Login or sign up to be automatically entered into our next $10,000 scholarship giveaway

Get Searching

- College Search

- College Search Map

- Graduate Programs

- Featured Colleges

- Scholarship Search

- Lists & Rankings

Articles & Advice

- Ask the Experts

- Campus Visits

- Catholic Colleges and Universities

- Christian Colleges and Universities

- College Admission

- College Athletics

- College Diversity

- Counselors and Consultants

- Education and Teaching

- Financial Aid

- Graduate School

- Health and Medicine

- International Students

- Internships and Careers

- Majors and Academics

- Performing and Visual Arts

- Public Colleges and Universities

- Science and Engineering

- Student Life

- Transfer Students

- Why CollegeXpress

- $10,000 Scholarship

- CollegeXpress Store

- Corporate Website

- Terms of Use

- Privacy Policy

- CA and EU Privacy Policy

Articles & Advice > Graduate School > Articles

3 Great Grad School Application Essay Examples

The grad school personal statement is an important part of your application. Here are a few good graduate admission essay examples to inspire you.

by CollegeXpress

Last Updated: Jan 3, 2024

Originally Posted: Jun 15, 2017

Graduate school application essays, personal statements, and letters of intent can be a major hurdle to overcome in the application process. Getting just the right words on paper to convey why you want to go to grad school and the impact you intend to have using your degree is a lot to ask. To help you get some inspiration and tell your story the right way, check out these three essay examples. Every essay here comes from a successful grad school application, and after reading the essay we break down just what makes it good. And you’re going to love their stories.

Daniel Masciello, Juris Doctor

University of Connecticut Class of 2015

T ry. To get. Some. Slee—it’s no use.

It’s 3:00 am, 90 minutes before our day at work in the landfills of rural Thailand is set to begin, and the 60-watt bulb is still shining bright overhead. It is radiant.

Directly on my left is one grown man’s bare armpit; to my right is more of the same. I keep my nose pointed at the ceiling. I can’t lift my arms because I am too big, a Caucasian beetle trying to fit into this Thai ant colony.

I’ve been lying still for the better part of six hours now, unable to determine exactly why my host family insists on leaving the brightest light in the house on all night (to this day, still a mystery). It is not for a child’s sake; I, at 22 years old, am the youngest in the home. I’m also the only American. Five grown men, lined up snugly on a queen-sized mattress, are soundly sleeping while I contemplate excuses for not working in the landfill that day.

Twelve hours later, over sticky rice and “fresh” vegetables (from the landfill), I try to call out some of my bunkmates for being afraid of the dark. Nobody laughs at my jokes, but they don’t stop smiling either. Perhaps they don’t understand my infantile Thai. From what I can understand of them, they enjoy talking about how grumpy I’ve been all day. No sleep for some 60-odd hours and putting in two grueling days in the landfill, filtering through mountains of trash from the nearby city of Khon Kaen, looking for yogurt containers and car batteries in the hot Thai sun—these things can change a man’s general disposition.

But I did wake up and go to work with my host family. No, I was not prepared physically or mentally, nor was I in the best of moods that day. But the smiling way of the Thai people is infectious, and it wasn’t long before I was smiling too that night, stomach full and ready for more...

That was back in the fall of 2008. The study abroad program I was participating in revolved around studying specific issues (damning rivers, mining minerals, razing slums, etc.), staying with a village that was negatively affected by an issue, and then working to help solve the problem. It was not uncommon to have sessions lasting eight or nine hours just to prepare for a town meeting the next day. Free time after exchanges and interviews would be spent working in the fields with the villagers or perhaps working on our program’s publications. It was not your typical study abroad experience. I have yet to learn of another like it.

It was also challenging at times. Thailand changed my view on a lot of things for the better, including what it means to truly work hard. As a waiter back home, it was a routine practice to work 40 hours a week in addition to going to class and studying. Still, sometimes I wonder if I used jobs outside of class as a crutch. I always had the excuse: I have to work to support myself. But so do a lot of people. And for some of those people, like many of the villagers in Thailand, working extra hours is not temporary. It's a way of life.

At the time I'm not sure I truly appreciated the privilege I had of going to college, as my undergraduate GPA might indicate. Part of that disappointing number is that I feel as if I was afraid of putting 100% of my effort into school. If I was to put all my effort in and still get mediocre grades, I would have considered myself a failure. Apparently I couldn’t or refused to handle that. How cowardly, not to mention foolish!

But while I was in Thailand, I developed a confidence in myself that I simply hadn’t been able to locate before. On multiple occasions I tasted the failure that comes with studying complex issues in a foreign land. Each time it tasted horrible. But I worked on these failures.

For example, I nagged my homestay families to help me with my Thai and forced myself to request constructive criticism in a group setting. Through these trials I discovered the sweetest feeling of them all: perseverance. That meal next to the landfill, described above, was one of the most deliciously memorable meals of my life for that same reason. I was exhausted and maybe a little bit grumpy, but I learned to work through it—and smile too.

I am well aware that law school will probably force me to even further revise my definition of hard work and present challenges and setbacks the likes of which I may not have yet experienced. But I would like to face these challenges, and most importantly overcome them, at your school. I hope my letters of recommendation and LSAT score give the indication that I am capable of doing so. This essay, lastly, is a chance for me to convince you that I can and will. I look forward to hearing from you.

Why this essay is great

Try to stop reading this personal statement, we dare you. The introduction grabs you and doesn’t let go. But besides spinning a great yarn that also says a lot about Daniel’s values, this application essay has an important function: it thoughtfully and maturely addresses any concerns the graduate admission committee might have regarding Daniel’s undergraduate academic performance. Showing rather than telling, he depicts a person who is prepared to do the work to overcome obstacles and learn from mistakes. And since he was admitted to the grad program, clearly it worked.

Related: How to Know If Law School Is Right for You

Bridget Sullivan, Master of Arts in Higher Education Administration

Boston College Class of 2017

I did not know higher education existed as a field until I came to college. Despite this, it has surprisingly been the field that has had the largest impact on my college experience. It has given me direction going forward.

College has been my most important experience so far, in that it has allowed me to better understand how I interact with my environment and how others experience the world around them. Without the Student Affairs professionals I have interacted with over the past four years, I would not be where I am today. I hope that in my future as a Student Affairs professional I can give students the great experience I have been privileged to receive. I will take the lessons I have learned and those that I will learn in the future to improve the college experience for many future generations going forward.

I have enjoyed being a Resident Advisor, a Parent Orientation Leader, and an Assistant Resident Director while attending the University of Massachusetts Lowell for the past four years. All of these jobs fall under the Office of Residence Life. These opportunities have been cornerstones of my college education. They have taught me the long-term and transferrable skills of organization, conflict management, and supervision.

I have most enjoyed being an Assistant Resident Director, as I get to work with the Resident Advisors and Resident Director in a more administrative capacity. The ARD works closely with the RD to get the work done and hold RAs accountable. I think my favorite part of being an ARD this year has been working with the RAs to make sure they have the best experience they can, while at the same time making sure they complete their work well and on time. I enjoy helping RAs and other students reach their full potential, and I feel that it is a learning process for me too. The ARD position has shown me how much I value helping others on the path I have set for myself through my experiences with the RAs I supervise.

