- Resources Home 🏠

- Try SciSpace Copilot

- Search research papers

- Add Copilot Extension

- Try AI Detector

- Try Paraphraser

- Try Citation Generator

- April Papers

- June Papers

- July Papers

What is a thesis | A Complete Guide with Examples

Table of Contents

A thesis is a comprehensive academic paper based on your original research that presents new findings, arguments, and ideas of your study. It’s typically submitted at the end of your master’s degree or as a capstone of your bachelor’s degree.

However, writing a thesis can be laborious, especially for beginners. From the initial challenge of pinpointing a compelling research topic to organizing and presenting findings, the process is filled with potential pitfalls.

Therefore, to help you, this guide talks about what is a thesis. Additionally, it offers revelations and methodologies to transform it from an overwhelming task to a manageable and rewarding academic milestone.

What is a thesis?

A thesis is an in-depth research study that identifies a particular topic of inquiry and presents a clear argument or perspective about that topic using evidence and logic.

Writing a thesis showcases your ability of critical thinking, gathering evidence, and making a compelling argument. Integral to these competencies is thorough research, which not only fortifies your propositions but also confers credibility to your entire study.

Furthermore, there's another phenomenon you might often confuse with the thesis: the ' working thesis .' However, they aren't similar and shouldn't be used interchangeably.

A working thesis, often referred to as a preliminary or tentative thesis, is an initial version of your thesis statement. It serves as a draft or a starting point that guides your research in its early stages.

As you research more and gather more evidence, your initial thesis (aka working thesis) might change. It's like a starting point that can be adjusted as you learn more. It's normal for your main topic to change a few times before you finalize it.

While a thesis identifies and provides an overarching argument, the key to clearly communicating the central point of that argument lies in writing a strong thesis statement.

What is a thesis statement?

A strong thesis statement (aka thesis sentence) is a concise summary of the main argument or claim of the paper. It serves as a critical anchor in any academic work, succinctly encapsulating the primary argument or main idea of the entire paper.

Typically found within the introductory section, a strong thesis statement acts as a roadmap of your thesis, directing readers through your arguments and findings. By delineating the core focus of your investigation, it offers readers an immediate understanding of the context and the gravity of your study.

Furthermore, an effectively crafted thesis statement can set forth the boundaries of your research, helping readers anticipate the specific areas of inquiry you are addressing.

Different types of thesis statements

A good thesis statement is clear, specific, and arguable. Therefore, it is necessary for you to choose the right type of thesis statement for your academic papers.

Thesis statements can be classified based on their purpose and structure. Here are the primary types of thesis statements:

Argumentative (or Persuasive) thesis statement

Purpose : To convince the reader of a particular stance or point of view by presenting evidence and formulating a compelling argument.

Example : Reducing plastic use in daily life is essential for environmental health.

Analytical thesis statement

Purpose : To break down an idea or issue into its components and evaluate it.

Example : By examining the long-term effects, social implications, and economic impact of climate change, it becomes evident that immediate global action is necessary.

Expository (or Descriptive) thesis statement

Purpose : To explain a topic or subject to the reader.

Example : The Great Depression, spanning the 1930s, was a severe worldwide economic downturn triggered by a stock market crash, bank failures, and reduced consumer spending.

Cause and effect thesis statement

Purpose : To demonstrate a cause and its resulting effect.

Example : Overuse of smartphones can lead to impaired sleep patterns, reduced face-to-face social interactions, and increased levels of anxiety.

Compare and contrast thesis statement

Purpose : To highlight similarities and differences between two subjects.

Example : "While both novels '1984' and 'Brave New World' delve into dystopian futures, they differ in their portrayal of individual freedom, societal control, and the role of technology."

When you write a thesis statement , it's important to ensure clarity and precision, so the reader immediately understands the central focus of your work.

What is the difference between a thesis and a thesis statement?

While both terms are frequently used interchangeably, they have distinct meanings.

A thesis refers to the entire research document, encompassing all its chapters and sections. In contrast, a thesis statement is a brief assertion that encapsulates the central argument of the research.

Here’s an in-depth differentiation table of a thesis and a thesis statement.

Now, to craft a compelling thesis, it's crucial to adhere to a specific structure. Let’s break down these essential components that make up a thesis structure

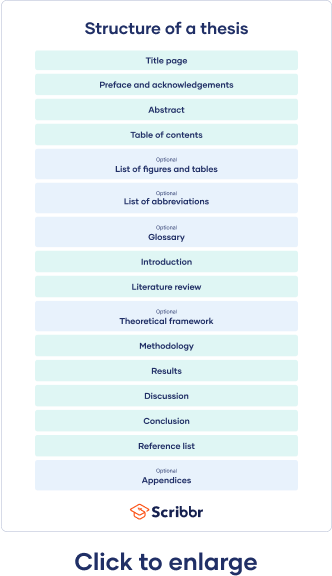

15 components of a thesis structure

Navigating a thesis can be daunting. However, understanding its structure can make the process more manageable.

Here are the key components or different sections of a thesis structure:

Your thesis begins with the title page. It's not just a formality but the gateway to your research.

Here, you'll prominently display the necessary information about you (the author) and your institutional details.

- Title of your thesis

- Your full name

- Your department

- Your institution and degree program

- Your submission date

- Your Supervisor's name (in some cases)

- Your Department or faculty (in some cases)

- Your University's logo (in some cases)

- Your Student ID (in some cases)

In a concise manner, you'll have to summarize the critical aspects of your research in typically no more than 200-300 words.

This includes the problem statement, methodology, key findings, and conclusions. For many, the abstract will determine if they delve deeper into your work, so ensure it's clear and compelling.

Acknowledgments

Research is rarely a solitary endeavor. In the acknowledgments section, you have the chance to express gratitude to those who've supported your journey.

This might include advisors, peers, institutions, or even personal sources of inspiration and support. It's a personal touch, reflecting the humanity behind the academic rigor.

