Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Real Estate Analyst Cover Letter Sample

Get invited for more job interviews & find inspiration for your own cover letter with this customizable Real Estate Analyst cover letter sample. Download this cover letter sample at no cost or modify it in any way using our professional cover letter builder.

Related resume guides and samples

How to write a successful account executive resume?

How to craft an effective real estate resume?

How to write a professional sales director resume?

How to write a compelling salesforce administrator resume?

How to build an effective salesman resume

How to craft an effective sales manager resume

How to build a top-notch sales representative resume

Real Estate Analyst Cover Letter Sample (Full Text Version)

Daniella Sanz

Dear Hiring Managers,

I am writing this letter to express my deep interest in applying for the Real Estate Analyst job within Werny Property Management, Inc. which has been advertised on Indeed.com as I am certain the combination of my career history and developed skills set makes me an ideal candidate for the role. What is more, I am confident that it would be a great opportunity for me to further grow professionally.

As stated in my enclosed resume, I am a Certified Real Estate Analyst offering exceptional critical thinking skills and the crucial ability to solve complex problems. At Sachs Goldman, Inc., where I worked for more than three years, I was given the responsibility for conducting a detailed analysis and evaluation of various commercial/residential properties, developing financial plans and budgets, and drafting settlement agreements, ensuring that all policies and procedures were always fully followed. Additionally, I developed cash flow models, maintained confidential documents and records, and pro-actively participated in the whole property sales process. During my time there, I had demonstrated numerous times that I am a performance-driven individual possessing a strong determination to meet and exceed all assigned goals and objectives.

Next, I am the University of Denver graduate with a bachelor's degree in Real Estate. At the university, I was not only among the top 5% of students with the best academic results but I was also involved in multiple extracurricular activities, including Economics Society, Entrepreneurship Society, and Riding Club. I am a native Spanish speaker with a proficiency in English and a basic knowledge of Chinese and Japanese. Last but not least, I am experienced with multiple important industry software programs, for instance, Zoho Real Estate CRM, RealNex, and Buildium. I would appreciate the opportunity to come in for an interview to discuss the opportunity and my qualifications in more detail. Thank you for considering my application.

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

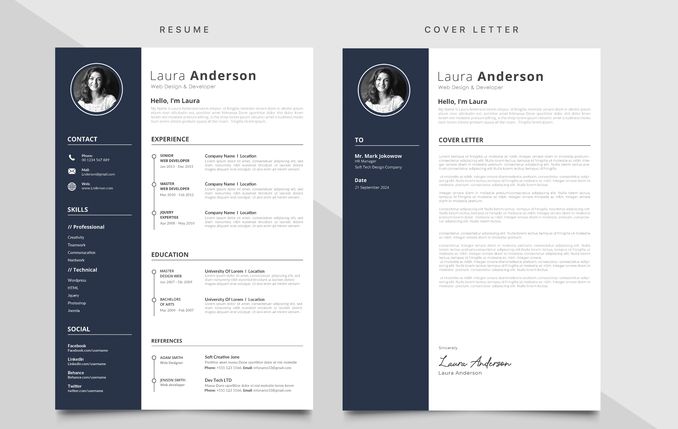

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Real Estate Sales Director Salesman Sales Representative Salesforce Administrator Sales Manager Account Executive

Related real estate resume samples

Related real estate cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Real Estate Analyst Cover Letter Example

A Real Estate Analyst’s job is to analyze the financial feasibility of real estate investments, especially from the perspective of an individual investor or investment firm. They are responsible for collecting data on properties, putting together models that show how profitable an investment might be, and reporting their findings to senior management or investors.

Write an amazing cover letter for the position of Real Estate Analyst using our Real Estate Analyst Cover Letter Example and Cover Letter Writing tips.

- Cover Letters

- Construction

A Real Estate Analyst may work in the real estate industry, for a bank, for a real estate investment firm, or for a real estate appraisal firm.

Some common places where a Real Estate Analyst may work include Commercial Banks, Real Estate Investment Firms, Real Estate Appraisal Firms, Municipalities, Non-Profit Housing Organizations, Private Equity Firms etc

The job outlook for real estate analysts is good. The Bureau of Labor Statistics (BLS) projects that employment for real estate analysts will grow by 11% from 2016 to 2026, which is faster than the average for all occupations.

A real estate analyst’s salary may vary depending on their level of experience, the size of the company they work for, and the city or region they work in. In general, real estate analysts earn an annual salary ranging from $40,000 to $80,000. Some real estate analysts may also receive a bonus, commission, or another form of compensation based on the success of their deals.

What to Include in a Real Estate Analyst Cover Letter?

Roles and responsibilities.

As a Real Estate Analyst, your job duties include:

- Analyzing markets and properties with respect to both local market conditions and broader economic trends.

- Evaluating sales performance and traffic flow in shopping centers, retail outlets, and restaurants.

- Creating spreadsheets in order to project potential cash flows from prospective purchases.

- Compiling due diligence materials such as feasibility studies and market research reports.

- Creating partnership agreements between entities interested in making joint ventures on purchases.

- Exploring opportunities for merger and acquisition deals between companies within their target market

Education & Skills

Real estate analyst skills:.

- Real estate analysts need to be able to understand financial statements and real estate trends in order to make sound investment decisions.

- Able to communicate effectively with clients, colleagues, and other real estate professionals.

- Skilled at developing business strategies as well as implementing them.

- Good understanding of the real estate market, the economics that drives it, and the ways in which these factors interact with each other.

- Make predictions about future trends and plan for each firm’s needs in the future.

- Expertise in Predictive Analysis and Forecasting.

- Experience with Scrum or other Agile Methodologies.

Real Estate Analyst Education Requirements:

- There are no specific education requirements for becoming a real estate analyst. However, it is recommended that individuals have a degree in business, economics, or finance. Alternatively, candidates may have experience in real estate, property management, or investment.

Real Estate Analyst Cover Letter Example (Text Version)

Dear Ms. [Last Name],

As a results-driven real estate analyst with proven skills in the development, implementation, and management of real estate investment strategies, I am prepared to make a significant impact on your company’s success. With my experience overseeing financial analysis and underwriting while adhering to the highest standards of quality control, I am confident that I can exceed your expectations for this role.

Currently, as a Real Estate Analyst for ABC Company, I oversee the critical functions of financial analysis and underwriting across multiple asset classes. In addition to this primary responsibility, I also manage internal and external communications regarding project reports, investor relations, property management issues, and financing.

With my ability to effectively communicate complex financial data to team members with various levels of technical understanding and expertise, I have been able to streamline operations and increase productivity throughout the organization.

I have a great deal of confidence in my ability to make a positive contribution to your company. As you will see from my enclosed resume, my professional background reflects the following key strengths:

- Extensive experience with financial modeling and statistical analyses.

- Ability to build strong relationships with clients and vendors alike.

- Strong leadership skills with the ability to motivate others.

I would welcome the opportunity to discuss how my qualifications would be a good fit for this position. Please contact me at your earliest convenience to set up an interview date and time.