Because of the ARD role I have been afforded, I have had the opportunity to see how this potential career may play out. I feel confident about my ability to transition to the professional side of the field because the ARD position has already forced me to take on many of these steps. I tested the waters of the potential career in my RA role last year; this year as an ARD has shown me that I know I can succeed.

I am passionate about student affairs and higher education because it is an opportunity to work with college students and help them grow and develop. I truly believe that there isn’t a more rewarding career than one that allows you to help others. This field allows me to assist others every day at a time in their lives when many students need it most. It was my developmental path, and I want to give that support to others.

So far my academics and daily practice have not been linked nor intentional. I am excited to be able to make this so by starting a graduate program in higher education. Understanding my former responsibilities in terms of theory and learning how to turn new theories into practice is a process I cannot wait to begin.

I know the Lynch School of Education can assist me in achieving this goal through their program in Higher Education Administration. The opportunity to study in the Boston area will give me a multitude of professional development opportunities that would be hard to find anywhere else. If I am admitted, I will work hard to maximize my time at the Lynch School and become a young professional who can innovate and improve upon current practices in the field.

This personal statement takes you on a journey, as Bridget discovers her calling as an undergrad, gets all the hands-on experience in it she can, and figures out the perfect way to make it her career: grad school. And not just any grad school—Boston College in particular! There’s no doubt in your mind that she’s going to take advantage of everything BC’s master’s program has to offer, and she has the real-world experience to back her claims up.

Related: Great Alternative Jobs for Education Majors Who Don't Want to Teach

Haviland Johannesson-Forgit, Master of Arts in Arts Administration

Vermont State University , formerly Castleton University Class of 2018

While contemplating how I should approach my personal and professional goals and how earning an advanced degree will support them, I came upon my application essay for Goddard College that I wrote close to three years ago:

“Oftentimes, children who lack positive, authoritative figures and emotional support end up making unwise choices that stay with them and induce prejudice and judgment from other people who may be ignorant to what caused these children to make the choices in the first place. This cultural stigmatism that exists in our society often leads to these children being segmented into a disenfranchised group as adults. The misunderstanding and neglect that occurs in communities towards socially disenfranchised children goes against everything that I was raised to take in regard when attempting to understand a person.

I envision my studies reaching children and young adults in many different communities. It is my goal to immerse myself in rural, inner-city, and lower-income communities and meet these children before or in the midst of their time when the decisions they make can influence where their life may lead. I believe that the teachings of dance as a holistic lifestyle will provide outlets of knowledge and self-expression for these children and young adults that will lead them in positive directions.”

In this essay we were expected to write about our intentions and ambitions for our studies; to address the passions that acted as the drive for our work during our attendance at the college as well as after graduation. In returning to this essay, I was pleased to discover that my ambition and dedication to using the performing arts as a source of structure and reliability for youth in this country has not changed. When applying to Goddard College for my undergraduate degree I knew that I would want to continue on to pursue my graduate degree afterwards to enhance myself as a qualified candidate working in my field. Earning my advanced degree will enable me to go forth in the world as a confident and learned individual prepared to create the positive opportunities I envisioned years ago.

While earning my advanced degree, I intend to learn the details and structure that is needed to successfully run arts organizations. The closeness that Castleton University has with the Association for Arts Administration in developing its program for the MA in Arts Administration encourages me; it assures me that the quality and rigor of the program at Castleton is the right fit for my personal and professional aspirations. The efficacy of the program combined with the professional portfolio of projects demonstrating a mastery of skills in a range of areas in the arts and the six-credit culminating internship is exactly what I am looking for in an advanced degree program.

My background in the performing arts is broad. Not only have I have spent many years performing in productions of theater and dance, but I have also devoted my time and learning to other aspects of performance arts, whether it be technical, political, or social. My time attending Goddard College has proven to be extremely educational in training me in areas of social justice and cultural realizations of privilege, class, and human rights. With an accomplished and culturally diverse faculty and staff, the College requires its students to incorporate this training into their degrees, which makes for globally conscious citizens.

What I stand to bring to Castleton University’s campus is a vibrant love for the performing arts accompanied by acute social awareness training. My dedication to improving myself as an individual in my career is resolute; earning my advanced degree is vital to my continuing as a professional in a field so important to the foundation of our culture. I look forward to the opportunity of earning my Master of Arts in Arts Administration at Castleton University.

Haviland draws a remarkable line from her undergraduate studies and goals to the present day . She’s been on a clear path for a long time, and grad school has always been part of the plan and the logical next step for her career. Her unwavering commitment to arts education and dance as a means for furthering social justice will serve her well professionally—and it probably impressed the graduate admission folks too. Haviland also references specific features of Castleton University’s graduate program, showing she’s genuinely interested in the school and its unique strengths.

Related: Careers for People Who Want to Use Their Creativity

We hope these essay examples helped you get a better idea of where to take your grad school personal statements. The most important part of writing your essay is ensuring every word you put on the page is authentically you and true to your goals. You can write a great essay and get into a good grad school; just give yourself the time and flexibility by starting early and focusing on your story. Good luck!

Need help getting the ball rolling on your graduate essays? Check out these Good Strategies for Writing Grad School Personal Essays from the experts at GradSchools.com.

Like what you’re reading?

Join the CollegeXpress community! Create a free account and we’ll notify you about new articles, scholarship deadlines, and more.

Tags: admission essays essay examples grad school grad school admission grad school applications personal statement examples personal statements

Join our community of over 5 million students!

CollegeXpress has everything you need to simplify your college search, get connected to schools, and find your perfect fit.

High School Class of 2023

I’m currently a college freshman attending Towson University. My major is Information Technology, and I plan to minor in Electronic Media & Film to achieve my goal of becoming a production engineer. Upon graduating high school earlier this year, I was awarded a $5,000 scholarship from CollegeXpress, which greatly assisted in paying my tuition. Truthfully, this financial reward was the difference in affording my room and board and tuition, along with other expenses for school. My family and I haven’t stopped celebrating my award since it was bestowed on me. I will never forget this opportunity for allowing me to get my foot into my university financially.

High School Class of 2021

CollegeXpress really helped me by letting me know the colleges ratings and placements. They gave me accurate information on my colleges tuition rates and acceptance. They even let me know the ration between students and faculty and the diversity of the college. Overall they told me everything I needed and things I didnt even think I needed to know about my college and other colleges I applied for.

Keaun Brown

$2,000 Community Service Scholarship Winner, 2020

As I transition to furthering my education, I can say with certainty that it simply wouldn’t be possible without the help of generous organizations such as CollegeXpress. Those who initially founded CX had no idea their platform would give a plethora of information to a first-generation homeless kid native to the ghettos of over half a dozen states. Everyone at CX and Carnegie Dartlet gave me a chance at a future when the statistics said I had none. And for that, I thank them.

High School Class of 2019

My college search began at CollegeXpress. Due to this helpful tool, I was able to gather a lot of information to guide my college planning decisions. Through CollegeXpress, I was also able to apply to several scholarships to help pay for my tuition. I would definitely recommend this website to anyone who wants to explore colleges and get more information from admission experts, counselors, and real students.

CollegeXpress helped me find the school I am currently attending by consistently sending me emails of other schools. This allowed me to do research on other schools as well as the one I am in now!

- Our Best Advice for Aspiring Graduate Students

- The Top Things to Know About Prerequisites for Graduate School

- When Is the Best Time to Apply to Law School?

