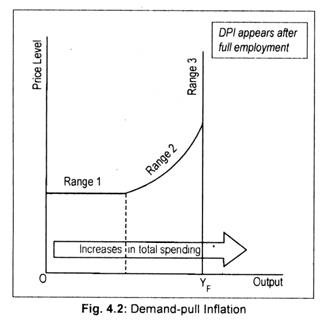

DPI can be explained in terms of Fig. 4.2, where we measure output on the horizontal axis and price level on the vertical axis. In Range 1, total spending is too short of full employment output, Y F . There is little or no rise in the price level. As demand now rises, output will rise. The economy enters Range 2, where output approaches towards full employment situation. Note that in this region price level begins to rise. Ultimately, the economy reaches full employment situation, i.e., Range 3, where output does not rise but price level is pulled upward. This is demand-pull inflation. The essence of this type of inflation is that “too much spending chasing too few goods.”

(v) Cost-push inflation:

Inflation in an economy may arise from the overall increase in the cost of production. This type of inflation is known as cost-push inflation (henceforth CPI). Cost of production may rise due to an increase in the prices of raw materials, wages, etc. Often trade unions are blamed for wage rise since wage rate is not completely market-determinded. Higher wage means high cost of production. Prices of commodities are thereby increased.

A wage-price spiral comes into operation. But, at the same time, firms are to be blamed also for the price rise since they simply raise prices to expand their profit margins. Thus, we have two important variants of CPI wage-push inflation and profit-push inflation.

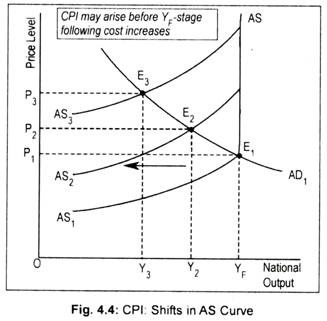

Anyway, CPI stems from the leftward shift of the aggregate supply curve:

B. On the Basis of Speed or Intensity:

(i) Creeping or Mild Inflation:

If the speed of upward thrust in prices is slow but small then we have creeping inflation. What speed of annual price rise is a creeping one has not been stated by the economists. To some, a creeping or mild inflation is one when annual price rise varies between 2 p.c. and 3 p.c. If a rate of price rise is kept at this level, it is considered to be helpful for economic development. Others argue that if annual price rise goes slightly beyond 3 p.c. mark, still then it is considered to be of no danger.

(ii) Walking Inflation:

If the rate of annual price increase lies between 3 p.c. and 4 p.c., then we have a situation of walking inflation. When mild inflation is allowed to fan out, walking inflation appears. These two types of inflation may be described as ‘moderate inflation’.

Often, one-digit inflation rate is called ‘moderate inflation’ which is not only predictable, but also keep people’s faith on the monetary system of the country. Peoples’ confidence get lost once moderately maintained rate of inflation goes out of control and the economy is then caught with the galloping inflation.

(iii) Galloping and Hyperinflation:

Walking inflation may be converted into running inflation. Running inflation is dangerous. If it is not controlled, it may ultimately be converted to galloping or hyperinflation. It is an extreme form of inflation when an economy gets shattered.”Inflation in the double or triple digit range of 20, 100 or 200 p.c. a year is labelled “galloping inflation”.

(iv) Government’s Reaction to Inflation:

Inflationary situation may be open or suppressed. Because of anti-inflationary policies pursued by the government, inflation may not be an embarrassing one. For instance, increase in income leads to an increase in consumption spending which pulls the price level up.

If the consumption spending is countered by the government via price control and rationing device, the inflationary situation may be called a suppressed one. Once the government curbs are lifted, the suppressed inflation becomes open inflation. Open inflation may then result in hyperinflation.

3. Causes of Inflation:

Inflation is mainly caused by excess demand/ or decline in aggregate supply or output. Former leads to a rightward shift of the aggregate demand curve while the latter causes aggregate supply curve to shift leftward. Former is called demand-pull inflation (DPI), and the latter is called cost-push inflation (CPI). Before describing the factors, that lead to a rise in aggregate demand and a decline in aggregate supply, we like to explain “demand-pull” and “cost-push” theories of inflation.