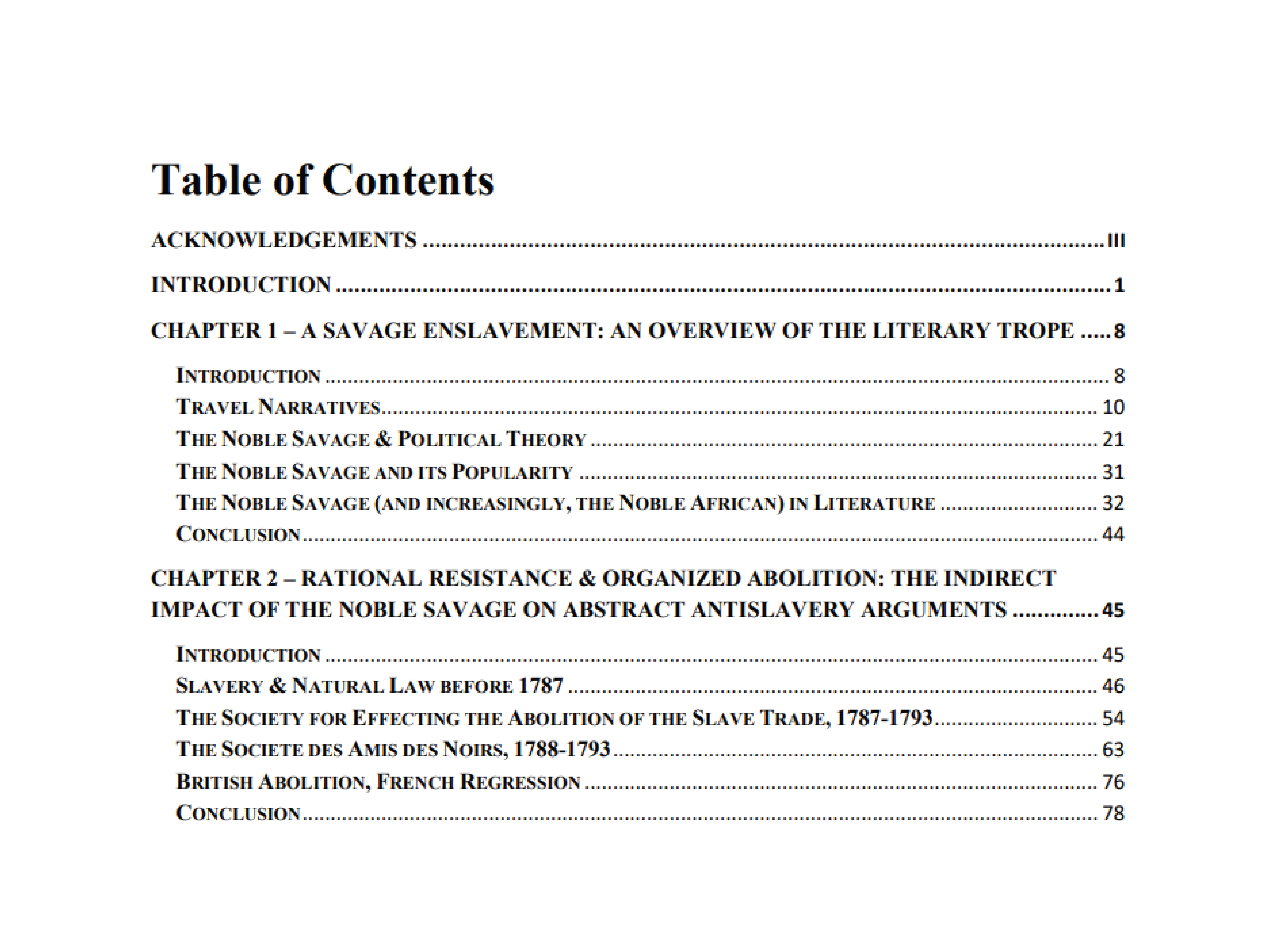

Table of contents

A roadmap for your readers, the table of contents lists the chapters, sections, and subsections of your thesis.

By providing page numbers, you allow readers to navigate your work easily, jumping to sections that pique their interest.

List of figures and tables

Research often involves data, and presenting this data visually can enhance understanding. This section provides an organized listing of all figures and tables in your thesis.

It's a visual index, ensuring that readers can quickly locate and reference your graphical data.

Introduction

Here's where you introduce your research topic, articulate the research question or objective, and outline the significance of your study.

- Present the research topic : Clearly articulate the central theme or subject of your research.

- Background information : Ground your research topic, providing any necessary context or background information your readers might need to understand the significance of your study.

- Define the scope : Clearly delineate the boundaries of your research, indicating what will and won't be covered.

- Literature review : Introduce any relevant existing research on your topic, situating your work within the broader academic conversation and highlighting where your research fits in.

- State the research Question(s) or objective(s) : Clearly articulate the primary questions or objectives your research aims to address.

- Outline the study's structure : Give a brief overview of how the subsequent sections of your work will unfold, guiding your readers through the journey ahead.

The introduction should captivate your readers, making them eager to delve deeper into your research journey.

Literature review section

Your study correlates with existing research. Therefore, in the literature review section, you'll engage in a dialogue with existing knowledge, highlighting relevant studies, theories, and findings.

It's here that you identify gaps in the current knowledge, positioning your research as a bridge to new insights.

To streamline this process, consider leveraging AI tools. For example, the SciSpace literature review tool enables you to efficiently explore and delve into research papers, simplifying your literature review journey.

Methodology

In the research methodology section, you’ll detail the tools, techniques, and processes you employed to gather and analyze data. This section will inform the readers about how you approached your research questions and ensures the reproducibility of your study.

Here's a breakdown of what it should encompass:

- Research Design : Describe the overall structure and approach of your research. Are you conducting a qualitative study with in-depth interviews? Or is it a quantitative study using statistical analysis? Perhaps it's a mixed-methods approach?

- Data Collection : Detail the methods you used to gather data. This could include surveys, experiments, observations, interviews, archival research, etc. Mention where you sourced your data, the duration of data collection, and any tools or instruments used.

- Sampling : If applicable, explain how you selected participants or data sources for your study. Discuss the size of your sample and the rationale behind choosing it.

- Data Analysis : Describe the techniques and tools you used to process and analyze the data. This could range from statistical tests in quantitative research to thematic analysis in qualitative research.

- Validity and Reliability : Address the steps you took to ensure the validity and reliability of your findings to ensure that your results are both accurate and consistent.

- Ethical Considerations : Highlight any ethical issues related to your research and the measures you took to address them, including — informed consent, confidentiality, and data storage and protection measures.

Moreover, different research questions necessitate different types of methodologies. For instance:

- Experimental methodology : Often used in sciences, this involves a controlled experiment to discern causality.

- Qualitative methodology : Employed when exploring patterns or phenomena without numerical data. Methods can include interviews, focus groups, or content analysis.

- Quantitative methodology : Concerned with measurable data and often involves statistical analysis. Surveys and structured observations are common tools here.

- Mixed methods : As the name implies, this combines both qualitative and quantitative methodologies.

The Methodology section isn’t just about detailing the methods but also justifying why they were chosen. The appropriateness of the methods in addressing your research question can significantly impact the credibility of your findings.

Results (or Findings)

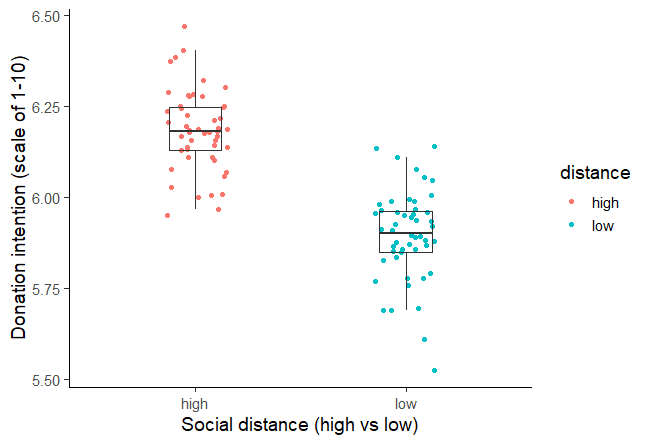

This section presents the outcomes of your research. It's crucial to note that the nature of your results may vary; they could be quantitative, qualitative, or a mix of both.

Quantitative results often present statistical data, showcasing measurable outcomes, and they benefit from tables, graphs, and figures to depict these data points.

Qualitative results , on the other hand, might delve into patterns, themes, or narratives derived from non-numerical data, such as interviews or observations.

Regardless of the nature of your results, clarity is essential. This section is purely about presenting the data without offering interpretations — that comes later in the discussion.

In the discussion section, the raw data transforms into valuable insights.

Start by revisiting your research question and contrast it with the findings. How do your results expand, constrict, or challenge current academic conversations?

Dive into the intricacies of the data, guiding the reader through its implications. Detail potential limitations transparently, signaling your awareness of the research's boundaries. This is where your academic voice should be resonant and confident.

Practical implications (Recommendation) section

Based on the insights derived from your research, this section provides actionable suggestions or proposed solutions.

Whether aimed at industry professionals or the general public, recommendations translate your academic findings into potential real-world actions. They help readers understand the practical implications of your work and how it can be applied to effect change or improvement in a given field.

When crafting recommendations, it's essential to ensure they're feasible and rooted in the evidence provided by your research. They shouldn't merely be aspirational but should offer a clear path forward, grounded in your findings.

The conclusion provides closure to your research narrative.

It's not merely a recap but a synthesis of your main findings and their broader implications. Reconnect with the research questions or hypotheses posited at the beginning, offering clear answers based on your findings.

Reflect on the broader contributions of your study, considering its impact on the academic community and potential real-world applications.

Lastly, the conclusion should leave your readers with a clear understanding of the value and impact of your study.