- The Ultimate Guide to Graduate School Applications

- What You Need to Know About 5 Common Graduate Admission Exams

Colleges You May Be Interested In

Abilene Christian University

Abilene, TX

New York Institute of Technology

Old Westbury, NY

Moody Theological Seminary

Chicago, IL

Asbury University

Wilmore, KY

Freed-Hardeman University

Henderson, TN

Personalize your experience on CollegeXpress.

With this information, we'll do our best to display content relevant to your interests. By subscribing, you agree to receive CollegeXpress emails and to make your information available to colleges and universities, scholarship programs, and other companies that have relevant/related offers.

Already have an account?

Log in to be directly connected to

Not a CollegeXpress user?

Don't want to register.

Provide your information below to connect with

- DACA/Undocumented

- First Generation, Low Income

- International Students

- Students of Color

- Students with disabilities

- Undergraduate Students

- Master’s Students

- PhD Students

- Faculty/Staff

- Family/Supporters

- Career Fairs

- Post Jobs, Internships, Fellowships

- Build your Brand at MIT

- Recruiting Guidelines and Resources

- Connect with Us

- Career Advising

- Distinguished Fellowships

- Employer Relations

- Graduate Student Professional Development

- Prehealth Advising

- Student Leadership Opportunities

- Academia & Education

- Architecture, Planning, & Design

- Arts, Communications, & Media

- Business, Finance, & Fintech

- Computing & Computer Technology

- Data Science

- Energy, Environment, & Sustainability

- Life Sciences, Biotech, & Pharma

- Manufacturing & Transportation

- Health & Medical Professions

- Social Impact, Policy, & Law

- Getting Started & Handshake 101

- Exploring careers

- Networking & Informational Interviews

- Connecting with employers

- Resumes, cover letters, portfolios, & CVs

- Finding a Job or Internship

- Post-Graduate and Summer Outcomes

- Professional Development Competencies

- Preparing for Graduate & Professional Schools

- Preparing for Medical / Health Profession Schools

- Interviewing

- New jobs & career transitions

- Career Prep and Development Programs

- Employer Events

- Outside Events for Career and Professional Development

- Events Calendar

- Career Services Workshop Requests

- Early Career Advisory Board

- Peer Career Advisors

- Student Staff

- Mission, Vision, Values and Diversity Commitments

- News and Reports

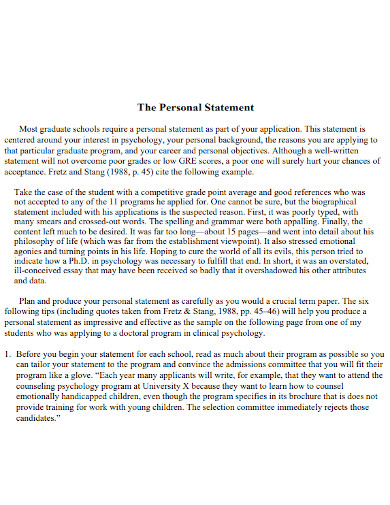

Graduate School Application Essays

- Share This: Share Graduate School Application Essays on Facebook Share Graduate School Application Essays on LinkedIn Share Graduate School Application Essays on X

Types of Essays

Regardless of the type of school you are applying to, you will be required to submit an admissions essay as part of the application process. Graduate programs want students with clear commitment to the field. Essay prompts typically ask applicants to discuss their previous experience, future professional goals, and how the program can help them in achieving those objectives. The essay gives the applicant the chance to articulate these goals and display strong writing skills. Remember to tailor your essay to each school and the faculty committee that reviews your application. But first, take note of what kind of essay is being requested of you. Here are the two main admission essays:

Personal Statement

A personal statement is a narrative piece describing how your character and experiences have formed you into someone who will contribute positively and effectively to not only the department but the academic discipline as a whole. This is often achieved by detailing social, educational, cultural, and economic obstacles you have overcome in your journey to get to where you are today and your future objectives. A personal statement is also an opportunity to highlight what is unique about you and how you will advance diversity within the institution.

Check out Personal Statement Resources for Graduate School Applications in the Resources section of Handshake for a brainstorming activity and essay samples that can help you get started on your personal statement.

Statement of Purpose

Interchangeably called a “research statement”, a statement of purpose will prompt you to describe your research interests and professional goals, how you plan to accomplish them, and why a specific program is best suited for you to do so. Be specific about your specialized interests within your major field. Be clear about the kind of program you expect to undertake, and explain how your study plan connects with your previous training and future goals.

Use the Outlining Your Statement of Purpose guide in the Resources section of Handshake to get started on your statement outline.

How to Write a Powerful Admission Essay

Whatever required format, your essay should be thoughtful, concise, compelling, and interesting. Remember, admissions officers read hundreds of personal essays. Below are some tips for your admissions essay writing process:

Before Writing

- Read the question: Be sure you are aware of all aspects of the prompt. Failing to pay attention to details in the prompt won’t reflect well on you as a potential candidate.

- What is distinct, special, and/or impressive about me and my life story?

- Have I overcome any particular hardships or obstacles?

- When did I become interested in this field and what have I learned about it?

- What are my career goals?

- What personal traits, values, and skill sets do I have that would make me stand out from other applicants?

- Create an outline: You might have a lot that you want to say, but you will need to whittle down your many thoughts and experiences to a concrete thesis with a select number of examples to support it. Create an outline for your draft, not only to organize your points and examples, but to help tailor your essay for your readers.

- Know your audience: Consider how your narrative can best meet the expectations of admissions committee members. Will faculty be reading this? Administrators? Experts in the field? Knowing your audience ahead of time will assist you in addressing the prompt appropriately.

While Writing

- Grab your reader’s attention: Start your essay with something that will grab the reader’s attention such as a personal anecdote, questions, or engaging depiction of a scene. Avoid starting things off with common phrases such as “I was born in…” or “I have always wanted to…” Consider the experiences that have shaped you or your career decision, and delve into them with a creative hook.

- Write well: Your essay is a sample of your writing abilities, so it’s important to convey your thoughts clearly and effectively. Be succinct—you don’t need to write out your full autobiography or resume in prose. Exclude anything that doesn’t support your thesis. Gentle humor is okay, but don’t overdo it. Also, don’t make things up! Be honest about your experiences.

- End strong: End your essay with a conclusion that refers back to the lead and restates your thesis. This helps unify your essay as a whole, connecting your detailed experiences back to the reason you are writing this essay in the first place—to show your qualifications for your graduate program of choice.

Final Touches

- Use resources: The MIT Communication Labs have a CommKit that collects all of the Comm Lab resources relevant to the grad application process , including recommendation letters & interviews

- Revise: Give yourself enough time to step away from your draft. Return with a fresh pair of eyes to make your edits. Be realistic with yourself, not your harshest critic. Make a few rounds of revisions if you need.

- Ask for help: Have your essay critiqued by friends, family, educators, and the MIT Writing and Communication Center or our Career Services staff.

- Proofread: Read your essay out loud or even record yourself and listen to the recording, to help you catch mistakes or poor phrasing you may have missed when reading to yourself. Also, don’t rely exclusively on your computer to check your spelling.

Breadcrumbs

How to write a standout graduate admissions essay, article highlights.

- Reflect before you begin your application essays.

- Outline your ideas before you put pen to paper.