(i) Demand-Pull Inflation Theory:

There are two theoretical approaches to the DPI—one is classical and other is the Keynesian.

According to classical economists or monetarists, inflation is caused by an increase in money supply which leads to a rightward shift in negative sloping aggregate demand curve. Given a situation of full employment, classicists maintained that a change in money supply brings about an equiproportionate change in price level.

That is why monetarists argue that inflation is always and everywhere a monetary phenomenon. Keynesians do not find any link between money supply and price level causing an upward shift in aggregate demand.

According to Keynesians, aggregate demand may rise due to a rise in consumer demand or investment demand or government expenditure or net exports or the combination of these four components of aggreate demand. Given full employment, such increase in aggregate demand leads to an upward pressure in prices. Such a situation is called DPI. This can be explained graphically.

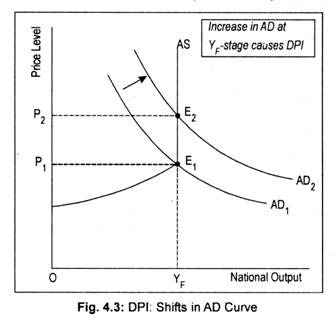

Just like the price of a commodity, the level of prices is determined by the interaction of aggregate demand and aggregate supply. In Fig. 4.3, aggregate demand curve is negative sloping while aggregate supply curve before the full employment stage is positive sloping and becomes vertical after the full employment stage is reached. AD 1 is the initial aggregate demand curve that intersects the aggregate supply curve AS at point E 1 .

The price level, thus, determined is OP 1 . As aggregate demand curve shifts to AD 2 , price level rises to OP 2 . Thus, an increase in aggregate demand at the full employment stage leads to an increase in price level only, rather than the level of output. However, how much price level will rise following an increase in aggregate demand depends on the slope of the AS curve.

(ii) Causes of Demand-Pull Inflation:

DPI originates in the monetary sector. Monetarists’ argument that “only money matters” is based on the assumption that at or near full employment excessive money supply will increase aggregate demand and will, thus, cause inflation.

An increase in nominal money supply shifts aggregate demand curve rightward. This enables people to hold excess cash balances. Spending of excess cash balances by them causes price level to rise. Price level will continue to rise until aggregate demand equals aggregate supply.

Keynesians argue that inflation originates in the non-monetary sector or the real sector. Aggregate demand may rise if there is an increase in consumption expenditure following a tax cut. There may be an autonomous increase in business investment or government expenditure. Government expenditure is inflationary if the needed money is procured by the government by printing additional money.

In brief, increase in aggregate demand i.e., increase in (C + I + G + X – M) causes price level to rise. However, aggregate demand may rise following an increase in money supply generated by the printing of additional money (classical argument) which drives prices upward. Thus, money plays a vital role. That is why Milton Friedman argues that inflation is always and everywhere a monetary phenomenon.

There are other reasons that may push aggregate demand and, hence, price level upwards. For instance, growth of population stimulates aggregate demand. Higher export earnings increase the purchasing power of the exporting countries. Additional purchasing power means additional aggregate demand. Purchasing power and, hence, aggregate demand may also go up if government repays public debt.

Again, there is a tendency on the part of the holders of black money to spend more on conspicuous consumption goods. Such tendency fuels inflationary fire. Thus, DPI is caused by a variety of factors.

(iii) Cost-Push Inflation Theory:

In addition to aggregate demand, aggregate supply also generates inflationary process. As inflation is caused by a leftward shift of the aggregate supply, we call it CPI. CPI is usually associated with non-monetary factors. CPI arises due to the increase in cost of production. Cost of production may rise due to a rise in cost of raw materials or increase in wages.

However, wage increase may lead to an increase in productivity of workers. If this happens, then the AS curve will shift to the right- ward not leftward—direction. We assume here that productivity does not change in spite of an increase in wages.

Such increases in costs are passed on to consumers by firms by raising the prices of the products. Rising wages lead to rising costs. Rising costs lead to rising prices. And, rising prices again prompt trade unions to demand higher wages. Thus, an inflationary wage-price spiral starts. This causes aggregate supply curve to shift leftward.