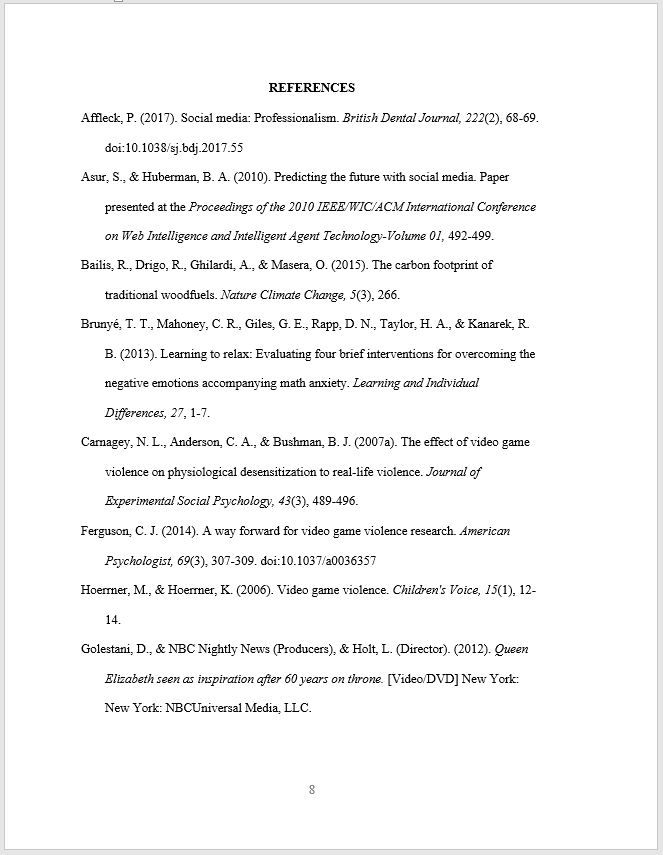

References (or Bibliography)

Every theory you've expounded upon, every data point you've cited, and every methodological precedent you've followed finds its acknowledgment here.

In references, it's crucial to ensure meticulous consistency in formatting, mirroring the specific guidelines of the chosen citation style .

Proper referencing helps to avoid plagiarism , gives credit to original ideas, and allows readers to explore topics of interest. Moreover, it situates your work within the continuum of academic knowledge.

To properly cite the sources used in the study, you can rely on online citation generator tools to generate accurate citations!

Here’s more on how you can cite your sources.

Often, the depth of research produces a wealth of material that, while crucial, can make the core content of the thesis cumbersome. The appendix is where you mention extra information that supports your research but isn't central to the main text.

Whether it's raw datasets, detailed procedural methodologies, extended case studies, or any other ancillary material, the appendices ensure that these elements are archived for reference without breaking the main narrative's flow.

For thorough researchers and readers keen on meticulous details, the appendices provide a treasure trove of insights.

Glossary (optional)

In academics, specialized terminologies, and jargon are inevitable. However, not every reader is versed in every term.

The glossary, while optional, is a critical tool for accessibility. It's a bridge ensuring that even readers from outside the discipline can access, understand, and appreciate your work.

By defining complex terms and providing context, you're inviting a wider audience to engage with your research, enhancing its reach and impact.

Remember, while these components provide a structured framework, the essence of your thesis lies in the originality of your ideas, the rigor of your research, and the clarity of your presentation.

As you craft each section, keep your readers in mind, ensuring that your passion and dedication shine through every page.

Thesis examples

To further elucidate the concept of a thesis, here are illustrative examples from various fields:

Example 1 (History): Abolition, Africans, and Abstraction: the Influence of the ‘Noble Savage’ on British and French Antislavery Thought, 1787-1807 by Suchait Kahlon.

Example 2 (Climate Dynamics): Influence of external forcings on abrupt millennial-scale climate changes: a statistical modelling study by Takahito Mitsui · Michel Crucifix

Checklist for your thesis evaluation

Evaluating your thesis ensures that your research meets the standards of academia. Here's an elaborate checklist to guide you through this critical process.

Content and structure

- Is the thesis statement clear, concise, and debatable?

- Does the introduction provide sufficient background and context?

- Is the literature review comprehensive, relevant, and well-organized?

- Does the methodology section clearly describe and justify the research methods?

- Are the results/findings presented clearly and logically?

- Does the discussion interpret the results in light of the research question and existing literature?

- Is the conclusion summarizing the research and suggesting future directions or implications?

Clarity and coherence

- Is the writing clear and free of jargon?

- Are ideas and sections logically connected and flowing?

- Is there a clear narrative or argument throughout the thesis?

Research quality

- Is the research question significant and relevant?

- Are the research methods appropriate for the question?

- Is the sample size (if applicable) adequate?

- Are the data analysis techniques appropriate and correctly applied?

- Are potential biases or limitations addressed?

Originality and significance

- Does the thesis contribute new knowledge or insights to the field?

- Is the research grounded in existing literature while offering fresh perspectives?

Formatting and presentation

- Is the thesis formatted according to institutional guidelines?

- Are figures, tables, and charts clear, labeled, and referenced in the text?

- Is the bibliography or reference list complete and consistently formatted?

- Are appendices relevant and appropriately referenced in the main text?

Grammar and language

- Is the thesis free of grammatical and spelling errors?

- Is the language professional, consistent, and appropriate for an academic audience?

- Are quotations and paraphrased material correctly cited?

Feedback and revision

- Have you sought feedback from peers, advisors, or experts in the field?

- Have you addressed the feedback and made the necessary revisions?

Overall assessment

- Does the thesis as a whole feel cohesive and comprehensive?

- Would the thesis be understandable and valuable to someone in your field?

Ensure to use this checklist to leave no ground for doubt or missed information in your thesis.

After writing your thesis, the next step is to discuss and defend your findings verbally in front of a knowledgeable panel. You’ve to be well prepared as your professors may grade your presentation abilities.

Preparing your thesis defense

A thesis defense, also known as "defending the thesis," is the culmination of a scholar's research journey. It's the final frontier, where you’ll present their findings and face scrutiny from a panel of experts.

Typically, the defense involves a public presentation where you’ll have to outline your study, followed by a question-and-answer session with a committee of experts. This committee assesses the validity, originality, and significance of the research.

The defense serves as a rite of passage for scholars. It's an opportunity to showcase expertise, address criticisms, and refine arguments. A successful defense not only validates the research but also establishes your authority as a researcher in your field.

Here’s how you can effectively prepare for your thesis defense .

Now, having touched upon the process of defending a thesis, it's worth noting that scholarly work can take various forms, depending on academic and regional practices.

One such form, often paralleled with the thesis, is the 'dissertation.' But what differentiates the two?

Dissertation vs. Thesis

Often used interchangeably in casual discourse, they refer to distinct research projects undertaken at different levels of higher education.

To the uninitiated, understanding their meaning might be elusive. So, let's demystify these terms and delve into their core differences.

Here's a table differentiating between the two.

Wrapping up

From understanding the foundational concept of a thesis to navigating its various components, differentiating it from a dissertation, and recognizing the importance of proper citation — this guide covers it all.

As scholars and readers, understanding these nuances not only aids in academic pursuits but also fosters a deeper appreciation for the relentless quest for knowledge that drives academia.

It’s important to remember that every thesis is a testament to curiosity, dedication, and the indomitable spirit of discovery.

Good luck with your thesis writing!

Frequently Asked Questions

A thesis typically ranges between 40-80 pages, but its length can vary based on the research topic, institution guidelines, and level of study.

A PhD thesis usually spans 200-300 pages, though this can vary based on the discipline, complexity of the research, and institutional requirements.

To identify a thesis topic, consider current trends in your field, gaps in existing literature, personal interests, and discussions with advisors or mentors. Additionally, reviewing related journals and conference proceedings can provide insights into potential areas of exploration.

The conceptual framework is often situated in the literature review or theoretical framework section of a thesis. It helps set the stage by providing the context, defining key concepts, and explaining the relationships between variables.

A thesis statement should be concise, clear, and specific. It should state the main argument or point of your research. Start by pinpointing the central question or issue your research addresses, then condense that into a single statement, ensuring it reflects the essence of your paper.

You might also like

AI for Meta Analysis — A Comprehensive Guide

How To Write An Argumentative Essay

Beyond Google Scholar: Why SciSpace is the best alternative

Thesis Statements

What this handout is about.

This handout describes what a thesis statement is, how thesis statements work in your writing, and how you can craft or refine one for your draft.