- Write freely, and then return to edit your essay on the second draft.

- Take your time. Break between writing and editing for a fresh perspective.

- Gather feedback from a trusted source.

- Read your essay aloud to identify needed edits.

Everyone has a story to tell, and we know there’s more to you and your talents than what’s on your resume. But how will you stand out from the crowd when applying to Johns Hopkins Carey Business School?

The essay portion of the application is your opportunity to expand beyond your transcript and resume. Share your unique strengths, your background, your growth, or whatever else makes you a strong candidate for Johns Hopkins Carey Business School.

In this article, you will find a detailed explanation of how to write a standout admissions essay.

How to prepare

Before you begin writing, read the essay prompts carefully. Take a moment to reflect and explore why you’re pursuing a graduate business degree. Consider having a pen and notepad nearby as you participate in this reflection exercise. Think about your path thus far and pinpoint moments of growth and learning. Take note of how these moments have shaped you and how these experiences will guide you through your graduate business degree at Carey.

Map your ideas:

Now that you have an idea of how to share your story within the context of the essay prompts, it’s time to draft an outline . Map out your key points and outline the supporting examples. As you map the direction and flow of your essay through the outline, keep in mind your audience. Our admissions officers read thousands of application essays, so you want to find a creative hook to make your story stand out.

Don’t overthink it! Start writing:

As you start to write your first draft, let the words flow. At this stage, don’t fixate on grammar or finding the perfect word– just get your thoughts on paper. You will finesse and polish your essay in the second draft.

Share this Article

What to read next.

Take a break:

Once you complete your first draft, take a day or two before returning to edit it. Coming back to your writing with fresh eyes allows you to read it with a new perspective. Tackle the details of grammar, punctuation, and vocabulary during this second pass. Consider reading your essay backward to help catch typos.

Get feedback:

Once you feel your essays are in a good place, it is highly recommended that you share them for review. Share them with your advisor, a trusted colleague, friend, or even your recommender . Getting insights from a trusted source can help you make your essay stronger, as well as catch any typos or small edits.

Finalize and submit:

You are almost done. Before submitting your essays, do a final review. Run a spell check and read the essays out loud to yourself. This trick allows you to identify areas that may need clarification or tweaks. As you review your final draft, make sure that you actually answered the question posed on the application.

Remember, the essay portion of your application is your chance to stand out from the crowd. By sharing who you are as a person, your growth thus far, your passions, your goals, and your voice, you can make a lasting impression. Best of luck with your application process!

Just the facts

Discover related content.

online programs

- How to apply

- How to apply: Full-time MS

- How to apply: Full-time MBA

Application Essays

What this handout is about.

This handout will help you write and revise the personal statement required by many graduate programs, internships, and special academic programs.

Before you start writing

Because the application essay can have a critical effect upon your progress toward a career, you should spend significantly more time, thought, and effort on it than its typically brief length would suggest. It should reflect how you arrived at your professional goals, why the program is ideal for you, and what you bring to the program. Don’t make this a deadline task—now’s the time to write, read, rewrite, give to a reader, revise again, and on until the essay is clear, concise, and compelling. At the same time, don’t be afraid. You know most of the things you need to say already.

Read the instructions carefully. One of the basic tasks of the application essay is to follow the directions. If you don’t do what they ask, the reader may wonder if you will be able to follow directions in their program. Make sure you follow page and word limits exactly—err on the side of shortness, not length. The essay may take two forms:

- A one-page essay answering a general question

- Several short answers to more specific questions

Do some research before you start writing. Think about…

- The field. Why do you want to be a _____? No, really. Think about why you and you particularly want to enter that field. What are the benefits and what are the shortcomings? When did you become interested in the field and why? What path in that career interests you right now? Brainstorm and write these ideas out.

- The program. Why is this the program you want to be admitted to? What is special about the faculty, the courses offered, the placement record, the facilities you might be using? If you can’t think of anything particular, read the brochures they offer, go to events, or meet with a faculty member or student in the program. A word about honesty here—you may have a reason for choosing a program that wouldn’t necessarily sway your reader; for example, you want to live near the beach, or the program is the most prestigious and would look better on your resume. You don’t want to be completely straightforward in these cases and appear superficial, but skirting around them or lying can look even worse. Turn these aspects into positives. For example, you may want to go to a program in a particular location because it is a place that you know very well and have ties to, or because there is a need in your field there. Again, doing research on the program may reveal ways to legitimate even your most superficial and selfish reasons for applying.

- Yourself. What details or anecdotes would help your reader understand you? What makes you special? Is there something about your family, your education, your work/life experience, or your values that has shaped you and brought you to this career field? What motivates or interests you? Do you have special skills, like leadership, management, research, or communication? Why would the members of the program want to choose you over other applicants? Be honest with yourself and write down your ideas. If you are having trouble, ask a friend or relative to make a list of your strengths or unique qualities that you plan to read on your own (and not argue about immediately). Ask them to give you examples to back up their impressions (For example, if they say you are “caring,” ask them to describe an incident they remember in which they perceived you as caring).

Now, write a draft

This is a hard essay to write. It’s probably much more personal than any of the papers you have written for class because it’s about you, not World War II or planaria. You may want to start by just getting something—anything—on paper. Try freewriting. Think about the questions we asked above and the prompt for the essay, and then write for 15 or 30 minutes without stopping. What do you want your audience to know after reading your essay? What do you want them to feel? Don’t worry about grammar, punctuation, organization, or anything else. Just get out the ideas you have. For help getting started, see our handout on brainstorming .

Now, look at what you’ve written. Find the most relevant, memorable, concrete statements and focus in on them. Eliminate any generalizations or platitudes (“I’m a people person”, “Doctors save lives”, or “Mr. Calleson’s classes changed my life”), or anything that could be cut and pasted into anyone else’s application. Find what is specific to you about the ideas that generated those platitudes and express them more directly. Eliminate irrelevant issues (“I was a track star in high school, so I think I’ll make a good veterinarian.”) or issues that might be controversial for your reader (“My faith is the one true faith, and only nurses with that faith are worthwhile,” or “Lawyers who only care about money are evil.”).

Often, writers start out with generalizations as a way to get to the really meaningful statements, and that’s OK. Just make sure that you replace the generalizations with examples as you revise. A hint: you may find yourself writing a good, specific sentence right after a general, meaningless one. If you spot that, try to use the second sentence and delete the first.

Applications that have several short-answer essays require even more detail. Get straight to the point in every case, and address what they’ve asked you to address.

Now that you’ve generated some ideas, get a little bit pickier. It’s time to remember one of the most significant aspects of the application essay: your audience. Your readers may have thousands of essays to read, many or most of which will come from qualified applicants. This essay may be your best opportunity to communicate with the decision makers in the application process, and you don’t want to bore them, offend them, or make them feel you are wasting their time.

With this in mind:

- Do assure your audience that you understand and look forward to the challenges of the program and the field, not just the benefits.

- Do assure your audience that you understand exactly the nature of the work in the field and that you are prepared for it, psychologically and morally as well as educationally.

- Do assure your audience that you care about them and their time by writing a clear, organized, and concise essay.

- Do address any information about yourself and your application that needs to be explained (for example, weak grades or unusual coursework for your program). Include that information in your essay, and be straightforward about it. Your audience will be more impressed with your having learned from setbacks or having a unique approach than your failure to address those issues.