This can be demonstrated graphically where AS 1 is the initial aggregate supply curve. Below the full employment stage this AS curve is positive sloping and at full employment stage it becomes perfectly inelastic.

Intersection point (E 1 ) of AD 1 and AS 1 curves determine the price level (OP 1 ). Now there is a leftward shift of aggregate supply curve to AS 2 . With no change in aggregate demand, this causes price level to rise to OP 2 and output to fall to OY 2 . With the reduction in output, employment in the economy declines or unemployment rises. Further shift in AS curve to AS 3 results in a higher price level (OP 3 ) and a lower volume of aggregate output (OY 3 ). Thus, CPI may arise even below the full employment (Y F ) stage.

(iv) Causes of Cost-Push Inflation:

It is the cost factors that pull the prices upward. One of the important causes of price rise is the rise in price of raw materials. For instance, by an administrative order the government may hike the price of petrol or diesel or freight rate. Firms buy these inputs now at a higher price. This leads to an upward pressure on cost of production.

Not only this, CPI is often imported from outside the economy. Increase in the price of petrol by OPEC compels the government to increase the price of petrol and diesel. These two important raw materials are needed by every sector, especially the transport sector. As a result, transport costs go up resulting in higher general price level.

Again, CPI may be induced by wage-push inflation or profit-push inflation. Trade unions demand higher money wages as a compensation against inflationary price rise. If increase in money wages exceed labour productivity, aggregate supply will shift upward and leftward. Firms often exercise power by pushing prices up independently of consumer demand to expand their profit margins.

Fiscal policy changes, such as increase in tax rates also leads to an upward pressure in cost of production. For instance, an overall increase in excise tax of mass consumption goods is definitely inflationary. That is why government is then accused of causing inflation.

Finally, production setbacks may result in decreases in output. Natural disaster, gradual exhaustion of natural resources, work stoppages, electric power cuts, etc., may cause aggregate output to decline. In the midst of this output reduction, artificial scarcity of any goods created by traders and hoarders just simply ignite the situation.

Inefficiency, corruption, mismanagement of the economy may also be the other reasons. Thus, inflation is caused by the interplay of various factors. A particular factor cannot be held responsible for any inflationary price rise.

4. Effects of Inflation:

People’s desires are inconsistent. When they act as buyers they want prices of goods and services to remain stable but as sellers they expect the prices of goods and services should go up. Such a happy outcome may arise for some individuals; “but, when this happens, others will be getting the worst of both worlds.”

When price level goes up, there is both a gainer and a loser. To evaluate the consequence of inflation, one must identify the nature of inflation which may be anticipated and unanticipated. If inflation is anticipated, people can adjust with the new situation and costs of inflation to the society will be smaller.

In reality, people cannot predict accurately future events or people often make mistakes in predicting the course of inflation. In other words, inflation may be unanticipated when people fail to adjust completely. This creates various problems.

One can study the effects of unanticipated inflation under two broad headings:

(a) Effect on distribution of income and wealth; and

(b) Effect on economic growth.

(a) Effects of Inflation on Distribution of Income and Wealth:

During inflation, usually people experience rise in incomes. But some people gain during inflation at the expense of others. Some individuals gain because their money incomes rise more rapidly than the prices and some lose because prices rise more rapidly than their incomes during inflation. Thus, it redistributes income and wealth.

Though no conclusive evidence can be cited, it can be asserted that following categories of people are affected by inflation differently:

(i) Creditors and debtors:

Borrowers gain and lenders lose during inflation because debts are fixed in rupee terms. When debts are repaid their real value declines by the price level increase and, hence, creditors lose. An individual may be interested in buying a house by taking loan of Rs. 7 lakh from an institution for 7 years.

The borrower now welcomes inflation since he will have to pay less in real terms than when it was borrowed. Lender, in the process, loses since the rate of interest payable remains unaltered as per agreement. Because of inflation, the borrower is given ‘dear’ rupees, but pays back ‘cheap’ rupees. However, if in an inflation-ridden economy creditors chronically loose, it is wise not to advance loans or to shut down business.

Never does it happen. Rather, the loan-giving institution makes adequate safeguard against the erosion of real value. Above all, banks do not pay any interest on current account but charges interest on loans.