Introduction

Writing in college often takes the form of persuasion—convincing others that you have an interesting, logical point of view on the subject you are studying. Persuasion is a skill you practice regularly in your daily life. You persuade your roommate to clean up, your parents to let you borrow the car, your friend to vote for your favorite candidate or policy. In college, course assignments often ask you to make a persuasive case in writing. You are asked to convince your reader of your point of view. This form of persuasion, often called academic argument, follows a predictable pattern in writing. After a brief introduction of your topic, you state your point of view on the topic directly and often in one sentence. This sentence is the thesis statement, and it serves as a summary of the argument you’ll make in the rest of your paper.

What is a thesis statement?

A thesis statement:

- tells the reader how you will interpret the significance of the subject matter under discussion.

- is a road map for the paper; in other words, it tells the reader what to expect from the rest of the paper.

- directly answers the question asked of you. A thesis is an interpretation of a question or subject, not the subject itself. The subject, or topic, of an essay might be World War II or Moby Dick; a thesis must then offer a way to understand the war or the novel.

- makes a claim that others might dispute.

- is usually a single sentence near the beginning of your paper (most often, at the end of the first paragraph) that presents your argument to the reader. The rest of the paper, the body of the essay, gathers and organizes evidence that will persuade the reader of the logic of your interpretation.

If your assignment asks you to take a position or develop a claim about a subject, you may need to convey that position or claim in a thesis statement near the beginning of your draft. The assignment may not explicitly state that you need a thesis statement because your instructor may assume you will include one. When in doubt, ask your instructor if the assignment requires a thesis statement. When an assignment asks you to analyze, to interpret, to compare and contrast, to demonstrate cause and effect, or to take a stand on an issue, it is likely that you are being asked to develop a thesis and to support it persuasively. (Check out our handout on understanding assignments for more information.)

How do I create a thesis?

A thesis is the result of a lengthy thinking process. Formulating a thesis is not the first thing you do after reading an essay assignment. Before you develop an argument on any topic, you have to collect and organize evidence, look for possible relationships between known facts (such as surprising contrasts or similarities), and think about the significance of these relationships. Once you do this thinking, you will probably have a “working thesis” that presents a basic or main idea and an argument that you think you can support with evidence. Both the argument and your thesis are likely to need adjustment along the way.

Writers use all kinds of techniques to stimulate their thinking and to help them clarify relationships or comprehend the broader significance of a topic and arrive at a thesis statement. For more ideas on how to get started, see our handout on brainstorming .

How do I know if my thesis is strong?

If there’s time, run it by your instructor or make an appointment at the Writing Center to get some feedback. Even if you do not have time to get advice elsewhere, you can do some thesis evaluation of your own. When reviewing your first draft and its working thesis, ask yourself the following :

- Do I answer the question? Re-reading the question prompt after constructing a working thesis can help you fix an argument that misses the focus of the question. If the prompt isn’t phrased as a question, try to rephrase it. For example, “Discuss the effect of X on Y” can be rephrased as “What is the effect of X on Y?”

- Have I taken a position that others might challenge or oppose? If your thesis simply states facts that no one would, or even could, disagree with, it’s possible that you are simply providing a summary, rather than making an argument.

- Is my thesis statement specific enough? Thesis statements that are too vague often do not have a strong argument. If your thesis contains words like “good” or “successful,” see if you could be more specific: why is something “good”; what specifically makes something “successful”?

- Does my thesis pass the “So what?” test? If a reader’s first response is likely to be “So what?” then you need to clarify, to forge a relationship, or to connect to a larger issue.

- Does my essay support my thesis specifically and without wandering? If your thesis and the body of your essay do not seem to go together, one of them has to change. It’s okay to change your working thesis to reflect things you have figured out in the course of writing your paper. Remember, always reassess and revise your writing as necessary.

- Does my thesis pass the “how and why?” test? If a reader’s first response is “how?” or “why?” your thesis may be too open-ended and lack guidance for the reader. See what you can add to give the reader a better take on your position right from the beginning.

Suppose you are taking a course on contemporary communication, and the instructor hands out the following essay assignment: “Discuss the impact of social media on public awareness.” Looking back at your notes, you might start with this working thesis:

Social media impacts public awareness in both positive and negative ways.

You can use the questions above to help you revise this general statement into a stronger thesis.

- Do I answer the question? You can analyze this if you rephrase “discuss the impact” as “what is the impact?” This way, you can see that you’ve answered the question only very generally with the vague “positive and negative ways.”

- Have I taken a position that others might challenge or oppose? Not likely. Only people who maintain that social media has a solely positive or solely negative impact could disagree.

- Is my thesis statement specific enough? No. What are the positive effects? What are the negative effects?

- Does my thesis pass the “how and why?” test? No. Why are they positive? How are they positive? What are their causes? Why are they negative? How are they negative? What are their causes?

- Does my thesis pass the “So what?” test? No. Why should anyone care about the positive and/or negative impact of social media?

After thinking about your answers to these questions, you decide to focus on the one impact you feel strongly about and have strong evidence for:

Because not every voice on social media is reliable, people have become much more critical consumers of information, and thus, more informed voters.

This version is a much stronger thesis! It answers the question, takes a specific position that others can challenge, and it gives a sense of why it matters.

Let’s try another. Suppose your literature professor hands out the following assignment in a class on the American novel: Write an analysis of some aspect of Mark Twain’s novel Huckleberry Finn. “This will be easy,” you think. “I loved Huckleberry Finn!” You grab a pad of paper and write:

Mark Twain’s Huckleberry Finn is a great American novel.

You begin to analyze your thesis:

- Do I answer the question? No. The prompt asks you to analyze some aspect of the novel. Your working thesis is a statement of general appreciation for the entire novel.

Think about aspects of the novel that are important to its structure or meaning—for example, the role of storytelling, the contrasting scenes between the shore and the river, or the relationships between adults and children. Now you write:

In Huckleberry Finn, Mark Twain develops a contrast between life on the river and life on the shore.

- Do I answer the question? Yes!

- Have I taken a position that others might challenge or oppose? Not really. This contrast is well-known and accepted.

- Is my thesis statement specific enough? It’s getting there–you have highlighted an important aspect of the novel for investigation. However, it’s still not clear what your analysis will reveal.

- Does my thesis pass the “how and why?” test? Not yet. Compare scenes from the book and see what you discover. Free write, make lists, jot down Huck’s actions and reactions and anything else that seems interesting.

- Does my thesis pass the “So what?” test? What’s the point of this contrast? What does it signify?”

After examining the evidence and considering your own insights, you write:

Through its contrasting river and shore scenes, Twain’s Huckleberry Finn suggests that to find the true expression of American democratic ideals, one must leave “civilized” society and go back to nature.

This final thesis statement presents an interpretation of a literary work based on an analysis of its content. Of course, for the essay itself to be successful, you must now present evidence from the novel that will convince the reader of your interpretation.

Works consulted

We consulted these works while writing this handout. This is not a comprehensive list of resources on the handout’s topic, and we encourage you to do your own research to find additional publications. Please do not use this list as a model for the format of your own reference list, as it may not match the citation style you are using. For guidance on formatting citations, please see the UNC Libraries citation tutorial . We revise these tips periodically and welcome feedback.

Anson, Chris M., and Robert A. Schwegler. 2010. The Longman Handbook for Writers and Readers , 6th ed. New York: Longman.

Lunsford, Andrea A. 2015. The St. Martin’s Handbook , 8th ed. Boston: Bedford/St Martin’s.

Ramage, John D., John C. Bean, and June Johnson. 2018. The Allyn & Bacon Guide to Writing , 8th ed. New York: Pearson.

Ruszkiewicz, John J., Christy Friend, Daniel Seward, and Maxine Hairston. 2010. The Scott, Foresman Handbook for Writers , 9th ed. Boston: Pearson Education.

You may reproduce it for non-commercial use if you use the entire handout and attribute the source: The Writing Center, University of North Carolina at Chapel Hill

Make a Gift

Think of yourself as a member of a jury, listening to a lawyer who is presenting an opening argument. You'll want to know very soon whether the lawyer believes the accused to be guilty or not guilty, and how the lawyer plans to convince you. Readers of academic essays are like jury members: before they have read too far, they want to know what the essay argues as well as how the writer plans to make the argument. After reading your thesis statement, the reader should think, "This essay is going to try to convince me of something. I'm not convinced yet, but I'm interested to see how I might be."