- Don’t waste space with information you have provided in the rest of the application. Every sentence should be effective and directly related to the rest of the essay. Don’t ramble or use fifteen words to express something you could say in eight.

- Don’t overstate your case for what you want to do, being so specific about your future goals that you come off as presumptuous or naïve (“I want to become a dentist so that I can train in wisdom tooth extraction, because I intend to focus my life’s work on taking 13 rather than 15 minutes per tooth.”). Your goals may change–show that such a change won’t devastate you.

- And, one more time, don’t write in cliches and platitudes. Every doctor wants to help save lives, every lawyer wants to work for justice—your reader has read these general cliches a million times.

Imagine the worst-case scenario (which may never come true—we’re talking hypothetically): the person who reads your essay has been in the field for decades. She is on the application committee because she has to be, and she’s read 48 essays so far that morning. You are number 49, and your reader is tired, bored, and thinking about lunch. How are you going to catch and keep her attention?

Assure your audience that you are capable academically, willing to stick to the program’s demands, and interesting to have around. For more tips, see our handout on audience .

Voice and style

The voice you use and the style in which you write can intrigue your audience. The voice you use in your essay should be yours. Remember when your high school English teacher said “never say ‘I’”? Here’s your chance to use all those “I”s you’ve been saving up. The narrative should reflect your perspective, experiences, thoughts, and emotions. Focusing on events or ideas may give your audience an indirect idea of how these things became important in forming your outlook, but many others have had equally compelling experiences. By simply talking about those events in your own voice, you put the emphasis on you rather than the event or idea. Look at this anecdote:

During the night shift at Wirth Memorial Hospital, a man walked into the Emergency Room wearing a monkey costume and holding his head. He seemed confused and was moaning in pain. One of the nurses ascertained that he had been swinging from tree branches in a local park and had hit his head when he fell out of a tree. This tragic tale signified the moment at which I realized psychiatry was the only career path I could take.

An interesting tale, yes, but what does it tell you about the narrator? The following example takes the same anecdote and recasts it to make the narrator more of a presence in the story:

I was working in the Emergency Room at Wirth Memorial Hospital one night when a man walked in wearing a monkey costume and holding his head. I could tell he was confused and in pain. After a nurse asked him a few questions, I listened in surprise as he explained that he had been a monkey all of his life and knew that it was time to live with his brothers in the trees. Like many other patients I would see that year, this man suffered from an illness that only a combination of psychological and medical care would effectively treat. I realized then that I wanted to be able to help people by using that particular combination of skills only a psychiatrist develops.

The voice you use should be approachable as well as intelligent. This essay is not the place to stun your reader with ten prepositional phrases (“the goal of my study of the field of law in the winter of my discontent can best be understood by the gathering of more information about my youth”) and thirty nouns (“the research and study of the motivation behind my insights into the field of dentistry contains many pitfalls and disappointments but even more joy and enlightenment”) per sentence. (Note: If you are having trouble forming clear sentences without all the prepositions and nouns, take a look at our handout on style .)

You may want to create an impression of expertise in the field by using specialized or technical language. But beware of this unless you really know what you are doing—a mistake will look twice as ignorant as not knowing the terms in the first place. Your audience may be smart, but you don’t want to make them turn to a dictionary or fall asleep between the first word and the period of your first sentence. Keep in mind that this is a personal statement. Would you think you were learning a lot about a person whose personal statement sounded like a journal article? Would you want to spend hours in a lab or on a committee with someone who shuns plain language?

Of course, you don’t want to be chatty to the point of making them think you only speak slang, either. Your audience may not know what “I kicked that lame-o to the curb for dissing my research project” means. Keep it casual enough to be easy to follow, but formal enough to be respectful of the audience’s intelligence.

Just use an honest voice and represent yourself as naturally as possible. It may help to think of the essay as a sort of face-to-face interview, only the interviewer isn’t actually present.

Too much style

A well-written, dramatic essay is much more memorable than one that fails to make an emotional impact on the reader. Good anecdotes and personal insights can really attract an audience’s attention. BUT be careful not to let your drama turn into melodrama. You want your reader to see your choices motivated by passion and drive, not hyperbole and a lack of reality. Don’t invent drama where there isn’t any, and don’t let the drama take over. Getting someone else to read your drafts can help you figure out when you’ve gone too far.

Taking risks

Many guides to writing application essays encourage you to take a risk, either by saying something off-beat or daring or by using a unique writing style. When done well, this strategy can work—your goal is to stand out from the rest of the applicants and taking a risk with your essay will help you do that. An essay that impresses your reader with your ability to think and express yourself in original ways and shows you really care about what you are saying is better than one that shows hesitancy, lack of imagination, or lack of interest.

But be warned: this strategy is a risk. If you don’t carefully consider what you are saying and how you are saying it, you may offend your readers or leave them with a bad impression of you as flaky, immature, or careless. Do not alienate your readers.

Some writers take risks by using irony (your suffering at the hands of a barbaric dentist led you to want to become a gentle one), beginning with a personal failure (that eventually leads to the writer’s overcoming it), or showing great imagination (one famous successful example involved a student who answered a prompt about past formative experiences by beginning with a basic answer—”I have volunteered at homeless shelters”—that evolved into a ridiculous one—”I have sealed the hole in the ozone layer with plastic wrap”). One student applying to an art program described the person he did not want to be, contrasting it with the person he thought he was and would develop into if accepted. Another person wrote an essay about her grandmother without directly linking her narrative to the fact that she was applying for medical school. Her essay was risky because it called on the reader to infer things about the student’s character and abilities from the story.

Assess your credentials and your likelihood of getting into the program before you choose to take a risk. If you have little chance of getting in, try something daring. If you are almost certainly guaranteed a spot, you have more flexibility. In any case, make sure that you answer the essay question in some identifiable way.

After you’ve written a draft

Get several people to read it and write their comments down. It is worthwhile to seek out someone in the field, perhaps a professor who has read such essays before. Give it to a friend, your mom, or a neighbor. The key is to get more than one point of view, and then compare these with your own. Remember, you are the one best equipped to judge how accurately you are representing yourself. For tips on putting this advice to good use, see our handout on getting feedback .

After you’ve received feedback, revise the essay. Put it away. Get it out and revise it again (you can see why we said to start right away—this process may take time). Get someone to read it again. Revise it again.

When you think it is totally finished, you are ready to proofread and format the essay. Check every sentence and punctuation mark. You cannot afford a careless error in this essay. (If you are not comfortable with your proofreading skills, check out our handout on editing and proofreading ).

If you find that your essay is too long, do not reformat it extensively to make it fit. Making readers deal with a nine-point font and quarter-inch margins will only irritate them. Figure out what material you can cut and cut it. For strategies for meeting word limits, see our handout on writing concisely .

Finally, proofread it again. We’re not kidding.

Other resources

Don’t be afraid to talk to professors or professionals in the field. Many of them would be flattered that you asked their advice, and they will have useful suggestions that others might not have. Also keep in mind that many colleges and professional programs offer websites addressing the personal statement. You can find them either through the website of the school to which you are applying or by searching under “personal statement” or “application essays” using a search engine.