Sincerely, [Your Name]

When writing a real estate analyst cover letter, be sure to highlight your experience and skills in the field. Additionally, emphasize your ability to provide accurate and timely analysis of real estate trends and data. If you have experience working with clients or investors, be sure to mention that as well.

Finally, be sure to tailor your letter to the specific job you are applying for, and highlight how your skills and experience make you the perfect candidate for the position.

Refer to our Real Estate Analyst Resume Sample for more tips on how to write your resume and accompany it with a strong cover letter.

Customize Real Estate Analyst Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Construction Cover Letters

Real Estate Analyst Cover Letter Examples

A great real estate analyst cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following real estate analyst cover letter example can give you some ideas on how to write your own letter.

or download as PDF

Cover Letter Example (Text)

Linnae Sauri

(596) 633-0200

Dear Ramsha Camporeale,

I am writing to express my interest in the Real Estate Analyst position at CBRE Group, Inc. With a solid foundation of five years at Jones Lang LaSalle Incorporated (JLL), I have honed my analytical skills and developed a keen understanding of real estate market trends, which I am eager to bring to your esteemed company.

At JLL, my role involved conducting in-depth market research, financial modeling, and investment analysis to support clients in making informed real estate decisions. My experience has equipped me with the ability to evaluate property portfolios, assess risk, and identify growth opportunities, ensuring that strategic advice is both data-driven and aligned with client objectives.

What excites me most about the opportunity at CBRE is the prospect of contributing to a team that is renowned for its innovative approach and market-leading solutions. I am particularly drawn to the cutting-edge tools and resources CBRE offers, which I believe will enable me to further refine my analytical capabilities and drive superior outcomes for your clients.

I am confident that my proactive approach to market analysis, along with my ability to clearly communicate complex data, will make a significant impact on your team. I am committed to continuous learning and staying ahead of market trends to ensure that my contributions not only meet but exceed expectations.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of CBRE Group, Inc. I am eager to bring my passion for real estate and my commitment to excellence to your company, and I am excited about the potential to contribute to your continued success.

Warm regards,

Related Cover Letter Examples

- Real Estate Sales Agent

- Real Estate Manager

- Real Estate Accountant

- Real Estate Agent

- Real Estate Appraiser

- Real Estate Assistant

- Create a Cover Letter Now

- Create a Resume Now

- My Documents

- Examples of cover letters /

Real Estate Analyst

Real Estate Analyst Cover Letter

You have the skills and we have tricks on how to find amazing jobs. Get cover letters for over 900 professions.

- Svitlana Harkusha - Head Career Expert

How to create a good cover letter for a real estate analyst: free tips and tricks

If you want to get on the recruiter's short list for an interview, compose a competent and catchy text for your cover letter. Be accurate and attentive when writing this short and simple document so that it forms the best impression of your personality. Show your expert skills and qualifications that will help you to increase the company's profit. Below, you will find useful tips and an expert real estate analyst cover letter example that will help you write a quality document that will interest the employer.

Make the opening paragraph of your letter clear and motivating. Show why you are a good match for this role and why you are the best candidate. Prove your ability to research current market trends and statistics to determine the best use of cash according to a company's goals.

You should not apply for a position if you cannot prove your experience. And it is inappropriate to make up experience and qualifications that are not true. List only those abilities that you really own.

This position requires a degree in business administration or finance, three or more years of experience in real estate, and an aptitude for analytical thinking as well. To further prove your qualifications be specific and mention your skills in business analytics, statistics, and research, as well as your ability to do appraisals and hold marketing campaigns.

If you do not have related experience in property management projects, it will be difficult for you to fulfill the duties of a real estate analyst. Purposefully list what you can do as a professional and what licenses you have.

Beyond excellent analytical skills to study the real estate market, you will also need the technical tools to offer the most effective solutions to key business partners including a clear knowledge of leases and legal documents and familiarity with basic office software and applications such as Microsoft Excel, Microsoft Word and Sharepoint.

Analytical and technical skills alone will not be enough to get the job role. You must have good communication skills to forge relationships with new clients and maintain partnerships with existing clients. Multitasking skills will allow you to handle multiple projects at the same time without sacrificing quality.

Sample cover letter for a real estate analyst position

The most effective way to digest the tips is to see their practical application. We have used all the important tips of the above units into a single a real estate analyst cover letter sample to demonstrate a winning document that can be created in GetCoverLetter editor.

Gordon Brown Real Estate Analyst 77 Avenue 5674-1121-3245 / [email protected] Lorna Thompson Recruiter “RNB Real Estate”

Dear Lorna, The real estate industry is all about cultivating relationships to help both sides of a sale to realize their dreams. As a highly qualified and passionate specialist with more than 10 years of experience in helping clients realize their goals in the real estate industry, I am excited to offer my candidacy for the Real Estate Analyst position at RNB Real Estate.

My background includes a Master's degree in business administration, a clear knowledge of leases and legal documents, and proficiency with basic office software and applications such as Microsoft Excel, Microsoft Word and Sharepoint. But my primary professional skills are aptitude for business analytics, interpretation of statistics, and research. These skills allow me to fully understand all current market trends to determine the best use of cash according to a company's goals.

Beyond my analytical and technical skills I also possess strong communication skills and the ability to multitask. My communication skills allow me to forge relationships with new clients and maintain partnerships with existing clients. My multitasking skills allow me to handle multiple projects at the same time without sacrificing quality.

I look forward to long-term cooperation with “RNB Real Estate." Please email me at [email protected] or call me at (xxx)-xxx-xxxx to set up a time for us to chat at your earliest convenience.

Sincerely, Gordon.

This example is not commercial and has a demonstrative function only. If you need unique Cover Letter please proceed to our editor.

Our constructor is almost like a magic wand! Use it to increase the chances of getting the best job.

How to save time on creating your cover letter for a real estate analyst

Our Get Cover Letter editor will help you make the process easy and fast. How it works:

Fill in a simple questionnaire to provide the needed information about yourself.

Choose the design of your cover letter.

Print, email, or download your cover letter in PDF format.

Why the Get Cover Letter is the best solution

The GetCoverLetter editor is open to any goals of applicants. Whether it be a presentation of a craft professional with a great list of achievements or even a real estate analyst without experience. Rest assured, the opportunities are equal for all the candidates.

We have studied the preferences of employers so that your cover letter will hit the bull’s eye.

Each applicant is unique. Therefore, we will create a winning presentation based on your personal advantages and experience.

Enter the necessary personal data into the editor and get the layout of a business document that is ready to be sent.

We want to make you shine and land that dream job. So what are you waiting for?

Templates of the best a real estate analyst cover letter designs

Any example of the document for a real estate analyst has a precise design per the requirements of the company or the general rules of business correspondence. In any case, the selection of templates in our editor will meet any expectations.

Or choose any other template from our template gallery

Overall rating 4.5

Overall rating 4.3

Get Cover Letter customer’s reviews

“GetCoverLetter knows which cover letter layouts work best. This online editor always provides the best format. Therefore, I recommend this service to everyone.”

“GetCoverLetter provided me with information about the necessary steps to make a good impression on the recruiter. These recommendations are suitable for both professionals and entry-level.”