An effective thesis cannot be answered with a simple "yes" or "no." A thesis is not a topic; nor is it a fact; nor is it an opinion. "Reasons for the fall of communism" is a topic. "Communism collapsed in Eastern Europe" is a fact known by educated people. "The fall of communism is the best thing that ever happened in Europe" is an opinion. (Superlatives like "the best" almost always lead to trouble. It's impossible to weigh every "thing" that ever happened in Europe. And what about the fall of Hitler? Couldn't that be "the best thing"?)

A good thesis has two parts. It should tell what you plan to argue, and it should "telegraph" how you plan to argue—that is, what particular support for your claim is going where in your essay.

Steps in Constructing a Thesis

First, analyze your primary sources. Look for tension, interest, ambiguity, controversy, and/or complication. Does the author contradict himself or herself? Is a point made and later reversed? What are the deeper implications of the author's argument? Figuring out the why to one or more of these questions, or to related questions, will put you on the path to developing a working thesis. (Without the why, you probably have only come up with an observation—that there are, for instance, many different metaphors in such-and-such a poem—which is not a thesis.)

Once you have a working thesis, write it down. There is nothing as frustrating as hitting on a great idea for a thesis, then forgetting it when you lose concentration. And by writing down your thesis you will be forced to think of it clearly, logically, and concisely. You probably will not be able to write out a final-draft version of your thesis the first time you try, but you'll get yourself on the right track by writing down what you have.

Keep your thesis prominent in your introduction. A good, standard place for your thesis statement is at the end of an introductory paragraph, especially in shorter (5-15 page) essays. Readers are used to finding theses there, so they automatically pay more attention when they read the last sentence of your introduction. Although this is not required in all academic essays, it is a good rule of thumb.

Anticipate the counterarguments. Once you have a working thesis, you should think about what might be said against it. This will help you to refine your thesis, and it will also make you think of the arguments that you'll need to refute later on in your essay. (Every argument has a counterargument. If yours doesn't, then it's not an argument—it may be a fact, or an opinion, but it is not an argument.)

This statement is on its way to being a thesis. However, it is too easy to imagine possible counterarguments. For example, a political observer might believe that Dukakis lost because he suffered from a "soft-on-crime" image. If you complicate your thesis by anticipating the counterargument, you'll strengthen your argument, as shown in the sentence below.

Some Caveats and Some Examples

A thesis is never a question. Readers of academic essays expect to have questions discussed, explored, or even answered. A question ("Why did communism collapse in Eastern Europe?") is not an argument, and without an argument, a thesis is dead in the water.

A thesis is never a list. "For political, economic, social and cultural reasons, communism collapsed in Eastern Europe" does a good job of "telegraphing" the reader what to expect in the essay—a section about political reasons, a section about economic reasons, a section about social reasons, and a section about cultural reasons. However, political, economic, social and cultural reasons are pretty much the only possible reasons why communism could collapse. This sentence lacks tension and doesn't advance an argument. Everyone knows that politics, economics, and culture are important.

A thesis should never be vague, combative or confrontational. An ineffective thesis would be, "Communism collapsed in Eastern Europe because communism is evil." This is hard to argue (evil from whose perspective? what does evil mean?) and it is likely to mark you as moralistic and judgmental rather than rational and thorough. It also may spark a defensive reaction from readers sympathetic to communism. If readers strongly disagree with you right off the bat, they may stop reading.

An effective thesis has a definable, arguable claim. "While cultural forces contributed to the collapse of communism in Eastern Europe, the disintegration of economies played the key role in driving its decline" is an effective thesis sentence that "telegraphs," so that the reader expects the essay to have a section about cultural forces and another about the disintegration of economies. This thesis makes a definite, arguable claim: that the disintegration of economies played a more important role than cultural forces in defeating communism in Eastern Europe. The reader would react to this statement by thinking, "Perhaps what the author says is true, but I am not convinced. I want to read further to see how the author argues this claim."

A thesis should be as clear and specific as possible. Avoid overused, general terms and abstractions. For example, "Communism collapsed in Eastern Europe because of the ruling elite's inability to address the economic concerns of the people" is more powerful than "Communism collapsed due to societal discontent."

Copyright 1999, Maxine Rodburg and The Tutors of the Writing Center at Harvard University

- Walden University

- Faculty Portal

Writing a Paper: Thesis Statements

Basics of thesis statements.

The thesis statement is the brief articulation of your paper's central argument and purpose. You might hear it referred to as simply a "thesis." Every scholarly paper should have a thesis statement, and strong thesis statements are concise, specific, and arguable. Concise means the thesis is short: perhaps one or two sentences for a shorter paper. Specific means the thesis deals with a narrow and focused topic, appropriate to the paper's length. Arguable means that a scholar in your field could disagree (or perhaps already has!).

Strong thesis statements address specific intellectual questions, have clear positions, and use a structure that reflects the overall structure of the paper. Read on to learn more about constructing a strong thesis statement.

Being Specific

This thesis statement has no specific argument:

Needs Improvement: In this essay, I will examine two scholarly articles to find similarities and differences.

This statement is concise, but it is neither specific nor arguable—a reader might wonder, "Which scholarly articles? What is the topic of this paper? What field is the author writing in?" Additionally, the purpose of the paper—to "examine…to find similarities and differences" is not of a scholarly level. Identifying similarities and differences is a good first step, but strong academic argument goes further, analyzing what those similarities and differences might mean or imply.

Better: In this essay, I will argue that Bowler's (2003) autocratic management style, when coupled with Smith's (2007) theory of social cognition, can reduce the expenses associated with employee turnover.

The new revision here is still concise, as well as specific and arguable. We can see that it is specific because the writer is mentioning (a) concrete ideas and (b) exact authors. We can also gather the field (business) and the topic (management and employee turnover). The statement is arguable because the student goes beyond merely comparing; he or she draws conclusions from that comparison ("can reduce the expenses associated with employee turnover").

Making a Unique Argument

This thesis draft repeats the language of the writing prompt without making a unique argument:

Needs Improvement: The purpose of this essay is to monitor, assess, and evaluate an educational program for its strengths and weaknesses. Then, I will provide suggestions for improvement.

You can see here that the student has simply stated the paper's assignment, without articulating specifically how he or she will address it. The student can correct this error simply by phrasing the thesis statement as a specific answer to the assignment prompt.

Better: Through a series of student interviews, I found that Kennedy High School's antibullying program was ineffective. In order to address issues of conflict between students, I argue that Kennedy High School should embrace policies outlined by the California Department of Education (2010).

Words like "ineffective" and "argue" show here that the student has clearly thought through the assignment and analyzed the material; he or she is putting forth a specific and debatable position. The concrete information ("student interviews," "antibullying") further prepares the reader for the body of the paper and demonstrates how the student has addressed the assignment prompt without just restating that language.

Creating a Debate

This thesis statement includes only obvious fact or plot summary instead of argument:

Needs Improvement: Leadership is an important quality in nurse educators.

A good strategy to determine if your thesis statement is too broad (and therefore, not arguable) is to ask yourself, "Would a scholar in my field disagree with this point?" Here, we can see easily that no scholar is likely to argue that leadership is an unimportant quality in nurse educators. The student needs to come up with a more arguable claim, and probably a narrower one; remember that a short paper needs a more focused topic than a dissertation.

Better: Roderick's (2009) theory of participatory leadership is particularly appropriate to nurse educators working within the emergency medicine field, where students benefit most from collegial and kinesthetic learning.

Here, the student has identified a particular type of leadership ("participatory leadership"), narrowing the topic, and has made an arguable claim (this type of leadership is "appropriate" to a specific type of nurse educator). Conceivably, a scholar in the nursing field might disagree with this approach. The student's paper can now proceed, providing specific pieces of evidence to support the arguable central claim.

Choosing the Right Words

This thesis statement uses large or scholarly-sounding words that have no real substance:

Needs Improvement: Scholars should work to seize metacognitive outcomes by harnessing discipline-based networks to empower collaborative infrastructures.