If your schedule and ours permit, we invite you to come to the Writing Center. Be aware that during busy times in the semester, we limit students to a total of two visits to discuss application essays and personal statements (two visits per student, not per essay); we do this so that students working on papers for courses will have a better chance of being seen. Make an appointment or submit your essay to our online writing center (note that we cannot guarantee that an online tutor will help you in time).

For information on other aspects of the application process, you can consult the resources at University Career Services .

Works consulted

We consulted these works while writing this handout. This is not a comprehensive list of resources on the handout’s topic, and we encourage you to do your own research to find additional publications. Please do not use this list as a model for the format of your own reference list, as it may not match the citation style you are using. For guidance on formatting citations, please see the UNC Libraries citation tutorial . We revise these tips periodically and welcome feedback.

Asher, Donald. 2012. Graduate Admissions Essays: Write Your Way Into the Graduate School of Your Choice , 4th ed. Berkeley: Ten Speed Press.

Curry, Boykin, Emily Angel Baer, and Brian Kasbar. 2003. Essays That Worked for College Applications: 50 Essays That Helped Students Get Into the Nation’s Top Colleges . New York: Ballantine Books.

Stelzer, Richard. 2002. How to Write a Winning Personal Statement for Graduate and Professional School , 3rd ed. Lawrenceville, NJ: Thomson Peterson.

You may reproduce it for non-commercial use if you use the entire handout and attribute the source: The Writing Center, University of North Carolina at Chapel Hill

Make a Gift

- Upcoming Events

- Finding Your Fit

- You Majored in What?!

- First-Generation Students

- International Students

- Religion at Work

- Student-Athletes

- Students of Color

- Students With Disabilities

- Undocumented / DACA Students

- Women at Work

- Law School Resources

- Graduate School Resources

Graduate School Essays and Written Materials

- International Graduate Schools

- Graduate School Interviews

- Graduate School FAQs

- Build Career-Ready Skills

- Business, Consulting & Finance

- Creative Arts & Communication

- Government, Law & Community

- Science Research

- Technology & Innovation

- Career Heroes

Commitment to Diversity

- Admitted Students

- Career Fairs and Events

- Recruiting Timelines

- Alumni Champions

- Become A Mentor

- Sponsored Events

- References and Recommendations

- Understand and Negotiate Offers

- Transcript Notation

- Third-Party/Other Employers

- Fraudulent Job Postings

- Forage Virtual Work Experiences

- International Search

- Project Onramp

- Application Information

- Frequently Asked Questions

- Appointments

- Cover Letters

- Career News

- Career Funding and Support

- Hiatt Career Closet

- LinkedIn Photo Booth

- Virtual Resources

- Life After College

- Undergraduate Alumni Support

- Class of 2023

- Employment by Industry

- Advancing Education

- Major to Industry

- Career Team

- External Team

- Management & Ops Team

- Privacy Notice

- Degree Programs

- Majors and Minors

- Graduate Programs

- The Brandeis Core

- School of Arts and Sciences

- Brandeis Online

- Brandeis International Business School

- Graduate School of Arts and Sciences

- Heller School for Social Policy and Management

- Rabb School of Continuing Studies

- Precollege Programs

- Faculty and Researcher Directory

- Brandeis Library

- Academic Calendar

- Undergraduate Admissions

- Summer School

- Financial Aid

- Research that Matters

- Resources for Researchers

- Brandeis Researchers in the News

- Provost Research Grants

- Recent Awards

- Faculty Research

- Student Research

- Centers and Institutes

- Office of the Vice Provost for Research

- Office of the Provost

- Housing/Community Living

- Campus Calendar

- Student Engagement

- Clubs and Organizations

- Community Service

- Dean of Students Office

- Orientation

Hiatt Career Center

- Spiritual Life

- Graduate Student Affairs

- Directory of Campus Contacts

- Division of Creative Arts

- Brandeis Arts Engagement

- Rose Art Museum

- Bernstein Festival of the Creative Arts

- Theater Arts Productions

- Brandeis Concert Series

- Public Sculpture at Brandeis

- Women's Studies Research Center

- Creative Arts Award

- Our Jewish Roots

- The Framework for the Future

- Mission and Diversity Statements

- Distinguished Faculty

- Nobel Prize 2017

- Notable Alumni

- Administration

- Working at Brandeis

- Commencement

- Offices Directory

- Faculty & Staff

- Alumni & Friends

- Parents & Families

- 75th Anniversary

- New Students

- Shuttle Schedules

- Support at Brandeis

The two essays most commonly associated with graduate school applications are the statement of purpose and the personal statement. This is an opportunity for you to connect more deeply with both the school and program to which you are applying. Each program will have different requirements, so it is essential to review the specific components for every application and take your time! Proper grammar, spelling and sentence structure are a must!

Before you begin to write, you should:

- Carefully research the program and consider how your professional and academic goals align with what is being offered.

- Review program application requirements, make note of the application deadline and reach out to the admissions office with any questions.

- Read all application instructions and identify the prompt(s) provided for your essay(s).

- Review the tips below for the type of writing you are being asked to produce.

Before you submit your application, you should:

- Proofread your work, then have a trusted friend or advisor proofread your work.

- Schedule an appointment with Hiatt to discuss your application materials.

Personal Statements

A personal statement is your opportunity to introduce yourself to the program, demonstrate your qualifications and provide personal information regarding your background and goals. While carefully addressing the prompts, help the admissions office appreciate that you are capable of succeeding in a rigorous academic program and that your clearly defined goals are a match for what they provide. Length requirements vary.

- Read the prompt and address each component.

- Have a very clear understanding of why you want to go to graduate school and why the schools to which you are applying are a good fit with your background and interests.

- Think about what makes you unique. Is there a particular cause, issue or interest that motivates your desire to continue your education in pursuit of a particular career?

- Be aware of your long-range goals, how an advanced degree will help you achieve them and how you might use your degree in the future.

- Refer to elements of the program that are a good fit for you.

- Use clichés and quotes from famous people.

- Overuse humor as you never know if the person(s) reading your essay will share your sense of humor.

- Address problems or weaknesses in your application. Keep the personal statement positive even if the subject is overcoming an obstacle.

- Overshare or dwell on personal problems.

Sample essays and tips for writing compelling statements

- Accepted.com Sample Essays

- GoGrad.com Sample Essays

- PrepScholar.com Sample Essays

Sample Grad School Essay:

Below is a sample essay from “Graduate Admissions Essays: Write Your Way Into The Graduate School Of Your Choice,” 3rd Edition, by Donald Asher that demonstrates many of the key elements that graduate admissions committees look for when reviewing an applicant’s personal statement.

"What is the most important difference between tobacco mosaic virus and the Eiffel Tower?" my professor asked on the last day of my introductory biochemistry class as he put two slides of the structures up on the screen. "Both are made of precise building blocks which elegantly come together to form the whole unit," he explained, "but only the virus knows how to put itself together." This was the point I had a Eureka! response. I truly recognized the beauty and complexity of life at the molecular level. That's when I first knew that I wanted to undertake biomedical research.

An interesting first line or paragraph is a gift to your reader. When you are applying to programs you want to pay particular attention to your opening line of your first paragraph. If you are a candidate with an unusual experience or story, launching your essay on that note can be a good idea.

One of the best types of opening paragraphs relates to epiphany which this author incorporates into their opening paragraph. Remember that it should be compelling, but not a cliché.