“I pointed out my general interpersonal skills and gave short and memorable hard skill descriptions. Now I have a perfect letter for my resume.”

Frequently Asked Questions

The more unique the knowledge you get, the more space for new questions. Do not be affraid to miss some aspects of creating your excellent cover letter. Here we took into account the most popular doubts to save your time and arm you with basic information.

- What should my a real estate analyst cover letter contain? The main purpose of a cover letter is to introduce yourself, mention the job you’re applying for, show that your skills and experience match the needed skills and experience for the job.

- How to properly introduce yourself in a cover letter? Greet the correct person to which your cover is intended for. Introduce yourself with enthusiasm.

- How many pages should my cover letter be? Your cover letter should only be a half a page to one full page. Your cover letter should be divided into three or four short paragraphs.

- Don't focus on yourself too much

- Don't share all the details of every job you've had

- Don't write a novel

Don’t let your dream job slip through your fingers. Let’s snag it now!

Other cover letters from this industry

You can use your experience in similar vacancies. In the links below, you will find original and convincing text examples. With our tips, you will describe your unique knowledge and specialist skills in a professional letter.

- Real Estate Agent

- The Academy

Real Estate Cover Letter Advice [For Aspiring Analysts]

A cover letter is your first point of contact with a potential employer, and gives you a unique opportunity to shape the narrative around your entire application.

And from what I’ve seen among candidates who have been successful in the real estate job search process, there are a few key components of a commercial real estate cover letter that are critical to add if you want to get noticed.

So aside from actually taking the time to create a cover letter in the first place, this article talks through how to write a cover letter for real estate analyst and associate roles , and some key points to add to significantly increase your chances of landing an interview.

If video is more your thing, you can watch the video version of this article here :

Make Unique Cover Letters Specific To Each Role

Submitting a cover letter is a huge opportunity to have a conversation with the recruiter or hiring manager that’s going to review your resume, and this gives you a platform to proactively connect the dots between what the company is looking for and what you can bring to the table.

This is your chance to pick out specific responsibilities and qualifications from the job description that you know you can demonstrate, and then highlight what you’ve done (or what you can do) in a very clear and tangible way.

One of the biggest missed opportunities I see from commercial real estate job applicants is that they put together a generic cover letter that’s the same for every job they apply to, and that cover letter also often repeats what’s already on their resume.

Instead, your cover letter should differ from your resume by going into significantly more detail on just a handful of roles, projects, or accomplishments that directly demonstrate your job-specific skills and experience, rather than just briefly touching on the general responsibilities you’ve had throughout your career.

The main objective with a cover letter is to show that you’re what the company was looking for when they initially posted the job opening, and ideally, that you’ve already been successful doing the things they would ask of you in the role.

Incorporate The Job Description

The easiest way to do this is to review the responsibilities and qualifications directly within the job description itself, and then choose just 3-5 of those bullet points to tailor your story around.

Great experiences to highlight here are projects you’ve successfully completed in the past that show you’ve already done what you would be required to do on the job, and you’ve been exposed to what the company does on a day-to-day basis.

When hiring commercial real estate analysts and associates, the skills that companies look for generally boil down to Excel skills, market research abilities, a foundational understanding of real estate finance, and the ability to create and present a clear thesis using data.

And even if you don’t have direct commercial real estate work experience, there are many different ways to demonstrate that you have these skills, through things like internships in other industries, full-time jobs in other industries, or even academic projects related to the real estate field.

Ideally, you want to be able to say, “I have experience doing X, as demonstrated by Y,” and then actually show what you’ve done or how you’ve put the work in through self-study to build the skills you’ll need.

It’s very easy to say you can do something on paper, but being able to show specific examples of when you built complex dashboards in Excel, put together presentations on a company’s financial performance, or put the work in to get certified in a software like ARGUS can all help you tell your story in a tangible way.

Talk Through Company Alignment

Once you’ve talked through why you’re qualified for the position, to finish out your cover letter, I would also recommend taking just 1-2 sentences to talk through your alignment with the company culture and why you’d be a great fit.

If the firm is focused on a specific mission that resonates with you or a specific strategy that lines up with your own long-term goals, this is a great opportunity to tie together everything you’ve talked about up to this point.

A company’s initiatives around ESG efforts, affordable housing, diversity and inclusion, redevelopment of underserved areas, or any other mission-oriented projects the firm is involved in can all give you topics to talk about if any of these resonate.

Even if the company has a more generic mission statement on their website, if you have any other unique things in common with the company’s senior leadership team, like playing competitive sports in college, coming from a military background, or being involved with local charitable organizations, these are all great things to highlight at the end of your letter.

If you can take the time to make your cover letter specific to the company and position you’re applying for, highlight a small handful of projects or accomplishments that directly demonstrate you have the skills and qualifications necessary, and you can showcase yourself as a culture fit, your cover letter can make it significantly more likely that you’ll be brought in for an interview.

And if you want more guidance on the commercial real estate job search, or want to make sure you have the technical skills you’ll need to pass an Excel modeling exam that might be given to you during the interview process, make sure to check out our all-in-one membership training platform, Break Into CRE Academy .

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This exam covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

As always, thanks so much for reading, and make sure to check out the Break Into CRE YouTube channel for more content that can help you take the next step in your real estate career.

Big vs. Small Real Estate Companies [Pros & Cons]

Real estate analyst vs. sales roles [where to start], grab the free real estate financial modeling crash course.

Learn The Three Pillars of Real Estate Financial Modeling & How To Build Models on Autopilot

Get instant access to the crash course

Learn the three key pillars of real estate financial modeling - and how to use them to build models from scratch.

You'll also receive access to free weekly videos to help you master real estate financial modeling & advance your career

- First Name *

- Phone This field is for validation purposes and should be left unchanged.