There are many words in this sentence that may be buzzwords in the student's field or key terms taken from other texts, but together they do not communicate a clear, specific meaning. Sometimes students think scholarly writing means constructing complex sentences using special language, but actually it's usually a stronger choice to write clear, simple sentences. When in doubt, remember that your ideas should be complex, not your sentence structure.

Better: Ecologists should work to educate the U.S. public on conservation methods by making use of local and national green organizations to create a widespread communication plan.

Notice in the revision that the field is now clear (ecology), and the language has been made much more field-specific ("conservation methods," "green organizations"), so the reader is able to see concretely the ideas the student is communicating.

Leaving Room for Discussion

This thesis statement is not capable of development or advancement in the paper:

Needs Improvement: There are always alternatives to illegal drug use.

This sample thesis statement makes a claim, but it is not a claim that will sustain extended discussion. This claim is the type of claim that might be appropriate for the conclusion of a paper, but in the beginning of the paper, the student is left with nowhere to go. What further points can be made? If there are "always alternatives" to the problem the student is identifying, then why bother developing a paper around that claim? Ideally, a thesis statement should be complex enough to explore over the length of the entire paper.

Better: The most effective treatment plan for methamphetamine addiction may be a combination of pharmacological and cognitive therapy, as argued by Baker (2008), Smith (2009), and Xavier (2011).

In the revised thesis, you can see the student make a specific, debatable claim that has the potential to generate several pages' worth of discussion. When drafting a thesis statement, think about the questions your thesis statement will generate: What follow-up inquiries might a reader have? In the first example, there are almost no additional questions implied, but the revised example allows for a good deal more exploration.

Thesis Mad Libs

If you are having trouble getting started, try using the models below to generate a rough model of a thesis statement! These models are intended for drafting purposes only and should not appear in your final work.

- In this essay, I argue ____, using ______ to assert _____.

- While scholars have often argued ______, I argue______, because_______.

- Through an analysis of ______, I argue ______, which is important because_______.

Words to Avoid and to Embrace

When drafting your thesis statement, avoid words like explore, investigate, learn, compile, summarize , and explain to describe the main purpose of your paper. These words imply a paper that summarizes or "reports," rather than synthesizing and analyzing.

Instead of the terms above, try words like argue, critique, question , and interrogate . These more analytical words may help you begin strongly, by articulating a specific, critical, scholarly position.

Read Kayla's blog post for tips on taking a stand in a well-crafted thesis statement.

Related Resources

Didn't find what you need? Email us at [email protected] .

- Previous Page: Introductions

- Next Page: Conclusions

- Office of Student Disability Services

Walden Resources

Departments.

- Academic Residencies

- Academic Skills

- Career Planning and Development

- Customer Care Team

- Field Experience

- Military Services

- Student Success Advising

- Writing Skills

Centers and Offices

- Center for Social Change

- Office of Academic Support and Instructional Services

- Office of Degree Acceleration

- Office of Research and Doctoral Services

- Office of Student Affairs

Student Resources

- Doctoral Writing Assessment

- Form & Style Review

- Quick Answers

- ScholarWorks

- SKIL Courses and Workshops

- Walden Bookstore

- Walden Catalog & Student Handbook

- Student Safety/Title IX

- Legal & Consumer Information

- Website Terms and Conditions

- Cookie Policy

- Accessibility

- Accreditation

- State Authorization

- Net Price Calculator

- Contact Walden

Walden University is a member of Adtalem Global Education, Inc. www.adtalem.com Walden University is certified to operate by SCHEV © 2024 Walden University LLC. All rights reserved.

- Skip to Content

- Skip to Main Navigation

- Skip to Search

Indiana University Bloomington Indiana University Bloomington IU Bloomington

- Mission, Vision, and Inclusive Language Statement

- Locations & Hours

- Undergraduate Employment

- Graduate Employment

- Frequently Asked Questions

- Newsletter Archive

- Support WTS

- Schedule an Appointment

- Online Tutoring

- Before your Appointment

- WTS Policies

- Group Tutoring

- Students Referred by Instructors

- Paid External Editing Services

- Writing Guides

- Scholarly Write-in

- Dissertation Writing Groups

- Journal Article Writing Groups

- Early Career Graduate Student Writing Workshop

- Workshops for Graduate Students

- Teaching Resources

- Syllabus Information

- Course-specific Tutoring

- Nominate a Peer Tutor

- Tutoring Feedback

- Schedule Appointment

- Campus Writing Program

Writing Tutorial Services

How to write a thesis statement, what is a thesis statement.

Almost all of us—even if we don’t do it consciously—look early in an essay for a one- or two-sentence condensation of the argument or analysis that is to follow. We refer to that condensation as a thesis statement.

Why Should Your Essay Contain a Thesis Statement?

- to test your ideas by distilling them into a sentence or two

- to better organize and develop your argument

- to provide your reader with a “guide” to your argument

In general, your thesis statement will accomplish these goals if you think of the thesis as the answer to the question your paper explores.

How Can You Write a Good Thesis Statement?

Here are some helpful hints to get you started. You can either scroll down or select a link to a specific topic.

How to Generate a Thesis Statement if the Topic is Assigned How to Generate a Thesis Statement if the Topic is not Assigned How to Tell a Strong Thesis Statement from a Weak One

How to Generate a Thesis Statement if the Topic is Assigned

Almost all assignments, no matter how complicated, can be reduced to a single question. Your first step, then, is to distill the assignment into a specific question. For example, if your assignment is, “Write a report to the local school board explaining the potential benefits of using computers in a fourth-grade class,” turn the request into a question like, “What are the potential benefits of using computers in a fourth-grade class?” After you’ve chosen the question your essay will answer, compose one or two complete sentences answering that question.

Q: “What are the potential benefits of using computers in a fourth-grade class?” A: “The potential benefits of using computers in a fourth-grade class are . . .”

A: “Using computers in a fourth-grade class promises to improve . . .”

The answer to the question is the thesis statement for the essay.

[ Back to top ]

How to Generate a Thesis Statement if the Topic is not Assigned

Even if your assignment doesn’t ask a specific question, your thesis statement still needs to answer a question about the issue you’d like to explore. In this situation, your job is to figure out what question you’d like to write about.

A good thesis statement will usually include the following four attributes:

- take on a subject upon which reasonable people could disagree

- deal with a subject that can be adequately treated given the nature of the assignment

- express one main idea

- assert your conclusions about a subject

Let’s see how to generate a thesis statement for a social policy paper.

Brainstorm the topic . Let’s say that your class focuses upon the problems posed by changes in the dietary habits of Americans. You find that you are interested in the amount of sugar Americans consume.

You start out with a thesis statement like this:

Sugar consumption.

This fragment isn’t a thesis statement. Instead, it simply indicates a general subject. Furthermore, your reader doesn’t know what you want to say about sugar consumption.

Narrow the topic . Your readings about the topic, however, have led you to the conclusion that elementary school children are consuming far more sugar than is healthy.

You change your thesis to look like this:

Reducing sugar consumption by elementary school children.

This fragment not only announces your subject, but it focuses on one segment of the population: elementary school children. Furthermore, it raises a subject upon which reasonable people could disagree, because while most people might agree that children consume more sugar than they used to, not everyone would agree on what should be done or who should do it. You should note that this fragment is not a thesis statement because your reader doesn’t know your conclusions on the topic.

Take a position on the topic. After reflecting on the topic a little while longer, you decide that what you really want to say about this topic is that something should be done to reduce the amount of sugar these children consume.

You revise your thesis statement to look like this:

More attention should be paid to the food and beverage choices available to elementary school children.

This statement asserts your position, but the terms more attention and food and beverage choices are vague.

Use specific language . You decide to explain what you mean about food and beverage choices , so you write:

Experts estimate that half of elementary school children consume nine times the recommended daily allowance of sugar.

This statement is specific, but it isn’t a thesis. It merely reports a statistic instead of making an assertion.

Make an assertion based on clearly stated support. You finally revise your thesis statement one more time to look like this:

Because half of all American elementary school children consume nine times the recommended daily allowance of sugar, schools should be required to replace the beverages in soda machines with healthy alternatives.