"Since then, my decision to pursue graduate study has been confirmed by both my undergraduate course work and my research experience. While studying immunology in my sophomore year, I learned for the first time not only the facts about the workings of the immune system but also the ideas and experiments that led to their discovery. As I became exposed to the experimental side of the information found in the textbook, I began to appreciate the sophisticated thought processes and energy required by scientific research.

"The most influential experience in persuading me to attend graduate school, however, has been my current independent research project, which will culminate in an honors thesis. I am examining the antigenicity of a protein in a novel drug delivery system. (Please see the accompanying research summary.) I am eager to bring the concepts I have learned in my project to the level of a graduate program of study.

"First, I discovered how the power of perseverance can overcome obstacles. When my experimental system, the ELISA, suddenly stopped working, careful troubleshooting led to the discovery of a minor technical problem. Through this experience, I learned how to critically dissect an experiment to find the root of error. In addition, the graduate student with whom I have been working for almost two years has taught me the ability to take an idea and follow it while at the same time demonstrating to me the balancing act involved in allocating time, money and energy to a project when the direction your results will take you is unknown.

"My research sponsor, with her contagious energy, has also influenced me with her enthusiastic approach to attacking new research areas, and has motivated me to work harder to reach my goals and the goals of the lab."

It is far better to give a rich description of one incident than to cram your essay full of activities and accomplishments without any hint of what you learned from them and what emotions they evoked in you during the process. Do not be overly redundant with this part of your application.

For example, your complete work history may be listed somewhere else on the application, so mention a particular job, a particular class, a particular accomplishment only to give new perspective or to let the committee know what each of these has meant to you personally. However, you can hint to the reader that there is additional and related information about you that they can find in other parts of the application. For example, here the author says, "Please see the accompanying research summary."

"The pathobiology graduate program at the College of Physicians and Surgeons of Columbia University is of interest to me for several reasons. First, the affiliation of the University with Presbyterian Hospital, Milstein Hospital, the Institute for Cancer Research and the Institute for Human Nutrition provides students with the opportunity to combine basic scientific studies with clinical applications. The resources available at the hospitals and centers aid students in immediately applying what they learn in the classroom and laboratory to situations where disease demands immediate attention.

"In addition, the location of the college in Manhattan is attractive because of its proximity to other research institutions and medical schools. Such a dynamic group of scientists provides many opportunities for the exchange of fresh ideas and collaborative efforts. Finally, the range of research conducted by the faculty is appealing. The studies of Nicole Sucio-Foca are of particular interest to me because they involve the creation of peptide vaccines, an area of immunological research which has much potential for the treatment or prevention of many diseases."

Demonstrate that you have read the catalog, researched the program online and considered your reasons for applying to this particular school. Find a common thread, then point to where your philosophy and theirs meet in happy confluence.

"Once in graduate school, I hope to pursue studies related to the development of vaccines. My interest in this topic stems not only from my course work specific to immunology but also from an additional academic experience in the course, 'The Burden of Disease in Developing Nations.' In this class, I learned that although vaccines are currently available to treat a myriad of diseases, some of these vaccines are useless to people in the developing world because they degrade under the conditions of high temperature or humidity which are often found in these countries. Multiple lines of research can thus address both the development of new vaccines and the improvement of currently existing vaccines so that they may be useful to the greatest number of people.

"In trying to create new vaccines for diseases for which they are currently not available, several approaches from immunology, biochemistry, molecular genetics, and organic chemistry can be considered. For example, an understanding of whether a humoral or cell-mediated immune response is best suited to fight a particular disease is needed. Immunologic techniques involving animal models and cell cultures studies can be used to determine how B and T cells interact to fight disease.

"Furthermore, specific pathogenic macromolecules can be used as the antigen in a vaccine rather than an entire protein. This method requires isolation and purification of protein subunits using biochemical assays such as gel electrophoresis, column chromatography, and protein sequencing. In addition, the gene encoding an antigen can also be used to develop a vaccine. Recombinant DNA techniques such as screening of genomic cDNA libraries, gene sequencing, and the polymerase chain reaction can be used to isolate, characterize, and amplify a specific gene.

"Finally, specific protein antigens can be chemically synthesized. This method requires not only a rigorous use of synthesis design from organic chemistry, but also principles of biochemistry to determine protein sequence and folding, as the conformation of a protein domain and not just its amino acid sequence is often recognized by antigen-presenting cells. Thus, x-ray crystallography and FTIR must be employed. All of these lines of research can lead to the development of new vaccines."

Admissions readers regularly state that they love to learn something while reading an applicant's essay. If you know a tremendous amount about something, whether it is a molecule or a minstrel singer, let the reader in on what is interesting to you about that topic.

Don’t make self-important and grandiose statements about the nature of a particular field or topic, but instead give the kinds of specifics that can only come from in-depth knowledge of a particular topic — ideally, one closely related to the readers' area of specialization.

"After graduate school, I will consider a career in the pharmaceutical industry. The ability to see an idea about a molecular process evolve into a product which will help make people’s lives healthier is my motivation for this choice. However, I am also considering a career in academia because I am interested in the possibility of combining research with teaching and interacting with undergraduates.

"I am currently tutoring genetics students and have previously tutored organic chemistry students, and the one-on-one interaction has enabled me to teach and learn at the same time. Through my involvement in Women in Science and Engineering as a biochemistry affinity group leader, I have been able to advise students about the selection of courses, summer jobs and potential professors with whom to do an independent study.

"The teaching experience which has proven to be the most challenging is serving as a ninth-grade religious education instructor for the past three years. I have prepared my own lessons and led discussions with a group of twenty sometimes less than enthusiastic 14-year-olds. Trying to capture their attention has forced me to be creative in my style and presentation of material. Thus, my involvement with students may persuade me to enter the academic research world."

Whether you are asked to or not, substantiating your career goals often makes for a strong essay. Saying you have "always wanted to be _________" is not as convincing as reporting specific actions that demonstrate the truth of that statement. Although many essay questions do not require you to delineate your future career plans, a student with logical, clearly defined career plans often comes across as mature and directed. Your image of your future career goals and anticipated contributions to your field, and to society in general, may seem to have a mission. Think of this as the "purpose" part of your personal statement.

"My past experiences have well-prepared me to pursue graduate education at the College of Physicians and Surgeons. My undergraduate education in the competitive atmosphere at Brandeis has enabled me to not merely reiterate ideas stated by my professors, but to apply the concepts I have learned to unfamiliar situations. During my four years here, both my study skills and my ability to process information have sharpened, as evidenced by an improvement in my grades within my major from a 3.0 grade point average my freshman year to a 3.6 junior year.

"The lack of self-confidence which plagued me during my first two years here was induced by both insufficient study skills and an unusually rigorous course load, wherein I completed my inorganic and organic chemistry courses in three semesters rather than four. I also took physical chemistry, usually reserved for upperclassmen, my sophomore year.

"In addition, my interactions with people within the Brandeis community outside the classroom have prepared me for the intellectual atmosphere at Columbia. The need to write and speak effectively on issues of importance, whether it involves a change in the housing policy or creating a new concentration, are requisite to enact positive change.

"One initiative which I undertook was the creation of a website for Women in Science and Engineering to help create better communication among women scientists both at Brandeis and at other universities. Therefore by combining my diverse undergraduate experience, I will be able to grow as a researcher in your pathobiology graduate program while contributing my ideas about both the research interests of my colleagues and issues facing the Columbia community."