(ii) Bond and debenture-holders:

In an economy, there are some people who live on interest income—they suffer most. Bondholders earn fixed interest income: These people suffer a reduction in real income when prices rise. In other words, the value of one’s savings decline if the interest rate falls short of inflation rate. Similarly, beneficiaries from life insurance programmes are also hit badly by inflation since real value of savings deteriorate.

(iii) Investors:

People who put their money in shares during inflation are expected to gain since the possibility of earning of business profit brightens. Higher profit induces owners of firm to distribute profit among investors or shareholders.

(iv) Salaried people and wage-earners:

Anyone earning a fixed income is damaged by inflation. Sometimes, unionised worker succeeds in raising wage rates of white-collar workers as a compensation against price rise. But wage rate changes with a long time lag. In other words, wage rate increases always lag behind price increases. Naturally, inflation results in a reduction in real purchasing power of fixed income-earners.

On the other hand, people earning flexible incomes may gain during inflation. The nominal incomes of such people outstrip the general price rise. As a result, real incomes of this income group increase.

(v) Profit-earners, speculators and black marketers:

It is argued that profit-earners gain from inflation. Profit tends to rise during inflation. Seeing inflation, businessmen raise the prices of their products. This results in a bigger profit. Profit margin, however, may not be high when the rate of inflation climbs to a high level.

However, speculators dealing in business in essential commodities usually stand to gain by inflation. Black marketers are also benefited by inflation.

Thus, there occurs a redistribution of income and wealth. It is said that rich becomes richer and poor becomes poorer during inflation. However, no such hard and fast generalisation can be made. It is clear that someone wins and someone loses during inflation.

These effects of inflation may persist if inflation is unanticipated. However, the redistributive burdens of inflation on income and wealth are most likely to be minimal if inflation is anticipated by the people. With anticipated inflation, people can build up their strategies to cope with inflation.

If the annual rate of inflation in an economy is anticipated correctly people will try to protect them against losses resulting from inflation. Workers will demand 10 p.c. wage increase if inflation is expected to rise by 10 p.c.

Similarly, a percentage of inflation premium will be demanded by creditors from debtors. Business firms will also fix prices of their products in accordance with the anticipated price rise. Now if the entire society “learn to live with inflation”, the redistributive effect of inflation will be minimal.

However, it is difficult to anticipate properly every episode of inflation. Further, even if it is anticipated it cannot be perfect. In addition, adjustment with the new expected inflationary conditions may not be possible for all categories of people. Thus, adverse redistributive effects are likely to occur.

Finally, anticipated inflation may also be costly to the society. If people’s expectation regarding future price rise become stronger they will hold less liquid money. Mere holding of cash balances during inflation is unwise since its real value declines. That is why people use their money balances in buying real estate, gold, jewellery, etc. Such investment is referred to as unproductive investment. Thus, during inflation of anticipated variety, there occurs a diversion of resources from priority to non-priority or unproductive sectors.

(b) Effect on Production and Economic Growth:

Inflation may or may not result in higher output. Below the full employment stage, inflation has a favourable effect on production. In general, profit is a rising function of the price level. An inflationary situation gives an incentive to businessmen to raise prices of their products so as to earn higher volume of profit. Rising price and rising profit encourage firms to make larger investments.

As a result, the multiplier effect of investment will come into operation resulting in a higher national output. However, such a favourable effect of inflation will be temporary if wages and production costs rise very rapidly.

Further, inflationary situation may be associated with the fall in output, particularly if inflation is of the cost-push variety. Thus, there is no strict relationship between prices and output. An increase in aggregate demand will increase both prices and output, but a supply shock will raise prices and lower output.

Inflation may also lower down further production levels. It is commonly assumed that if inflationary tendencies nurtured by experienced inflation persist in future, people will now save less and consume more. Rising saving propensities will result in lower further outputs.

One may also argue that inflation creates an air of uncertainty in the minds of business community, particularly when the rate of inflation fluctuates. In the midst of rising inflationary trend, firms cannot accurately estimate their costs and revenues. That is, in a situation of unanticipated inflation, a great deal of risk element exists.