Privacy Overview

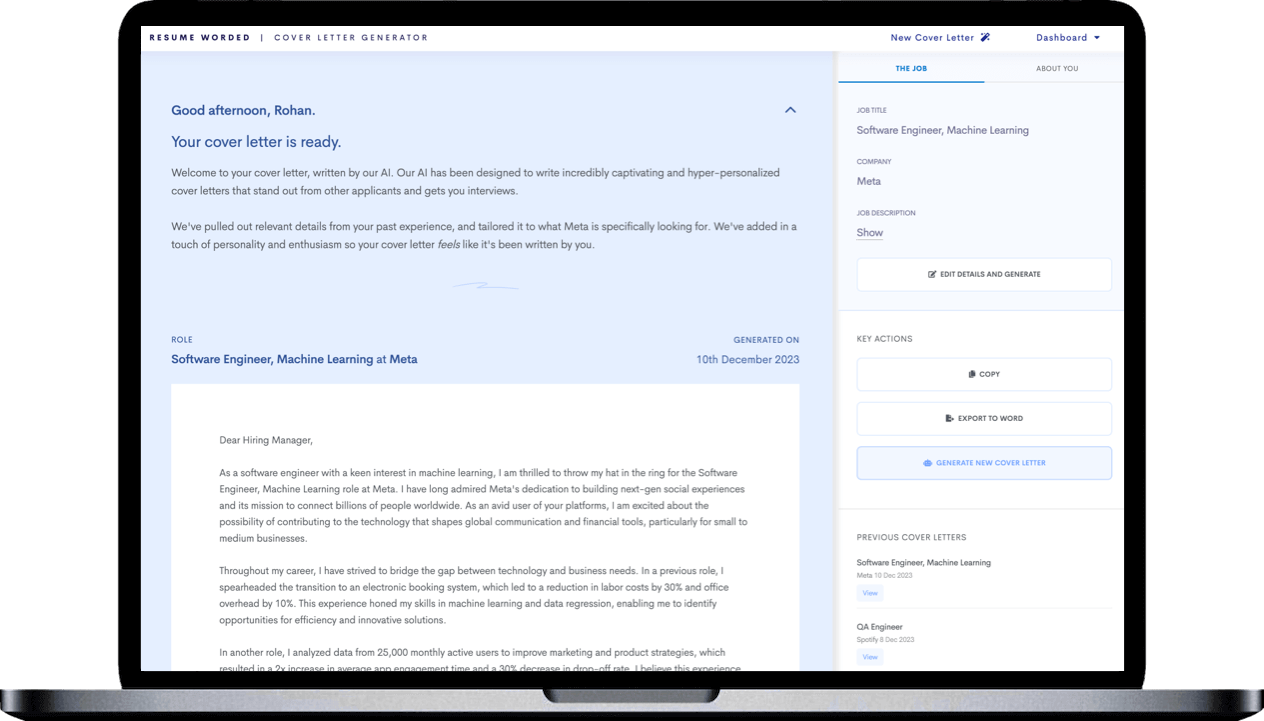

Resume Worded | Career Strategy

9 real estate financial analyst cover letters.

Approved by real hiring managers, these Real Estate Financial Analyst cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Real Estate Financial Analyst

- Senior Real Estate Financial Analyst

- Real Estate Investment Analyst

- Alternative introductions for your cover letter

- Real Estate Financial Analyst resume examples

Real Estate Financial Analyst Cover Letter Example

Why this cover letter works in 2024, quantifiable achievements.

By mentioning a specific accomplishment (identifying $2 million in cost savings), this cover letter showcases the candidate's impact and ability to deliver tangible results. Always try to include quantifiable achievements to stand out from the competition.

Relevant Skills & Experience

This sentence effectively highlights the candidate's relevant skills (developing financial models) and connects them to the company's needs. Make sure to tailor your cover letter to the specific role and showcase how your skills align with the company's requirements.

Industry Passion & Excitement

Showing genuine interest in the company's focus (renewable energy and infrastructure) helps demonstrate that the candidate is not just applying to any job, but is truly passionate about this specific role and industry. Make sure to express your excitement and enthusiasm for the position.

Mentioning the Company's Reputation

Naming the company you're applying to is not enough, it's important to also tell them why you want to work there. Mentioning JLL's reputation for innovation in real estate investment shows you've done your homework and you're excited about what they do. This tells me you're not just looking for any job, but specifically a role at JLL.

Highlighting an Achievement with Hard Numbers

When you talk about developing a predictive model with a 89% accuracy rate, it not only showcases your skills but also the impact you had in your previous role. Quantifying your achievements like this gives me a clear picture of what kind of value you can bring to the team.

Showcasing Leadership and Effective Communication

Bringing up your initiative to improve communication between the finance and development teams clearly demonstrates your leadership skills. Moreover, it shows you're not just good at crunching numbers, but also at facilitating communication and improving efficiency, which are important in a cross-functional team.

Showcasing Success Through Quantifiable Achievements

By detailing specific projects where you've driven significant improvements—like increasing portfolio profitability by 20%—you're giving hiring managers concrete examples of your skills in action. This gives a tangibility and credibility to your claims, showing not just that you can talk the talk, but you've walked the walk, too.

Show your passion for real estate finance

Telling why you like the company and the field shows you're not just looking for any job, but the right job. This makes your application more personal.

Demonstrate your financial analysis skills

By explaining the kind of work you've done, like analyzing financial data, you make it clear you have the skills needed for the job.

Highlight your successful projects

Talking about specific successful investments you've made, such as the apartment complex, shows you can apply your skills to get good results.

Emphasize teamwork in real estate projects

Stating your ability to work well with others highlights a crucial skill for success in real estate, where many different people need to work together.

Show your eagerness to contribute

Ending by saying you want to help the company succeed shows you're not just thinking about what you can get from the job, but also what you can give.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Connect with the company's business model

Expressing a genuine interest in the company's unique approach indicates you have a deep understanding of their place in the market, which is crucial for a real estate financial analyst.

Detail your analytical skills development

Discussing how you've honed your analytical skills and the outcomes of your work shows a commitment to growth and results, key for a financial role.

Showcase strategic thinking

Highlighting your experience with complex financial data and strategic decision-making presents you as a thoughtful and insightful candidate, ideal for a financial analyst position.

Share your passion for real estate investing

Your excitement about working with a team of professionals in the field not only shows your eagerness to learn but also your commitment to contributing to the company's success.

Express gratitude and eagerness for discussion

Thanking the hiring manager and expressing eagerness for a discussion about alignment with the company's goals suggests politeness and a proactive approach, rounding out your application positively.

Senior Real Estate Financial Analyst Cover Letter Example

Aligning with the company's values.

Explicitly stating that you're drawn to CBRE for their sustainable real estate solutions shows that you share the company's values. This lets me know that you're not just looking for a job, but a place where you believe in what they're doing, which is a strong indicator of long-term commitment.

Honoring Your Accomplishments with Concrete Numbers

Creating a financial model that improved forecast accuracy by 18% is a solid achievement. By sharing this, you're showing me the tangible results of your efforts and the direct impact you had on your previous company's success. This is the kind of evidence that convinces employers of your potential value.

Demonstrating Initiative and Efficiency

Mentioning that you automated data collection and analysis processes, which resulted in a 30% reduction in manual effort, is an excellent example of your initiative and efficiency. It tells me you're not just a team player, but someone who takes the lead in finding better ways to do things.

Aligning Personal Values with Company Culture

Paying attention to a company's values and initiatives can make you more appealing as a candidate. Here, expressing excitement about JLL's innovative real estate solutions not only shows that you've done your homework, but also that you identify with their mission. This can signal to hiring managers that you're likely to fit in well with their company culture.

Connect your admiration to your application

Expressing your respect for the company's work and wanting to be part of it shows you're likely to be a motivated and engaged employee.

Present your achievements in real estate finance

Describing a major deal you worked on, like the office building purchase, shows you have experience with significant projects.

Quantify your real estate success

Giving specific numbers, like the 10% better performance of the property, makes your achievements more impressive and believable.

Link your skills to the company's needs

By saying your skills and experience match what the company is looking for, you're making it easier for them to see you in the job.

Express your desire to join the team

Saying you want to discuss your contribution to their success shows you're already thinking about how you can help the company grow.

Real Estate Investment Analyst Cover Letter Example

Show your alignment with company values.