Additional Types of Essays

Research statements.

A research statement is a brief statement (typically one to two pages) which describes your past research experiences, current research endeavors and a description of where you hope to take your research moving forward.

Pro Tip: Make sure that your research can be pursued in the program you are applying for.

Diversity Statements

Graduate programs are invested in ensuring inclusivity and diversity within their learning communities. A diversity statement is a one page essay where you describe your experience with diversity as well as the diverse perspective, qualities and characteristics that you bring to the table.

Writing Samples

Graduate programs may ask for a writing sample to assess your ability to write well and think critically. Your submission should exemplify the best writing you are capable of producing. Many students edit or retool an existing paper they did well on, and you may feel free to create an entirely new document. Typical length is 10-20 pages, although you should follow whatever instructions are provided.

Philosophy of Education

This essay is typically required for teaching programs. It is a short reflective statement which explains your beliefs about teaching and learning, along with specific examples of how you will employ those beliefs in the classroom.

An addendum is an optional essay (one-page max) that applicants can use to explain a special circumstance that might otherwise cause a red flag on your application. This concise essay should focus on explanations rather than excuses. You can submit an addendum as part of your application whether or not the school invites you to do so. You should not automatically write an addendum essay, so be sure to consult with the Hiatt Career Center if you are considering one.

Common addenda topics include:

- You want to address a questionable or unfavorable aspect of your application.

- You have a failed class, withdrew from more than one class, withdrew from school or were on academic probation.

- Your grades dropped for a period of time.

- You believe that GPA /GRE score doesd not reflect your aptitude (include what does and why).

- There is a significant gap in your resume.

- Majors + Careers

- Identity at Work

- The Hiatt Ecosystem

- Make Connections

- Gain Experience

- Navigate Resources

- Find Where Brandeisians Go

- Learn About Us

Phone: 781-736-3618 [email protected]

We work and collaborate with all students and alumni of all affiliations, backgrounds, identities and preferences. Read about our commitment .

The Writing Sample for Graduate School

Applying to graduate school and choosing academic writing that showcases your academic excellence can be challenging. Don’t worry! Although your writing sample is crucial, it doesn’t need to be perfect. It should effectively communicate, demonstrate your potential for advanced academic work, and importantly, show your ability to specialize in a program’s field of interest. We offer tips to help you select the best writing sample for your graduate school.

Use an Appropriate Professional Style Guide

Your writing sample should show topical expertise, but also an understanding of professional research. Find the standard style guide for your chosen field, and make sure it’s applied consistently–not just citations, but also any formatting for cover pages, pages numbers, and bibliographies.

Keep it Relevant

Select a sample that closely reflects your areas of potential interest. This means the sample with the highest grade may not be the best. It may be worthwhile to revise a B+ paper and use it a writing sample if it’s more relevant to the field you want to study than that A paper from a different academic area.

Take your time!

If there’s no obvious pick that’s OK. Don’t rush when selecting a writing sample. Instead, take some time to review your options–pick something that will make an impression on the admissions committee, and don’t be afraid to revise. You may be tempted to write something new for submission – this is almost always a bad idea. Remember that previous work has been written for a reason and has likely seen feedback from trusted advisors.

Make Sure it is Free of Errors

As already hinted, you may need to edit the sample you choose. Remember you want to express your professional readiness for advanced studies with your writing sample, so triple check for typographical and other errors before submitting it with your application package.

Follow the Instructions!

ay close attention to any requirements set out for you application materials, and make sure you meet the required length. Typically, you don’t want to exceed them either–more is not always better. Remember that graduate applications are also about showing that you can follow directions.

Structure and Organization Matter!

Academic writing should be a well written with a concise beginning, clear middle and an effective end. Make sure that each part of your essay is clear, compelling, and, well, present in your writing sample. Even the most brilliant ideas and research get lost in a poorly structured essay.

Showcase Your Research Skills!

This can take different forms depending on your field. If you’re applying to an experiment-driven program in physics or sociology you may need to demonstrate your grasp of research best practices in field. In a scholarly program such as history or literature you may need to demonstrate a meaningful grasp of research with primary documents, or applying specific methodologies in analysis.

Demonstrate Your Critical Thinking

A strong writing sample showcases your critical thinking skills, which means evaluating the strengths and weaknesses of a prevailing view and drawing conclusions based on evidence. Your writing should engage with existing work in the field. In the writing sample, you show the reader what you already know and what questions you want to explore.

Reveal Yourself as an Effective Communicator

Finally, choosing a well-written academic paper for your application involves communicating complex ideas effectively, whether your own or others’ (with proper attribution). The best samples balance engaging with existing ideas and introducing your own. This balance is crucial for grad school success, offering a chance to showcase this skill and engage your reader through your writing sample .

Graduate Admissions Support

In conclusion, we know that applying for graduate school can be a stressful process. We’re here to help you navigate the ups and downs. Check out more helpful tips and articles demystifying graduate school admissions on our blog . Looking for help with your application essays? We have samples of real Personal Statements that got people accepted to graduate programs – with our expert feedback to help you write your essays.

View all posts

More from Magoosh

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Testimonials

Free Resources

PrepScholar GRE Prep

Gre prep online guides and tips, 3 successful graduate school personal statement examples.

Looking for grad school personal statement examples? Look no further! In this total guide to graduate school personal statement examples, we’ll discuss why you need a personal statement for grad school and what makes a good one. Then we’ll provide three graduate school personal statement samples from our grad school experts. After that, we’ll do a deep dive on one of our personal statement for graduate school examples. Finally, we’ll wrap up with a list of other grad school personal statements you can find online.

Why Do You Need a Personal Statement?

A personal statement is a chance for admissions committees to get to know you: your goals and passions, what you’ll bring to the program, and what you’re hoping to get out of the program. You need to sell the admissions committee on what makes you a worthwhile applicant. The personal statement is a good chance to highlight significant things about you that don’t appear elsewhere on your application.

A personal statement is slightly different from a statement of purpose (also known as a letter of intent). A statement of purpose/letter of intent tends to be more tightly focused on your academic or professional credentials and your future research and/or professional interests.

While a personal statement also addresses your academic experiences and goals, you have more leeway to be a little more, well, personal. In a personal statement, it’s often appropriate to include information on significant life experiences or challenges that aren’t necessarily directly relevant to your field of interest.

Some programs ask for both a personal statement and a statement of purpose/letter of intent. In this case, the personal statement is likely to be much more tightly focused on your life experience and personality assets while the statement of purpose will focus in much more on your academic/research experiences and goals.

However, there’s not always a hard-and-fast demarcation between a personal statement and a statement of purpose. The two statement types should address a lot of the same themes, especially as relates to your future goals and the valuable assets you bring to the program. Some programs will ask for a personal statement but the prompt will be focused primarily on your research and professional experiences and interests. Some will ask for a statement of purpose but the prompt will be more focused on your general life experiences.

When in doubt, give the program what they are asking for in the prompt and don’t get too hung up on whether they call it a personal statement or statement of purpose. You can always call the admissions office to get more clarification on what they want you to address in your admissions essay.

Quick side note: we've created the world's leading online GRE prep program that adapts to you and your strengths and weaknesses. Not sure what to study? Confused by how to improve your score? We give you minute by minute guide.