Notice how the thesis answers the question, “What should be done to reduce sugar consumption by children, and who should do it?” When you started thinking about the paper, you may not have had a specific question in mind, but as you became more involved in the topic, your ideas became more specific. Your thesis changed to reflect your new insights.

How to Tell a Strong Thesis Statement from a Weak One

1. a strong thesis statement takes some sort of stand..

Remember that your thesis needs to show your conclusions about a subject. For example, if you are writing a paper for a class on fitness, you might be asked to choose a popular weight-loss product to evaluate. Here are two thesis statements:

There are some negative and positive aspects to the Banana Herb Tea Supplement.

This is a weak thesis statement. First, it fails to take a stand. Second, the phrase negative and positive aspects is vague.

Because Banana Herb Tea Supplement promotes rapid weight loss that results in the loss of muscle and lean body mass, it poses a potential danger to customers.

This is a strong thesis because it takes a stand, and because it's specific.

2. A strong thesis statement justifies discussion.

Your thesis should indicate the point of the discussion. If your assignment is to write a paper on kinship systems, using your own family as an example, you might come up with either of these two thesis statements:

My family is an extended family.

This is a weak thesis because it merely states an observation. Your reader won’t be able to tell the point of the statement, and will probably stop reading.

While most American families would view consanguineal marriage as a threat to the nuclear family structure, many Iranian families, like my own, believe that these marriages help reinforce kinship ties in an extended family.

This is a strong thesis because it shows how your experience contradicts a widely-accepted view. A good strategy for creating a strong thesis is to show that the topic is controversial. Readers will be interested in reading the rest of the essay to see how you support your point.

3. A strong thesis statement expresses one main idea.

Readers need to be able to see that your paper has one main point. If your thesis statement expresses more than one idea, then you might confuse your readers about the subject of your paper. For example:

Companies need to exploit the marketing potential of the Internet, and Web pages can provide both advertising and customer support.

This is a weak thesis statement because the reader can’t decide whether the paper is about marketing on the Internet or Web pages. To revise the thesis, the relationship between the two ideas needs to become more clear. One way to revise the thesis would be to write:

Because the Internet is filled with tremendous marketing potential, companies should exploit this potential by using Web pages that offer both advertising and customer support.

This is a strong thesis because it shows that the two ideas are related. Hint: a great many clear and engaging thesis statements contain words like because , since , so , although , unless , and however .

4. A strong thesis statement is specific.

A thesis statement should show exactly what your paper will be about, and will help you keep your paper to a manageable topic. For example, if you're writing a seven-to-ten page paper on hunger, you might say:

World hunger has many causes and effects.

This is a weak thesis statement for two major reasons. First, world hunger can’t be discussed thoroughly in seven to ten pages. Second, many causes and effects is vague. You should be able to identify specific causes and effects. A revised thesis might look like this:

Hunger persists in Glandelinia because jobs are scarce and farming in the infertile soil is rarely profitable.

This is a strong thesis statement because it narrows the subject to a more specific and manageable topic, and it also identifies the specific causes for the existence of hunger.

Produced by Writing Tutorial Services, Indiana University, Bloomington, IN

Writing Tutorial Services social media channels

- More from M-W

- To save this word, you'll need to log in. Log In

Definition of thesis

Did you know.

In high school, college, or graduate school, students often have to write a thesis on a topic in their major field of study. In many fields, a final thesis is the biggest challenge involved in getting a master's degree, and the same is true for students studying for a Ph.D. (a Ph.D. thesis is often called a dissertation ). But a thesis may also be an idea; so in the course of the paper the student may put forth several theses (notice the plural form) and attempt to prove them.

Examples of thesis in a Sentence

These examples are programmatically compiled from various online sources to illustrate current usage of the word 'thesis.' Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Send us feedback about these examples.

Word History

in sense 3, Middle English, lowering of the voice, from Late Latin & Greek; Late Latin, from Greek, downbeat, more important part of a foot, literally, act of laying down; in other senses, Latin, from Greek, literally, act of laying down, from tithenai to put, lay down — more at do

14th century, in the meaning defined at sense 3a(1)

Dictionary Entries Near thesis

the sins of the fathers are visited upon the children

thesis novel

Cite this Entry

“Thesis.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/thesis. Accessed 14 Apr. 2024.

Kids Definition

Kids definition of thesis, more from merriam-webster on thesis.

Nglish: Translation of thesis for Spanish Speakers

Britannica English: Translation of thesis for Arabic Speakers

Britannica.com: Encyclopedia article about thesis

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

Your vs. you're: how to use them correctly, every letter is silent, sometimes: a-z list of examples, more commonly mispronounced words, how to use em dashes (—), en dashes (–) , and hyphens (-), absent letters that are heard anyway, popular in wordplay, the words of the week - apr. 12, 10 scrabble words without any vowels, 12 more bird names that sound like insults (and sometimes are), 8 uncommon words related to love, 9 superb owl words, games & quizzes.

Differences Finder

What is the Difference Between Thesis and Report

Thesis and Report are two commonly confused terms, each with its own unique features, purposes, and formats. While both are written in an academic setting, there are several distinct differences between the two that should …

Published on: Education

Thesis and Report are two commonly confused terms, each with its own unique features, purposes, and formats. While both are written in an academic setting, there are several distinct differences between the two that should be taken into consideration.

A thesis is typically a long, research-based essay that is written as part of a student’s degree program. It is an in-depth exploration of a specific topic and involves the student’s own research and analysis. The primary purpose of a thesis is to demonstrate that the student has a comprehensive understanding of the topic, and is capable of applying the knowledge they have acquired during their degree program to a specific problem or issue. A thesis is usually written in the form of a book, which includes an introduction, literature review, methodology, results, and conclusion.

On the other hand, a report is a shorter document that is typically written in response to a specific problem or issue. It may be based on research, but its primary purpose is to provide an accurate description of a current situation or past event. Reports are generally written in a more concise and descriptive format, as opposed to the more analytical style of a thesis. Reports also usually include recommendations for further action based on the findings.

In conclusion, while both a thesis and a report are written in an academic setting, there are several differences between the two that should be taken into consideration. A thesis is an in-depth exploration of a specific topic and is typically written in the form of a book, while a report is a shorter document that is usually written in response to a specific problem or issue. Additionally, the primary purpose of a thesis is to demonstrate that the student has a comprehensive understanding of the topic, while a report is primarily designed to provide an accurate description of a current situation or past event.

Thesis vs Report: An Overview

Thesis and report writing are two distinct processes that are used in academic writing to convey different types of information. To understand the differences between the two, we must first define them. A thesis is an extensive paper that is written as a requirement for a degree or diploma at a university or college. It is typically a long-term project that involves a considerable amount of research and analysis. A report, on the other hand, is a shorter written work, usually composed of facts and figures, that is used to present information in a concise manner.

Thesis vs Report: Content and Structure

The content and structure of a thesis and a report are very different. A thesis is typically an in-depth exploration of a specific topic, and it may include a series of chapters that discuss related concepts, theories, and research. The structure of the thesis typically follows the standard academic format, with an introduction, body paragraphs, and a conclusion. The introduction of a thesis typically explains the topic that will be explored and provides an overview of the structure of the document. The body paragraphs of the thesis will then discuss the research, theories, and evidence that relate to the topic. Finally, the conclusion will summarize the research and offer a conclusion or opinion on the topic.

A report, on the other hand, is typically shorter than a thesis and is generally used to present specific information in a concise manner. Reports often contain a title page, an executive summary, a table of contents, and sections that present the data and discuss the implications of the findings. Reports are typically used to present data related to a particular field or topic, such as a market analysis or a financial statement. Reports may also include charts and graphs to help illustrate the data.

Thesis vs Report: Purpose and Style

The purpose and style of a thesis and a report also differ significantly. The purpose of a thesis is typically to explore a particular topic in depth, and the document should be written in an academic style with formal language. The thesis should also include citations to sources that are used to support the arguments that are presented.