Pointing out why a company's mission speaks to you makes your cover letter more personal and shows you've researched the company.

Highlight your real estate finance impact

Sharing specific examples of past successes, like optimizing a portfolio, demonstrates your capability to contribute meaningfully right away.

Emphasize actionable insight skills

Mentioning your ability to provide actionable insights from data shows you understand the importance of data in driving decisions in real estate investment.

Express enthusiasm for fast-paced work

Telling a potential employer that you thrive under pressure indicates you're a fit for dynamic environments, a valuable trait in real estate finance.

Invite further discussion

Ending with an invitation to discuss how you can contribute to the team encourages the hiring manager to think about your potential impact and sets the stage for an interview.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Real Estate Financial Analyst Roles

- Entry Level/Junior Financial Analyst Cover Letter Guide

- Financial Analyst Cover Letter Guide

- Financial Analyst Intern Cover Letter Guide

- Investment Analyst Cover Letter Guide

- Portfolio Manager Cover Letter Guide

- Real Estate Financial Analyst Cover Letter Guide

- Senior Financial Analyst Cover Letter Guide

Other Finance Cover Letters

- Accountant Cover Letter Guide

- Auditor Cover Letter Guide

- Bookkeeper Cover Letter Guide

- Claims Adjuster Cover Letter Guide

- Cost Analyst Cover Letter Guide

- Credit Analyst Cover Letter Guide

- Finance Director Cover Letter Guide

- Finance Executive Cover Letter Guide

- Financial Advisor Cover Letter Guide

- Financial Controller Cover Letter Guide

- Loan Processor Cover Letter Guide

- Payroll Specialist Cover Letter Guide

- Purchasing Manager Cover Letter Guide

- VP of Finance Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

- Resume Samples

- Resume Examples

- Resume Templates

- Cover Letters

- Writing Objectives

- Interview Tips

- Career Options

- Real Estate Analyst Cover Letter

- Resume Cover Letter

Real Estate Analyst Cover Letter Sample

Contact Us : Privacy Policy

15 Analyst Cover Letters That Will Get Hired (NOW)

Are you are looking to write a cover letter for Analyst jobs that will impress recruiters and get you noticed by hiring managers? You need one to apply for a job, but you don’t know what to say.

A cover letter is an introduction to your resume, and in some cases, it can be the deciding factor for whether you get an interview or not. It’s important to make sure your cover letter is tailored to the job that you are applying for and that it highlights your experience in relation to the desired position.

Here are 15 amazing Analyst cover letters that are professionally written and will help you stand out and get that job!

Analyst Cover Letters

Each cover letter is written with a different focus. Review all of them and pick the ones that apply to your situation. Take inspiration from multiple samples and combine them to craft your unique cover letter.

Analyst Sample 1

I am writing to inquire about the Analyst position advertised on Monster.com. I am interested in the position and would like to be considered for it should it become vacant. My relevant skills and experience include: Strong analytical skills

Ability to use qualitative and quantitative data My relevant education includes: A bachelor’s degree in business from a university in Illinois, United States of America If you have any further questions, please contact me at 555-555-5555 or email me at [email protected] Thank you for your time and consideration, Matthew Adams

Analyst Sample 2

Dear Hiring Manager, Hello, I am writing to express my interest in the Analyst position located at xxxx. I would like to begin by telling you about my skills and experience that make me an ideal candidate for this position. I have many years of experience as an analyst in the technology industry. My knowledge ranges from data gathering to statistical analysis and report writing. I know how important it is to provide accurate reporting so that management can make informed decisions based on facts rather than assumptions or speculation. I am confident that my skills will help your company improve its service offerings, if given the opportunity to work with your team. Sincerely,

Analyst Sample 3

I am writing to express my interest in the Analyst position at your company. I have expertise in _____ and _____, and would be a great asset to your company. I’m confident that with my resourcefulness and ability to produce results, coupled with my good communication skills, I will be able to meet all of the expectations of this job.

I hope you will give me an opportunity to pursue this career opportunity by submitting an application for the Analyst position at your company.

Analyst Sample 4

Dear Sir or Madam,

I am writing to express my interest in the Analyst position. I have over 10 years experience as an analyst and I am looking for a new opportunity that will bring me back to work. I know that this is a high-stress environment with long hours, but it is one I thrive in given my passion for the job. Alongside my experience, I would bring excellent communication skills and strong organizational skills. Thank you for your consideration!

Analyst Sample 5

I am very interested in the Analyst position at your company, and believe my qualifications would be a great fit. I have seven years of experience in Marketing, four years of which are as an Account Executive. I am confident that my skills are essential to the success of your company. If you have any questions about my qualifications, please don’t hesitate to contact me directly. Stay tuned for more information on how I can contribute to your business’s success!

Analyst Sample 6

Hello _____, I am writing to express my interest in the Analyst position at _____. I am a recent graduate with a degree in Marketing and have five years of relevant experience. My excellent communication skills, combined with my ability to think critically, will make me an asset to your company. I am confident that these skills will allow me to excel in this position. I would be happy to provide you with additional information or speak personally about this opportunity if you are interested in learning more about me and my qualifications. Thank you for your time and consideration.

Sincerely Yours,

Analyst Sample 7

Hello, My name is . I am a recent college graduate with an Associate’s degree in Business Administration and I am searching for an Analyst position at your company. My education background has prepared me for this position and my expertise will make me an excellent addition to your team. I have extensive knowledge in Microsoft Office programs such as Word, Excel, PowerPoint, and Outlook along with various other softwares like Adobe Photoshop, Adobe Illustrator, and Google Analytics . I am highly organized with strong communication skills that enables me to work well both independently or collaboratively on group projects. My years of customer service experience also makes me a dependable employee who loves to build relationships through getting the job done right the first time.

Analyst Sample 8

to whom it may concern,

I am writing to express my interest in the Analyst position. I have seven years of experience in computer programming and project management, including six months as a consultant for our company, T&D Solutions. My interpersonal skills are excellent and I am eager to take on the responsibilities of the Analyst position. I achieved an honors degree in Computer Science from Central College with a 4.0 GPA and will complete my MBA at Stanford by September 2017. If you would like more information about me please do not hesitate to contact me at any time. Thank you for your consideration of this application for employment opportunity.

Analyst Sample 9

I am a recent graduate of the University of Alabama, where I studied economics. Currently, I am seeking employment in accounting or finance. My academic record shows that I have an excellent GPA, and my leadership experience includes being President of the Financial Management Association which involved working closely with others to plan and implement effective outreach events. I have strong analytical skills and would match well with your needs for an Analyst position. Thank you for your consideration!

Analyst Sample 10

Please consider me for the Analyst position. I am a recent graduate with a Bachelor’s Degree in Engineering and Management. I have 3 years of experience as an Engineer and 14 months of experience as an Assistant Accountant at Company X, where I was responsible for financial analysis, designing systems to improve accuracy, and managing budgets. My proven abilities show that I am capable of handling complex responsibilities under tight deadlines.

I hope you will consider my qualifications for this position and thank you for your time.