It is because of uncertainty of expected inflation, investors become reluctant to invest in their business and to make long-term commitments. Under the circumstance, business firms may be deterred in investing. This will adversely affect the growth performance of the economy.

However, slight dose of inflation is necessary for economic growth. Mild inflation has an encouraging effect on national output. But it is difficult to make the price rise of a creeping variety. High rate of inflation acts as a disincentive to long run economic growth. The way the hyperinflation affects economic growth is summed up here. We know that hyper-inflation discourages savings.

A fall in savings means a lower rate of capital formation. A low rate of capital formation hinders economic growth. Further, during excessive price rise, there occurs an increase in unproductive investment in real estate, gold, jewellery, etc. Above all, speculative businesses flourish during inflation resulting in artificial scarcities and, hence, further rise in prices.

Again, following hyperinflation, export earnings decline resulting in a wide imbalances in the balance of payment account. Often galloping inflation results in a ‘flight’ of capital to foreign countries since people lose confidence and faith over the monetary arrangements of the country, thereby resulting in a scarcity of resources. Finally, real value of tax revenue also declines under the impact of hyperinflation. Government then experiences a shortfall in investible resources.

Thus economists and policymakers are unanimous regarding the dangers of high price rise. But the consequence of hyperinflation are disastrous. In the past, some of the world economies (e.g., Germany after the First World War (1914-1918), Latin American countries in the 1980s) had been greatly ravaged by hyperinflation.

The German inflation of 1920s was also catastrophic:

During 1922, the German price level went up 5,470 per cent. In 1923, the situation worsened; the German price level rose 1,300,000,000 (1.3 billion) times. By October of 1923, the postage in the lightest letter sent from Germany to the United States was 200,000 marks. Butter cost 1.5 million marks per pound, meat 2 million marks, a loaf of bread 200,000 marks, and an egg 60,000 marks! Prices increased so rapidly that waiters changed the prices on the menu several times during the course of a lunch!! Sometimes, customers had to pay the double price listed on the menu when they observed it first!!! A photograph of the period shows a German housewife starting the fire in her kitchen stove with paper money and children playing with bundles of paper money tied together into building blocks!

Currently (September 2008), Indian economy experienced an inflation rate of almost 13 p.c.—an unprecedented one over the last 16 or 17 years. However, an all-time record in price rise in India was struck in 1974-75 when it rose more than 25 p.c. Anyway, people are ultimately harassed by the high dose of inflation. That is why, it is said that ‘inflation is our public enemy number one.’ Rising inflation rate is a sign of failure on the part of the government.

Related Articles:

- Demand Pull Inflation and Cost Push Inflation | Money

- Essay on the Causes of Inflation (473 Words)

- Cost-Push Inflation and Demand-Pull or Mixed Inflation

- Difference between Open Inflation and Suppressed Inflation

Home — Essay Samples — Economics — Inflation — Measures to Control Inflation

How to Control Inflation in Pakistan

- Categories: Inflation

About this sample

Words: 634 |

Published: Jan 15, 2019

Words: 634 | Page: 1 | 4 min read

Table of contents

Inflation essay outline, inflation essay example, introduction.

- Introduction to the issue of inflation in Pakistan

Controlling Inflation Through Monetary Policy

- Tightening monetary policy by increasing interest rates

- Impact of higher interest rates on borrowing, consumer spending, and inflation

- Currency value and import costs

Reducing Government Expenditure

- Strategies for reducing government spending

- Effect on demand and inflation

Increasing Taxes

- Using taxation to reduce disposable income

- Balancing tax increases to avoid worsening poverty

Promoting Local Production

- Encouraging local industries and businesses

- Impact on supply and inflation

Stabilizing Exchange Rates

- Maintaining exchange rate stability

- Reducing the prices of imported goods and services

Controlling Money Supply

- Methods to control the money supply

- Role of central banks and commercial banks

Managing Inflation Expectations

- Creating a stable and transparent environment

- Communication with the public

Implementing Structural Reforms

- Tax system, infrastructure, productivity, and public sector reforms

- Impact on competitiveness and supply

- Summary of the multi-pronged approach to controlling inflation in Pakistan

Works Cited

- Ahmed, A. (2021). Understanding Pakistan's inflation dynamics. Business Recorder.