The purpose of a report, on the other hand, is typically to present facts and figures in a concise manner. Reports are typically written in a more formal style than a thesis and should include citations to sources when necessary. Reports may also include visuals such as charts and graphs to help illustrate the data. Additionally, reports should be written in a clear and concise manner to ensure that the information is easily understood by the reader.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

About Diffinder

Difference Between Anova and Ancova

Difference between left and right handed scissors.

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, automatically generate references for free.

- Knowledge Base

- Dissertation

- What Is a Thesis? | Ultimate Guide & Examples

What Is a Thesis? | Ultimate Guide & Examples

Published on 15 September 2022 by Tegan George . Revised on 5 December 2023.

A thesis is a type of research paper based on your original research. It is usually submitted as the final step of a PhD program in the UK.

Writing a thesis can be a daunting experience. Indeed, alongside a dissertation , it is the longest piece of writing students typically complete. It relies on your ability to conduct research from start to finish: designing your research , collecting data , developing a robust analysis, drawing strong conclusions , and writing concisely .

Thesis template

You can also download our full thesis template in the format of your choice below. Our template includes a ready-made table of contents , as well as guidance for what each chapter should include. It’s easy to make it your own, and can help you get started.

Download Word template Download Google Docs template

Instantly correct all language mistakes in your text

Be assured that you'll submit flawless writing. Upload your document to correct all your mistakes.

Table of contents

Thesis vs. thesis statement, how to structure a thesis, acknowledgements or preface, list of figures and tables, list of abbreviations, introduction, literature review, methodology, reference list, proofreading and editing, defending your thesis, frequently asked questions about theses.

You may have heard the word thesis as a standalone term or as a component of academic writing called a thesis statement . Keep in mind that these are two very different things.

- A thesis statement is a very common component of an essay, particularly in the humanities. It usually comprises 1 or 2 sentences in the introduction of your essay , and should clearly and concisely summarise the central points of your academic essay .

- A thesis is a long-form piece of academic writing, often taking more than a full semester to complete. It is generally a degree requirement to complete a PhD program.

- In many countries, particularly the UK, a dissertation is generally written at the bachelor’s or master’s level.

- In the US, a dissertation is generally written as a final step toward obtaining a PhD.

Prevent plagiarism, run a free check.

The final structure of your thesis depends on a variety of components, such as:

- Your discipline

- Your theoretical approach

Humanities theses are often structured more like a longer-form essay . Just like in an essay, you build an argument to support a central thesis.

In both hard and social sciences, theses typically include an introduction , literature review , methodology section , results section , discussion section , and conclusion section . These are each presented in their own dedicated section or chapter. In some cases, you might want to add an appendix .

Thesis examples

We’ve compiled a short list of thesis examples to help you get started.

- Example thesis #1: ‘Abolition, Africans, and Abstraction: the Influence of the “Noble Savage” on British and French Antislavery Thought, 1787-1807’ by Suchait Kahlon.

- Example thesis #2: ‘”A Starving Man Helping Another Starving Man”: UNRRA, India, and the Genesis of Global Relief, 1943-1947’ by Julian Saint Reiman.

The very first page of your thesis contains all necessary identifying information, including:

- Your full title

- Your full name

- Your department

- Your institution and degree program

- Your submission date.

Sometimes the title page also includes your student ID, the name of your supervisor, or the university’s logo. Check out your university’s guidelines if you’re not sure.

Read more about title pages

The acknowledgements section is usually optional. Its main point is to allow you to thank everyone who helped you in your thesis journey, such as supervisors, friends, or family. You can also choose to write a preface , but it’s typically one or the other, not both.

Read more about acknowledgements Read more about prefaces

The only proofreading tool specialized in correcting academic writing

The academic proofreading tool has been trained on 1000s of academic texts and by native English editors. Making it the most accurate and reliable proofreading tool for students.

Correct my document today

An abstract is a short summary of your thesis. Usually a maximum of 300 words long, it’s should include brief descriptions of your research objectives , methods, results, and conclusions. Though it may seem short, it introduces your work to your audience, serving as a first impression of your thesis.

Read more about abstracts

A table of contents lists all of your sections, plus their corresponding page numbers and subheadings if you have them. This helps your reader seamlessly navigate your document.

Your table of contents should include all the major parts of your thesis. In particular, don’t forget the the appendices. If you used heading styles, it’s easy to generate an automatic table Microsoft Word.

Read more about tables of contents

While not mandatory, if you used a lot of tables and/or figures, it’s nice to include a list of them to help guide your reader. It’s also easy to generate one of these in Word: just use the ‘Insert Caption’ feature.

Read more about lists of figures and tables

If you have used a lot of industry- or field-specific abbreviations in your thesis, you should include them in an alphabetised list of abbreviations . This way, your readers can easily look up any meanings they aren’t familiar with.

Read more about lists of abbreviations

Relatedly, if you find yourself using a lot of very specialised or field-specific terms that may not be familiar to your reader, consider including a glossary . Alphabetise the terms you want to include with a brief definition.

Read more about glossaries

An introduction sets up the topic, purpose, and relevance of your thesis, as well as expectations for your reader. This should:

- Ground your research topic , sharing any background information your reader may need

- Define the scope of your work

- Introduce any existing research on your topic, situating your work within a broader problem or debate

- State your research question(s)

- Outline (briefly) how the remainder of your work will proceed

In other words, your introduction should clearly and concisely show your reader the “what, why, and how” of your research.

Read more about introductions

A literature review helps you gain a robust understanding of any extant academic work on your topic, encompassing:

- Selecting relevant sources

- Determining the credibility of your sources

- Critically evaluating each of your sources

- Drawing connections between sources, including any themes, patterns, conflicts, or gaps

A literature review is not merely a summary of existing work. Rather, your literature review should ultimately lead to a clear justification for your own research, perhaps via:

- Addressing a gap in the literature

- Building on existing knowledge to draw new conclusions

- Exploring a new theoretical or methodological approach

- Introducing a new solution to an unresolved problem

- Definitively advocating for one side of a theoretical debate

Read more about literature reviews

Theoretical framework

Your literature review can often form the basis for your theoretical framework, but these are not the same thing. A theoretical framework defines and analyses the concepts and theories that your research hinges on.

Read more about theoretical frameworks

Your methodology chapter shows your reader how you conducted your research. It should be written clearly and methodically, easily allowing your reader to critically assess the credibility of your argument. Furthermore, your methods section should convince your reader that your method was the best way to answer your research question.

A methodology section should generally include:

- Your overall approach ( quantitative vs. qualitative )

- Your research methods (e.g., a longitudinal study )

- Your data collection methods (e.g., interviews or a controlled experiment

- Any tools or materials you used (e.g., computer software)

- The data analysis methods you chose (e.g., statistical analysis , discourse analysis )

- A strong, but not defensive justification of your methods

Read more about methodology sections

Your results section should highlight what your methodology discovered. These two sections work in tandem, but shouldn’t repeat each other. While your results section can include hypotheses or themes, don’t include any speculation or new arguments here.

Your results section should:

- State each (relevant) result with any (relevant) descriptive statistics (e.g., mean , standard deviation ) and inferential statistics (e.g., test statistics , p values )

- Explain how each result relates to the research question

- Determine whether the hypothesis was supported

Additional data (like raw numbers or interview transcripts ) can be included as an appendix . You can include tables and figures, but only if they help the reader better understand your results.

Read more about results sections

Your discussion section is where you can interpret your results in detail. Did they meet your expectations? How well do they fit within the framework that you built? You can refer back to any relevant source material to situate your results within your field, but leave most of that analysis in your literature review.

For any unexpected results, offer explanations or alternative interpretations of your data.

Read more about discussion sections

Your thesis conclusion should concisely answer your main research question. It should leave your reader with an ultra-clear understanding of your central argument, and emphasise what your research specifically has contributed to your field.

Why does your research matter? What recommendations for future research do you have? Lastly, wrap up your work with any concluding remarks.

Read more about conclusions

In order to avoid plagiarism , don’t forget to include a full reference list at the end of your thesis, citing the sources that you used. Choose one citation style and follow it consistently throughout your thesis, taking note of the formatting requirements of each style.

Which style you choose is often set by your department or your field, but common styles include MLA , Chicago , and APA.

Create APA citations Create MLA citations