Analyst Sample 11

Dear Human Resources Manager,

I am writing to express my interest in the Analyst position at _______. I have over 7 years of experience in analyzing data to identify trends and propose solutions. I am confident that my skills and qualifications will make me an asset to your team and organization. Please contact me for a more detailed resume and references, and I will follow up with you soon.

Sincerely, __________

Analyst Sample 12

Dear Hiring Manager,

I am a fresh graduate with 2 years of experience in analyzing data for financial institutions. I have superb skills in finance, statistics and computer science. My expertise lies in analyzing qualitative data to derive conclusions that are then used to create or revise models for future predictions. My ability to think critically to find the root causes of problems is one of my strongest assets. This skill set has helped me analyze complex data sets and identify trends, patterns, variances and other anomalies that others may not see quickly or easily; this enables me make accurate predictions based on the information I collect.

I would like to apply for an Analyst position with your company because I enjoy working with numbers and solving complex problems using critical thinking

Analyst Sample 13

Dear _________, I would like to apply for a Analyst position with your company. I have a degree in Business Management and a certification in Data Analysis. I’m confident that my experience as an analyst will be an asset to this company. The skills and qualifications that will contribute to the success of your company include: Financial Management Skills, Skill with Statistical Analysis, Ability to Work as Part of a Team, Strong Communication Skills.

Analyst Sample 14

I am writing to express my interest in the Analysts position you are advertising. I have a Master’s degree in Marketing and leadership experience from the company Acme Inc. My education and experience qualify me for this position. I am anxious to learn more about your company and discuss how I can help you achieve your goals. Please contact me at *************** if you are interested in interviewing me further or if there is opportunity for an introduction with other executives at Acme Inc.

I hope to hear from you soon so that I may apply my skills to meet your needs for this open position, it would be an honor to work with you!

Analyst Sample 15

I am a recent graduate from the Business Administration program at ____ University. My background in business and my experience working in a variety of industries have made me well-rounded, analytical thinker who is able to quickly learn new things and apply them to solve problems. I believe that I would make an excellent addition to your team. Please find my resume attached for your review. Thank you for your time and consideration.

Recruiters and hiring managers receive hundreds of applications for each job opening.

Use the above professionally written Analyst cover letter samples to learn how to write a cover letter that will catch their attention and customize it for your specific situation.

Related Careers:

- 15 Architect Cover Letters That Will Get Hired (NOW)

- 15 Dental Assistant Cover Letters That Will Get Hired (NOW)

- 15 Net Developer Cover Letters That Will Get Hired (NOW)

- 15 Fashion Stylist Cover Letters That Will Get Hired (NOW)

- 15 Custodian Cover Letters That Will Get Hired (NOW)

- 15 Program Manager Cover Letters That Will Get Hired (NOW)

- 15 NICU Nurse Cover Letters That Will Get Hired (NOW)

- 15 Retail Pharmacist Cover Letters That Will Get Hired (NOW)

- 15 Customer Service Representative Cover Letters That Will Get Hired (NOW)

- 15 School Secretary Cover Letters That Will Get Hired (NOW)

Leave a Comment Cancel reply

You must be logged in to post a comment.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Real Estate

Real Estate Analyst Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the real estate analyst job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Develop recommendations and presentations to real estate senior management on investment acquisition, development and disposition opportunities

- Assist in identifying business opportunities to acquire, develop and manage properties in new markets

- Assist the Lease Administration Specialist, FWP Manager, and real estate portfolio managers in day to day duties

- Partner and work closely with internal teams to collect and manage data for management reporting

- Perform market research and analysis for properties and markets considered for acquisition, development, or asset management

- Performs preliminary costing analysis in consultation with project management and voice/data, provides funding documents, etc

- Tracks ongoing density and utilization of space and develops plans to improve efficient and effective work environments

- Provide peer analysis and analytics for senior management and the debt origination team necessary to benchmark new originations and performance

- Provide analytical and asset management support on a portfolio of mixed-use properties

- Work closely with the Originator to assist in negotiating deal terms, if necessary

- Perform accurate underwriting analysis of the property, as well as thorough review of the sponsor and it’s credit worthiness

- Identify and escalate problem credits to Senior Management and Executive Loan Committee

- Maintain a CREMF database from which portfolio analytics and reports are produced and given to management, regulatory examiners, and investors

- Develop strong relationships and effective lines of communication with colleagues and third parties (including joint venture partners and loan servicers)

- Developing and maintaining forecasts, closely monitoring the market and reforecasting when necessary

- Underwrite retail shopping centers using Argus and Excel software

- Developing and maintaining budgets for an assigned portfolio of commercial real estate properties

- Preparing reporting packages for investors and Senior Management

- Audit internal and partner financial models/underwriting

- Maintaining quarterly market reports

- Preparing Investor Committee portfolio summaries

- Ability to be able to learn new technologies quickly

- Has basic or good knowledge of best practices and how own area of expertise integrates with others

- Technical knowledge of commercial mortgages including loan transactions and pre- and post-close documentation; strong attention to detail and extreme accuracy

- Ability to quickly adapt to new methods, work under tight deadlines and stressful conditions

- Advanced ability to deliver excellent client service

- Works quickly and is able to assist other team members where appropriate. Works independently

- Advanced oral and written communication skills demonstrating ability to share and transfer knowledge

- Ability to be able to develop relationships at all levels of the business

- Basic knowledge of financial controls and accounting principles

- Expert knowledge of excel (pivot tables, templates, reporting)

15 Real Estate Analyst resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, am global real assets real estate analyst resume examples & samples.

- 1-3 years of post graduate analyst experience coming from any financial service, accounting or real estate organization

- Review annual operating and capital budgets

- Prepare discounted cash flow models in Argus and Excel

- Complete supporting analysis on existing investments, development projects and potential acquisitions on behalf of asset managers

- Exposure to financial modeling and discounted cash flow analysis

- Experience with Argus, Dyna, or similar valuation software highly desirable

Global Real Estate Analyst Resume Examples & Samples

- Bachelor’s Degree required

- Ability to work independently and multitask

- Strong analytic capabilities and skills

- Excellent organizational skills with keen attention to detail

- Expert in the use of Word, Excel, and PowerPoint

- Strong end-to-end generalist problem-solving skills

Real Estate Analyst Resume Examples & Samples

- Bilingual candidates preferred

- 3+ years of premises related work

- Advanced understanding of corporate real estate protocols would be an asset

- General knowledge of bank and technology standards (e.g., infrastructure processes, applications)

- Advanced understanding of businesses and/or organizational practices/disciplines

- Possess a broad understanding of the LoB’s applications, projects, and processes

- Proactive team player with effective time management skills; ability to work independently, manage multiple deadlines/projects and keep key players informed

- Strong oral communication, facilitation, and negotiation skills

- Advanced knowledge of MS Project, MS Powerpoint, MS Word and MS Excel,

- Responsibilities include credit analysis, risk rating determinations, credit approvals, coordinating deal closings and active monitoring of the portfolio to identify credit migration

- Partner with our Real Estate Fixed Income teams on writing credit approval memos, coordinating Citi Admin Agency lead Bank meetings, devising syndications strategies and negotiating credit agreement and deal structures