- Government of Pakistan. (2022). Pakistan Economic Survey 2021-22. Ministry of Finance.

- Hussain, M. (2020). Inflation in Pakistan: Causes and possible solutions. The Express Tribune. https://tribune.com.pk/story/2250261/inflation-in-pakistan-causes-and-possible-solutions

- Khan, M. A. (2021). Pakistan's economy and inflationary pressures. The Diplomat. https://thediplomat.com/2021/01/pakistans-economy-and-inflationary-pressures/

- Khan, S., & Ahmad, H. (2020). Fiscal deficit, external debt and inflation nexus: Evidence from Pakistan. The Journal of Developing Areas, 54(3), 1-15.

- Khan, T. A. (2019). Impact of taxation on inflation: Empirical evidence from Pakistan. Pakistan Journal of Commerce and Social Sciences, 13(3), 693-713.

- Khattak, S. A. (2021). Pakistan's economic growth, inflation and fiscal policy. Journal of Economic and Social Thought, 8(1), 25-38.

- Majeed, M. T. (2020). Examining the relationship between inflation and economic growth in Pakistan. Bulletin of Monetary Economics and Banking, 23(1), 21-36.

- Qayyum, A., & Ahmed, A. (2021). An empirical analysis of inflation dynamics in Pakistan. The Pakistan Development Review, 60(1), 1-24.

- State Bank of Pakistan. (2022). Monetary policy statements. https://www.sbp.org.pk/monetary_policy/statements/index.htm

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Prof Ernest (PhD)

Verified writer

- Expert in: Economics

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

1 pages / 401 words

1 pages / 581 words

2 pages / 1291 words

3 pages / 1311 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Inflation

Fuel prices are a topic of perennial concern and discussion, as they have far-reaching implications for individuals, businesses, and economies worldwide. This essay delves into the complex subject of fuel prices, examining the [...]

Nowadays, economic policies enacted by the United States have reverberated across the global stage, influencing international trade dynamics and shaping the trajectory of the world economy. One such policy that has garnered [...]

This essay explores the impact of inflation on the American economy, delving into the effects on consumers and businesses. It discusses how rising prices can lead to reduced purchasing power, affecting the standard of living [...]

Inflation management is a critical aspect of macroeconomic policy, particularly in times of unforeseen challenges. The years 2023-2024 have presented a myriad of complex macroeconomic issues, including but not limited to the [...]

Measuring inflation is a difficult problem for government statisticians. To do this, many items representing the economy are gathered in what is called "market basket". The cost of this basket will be compared over time. As a [...]

The occurrence of grade inflation is affecting the quality of education throughout the system. A lot of students, at every level of education, are promoted to higher grades even though they are unqualified for that grade. Grade [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Sunday 30 June 2019

Inflation - rising prices english essay for matric, 12th, ba classes.

Inflation - Rising Prices Outline:

You may also like:.

About Maher Afrasiab

Hello, I am Maher Afrasiab a founder of Ratta.pk and some other websites. I have created ratta.pk to promote the eductaion in Pakistan. And to help the students in their studies. Find me on Facebook: @Maher Afrasiab

- English Learning Notes

- History Notes

- English Essays

- General knowledge

- Guess Papers

Essay on Inflation in Pakistan for Students

by Pakiology | Mar 22, 2024 | Essay | 0 comments

In this essay on inflation in Pakistan, we will look at the causes, effects, and solutions to this issue that has been affecting the country for decades. The term ‘inflation’ refers to a sustained rise in the prices of goods and services in an economy. In Pakistan, inflation has been a major concern since the late 1990s, with the Consumer Price Index (CPI) reaching a peak in 2023. We will explore the various factors that have contributed to inflation in Pakistan, its economic effects, and what can be done to address the issue.

Page Contents

Essay on Inflation Outlines

Causes of inflation in pakistan, effects of inflation, solution to control inflation.

- Introduction

Inflation in Pakistan is caused by several factors, which can be divided into two main categories: domestic and external. The main domestic causes of inflation are an increase in money supply, an increase in government spending, an increase in indirect taxes, and a decrease in economic growth.