- An Analyst will work directly with senior transactors and relationship bankers in the origination and execution of new transactions

- Assist in property and company level on-going due diligence

- Contribute to the timely completion of portfolio reviews, and portfolio stress tests for senior risk and business management

- Interact with Audit and Risk Review personnel and with external regulators during their periodic reviews

- Bachelors degree in Business Administration, Economics, or Finance

- 1 year of industry work experience

Real Estate Analyst, Special Assets Resume Examples & Samples

- Completes other administrative functions as needed or requested

- Assists with the resolution of audit and regulatory issues as required within agreed timeframes

- Identifies, assesses and escalates compliance issues/concerns to supervisor

- Delivers a work product that requires less revision

- Four year degree in real estate, finance or accounting required. Degree in Real Estate or background in the Low Income Housing Tax Credit industry (LIHTC), Property Management or LIHTC financial modeling preferred

- Experience financial modeling and general tax and accounting concepts preferred

- Must demonstrate strong written and verbal communication skills

- Strong organizational skills and a basic knowledge of income forecasting and valuation techniques

- Team player that can work well with others and be able to handle multiple tasks simultaneously

- Strong prioritization and effective analytical skills directed to accomplishing the overall departmental goals

Grandbridge Commercial Real Estate Analyst Resume Examples & Samples

- 1) Manages the commercial real estate analysis function in loan production office(s)

- 2) Provides high level analytical support for a loan production office including the preparation of preliminary and final mortgage loan applications, submissions and documents. Assists in the underwriting, approval, and closing of mortgage loan transactions

- 3) Responsible for training of loan production analysts

- 4) Assists corporate staff in managing the analyst functions in loan production office(s)

- 5) Manages the workload and quality of work of mortgage loan analysts

- 6) Attends real estate industry trade functions, representing Grandbridge Real Estate Capital

- 7) Reads periodicals and market surveys; advising corporate and loan production staff as to current trends in commercial real estate

- 8) Creates and maintains real estate data files

- 9) Attends meetings with borrowers and lenders to develop relationships

- 10) Analyzes complex real estate property and financial situations for producers, providing well-founded advice as to alternate courses of action

- 11) Is able to obtain, understand and analyze data needed to prepare mortgage loan submissions from property owners, borrowers, lenders and third party sources. Included may be leases, sales contracts, income and expense statements, surveys, property income and expense statements, borrower financial statements, articles of incorporation, partnership agreements, deeds, easements, environmental reports, property condition reports, appraisals, title policies, deeds of trust, notes, mortgage loan commitments, lender checklists, lender loan program requirements, real estate market surveys, comparable sales, overall capitalization rates, vacancy rates, prime and t-bill rates

- 12) Is able to: inspect properties, take digital and film photographs, make notes and maps as to the physical and economic conditions of the property, its immediate area, its neighborhood and its city

- 13) Is able to interview owners, tenants, third party report providers, requesting and obtaining information from them as needed

- 14) Is able to analyze leases, historical income and expense characteristics to derive an estimate of Net Operating Income for a commercial real estate property. Included is the ability to analyze the Net Operating Income with respect to normal market income levels, stabilized vacancy rates, normalized expenses, lender's specific requirements or lender's appraisal standards

- 15) Is able to analyze the borrower's legal structure and financial statements with regard to normal market parameters and the lender's requirements

- 16) Is able to analyze the characteristics of the real estate with respect to industry norms and specific lender requirements

- 17) Is able to prepare preliminary and final mortgage loan submissions in concert with the originating producer using Microsoft Word and Excel

- 18) Understands specific lender requirements for submissions of loan package

- 19) Is able to order, track and analyze appraisals, environmental and engineering studies, credit reports, Dunn & Bradstreet reports, demographic reports and other third party reports needed for the mortgage loan submission and/or closing

- 20) Is able to review third party appraisals for compliance with lender requirements and discuss findings with lender representatives

- 21) Is able to track the committed transaction through the closing process, obtaining additional information from the borrower as necessary for closing

- 22) Is able to interface with both borrower and lender, calling lender to obtain loan quotes. In concert with the producer, is able to take primary responsibility for the negotiation of applications, commitments and loan closing functions

- 23) Understands the physical aspects of all commercial property types, typical real estate lending parameters, interest rate structures, tests of reasonableness

- 1) Undergraduate degree in business or related field or equivalent education and related training/ experience

- 2) Seven (7) or more years as a commercial real estate analyst, broker, leasing agent or property manager

- 3) Completion of the Mortgage Banker's Association's Commercial Real Estate Finance Underwriting Seminar and Courses 110, 120, and 310 of the Appraisal Institute

- 4) Must have earned the CCIM designation awarded by the CCIM Institute, an affiliate of the National Association of Realtors

- 5) Has a high level of computer skills, including superior abilities with Microsoft products such as Excel, Word, PowerPoint, etc. and their related applications

- 6) Is proficient with contact databases, Lotus Notes, geographical mapping programs, digital imaging, the Internet, digital and film cameras and report binding machines

- 7) Proficient with industry standard commercial real estate analysis programs such as Argus

- 8) Is highly organized

- 9) Has the ability to organize, direct and supervise others

- 10) Has a high attention to detail

- 11) Has the ability to meet deadlines

- 12) Has the maturity and self-confidence to simultaneously handle a variety of assignments

- 13) Is able to work harmoniously with internal/external workers/customers

- 14) Able to take initiative with nominal direction

- 15) Have excellent written and verbal communication skills

- 16) Is able to take initiative with nominal direction

- 17) Ability to travel as required

- 1) MBA or a Masters in Finance or Real Estate from a college or university

Accounting / Real Estate Analyst Resume Examples & Samples

- Regular accounting system maintenance. This responsibility would including completing the monthly and annual system close process and reminding accounting and property management staff of time sensitive procedures. Prepare the setup of new entities and new bank accounts in the system

- Manager of systems policies and procedures. This responsibility would include creating new and updating existing policies and procedures for accounting system software use and establishing access controls for all users. Create common location for all policies and procedures so employees may access at any time and publicize changes in policies to employees

- Testing new accounting system modules and managing rollout. This responsibility would include learning about new or updated accounting system features available to the company, analyzing the positives/negatives of the features with users, trying out the features in a test environment, and then preparing an implementation schedule with the assistance of the third party systems consultants. Once system changes are in place, hold training sessions with employees on how to use the features and field questions as needed

- Interface with Accounting System help desk. Serve as Help Desk for users of Yardi and Timberline. This would include fielding questions from the accounting and property management team on system errors or questions, and relaying these questions to the help desk of the software developer. Follow up if an immediate solution is not available and keep team members informed on status of open issues

- Develop and manage accounting system reports. This responsibility would include interacting with key decision-makers and users within the company to determine what types of management reports would help them track relevant results with system data. Use existing reports and functions or design system reports that would provide important data to system users. Work with a third party consultant to prepare all necessary features of the report and design custom reports with the user. Generate reports that integrate with Microsoft Word and Excel so that data can be modified as needed

- Full knowledge of Yardi’s capabilities with the ability to learn Timberline

- The ability and mentality to dig in and help in building our organization’s success with a passion that is consistent at all levels of our organization, from our staff to our most senior leaders

- Troubleshoot technology with the ability to navigate the accounting systems software data to maximize utilization, prepare useful reports, and/or work with outside consultants to develop reports that would prove useful to end users and management

- Apply and communicate continuous process improvements to allow for growth and utilization of new technology. Be available for training when necessary

- A full understanding of property management operations and as it relates to accounting needs and technology

- Extremely comfortable rolling up sleeves and being “hands on”

- Provide support to the UBS Global Real Estate - US Marketing and Client Service team in the following areas: investor, consultant and prospect research; identify opportunities to expand existing investor/consultant relationships; client servicing; and presentations

- Over time build and sustain long-term relationships with internal and/or external clients based on mutual understanding, trust and respect. Focus on identifying and meeting client needs

- Assist in presentation preparation and client on-boarding procedures

- Communicate with clients, prospects and consultants on past performance, capabilities and significant organizational / fund changes

- Develop knowledge and understanding of the organization and funds in order to represent GRE-US in client, prospect and consultant meetings and at conferences

- Provide support to the client servicing team as related to client servicing, consultant servicing, RFPs, the new business/contracts, reporting, conferences and SSAE 16 audits

- Deliver and report effective client and consultant feedback on a regular basis, and share client- and consultant-based information with other marketing team members as well as business heads

- Develop new client, consultant and prospect relationships

- Proactively prepare for and accommodate changes to systems, marketing materials and processes that will be caused by the introduction of new sources of capital

- Assist in special assignments as needed for other areas within UBS Realty Investors

- LI-Priority

Real Estate Analyst Asset Management Resume Examples & Samples

- Provide analytical and asset management support on a portfolio of 25-30 properties

- The position is a primary point of contact for the review and administration of construction draws on a fairly active portfolio of industrial properties

- Evaluate leasing alternatives and apartment pricing strategies

- Assist in the development and analysis of annual operating budgets. Review monthly reporting packages and evaluate variances and trends in operating income and expenses

- Verify property information for appraisers and real estate tax consultants

- Review, monitor and recommend approval of capital disbursements, including those for construction loans

- Assist in the maintenance of internal databases

- LI-Recruiter

- Internal and Industry Benchmarking

- Critical analytical support for major real estate decisions

- Development of senior management presentations and facilitation of initiative approvals

- Coordination with external stakeholders to ensure adherence to stated targets and implementation of new policies and procedures

- Ability to work under pressure with tight deadlines and still provide accurate results

- Track and Report CRS Productivity and Reserve schedules

- Advanced interpersonal skills to communicate with regional teams

- Must have working knowledge of basic GAAP accounting

- Provide analytical support for a loan production office including the preparation of preliminary and final mortgage loan applications, submissions and documents. Assists in the underwriting and closing of mortgage loan transactions

- Obtain, understand and analyze data needed to prepare mortgage loan submissions from property owners, borrowers, lenders and third party sources. Included may be leases, sales contracts, income and expense statements, surveys, borrower financial statements, entity documents, deeds, easements, environmental reports, property condition reports, appraisals, title policies, mortgage loan commitments and loan documents, lender checklists, lender loan program requirements, market surveys, etc

- Inspect properties, take photographs, make notes and maps as to the physical and economic conditions of the property, its immediate area, its neighborhood and its city

- Interview owners, tenants, third party report providers, requesting and obtaining information from them as needed

- Prepare economic pro formas and perform sensitivity analyses and discounted cash flows

- Analyze the characteristics of the real estate with respect to industry norms and specific lender requirements

- Order, track and analyze appraisals, environmental and engineering studies, credit reports, Dunn & Bradstreet reports, demographic reports and other third party reports needed for the mortgage loan submission and/or closing

- Attend real estate industry trade functions to acquire knowledge and data

- Create and maintain real estate data files

- Attend meetings with borrowers and lenders

- Undergraduate degree in business or related field and 0-3 years experience as commercial real estate analyst, broker, leasing agent or property manager or equivalent education and related experience

- Has strong computer skills, including strong proficiency with Microsoft Excel and Word

- Understands and is competent with financial modeling including discounted cash flow analyses

- Is proficient with Internet research

- Is highly organized and has a high attention to detail

- Has excellent written and oral communication skills

- Has the ability to meet deadlines

- Has the maturity and self-confidence to simultaneously handle a variety of assignments

- Is able to work harmoniously with internal/external workers/customers

- Is able to take initiative with nominal direction

- Has the ability to travel as required

Intern Real Estate Analyst Beijing Resume Examples & Samples

- Valuation and performance analysis of targeted and existing assets through financial modelling and scenario analysis

- Assisting with the review and approval of asset acquisitions including financial analysis of the acquisitions and appropriate funding strategy

- Working closely with other professional advisors in a transaction setting, including legal and financial advisors

- Assisting with or owning research projects and analysis relating to both existing and targeted assets

- Assisting with the preparation of approval papers, management reports and board materials

- Preparation of marketing and investor relations materials for internal and external use

- Position can be located in either Cedar Rapids, IA or Baltimore, MD AAM office locations

- Four year degree in relevant field or equivalent work experience. Degree in Real Estate or background in the Low Income Housing Tax Credit industry (LIHTC), Property Management or LIHTC financial modeling preferred

- 3-5 years' experience financial modeling and general tax and accounting concepts

IBD, Classic, Real Estate, Analyst Resume Examples & Samples

- Bachelor’s degree and at least 1 year of relevant work experience at a top-tier investment bank (or related field)

- Top class ranking at previous employer

- A proven ability to think commercially about the needs of the client

- 1) Provides high level analytical support for a loan production office including the preparation of preliminary and final mortgage loan applications, submissions and documents. Assists in the underwriting, approval, and closing of mortgage loan transactions

- 2) Coordinates the workload and quality of analysts in the absence of the Commercial Real Estate Analyst IV and/or Commercial Office Manager

- 3) Attends real estate industry trade functions to acquire knowledge and data

- 4) Reads periodicals and market surveys

- 5) Creates and maintains real estate data files

- 6) Attends meetings with borrowers and lenders to develop relationships

- 7) Analyzes real estate property and financial situations for producers, providing well-founded advice as to alternate courses of action

- 8) Is able to obtain, understand and analyze data needed to prepare mortgage loan submissions from property owners, borrowers, lenders and third party sources. Included may be leases, sales contracts, income and expense statements, surveys, property income and expense statements, borrower financial statements, articles of incorporation, partnership agreements, deeds, easements, environmental reports, property condition reports, appraisals, title policies, deeds of trust, notes, mortgage loan commitments, lender checklists, lender loan program requirements, real estate market surveys, comparable sales, overall capitalization rates, vacancy rates, prime and t-bill rates

- 9) Is able to: inspect properties, take digital and film photographs, make notes and maps as to the physical and economic conditions of the property, its immediate area, its neighborhood and its city

- 10) Is able to interview owners, tenants, third party report providers, requesting and obtaining information from them as needed